Harris&Ewing District National Bank, Washington, DC 1931

The real world.

• I Walked From Liverpool To London. Brexit Was No Surprise (G.)

On 2 May this year, I set off to walk from Liverpool to London, a journey of 340 miles that would take me a month. I was walking in the footsteps of the People’s March for Jobs, a column of 300-odd unemployed men and women who, on the same day in 1981, exactly 35 years previously, had set off from the steps of St George’s Hall to walk to Trafalgar Square. In the two years after Margaret Thatcher had been elected, unemployment had gone from 1 to 3 million, as her policies laid waste to Britain’s manufacturing base. In 1981, we saw Rupert Murdoch buy the Times and Sunday Times. We witnessed inner-city riots, unprecedented in their scale and violence, in Liverpool and London. The formation of the SDP split the left. The Tories lost their first assault on the coal miners, capitulating over the closure of 23 pits.

My father, Pete Carter, was one of those who organised the original walk. My journey was an attempt to work out what had happened to Britain in the intervening years. What I saw and heard gave me an alarming sense of how the immense social changes wrought by Thatcherism are still having a profound effect on communities all over England. It also meant that when I awoke last Thursday to the result of the EU referendum, I wasn’t remotely surprised. I left Liverpool the week of the Hillsborough inquest verdict, flowers and scarves still adorning lampposts. The inquest had finally vindicated the families of the 96 killed at the 1989 FA Cup semi-final, exposing the lies and cover-ups of the police, the media and the political class, who had spent over a quarter of a century traducing not only those fans, mostly working class, but also the city and its people.

In fact, that demonising had found expression in 1981, too, when Geoffrey Howe suggested to Thatcher privately that, after the Toxteth riots, Liverpool should be subject to a “managed decline”. I walked through Widnes and Warrington, past huge out-of-town shopping centres and through the wastelands of industrial decay. In Salford, down streets where all the pubs were boarded up and local shops, if you could find them, had brick walls for windows and prison-like metal doors, I found an Airbnb. My host was selling her terraced house. I sat in her living room as the estate agent brought around potential buyers. They were all buy-to-let investors from the south of England, building property portfolios in the poverty, as if this was one giant fire sale.

“..an uncanny gemütlichkeit..”

• UK Will Emerge From Brexit Just Fine, It’s Europe That’s In Trouble (CNBC)

The British never wanted to be part of a German-dominated European federal super state. The exit from the EU will allow the U.K. to reclaim parts of national authority that its political elites ceded to unelected Brussels officials free of any meaningful democratic oversight. The scare-mongering about the end of the U.K. and the unraveling EU is meaningless. My guess is that the U.K. will do better that the unwieldy “union” of 27 countries whose leaders have yet to figure out where they are going. But let’s take a look at the U.K. first. The first good sign is that the leave leaders are behaving in the tradition of the British battle cry: “Keep Calm and Carry On.”

They are watching the fury and the confusion in Berlin, Paris and Brussels. The leading voices in these capitals are screaming for an expeditious divorce as a swift and exemplary punishment (yes, to deter other would-be exit followers), because the Europe’s oldest parliamentary democracy spoke for the rest of the continent and dared to denounce the EU’s failing ways. In case you wondered, that is how low the ideal of European brotherhood and union has fallen. These muddled up and agitated minds in Paris, Berlin and Brussels will just create more chaos and alienate more people who were looking at the EU as a haven of peace and prosperity. The leave people, by contrast, are playing with an uncanny gemütlichkeit. They are saying that they are Europeans, and that they just want to build a close European relationship of a different kind.

Will that work? All we hear now is that it won’t. Well, maybe there is some prescience in there, but please take a look at these numbers. The U.K. is by far Germany’s most profitable export market. Last year, Germany’s trade surplus with the U.K. came in at €51 billion, accounting for 34% of the German surplus with the EU. That surplus was also 42% higher than the German trade surplus with France, Berlin’s largest European trade partner. With its €89.3 billion worth of exports to the U.K. last year, Britain is Germany’s third-largest export market, after the U.S. and France. Will Germany give this up by shutting the U.K. out of a free-trade agreement with the EU? Of course it won’t.

It’ll be fun to see the hot potato being tossed around.

• Britain ‘May Never’ Trigger EU Divorce (AFP)

Britain “may never” trigger the formal divorce process with the EU despite last week’s referendum in which the country voted to leave, EU diplomats said Sunday. “My personal belief is they will never notify” the EU about their intention to leave, a senior EU diplomat said on condition of anonymity. A state leaving the EU must formally notify the European Council of all 28 EU leaders under Article 50 of the 2007 Lisbon Treaty, setting the clock ticking on a two-year period for Britain to negotiate its divorce. “We want London to trigger Article 50 now, to have clarity. I expect, as we can’t force them, for them to take their time,” the diplomat added. “And I would not exclude, it’s my personal belief, that they may never do it.”

The official did not specify if he believed Britain would avoid it by holding a new referendum, or simply dragging out the process to extract a better divorce deal, but said all such decisions were up to London. Cameron has said he will resign by October and that it is for his successor to launch the process and lead the negotiations. Despite growing pressure from EU leaders, Cameron was not expected to trigger Article 50 at an EU summit on Tuesday, another senior EU official said. Britain’s EU partners believed the notification should come by Christmas at the latest. “There cannot be any kind of negotiation with Britain before there is a notification.”

A distorted view because of the gains prior to the referendum. Everything was getting pumped up by expectations of no Brexit, and than that ‘gain’ was lost again. it’s like a gambler who wins big only to lose it all again at the end of the night. Did he lose, or just draw?

• Post-Brexit Global Equity Loss Of Over $2 Trillion Worst Ever: S&P (R.)

The $2.08 trillion wiped off global equity markets on Friday after Britain voted to leave the European Union was the biggest daily loss ever, trumping the Lehman Brothers bankruptcy during the 2008 financial crisis and the Black Monday stock market crash of 1987, according to Standard & Poor’s Dow Jones Indices. Global markets skidded following the unexpected result from the June 23 referendum, in which Britons voted to withdraw from the EU by a 52% to 48% margin. Markets in mainland Europe were hit the worst, with Milan and Madrid each down more than 12% for their biggest losses ever. Britain’s benchmark FTSE 100 was down nearly 9% at one point on Friday, but rallied to close down 3.15%.

The route started in Asia, with the Nikkei .N225 down 7.9%, and carried over into Wall Street as the S&P 500 fell 3.6%. Mohit Bajaj, director of ETF trading solutions at WallachBeth Capital in New York, said the severity of the sell-off was partly due to investors misreading the outcome and betting the wrong way. “People positioned themselves longer because they thought the market was going to pop,” he said. “We knew that we were going to sell off pretty hard and people were kind of shocked by the market.” In dollar terms, Friday’s loss overtook the previous record from Sept. 29, 2008, the day when Congress rejected a $700 billion bailout package for Wall Street during the financial crisis. On that day, global markets lost $1.94 trillion.

The Guardian has a hard time losing.

• Firms Plan To Quit UK As City Braces For More Post-Brexit Losses (G.)

British businesses have warned that Brexit will trigger investment cuts, hiring freezes and redundancies as the consequences of leaving the European Union threaten to destabilise markets further this week. The survey by the Institute of Directors (IoD), which found that the majority of businesses believed Brexit was bad for them, comes amid fears that investors will wipe billions more pounds off share values on Monday morning, and signs that the pound, which hit a 30-year low on Friday, was coming under further pressure from trading in Asia. Sterling was down more than 1% as the Asian markets opened late on Sunday. [..]

[..] fears are spreading that an estimated 100,000 roles could be lost in the financial sector if banks press on with contingency plans to move jobs out of the UK. The political uncertainty gripping the UK following the resignation of prime minister David Cameron and turmoil in the Labour party has put the City on alert for more volatility. With fears that the economic turmoil following the result will tip the country into recession, the snap poll of IoD members found that company bosses were considering a range of options, including hiring and investment freezes and relocating some of their operations. Simon Walker, the IoD’s director general, said the organisation would not “sugar-coat” the damaging outcome: “A majority of business leaders think the vote for Brexit is bad for them.”

“Businesses will be busy working out how they are going to adapt and succeed after the referendum result,” said Walker of the group which has 34,500 members, ranging from start-up entrepreneurs to chief executives of multinational companies. “But we can’t sugar-coat this, many of our members are feeling anxious.” In the poll, 36% of IoD members said the outcome of last Thursday’s vote would lead them to cut investment in their business whereas just 9% said the opposite was true. Just under half said it would not change their investment plans.

“..He will be remembered as the worst British prime minister ever….”

• Brexit: Most Commentaries Miss The Point (Kuttner)

When the original institutions that later became the E.U. were created in the 1940s and 1950s, the international system was designed on the ashes of depression and war to rebuild an economy of full employment and broad based prosperity. The system worked remarkably well. In the 1980s, as a backlash against the dislocations of the 1970s, Margaret Thatcher came to power in Britain (and Ronald Reagan in the US). Their policies returned to a dog-eat-dog brand of capitalism that benefited elites and hurt ordinary people. By the 1990s, when the European Economic Community became a more tightly knit European Union, it too became an agent of neo-liberalism.

Policies of deregulation ended in the financial collapse of 2008. The austerity cure, enforced the gnomes of Brussels and Frankfurt and Berlin, is in many ways worse than the disease. Rising mass discontent has failed to dethrone the elites responsible for these policies, but it has resulted in lose of faith in institutions. The one percent won the policies but lost the people. So, yes, the Brits who voted for Brexit got a lot of facts and details wrong. And Britain will probably be worse off as a result. But they did grasp that the larger economic system is serving elites and is not serving them. The tragedy is that we are further away from a reformed EU than ever. A progressive EU, more in the spirit of 1944, is not on the menu.

The exit of Britain will give even more power to Angela Merkel’s Germany, architect and enforcer of austerity. The rest of Europe will become more like Greece economically and more like the British rightwing politically. there will be more far-right populist movements for other nations to quit the EU. This has already begun in France and the Netherlands, two of the founding nations of the European Community — and ones that also benefit, on balance, from the EU. [..] What makes this vote so tragic is the absence of enlightened leadership, either in Britain or on the continent, to propose something better. Prime Minister David Cameron, who proposed the reckless gamble of a referendum as a tactical feint to paper over an intra-party schism, may now be responsible for the dissolution of two unions — not just the EU, but the UK, as Scotland secedes. He will be remembered as the worst British prime minister ever..

“Like the Labour Party in Britain, the leaders of the Syriza government in Athens are the products of an affluent, highly privileged, educated middle class, groomed in the fakery and political treachery of post-modernism. ”

• Raw Democracy: Why The British Said No To Europe (Pilger)

The day after the vote, the columnist Martin Kettle offered a Brechtian solution to the misuse of democracy by the masses. “Now surely we can agree referendums are bad for Britain”, said the headline over his full-page piece. The “we” was unexplained but understood – just as “these people” is understood. “The referendum has conferred less legitimacy on politics, not more,” wrote Kettle. “ … the verdict on referendums should be a ruthless one. Never again.” The kind of ruthlessness Kettle longs is found in Greece, a country now airbrushed. There, they had a referendum and the result was ignored. Like the Labour Party in Britain, the leaders of the Syriza government in Athens are the products of an affluent, highly privileged, educated middle class, groomed in the fakery and political treachery of post-modernism.

The Greek people courageously used the referendum to demand their government sought “better terms” with a venal status in Brussels that was crushing the life out of their country. They were betrayed, as the British would have been betrayed. On Friday, the Labour Party leader, Jeremy Corbyn, was asked by the BBC if he would pay tribute to the departed Cameron, his comrade in the “remain” campaign. Corbyn fulsomely praised Cameron’s “dignity” and noted his backing for gay marriage and his apology to the Irish families of the dead of Bloody Sunday. He said nothing about Cameron’s divisiveness, his brutal austerity policies, his lies about “protecting” the Health Service. Neither did he remind people of the war mongering of the Cameron government: the dispatch of British special forces to Libya and British bomb aimers to Saudi Arabia and, above all, the beckoning of WWIII.

In the week of the referendum vote, no British politician and, to my knowledge, no journalist referred to Vladimir Putin’s speech in St. Petersburg commemorating the seventy-fifth anniversary of Nazi Germany’s invasion of the Soviet Union on 22 June, 1941. The Soviet victory – at a cost of 27 million Soviet lives and the majority of all German forces – won the Second World War. Putin likened the current frenzied build up of Nato troops and war material on Russia’s western borders to the Third Reich’s Operation Barbarossa. Nato’s exercises in Poland were the biggest since the Nazi invasion; Operation Anaconda had simulated an attack on Russia, presumably with nuclear weapons.

On the eve of the referendum, the quisling Secretary-General of Nato, Jens Stoltenberg, warned Britons they would be endangering “peace and security” if they voted to leave the EU. The millions who ignored him and Cameron, Osborne, Corbyn, Obama and the man who runs the Bank of England may, just may, have struck a blow for real peace and democracy in Europe.

Not a currency manipulator, but an innocent victim of Brexit. Well played.

• China Devalues Yuan Most In 10 Months, Warns Of Brexit “Butterfly Effect” (ZH)

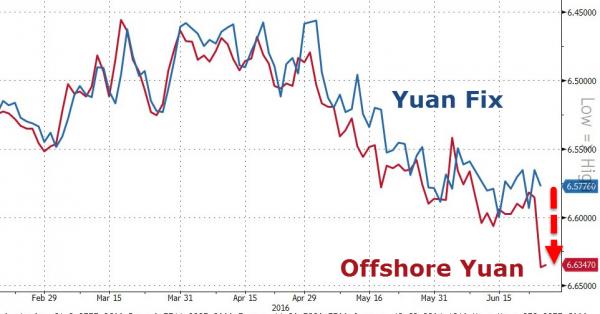

In a somewhat shockingly honest admission of the frgaility of the global financial system, Chinese Premier Li warns that a disillusioned British butterfly has flapped its wings and the entire global financial system could collapse. Responding to the plunge in offshore Yuan since the Brexit vote (down 7 handles to 5-month lows over 6.65), PBOC devalued Yuan fix by 0.9% (6 handles) – the most since the August crash – to Dec 2010 lows. Finally, we note USD liquidity pressures building as EUR-USD basis swaps plunge.

While Chinese stocks remain ‘stable’ (despite Goldman suggesting more pain is due – regional cost of equity to rise 50-75bps as risk appetite shrinks after Brexit, equal to 5%-10% index decline), the less managed rest of the world is struggling and China knows it…

Premier Li Keqiang said an increase in instability in a particular country or region could trigger the “Butterfly Effect,” which could, in turn, affect the global economic recovery and financial market stability, according to comments posted on Chinese central govt’s website. All economies highly dependent on each other and no country can manage alone, Li said during meeting with WEF executive chairman Klaus Schwab in Tianjin. Li called on all nations to enhance coordination and work together to address difficulties.

The shift in the Yuan Fix (red) seemed clear from the collapse in offshore Yuan… CNH > 6.65 (7 handles weaker than pre-Brexit)

[..] Here’s why Americans might want to care about this Brexit butterfly and China crash…

Strong by Pesek. Go through Google (News) to access the whole article.

• Why Xi Refuses to Let China’s Zombies Die (Pesek)

The staying power of AMC’s “The Walking Dead” with Chinese viewers is a wonder to behold. The most watched U.S. show in China even has mainlanders flocking to California for the July 4 opening of Universal Studios Hollywood’s newest attraction: a walk-through park that lets you act the part of post-apocalyptic survivor fleeing the flesh-eating undead. Soon enough, though, China’s 1.4 billion people may be able to get their zombie fix at home, where the government is staging the economic equivalent of their favorite TV experience. That’s because President Xi Jinping’s pledge to breathe new life into a staggering growth model faces its own untimely death (adding to the world’s grief over the U.K. exiting the EU).

The first real sign of China’s zombification was Beijing’s failure to attack overcapacity in industries ranging from shipbuilding to steel to mining to cement. In March, the Financial Times provoked anger in Beijing with its “China’s State-Owned Zombie Economy” headline, along with many others in the foreign media. The second hint came in April, when Xi’s government rolled out plans for a Japan-like debt-to-equity swap program. The International Monetary Fund pounced, warning that securitizing loans might “worsen the problem” by supporting “zombie” companies better off disappearing. Now comes indications of a stealth effort to boost stimulus to hit this year’s 6.5% growth target, even as Xi insists he’s tackling the excesses imperiling China’s future.

Officially, Beijing’s fiscal deficit including off-balance sheet items will be about 3% this year. Economists at UBS and elsewhere now say it’s higher than 10%. In other words, the invisible hand of the state is playing an increasing role in an economy Xi claims to be turning over to the private sector and market forces, deadening China’s animal spirits. These behind-the-curtain shenanigans mean the Zhu Rongji moment investors crave to rebalance growth engines isn’t afoot. China’s premier from 1998 to 2003 shook up the state sector as rarely before, shuttering lifeless enterprises and killing more than 40 million jobs. Xi needs to pull off an even bigger feat if he’s going resurrect a reform process that’s had few obvious successes.

Home › Forums › Debt Rattle June 27 2016