DPC “Wood Street, Pittsburgh, Pennsylvania.” 1905

Entirely meaningless. No-one’s committed to any specific cuts. In the end it’s all about market share and nobody wants to lose any.

• OPEC Agrees Modest Oil Output Curbs In First Deal Since 2008 (R.)

OPEC agreed on Wednesday modest oil output cuts in the first such deal since 2008, with the group’s leader Saudi Arabia softening its stance on arch-rival Iran amid mounting pressure from low oil prices. “OPEC made an exceptional decision today … After two and a half years, OPEC reached consensus to manage the market,” said Iranian Oil Minister Bijan Zanganeh, who had repeatedly clashed with Saudi Arabia during previous meetings. He and other ministers said the OPEC would reduce output to a range of 32.5-33.0 million barrels per day. OPEC estimates its current output at 33.24 million bpd.

“We have decided to decrease the production around 700,000 bpd,” Zanganeh said. The move would effectively re-establish OPEC production ceilings abandoned a year ago. However, how much each country will produce is to be decided at the next formal OPEC meeting in November, when an invitation to join cuts could also be extended to non-OPEC countries such as Russia. Oil prices jumped more than 5% to trade above $48 per barrel as of 2015 GMT. Many traders said they were impressed OPEC had managed to reach a compromise after years of wrangling but others said they wanted to see the details.

Wonder how this plays into the OPEC ‘agreement’.

• Congress Rejects Obama Veto, Saudi 9/11 Bill Becomes Law (R.)

Congress on Wednesday overwhelmingly rejected President Barack Obama’s veto of legislation allowing relatives of the victims of the Sept. 11 attacks to sue Saudi Arabia, the first veto override of his presidency, just four months before it ends. The House of Representatives voted 348-77 against the veto, hours after the Senate rejected it 97-1, meaning the “Justice Against Sponsors of Terrorism Act” will become law. The vote was a blow to Obama as well as to Saudi Arabia, one of the United States’ longest-standing allies in the Arab world, and some lawmakers who supported the override already plan to revisit the issue. Obama said he thought the Congress had made a mistake, reiterating his belief that the legislation set a dangerous precedent and indicating that he thought political considerations were behind the vote.

“If you’re perceived as voting against 9/11 families right before an election, not surprisingly, that’s a hard vote for people to take. But it would have been the right thing to do,” he said on CNN. Obama’s 11 previous vetoes were all sustained. But this time almost all his strongest Democratic supporters in Congress joined Republicans to oppose him in one of their last actions before leaving Washington to campaign for the Nov. 8 election. “Overriding a presidential veto is something we don’t take lightly, but it was important in this case that the families of the victims of 9/11 be allowed to pursue justice, even if that pursuit causes some diplomatic discomforts,” Senator Charles Schumer, a top Senate Democrat, said in a statement.

Schumer represents New York, site of the World Trade Center and home to many of the nearly 3,000 people killed in the 2001 attacks, survivors and families of victims. The law, known as JASTA, passed the House and Senate without objections earlier this year. Support was fueled by impatience in Congress with Saudi Arabia over its human rights record, promotion of a severe form of Islam tied to militancy and failure to do more to ease the international refugee crisis. The law grants an exception to the legal principle of sovereign immunity in cases of terrorism on U.S. soil, clearing the way for lawsuits seeking damages from the Saudi government.

“..it is strikingly reminiscent of the so-called liquidity trap of the 1930s, when central banks were also “pushing on a string.”

• Desperate Central Bankers (Stephen Roach)

As in Japan, America’s subpar recovery has been largely unresponsive to the Fed’s aggressive strain of unconventional stimulus – zero interest rates, three doses of balance-sheet expansion (QE1, QE2, and QE3), and a yield curve twist operation that seems to be the antecedent of the BOJ’s latest move. (The BOJ has just announced that it is targeting zero interest rates for ten-year Japanese government bonds.) Notwithstanding the persistent growth shortfall, central bankers remain steadfast that their approach is working, by delivering what they call “mandate-compliant” outcomes. The Fed points to the sharp reduction of the US unemployment rate – from 10% in October 2009 to 4.9% today – as prima facie evidence of an economy that is nearing one of the targets of the Fed’s so-called dual mandate.

But when seemingly solid employment growth is juxtaposed against weak output, the story unravels, revealing a major productivity slowdown that raises serious questions about America’s long-term growth potential and an eventual buildup of cost and inflationary pressures. The Fed can’t be faulted for trying, argue the counter-factualists who insist that only unconventional monetary policies stood between the Great Recession and another Great Depression. That, however, is more an assertion than a verifiable conclusion. While policy traction has been notably absent in the real economies of both Japan and the US, asset markets are a different story. Equities and bonds have soared on the back of monetary policies that have led to rock-bottom interest rates and massive liquidity injections.

The new unconventional monetary policies in both countries are obviously missing the disconnect between asset markets and real economic activity. This reflects the aftermath of wrenching balance-sheet recessions, in which aggregate demand, artificially propped up by asset-price bubbles, collapsed when the bubbles burst, leading to chronic impairment of overleveraged, asset-dependent consumers (America) and businesses (Japan). Under such circumstances, the lack of response at the zero bound of policy interest rates is hardly surprising. In fact, it is strikingly reminiscent of the so-called liquidity trap of the 1930s, when central banks were also “pushing on a string.”

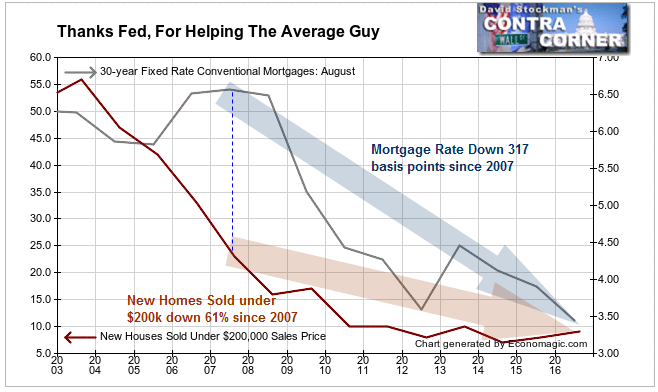

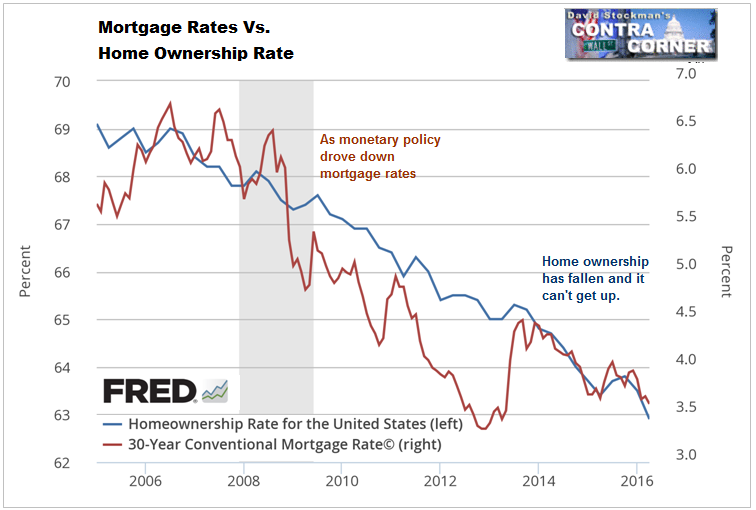

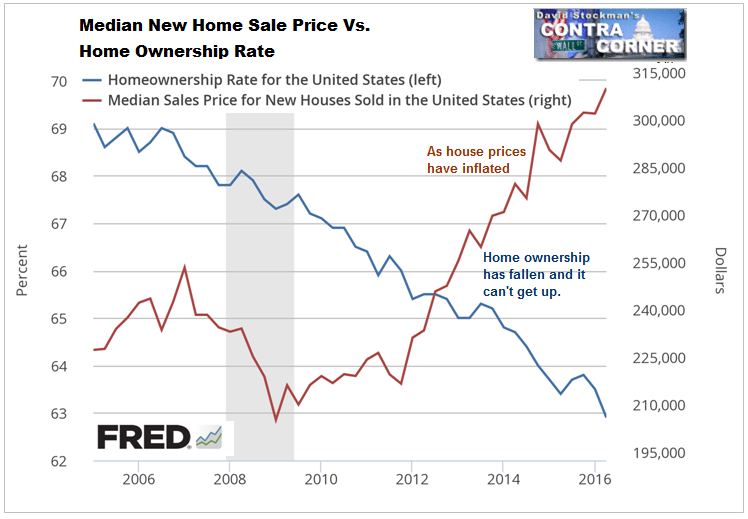

The Fed kills the American homeownership dream.

• Disturbing Facts About The Fed’s Phony Housing “Recovery” (Adler)

But the Fed got the result it intended. It wanted to inflate prices to save the banks from their stupidity and criminality. Decisions were made at the highest levels of the Fed and the Federal Government to not only let the banks off the hook, but to rescue them. The only way to do that was to forego prosecution of massive criminal wrongdoing, and to engineer price inflation, so that the criminal perpetrators of the fraud that drove the Great Bubble would be free to re-offend. The Fed’s claim of trying to help the typical consumer is hogwash. The benefits of the low interest rate policy have flowed only to the upper income strata. In our monthly updates of our “Thanks Fed For Helping the Average Guy” we see that the chance of the “average guy” to buy a new home remains virtually nil.

Not only has there been no recovery in homes priced under $200,000, sales in that price range have essentially disappeared in spite of the world’s major central banks pushing mortgage rates down. Builders no longer have any interest in producing product in that price range because demand has weakened so much at that level. People at the reported median US household income simply can’t afford to buy houses regardless of the fact that they may be borderline qualified. Prior to the housing crash, most new homes sold were in the under $200,000 price range.Since 2007, mortgage rates have been cut nearly in half. Yet production and sales of homes in the under $200,000 range have continued falling, now down 61% since 2007.

Builders have shifted their efforts to the $200-$400k range, where they still have some margin, and can move enough inventory to earn a profit. The higher the price of the home, the more profitable it is for a builder. Unfortunately, homes priced above $230,000 are beyond the reach of households earning the reported median household income of $56,000, a figure which itself we believe is overstated. Because of central bank driven housing inflation, and suppression of household income growth (also partly attributable to ZIRP) home ownership is increasingly out of reach for an ever growing percentage of US households If monetary policy were helping the housing market, the rate of homeownership should be at least stable. Instead, as mortgage rates have been consistently suppressed since 2007, homeownership has fallen concurrently.

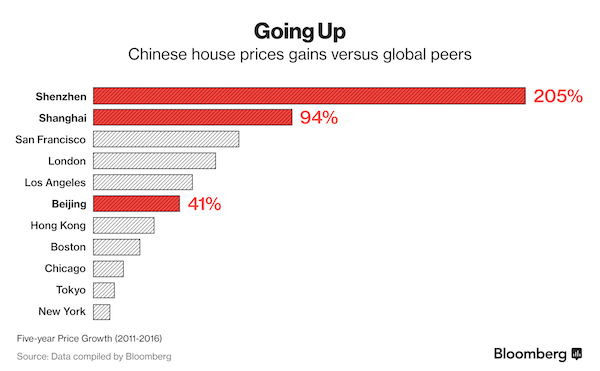

The bubble made him a billionaire.

• China’s Richest Man: Country’s Real Estate Is ‘Biggest Bubble In History’ (CNN)

Chinese billionaire Wang Jianlin made his fortune in the country’s real estate market – and now he’s warning that it’s spiraling out of control. It’s the “biggest bubble in history,” he told CNNMoney in an exclusive interview Wednesday. Bubble is a sensitive word in China after the dramatic rise and spectacular crash in the country’s stock market last year, which wiped out the savings of millions of small investors who thought Beijing wouldn’t allow the market to drop. After struggling to contain the fallout from the stock market debacle, China’s leaders could face a similar headache in the real estate sector. The big problem, according to Wang, is that prices keep rising in major Chinese metropolises like Shanghai but are falling in thousands of smaller cities where huge numbers of properties lie empty.

“I don’t see a good solution to this problem,” he said. “The government has come up with all sorts of measures – limiting purchase or credit – but none have worked.” It’s a serious worry in China, where the economy is slowing at the same time as high debt levels continue to increase rapidly. There are massive sums at stake in the real estate market: direct loans to the sector stood at roughly 24 trillion yuan ($3.6 trillion) at the end of June, according to Capital Economics.

“Deteriorating corporate finances and a rebalancing reversal seem a high price to pay for a quarter’s worth of stability..”

• Beige Book Sounds Warning Over Chinese Economy (WSJ)

Recent stability in the Chinese economy masks deep-seated problems that threaten to rattle global markets in advance of a leadership change next year, according to a survey. Ignoring these risks is shortsighted, said authors of the China Beige Book International, a quarterly survey that tracks the world’s second-largest economy. Data from the group’s third-quarter survey of 3,100 Chinese firms and 160 bankers point to some potential problems. New growth engines intended to shift the economy away from investment toward consumption-led growth are increasingly wobbly as corporate cash flow is squeezed and Beijing doubles down on traditional engines to stabilize output, the China Beige Book says.

“I’d find it earth-shatteringly surprising if we don’t have a significant problem between now and China’s leadership change” in the fall of 2017 when the 19th Party Congress convenes, said Leland Miller, China Beige Book’s president. “This is not a stable economy. It’s one that twists and turns and happens to end up at the same spot. There are real problems below the surface.” Growth in China’s service industry, a cornerstone of its planned transition to a new and more sustainable economic model, weakened during the third quarter as financial services, private healthcare, telecommunications, media and other subsectors flagged, the group’s data showed. In retail, the apparel, luxury goods and food sectors slowed, it said, as online retailers continued to cannibalize brick-and-mortar sales.

Despite Beijing’s pledge to reduce excess Industrial capacity and pare debt, China remains heavily dependent on government spending to power traditional debt-fueled growth engines, the group said. Much of the economic momentum during the third quarter came from infrastructure, manufacturing, commodities and real estate and many of these sectors are in danger of losing momentum, it said. While property sales remained strong in major cities, cash flow in the sector tightened and borrowing increased, a sign that investors should “think about getting off this train sooner rather than later,” the China Beige Book said. “Deteriorating corporate finances and a rebalancing reversal seem a high price to pay for a quarter’s worth of stability,” the group added.

“..the real-estate boom is leading couples to divorce, as a move to pay less property-related taxes..”

• China Property Bubble In Global Perspective (BBG)

China is turning Japanese. That’s the increasingly held view of observers comparing China’s frenzied real-estate market with the epic bust that more than two decades ago hobbled one of its biggest economic rivals. While the two scenarios aren’t a carbon copy, similarities between China’s record credit boom in recent years and Japan’s bubble era have been made at various times by a number of economists and investors. Now, those voices are being heard more often – even within China. Huang Yiping, a Peking University professor who advises China’s central bank, warned Saturday about leverage that continues to climb, saying that the top risk is more and more investment generates less growth. “That’s exactly the story that unfolded in Japan.”

[..] Hardly a week goes by without a warning that China is stoking a new bubble only a year after a $5 trillion stock market crash that rocked policy makers. Curbs to cool demand have struggled for traction, and Chinese media outlets carry reports of panic buying. A commentary published by a WeChat account affiliated to the People’s Daily, the Communist Party’s mouthpiece, on Monday said the real-estate boom is leading couples to divorce, as a move to pay less property-related taxes. It also said companies risk losing competitiveness as they focus on gaining from real estate rather than focusing on their own industry.

One example of a company benefiting from property: Nanjing Putian Telecommunication-B, a loss-making telecommunication equipment manufacturer, which is selling two apartments in the heart of Beijing’s school district to shore up its balance sheet. The value of the residences is estimated to have risen more than 10-fold since the firm bought them in 2004. At least 73 listed companies said they’re planning to sell or have sold properties to shore up cash. “I am big on the parallels,” said Roy Smith, the New York University academic who as a banker in 1990 anticipated Japan’s decline. Japan’s market crash “led to a financial crisis that they never recovered from. China probably faces a debt-led financial crisis too, which could have significant consequences,” he said.

“..it’s the interconnectedness with the rest of the system that is the problem.”

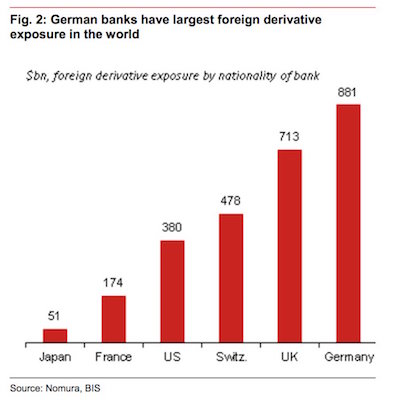

• ‘Radioactive’ Deutsche Bank Could Go Nuclear At Any Time (Exp.)

Germany’s biggest bank reportedly has a $45 TRILLION portfolio of underlying assets that its clients are taking a position in – which equates to more than 10 times Germany’s entire GDP. And the problem is that no one really knows what’s makes up Deutsche’s book of exposure and so-called derivatives book because it’s so opaque and complicated, according to Michael Hewson, chief market analyst at CMC Markets UK. He told Express.co.uk: “Deutsche has the biggest derivatives book in the world, and people will say that its hedged to a greater or lesser extent, but it’s the interconnectedness with the rest of the system that is the problem. “There doesn’t seem to be transparency about what’s in its book. No one really knows what the ripple-out effects would be.”

“That makes Deutsche radioactive about whether or not I would want to invest in it. “A bank becomes a risk to the financial system as a whole when the degree to which it is interconnected with other institutions increases. Deutsche Bank is currently a counterparty to virtually every major bank in the world, in virtually all asset classes. Deutsche Bank denies it has the biggest derivatives exposure – its portfolio of financial contracts based on the value of other assets – and insists that 85% of its exposure is to investment grade counter-parties. Investor confidence in Deustsche has been shaken over the last two days after German Chancellor Angela Merkel said it would not step in to rescue the bank if needed. But experts claim Berlin could be left with little choice but to intervene.

“..there was doubt that European banks still had a viable business model…”

• Europe’s Banks ‘Not Investable’ Says Credit Suisse CEO (G.)

One of Europe’s most senior bankers has said the embattled sector is “not really investable”, in remarks that underline the difficulties the continent’s big banks could face if they have to raise new funds. Tidjane Thiam, chief executive of Credit Suisse, issued the warning about the problems the sector faces as the focus remained on Deutsche Bank and its battle to reduce a $14bn (£10.5bn) penalty from the US authorities for mis-selling mortgage bonds. On Wednesday the German government raced to deny a report that it was preparing a bailout plan under which it might take a 25% stake in Deutsche Bank, which is the country’s biggest bank. With assets half the size of the German economy it is regarded as the bank that poses the biggest risk to global financial stability.

Shares in Deutsche Bank have plunged to near-30-year lows this week amid reports – which were then denied – that it had asked for German government intervention to help reduce the punishment from the US Department of Justice (DoJ). Their decline was arrested on Wednesday, when the bank sold a UK insurance company for €1bn; they closed 2% higher at €10.76. Thiam told a Bloomberg conference that Europe’s banks were in a “very fragile situation” and said there was doubt that European banks still had a viable business model. Concerns about rock-bottom interest rates and how much capital banks should hold meant returns to investors were too low, making banks “not really investable”.

Comey’s back in the Senate. A few painful minutes of that here. He’ll either have to come clean or resign.

• Rep. Gowdy Questions FBI Director Comey (USHouseJudiciary)

Get out of the EU while you can!

• Varoufakis: UK Should Activate Article 50 Now, Create Space And Time (CityAM)

Academic, EU-tormenter, former Greek finance minister and leather-jacket-wearing big thinker Yanis Varoufakis has blasted George Osborne and told the UK to get a move on with triggering Article 50. In an interview with the Today programme, Varoufakis, who resigned from the Syriza-led government last summer after he helped prime minister Alexis Tsipras take Greece to the edge of leaving the single currency, also outlined his latest thinking on what he sees as the doomed European project. Echoing statements made to the Institute of Directors yesterday, Varoufakis said the UK was about to travel into unchartered waters, and would discover just how difficult and inflexible the European institutions can be.

You can check out any time you like, as the Hotel California song says, but you can’t really leave. The proof is Theresa May has not even dared to trigger Article 50. It’s like Harrison Ford going into Indiana Jones’ castle and the path behind him fragmenting. You can get in, but getting out is not at all clear.

On what strategy the UK should adopt, Varoufakis, who was an academic before entering parliament for the first time in 2015 and diverting his considerable attention to anti-austerity campaigning, said: “My advice is simple: Activate Article 50, use those years as best you can and then strike a deal for the three or four years after Britain should be associated in a Norway-style agreement, and then use that period to have a robust debate on what’s to become later. “You need to create space and time during which to prepare yourself as a nation and a government. “The discussion before Brexit was very low quality, verging between scare-mongering on the one side and xenophobia on the other. There was no debate about a post-Brexit Britian.”

Varoufakis also suggested the Eurozone was on the brink of a breaking up and, despite calls from academics, politicians, economists and people on both the left and right that the European project is unsustainable, he believes not enough people are aware of its failures. He added: “Given these centrifugal forces, Brexit inspires several forces within the Eurozone to go it alone. The trouble with the euro … given it was very very badly constructed, is that it was always going to lead to a rupture which would make the EU totally and utterly unsustainable. “My great fear is that if the Eurozone goes, the EU goes. The repercussions are going to be dire.”

An entire list of threats.

• Hard Brexit Looms As 28 Red Lines Turn Deeper Shade Of Scarlet (BBG)

EU governments are refusing to grant the U.K. any leeway on the link between immigration and trade as it prepares to leave the bloc, raising the likelihood of a “hard Brexit.” Almost 100 days since a referendum signaled the end of Britain’s four decades of EU membership, a Bloomberg News analysis has identified a hardening of positions with even the U.K.’s traditional allies such as Ireland insisting it cannot “cherry pick” in the looming divorce talks. The U.K. “cannot have the advantages of the EU without carrying out the obligations,” Irish Finance Minister Michael Noonan said. Such intransigence may mean PM Theresa May ends up favoring a clean break from the EU to secure her goal of tougher immigration controls even if that costs the country access to the single market, a scenario dreaded by bankers and business executives.

“The dynamics within the government give the upper hand at the moment to the hard Brexit supporters,” former Foreign Secretary David Miliband told Bloomberg TV. The analysis is based on interviews and public comments from officials in all 28 EU governments. Among the other demands listed is that Britain must have “inferior” terms to what it currently enjoys as an EU member for fear that too many concessions will fan calls to leave from elsewhere in the region. Some want the U.K. to keep contributing to the EU budget in return for what benefits it does secure. Central eastern European countries are particularly animated on ensuring that the rights of their citizens to work in the U.K. are protected, with some threatening to veto any Brexit deal that doesn’t allow for that. Others are worried the U.K. will seek to slash corporate taxes.

Treason. “We think this is a crime because it involves basic public services.”

• Greece Approves Plan To Transfer State Utilities To New Asset Fund (DW)

Greece’s parliament passed new reforms on Tuesday night to cut pension expenditure and transfer control of public utilities to a new asset fund. The reforms seek to unlock €2.8 billion in financial loans as part of the country’s latest bailout program. The reforms were passed by a narrow 152-141 majority vote in Greece’s 300-seat parliament, after 152 parliamentary members of the ruling Syriza-Independent Greeks coalition approved the reform bill. Only one member of the coalition voted against the bill, along with all opposition members. The reforms will see public assets transferred to a new asset fund created by Greece’s creditors. Assets include airports and motorways, as well as water and electricity utilities.

The holding company groups together these state entities with the country’s privatization agency, the bank stability fund and state real estate. It will be led by an official chosen by Greece’s creditors, although Greece’s Finance Ministry will retain overall control. The reforms sparked significant backlash among demonstrators and public sector workers. Ahead of the vote, protestors outside of the parliament in Athens chanted, “Next you’ll sell the Acropolis!” Greece’s public sector union criticized the reforms, saying that the transfer of public assets paved the way for a fire-sale to private investors. “Health, education, electricity and water are not commodities. They belong to the people,” the union said in a statement.

Workers at Greece’s public water utility companies in Athens and Thessaloniki walked out on Tuesday to protest the reforms. “They are handing over the nation’s wealth and sovereignty,” George Sinioris, head of the water company workers association said. “We think this is a crime because it involves basic public services. We will respond with court challenges, strikes, building occupations and other forms of protest.”

” If an organisation can exhibit psychopathy then the IMF has it!”

• The Planned Destruction Of Greece Continues … (Mitchell)

After all the hoopla last year with the rise and fall of Syriza one’s attention span strays from what is happening in Greece at present and how it demonstrates the continued (and permanent) failure of the Eurozone. We also become inured to badness after badness is normalised. I was reminded of the depth of the malaise in that nation last week when I was in Kansas City. I won’t disclose confidences but an influential person (in the Greek context) I spoke to now regard their previous support for remaining within the Eurozone as a mistake and they consider my assessment of the situation (which they opposed at the time) to be closer to reality.

That was an interesting conversation and credit to them for being able to recognise an error of judgement. I was also reminded of the absurdity of the Eurozone when the IMF released its latest – Greece: Staff Concluding Statement of the 2016 Article IV Mission (September 23, 2016). This is normalisation of badness in bold! The current thinking is that the Greek unemployment rate will remain in double figures until at least 2050, that business investment has collapsed, real GDP is around 27% below its pre-GFC level – and – more significant and accelerated austerity is required. If an organisation can exhibit psychopathy then the IMF has it!

Conclusion: I haven’t written about Greece (or the Eurozone) for a while – it is depressing thinking about it really and I cannot imagine how the citizens in Greece are dealing with the planned destruction of their prosperity by highly paid officials in Brussels, Frankfurt and, particularly Washington. The scale of the destruction is beyond belief really and constitutes in my non-legal brain a crime against humanity. Someone in the IMF and Brussels should be paying for the professional incompetence that has created this human disaster.

The world on its head. We all understand that it’s Brussels that has failed to live up to its commitments. Not Greece. But let them try out that Dublin reboot on Italy, see what happens.

• Brussels Pushes Greece For Action On Migrants Before Dublin Pact Reboot (Kath.)

European officials are calling on Athens to take action by the end of this year ahead of the review and reactivation of the Dublin Regulation, which would lead to EU member-states returning migrants to Greece. The European Commission on Wednesday asked Athens to improve reception facilities, accelerate the processing of asylum claims and create separate facilities for unaccompanied minors. European Migration Commissioner Dimitris Avramopoulos said there will be no returns to Greece in the months leading up to the review of the pact, which stipulates that migrants lodge their asylum appeals in the first EU country they enter.

He said the goal remains a “gradual resumption” of migrant transfers to Greece but that “we need to avoid that an unsustainable burden be put on Greece.” Meanwhile the Commission aims to relocate 30,000 migrants from Greece to other EU countries by the end of next year. The presense of migrants in Greece has fuelled tensions with protests on Chios and in Rethymno on Wednesday.

Home › Forums › Debt Rattle September 29 2016