Johannes Vermeer The girl with the wine glass (Dame en twee heren) 1659

Here's President Putin's full speech, translated, denouncing Wagner / Prigozhin's actions as treasonous and ordering the end to the military rebellion. pic.twitter.com/EgFtNIn6pR

— Ian Miles Cheong (@stillgray) June 24, 2023

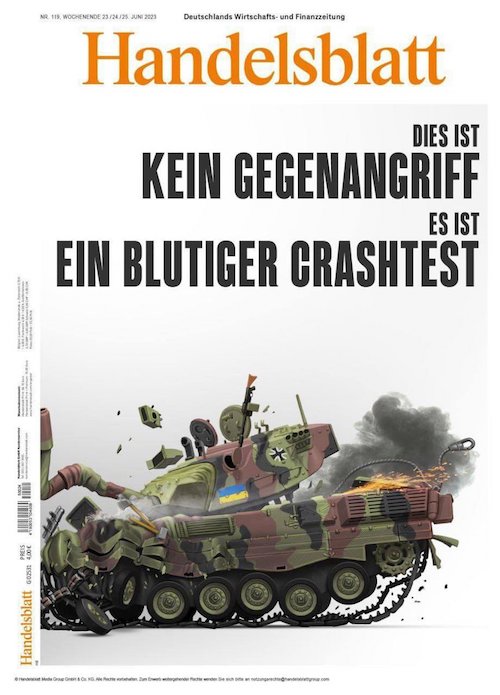

This is not a counteroffensive, it’s a bloody crashtest.

Why NATO can’t beat Russia.

-Scott Ritter pic.twitter.com/zG0Uw45WxW

— Richard (@ricwe123) June 23, 2023

Pressure difference between a space capsule and the vacuum of space: Less than 1 atm.

Pressure difference between a submersible at the Titanic and the surrounding water pressure: Nearly 400 atm. (5,600 lbs per sq inch)

Así habría implosionado el submarino Ocean que bajaba al Titanic…

— Arte y libros. (@Arteymas_) June 22, 2023

There will be no presidential elections in Ukraine until the end of the war – Zelensky

Lumumba

"The president of Ukraine is an actor. When I listen to (Zelensky), he still thinks he's acting, which is tragic because he is now acting but real people are dying. Ukraine has become a theater, where NATO is testing its weapons." — Kenyan Prof Lumumba pic.twitter.com/3V7f8UqzhZ

— sarah (@sahouraxo) June 23, 2023

Baerbock

"I put Ukraine first, no matter what my German voters think or how hard their life is"

Annalena Burbock, German Foreign Minister pic.twitter.com/2ws8euTrrw

— Sprinter (@Sprinter99880) June 23, 2023

Obama

Supporting Ukraine is "vital" for democracy, former President @BarackObama tells me. Russia's fullscale invasion "was a wakeup call to Europe… to the West and to democracies around the world, that the old ways of thinking, might makes right… those forces have to be confronted." pic.twitter.com/LHtuQB5LNf

— Christiane Amanpour (@amanpour) June 23, 2023

Jean-Pierre

HOLY SMOKES: Reporters TURN on Karine Jean Pierre, gang up on her for 4 minutes straight asking about Joe Biden's connection to Hunter's overseas business dealings after bombshell text messages reveal criminal corruption scheme pic.twitter.com/GYUhEfq6jz

— Danny De Urbina (@dannydeurbina) June 23, 2023

Kirby

Newsmax's @JamesRosenTV reads the entire text Hunter Biden sent to a Chinese businessman which stated Joe Biden was "in the room" in an effort to get him to pay them.

Kirby refuses to answer and then walks away from the podium pic.twitter.com/MsstdH4dWH

— Greg Price (@greg_price11) June 23, 2023

It’s all true. Hunter, the laptop, the bribes, the foreign cash, the money laundering to his dad. The President of the United States is a crook and a traitor. The DOJ has known all of it for years. So they’re destroying Trump’s life to protect Biden.

Holy Shit! pic.twitter.com/GUtNFrYy8d

— Karli Bonne’ (@KarliBonnita) June 22, 2023

Strange things happened in the past 24 hours. Core: until now it was Prigozhin vs Shoigu and Gerasimov. Now it’s Prigozhin vs Putin. Or at least he doesn’t leave Putin a way out.

But Prigozhin has been part of PR schemes before -Bakhmut-, to lure Ukraine into thinking they could attack, only to get slaughtered.

• Prigozhin Charged With Armed Mutiny, To Face Up To 20 Years In Prison (TASS)

The Russian Defense Ministry called the reports on strikes at Wagner PMC units false. The Ministry added that Russian forces continue to carry out missions in the special military operation area. Later, the Ministry announced that the Kiev regime took advantage of Prigozhin’s provocation and is concentrating forces of 35th and 36th Marine Brigades on the Bakhmut direction for offensive action. Kremlin Spokesman Dmitry Peskov said that President Vladimir Putin was informed about the situation around Prigozhin and “necessary measures are being taken.” According to the spokesman, all Russian security agencies report to Putin about measures being taken around the clock.

The National Antiterrorism Committee announced that Prigozhin’s statements became grounds for initiation of the criminal case over charges of calls for an armed mutiny; the Committee demanded to immediately stop illegal actions. Later, the Prosecutor General’s Office said that the criminal case was initiated legitimately and was justified. The Office promised to provide legal assessment to Prigozhin’s actions. The Wagner PMC founder may face between 12 and 20 years in prison. Prigozhin’s statements effectively constitute calls for beginning of and armed civil conflict, Russian Federal Security Service (FSB) press office said. “Prigozhin’s statements and actions effectively constitute calls for an armed civil conflict on Russian territory and a stab in the back of Russian servicemen fighting with pro-Nazi Ukrainian forces,” the press office said.

Russia’s Deputy Commander of Russian joint forces in the special military operation area Sergey Surovikin called on the Wagner PMC to comply with President Vladimir Putin’s order and to resolve all issues peacefully. “I urge you to stop. The enemy is waiting for our internal political situation to escalate. We must not play in enemy’s favor in this difficult time. Before it is too late, it is necessary to submit to the will and order to the nationally elected president of the Russian Federation, to stop the convoys, to take them back to their permanent deployment and concentration locations, and to only resolve all issues peacefully,” he said. Russia’s Channel 1 aired two special reports. The first said that the video about the “strike” on Wagner PMC positions is fake, proven by the absence of other video footage, and the fact that audio files on Prigozhin’s Telegram channel were recorded simultaneously and were published as scheduled messages. In addition, the report announced the initiation of the criminal case against Prigozhin.

Moscow’s critical facilities have been put under reinforced protection, security measures in the capital have been increased, a source in law enforcement agencies told TASS. According to the source, Russian National Guard special units were put on full alert. Car traffic has been blocked on Russia’s M-4 highway past Rostov-on-Don towards Aksay, according to TASS reported at the scene. All cars moving from Rostov-on-Don towards Aksay are being redirected back in the city, and police checkpoints have been reinforced. Checkpoints have been established near the Southern Military District headquarters in Rostov-on-Don, with military and law enforcement upholding the public order.

Military checkpoints have been established on streets adjacent to the headquarters, with numerous police cars; an armored personnel carrier was spotted near the headquarters building. The city’s central streets are being patrolled by police cars; aircraft was heard in air in Western parts of the city. No security agency has provided any official comments yet. Meanwhile, the situation at the “Wagner PMC Center” building in St. Petersburg remains calm, there are no Russian National Guard employees or employees of other security services, according to a TASS reporter. Security detail on duty debunked reports of searches in the building. Crimean authorities urged residents to only trust official information due to intensified activities of Ukraine’s Informational and Psychological Operation Center (TSIPsO).

The whole thing was started based on a bunch of videos?

• Russian MoD Denies Media Reports of Strikes on Wagner Positions (Sp.)

Earlier, videos surfaced on social media attributed to the Wagner private military contractor accusing the Russian military of hitting a Wagner camp in rear areas. The MoD has characterized these videos as a “media provocation.” Reports about Russian military strikes on Wagner rear area camps are not true, Russia’s Defense Ministry has said. “All the messages and videos distributed on social networks on behalf of [Wagner Head Yevgeny] Prigozhin about alleged ‘strike by Russian Defense Ministry on the rear camps of the Wagner PMC do not correspond to reality and are an informational provocation,” the ministry said in a statement posted to its Telegram page Friday. “The Armed Forces of the Russian Federation continue to carry out combat missions on the line of contact with the Armed Forces of Ukraine in the area of the special military operation,” it added.

Kremlin spokesman Dmitry Peskov told reporters Friday that President Putin has been “informed of all events around Prigozhin,” and said that “necessary measures are being taken.” The press secretary did not elaborate. Russia’s National Anti-Terrorism Committee said Russia’s Federal Security Service (FSB) had opened a criminal case over “calling for an armed rebellion,” and that allegations spread on behalf of Wagner chief Prigozhin were “unfounded.” “In connection with these statements, the FSB has opened a criminal case over calls for an armed rebellion. We demand that these illegal actions be stopped immediately,” the committee said. Earlier in the day, footage and audio attributed to Wagner troops and Prigozhin surfaced online alleging that a “missile attack” had been launched at a Wagner camp, and that the strike was “delivered from the rear, that is by forces of the Russian Defense Ministry.”

The voice attributed to Prigozhin appeared to call for the ouster of the Defense Ministry’s leadership. The footage and audio were immediately jumped on by Ukrainian and US state-funded media outlets, which have been reporting heavily on Prigozhin’s criticism of Russian generals in recent weeks. Wagner units and Russian Army forces jointly took part in the battle of Artemovsk (Bakhmut), liberating the Donbass city in late May after eight months of heavy fighting which pinned down large concentrations of Ukrainian troops, allowed Russia to train up its mobilized reserves, and resulted in a major defeat for Kiev ahead of its now-stalled counteroffensive.

From yesterday, before the “coup attempt”. Prigozhin says Russia is losing. Got me thinking, because that’s something not even the most pro-Ukraine western MSM reports.

• Russian Army Retreating In Ukraine, Putin Being Deceived – Prigozhin (Az.)

Russian troops are retreating along the front line in Ukraine – in Zaporizhzhia and Kherson, while the Russian Defense Ministry and the Russian General Staff are talking about a possible victory and are providing false information to Russian President Vladimir Putin, Head of Wagner PMC Yevgeny Prigozhin said, Report informs referring to Russian media. He noted that the Armed Forces of Ukraine are actively neutralizing the Russian army, adding that the Ministry of Defense and the General Staff ‘still hope that they can win this war’ and ‘thoroughly deceive the president.’

In his video, Prigozhin shared his vision of the events taking place in Ukraine. In particular, the founder of PMC Wagner said that by February 24, 2022, the situation in Donbass was no different from what had been happening there since 2014. Ukraine was not going to attack Russia together with NATO. The Ministry of Defense, speaking about the upcoming Ukrainian offensive, deceived both the public and the President of Russia, Prigozhin claims. The war was needed only so that a ‘bunch’ of people simply ‘triumphed and promoted,’ as well as the oligarchs who profit from it, Prigozhin noted.

Also from yesterday, and also a strange statement.

• Prigozhin Says Russia’s Invasion of Ukraine Unjustified (MT)

Russia did not face an imminent security threat to justify its full-scale invasion of Ukraine, Yevgeny Prigozhin, the founder of Russia’s Wagner mercenary outfit, said in a bombshell video posted on social media Friday. “The Armed Forces of Ukraine were not going to attack Russia with the NATO bloc,” Prigozhin explained in the half-hour tirade released by his press service. “The Russian Defense Ministry is deceiving the public and the president,” he added. Prigozhin’s comments were at odds with the casus belli given by President Vladimir Putin when he ordered troops into Ukraine last February, although the private army chief avoided personally attacking the Russian leader. Putin has cited NATO expansion near Russia’s borders as one of the main justifications for invading neighboring Ukraine.

Meanwhile, Prigozhin escalated his criticism of Russian Defense Minister Sergei Shoigu by claiming that Russia went to war “for the self-promotion of a bunch of bastards.” He blamed Russia’s military leadership for “poorly planning” the invasion and “embarrassing” the military after a series of setbacks on the battlefield last year. “Shoigu killed thousands of the most combat-ready Russian soldiers in the first days of the war,” he charged. “The mentally ill scumbags decided ‘It’s okay, we’ll throw in a few thousand more Russian men as ‘cannon fodder.’ ‘They’ll die under artillery fire, but we’ll get what we want’,” Prigozhin continued. “That’s why it has become a protracted war.”

Prigozhin also accused Kremlin-linked oligarchs of seeking to plunder Ukraine’s resources after its military capture and appointment of a puppet regime in Kyiv. “The task was to divide material assets in Ukraine. There was widespread theft in the [industrial eastern Ukrainian territory of the] Donbas, but they wanted more.” Some analysts have interpreted Prigozhin’s latest comments as a sign of his growing political ambitions. He addressed the Ukrainian forces’ ongoing counteroffensive in similarly critical terms, saying the Russian army is retreating from the partially occupied Zaporizhzhia and Kherson regions. “We are washing ourselves in blood. No one is bringing reserves. What they tell us is the deepest deception,” Prigozhin said, referring to Putin and Shoigu’s claims that Russia is successfully pushing back Ukrainian counterattacks.

“Mikhail Podoliak, a senior aide to Zelensky, blamed the offensive’s failure on the West’s apparent hesitance to give Kiev all of the heavy weapons it asked for..”

• Zelensky May ‘Sacrifice All Of Europe’ – Russian Envoy (RT)

Ukrainian President Vladimir Zelensky could stage a false-flag attack at the Zaporozhye Nuclear Power Plant (ZNPP) in order to provoke NATO intervention, Russia’s deputy permanent representative to the UN, Dmitry Polyanskiy, warned on Friday. Polyanskiy said on Twitter that Russia had “just drawn attention to these plans of [the] Kiev regime during the UN Security Council meeting” that morning. “The whole of Europe may be easily sacrificed by Ze and his blind Russophobic sponsors,” he added. “Don’t tell us we didn’t warn you!” Zelensky’s “plan” – according to some pro-Russian commentators – would involve causing a nuclear accident at the ZNPP facility, which has been under Russian control since the early days of the special military operation in Ukraine. According to this theory, Kiev would then blame the ensuing disaster on Russia, leading NATO to openly declare war on Russia in response.

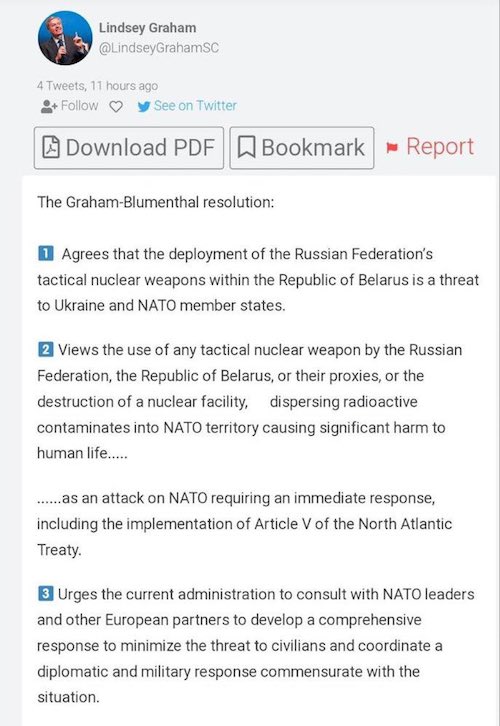

This exact scenario was mapped out by US Senators Lindsey Graham and Richard Blumenthal on Thursday. The two lawmakers proposed a resolution under which the US would consider a meltdown at the plant as an act of war against NATO, due to the fact that Poland would be affected by radioactive fallout. Russia’s ambassador in Washington, Anatoly Antonov, cautioned that the “crazy” resolution could be laying the groundwork for such a false-flag incident. Zelensky claimed on Thursday that Russia is preparing a “terrorist act” at the ZNPP, adding that “radiation knows no borders” and “who it hits” will depend on the “direction of the wind.” Russia has repeatedly accused Ukraine of shelling the ZNPP, with Moscow’s permanent ambassador to the UN, Vassily Nebenzia, demanding on multiple occasions that the UN Security Council order Kiev to cease firing on the plant. Ukrainian forces also made several attempts to retake the plant by crossing the Dnieper River last year, and allegedly attacked it with explosives-laden drones on Friday morning.

“Ukraine blew up the Nova Kakhovka hydroelectric power station in order to distract the world from the failures of their much-publicized counteroffensive,” Zaporozhye authorities said in a statement. “Now they need another disaster, this time a nuclear one, for which they will again blame Russia.” Launched at the beginning of this month, Ukraine’s counteroffensive has cost Kiev 13,000 troops so far, without netting any significant territorial gains, according to the Russian Defense Ministry. With American and Western officials reportedly displeased, Mikhail Podoliak, a senior aide to Zelensky, blamed the offensive’s failure on the West’s apparent hesitance to give Kiev all of the heavy weapons it asked for in recent months.

“..obsessed with this notorious counterattack, set little store on the interests of their people and the future of their country..”

• Russian UN Ambassador Says Ukrainian Counteroffensive ‘Suicidal’ (TASS)

The counteroffensive from Ukraine’s armed forces is fully self-destructive, set in motion with complete disregard for the interests of the Ukrainian people, Russian UN Ambassador Vasily Nebenzya told a meeting of the UN Security Council on Friday. “Ukraine’s armed forces have been conducting a suicidal counteroffensive against Russian positions for almost a month now; it has already cost them tens of thousands of mobilized men, several hundred pieces of armored hardware, and it is called in Ukrainian society none other than the Zaporozhye slaughter,” Nebenzya said. “As was the case with the Bakhmut slaughter, where the Kiev regime sent Ukrainian soldiers to their deaths for several months just to prove to Western arms suppliers that Ukraine could defeat Russia.

Of course, they only succeeded in proving the opposite, which [Ukrainian President Vladimir] Zelensky and his clique are trying to forget today.” “Now they face a bigger task: how to make a victory out of a complete fiasco and defeat. Toiling on this task together with them are Washington, London and Brussels, who never think about Ukraine as such and its interests,” the UN ambassador went on to say.

“Against the background of what is going on, it is even more evident today that they are interested in this country only as an instrument to weaken or at least restrain Russia. That is why they will not let the puppet regime in Kiev have any peace talks, at least as long as there are still some Ukrainians left. The same way they didn’t allow it to be done in March last year, as Russian President Vladimir Putin explained in detail at a meeting with African leaders,” Nebenzya said. “It is obvious that those in Kiev, who are behind this terrorist attack (Kakhovka hydroelectric power plant blast – TASS), obsessed with this notorious counterattack, set little store on the interests of their people and the future of their country,” the diplomat stressed.

“..Russia called up 300,000 reservists on top of the 150,000 force that they went into Ukraine with..”

• West in Denial About Failure of Ukrainian ‘Counter-Offensive’ (Tweedie)

Former CIA director and US Central Command chief General David Petraeus predicted on June 6, two days into Kiev’s southern offensive, that “the Russians will prove to be more brittle than the expectation is” when faced with Western-supplied armour, also claiming that Moscow’s troops were poorly trained, equipped and led and exhausted after a year on the front line without a break. Since then, the Russian army’s Vostok (East) battlegroup has destroyed at least 246 Ukrainian tanks, including 13 NATO models including the vaunted Leopard 2s, along with more than 440 other armoured vehicles, while the Ukrainian forces have suffered some 13,000 casualties Military analyst Mark Sleboda told Sputnik that Petraeus’ statements were “blatantly false.”

“First of all, Russia called up 300,000 reservists on top of the 150,000 force that they went into Ukraine with,” he pointed out. “These are all people who had prior experience in the military, and then they received over eight months of training since they were called up on top of this.” He also attacked the Western view of the conflict as akin to a heroic war film. “Some people believe this is a Hollywood movie and expect results,” Sleboda noted. “No it’s not. Why would we think that this is a Hollywood movie?” “We had videos of this Kiev regime information war, which they have always prioritized over the real war,” Sleboda underscored. “We had a number of Ukrainian military flashing through them, showing them all shushing us into silence, assuring us that there is a plan for the counteroffensive.”

That was followed by an “obvious deepfake video” of Ukrainian military intelligence chief Kyrylo Budanov, believed hit by a Russian missile strike on his Kiev headquarters on May 29, “staring into the camera for a interminable period of time, blinking oddly at these intervals.” The military analyst predicted that once the Ukrainian offensive runs out of steam, Russia will mount a counter-offensive in the “proper use of the term.” “But it probably will not look like a big arrow sweeping Hollywood style offensive, like we’ve been expected to believe,” Sleboda said. “I expect it will be more of the same focused on liberating the last these fortress strongholds in the Donbass.”

“There won’t be a big tank blitzkrieg, riding on the minefields, because we’ve seen how well they work for Kiev,” the security expert stressed. “It will be doing what works for them, which is the slow grind of artillery and air power from above.” The analyst argued that Russia was much better prepared for a protracted conflict than the Kiev regime and its Western masters. “Putin is definitely sending signals that Russia considers that it is in this conflict for the long term,” Sleboda said, but the US and NATO as a whole “are running low on the stockpiles of many items that are essential for the Kiev regime to continue the conflict, like artillery shells.”

“‘Western’ equipment is more complex than Soviet era stuff. It also requires more specialized maintenance. The Ukraine received a zoo.”

• The Counteroffensive Had No Chance. NATO Failed To Explain That (MoA)

At the end of 2022 the Ukrainian army had been exhausted and had been already been destroyed twice. The Russians had first destroyed large parts of the original equipment of the Ukrainian army and then the Soviet era equipment that was brought to Ukraine from former Warsaw Pact nations. More importantly they had killed or wounded many of the experienced non-commissioned staff (Sergeants etc) and lower rank officers of the Ukrainian military that command and are the core of each company. The newly mobilized Ukrainian forces did not have the knowledge or training necessary to replace them. ‘Western’ equipment is more complex than Soviet era stuff. It also requires more specialized maintenance. The Ukraine received a zoo.

The many types of equipment and the many incompatible kinds of ammunition they use are a logistic nightmare. ‘Western’ training for the mobilized Ukrainian forces did not bring up more capable soldiers than Soviet training would have done. Those who watched NATO stumble in Yugoslavia, Afghanistan, Iraq and Libya should have recognized that. Russian on the other side mobilized 300,000 soldiers who mostly had been contract soldiers before they had returned to private life. They received extensive refresher training. They now mostly get paid more than in their civilian life which certainly helped to increase their motivation. Russia also changed the structure of its military. The main Russian fighting force in 2022 was made up of Brigade Tactical Groups (BIG). Each of them was part of a garrison brigade which next to the one contract soldier BTG had additional battalions that were mostly training conscripts. Under Russian laws the conscript battalions could not be used on foreign ground.

The fighting BTG’s had few real infantry soldiers. Next to their 9 infantry platoons they had 8 artillery and 5 auxiliary platoons. Of a total of some 800 plus soldiers in a BTG only 200 were actually infantry that could man the trenches. The whole structure was too big and too difficult to command. After the mobilization had brought up enough men the Russian military changed from BTGs to a mobile brigade structure. Under a higher commander the brigade holds two or three battalions that each consist of three or four companies of mobile infantry or tanks. Most of the artillery and auxiliary troops of the former BTGs are now concentrated under the brigade structure and can be used more flexible wherever they are needed. The tooth to tail ratio in the frontline battalions is now much higher than in a BTG and the whole structure is easier to command.

Twitter thread by @MikaelValterss1

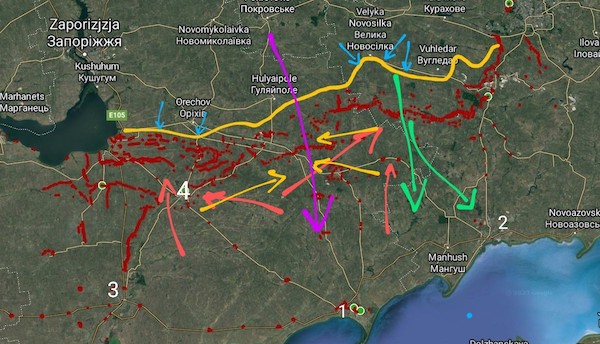

• Analysis Ukrainian Counteroffensive Part 2 June 23 (Valtersson)

Some asks how I can say that the Ukrainian counteroffensive already is a failure. Many Ukrainian units haven’t seen combat yet, so things could change. The easy answer is that it’s hard to make up for early losses. UkrAF has 40-50 good field brigades, usable for offensive purposes. A problem is that many soldiers are raw and have had to short training, but the brigades also has many battle hardened veterans and good weaponry. Half of these are on the Southern front and half on the Eastern front. Earlier a large part of them used to be a strategic reserve. On the Southern front about a third of the units has seen combat and maybe two thirds on the Eastern front. All in all, half of the brigades has seen combat recently. Half a dozen of the brigades has been rotated away. Probably due to high losses. That’s mean that 12-15 percent of the Ukrainian Field Army is used up since the beginning of June.

On the Eastern front there are a lack of fresh Ukrainian units and the possibility of major Ukrainian counteroffensives are limited. Some believe that Ukraine prepares for a large scale offensive e near Kreminna, but I think that’s unlikely, even though a large number of Ukrainian brigades are stationed there. But many of these are made up of fresh recruits with limited training and no heavy equipment. The better brigades are in the second line. This positioning of units are probably to defend against a Russian offensive, with the good brigades as counterattack units. On the Southern front, Ukrainian forces probably are in a quandary about what to do. Abandoning the Counteroffensive and save unit or gamble everything on success.

The original plan was probably to attack in the west and east with strong forces (blue arrows), making so large breakthroughs that Russian reserves would be moved there (red arrows) and leaving the Centre exposed. The second attack would come in the centre (purple arrow) with the aim of breaking through to the Russian rear and move towards Berdyansk (1). If Russian reserves turned around and attacked the Ukrainians I the Centre (yellow arrows), Ukrainian reserve units could move eastwardsand, help breaking through south of Vreminka salient (green arrow) and move towards Mariupol (2). I don’t think the attacks in the west towards Tokmak (4) and Melitopol (3) was the main push, since there are many strong defencelines to fight through to get there.

In the Centre and south of Vreminka salient the Russian defences are much thinner and easier to break through. Unfortunately for the Ukrainians, Russian units, air power, artillery, mine fields etc was much stronger than expected. So there was no need to move around reserves to handle Ukrainian breakthroughs. Instead the Ukrainian avant-garde brigades got severely mauled by Russian forces. Now the UkrAF are clerly weakened after dozens of attacks against the Russian forward positions,not even getting to the real russian fortifications. If things continue like this the coming 19 days 25-30 percent of the assault brigades in the south will be spent and all reserves used up on the Eastern front. Even if there are some territorial gains, larger than the first 19 days, the brigades left, probably aren’t strong enough to achieve a breakthrough of the Russian main defencelines and if they could do that, there wouldn’t be much left to continue advancing.

Especially with Russian strategic reserves arriving on the Southern front. The offensive isn’t over and it might continue during the summer. But if it does Ukraine might have spent most of their offensive power to do nothing in the South, all the while RuAF might have used Ukrainian preoccupation with Zaporizhia and South Donetsk to make own breakthroughs in the East and North. Breakthroughs hard to contain if Ukraine spends its offensive power running into a wall in the South. Abort the Counteroffensive and save the reserve to counter russian offensives.

Jim Rickards: “Foreign Affairs is the voice of the globalists. Last year they discussed a Ukrainian victory and the end of Putin. Today, it’s a stalemate and armistice. Next year it will be Ukrainian terms of surrender. They just don’t get it. Russia is a superpower.”

• Why an Armistice Offers the Best Hope for Peace in Ukraine (Foreign Affairs)

Today, the Korean Peninsula remains a site of high geopolitical tension. North Korea is governed by a dictator who brutally represses his citizens and regularly threatens his neighbors with nuclear weapons. But the carnage of the Korean War is now a distant memory, and the peace produced by the armistice allowed South Korea to develop a robust economy and, eventually, a stable liberal democracy. For all its flaws, the armistice was a success. The war ravaging Ukraine today bears more than a passing resemblance to the Korean War. And for anyone wondering about how it might end, the durability of the Korean armistice—and the high human cost of the delay in reaching it—deserves close study. The parallels are clear.

In Ukraine, as in Korea seven decades ago, a static battlefront and intractable political differences call for a cease-fire that would pause the violence while putting off thorny political issues for another day. The Korean armistice “enabled South Korea to flourish under American security guarantees and protection,” the historian Stephen Kotkin has pointed out. “If a similar armistice allowed Ukraine—or even just 80 percent of the country—to flourish in a similar way,” he argues, “that would be a victory in the war.” The negotiations that produced the Korean armistice were long and difficult and took place alongside heavy fighting, before the war’s costs were clear enough to persuade either side to compromise. The same would likely be true today.

The Korean experience also suggests that the obstinacy of Russian President Vladimir Putin—who, like Stalin, seems averse to compromise of any kind—could be especially obstructive. On top of that, domestic politics in the United States and the gap between Washington’s and Kyiv’s legitimate but distinct interests could trip up a cease-fire. At the moment, debate in Washington often focuses on the question of when would be the right time to start pushing Ukraine to negotiate, and the consensus answer has generally been, “Not yet.” The Korean War shows that, in a military stalemate, it can take a very long time for both sides to clearly see that the costs of continuing to fight are outweighing the benefits. And by the time they do, a great deal of death and destruction can occur without producing any meaningful advantages.

If the United States, NATO, and other supporters of Ukraine do decide to work toward a cease-fire, the end of the Korean War offers three practical lessons. First, they must be willing to fight and talk simultaneously, using battlefield pressure to enforce demands at the negotiating table. Second, they should include the United Nations in any negotiations, since neutral arbiters are an asset. Finally, they should condition future security assistance and postconflict support for Ukraine on Kyiv’s willingness to make some concessions. A complete victory for Ukraine and the West and a total defeat for the other side would be a welcome end to the Ukraine war, just as it would have been in Korea. And as in Korea, the risk of escalation confounds such an outcome. Kyiv, Washington, and their partners in opposing Moscow’s aggression should understand that an armistice that both Ukraine and Russia can accept—even if it fails to settle all the important questions—would still be a win.

A nuke attack would activate Article 5. So you fake one.

• Envoy Slams US Senators’ ‘Absurd’ Claims About Nuclear Strike on Ukraine (Sp.)

Earlier, US Senator Lindsey Graham (R-SC) said the lawmakers were introducing a resolution to consider the use of a nuclear weapon by Russia in Ukraine as an attack on the NATO alliance. US senators’ speculations about the possibility of Russia using nuclear weapons in Ukraine are absurd and contribute to the escalation of tensions, Russian Ambassador to the United States Anatoly Antonov said on Thursday.”Speculations about Russia’s possible use of tactical nuclear weapons are absurd. The provocative and short-sighted rhetoric of US lawmakers only contributes to the escalation of tensions and increases the risk of the situation sliding to an even more dangerous line,” Antonov said in a statement shared among media.

Antonov slammed the resolution as another “crazy initiative” of “Russophobe senators” in the US. Russia’s deployment of tactical nuclear weapons in Belarus was done on legal grounds, the ambassador noted. “We have not violated a single international obligation and have done exactly what the Americans have been doing for decades, deploying nuclear bombs on the territories of European allies,” Antonov said.The ambassador suggested that these speculations serve to prepare the world community for a false-flag provocation at the Zaporozhye nuclear power plant by sliding a “dirty bomb” there and blaming it on Russia.

Russian President Vladimir Putin said in mid-June that Russia had transferred the first part of the nuclear warheads to Belarus and would complete the task of moving tactical nuclear weapons completely by the end of the year. Putin said the deployment was an element of deterrence and a signal to those thinking about inflicting a strategic defeat on Russia. Russian Foreign Intelligence Service head Sergey Naryshkin said earlier in June that Kiev could continue to work on the creation of a “dirty bomb,” adding that the possible use of the “dirty bomb” by Kiev would have severe consequences for the life and health of the entire population and ecosystems of Eastern Europe.

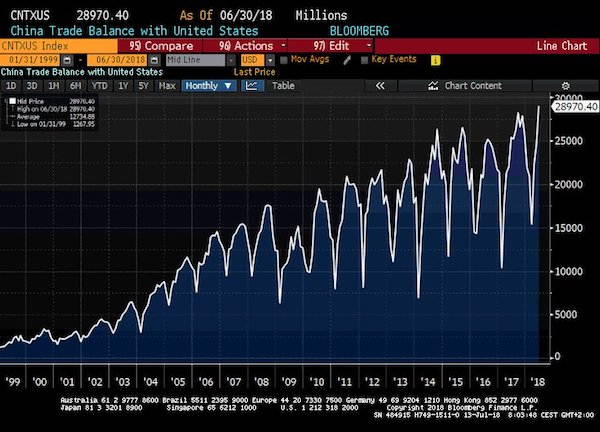

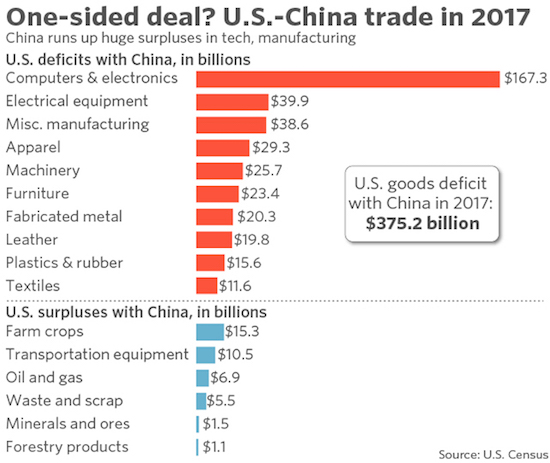

Well, sure, but China could rise because they produced cheaper and thus made US corporate profits bigger.

• The PRC’s Rise Is A Failure Of American Presidential Leadership (Thayer)

The foundation of the People’s Republic of China’s rapid growth was laid by Deng Xiaoping. Yet, it could not have been accomplished without U.S. support and cooperation. That the PRC is now the principal enemy of the United States and its challenger in all aspects of global politics is prima facie evidence of the failure of U.S. presidential leadership to prevent its rise. The fundamental responsibility of every U.S. president was to defend the safety and national security of the United States. Since the end of World War II, the central objective of every U.S. president was to sustain what their predecessors had created. Then, having defeated one peer competitor, the Soviet Union, their obligation was to prevent the rise of another. It was an easier strategic task given the abject poverty and military weakness of the PRC.

Thus, sustaining the status quo should have been a far easier task than generating U.S. victory in World War II and the defeat of the Soviets in the Cold War. Yet they failed. This failure compels an examination of why it occurred, and thus why post-Cold War U.S. presidents wasted what had been provided by previous generations. The buck stops with the U.S. presidents. During this period—Bill Clinton, George W. Bush, and Barack Obama squandered our earned advantage, before Trump attempted to reverse course, and now Joe Biden appears to be reversing Trump’s course correction.

An accounting begins with the recognition that presidential leadership regarding the PRC threat was absent in the aftermath of the Cold War. In fact, the U.S. aided the PRC’s rise through ever-greater volumes of trade and investment. While President Jimmy Carter granted Most Favored Nation (MFN) trade status to Beijing in 1980, the PRC’s growth did not take off until Deng fully supported capitalism in the wake of his 1992 economic reforms. Two years later, President Clinton ended the need for MFN renewal on a yearly basis, which had been linked, at least, to improvements in the PRC’s atrocious human rights record. Clinton granted the PRC MFN status on a permanent basis and placed the PRC on the path towards membership in the World Trade Organization (WTO). The PRC then entered the West’s economic ecosystem. From that time, the PRC’s rise was rapid and added a new peer competitor.

“..Victoria Nuland, the architect of the 2014 EuroMaidan coup in Kiev, has said “the war is going to last six years, 16 years. So it basically depend on the new president who’s going to continue, how far he’s going to go.”

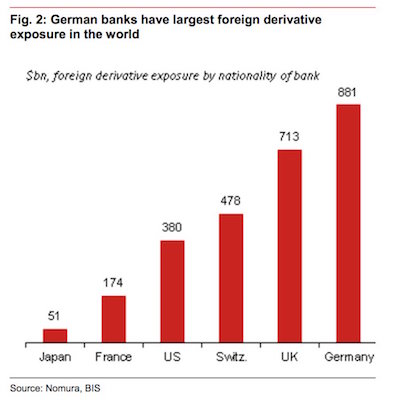

• Cash-Strapped Europe Still Paying to Arm Ukraine for Proxy Conflict (Tweedie)

Europe is spending ever more on arming Ukraine — while its populations become increasingly impoverished. European Commission President Ursula von der Leyen is set to demand at a Ukraine aid conference in the UK that member states stump up a further €50 billion to cover the cost of financial and military aid to the Kiev regime. That comes as governments of European Union and NATO members implement austerity policies and raise interest rates to extortionate levels in the face of the inflationary crisis brought on by sanctions on Russia. Brussels-based journalist Elijah J Magnier told Sputnik that the “Eurocrat” von der Leyen’s demand was out-of-touch “when Europe is under a stress and financial difficulties, when the French President, Emmanuel Macron, is having [disagreement] with the population because you want to increase the pension scheme saying there is no money.”

“It is really not appropriate and doesn’t correspond to the suffering that the European citizens are going through,” Magnier stressed. The major concern is that “Europe is preparing itself too, for a long war with Russia,” Magnier warned. “It means Europe is doubling down, is not facing the reality that the Ukrainians are losing, that at the end of the day, every war is solved only around the table.” “When we hear the Americans saying: ‘we will send F-16s’, capable of carrying nuclear bombs, or we going to give Ukraine weapons or ammunition with depleted uranium, it seems that what has been done so far by the 50 Western nations and their allies meeting in Ramstein in Germany, has not been enough to drag Russia into a wider-scale war.” The journalist noted that US Under Secretary of State Victoria Nuland, the architect of the 2014 EuroMaidan coup in Kiev, has said “the war is going to last six years, 16 years. So it basically depend on the new president who’s going to continue, how far he’s going to go.”

“We are treated in these twilight months of the “Joe Biden” regime to a cavalcade of revelations laying out the degeneracy of a federal justice system at war with the American people..”

• Teachable Moment (Jim Kunstler)

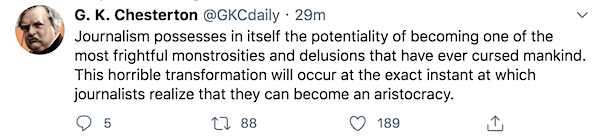

I hope you agree this has been an instructive week for our republic, sinking to the bottom as fast as the Titan submersible on its way to consort with its grandmama, the RMS Titanic. Here’s what I learned, for instance, from Special Counsel John Durham’s visit to the House Judiciary Committee: When asked why he did not seek grand jury testimony from the primary culprits in the Russia Collusion hoax — Comey, McCabe, and Strzok — he told the room it would have been “unproductive” because they habitually claimed to “not recall” anything when testifying in Congress. That’s an interesting legal theory. If it is so, we must suppose that any witness in a criminal inquiry may decline testifying on the grounds of claiming a defective memory. I’m not a lawyer, of course, but is it not the case that witnesses can be prompted to recall events when presented with evidence? E.g., “…here is your smartphone text of July 29 saying, ‘Don’t worry, we’ll stop him [Trump].’ What means did you have in mind to accomplish that, Mr. Strzok?”

In the four-year lead-up to his personal appearance in the House, many of us were fooled into thinking Mr. Durham was a serious dude. (I sure was.) Turns out the ferocious facial hair masked a rather timorous persona. Mr. Durham apparently did not dare test the boundaries of the narrow lane laid out in the scoping directives set forth by then Attorney General Barr. Mr. D. did find a line of criminal conduct between Lawfare artist Michal Sussmann, the Fusion GPS disinfo company, the DC law firm Perkins Coie, and candidate Hillary MyTurn in the creation and marketing of the Steele Dossier — yet he never called Hillary to do any ‘splainin about it (or anything else she did in 2016). Weird, a little bit.

While his omissions and missteps were spotlighted by the Republican members, Mr. Durham was mugged, kicked to the curb, stomped, and peed-on by the committee Democrats, who still labor to prop-up the dead-letter Russia Collusion fraud against all evidence and reason. As usual, the lead attack dog on that was Rep. Adam Schiff (D-CA). He was rewarded the next day with a censure vote for seven years of shameless lying about said fraud, and stripped of his seat on the House Intel Committee, which he used, as then-chairman, to launch Trump Impeachment #1 in 2019 with fake “whistleblower” (and CIA goblin) Eric Ciaramella, whom Mr. Schiff naturally lied about never meeting prior to the proceeding.] We are treated in these twilight months of the “Joe Biden” regime to a cavalcade of revelations laying out the degeneracy of a federal justice system at war with the American people and its shady machinations in service to the Biden family global bribery operation.

Babies

"Oh, you have babies… can I see them?" pic.twitter.com/fXU8dKGCtU

— B&S (@_B___S) June 23, 2023

Human hand vs eagle’s talon

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.