Andreas Feininger Production B-17 heavy bomber at Boeing plant, Seattle Dec 1942

Now that the MSM is slowly and finally waking up to the reality of the virus, the information to read and post and comment on, becomes overwhelming. Last week I twice took out the virus-related info to include in separate articles (Virus Rattles if you will), but today I need the extra time doing that involves, for other things.

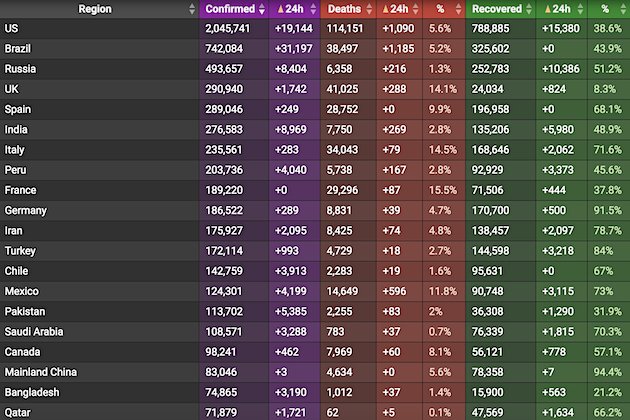

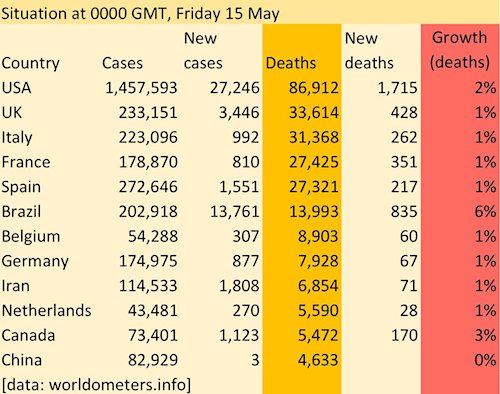

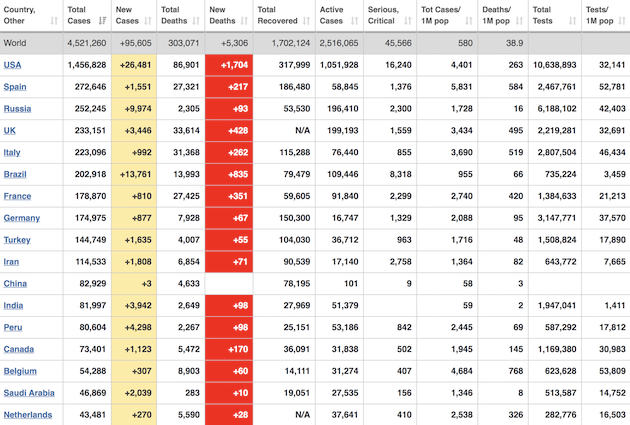

Still, one observation: yesterday, we saw the highest daily death toll of the entire crisis. Today, we see the lowest. As Xi is pushing hard for the economy. Credibility remains a major issue.

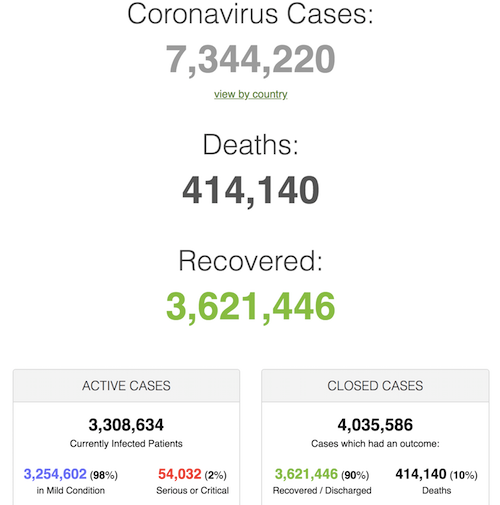

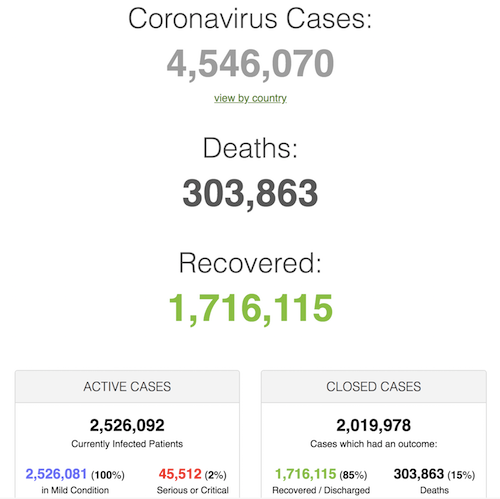

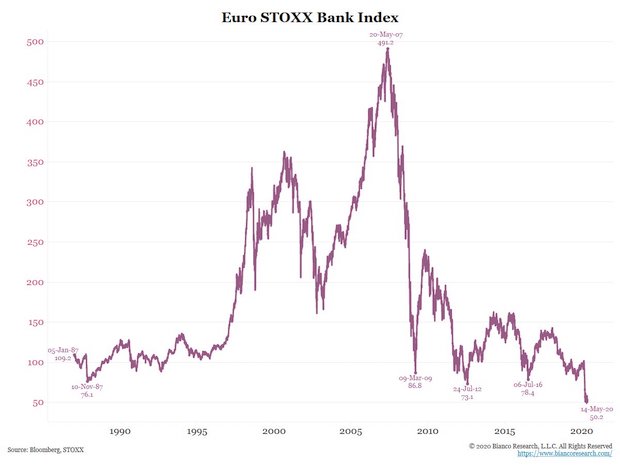

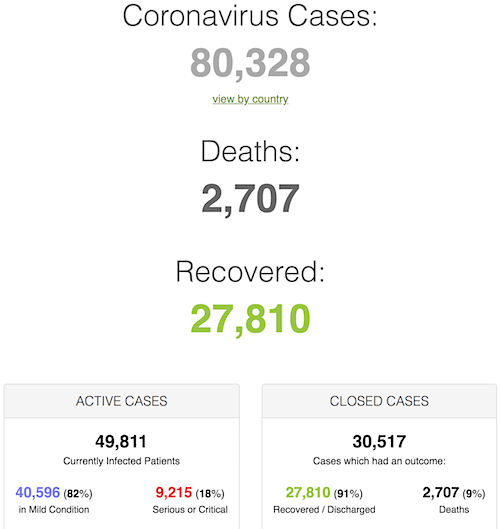

• Cases 80,328 (+ 621 from yesterday’s 79,707).

• Deaths 2,707 (+ 81 from yesterday’s 2,626)

From SCMP:

From Worldometer:

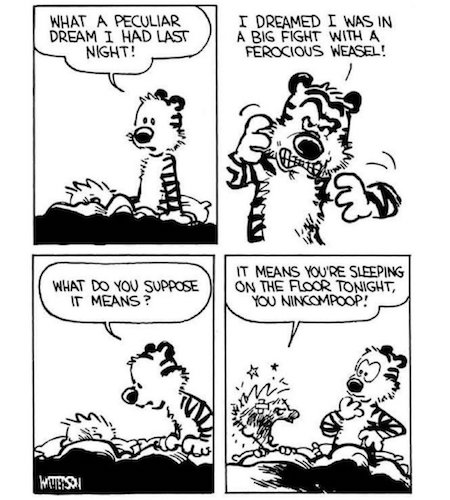

Ben Hunt keeps his eyes on the ball:

“..build dedicated treatment wards before they’re required..”

“..protect healthcare professionals before they get sick..”

“..update our testing and diagnostic capabilities before they are swamped..”

“..bolster our healthcare systems BEFORE the need overwhelms the capacity..”

• The Fall of Wuhan (Ben Hunt)

Last week I wrote about the corrupt political response of the World Health Organization to COVID-19. This week I’m writing about the corrupt political response of the United States to COVID-19. Because it’s happened before. In August 2005, the city of New Orleans fell. New Orleans did not fall because of Hurricane Katrina. New Orleans fell because of the corrupt political response to Hurricane Katrina. “We can stabilize the situation. Again, I want to thank you all. Brownie, you’re doing a heckuva job!” – President George W. Bush. In January 2020, the city of Wuhan fell. Wuhan did not fall because of COVID-19. Wuhan fell because of the corrupt political response to COVID-19.

“Wuhan is a heroic city, and people of Hubei and Wuhan are heroic people who have never been crushed by any difficulty and danger in history. All regions and departments performed their duties actively and conscientiously.” – Xi the Commander (no, I am not making this up; this is how the Xinhua news service describes him now … “Xi the Commander”) A corrupt political response is always the same. It never changes in form. It never changes in function. A corrupt political response occurs when a political leader sacrifices national interest for regime or bureaucratic interest … when a constructed narrative of “Yay, Calm and Competent Control!” is maintained for the political benefit of the Leader at the expense of the Led.

Oh, the Leader and his flunkies will convince themselves that the narrative “is in the public interest” … that the narrative will “buy them time” … that the narrative is necessary because “the other side” would do the same or worse if given half a chance. It’s all the excuses that all the Renfields to all the professional politicians tell themselves as they slowly sell their souls. It’s what every President and every Director-General and every Senator and every CEO eventually comes to believe, that their personal interests are identical to “their” people’s interests.

[..] Every once in a very great while, an honest-to-god crisis reveals the political self-interest and mendacity behind your carefully constructed narrative of “Yay, Calm and Competent Control!” . Like the fall of New Orleans revealed George W. Bush. Like the fall of Wuhan revealed Xi Jinping. What we must prevent today is the NEXT city to fall. We must prevent the fall of Daegu. We must prevent the fall of Qom. We must prevent the fall of Milan. Looking ahead, we must prevent the fall of Yokohama. We must prevent the fall of San Francisco. Because containment has failed. What we’re seeing in South Korea, Iran and Italy is what exponential disease propagation looks like in the real world. Real world data is spiky. Real world data is messy. Real world exponential growth looks like nothing, nothing, nothing … then cluster, cluster, cluster … then BOOM!

[..] Containment has failed. And so now we must fight. As individuals that means social distancing. As individuals that means doing what we can to stay healthy and prepare for a storm. As a nation that means a war-footing to build dedicated treatment wards before they’re required, to protect healthcare professionals before they get sick, to update our testing and diagnostic capabilities before they are swamped … to do everything possible to bolster our healthcare systems BEFORE the need overwhelms the capacity. Above all, that means calling out our leaders for their corrupt political responses to date, and forcing them through our outcry to adopt an effective virus-fighting policy for OUR benefit, not theirs. We got this.

Read more …

2nd-3rd scientist saying this. By then mortality rate will likely be 1% or so. But 1% of a huge number is a huge number in itself.

• 40-70% Of People Will Be Infected With COVID19 – Epidemiologist (Atl.)

The Harvard epidemiology professor Marc Lipsitch is exacting in his diction, even for an epidemiologist. Twice in our conversation he started to say something, then paused and said, “Actually, let me start again.” So it’s striking when one of the points he wanted to get exactly right was this: “I think the likely outcome is that it will ultimately not be containable.” [..] Lipsitch predicts that, within the coming year, some 40 to 70 percent of people around the world will be infected with the virus that causes COVID-19. But, he clarifies emphatically, this does not mean that all will have severe illnesses. “It’s likely that many will have mild disease, or may be asymptomatic,” he said. As with influenza, which is often life-threatening to people with chronic health conditions and of older age, most cases pass without medical care. (Overall, around 14 percent of people with influenza have no symptoms.)

Lipsitch is far from alone in his belief that this virus will continue to spread widely. The emerging consensus among epidemiologists is that the most likely outcome of this outbreak is a new seasonal disease—a fifth “endemic” coronavirus. With the other four, people are not known to develop long-lasting immunity. If this one follows suit, and if the disease continues to be as severe as it is now, “cold and flu season” could become “cold and flu and COVID-19 season.” At this point, it is not even known how many people are infected. As of Sunday, there have been 35 confirmed cases in the U.S., according to the World Health Organization. But Lipsitch’s “very, very rough” estimate when we spoke a week ago (banking on “multiple assumptions piled on top of each other,” he said) was that 100 or 200 people in the U.S. were infected.

That’s all it would take to seed the disease widely. The rate of spread would depend on how contagious the disease is in milder cases. On Friday, Chinese scientists reported in the medical journal JAMA an apparent case of asymptomatic spread of the virus, from a patient with a normal chest CT scan. The researchers concluded with stolid understatement that if this finding is not a bizarre abnormality, “the prevention of COVID-19 infection would prove challenging.” Even if Lipsitch’s estimates were off by orders of magnitude, they wouldn’t likely change the overall prognosis. “Two hundred cases of a flu-like illness during flu season—when you’re not testing for it—is very hard to detect,” Lipsitch said. “But it would be really good to know sooner rather than later whether that’s correct, or whether we’ve miscalculated something.

The only way to do that is by testing.” Originally, doctors in the U.S. were advised not to test people unless they had been to China or had contact with someone who had been diagnosed with the disease. Within the past two weeks, the CDC said it would start screening people in five U.S. cities, in an effort to give some idea of how many cases are actually out there. But tests are still not widely available. As of Friday, the Association of Public Health Laboratories said that only California, Nebraska, and Illinois had the capacity to test people for the virus.

Read more …

The sleight of hand used to argue for factories restarting: “Xi said that as many as 1,396 counties and districts, some 46% of the nation’s total, had not reported a single confirmed case of the coronavirus.”

• Xi Jinping Rings Alarm On Economy As China Shifts Priority To Growth (SCMP)

President Xi Jinping has rung the alarm bell on China’s economic growth as worries mount over the coronavirus’ impact on the economy, unemployment and global supply chains. Speaking on Sunday, Xi made it clear that the priority for most of the country was to get the world’s second biggest economy up and running after extensive delays. “It is unavoidable that the novel coronavirus epidemic will have a considerable impact on the economy and society,” said Xi in a lengthy televised address that was watched by as many as 170,000 officials and published by state news agency Xinhua. But Xi, China’s most powerful leader in decades, added the country’s social and economic system “can’t be paused for a long”.

The edited version of Xi’s speech was published soon after it was delivered, reflecting the urgency of the guidelines. Containment measures including mandatory quarantine for workers, partial shutdowns of factories and transport restrictions have caused significant disruptions to the economy, which was already growing at record low levels before the virus outbreak. Xi said that as many as 1,396 counties and districts, some 46 per cent of the nation’s total, had not reported a single confirmed case of the coronavirus. These low-risk zones, along with areas with only a small number of infections, should “comprehensively restore production” and life as usual, he said. “Medium-risk” regions should resume production in an “orderly manner”, while the priority for hard-hit areas like Hubei, the province at the centre of the outbreak, was still containing the virus, he said.

Read more …

Comments about Wuhan from the video:

• 40 portable incinerators X 30 corpses/incinerator/day = 1,200 corpses/day

• 100 additional portable incinerators ordered

• In addition to 47 crematories running in full capacity

• Another 1MM incinerators on the way!

And people tell me I’m exaggerating!

• Confusion In Wuhan As Move To Ease Coronavirus Lockdown Is Reversed (SCMP)

Just three hours after announcing that visitors trapped in Wuhan – the Chinese city at the heart of the coronavirus epidemic – could leave on Monday, authorities reversed the decision, saying it had been made without approval. The local government revoked the notice it said had been issued by a subordinate working group from the city’s disease control command centre without approval from their superiors. “The centre, headed by Wuhan mayor Zhou Xianwang, said the officials who had issued the order without authorisation had been reprimanded. “Wuhan resolutely adheres to the spirit of Chinese President Xi [Jinping] … strictly controls every exit from Wuhan and the management of personnel, in order to prevent the spread of the [coronavirus],” it said in a statement retracting the earlier notice.

Extreme lockdown measures have been in place in Wuhan – capital of Hubei and home to 11 million people – since January 23, with all residential areas quarantined and roads and transport links closed. The retracted order would have allowed non-residents who did not have symptoms of the virus and had not had contact with infected patients to leave the city. It had also said locals involved in disease control efforts or essential daily services such as utilities and the delivery of necessities, as well as those who needed specialist medical treatment outside Wuhan, could leave without permission.

[..] More than 75 per cent of deaths in China from the new coronavirus – which causes a disease known as Covid-19 – have been in Wuhan, where the outbreak is believed to have originated in December. [..] According to Taoran Notes, a social media account affiliated with the official Economic Daily newspaper, the earlier notice had been issued by one of Wuhan’s five deputy mayors without authorisation, but it did not name the official.

Read more …

600 “official” cases, 50 deaths. That rhymes with Worldometer’s 9% mortality rate. But sure, it could also mean a huge amount of undetected or unconfirmed cases.

• How Iran’s Death Toll Came To Be The Highest Behind Only China (SCMP)

Iran has been thrust to the forefront of rising global concern about the spread of the novel coronavirus after reporting by far the most deaths of any country apart from China. Iranian health officials have confirmed 12 deaths from the Covid-19 disease among 61 cases in the country, while a parliamentarian representing the city at the centre of the outbreak in the country has claimed the death toll stands at 50. Either figure would dwarf death tolls in South Korea, Japan and Italy, until now the most severely-affected countries outside China…

After insisting as recently as last week that the country had no cases of the coronavirus, Iranian authorities on February 19 confirmed the deaths of two elderly people in the city of Qom, about 145km south of the capital Tehran, followed by more fatalities in subsequent days. On February 24, officials raised the death toll to 12, from eight the previous day – making the outbreak in Iran the deadliest outside China. Ahmad Amirabadi Farahani, a lawmaker for the city of Qom, said on the same day there had been in fact 50 deaths, claiming the government was late to announce the outbreak and his city was ill-equipped to deal with the public health emergency.

Deputy Health Minister Iraj Harirchi disputed those claims in a press conference on state television, pledging to resign if the death toll was even one-quarter of the higher figure. [..] After officials earlier speculated about possible sources of the outbreak including Chinese workers and pilgrims from Pakistan, Iran’s health minister Saeed Namaki on Sunday said the contagion was believed to be linked to a merchant from Qom who regularly travelled between Iran and China. The Iranian, who died from the virus, had been using indirect flights to get around a ban on direct flights between the countries introduced at the end of January.

[..] The disproportionately high fatality rate in Iran’s official figures – with about one in five of those infected succumbing to the virus, compared to one in 50 in China – has been taken by some experts as a sign the true number of cases in the country is far higher than currently known. Assuming a fatality rate of about 2 per cent, the official death toll so far would translate into about 600 cases overall in Iran, about 10 times the current count.

Read more …

More sleight of hand. I’ve been saying for a long time that it’s sbout SMEs, not Apple suppliers. Small firms account for at least 80% of jobs.

• China Overestimating Economic Recovery By Leaving Out Small Businesses (SCMP)

China’s economic recovery amid the coronavirus outbreak has likely been overstated as data only covers larger companies and excludes the vast majority of the smaller workshops and manufacturers. [..] On Monday, National Development and Reform Commission spokesman Cong Liang said that over 90 per cent of industrial enterprises in Zhejiang province, one of the country’s top manufacturing bases, had resumed operation. According to Cong, over 70 per cent of production in the manufacturing and export hubs of Guangdong, Jiangsu, Shandong and Liaoning had also restarted. However, the official figures only cover larger firms, namely enterprises with capacities “above state designated sizes”, which are enterprises that have a minimum annual turnover of 20 million yuan (US$2.85 million), according to the government’s official definition.

China’s state statistics system normally only covers industrial enterprises with an annual turnover above this level as they accounted for around 90 per cent of the nation’s output in terms of value. In addition, the figures concerning firms that have resumed operation overlook the level of production within a specific factory, as the official data classes a factory that may have only resumed slightly more than half of its capacity as having resumed production. [..] The smaller firms, for example, are often unable to met virus prevention conditions set by local governments, including having enough facial masks for employees. A monthly survey of small and medium-sized enterprises (SMEs) in China, conducted by Standard Chartered Bank for the period up to the start of last week, found that firms were on average operating at 42 per cent, while only 47 per cent of workers had returned on average.

Read more …

Please imagine how you would test 200,000 people. Do they really have that many test kits? Where do they buy them?

• South Korea To Test 200,000 Sect Members As Pandemic Fears Hit Markets (G.)

South Korea has stepped up its “maximum measures” to contain the coronavirus with plans to test around 200,000 members of a secretive church believed to be at the centre of the country’s outbreak. Along with an emergency budget and a crackdown on the hoarding of face masks, the government in Seoul will test members of the Shincheonji Church of Jesus after its founder agreed to provide authorities with the names of all its members in the country. It came as financial markets saw more heavy losses across Asia Pacific on Tuesday over fears the coronavirus was spreading more widely from China and will cause disruption in countries such as South Korea, the world’s 12th biggest economy.

The Nikkei in Tokyo was down 3.3% while the Shanghai Composite sank 2%. Stocks in Australia fell 1.6% and Hong Kong was also in the red although futures trading pointed to a recovery later in the day in European and US markets. In Japan, a fourth person from the Diamond Princess cruise ship died and the country’s education minister said schools with reported coronavirus cases should be temporarily closed. Koichi Hagiuda told reporters on Tuesday that education boards of Hokkaido in northern Japan and Chiba City near Tokyo have been told to take this preventive measure, NHK says.

In China, where 71 new deaths and 508 new cases were reported on Tuesday, health officials said strict control and prevention measures would remain in place in Hubei province, the epicentre of the global outbreak. The national health commission added it would also strictly control the outbound movement of people in Wuhan and other cities in Hubei province with existing traffic controls. At Tianjin University, near Beijing, scientists said they had developed an oral vaccine for Covid-19. The professor who led the project, Huang Jinhai, said the vaccine could also serve as a potential therapy for infected patients. Chinese state media said the university was looking for partners to run clinical trials.

Read more …

” South Korea has a fantastic health care system. They tested over 20,000 people and ended up with over 800 positive cases. That’s showing that this is a highly contagious virus..”

• Virus Spreads Despite Best Efforts Of Top Healthcare Systems (Fox)

Fears of a global pandemic continue to grow as coronavirus cases spike in several countries, including Italy, South Korea and Iran, as the U.S. stock market nosedived early Monday. A staggering 50 people died in the Iranian city of Qom from the new coronavirus in the month of February, Iran’s semiofficial ILNA news agency reported on Monday. The new death toll is significantly higher than the latest number of confirmed cases that Iranian officials had reported just a few hours earlier, which stood at just 12 deaths out of 47 cases, according to state TV. The 50 deaths date back as far as Feb. 13, according to an Iranian official. Iran previously reported its cases and deaths from the virus on Feb. 19.

Authorities are struggling to contain and understand the outbreak in those countries, where infected cases have skyrocketed as they have increased over 2,000 percent in the past couple of weeks. Italy is considered the site of Europe’s first major outbreak and the largest outside of Asia. The number of infected cases jumped to 152, compared to just three 10 days ago. Siegel told anchor Ed Henry that it’s even “more concerning” to hear there are more than 800 cases reported in South Korea. “I’ve been saying that it’s all about health care infrastructure, that China doesn’t have it, we have it, other Western countries have it. Well, guess what, South Korea has a fantastic health care system. They tested over 20,000 people and ended up with over 800 positive cases. That’s showing that this is a highly contagious virus that is spreading despite the best efforts of top health systems to contain it,” he said.

Read more …

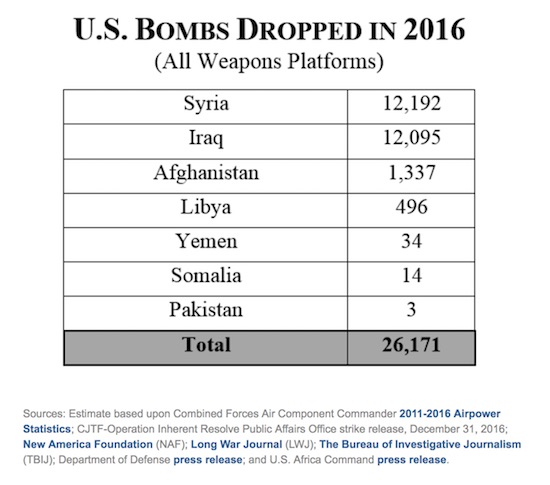

China is also the main market for many endangered species from elsewhere in the world. Can we please stop that too? Just boycott the country for allowing rhino, tiger and elephant body parts trade. Full boycott. Here’s our chance..

• Closures Reveal Vast Scale Of China’s Secretive Wildlife Farm Industry (G.)

Nearly 20,000 wildlife farmsraising species including peacocks, civet cats, porcupines, ostriches, wild geese and boar have been shut down across China in the wake of the coronavirus, in a move that has exposed the hitherto unknown size of the industry. Until a few weeks ago wildlife farming was still being promoted by government agencies as an easy way for rural Chinese people to get rich. But the Covid-19 outbreak, which has now led to over 1,800 deaths and more than 72,000 known infections, is thought to have originated in wildlife sold at a market in Wuhan in early December, prompting a massive rethink by authorities on how to manage the trade. China issued a temporary ban on wildlife trade to curb the spread of the virus at the end of January and began a widespread crackdown on breeding facilities in early February.

The country’s top legislative officials are now rushing to amend the country’s wildlife protection law and possibly restructure regulations on the use of wildlife for food and traditional Chinese medicine. The current version of the law is seen as problematic by wildlife conservation groups because it focuses on utilisation of wildlife rather than its protection. “The coronavirus epidemic is swiftly pushing China to reevaluate its relationship with wildlife,” Steve Blake, chief representative of WildAid in Beijing, told the Guardian. “There is a high level of risk from this scale of breeding operations both to human health and to the impacts on populations of these animals in the wild.” Further instructions from the National People’s Congress are expected next week to give authorities more tools to enforce the ban and restrict trade until the law is amended.

Read more …

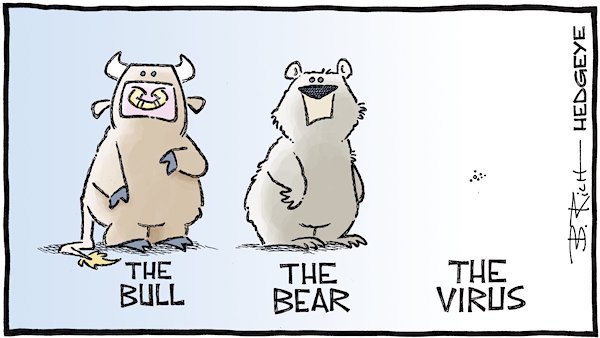

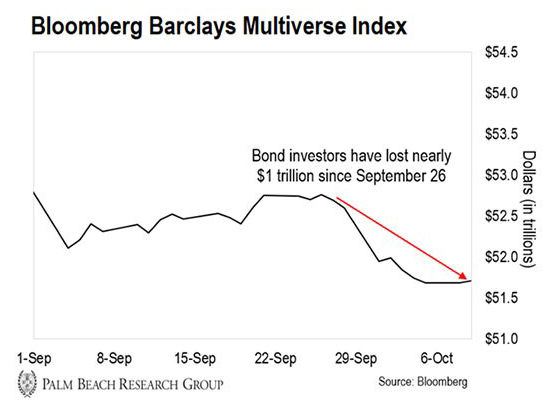

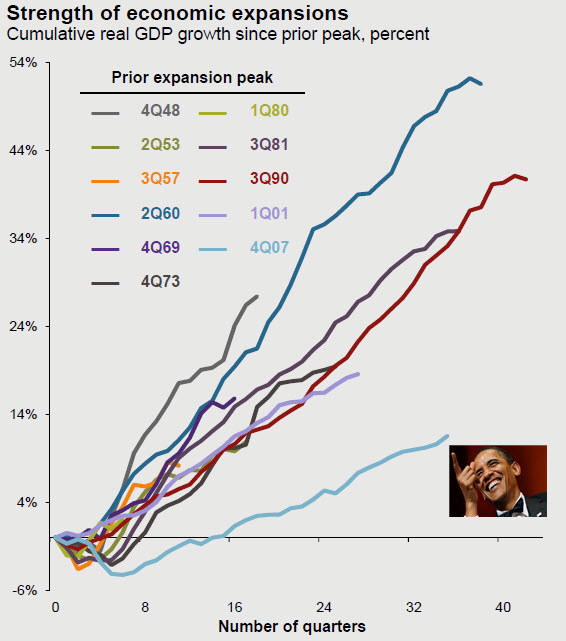

“The China boom was a lot like the shale oil “miracle.” They were both great stunts. They produced a lot of stuff by borrowing from the future. Now we have all that stuff and we have to maintain it, keep if running, borrow more money to make that happen… and suddenly, that’s no longer plausible. ”

• Why Didn’t We See That Coming? (Kunstler)

And now the Corona virus steps onstage to ramify that situation, beginning with a virtual shut-down of the excessively complex, over-engineered, just-in-time global economy. Things are not being produced and supply lines are shutting down. Car-makers outside China have a couple of weeks before their production lines halt for a lack of parts. But, of course, every other industry will have similar problems and stoppages. Many working Americans are barely getting by from one paycheck to the next. How many missed paychecks will it take for genuine hunger to kick in and desperation with it? We don’t know because the US news media has been busy conjuring the many loves of Vlad Putin.

This is getting serious now. Some of you may have noticed this morning that the stock indexes are heading into the worst open in years. Today, Mr. Market woke up, like Rip Van Winkle, and discovered that the world changed while he was sleeping. There’s a fair chance that the conditions of daily life in America will deteriorate sharply in the months ahead. We’ve been remote-viewing the empty streets of Wuhan and other Chinese cities since January, thinking it was like one of our cable-network horror shows. It’s not inconceivable that an American City, or more than one, will be subject to quarantine, or that a whole lot of people just won’t leave their houses for a period of time. Will the truckers still truck things that people need? We don’t know. How do you hold a political convention in a situation like that, or even an election?

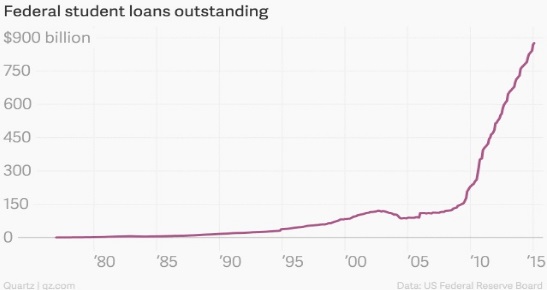

The situation in China may be too far gone already. The country’s finances were a gigantic game of pretend. In the old Soviet Union, beloved by Bernie, the joke was, “they pretend to pay us, and we pretend to work” — not a great formula for enduring prosperity. In China, the updated joke was “we pretend to make loans, and you pretend to pay them back.” The China boom was a lot like the shale oil “miracle.” They were both great stunts. They produced a lot of stuff by borrowing from the future. Now we have all that stuff and we have to maintain it, keep if running, borrow more money to make that happen… and suddenly, that’s no longer plausible. The entire industrialized world has fallen for the debt stunt. Observers have been waiting to see what would finally provoke the unwinding of massive false promises. Looks like the wait is over.

Read more …

Gee, what a surprise.

• Airline Stocks Tumble As Coronavirus Spreads Outside Of China (CNBC)

Airline stocks fell Monday as fears about the spread of the coronavirus beyond China added to worries about travel demand and the broader economy, despite a drop in fuel prices. American Airlines shares led the S&P 500 lower with an 9.8% slide in midday trading, hitting a more than four-month low. Delta Air Lines’ stock lost 7.2% to the lowest price in nearly four months, while United Airlines was off 4.3%. All U.S. airline stocks were down more sharply than the broader market. The S&P 500 fell 2.6%. Close to 80,000 cases of the virus, now known as COVID-19, have been reported along with at least 2,621 deaths. Cases outside of China, where most of the infections are located, have increased, with Italy reporting more than 220 and South Korea confirming more than 830.

Ireland’s Department of Foreign Affairs and Trade warned citizens not to travel to affected areas, helping drive down shares of European carriers. Budget airline easyJet lost more than 16% while rival Ryanair was down 12%. Deutsche Lufthansa fell 8.8%, British Airways’ parent, International Consolidated Airlines Group, was off 9% and Air France-KLM fell 8.4%. More than 200,000 flights to, from and within China have already been canceled because of the virus, according to aviation consulting firm Cirium, and more disruptions are possible if the virus continues to spread. The coronavirus is expected to eat into carriers’ revenue this year. Air travel demand globally is set to fall for the first time since 2009 and cost airlines some $29 billion — mostly in the Asia-Pacific region — in revenue, the International Air Transport Association warned last week.

Read more …

Weinstein still has plenty money to pay for whoever he wants. They couldn’t get him on the most serious charges. Just throw away the key.

• Weinstein To Face 8 More Allegations After New York Verdict (G.)

The verdict in the New York case against Harvey Weinstein is only the beginning of the movie mogul’s prosecution, with separate charges against the disgraced producer ahead in Los Angeles. In the most high-profile trial of the #MeToo movement yet, a New York jury on Monday found Weinstein guilty of third-degree rape for an attack in a New York hotel and guilty of a criminal sex act for forcing oral sex on a former television production assistant. The fallen titan of Hollywood, who was taken away in handcuffs, could face 25 years in prison and will have to register as a sex offender. Next, Weinstein is due to face a criminal case in LA, which stems from investigations by law enforcement in southern California into eight allegations.

LA prosecutors have filed charges for two incidents that allegedly occurred within a two-day period. Those charges include forcible rape, forcible oral copulation, sexual penetration by use of force and sexual battery by restraint, carrying a potential 28-year prison sentence. It’s not yet clear how LA prosecutors plan to proceed following Monday’s verdict in New York. Weinstein could be immediately brought to California after his 11 March sentencing in New York. He could pursue a plea deal in LA after his guilty verdict in Manhattan, or he could end up facing a second trial, said Laurie Levenson, criminal law professor at Loyola Law School. Either way, it’s an uphill battle for the former movie producer, she said: “When he heads to LA, he’s already a convicted rapist.”

Read more …

Putin is about to hand Erdogan an ultimatum or two. The US must go home.

• US Proposals To Whitewash Idlib Terrorists Unacceptable – Lavrov (RT)

Moscow will resist any attempts to whitewash the terrorists holed up in Idlib, Syria, Russian Foreign Minister Sergey Lavrov said, adding that engaging in talks with them as the US is hinting is out of question. Hayat Tahrir al-Sham, an Al-Qaeda offshoot previously known as Al-Nusra, which controls Idlib, has been designated as a terrorist organization not only by the UN, but by the US itself, Lavrov said. However, officials in Washington, including the special envoy for Syria, James Jeffrey, “allow themselves statements, from which a conclusion can be made that ‘it’s not such a terrorist organization anymore’ and that dialogue with it can be established under some circumstances,” he said. “It’s not the first time we hear such hints and we consider them absolutely unacceptable.”

The foreign minister also said that another round of consultations between Russia and Turkey is currently being prepared in ordered “to agree on ways of turning Idlib into a real de-escalation where the terrorists aren’t in charge.” Tensions are high between Moscow and Ankara after Turkey sent troops to Idlib a few weeks ago amid a large-scale offensive by the Syrian military on the last terrorist stronghold in the country. The move provoked clashes between the Turkish and Syrian forces, with casualties on both sides. Ankara is demanding that Moscow pressure Damascus into ceasing its operation, while Russia has told Turkey that its promise to separate the ‘moderate opposition’ from the terrorists still remains unfulfilled.Lavrov insisted that it was no surprise for the Turkish military that the terrorists were being targeted. Earlier Russian-Turkish agreements on Idlib never envisaged that strikes against Hayat Tahrir al-Sham would stop, he added.

Read more …

“Edward Fitzgerald QC: Mental state of Assange deteriorating such that there is possibility he may not be able to participate in his own trial. Defense outlines why they believe it’s unjust an oppressive to pursue trial so long after alleged offenses..”

“Julian Assange faces life in prison for publishing true information that was in the public interest..if truth becomes treason we are all in trouble.”

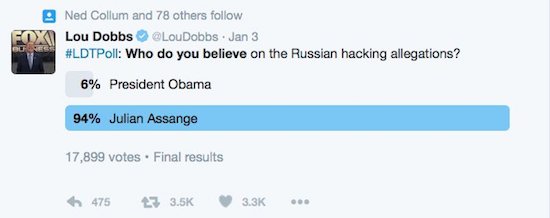

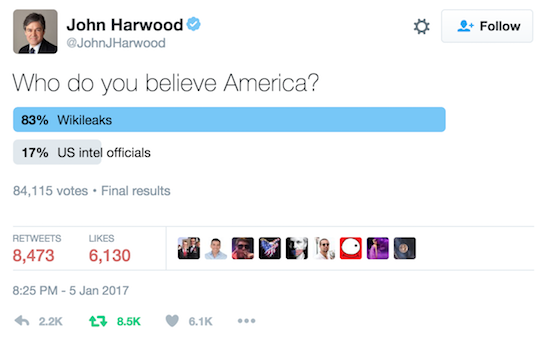

Still, making it all against Trump doesn’t seem the wisest move. Try US Intel. Obviously, Trump’s role is terrible as well, but Assange went into the Embassy in 2012. Trump became president in 2017.

• Julian Assange ‘Suicide Risk’ If Extradited From UK To US – Lawyer (SCMP)

Julian Assange should not be extradited to the United States as he would not get a fair trial and would be a suicide risk, his lawyer told a British court hearing on Monday. Assange’s lawyer, Edward Fitzgerald, said extradition would expose Assange to inhumane and degrading treatment by a disproportionate sentence and prison conditions. Fitzgerald said the extradition request was motivated by politics rather than any genuine crimes. He said it would be unjust and oppressive to extradite him because of his mental state and risk of suicide. He said the US attitude to Assange had changed when Donald Trump came to power and that the US president wanted to make an example of his client.

Fitzgerald said in 2013 the US government under former President Barack Obama had decided that Assange should not face any action. But that in 2017, after the 2016 election of Trump, an indictment was brought against Assange. Why the change? “The answer is President Trump came into power with a new approach to freedom of speech and a new hostility to the press amounting effectively to declaring war on investigative journalists,” Fitzgerald said. The indictment was brought, “not on the basis of new revelations, but because it had become politically expedient and desirable,” Fitzgerald said.

Read more …

The background Assange’s lawyers will provide. They promise big surprises.

• Assange Fight Draws In Trump’s New Intel Chief (Pol.)

Attorneys for Julian Assange [..] plan to introduce evidence in the WikiLeaks founder’s extradition hearing involving President Donald Trump’s new intel chief Richard Grenell. Gareth Peirce, a lawyer representing Assange in his extradition proceedings in London, plans to argue this week that the process to try to extradite her client was abused from early on. Representatives for Assange’s defense team say they expect to introduce recordings and screenshots of communications of a close Grenell associate, including a secondhand claim that Grenell was acting on the president’s orders. Grenell’s sudden embroilment in Assange’s extradition fight comes at an inconvenient time, as Democrats and national security veterans criticize him as ill-suited and unqualified to be the acting director of national intelligence.

And it threatens to spotlight his close relationship with President Trump, feeding the widespread perception that the president is politicizing intelligence work for partisan ends. At the heart of the Assange team’s argument is an ABC News report from last April alleging that, while serving as Trump’s ambassador to Germany, Grenell told Assange’s Ecuadorean hosts that the U.S. government would not pursue the death penalty for Assange if Ecuador allowed British officials to enter its embassy in London and arrest him. Assange’s legal team will claim that Grenell’s role was more extensive than previously known, and that it corrupted the extradition process early on. The suggestion will be that the U.S. was so desperate to get Assange in its custody that American officials, via Grenell, agreed in advance to take a particular sentence off the table before even allowing a trial and sentencing to play out.

The WikiLeaks founder’s attorneys are also expected to present evidence that they believe shows Trump explicitly tasked Grenell with making the offer, thereby politicizing the process. One of Assange’s lawyers, Edward Fitzgerald, hinted at this argument in his opening statement on Monday, when he said that Assange’s prosecution was “not motivated by genuine concerns for criminal justice but politics.” The evidence submitted this week will include new materials submitted to Assange’s legal team by political activist and journalist Cassandra Fairbanks, a staunch defender of Assange who has worked for the Russian state-run news site Sputnik and the far-right outlet Gateway Pundit. She is expected to be listed as a formal witness in the case.

Fairbanks recorded two phone calls she had with one of Grenell’s close associates, Arthur Schwartz, and took screenshots of their conversations about Assange and Grenell. [..] Schwartz appeared to grow frustrated and fearful after Fairbanks tweeted, on Sept. 10, 2019, that Grenell “was the one who worked out the deal for Julian Assange’s arrest.” “I don’t want to go to jail,” Schwartz told Fairbanks in a September 2019 phone call, accusing her of posting “classified information” in the tweet. Fairbanks posted the tweet around the time Grenell’s name was being floated to replace John Bolton as Trump’s national security adviser. “Please. I’m begging you,” Schwartz says in the recording. “They look at you, they see that we speak, that’s bad.”

Read more …

The US is trying to make this about the risk Assange has exposed sources to. But in 2013, even anti-Assange paper the Guardian said

The US counter-intelligence official who led the Pentagon’s review into the fallout from the WikiLeaks disclosures of state secrets told the Bradley Manning sentencing hearing on Wednesday that no instances were ever found of any individual killed by enemy forces as a result of having been named in the releases.

Not only did none of them die, they weren’t even hurt. It’s all a fable, coming from US intel hiding behind state secret veils. The actual story for at least some of the releases is more or less the opposite: that Assange spent entire sleepless nights redactingout namea and details in docs that sources like the Guardian wanted to publish in full.

• Julian Assange ‘At High Risk Of Suicide’ If Extradited To US -Lawyer (Ind.)

WikiLeaks founder Julian Assange is at “high risk of suicide” if he is sent to the US to face claims he endangered the lives of whistleblowers around the world, a court has heard. At an extradition hearing in London, Assange’s lawyers argued he is the victim of a politically motivated prosecution that forms part of Donald Trump’s “war on investigative journalists”. But the US government claimed some sources had “disappeared” after the WikiLeaks founder put them at risk of “serious harm, torture or even death” by leaking classified information. James Lewis QC, opening the case against Assange, said on Monday that information published by WikiLeaks was useful to enemies of the US.Mr Lewis told Woolwich Crown Court, which is sitting as a magistrates’ court, that most of the charges related to “straightforward criminal activity” in a “conspiracy to steal from and hack into” the Department of Defence computer system.

“These are ordinary criminal charges and any person, journalist or source who hacks or attempts to gain unauthorised access to a secure system, or aids and abets others to do so, is guilty of computer misuse,” the barrister said. “Reporting or journalism is not an excuse for criminal activities or a licence to break ordinary criminal laws.” Mr Lewis said that the US identified hundreds of “at-risk and potentially at-risk people” around the world due to WikiLeaks’ actions and made efforts to warn them of the danger they faced. “The US is aware of sources, whose redacted names and other identifying information was contained in classified documents published by WikiLeaks, who subsequently disappeared, although the US can’t prove at this point that their disappearance was the result of being outed by WikiLeaks,” he added.

Read more …

Size matters.

If you read us, please support us. It’s the only way the Automatic Earth can survive. Donate on Paypal and Patreon.