AFP Photo/Johannes EISELE Giant Trump Chicken

Hear hear!

• Locating Fascism on the Home Map (Ford)

In decadence and decline, the U,S. has produced two strong strains of fascism that now vie for supremacy. The First Black President, now outgoing, represents the “cosmopolitan, global obsessed” variety of fascist. Donald Trump hails from an older fascist strain, “crude and petty, too ugly for global prime time.” At this stage in history, the two corporate parties seem incapable of producing anything other than fascists of one kind or the other.

Barack Obama was a savior – of a drowning ruling class. Under his administration, Wall Street rose from near-death to new heights of speculative frenzy, awash in capital brutally extracted from the vanishing assets and past and future earnings of the vast majority of the population, or gifted in the form of trillions in free money at corporate-only Federal Reserve windows. The Big Casino, reduced to a rubble of its own contradictions in 2008, ushered in the New Year just shy of the once-fantastical 20,000 mark. Analysts credited Donald Trump’s victory for the bankers’ bacchanal, but it was Obama who made the party possible by overseeing the restructuring of the U.S. economy to accommodate and encourage the hyper-consolidation of capital – another way to describe the deliberate deepening of economic (and political) inequality. Having accomplished the mission assigned him by Wall Street in return for record-breaking contributions to his first campaign, Obama is said to be angling for a hot-money squat in Silicon Valley, the super-rich sector that was most supportive of his presidency.

Meanwhile, Hillary Clinton is melting quicker than the Wicked Witch of the West, principally due to the failure of traditionally Democratic working (and out of work) people of all races to turn out on November 8 – a perfectly understandable response to a party and a system that offers them absolutely nothing but grief, in ever quickening increments. The merciless downsizing of the American worker is a central element of Obama’s legacy. Real wages had been frozen or declining for decades. However, economic restructuring in the Age of Obama demanded that millions of workers be crushed all the way through the floor to a lower level of hell: temporary, contract, not-really-a-job, part-time “gig” employment. If the 1930s squatter shanty-towns called “Hoovervilles” were testaments to President Herbert Hoover’s economic policies, then the maddeningly precarious, no guaranteed hours, no benefits, zero job security, fraction of a shift, arbitrarily scheduled employment of today should be called ObamaJobs. A new study by economists at Princeton and Harvard universities shows that an astounding 94% of the 10 million jobs created during the First Black President’s two terms in office were ObamaJobs.

“Risk has been priced out of the market..”

• ‘The Bull Market Is In Its Final Inning’ (CNBC)

As investors await the Dow Jones 20,000 with baited breath, one widely followed chart watcher believes the current market rally is actually on its last legs. On Friday, blue chip shares in the Dow Industrial Average flirted with the psychologically charged 20,000 level, which have largely been driven higher by anticipation over President-elect Donald Trump’s business-friendly policies. Yet a few observers think the party is nearly over, and the punch bowl is about to run dry. “Risk has been priced out of the market,” said Sven Henrick of NorthmanTrader.com on CNBC’s “Futures Now.” Henrich, who is known online as the Northman Trader, said that despite the abundance of optimism on the part of investors, technical indicators could be pointing to some near-term pain.

According to the Northman’s chartwork, every time the S&P 500 Index has hit new highs, it eventually retreats back towards its 25-day moving average line, which would translate to a 4% pullback from current levels. The S&P 500 has rallied 6% since the election, and hit an intraday record high on Friday. “I would expect that at some point there would be a buying opportunity for people who may want to invest in this market,” said Henrich. “But if this line breaks, we may see significantly more downside that we’ve seen in previous corrections as well.” What’s more, Henrich also believes that the S&P 500 has continued to trade in a “bearish wedge pattern” that began just after the end of the last recession.

The wedge pattern Henrich speaks of consists of two trend lines: One that runs along the S&P’s highs and a second that runs along its lows, that look to meet sometime in 2017. It is at that point that Henrich believes the rally will have run its course, and a downside will soon follow. On a fundamental basis, the Northman Trader is troubled by “record debt levels” that the global governments have incurred. “In 2016, the U.S. government ran a deficit of over $600 billion,” explained Henrich.” “If we now add tax cuts and stimulus spending, you’re either going to have to cut a significant amount of programs somewhere, or you’re going to end up with an even larger deficit.”

For domestic use only?

• Chinese Warns Trump: End One China Policy And China Will Take Revenge (R.)

State-run Chinese tabloid Global Times warned U.S. President-elect Donald Trump that China would “take revenge” if he reneged on the one-China policy, only hours after Taiwan’s president made a controversial stopover in Houston. Taiwanese President Tsai Ing-wen met senior U.S. Republican lawmakers during her stopover in Houston on Sunday en route to Central America, where she will visit Honduras, Nicaragua, Guatemala and El Salvador. Beijing had asked Washington not to allow Tsai to enter the United States and that she not have any formal government meetings under the one China policy. A photograph tweeted by Texas Governor Greg Abbott shows him meeting Tsai, with a small table between them adorned with the U.S., Texas and Taiwanese flags. Tsai also met Texas Senator Ted Cruz.

“Sticking to (the one China) principle is not a capricious request by China upon U.S. presidents, but an obligation of U.S. presidents to maintain China-U.S. relations and respect the existing order of the Asia-Pacific,” said the Global Times editorial on Sunday. The influential tabloid is published by the ruling Communist Party’s official People’s Daily. Trump triggered protests from Beijing last month by accepting a congratulatory telephone call from Tsai and questioning Washington’s commitment to China’s position that Taiwan is part of one China. “If Trump reneges on the one-China policy after taking office, the Chinese people will demand the government to take revenge. There is no room for bargaining,” said the Global Times.

“..mimic his signature hand gestures with their tiny wings.”

• It’s Gonna Be Huge: China Factory Hatches Giant Trump Chickens (AFP)

A Chinese factory is hatching giant inflatable chickens resembling Donald Trump to usher in the Year of the Rooster. The five-metre (16-foot) fowls sport the distinctive golden mane of the US president-elect and mimic his signature hand gestures with their tiny wings. Cartoon figures of animals from the Chinese zodiac are ubiquitous around Chinese New Year at the end of this month. The balloon factory is selling its presidential birds for as much as 14,400 yuan ($2,080) on Chinese shopping site Taobao for a 10-metre version.

A golden mane and tiny wings that mimic his hand gestures – the resemblence of inflatable chickens produced for the Chinese New Year to US President-elect is unmistakable (AFP Photo/Johannes EISELE)

“I saw his image on the news and he has a lot of personality, and since Year of the Rooster is coming up I mixed these two elements together to make a Chinese chicken,” factory owner Wei Qing told AFP. “It is so funny, so we designed it and tried to sell it and it turned out to be popular.” The cartoon balloon appeared to be based on a sculpture designed by US artist Casey Latiolais, which was unveiled at a shopping mall last month in Taiyuan, capital of the northern province of Shanxi. Wei said he was not aware that the American designer had created the original, but added that “there are some differences in the facial expression. And that one is glass. Ours is inflatable.”

“If we do get any reforms this year, they are going to be Potemkin reforms. The veneer will look like they are moving to a market economy, and the reality will be anything but.”

• How Meaningful Will China “Opening Up” Markets To Foreigners Be? (BBG)

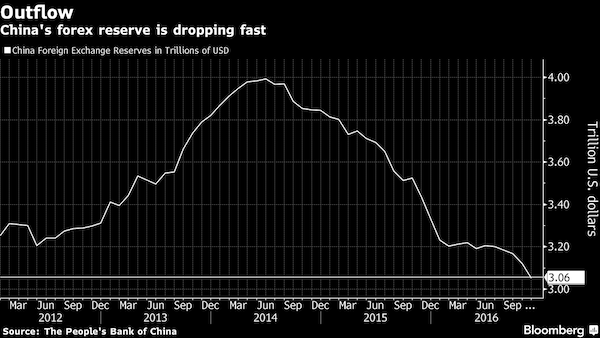

China’s recent policy of opening its markets to foreigners is expected to continue this year, but there are questions about how meaningful the change will be amid a clampdown on money leaving the country. While China loosened restrictions on its interbank bond market and relaxed rules for offshore investors trading stocks, it also saw $762 billion head overseas in the first 11 months of last year, according to Bloomberg Intelligence estimates, as investors sought safety in foreign assets. That helped push the yuan down 6.5% against the dollar in 2016, the most since 1994. Seeking to stem the flow, mainland authorities tightened rules that contributed to MSCI Inc. refusing to add Chinese-listed shares to its global indexes.

China’s regulators have indicated that this year foreigners might be allowed to access commodity futures and bond derivatives, while MSCI will again consider adding mainland stocks. But concerns remain about how open China’s markets will be, especially on the issue of taking assets out of the country. The contrast highlights the tension authorities face between inviting more investment while keeping control of the financial sector. “I’d describe China’s strategy as a pipeline strategy. Essentially what they do is to create various pipelines of inflows and outflows,” said John Greenwood, London-based chief economist at Invesco Asset Management. “The problem is the flows are always in the opposite direction of what they want.”

Among last year’s steps, Beijing lifted almost all quotas on China’s interbank bond market and scrapped some constraints under the Qualified Foreign Institutional Investor program, which governs how offshore funds invest in mainland markets. The Shenzhen-Hong Kong stock exchange link, the second between the mainland and the former British colony, opened in December. Expectations then rose as an official with the People’s Bank of China said the central bank is committed to further opening the interbank market, including giving foreign investors access to foreign-exchange and interest-rate derivatives to hedge risks, and expanding trading hours. Even as China opens up to incoming funds, it has been clamping down on outflows.

Officials have banned the use of friends’ currency quotas, made it more difficult to buy insurance policies in Hong Kong and prepared restrictions on overseas acquisitions by Chinese companies. Grants of new quotas for domestic fund managers to invest overseas were frozen, according to data compiled by Bloomberg. The tightening of outflow rules makes it hard for some to say that the country is fully embracing financial reform. “We have already seen in China’s case, markets only work when they go up. You are not allowed to go down,” said Michael Every at Rabobank in Hong Kong. “If we do get any reforms this year, they are going to be Potemkin reforms. The veneer will look like they are moving to a market economy, and the reality will be anything but.”

“500,000-plus corruption investigators..” Who are corrupt.

• China Tightens Rules After Anti-Corruption Staff Caught Up In Graft (R.)

China’s top anti-corruption watchdog has tightened supervision of its 500,000-plus corruption investigators, after some of its own staff were caught in graft probes. The Central Commission for Discipline Inspection (CCDI) said in a statement on its website late on Sunday that a new regulation would be applied to procedures such as evidence collection and case reviews, without providing further details. “Trust cannot replace supervision,” the CCDI said in the statement, released after it held an annual 3-day meeting. “We must make sure the power granted by the (Communist) Party and the people is not abused,” it said.

State newspaper the China Daily, which did not indicate its sources, said the new regulation would set clear standards on how to handle corruption tips, how to handle ill-gotten assets, and would encourage audio and video recordings to be made throughout interrogations. More than 7,900 disciplinary officials have been punished for wrongdoing since 2012, the newspaper said, citing CCDI figures. Of those, 17 were CCDI staffers who were put under investigation for graft, it said. On Friday, state news agency Xinhua quoted Chinese President Xi Jinping as saying that the battle against corruption “must go deeper”, and called for the Communist Party to be governed “systematically, creatively and efficiently”.

Stuck.

• China’s Pyrrhic Growth Victory Spurs 2017 Shift To Contain Risks (BBG)

As China’s top leaders tallied the cost of another year of debt-fueled growth at a December meeting, the imperative for stability as a leadership reshuffle loomed later this year prompted an unexpected conclusion. The price was too high, the leaders agreed, according to a person familiar with the situation. The buildup of debt used to fuel smokestack industries from steel to cement had helped win the short-term battle for growth, but the triumph itself undermined the foundations of long-term expansion, the leaders decided, according to the person, who asked not to be named because the meeting was private. What followed was an order to central and local government officials that if they are forced to choose this year, stability must be the priority while everything else, including the growth target and economic reform, is secondary, said another four people familiar with the situation.

Other concerns aired at the meeting that contributed to the policy shift were the short-term risk of a confrontation with the U.S. under President-elect Donald Trump over trade or Taiwan, and longer-term challenges including how to spur the innovation needed to prevent economic stagnation as well as cleaning up toxic air that enrages and poisons citizens, said the person. Left unsaid was that economic growth underpins the legitimacy of Communist Party rule. “China’s reaching the point where it has to pick its poison and giving up a half%age point of growth would be far less politically damaging than instability in the bond or currency markets,” said David Loevinger, a former China specialist at the U.S. Treasury and now an analyst at fund manager TCW in Los Angeles. “Looking past the Party Congress later in the year, President Xi Jinping may realize that unlike his predecessor, Hu Jintao, he can’t kick the can to his successor, even more so if he plans on extending his term” beyond 2022.

At the December meeting, officials expressed alarm over the nation’s rapid accumulation of total debt, with some present noting that other nations have experienced crises after allowing debt to climb to about 300% of gross domestic product, the person said. China’s credit boom may have pushed overall debt at the end of 2016 to 265% of GDP. Also aired at the meeting was the risk that China falls into the so-called Thucydides trap, a theory attributed to the eponymous Greek philosopher that says a rising power will clash with an established force. So menacing is the array of economic and political challenges confronting the nation that some leaders at the meeting said there’s no prospect for yuan appreciation against the dollar until at least 2020, said the person. “Tapping the brakes may help avoid the economy skidding off the road,” said Frederic Neumann at HSBC in Hong Kong.

Interesting point of view.

• The Rise, Fall and Comeback Of China’s Economy Over The Last 800 Years (BI)

China’s economy led its European counterpart by leaps and bounds at the start of the Renaissance. China was so far ahead, in fact, that economic historian Eric L. Jones once argued that the Chinese empire “came within a hair’s breadth of industrializing in the fourteenth century.” At the start of the 15th century, China already had the compass, movable type print, and excellent naval capacity. In fact, Chinese Admiral Zheng He commanded expeditions to Southeast Asia, South Asia, Western Asia, and East Africa from about 1405-1433 – about a century before the Portuguese reached India. He also had ships several times the length of Christopher Columbus’ Santa Maria, the largest of Columbus’ three ships that crossed the Atlantic.

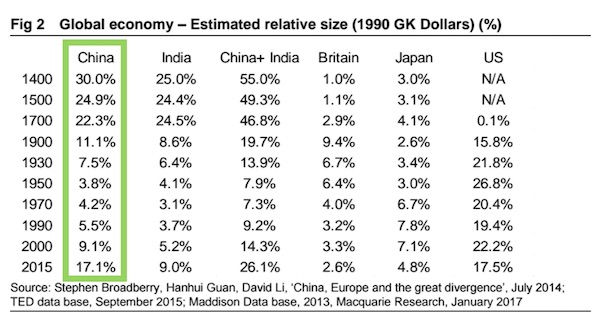

Still, it’s hard to understand the magnitude of the shift China’s economic fortunes have seen just with historical anecdotes. And so, in a recent note to clients, Macquarie Research’s Viktor Shvets included two fascinating charts showing the changes China saw over the last 800 years, which we included below. The first chart shows the estimated percent share of a given country’s economy as a part of the overall world economy. In the 15th and 16th centuries, China was about 25-30% of the global economy, but come 1950-1970, after the destruction of World War II and under the rule of Mao Zedong, it was under 5%. Today, its economy is about 17% of the global economy – roughly the same as the US.

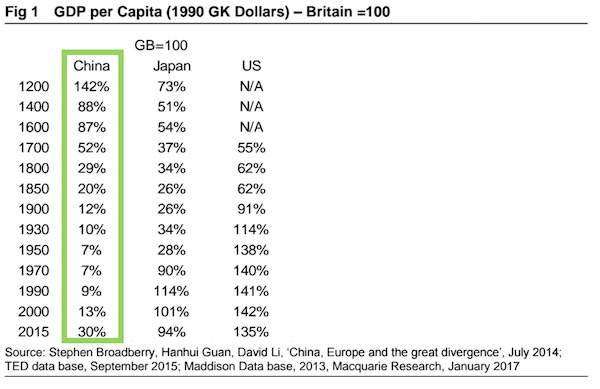

The second chart compares GDP per capita in China, Japan, and the US to the British GDP per capita measured in 1990 US dollars. In this case, the British GDP per capita in each year is 100, so if a number from China, Japan, or the US is above 100, then its GDP per capita is greater than in Britain, and if the number falls below 100, per capita output is lower than that in Britain. As Shvets writes, on a per capita basis, China was the wealthiest part of the world in the 1200-1300s — aside from Italy. Even as late as the 1600s it was roughly on par with the Brits. However, after that, the GDP per capita relative to Britain declines all the way up to the 1970s, when it was below 10% of the British standard of living. Around 1990, it starts to pick up again, but it has yet to recover to levels seen in 1200-1600.

And what does this say about China?

• Australia Predicts Dramatic Fall In Iron Ore Prices (BBC)

Shares in Australian mining companies have fallen after the government forecasted a dramatic decline in iron ore prices. The government forecast an iron ore price of $46.70 a tonne by 2018, almost half the current level of $80. The current price is supported by resurgent demand from China. But the Department of Industry, Innovation and Science said that demand was unlikely to continue over the coming years. The department also lowered its forecast for iron ore exports by 2% to 832.2 million tonnes for the fiscal year 2016-17. Australia is the world’s biggest supplier of iron ore and shares in the country’s main mining companies fell after the report was released. Hardest hit was Fortescue Metals which fell more than 3% in early trade, while commodity giants BHP Billiton and Rio Tinto also saw their shares prices drop. In its forecast early last year, the department had predicted an iron ore price of $44.10 per tonne, but an increase in Chinese demand spurred the price to above $80.

This guy’s been lying outright to US authorities.

• FBI Arrests Volkswagen Exec on Conspiracy Charges in Emissions Scandal (NYT)

The Federal Bureau of Investigation has arrested a Volkswagen executive who faces charges of conspiracy to defraud the United States, two people with knowledge of the arrest said on Sunday, marking an escalation of the criminal investigation into the automaker’s diesel emissions cheating scandal. Oliver Schmidt, who led Volkswagen’s regulatory compliance office in the United States from 2014 to March 2015, was arrested on Saturday by investigators in Florida and is expected to be arraigned on Monday in Detroit, said the two people, a law enforcement official and someone familiar with the case. [..] In a statement, Jeannine Ginivan, a spokeswoman for Volkswagen, said that the automaker “continues to cooperate with the Department of Justice” but that “it would not be appropriate to comment on any ongoing investigations or to discuss personnel matters.”

Lawsuits filed against Volkswagen by the New York and Massachusetts state attorneys general accused Mr. Schmidt of playing an important role in Volkswagen’s efforts to conceal its emissions cheating from United States regulators. Starting in late 2014, Mr. Schmidt and other Volkswagen officials repeatedly cited false technical explanations for the high emissions levels from Volkswagen vehicles, the state attorneys general said. In 2015, Mr. Schmidt acknowledged the existence of a so-called defeat device that allowed Volkswagen cars to cheat emissions tests. Volkswagen eventually said that it had fitted 11 million diesel cars worldwide with illegal software that made the vehicles capable of defeating pollution tests. [..] James Liang, a former Volkswagen engineer who worked for the company in California, pleaded guilty in September to charges that included conspiracy to defraud the federal government and violating the Clean Air Act. But Mr. Schmidt’s arrest brings the investigation into the executive ranks.

Settling the UK alone could cost VW £3.6 billion.

• UK Motorists Launch Class-Action Suit Against VW (G.)

Thousands of British motorists have launched a lawsuit against Volkswagen over the “dieselgate” emissions scandal, in a claim that could end up costing the carmaker billions of pounds. The group of 10,000 VW owners has filed a class action lawsuit against the German car firm, seeking £30m, or £3,000 each. If VW ends up having to pay the amount to each one of the 1.2 million people in the UK who own affected cars, including its Skoda, Audi and Seat marques, it would cost the company around £3.6bn.The German firm has yet to reach a settlement with British and European owners affected by the scandal, in which the company admitted using “defeat devices” to cheat emissions tests, making its cars appears greener than they were.

It has not compensated British owners despite reaching a £15bn settlement with 500,000 US drivers, offering instead to fix affected vehicles. The class action suit, which is being led by law firm Harcus Sinclair, is expected to claim that drivers should be compensated because they paid extra for what they thought were clean diesel cars. In fact, the claimants will allege, the cars emitted far higher levels of NOx – a mixture of pollutants nitrogen oxide and nitrogen dioxide – than stated. Damon Parker, head of litigation at Harcus Sinclair, told the Daily Mail that claimants were “angry and believe that VW might get away with it”. “They feel that they have been left with no choice but to take legal action,” Parker said. “We have paved the way for consumers who trusted but were let down by VW, Audi, Seat and Skoda to seek redress through our courts.

My guess is pollsters and media will get this as wrong as they got Brexit and Trump.

• Le Pen: I’ll Come To Brussels And Dismantle France’s Relationship With EU (EUK)

Marine Le Pen announced her first foreign visit would be to Brussels to dismantle France’s relationship with the EU if elected president later this year. The National Front leader has been a long-time critic of the EU and has promised to push back the sprawling European superstate and take back sovereignty to France. The 48-year-old said: “I would go to Brussels to immediately launch negotiations allowing me to give back to the French people their sovereignty.” The right-wing leader attacked the faltering euro currency as one of the root problems of the EU and described her main economic proposals as “economic patriotism, intelligent protectionism and a return to monetary independence”. She added: “The euro is a major obstacle to the development of our economy.”

Le Pen mooted that she was in favour of maintaining a form of common currency mechanism between France and the EU to help prevent sharp currency fluctuations. Recent opinion polls predicted that Le Pen would finish second in April’s first round of voting – putting her through to the next round in a run-off against Les Repubicain’s François Fillon. If pollsters are correct, France would be guaranteed a right-wing leader after five years of left-wing leadership from Francois Hollande.

Farage got his price, Grillo still has nothing. Weird to ally himself with Verhofstadt, but it’s how Brussels is set up: you either force yourself into some group or you don’t count.

• Beppe Grillo Calls For Five Star Movement Vote On Quitting Farage Bloc (G.)

The founder of Italy’s populist Five Star Movement (M5S) has asked members to vote on splitting from a Eurosceptic bloc of MEPs co-chaired by Nigel Farage. Beppe Grillo, a comedian turned politician, said in a post on his blog that since Farage had led Ukip to Britain voting to leave the EU, the two parties no longer shared common goals and he recommended leaving the Europe of Freedom and Direct Democracy (EFDD). “Recent events in Europe, such as Brexit, have led us to reconsider the nature of the EFDD group,” Grillo wrote. “With the extraordinary success of the leave campaign, Ukip achieved its political objective: to leave the EU. “Let’s discuss the concrete facts: Farage has already abandoned the leadership of his party and British MEPs will leave the European parliament in the next legislature. Until then, our British colleagues will be focused on developing the choices that will determine the UK’s political future.”

Grillo and Farage forged an alliance over lunch in Brussels after 2014’s European elections, in which Ukip took the largest share of the vote in Britain and M5S came second in Italy after winning 17 seats. Both said at the time that the group was aimed at “restoring freedom and national democracy”, with Farage adding: “Expect us to fight the good fight to take back control of our countries’ destinies.” In a move that would see his party mesh with European liberals, Grillo has called an online referendum, scheduled for Sunday and Monday, on breaking away and instead forming a new group with the Alliance of Liberals and Democrats for Europe (ALDE), led by the former Belgian prime minister, Guy Verhofstadt, who is also the EU’s chief Brexit negotiator. Grillo has long called for a referendum on Italy’s membership of the euro currency, but not on Italy leaving the EU.

With ALDE’s 68 MEPs, the alliance could become the “third political force in the European parliament”, Grillo wrote, while pointing to the fact that his party had only voted alongside Ukip about 20% of the time within the past few years. He said the two shared values linked to “direct democracy, transparency, freedom and honesty”. “With our vote we can make a difference and influence the result of many important decisions to counter the European establishment,” Grillo added. Farage said in a statement: “In political terms it would be completely illogical for Five Star to join the most Euro fanatic group in the European parliament. The ALDE group doesn’t support referenda or the basic principle of direct democracy. ALDE are also the loudest voice for a EU army. I suspect if Five Star joins ALDE it’s support will not last long.” A Ukip spokesman said: “Both Ukip and Five Star are free to choose to stay or quit a political relationship. While it’s interesting that some Five Star MEPs adamantly wish to stay in the EFDD group, as adults we wish them all the best whatever they do.”

The scandal spreads and deepens. Tens of millions have been handed to NGOs to prepare for winter, and they simply haven’t done it. While those of us that could make it happen don’t have the money. People have to die first?

• New Cold Snap, Heavy Snowfall Causes Problems Across Greece (Kath.)

A new cold snap brought snowfall to many parts of the country, leaving the Sporades islands of Alonissos and Skopelos without a ferry connection to the mainland and the Aegean islands of Lesvos and Chios struggling to care for hundreds of migrants amid freezing temperatures. Schools remained closed in many parts of the country due to heavy snowfall, including in the northern suburbs of Athens. According to meteorologists, the bad weather is set to continue through Wednesday. From Monday evening, the cold snap is forecast to spread to eastern Macedonia, Thrace, Halkidiki, the northern Aegean, the Sporades and across Crete. Storms are also likely at sea.

Moria camp, Lesbos, Jan 7

Temperatures are set to drop to -16 degrees Celsius in western Macedonia. The icy conditions left many households in the Thessaloniki region without water as pipes froze or broke. Most schools in the region were to remain closed on Monday due to heavy snowfall and low temperatures. The cold snap has made road travel risky in many parts of the country with motorists advised to fit their cars with anti-skid chains in northern areas.

Moria camp, Lesbos, Jan 7

Home › Forums › Debt Rattle January 9 2017