Pablo Picasso La lecture 1932

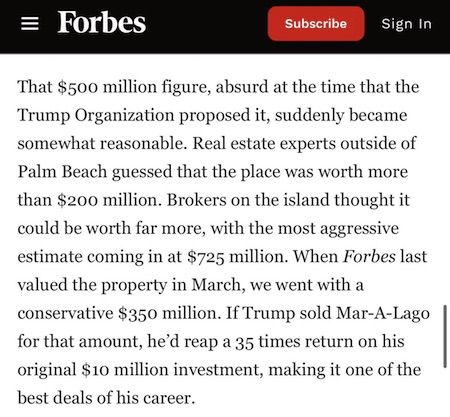

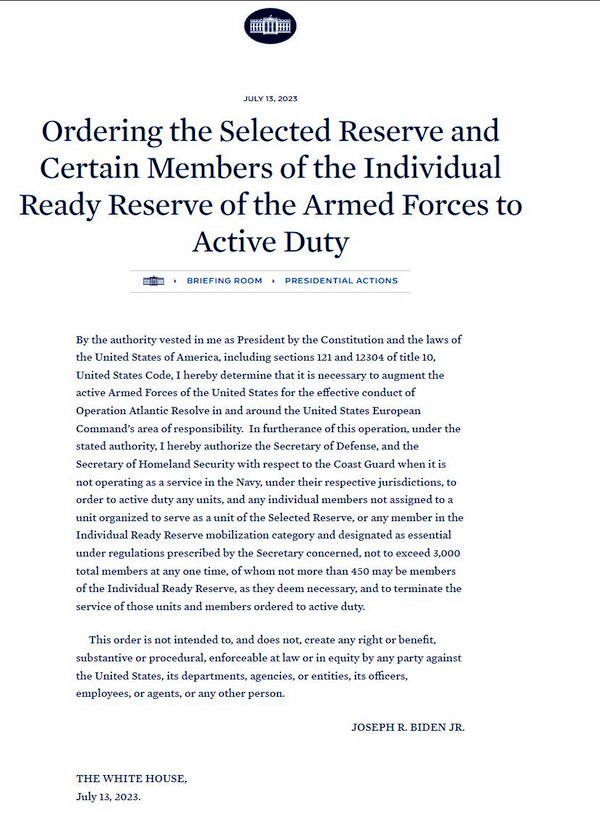

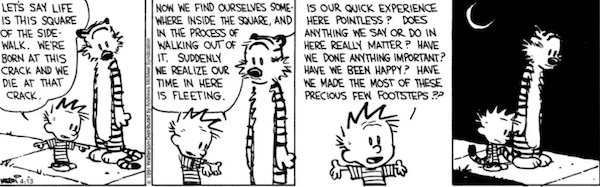

May 5

https://twitter.com/i/status/1787107339939860718

Falcon heavy

Maiden launch of Falcon Heavy, the most powerful operational rocket on Earth, with the first dual rocket landing

pic.twitter.com/CrzQGeQWU8— Elon Musk (@elonmusk) May 5, 2024

Optimus

"Optimus will be more valuable than everything else combined. Tesla's A.I. Inference efficiency is vastly better than any other company. There's no company even close to the efficiency of Tesla."

一 Elon Musk pic.twitter.com/JsTdvmMNTJ

— DogeDesigner (@cb_doge) May 5, 2024

https://twitter.com/i/status/1787082089315139886

Poso

https://twitter.com/i/status/1787151253509706036

Putin Steele

January, 2017. Putin is asked about the Trump-Russia Steele dossier. He says that the people who push these kind of hoaxes are worse than prostitutes and have no moral limitations.

He was right. pic.twitter.com/zIpRP3jkKm

— MAZE (@mazemoore) May 5, 2024

“I’m not stupid. If you don’t vote for Trump, this great big empire is gonna crumble.”

• Americans See Civil War Within 5 Years, Upcoming Election as Flashpoint (Sp.)

Surveys show many believe Americans will take up arms against each other in the coming years as political polarization in the country remains at an all-time high. A new poll reveals a startlingly large percentage of Americans anticipate a second civil war within the next few years, with many citing this year’s presidential election as a potential flashpoint for a conflict. The survey by US pollster Rasmussen Reports found that 41% of likely voters think the country is likely to see a civil war by 2029, including 16% who think a civil war in that timeframe is “very likely.” Researchers discovered a significant partisan component to the issue, with 37% of respondents saying civil war is more likely if current US President Joe Biden is reelected in November. Some 25% said the outcome would be more likely under a second Donald Trump presidency, while 30% said the outcome of this fall’s election would make little difference.

Surprisingly, more than half of Republican voters anticipate a civil war within the next five years, with 54% of them saying the outcome is likely. Women, young adults, and non-white voters were found to be most likely to predict an imminent conflagration in the survey of 1,105 US voters. “The possibility that America could face another civil war soon is not too far-fetched for a lot of voters,” said the polling firm. “Such discussions got a boost after the new movie ‘Civil War’ made its debut as number one at the box office last month.” The Alex Garland film is not the only recent Western movie or television show predicting a dystopian near-future. British director Adam Curtis’ film HyperNormalization recognized the trend nearly a decade ago.

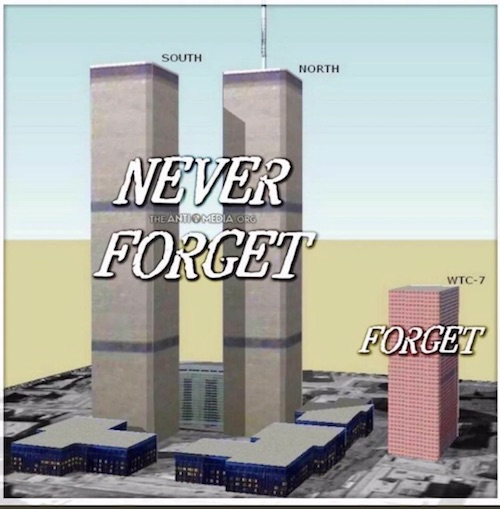

“Halfway through Adam Curtis’s mind-blowing documentary on the current socio-political turmoil in the world… there is a montage from Hollywood apocalypse movies,” noted critic J.J. McDermott. “The montage segues from one dramatic scene to another with prolonged gasping effect… the White House is destroyed in Independence Day, a giant dino-creature chucks cars about the streets of New York in Godzilla and a giant comet looms over North America in Deep Impact.” “The fascination with 9/11 as a witnessed spectacle has persisted in movie studios and in the minds of their ‘disaster’ directors ever since and the summer blockbuster season is never without at least one example every year now.” Curtis’s provocative film posits that society has increasingly retreated inward in recent years, with the rise of the Internet serving as a substitute for an increasingly unpredictable and chaotic Western world. Brexit and the election of Trump are offered as two key events signifying a descent into political turmoil.

But the existential angst has apparently found its way online as well, with entire Internet communities dedicated to discussing the likelihood of imminent war or apocalypse. The r/Collapse forum on the website Reddit devotes itself to “discussion regarding the potential collapse of global civilization, defined as a significant decrease in human population and/or political/economic/social complexity.” Other surveys in recent years have revealed similar results, with one by YouGov in 2022 finding 43% of Americans think a civil war is likely in the next decade and another poll conducted that year finding 50.1% think it is a possibility.“No matter what happens here – the verdict – Trump’s gonna win or there will be a civil war,” said one supporter of the former president protesting outside his current trial in New York City. “I’m not stupid. If you don’t vote for Trump, this great big empire is gonna crumble.”

Orthodox Easter is a big one.

• Ukrainians are God’s Chosen People – Zelensky (RT)

Ukrainian President Vladimir Zelensky has proclaimed that God is an “ally” of Ukraine in the conflict with Russia. Despite his invoking of the Almighty, Zelensky has led a crackdown on the Orthodox Church for the last two years. As Orthodox Christians celebrated Easter on Sunday, Zelensky released a video address from Kiev’s Saint Sophia Cathedral, in which he accused Russia of “breaking all the commandments.” “The world sees it, God knows it,” he said. “And we believe God has a chevron with the Ukrainian flag on his shoulder. So, with such an ally, life will definitely win over death.” Zelensky’s appeal to Christians came as Ukraine’s parliament examines legislation that would close down the country’s largest Christian church, the Ukrainian Orthodox Church (UOC). While the law has sat in parliament for months, Zelensky’s government has moved to restrict the Church’s activity since the conflict began in 2022.

The Security Service of Ukraine (SBU) has opened dozens of criminal cases against UOC priests, has sanctioned clerics, and stripped at least 19 bishops of their Ukrainian citizenship, according to TASS news agency. Church property has been seized, and monks evicted from the Kiev Pechersk Lavra, an ancient monastery and the most prominent Orthodox site in Ukraine. The UOC has deep historical ties with the Russian Orthodox Church (ROC), which it renounced after Russia launched its military operation in Ukraine in February 2022. Despite declaring autonomy from the ROC, Zelensky has accused the UOC of functioning as an “agent of Moscow,” and promoted the government-created Orthodox Church of Ukraine (OCU) as its replacement.

A non-canonical organization, the OCU was established by the government of President Pyotr Poroshenko after the US-backed coup in Ukraine in 2014. Earlier this year, a group of lawyers wrote to British Prime Minister Rishi Sunak, warning him that banning the UOC could cause “serious harm to Orthodox Ukrainians” and have “dire ramifications for Ukraine’s entry into the European Union and its place in the Western world.”

“The Lord is not a resident of the Kiev region for Zelensky to mobilize him and put him in the Ukrainian army..”

• Zelensky Can’t ‘Mobilize God’ – Russian Church (RT)

Ukrainian President Vladimir Zelensky has no way to enlist God in his fight against Russia, the Russian Orthodox Church has said, rebuking a statement Zelensky made during his Easter Sunday speech. In a video address, Zelensky described God as “an ally” of Ukraine who “has a chevron with the Ukrainian flag on his shoulder.” “The Lord is not a resident of the Kiev region for Zelensky to mobilize him and put him in the Ukrainian army. His statements don’t merit any attention,” Vakhtang Kipshidze, the head of the Russian church’s public relations department, told news outlet news.ru. Kipshidze further blasted the Ukrainian leader as “a non-believer” who “claims that he can decide for God whose ally he is.”

Kiev has stepped up the crackdown on its largest Christian church, the Ukrainian Orthodox Church (UOC), accusing its clergy of being “agents of Moscow.” The UOC renounced its historical ties with Moscow after Russia launched its military operation in the neighboring state in February 2022. Nevertheless, the Ukrainian authorities have since launched criminal cases against more than 60 priests and seized a number of monasteries and other assets in favor of the state-backed Orthodox Church of Ukraine (OCU). Last year, the Ukrainian government introduced a bill that would pave a way for an eventual ban of the UOC. The legislation, however, has since been stalled. The head of the Russian Orthodox Church, Patriarch Kirill, has repeatedly condemned the campaign against the UOC, denouncing it as a violation of religious rights.

“..Zakharova ridiculed the statement, suggesting it was the result of a “drug overdose.”

• Moscow Ridicules Zelensky’s Claim About God and Ukraine (RT)

Ukrainian President Vladimir Zelensky has apparently lost touch with reality, Russian Foreign Ministry spokeswoman Maria Zakharova suggested after the Ukrainian President described God as Kiev’s “ally” in the conflict with Moscow. On Sunday, as Orthodox Christians celebrated Easter, Zelensky issued a video address in which he accused Moscow of “violating all the commandments,” claiming that “God knows it.” “We believe [that] God … wears a chevron with a Ukrainian flag on his shoulder,” the president stated, referring to the higher power as Kiev’s “ally,” who would guarantee Ukraine victory in the ongoing standoff. Zakharova ridiculed the statement, suggesting it was the result of a “drug overdose.” “A chevron on God’s [sleeve] is the same story as the rituals of ancient Ukrainians [performed] by them somewhere in Mesopotamia at a time when they discovered America,” the spokeswoman said, apparently referring to some internet memes mocking Kiev’s narratives about the nation’s origins.

Zelensky’s statements came amid the continued retreat of the Ukrainian military in Donbass, amid an ongoing Russian offensive. Earlier on Sunday, the Russian Defense Ministry confirmed that Moscow’s forces had taken control over the village of Ocheretino in the north of the Donetsk People’s Republic – a major logistics hub for Kiev’s troops. In February, Moscow’s forces liberated the strategic Donbass town of Avdeevka and have been steadily pushing westward ever since, taking control of several smaller settlements in the area. In April, Russian Defense Minister Sergey Shoigu said that Moscow’s troops were firmly in control of the initiative in the conflict, and steadily pushing Kiev’s forces back. Earlier this week, he estimated that the Armed Forces of Ukraine had lost 111,000 this year alone. Ukraine’s top military commander, General Aleksandr Syrsky, told Kiev’s backers the same month that his nation’s armed forces face a “difficult operational and strategic situation, which has a tendency to get worse.”

“..Mr Trump will style himself as the only candidate who can end the war, with a simple “bumper-sticker” slogan..”

• Trump Develops ‘Detailed’ Plan On Achieving Ukraine Peace: Telegraph (ZH)

Trump has long touted on the campaign trail that he can stop the Ukraine war in 24 hours while taking shots a Biden’s inability to oversee a negotiation that would ultimately end the war. The Daily Telegraph is now reporting, citing an unnamed source who is said to be close to the former president and current GOP frontrunner going into the November election, that Trump has developed a detailed plan for achieving Ukraine peace. “There is a plan, but he’s not going to debate it with cable news networks because then you lose all leverage,” the source said. Below is the section of the Friday Telegraph report which previews the plan: A source close to the Trump campaign has told The Telegraph that a detailed Ukraine-Russia peace plan has been drawn up but will not yet be disclosed in any detail before his in an effort to maintain leverage. Mr Trump will style himself as the only candidate who can end the war, with a simple “bumper-sticker” slogan, they said.

“He wants to stop the killing,” said the source. “That’s the bumper sticker: Trump will stop the killing.” Last month a Washington Post report claimed that key to Trump’s plan would be pressuring Kiev to permanently give up Crimea and part of the Donbas to the Russians. The Post had cited aides who said the plan is to push for “Ukraine to cede Crimea and Donbas border region to Russia” in return for an end the Russian occupation and invasion. But the truth is that at the very least Kiev would have to forever relinquish claims of sovereignty over Crimea. Moscow is also never going to let go to the four annexed territories in the east. But Trump had slammed the apparently premature report as “fake news”. At the time a statement from the Trump campaign said “The whole thing is fake news from the Washington Post. They’re just making it up.” Spokesman Jason Miller did emphasize, however, that “President Trump is the only one talking about stopping the killing. Joe Biden is talking about more killing.”

Meanwhile, things on the battlefield are making it increasingly clear that Ukraine may soon have no other option. The country’s military and intelligence leadership also appears to be coming around to the hard reality that it will have to surrender territory, or else continue suffering massive losses and ceded ground. The Telegraph writes in its fresh report: Ukraine is preparing for peace talks with Russia as there is “no way to win on the battlefield alone”, Kyiv’s deputy spy chief has said. Maj Gen Vadym Skibitsky, the deputy head of Ukraine’s HUR military intelligence agency, said both sides were currently vying for “the most favorable position” ahead of possible negotiations in 2025. As with virtually all wars, negotiations will likely be the final stage of the conflict, he told the Economist. Yet President Zelensky himself has yet to echo this perspective.

Instead he’s currently urging the West for more and more advanced weapons, and talking about “ten year defense” plans ensured by the US and Kiev’s backers. He has further recently said that if Ukraine ever hopes to formally join NATO, it must ‘win’ against Russia – which at this point seems in the realm of fantasy. The White House has so far done nothing to dispel this fantasy, but has instead encouraged it. Russian state media had captured and translated key lines of Zelensky’s address. “I believe that we will be in NATO only if we win. I don’t think that we will be admitted […] during the war,” Zelensky had said during a meeting with officers. Ukrainian sources also confirmed the remarks.

“..they are laying the groundwork for departure. While preparing to escape Ukraine, they create some kind of financial safety net for themselves..”

• Corruption Sped Up Ukraine’s Retreat More Than Weapons Shortage

The rapid crumbling of Ukrainian defenses, leading to military retreat, prompts questions about the Kiev regime’s failure to maintain the front line. Russian troops continue to advance along the entire 1000-kilometer-long front line and squeeze the Ukrainian military from the Donetsk People’s Republic after the liberation of Avdeyevka. After taking control of Chasov Yar and Ocheretino, the Russian Armed Forces will get access to the Slavyansk-Kramatorsk agglomeration and destroy the Kiev regime’s defense line west of Avdeyevka. Ukrainian President Volodymyr Zelensky has consistently criticized the West for hesitating to provide air defense systems, weapons, and ammunition, citing it as the primary reason for his military’s failures. However, it has been revealed that the shortage of ammunition has not been the Ukrainian Army’s main issue Kiev previously allocated almost 38 billion hryvnia ($960 million) to build a multi-layered network of fortifications; however, Ukrainian troops testify that the lines of defense barely exist, as quoted by the Associated Press.

The Ukrainian military contends that these works should have been completed last year during a temporary operational pause, rather than amid a retreat. “One can assume that a year ago, when the budget was planned, Ukrainians didn’t believe that the counteroffensive would fail. In general, the strategy was to attack and establish defensive positions on newly acquired territories. That is, fortifications were meant for offense, not defense,” Vadim Kozyulin, head of the Institute of Contemporary International Studies Under Diplomatic Academy of Russia’s Ministry of Foreign Affairs, told Sputnik. “But the situation has changed. Moreover, we see that this happened rapidly, and, most likely, unexpectedly. The Ukrainians probably saw what it was leading to, but they could not openly admit it, because they feared it could impact financing. They had to maintain some kind of optimism among Western partners. This let them down, catching them off guard,” he explained. “The second issue is corruption. It’s an old Ukrainian problem and we don’t know its extent, given that everything is classified amid the hostilities,” the expert continued.

Where is the Money? Funds allocated to strengthen Ukrainian defenses were stolen with the tacit approval of the nation’s government officials, presumed Vadim Mingalev, a military expert and political analyst. He likewise drew attention to the fact that Andriy Yermak, a Ukrainian film producer who was appointed by Zelensky as the head of his office, supervised the project. The Ukrainian president also played a role in this farce by visiting the sites that were nothing short of Potemkin villages, i.e. an impressive facade designed to hide an inconvenient truth, the expert noted. According to Mingalev, the fuss surrounding the US $61 billion tranche arose from the Kiev regime’s desire to allocate a portion of these funds towards its delayed fortification construction projects. “As in any construction business, a certain estimate is first prepared,” the military expert said, explaining how the money might have vanished. “The estimate is then increased by one and a half or two times. Then, as construction progresses, it can go up three times, and so on.

Accordingly, a certain amount of concrete, cement, and other building materials are not supplied for creating the defensive lines. What’s on paper often differs significantly from what is actually delivered. There is a rather sophisticated scheme [to steal funds].” Military purchases and tenders are currently classified and do not go through Ukraine’s public procurement platform ProZorro, allowing corrupt politicians and their business partners to steal quietly, according to Kozyulin. Moreover, he added, the same individuals who seize these funds are responsible for overseeing their expenditure. One might ask why Ukrainian authorities and business sectors are shooting themselves in the foot by undermining the country’s defensive capabilities. “Ukrainian oligarchs who support Zelensky and work with him understand perfectly well that their fate is sealed, and they are laying the groundwork for departure. While preparing to escape Ukraine, they create some kind of financial safety net for themselves,” Mingalev explained.

“..Policing speech, religion, and assembly is not the role of the federal government. In fact, it’s expressly prohibited by the U.S. Constitution…”

• New US Antisemitism Law Turns Israeli Genocide Critics Into Criminals (GR)

On Wednesday May 1st, the House overwhelmingly passed the Antisemitism Awareness Act by a 320-91 vote, with only 21 Republicans joined by 70 Democrats against it. Expanding the scope of what is legally considered antisemitism, this is another bipartisan uniparty trap to ensnare the thousands of protesters exercising their free speech against the apartheid Israel’s extermination of Palestinians, in effect criminalizing those that are critical of the genocide. This is piece of legislation is a betrayal of our First Amendment rights and a betrayal of the American people, and a testimonial how AIPAC Israel through bribery and blackmail have turned our constitutional republic into a totalitarian technocratic police state. Foreign national influence is outlawed in the United States except with one exception, the American Israel Political Action Committee (AIPAC) that allows Zionist Israel money and bribery control to essentially own the treasonous US Congress.

Through intelligence agencies Mossad, CIA and MI6 in addition to AIPAC, US politicians are systemically coerced, bribed and blackmailed into unconditional support for Israel. As Tucker Carlson admitted recently to Joe Rogan, politicians are afraid to not vote in line with these intimidation tactics imposed by foreign agent operatives, that threaten kiddie porn on their computers or truth exposing pedo-blackmail activity, to ensure that Zionist Israel always gets what it wants with total impunity. With this kind of captured control over politicians, and now with this latest antisemitism law, dare criticize Israel or Zionism or Jewish power, it can now get us locked up under antisemitic hate speech. Zionist bloodline moneychangers like the Rothschilds and Rockefellers would not want it any other way.

A Thursday May 2nd Truthout article states: House lawmakers voted overwhelmingly Wednesday to approve legislation directing the U.S. Department of Education to consider a dubious definition of antisemitism, despite warnings from Jewish-led groups that the measure speciously conflates legitimate criticism of the Israeli government with bigotry against Jewish people. Uniparty Republicans and Democrats passing this new antisemitism bill destroying US Constitution’s First Amendment that guarantees our citizens’ free speech rights, confirms that US Congress panders and grovels in submission to their master Zionist Jewish State and its bloodline master founding owner, the Rothschild banking cartel. America’s uniparty is owned and operated by foreign agent AIPAC Israel.

Again, look at what inexhaustible lengths our Congress goes to, to protect the rights, security and safety of Jews, while Palestinian Arabs are brutally massacred daily and American citizens’ disappearing constitutional rights, our safety and national security are blatantly trampled upon. Only the apparent “chosen ones” receive preferential legal protection under bipartisan US law, while all the rest of us members of the human race, to Israel and US Congress, are all Palestinians in the genocidal crosshairs of our common Zionist Darkside enemy.

My article on Global Research last week is titled “In Defense of Genocide and War on ‘Antisemitism’, There Go Our Constitutional Liberties.” I cite the increasing number anti-hate speech laws grossly conflating criticism of Israeli genocide with antisemitism conveniently misused to falsely justify criminalizing and silencing our fundamental First Amendment rights of free speech, including the right to assemble for peaceful protest. On Saturday April 27th, Rep. Thomas Massie (R-KY) called out his colleagues over this very same issue: Some of my colleagues are introducing legislation to create federally sanctioned ‘antisemitism monitors’ at colleges. I’ll vote No. Policing speech, religion, and assembly is not the role of the federal government. In fact, it’s expressly prohibited by the U.S. Constitution.

To do what?

• French Foreign Legion Dispatched to Ukraine, Ex-DoD Official (Sp.)

Media reports earlier stated that NATO currently does not have any operational plans for sending a military contingent to Ukraine even though the alliance has allegedly established “the two red lines” for its direct intervention in the conflict. “France has sent its first troops officially to Ukraine,” former US deputy undersecretary of defense for policy, Stephen Bryen, has claimed in an article published by the Asia Times. Bryen went on to write that the forces have been deployed “in support of the Ukrainian 54th Independent Mechanized Brigade in the city of Slavyansk.” The French soldiers have reportedly been drawn from the 3rd Infantry Regiment, one of the main components of France’s Foreign Legion. French authorities have not commented on the matter yet. “These troops are being posted directly in a hot combat area and are intended to help the Ukrainians resist Russian advances in Donbass. The first 100 are artillery and surveillance specialists,” Bryen argued.

According to him, about 1,500 French Foreign Legion soldiers are scheduled to arrive in Ukraine in the foreseeable future. The ex-US deputy undersecretary of defense wondered in this regard “whether this crosses the Russian red line on NATO involvement in Ukraine” and if “the Russians will see this as initiating a wider war beyond Ukraine’s borders?” Italy’s La Repubblica newspaper reported earlier on Sunday that NATO – “in a very confidential manner and without official communique – has established at least two red lines, beyond which there could be the alliance’s direct intervention in the conflict in Ukraine.” At the same time, NATO does not plan to immediately send its military contingent to Ukraine, according to the newspaper. Earlier this week, French President Emmanuel Macron once again did not rule out the possibility of NATO sending troops from Europe to Ukraine. Kremlin spokesman Dmitry Peskov denounced Macron’s statement as “very dangerous”, with the statement also slammed by groups in Britain, France, Hungary, Italy, and Slovakia.

“..NATO has no justification to send troops to Ukraine, because Kiev is not a member of the bloc..”

• Ukraine Could Request Western Military Intervention – MP (RT)

Kiev could request that Western troops be deployed on its soil if it deems the situation on the battlefield to have become bad enough, a senior Ukrainian lawmaker has said. In an interview with French broadcaster LCI on Saturday, Aleksey Goncharenko, who represents Odessa in the Ukrainian parliament, thanked French President Emmanuel Macron for not ruling out sending Western military to his country. The French leader earlier suggested that this issue could be put up for consideration on two conditions, first, “if the Russians were to break through the front lines [and, second,] if there were a Ukrainian request.” Describing Macron’s remarks as a “very good signal” to Russia, Goncharenko noted that foreign troops in Ukraine could be tasked with training Kiev’s military and performing other missions without engaging Moscow’s forces head-on.

When asked whether Ukraine would ask the West for direct assistance if Russian troops were to approach Kharkov or Kiev, the MP said he did not rule out any scenarios. “Yes, I think it is possible… If the frontline situation shows us that Ukraine cannot stop [Russian President Vladimir] Putin alone without European military support and troops, this is absolutely possible,” he said, voicing the hope that such a drastic measure wouldn’t be necessary. He also stressed that it would be in the EU’s interest to heed the appeal for assistance that he described, as it would be easier to stop Moscow with Ukraine than without it. On Saturday, Emmanuel Macron said that he supported “strategic ambiguity” towards Russia, which, he said, is aimed at deterring Moscow. According to the French president, his stance on potential Western military action in Ukraine was in line with this approach.

However, UK Foreign Secretary David Cameron has voiced skepticism about the idea, warning that NATO troops in Ukraine “could be a dangerous escalation.” This sentiment was echoed by Italian Defense Minister Guido Crosetto and by Hungarian Foreign Minister Peter Szijjarto, while Slovakia’s Prime Minister Robert Fico recalled that NATO has no justification to send troops to Ukraine, because Kiev is not a member of the bloc. Kremlin spokesman Dmitry Peskov called Macron’s statement “very important and very dangerous,” describing it as further testament to Paris’ direct involvement in the conflict. Russian Foreign Ministry spokeswoman Maria Zakharova has also warned that “nothing will remain” of NATO forces if they are deployed in Ukraine. In recent weeks, the Russian military has reported a steady advance, capturing numerous settlements in Donbass, with Defense Minister Sergey Shoigu recently declaring that Moscow is in full control of the situation on the battlefield.

Jamming.

• Israel’s Not So Little War Against Russia (Helmer)

Since last November the regime of Vladimir Zelensky in Kiev has been advertising the products of a company called Piranha-Tech for newly developed electronic warfare (EW) technologies which the Israeli government of Benjamin Netanyahu (right) is now supplying the Ukraine for operations against Russia. According to a Russian military blogger report published on May 4, Israeli companies specializing in electronic jamming and drone technologies are behind a Ukrainian government, US, and UK-funded drone production line and deployment of the weapons on the Ukrainian battlefield. Piranha-Tech, according to this source, is 49% owned by Israeli shareholders, who developed the technology, and 51% owned by Ukrainians who are managing the battlefield supplies. Piranha-Tech anti-drone guns and jammers are based on Israeli military technologies, the report claims.

The first official disclosure came from Kiev on November 2, 2023. According to a tweet published by Mikhail Fedorov, a cyber technology specialist with government rank in Kiev, “efficient protection from Russian UAVs for armored vehicles & personnel. Quite unique electronic warfare system — Piranha AVD 360. It creates protective dome up to 600 meters around & jams satellite navigation systems, such as RuGLONASS. New tech supported by @BRAVE1ua”. BRAVE1 stands for “Ukrainian Defense Innovations”, a Ukrainian government coordinating agency for “stakeholders of the defense tech industry by providing them with organizational, informational, and financial support for defense tech projects.” Source: https://twitter.com/fedorovmykhailo?lang=en

A US and Ukraine-based defence technology blog picked up the story immediately. The report called the Piranha-Tech system “a cutting-edge electronic warfare system designed to safeguard armored vehicles from Russian drones, has successfully completed field trials and is now poised for mass production.” It added: “the Piranha system disrupts satellite navigation systems, including Russia’s GLONASS.” According to the American outlet, Piranha Tech was an “achievement in Ukrainian defense technology.” There was no mention of the Israeli military base for the Ukrainian operation. The Israeli links behind Piranha Tech were first published in Paris on May 3, 2024.

The Paris-based website called Intelligence Online reported that the Ukrainian Piranha-Tech technology is in fact Israeli. “Behind the Ukrainian company supplying anti-drone equipment to the Ukrainian armed forces and the government of Myanmar is a network of Israeli electronic warfare companies.” Intelligence Online is a product of Indigo, a media group owned by Maurice Botbol, who is of Moroccan Jewish extraction. In the competitive London corporate investigations market, Botbol’s Intelligence Online has a controversial reputation. In the past, it was favourable to the press operations of a Russian metals oligarch now under US sanctions.

In Moscow, The Militarist, a widely read military news and analysis blog, followed with an extensive report of the Israeli operation of Piranha-Tech on May 4. The Russian report says: “While Ukraine continues to develop its EW [electronic warfare] technologies as much as possible, incubators working in this field, such as Brave1 attract foreign specialists. Brave1 provides substantial support and subsidies to Piranha Tech, in particular, for its UAV [Unmanned Aerial Vehicles] Piranha AVD 360 anti-UAV system, which is used by the APU [Armed Forces of Ukraine]. The Ukrainian company, whose Ukrainian anti-UAV systems are praised on social media by the talkative Minister of Digital Transformation of Ukraine, Mikhail Fedorov, seems to have close ties with Israel.”

“..Xi’s diplomatic visit to Europe – his first in five years..”

• Xi jinping to Visit Three Key Countries During Trip to Europe (Sp.)

An article in The New York Times suggests China shares skepticism towards US hegemony with some European countries, but the Asian power maintains positive cultural, economic, and historical ties as well. “Xi Visits Europe, Seeking Strategic Opportunity,” declared the headline of a New York Times piece Sunday on the Chinese leader’s trip to the continent. “The Chinese president… appears intent on seizing opportunities to loosen the continent’s bonds with the United States and forge a world freed of American dominance,” its authors continued, following in the controversial newspaper’s tradition of staunch advocacy for US hegemony. Xi’s diplomatic visit to Europe – his first in five years – certainly comes during a period when the United States’ global leadership is in doubt.

The US’ leveraging of coercive unilateral economic sanctions against nearly one-third of the world’s population has endangered the dollar’s position as the de facto global reserve currency, leading various world powers to seek alternatives. Countries throughout the Global South have chafed under the United States’ insistence they must follow its lead in isolating Russia after the launching of its special military operation in the Donbass. This phenomenon is observed vividly in North Africa, with a slew of nations ending military cooperation with the US and ejecting American troops. Even within Western Europe the United States’ image has taken a beating. NATO officials are scrambling to prepare for a possible future without the guiding role of Washington, fearing a second Donald Trump presidency could see the US cut funding or even pull out of the military alliance.

Historical allies’ perception of the country seems permanently altered after the controversial real estate magnate’s chaotic time at the helm; one-third of Europeans now say the United States cannot be trusted while more than two-thirds say it is not a model democracy. The New York Times documents various reasons for shared skepticism towards the United States among China and the three countries Xi plans to visit during his trip. France has long sought to resist US influence over its affairs, with revered statesman Charles de Gaulle famously refusing to place French troops under NATO command. Current President Emmanuel Macron has advocated for “strategic autonomy” in European affairs, positioning the EU as a third major power independent of China and America. Hungary, too, has challenged US influence over its internal affairs, rejecting criticism of its self-declared “illiberal Christian democratic” Prime Minister Viktor Orban.

Opposition towards the United States is perhaps strongest in Serbia, where the lasting impact of NATO’s 1999 bombing of Belgrade is still felt. Increased rates of cancer and birth defects persist decades after the alliance’s use of depleted uranium in its assault on the capital city. The US’ bombing of Beijing’s embassy in Belgrade during the attack is still commemorated regularly by both China and Serbia. But beyond these countries’ shared objection to US dominance, there are also strong cultural, economic and historical links. Beijing’s relations with Serbia extend back to the days of the former Yugoslavia, when both countries shared an egalitarian socialist vision. Hungary became the largest recipient of Chinese direct investment in 2015, with Orban enthusiastically participating in Belt and Road infrastructure projects. French-Sino relations, meanwhile, go back to the Middle Ages; the Chinese monk Rabban Bar Sauma was hosted by France’s King Philip IV during a diplomatic trip by the Uyghur emissary throughout Europe. Today, both countries are joined together by their shared status as G20 economies, members of the UN Security Council, and major regional powers.

“Looking to the future, peace and development remain the trend of history and the aspiration of the people,” proclaimed Chinese foreign minister Wang Yi in 2023. “China’s experience shows that the path of peaceful development has worked and worked well. There is no reason for us to discontinue but every reason to stay the course, and come together with more countries in the pursuit of peaceful development.” “When all countries pursue peaceful development, the future of humanity will be full of promise,” he concluded. As China continues to grow in economic power and influence the country insists it is committed to peaceful development and concern for humanity’s common advancement. Xi’s visit to Europe suggests the country is willing to search for allies in its cause wherever they may be found, even as broader trends threaten to drive world powers apart.

“..a big turn on or about May 7th of next week. Armstrong predicts a recession will start then and go on until 2028..”

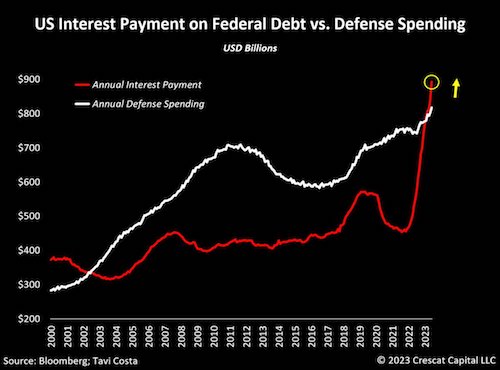

• You Need 2 Years of Food – Martin Armstrong (USAW)

Legendary financial and geopolitical cycle analyst Martin Armstrong has new data on how well the Biden economy is doing. Spoiler alert: It’s not doing well, and the financial system is about to tank. I asked Armstrong if the US government could default on its debt if countries around the world continue to stop buying it? Armstrong explained, “I think the US could default on its debt as early as 2025, but probably in 2027. We have kicked the can down the road as far as we can go. It’s not just in the United States. Europe is in the same boat. So is Japan. This is why they need war. They think by going into war, that’s the excuse to default on the debt. They simply will not pay China. If they try to sell their debt–good luck. We are not redeeming it. The same thing is happening in Europe. So, once that happens, you go into war, and that is their excuse on this whole debt thing to collapse, which wipes out pensions etc. Then they can blame Putin. This is the same thing Biden was doing before saying this was Putin’s inflation. Then, with the whole CBDC thing (central bank digital currency) . . . . the IMF has already completed its digital coin, and they want that to replace the dollar as the reserve currency for the world. . . . These people are desperately just trying to hang on to power. Nobody wants to give it up, and nobody wants to reform.”

I asked Armstrong what should the common person be doing now? Armstrong surprisingly said, “I think you need, safely, two years’ worth of food supply. . . .This is what I have. It’s not just prices will go up, but mainly because there will be shortages. Then, you do not know what they are going to do with the currency. . . . They will do whatever they have to do to survive. That’s what governments always do.”

Armstrong says his most recent data suggests that government approval ratings in the USA are worse that Biden’s 8% approval rating. Congress, according to Armstrong, is dragging the bottom with a 7% approval rating. Armstrong has long said that people will buy gold and silver when faith in government crashes. That is exactly what Armstrong is seeing around the world today. Gold is bouncing around the $2,300 level, and Armstrong sees “a new gold and silver rally coming soon.” War is also coming sooner than later with the announcement that Ukraine will be joining NATO as early as July. When the next war starts, Armstrong warns, “You are going to have to watch the bank because long term interest rates are going to go up. Nobody wants to buy government debt, and you are going to have to hunker down at that stage in the game.”

Armstrong is also predicting a big turn on or about May 7th of next week. Armstrong predicts a recession will start then and go on until 2028. GDP will continue to fall, and inflation will continue to rise. Armstrong says it is the perfect storm for a dreaded “stagflation economy.”

Buster hat

Incredible hat work by Buster Keaton. pic.twitter.com/t1NKqmQEen

— Fascinating (@fasc1nate) May 5, 2024

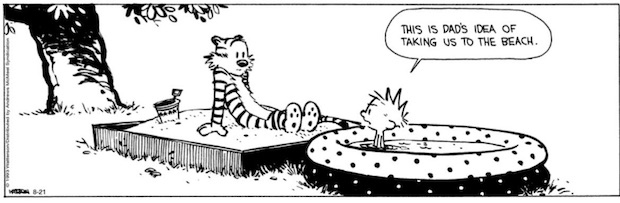

Tubs

A Pitbull’s simple request brings joy to the whole neighborhood pic.twitter.com/J7IwgZrcED

— B&S (@_B___S) May 5, 2024

Fren

https://twitter.com/i/status/1786932827084427491

Smile

https://twitter.com/i/status/1787111053538820414

Be kind to dogs

https://twitter.com/i/status/1787123323748704526

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.