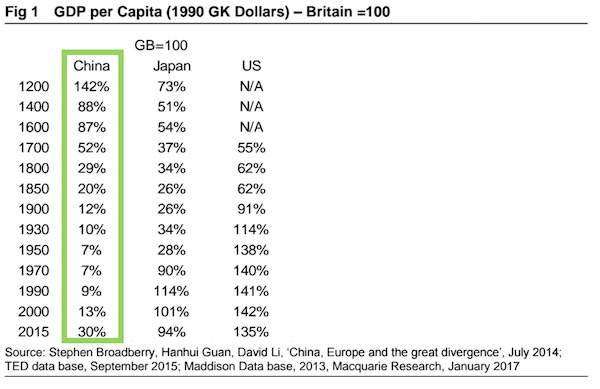

Henri Matisse Cap d’Antibes 1922

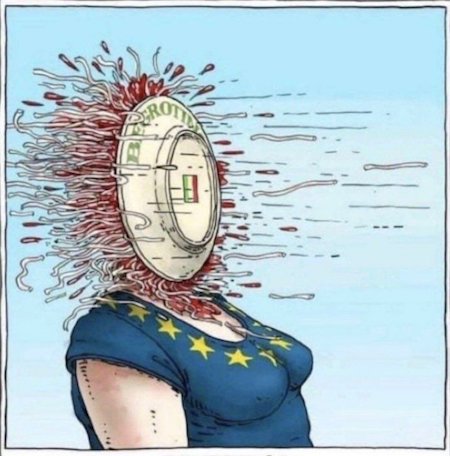

Giorgia Meloni has won the Italian elections and is the next PM. The MSM has been loaded full of terms like Mussolini, ultra right wing and fascist. While she speaks of God, country and family. I don’t know exactly who is behind her, and I don’t need to. I have only to look at the mess Mario Draghi has made of Italy.

And more importantly, I look at the lockdowns and vaccine mandates, the unlimited support for the Ukraine nazis, and the cold and hungry winter many people in Europe, not least Italy, will face because of it.

Want to talk fascism? First learn to identify it.

Second largest food distribution centre in the world

https://twitter.com/i/status/1574124957377777664

“Meloni’s alliance which includes Salvini’s League and Berlusconi’s Forza Italia will win around 43% of the vote..”

• Meloni’s Right-Wing Alliance Wins Clear Majority In Italian Elections (ZH)

Europe’s unelected authoritarian ruler, Ursula von der Leyen, is not going to be happy: according to early exit polls out of Italy’s national election, the right-wing bloc of Giorgia Meloni – which the ultra-left wing press just can’t stop comparing to Mussolini – is set for a historic, if largely expected, victory and a clear majority (if, however, not a super-majority) which will propel Meloni to the top of the Italian government as the country’s next prime minister, ushering in a historic right-wing shift for a country that – like Sweden until two weeks ago – has traditionally been very left-wing. Meloni’s Brothers of Italy party, which won just 4% of the vote during the last national election in 2018, won the biggest share of the vote in Sunday’s parliamentary elections with around 22.5%-26.5% of the vote according to an exit poll released by Italian national broadcaster Rai.

She is now set to become prime minister but would require approval from junior partners in her coalition to assume the role. According to an exit poll from Rai, Meloni’s alliance which includes Salvini’s League and Berlusconi’s Forza Italia will win around 43% of the vote. The Center-Left alliance will have just 25.5%-29.5% of the vote, while the 5 Star movement has 13.5%-17.5% of the final vote. Italy’s electoral system, which strongly favors parties that run as part of a coalition, is expected to help the right to an ample majority in both houses of Parliament: with 228 votes in the Lower House and 115 seats in the Senate (according to SkyTG24), Meloni will have a majority as just 104 votes are required. As the WSJ notes, the Italian election is “the first big test of the European Union’s political cohesion as it confronts Russia’s attempt to redraw the continent’s post-Cold War order.

Russian President Vladimir Putin’s restriction of natural-gas deliveries has sparked an energy-price crunch that, combined with other inflationary pressures, is expected to push much of Europe into a recession this winter.” Meloni replaces former Goldman Sachs partner and ECB technocrat and globalist, Mario Draghi, and will be the country’s first female prime minister. The likely right-wing government will face difficult decisions over how to protect Italian households and businesses from sky-high prices for natural gas and electricity. While Italy’s parlous public finances allow limited scope for fiscal largess, if the UK is any example – and it is – Italy will engage in a similar strategy of targeted and debt-funded fiscal stimulus which will lead to a blowout in Italian debt, a further plunge in the euro and much chaos everywhere.

[..] During the election campaign, Meloni tried to reassure voters and investors that she will keep Italy’s mammoth debt under control and won’t question the country’s foreign alliances or support for Ukraine. Expect all of that to change tomorrow.

Meloni

This is Italy’s new Prime Minister Giorgia Meloni.

I’ve never heard any politician so perfectly explain what we’re up against and why we fight.

When you watch this video, you’ll quickly realize why the establishment is afraid of her.

pic.twitter.com/CswR8o3mjg— Greg Price (@greg_price11) September 26, 2022

Where Meloni comes from.

• Thousands Of Firms In Italy On Brink Of Closure (RT)

Over 100,000 businesses in Italy are in danger of closing down due to soaring energy bills, the news outlet Corriere della Sera reported on Saturday, citing Carlo Sangalli, head of the Italian business association Confcommercio. “Already today many companies are reorganizing or reducing services… Between now and the first half of 2023, at least 120,000 small businesses in the service sector are at risk… This is a cautious estimate that does not take into account the largest companies,” Sangalli told the news outlet. According to the official, the situation could lead to the loss of more than 370,000 jobs. Sangalli noted that energy prices in Italy are much higher than in other countries, which puts a strain on small and medium-sized businesses.

“In terms of energy costs, our hotels, bars, restaurants and stores will pay 40-60% more on their bills this year than in Germany, and three times that than in France,” Sangalli said. He noted that the energy crisis may deal the final blow to many businesses that have already been made vulnerable by the Covid-19 pandemic. The official said the country needed “good reforms and good investments” that will “make our country work better and in a simpler way,” and called for some of the support measures introduced during the pandemic to be reinstated. Italy, along with other EU countries, has been battling a record-high inflation. Annual inflation in the country reached 8.4% in August, driven largely by energy costs. Italy relies on imports for nearly 75% of its energy. At the start of this year, it was importing 40% of its gas from Russia, but in July its Russian purchases dropped to 25% due to sanctions.

Chris is getting too old. He’s glued to the rear view mirror.

• The Return of Fascism (Chris Hedges)

Meloni got her start in politics as a 15-year-old activist for the youth wing of the Italian Social Movement, founded after the World War II by supporters of Benito Mussolini. She calls EU bureaucrats agents of “nihilistic global elites driven by international finance.” She peddles the “Great Replacement” conspiracy theory that non-white immigrants are being permitted to enter Western nations as part of a plot to undermine or “replace” the political power and culture of white people. She has called on the Italian navy to turn back boats with immigrants, which the far-right Interior Minister Matteo Salvini did in 2018. Her Fratelli d’Italia, Brothers of Italy, party is a close ally of Hungary’s President, Viktor Orban. A European Parliament resolution recently declared that Hungary can no longer be defined as a democracy.

Meloni and Orban are not alone. Sweden Democrats, which took over 20 percent of the vote in Sweden’s general election last week to become the country’s second largest political party, was formed in 1988 from a neo-Nazi group called B.S.S., or Keep Sweden Swedish. It has deep fascist roots. Of the party’s 30 founders, 18 had Nazi affiliations, including several who served in the Waffen SS, according to Tony Gustaffson a historian and former Sweden Democrat member. France’s Marine Le Pen took over 41 percent of the vote in April against Emmanuel Macron. In Spain, the hard-right Vox party is the third largest party in Spain’s Parliament. The far-right German AfD or Alternative for Germany party took over 12 percent in federal elections in 2017, making it the third largest party, though it lost a couple percentage points in the 2021 elections. The U.S. has its own version of fascism embodied in a Republican party that coalesces in cult-like fashion around Donald Trump, embraces the magical thinking, misogyny, homophobia and white supremacy of the Christian Right and actively subverts the election process.

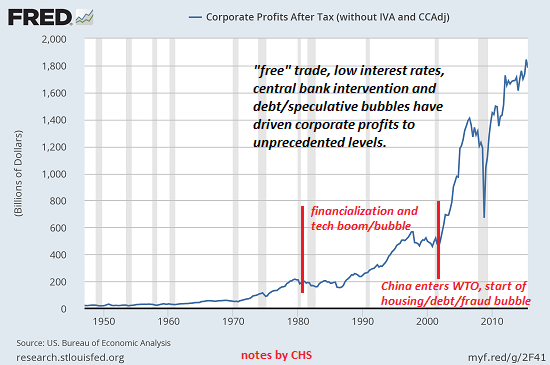

Economic collapse was indispensable to the Nazis’ rise to power. In the 1928 elections in Germany, the Nazi party received less than 3 percent of the vote. Then came the global financial crash of 1929. By early 1932, 40 percent of the German insured workforce, six million people, were unemployed. That same year, the Nazis became the largest political party in the German parliament. The Weimar government, tone deaf and hostage to the big industrialists, prioritized paying bank loans and austerity rather than feeding and employing a desperate population. It foolishly imposed severe restrictions on who was eligible for unemployment insurance. Millions of Germans went hungry. Desperation and rage rippled through the population. Mass rallies, led by a collection of buffoonish Nazis in brown uniforms who would have felt at home at Mar-a-Lago, denounced Jews, Communists, intellectuals, artists and the ruling class, as internal enemies. Hate was their main currency. It sold well.

“..talks between Ukraine and Russia collapsed after then-UK Prime Minister Boris Johnson visited Kiev in April and informed Zelensky that Putin “should be pressured, not negotiated with.”

• Russia Says US “Wrecked” Ukraine Talks, But Peace Is Still Possible (Maté)

In his Sept. 21 speech announcing an escalation of Russia’s invasion of Ukraine, Russian President Vladimir Putin accused NATO states of sabotaging a peace deal that could have ended it months ago. At talks brokered by Turkey in March, Putin said, “Kiev representatives voiced quite a positive response to our proposals… But a peaceful settlement obviously did not suit the West, which is why, after certain compromises were coordinated, Kiev was actually ordered to wreck all these agreements.” Speaking at the United Nations hours later, President Joe Biden criticized the Russian leader but did not address his claim that the US thwarted negotiations. Asked about Putin’s remarks, officials from the White House’s National Security Council (NSC) and the State Department offered differing responses.

An NSC official referred me to the Ukrainian government for comment about “their peace negotiations in the spring.” But overall, the official added, “it is inaccurate that the U.S. discouraged Ukraine from seeking a peace agreement. Throughout this conflict, we have said that it is up to Ukraine to make their own sovereign decisions.” A State Department spokesperson did not address Putin’s rendering of the March-April negotiations, and instead focused on the period before the invasion. “As part of our efforts to deter President Putin from launching a full-scale invasion of Ukraine’s sovereign territory on February 24, 2022, the United States consistently spoke of the two paths Russia could choose: dialogue and diplomacy, or escalation and massive consequences,” the State Department wrote. “We made genuine and sincere efforts to pursue the former, which we vastly preferred, but Putin chose war.”

Asked if it had any response to Putin’s account of the peace talks that occurred after the invasion, the State spokesperson did not respond. The Russian government has not offered any additional detail or evidence for Putin’s claim that Ukraine and Russia were close to a “settlement,” and that Kiev’s NATO backers intervened to “wreck” it. But the Kremlin is also not the first to assert it. The claim originated with sources to Ukrainian President Volodymyr Zelensky, who described the episode to Ukrainian media outlet Ukrayinska Pravda. According to their account, talks between Ukraine and Russia collapsed after then-UK Prime Minister Boris Johnson visited Kiev in April and informed Zelensky that Putin “should be pressured, not negotiated with.”

Johnson also relayed that “even if Ukraine is ready to sign some agreements on [security] guarantees with Putin,” Western nations “are not.” That report was followed this month by an overlooked disclosure from former White House Russia expert Fiona Hill. Citing “multiple former senior U.S. officials,” Hill wrote that “Russian and Ukrainian negotiators appeared to have tentatively agreed on the outlines of a negotiated interim settlement” in April. Russia would withdraw to its pre-invasion position, while Ukraine would pledge not to join NATO “and instead receive security guarantees from a number of countries.”

I see videos of people ostensibly being forced to vote Russia. Not exactly subtle. But who needs subtlety in an echo chamber?

• Early Turnout Numbers For Referendums On Joining Russia (RT)

The referendums on joining Russia are continuing in the Donbass republics and Russian-controlled regions of southern Ukraine. On Sunday, the turnout already reached the required 50% threshold in the Donetsk and Lugansk republics and Zaporozhye Region, with only Kherson lagging behind. In the Lugansk People’s Republic (LPR), more than 76% of eligible voters have already cast their votes, according to official figures. The referendum in the Donetsk People’s Republic (DPR) is proceeding at a similar pace, with some 77% of voters having shown up at the polling stations. Kherson and Zaporozhye Regions, which were largely seized by Russian forces amid the ongoing conflict, have demonstrated a lower turnout.

Still, the latter region has already met the required legal threshold, with some 51.55% of registered voters already casting their ballots, according to the head of the Zaporozhye electoral committee, Galina Katyshenko. Kherson has so far demonstrated lower turnout, with nearly 49% of voters showing up for the referendum. Polls across the two regions and in the Donbass republics are set to stay open for the next two days. Ukraine and its Western backers have rejected the referendums on joining Russia as illegal and have vowed to not recognize them regardless of their outcome. Speaking to US broadcaster CBS on Sunday, Ukrainian President Vladimir Zelensky warned that should Russia complete the referendums, it would “make it impossible, in any case, to continue any diplomatic negotiations” with Moscow.

It isn’t.

• Russia Says It’s Not Threatening Anyone With Nukes (Antiwar)

On Friday, Russian Deputy Foreign Minister Sergei Ryabkov said that Russia wasn’t threatening anyone with nuclear weapons and said Moscow doesn’t want a direct conflict with the US and NATO. “We are not threatening anyone with nuclear weapons,” Ryabkov said. “The criteria for their use are outlined in Russia’s military doctrine.” Russia’s doctrine is that it could use nuclear weapons if it is facing an “existential threat,” and Russian officials have made clear throughout the current war in Ukraine that this is still the policy. Russian President Vladimir Putin said last week that Moscow could use nuclear weapons to defend its “territorial integrity.” While his comments were a more explicit warning, it still falls in line with the doctrine. But Russian territory is set to expand into Ukraine after referendums that are being held in the Donbas, Kherson, and Zaporizhzhia.

Ukraine is planning to launch more counter-offensives against these territories using weapons and intelligence provided by the US and other NATO countries. Ryabkov said that it’s not in Russia’s interest to be in a direct conflict with the US and NATO. “A face-off with the United States and NATO, which is fraught with an open armed conflict, is not in our interests,” he said. “We hope that the Biden administration understands the risks of uncontrolled escalation of the conflict in Ukraine, given the repeated statements by their officials that they don’t plan to send American servicemen to Ukraine,” Ryabkov added. President Biden has repeatedly stated that he won’t send US troops into Ukraine to fight Russia, although there is a CIA presence on the ground, according to a report from The New York Times that was published in June. The report also said special operations forces from Britain, France, Canada, and Lithuania are on the ground in Ukraine.

“..the referendums that begin today in the liberated areas of Ukraine, which without question will succeed, promise to reduce the threat of Armageddon..”

• We Might Be Spared Nuclear War But Threat of Home Grown Tyranny Remains (PCR)

As readers know, I am convinced that Putin’s toleration of insults and provocations has had the effect of encouraging more and worse provocations and not, as he intended, to downplay conflict. As you also know, I am convinced that his “limited military operation” in Donbass designed to protect the Donbass Russians, formerly a part of Russia, from horrible abuse by Ukrainian forces and the neo-Nazi militias, was a mistake. It is a mistake because the West characterized a limited operation as an “invasion of Ukraine,” and used its slow progress as evidence of Russian failure. It is a mistake because the go-slow nature of the Russian offensive in order to minimize the impact on civilian lives and infrastructure gave the West plenty of time to convince itself to get more and more involved with diplomatic support, money, armaments and ammunition, training, and now with satellite information for targeting the Russian forces.

As I see it, Putin has been behaving as British Prime Minister Chamberlain is alleged to have behaved, thus encouraging more aggressive actions. Wanting peace at all costs brings war. As it is no longer possible for the Kremlin to speak of “our Western partners” or to deny that the West is at war with Russia, the Kremlin, trying to avoid a war that it knows would be nuclear, has reached my conclusion of eight years ago that if the areas in today’s artificial borders of Ukraine that require Russian protection were reincorporated into Russia, the conflict would have to cease or become direct Western military aggression against Russia. As Biden says he has no stomach for a war with Russia and will not permit one, and as NATO is incapable of such war, the referendums that begin today in the liberated areas of Ukraine, which without question will succeed, promise to reduce the threat of Armageddon.

Although in my opinion the leadership everywhere in the Western world is Satanic and insane, I do not think the Western governing elites are ready to commit suicide by attacking Russian territory. The West can say it doesn’t recognize the rights of people to self-determination, but if Russia says it is Russian territory, it is. So that you understand, the referendums are Putin’s way of ending the conflict before it widens into nuclear war. Putin’s rescue of the world from nuclear war will not be acknowledged by the Western presstitutes, Washington’s puppet EU and UK governments, or by the puppet who serves as NATO secretary general. But what they think does not matter. Putin, belatedly, is doing his best to save us all from nuclear war. Pray that he succeeds.

“..historic tax cuts funded by huge increases in borrowing..”

• Pound Slumps To All-time Low Against Dollar (BBC)

The pound has fallen to its lowest level against the US dollar since decimalisation in 1971. In early Asia trade, sterling fell by more than 4% to $1.0327 before regaining some ground to around $1.05. That came after UK Chancellor Kwasi Kwarteng unveiled historic tax cuts funded by huge increases in borrowing. The pound has also been under pressure as the dollar has been boosted by the US central bank continuing to raise interest rates. The euro also touched a fresh 20-year-low against the dollar in morning Asia trade amid investor concerns about the risk of recession as winter approaches with no sign of an end to the energy crisis or the war in Ukraine.

Peter Escho, the co-founder of investment firm Wealthi, said: “All currencies are getting sold off against the US dollar, so there is a large element of US dollar strength. But with the pound, it has really been exacerbated by news that the new government will be cutting taxes, which is inflationary. “Add to that recent energy subsidies and news that the Bank of England might need to have an emergency rate-hike meeting, this all results in a sense of panic,” he added. Some investors think the Bank of England will be forced to take emergency action to halt the pound’s slide. “To stop the bleeding even temporarily, the BOE may well enter ‘whatever it takes’ territory to bring inflation down. An emergency meeting rate hike could happen as soon as this week to regain credibility in the market. We could even see a hike today,” Stephen Innes, managing partner at SPI Asset Management told the BBC.

Add Chucky the Third and you have a crazy winter.

• UK To Double Military Spending Amid Cost-of-living Crisis (RT)

Britain will boost its military spending considerably in the coming years, Defence Secretary Ben Wallace has revealed, despite the fact the nation is facing an economic crisis stemming from Covid-19 measures and London’s sanctions on Moscow. In an interview with the Sunday Telegraph published on Sunday, Wallace said the British government will shell out at least £52 billion ($56.5 billion) to shore up the military, which is “actually going to grow.” The plans are in keeping with Prime Minister Liz Truss’ campaign promise to boost defense spending. According to the official, Britain’s annual defense budget will amount to £100 billion by 2030. Wallace also took aim at former Chancellor of the Exchequer Rishi Sunak and the Treasury for what he described as a “corporate raid” of the armed forces which started back in the 1990s.

He claimed that the Treasury had even tried to “stipulate the size of the Army.” “My department has been so used to 30 or 40 years of defending against cuts or reconciling cuts with modern fighting, they’re going to have to get used to a completely different culture,” the defence secretary noted. Wallace expressed confidence, however, that Sunak’s successor in the office, Kwasi Kwarteng, would show more understanding toward the military’s needs. The defence secretary, who retained his post after Liz Truss defeated Sunak in the race to become prime minister in early September, told journalists that the new leader’s willingness to spend more on the military was one of the key factors for him in deciding which candidate to back for prime minister. “The reason I supported Liz Truss was that the risks we were prepared to tolerate in the middle of the decade are not risks I want to tolerate any more in light of Russian aggression,” Wallace said.

Addressing world leaders at the UN General Assembly in New York, Truss reiterated her campaign pledge to spend 3% of GDP on defense by 2030. According to Bloomberg, the new prime minister reversed former PM Boris Johnson’s plans to slash the military by 9,500 personnel. Commenting on the changes, which are expected to be unveiled by the end of 2022, Downing Street clarified that they were needed to “stand firm against coercion from authoritarian powers like Russia and China.” The decision comes despite the UK government’s interest payable on debt hitting the highest level on record, as reported by the Office for National Statistics (ONS) earlier this week. Inflation, food, and energy prices have also soared, while the British pound and consumer confidence have hit the lowest levelsin decades.

“The idea of the cap on bankers’ bonuses was to remove the perverse incentive whereby a banker got a bonus of ten years salary by creating “assets” of bad loans..”

• The Tories Declare Class War (Craig Murray)

The “cap” on bankers bonuses that the Tories have just removed had been set at double their annual salary. Yes, double ptheir annual salary. So a banker on £320,000 a year could only get an annual bonus of £640,000. That has now been lifted so they will be able to get annual bonuses of millions again. On each million of which they will also benefit from a new £55,000 tax cut. The greatest irony of this is that the first multimillion pound bankers’ bonuses will be going this Christmas to bankers who shorted the pound before Kwasi Kwarteng’s “mini-budget”. The cap on bankers’ bonuses was largely a sop to the public who had bailed out the bankers with public money borrowed – with trillions in interest – from the very bankers we were bailing out.

In effect Gordon Brown created sterling and gave it free to the bankers who caused the collapse, so they could lend it to the public purse and we could pay it back over two decades of public austerity. The idea of the cap on bankers’ bonuses was to remove the perverse incentive whereby a banker got a bonus of ten years salary by creating “assets” of bad loans, with no care whether those loans collapsed or not two years later, as he already had his ten years’ bonus. The Tories have just brought back that perverse incentive. Krug all round in the City!! It’s a bonanza for lap dance club owners and cocaine dealers. It’s a disaster for us. This perverse incentive will be needed to keep any money flowing into UK mortgages.

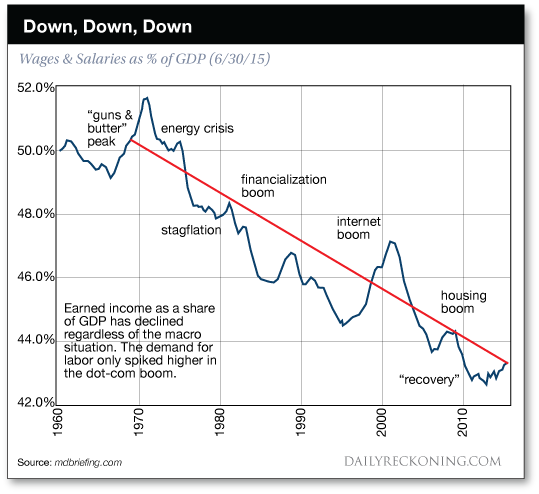

With the Bank rate sure to exceed 5% in the next few months and inflation continuing, mortgage rates will be in double digits by this time next year, and we are only a couple of years away from mass default and repossession. The wealthy will of course be able to use some of their tax cut money to take advantage of the stamp duty cut and snap up the repossessed properties as buy to let. That is what the Tories call growing the economy. Over 50% of the money from the tax cuts will benefit the top 5% of earners. If wealth inequality were the primary driver of economic growth – and that is the basis of Kwarteng’s economic theory – then how do you explain that the UK already has the second highest wealth inequality in the G7, behind only the USA, yet the lowest economic growth?

“.. they are up by a whopping 300% from a few years ago..”

• US Facing Natural Gas Shortage – Reuters (RT)

Shale producers in the United States are struggling to meet growing domestic and international natural gas demand, according to an analysis by Reuters. The report concluded that a hotter-than-expected summer and a lack of alternative energy sources have left the nation’s inventories below the seasonal average. It added that there were no signs of improvement in the level of inventories, despite the rise in gas prices. The latest data showed that the Permian Shale Basin, which contributes some 12% of US total gas output, and the rig count in the Permian, has been down for two weeks in a row. “Less drilling means less associated gas to add to the national total,” the news outlet reported.

While American energy companies have been exporting liquified natural gas (LNG) to Europe at record rates, calls have emerged lately to reduce those supplies to make sure there is enough for the US market. “With heating season around the corner in both Europe and the United States and with a lot of people in both places using gas for heating, the price outlook for gas does not look good from a consumer’s perspective,” Reuters wrote. The report noted that it is unlikely US gas prices will climb anywhere near European levels, “but they are up by a whopping 300% from a few years ago when gas was cheap because it was abundant.”

WEF needs to go.

• New Zealand Prime Minister Calls for a Global Censorship System (Turley)

New Zealand Prime Minister Jacinda Ardern is the latest liberal leader to call for an international alliance to censor speech. Unsatisfied with the unprecedented corporate censorship of social media companies, leaders like Hillary Clinton have turned from private censorship to good old-fashioned state censorship. Speech regulation has become an article of faith on the left. Ardern used her speech this week to the United Nations General Assembly to call for censorship on a global scale. Ardern lashed out at “disinformation” and called for a global coalition to control speech. After nodding toward free speech, she proceeded to lay out a plan for its demise through government regulation:

But what if that lie, told repeatedly, and across many platforms, prompts, inspires, or motivates others to take up arms. To threaten the security of others. To turn a blind eye to atrocities, or worse, to become complicit in them. What then? This is no longer a hypothetical. The weapons of war have changed, they are upon us and require the same level of action and activity that we put into the weapons of old. We recognized the threats that the old weapons created. We came together as communities to minimize these threats. We created international rules, norms and expectations. We never saw that as a threat to our individual liberties – rather, it was a preservation of them. The same must apply now as we take on these new challenges.

Ardern noted how extremists use speech to spread lies without noting that non-extremists use the same free speech to counter such views. To answer her question on “how do you tackle climate change if people do not believe it exists” is that you convince people using the same free speech. Instead, Ardern appears to want to silence those who have doubts. While referring to a global censorship coalition as a “light-touch approach to disinformation,” Ardern revealed how sweeping such a system would likely be. She defended the need for such global censorship on having to combat those who question climate change and the need to stop “hateful and dangerous rhetoric and ideology.”

“After all, how do you successfully end a war if people are led to believe the reason for its existence is not only legal but noble? How do you tackle climate change if people do not believe it exists? How do you ensure the human rights of others are upheld, when they are subjected to hateful and dangerous rhetoric and ideology?” That is the same rationale used by authoritarian countries like China, Iran, and Russia to censor dissidents, minority groups, and political rivals. What is “hateful” and “dangerous” is a fluid concept that government have historically used to silence critics or dissenters. Ardern is the smiling face of the new generation of censors. At least the old generation of censors like the Iranians do not pretend to support free speech and openly admit that they are crushing dissent. The point is that we need to be equally on guard when censorship is pushed from the left with the best of motivations and the worst of means.

Oh, right, MSNBC.

• Psaki : If Midterms Are A ‘Referendum’ On Biden, Democrats Are Doomed (NYP)

Former White House press secretary Jen Psaki bluntly admitted that if the November midterm elections are a “referendum” on President Biden, the Democrats will lose. Psaki, who left the White House in May to take a job at MSNBC, said if the midterms focus on the “most extreme” party, mentioning Republican Georgia Rep. Marjorie Taylor Greene by name, then Democrats will be celebrating on election day. “If it is a referendum on the president, they will lose. And they know that. They also know that crime is a huge vulnerability for Democrats, I would say one of the biggest vulnerabilities,” Psaki said Sunday on NBC News’ “Meet the Press.”

She said she has been watching the US Senate race play out in Pennsylvania between Lt. Gov. John Fetterman, the Democratic candidate, and GOP celebrity heart surgeon Dr. Mehmet Oz, and noted that Republicans are running ads painting Fetterman as soft on crime. What’s been interesting to me is it’s always you follow the money, and where are people spending money. And in Pennsylvania, the Republicans have been spending millions of dollars on the air on crime ads against Fetterman because that’s where they see his vulnerability , Biden’s one-time chief spokeswoman said. So yes, the economy is hanging over everything. But you do have to look at state-by-state factors, and crime is a huge issue in the Pennsylvania race, she said. While Biden’s approval ratings have recently climbed into the mid-40s from the dregs in recent polls, a Washington Post/ABC News survey released Sunday found it remains below that at 39%. The president’s disapproval rating is at 53%, the poll found.

Peace is not welcome in Krakow.

• Roger Waters Cancels Poland Concerts After Ukraine War Remarks (RFE)

Pink Floyd co-founder Roger Waters has canceled concerts planned in Poland amid anger over his stance on Russia’s unprovoked war against Ukraine, Polish media reported. An official with the Tauron Arena in Krakow, where Waters was scheduled to perform two concerts in April, said they would no longer take place. “Roger Waters’ manager decided to withdraw…without giving any reason,” Lukasz Pytko from Tauron Arena Krakow said on September 24 in comments carried by Polish media outlets. The website for Waters’ This Is Not a Drill concert tour did not list the Krakow concerts previously scheduled for April 21 and 22.

City councilors in Krakow were expected to vote next week on a proposal to name Waters as a persona non grata, expressing “indignation” over the musician’s stance on the war in Ukraine. Allowing “Roger Waters, an open supporter of [Russian President Vladimir] Putin, to play in Krakow…would be shameful for our city,” city councilor Lukasz Wantuch said last week on social media. “Let him sing in Moscow.” Waters wrote an open letter to Ukrainian first lady Olena Zelenska earlier this month in which he blamed “extreme nationalists” in Ukraine for having “set your country on the path to this disastrous war.” Waters has also criticized NATO, accusing it of provoking Russia.

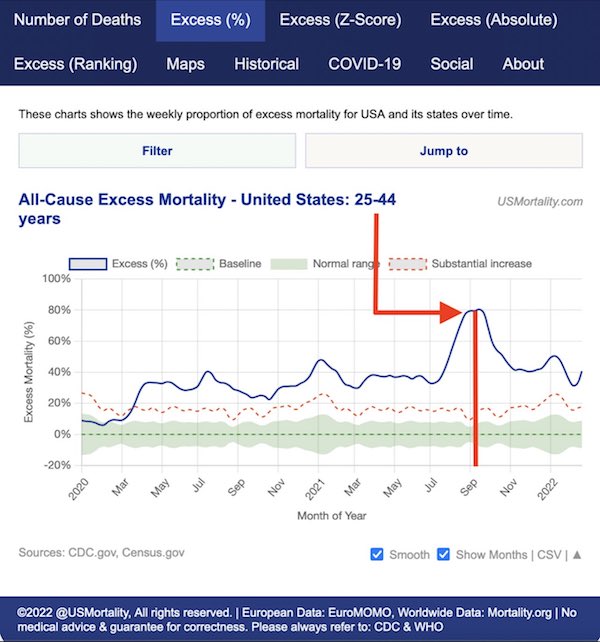

Malhotra

Are mRNA vaccines safe & effective? Not according to new peer reviewed papers by @DrAseemMalhotra

'Curing the pandemic of misinformation on Covid-19 mRNA vaccines through real evidence based medicine'

Paper PT 1: https://t.co/53WWgNpWB8

Full interview: https://t.co/6kiMUr261i pic.twitter.com/9JZAr5fHoT

— James Freeman (@JamesfWells) September 26, 2022

This is not stained glass. It’s a dragonfly’s wing seen up close. Dragonfly wings kill bacteria on contact by ripping apart their cell membranes with sharp nanopillars.

Bolt

To be remembered, be the best and put a smile on people’s faces pic.twitter.com/t3yaI2tYq4

— Vala Afshar (@ValaAfshar) September 25, 2022

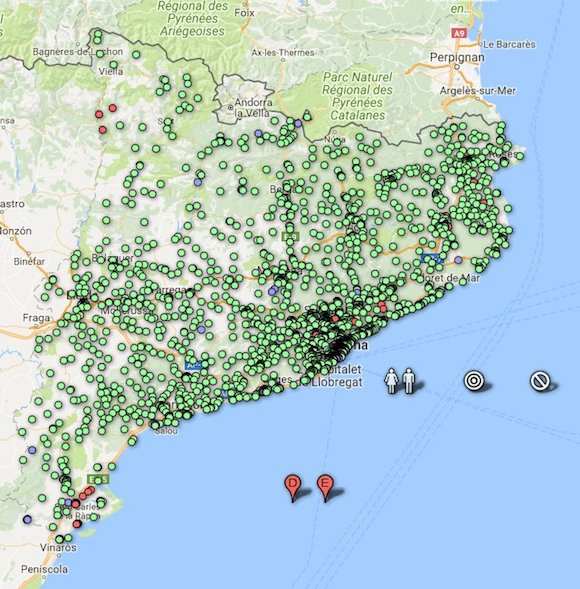

Hydrosaurus, aka the Sailfin Dragon, is found in the rainforests of the Philippines

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.