Joan Miro The sun embracing the lover 1952

“The “something-had-to-give” moment appears to be arriving.”

• Don’t Rely on US Consumers to Power Global Growth (DDMB)

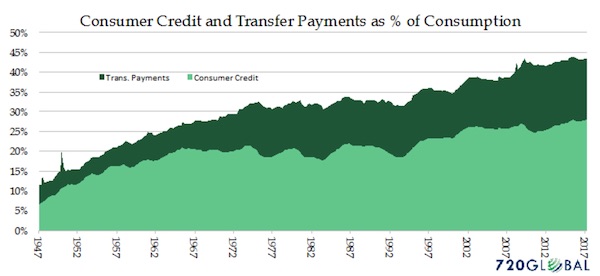

U.S. consumers account for 18% of global GDP, and it’s tempting to rely on them to continue carrying the aging recovery to support world growth. The data and growing lender anxiety, though, suggest investors should prepare for what is increasingly looking like an inevitable slowdown in economic growth next year. Although American households managed to maintain their spending levels in the face of dwindling prospects for future economic expansion, they have done so by taking on incremental debts, which could soon prove unsustainable. Headed into the 1960s, consumer credit as apercentage of disposable income was 14%. As baby boomers came of age and started settling down in suburbia to build families under their own roofs, this figure rose to 18% where it largely remained until the early 1990s.

The go-go run of the 1990s, though, was the first major break from history; consumer credit as apercentage of household discretionary spending rose to 24% by the turn of the century and remained there until the recession of 2007-2008. And while there was a movement toward deleveraging, it was short-lived. Today the ratio sits at a high of 26%. The upshot is that when consumer credit is combined with government transfer payments the total amounts to about 43% of all consumer spending. Put differently, almost a third of U.S. growth relies on increasing debt in one form or another.

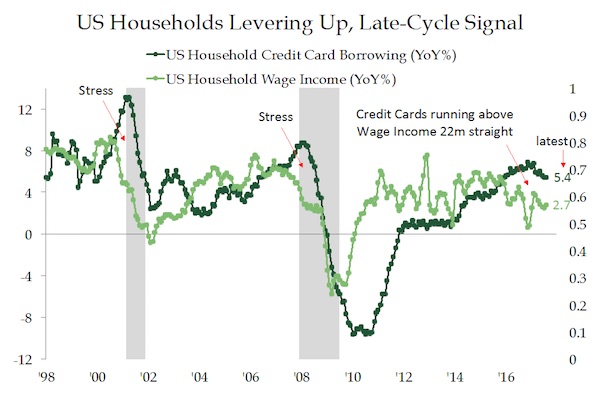

Economists have long emphasized the historically low debt-service costs households must shoulder as proof that the rebuild in debt levels was not problematic. It was telling that fresh data revealed Americans ploughed more of their income to paying debts last year, the first increase in seven years. Moody’s warned the troubling finding would lead to further increases in default rates. JPMorgan Chase and Citigroup validated the data in their most recent earnings reports in which they boosted their reserves for losses on consumer loans by the most in more than four years. Credit card debt, which clocked a brisk 7% growth rate in August, was specifically cited. Citigroup added that the increase was coming faster than anticipated. The stresses, though, have been growing for almost two years when increases in credit card borrowing began to outpace that of incomes. The “something-had-to-give” moment appears to be arriving.

“..a more accurate picture of how much a country really produces..” It’s almost too easy.

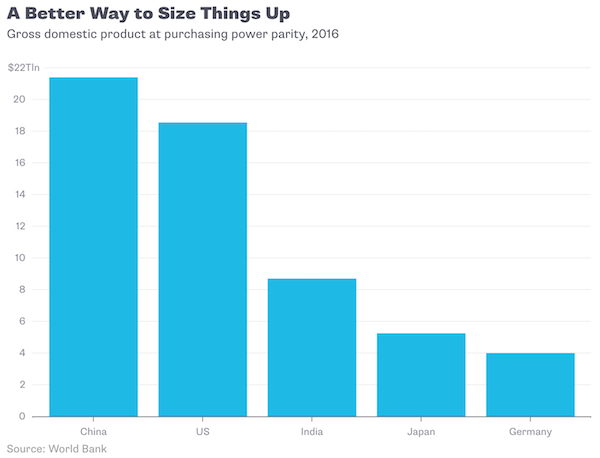

• Who Has the World’s No. 1 Economy? Not the US (BBG)

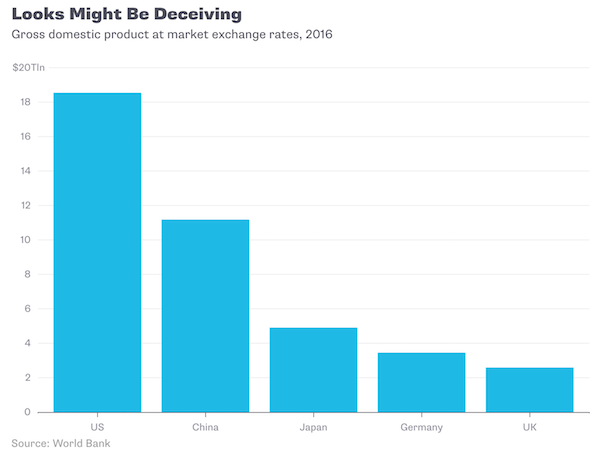

What’s the most powerful country in the world? There’s a good case to be made that it’s China. There are many kinds of power – diplomatic, cultural, military and economic. So an easier question to ask is: What’s the world’s largest economy? That’s almost certainly China. Many might protest when hearing this. After all, the U.S. still produces the most when measured at market exchange rates:

But this comparison is misleading, because things cost different amounts in different countries. GDP is supposed to measure the amount of real stuff — cars, phones, financial services, back massages, etc. – that a country produces. If the same phone costs $400 in the U.S. but only $200 in China, China’s GDP is getting undercounted by 50% when we measure at market exchange rates. In general, less developed countries have lower prices, which means their GDP gets systematically undercounted.Economists try to correct for this with an adjustment called purchasing power parity (PPP), which controls for relative prices. It’s not perfect, since it has to account for things like product quality, which can be hard to measure. But it probably gives a more accurate picture of how much a country really produces. And here, China has already surpassed the U.S.:

If you don’t trust the murky PPP adjustments, a simple alternative is just to look at the price of a Big Mac. The same burger costs 1.8 times more in the U.S. than in China. Adjusting the market-exchange-rate GDP numbers by that ratio would put China even farther ahead. In some dimensions, China’s lead is even larger. The country’s manufacturing output overtook that of the U.S. almost a decade ago. Its exports are more than a third larger as well.

“..capital is being socially produced, and the returns are being privatised..” The serpent and the tail.

• Capitalism Is Ending Because It Has Made Itself Obsolete – Varoufakis (Ind.)

Former Greek finance minister Yanis Varoufakis has claimed capitalism is coming to an end because it is making itself obsolete. The former economics professor told an audience at University College London that the rise of giant technology corporations and artificial intelligence will cause the current economic system to undermine itself. Mr Varoufakis, who took on EU institutions over Greek debt repayments in 2015, said companies such as Google and Facebook, for the first time ever, are having their capital bought and produced by consumers. “Firstly the technologies were funded by some government grant; secondly every time you search for something on Google, you contribute to Google’s capital,” he said. “And who gets the returns from capital? Google, not you. “So now there is no doubt capital is being socially produced, and the returns are being privatised. This with artificial intelligence is going to be the end of capitalism.”

Warning Karl Marx “will have his revenge”, the 56-year-old said for the first time since capitalism started, new technology “is going to destroy a lot more jobs than it creates”. He added: “Capitalism is going to undermine capitalism, because they are producing all these technologies that will make corporations and the private means of production obsolete. “And then what happens? I have no idea.” Describing the present economic situation as “unsustainable” and fearing the rise of “toxic nationalism”, Mr Varoufakis said governments needed to prepare for post-capitalism by introducing redistributive wealth policies. He suggested one effective policy would be for 10% of all future issue of shares to be put into a “common welfare fund” owned by the people. Out of this a “universal basic dividend” could be paid to every citizen.

The serpent and the tail. Exhibit no. 1: corporate America in the 21st century.

• Something Wicked This Way Comes: McDonald’s Stock Buybacks (Lebowitz)

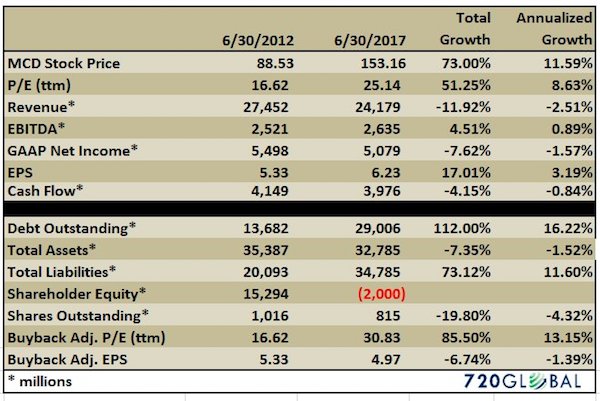

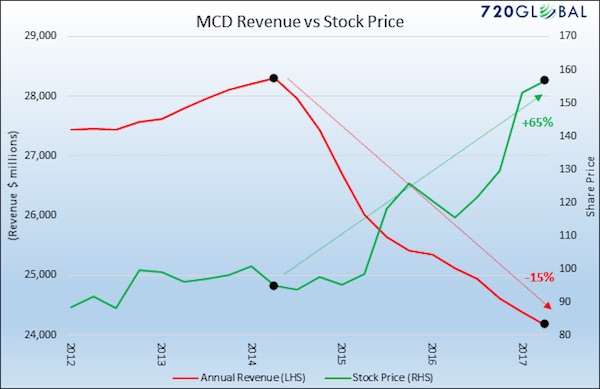

We have written six articles on stock buybacks to date. While each discussed different themes including valuations, executive motivations, and corporate governance, they all arrived at the same conclusion; buybacks may boost the stock price in the short run but in the majority of cases they harm shareholder value in the long run. Data on MCD provides support for our conclusion. Since 2012, MCD’s revenue has declined by nearly 12% while its earnings per share (EPS) rose 17%. This discrepancy might lead one to conclude that MCD’s management has greatly improved operating efficiency and introduced massive cost-cutting measures. Not so. Similar to revenue, GAAP net income has declined almost 8% over the same period, which rules out the possibilities mentioned above.

To understand how earnings-per-share (EPS) can increase at a double-digit rate, while revenue and net income similarly decline and profit margins remain relatively flat, one must consider the effect of share buybacks. Currently, MCD has about 20% fewer shares outstanding than they did five years ago. The reduction in shares accounts for the warped EPS. As noted earlier, EPS is up 17% since 2012. When adjusted for the decline in shares, EPS declined 7%. Given the 12% decline in revenue and 8% drop in net income, this adjusted 7% decline in EPS makes more sense. MCD currently trades at a trailing twelve-month price to earnings ratio (P/E) of 25. If we use the adjusted EPS figure instead of the stated EPS, the P/E rises to 30, which is simply breathtaking for a company that is shrinking. It must also be noted that, since 2012, shareholder equity, or the difference between assets and liabilities, has gone from positive $15.2 billion to negative $2 billion. A summary of key financial data is shown later in this article.

In addition to adjusting MCD’s earnings for buybacks, investors should also consider that to accomplish this financial wizardry, MCD relied on a 112% increase in their debt. Since 2012, MCD spent an estimated $23 billion on share buybacks. During the same period, debt increased by approximately $16 billion. Instead of repurchasing shares, MCD could have used debt and cash flow to expand into new markets, increase productivity and efficiency of its restaurants or purchase higher growth competitors. MCD executives instead manipulated EPS and ultimately the stock price. To their good fortune (quite literally), the Board of Directors and shareholders appear well-deceived by the costume of a healthy and profitable company. The following table compares MCD’s fundamental data and buyback adjusted data from 2012 to their last reported earnings statement.

The graph below compares the sharp increase in the price of MCD to the decline in revenue over the last five years.

.. but I ain’t got wings .. coming down .. is the hardest thing ..

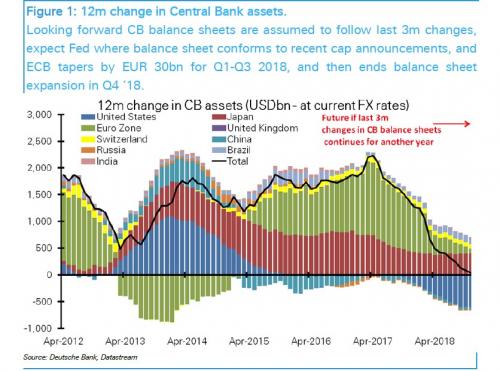

• $1 Trillion In Liquidity Is Leaving: Market’s First Crash-Test In 10 Years (ZH)

In his latest presentation, Francesco Filia of Fasanara Capital discusses how years of monumental liquidity injections by major Central Banks ($15 trillion since 2009) successfully avoided a circuit break after the Global Financial Crisis, but failed to deliver on the core promise of economic growth through the ‘wealth effect’, which instead became an ‘inequality effect’, exacerbating populism and representing a constant threat to the status quo. Fasanara discusses how elusive, over-fitting economic narratives are used ex-post to legitimize the “fake markets” – as defined previously by the hedge fund – induced by artificial flows.

Meanwhile, as an unintended consequence, such money flows produced a dangerous market structure, dominated by both passive-aggressive investment vehicles and a high-beta long-only momentum community ($8 trn and rising rapidly), oftentimes under the commercial disguise of brands such as behavioral Alternative Risk Premia, factor investing, risk parity funds, low vol / short vol vehicles, trend-chasing algos, machine learning. However as Filia, and many others before him, writes, only when the tide goes out, will we discover who has been swimming naked, and how big of a momentum/crowding trap was built up in the process.

The undoing of loose monetary policies (NIRP, ZIRP), and the transitioning from ‘Peak Quantitative Easing’ to Quantitative Tightening, will create a liquidity withdrawal of over $1 trillion in 2018 alone. The reaction of the passive community will determine the speed of the adjustment in the pricing for both safe and risk assets. And, echoing what Deutsche Bank said last week, when it warned that central bank liquiidty injections will collapse from $2 trillion now to 0 in 12 months, a “most worrying” turn of events, Fasanara doubles down that “such liquidity withdrawal will represent the first real crash-test for markets in 10 years.”

A global problem.

• Dollar Funding Shortage Never Went Away And Starts To Get Worse Again (ZH)

Since last month, the Treasury has rebuilt the balance in its account at the Fed from $38bn on 6 September 2017 to $170bn on 11 October 2017, for a net increase of $132bn…not insignificant. Obviously, if and when the Treasury rebuilds its account at the Fed to the previous level, dollar liquidity could become extremely tight again, especially if the Fed is tapering its balance sheet at the same time. We have been wondering whether the Fed governors fully understand this, although some of the boys at 33 Liberty no doubt do. Credit guys also understand it “there’s another reason the strain is set to grow. The Fed is set to boost the pace of its balance-sheet roll-off each quarter, potentially putting upward pressure on U.S. rates relative to Europe and making it tougher for global investors to get dollar funding,” according to Mark Cabana, head of U.S. short rates strategy at Bank of America Corp.”

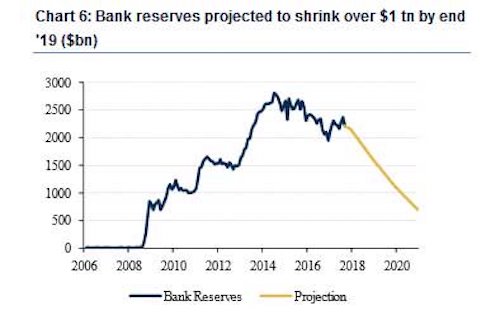

Clearly the issue is attracting the attention of investors as BoA analyst, Cabana writes in a recent report, and explains that “we have received a number of client questions recently about the outlook for banking reserves both in the near and medium term due to the Fed’s balance sheet unwind and potential swings in Treasury’s cash balance.” In summary, Cabana expects a large reserve drain in Q2 2018 with banking reserves dropping by more than $1 trillion by the end of 2019, which “highlights the potential for funding strains to emerge around Q2 next year and uncertainties around the Fed’s longer-run policy framework… This reserve drain and the Fed’s portfolio unwind should pressure funding conditions tighter through wider FRA-OIS and more negative XCCY (cross currency basis swaps) levels.”

Minsky.

• China’s Central Bank Warns Of Sudden Collapse In Asset Prices (R.)

China will fend off risks from excessive optimism that could lead to a “Minsky Moment,” central bank governor Zhou Xiaochuan said on Thursday, adding that corporate debt levels are relatively high and household debt is rising too quickly. A Minsky Moment is a sudden collapse of asset prices after a long period of growth, sparked by debt or currency pressures. The theory is named after economist Hyman Minsky. China will control risks from sudden adjustments to asset bubbles and will seriously deal with disguised debt of local government financing vehicles, Zhou said. The People’s Bank of China governor was speaking on the sidelines of China’s 19th Communist Party congress.

Cult, anyone?

• Xi Jinping Gets His Own School of Thought (G.)

China’s communist leader Xi Jinping looks to have further strengthened his rule over the world’s second largest economy with the confirmation that a new body of political theory bearing his name will be written into the party’s constitution. On day two of a week-long political summit in Beijing marking the end of Xi’s first term, state-media announced the creation of what it called Xi Jinping Thought on Socialism with Chinese Characteristics for a New Era. “The Thought is … a historic contribution to the Party’s development,” Zhang Dejiang, one of the seven members of China’s top ruling council, the politburo standing committee, told delegates at the 19th party congress according to Beijing’s official news agency, Xinhua. Liu Yunshan, another standing committee member, said the elevation of Xi’s Thought into the party’s list of “guiding principles” was of “great political, theoretical and practical significance”.

“All members of the Party should study hard Xi’s ‘new era’ thought,” he was quoted as saying. Experts say the decision to grant Xi his own eponymous school of thought, while arcane-sounding, represents a momentous and highly symbolic occasion in the politics and history of the world’s most populous nation. Only two previous leaders – Chairman Mao and Deng Xiaoping – have been honoured in such a way with theories called Mao Zedong Thought and Deng Xiaoping Theory. The names of Xi’s immediate predecessors – Hu Jintao and Jiang Zemin – were not attached to the political philosophies they bequeathed to the party. The official inception of Xi Jinping Thought – which now seems certain to be formally added to the party’s charter next week – also reinforces suspicions that Xi will seek to stay in power beyond the end of his second-term, in 2022.

“It is a huge deal,” said Orville Schell, a veteran China expert who has been studying Chinese politics since the late 1950s. “It is sort of like party sky writing. If you get your big think in the constitution it becomes immortal and Xi is seeking a certain kind of immortality.” However, Schell, the head of the Asia Society’s Center on US-China Relations, said the decision to honour Xi was not only noteworthy “because it makes Xi Jinping look like a thought leader comparable to Chairman Mao.” “It also suggests that [China’s political system] Socialism with Chinese Characteristics is a viable counter-model to the presumption of western liberal democracy and capitalism. In a sense, what Xi is setting up here is not only a clash of civilisation and values, but one of political and economic systems,” he said.

The deadline has passed. Madrid prepares to take over Catalonia on Saturday. This leaves the Catalan parliament time to vote on independence.

• Spain-Catalonia Standoff Set To Intensify As Leaders Take Hard Lines (R.)

Spain’s political showdown with Catalonia is set to reach a new level on Thursday when political leaders in Madrid and Barcelona are expected to make good on pledges made to their supporters to stick to their tough positions over the region’s future. In an unprecedented move since Spain returned to democracy in the late 1970s, Prime Minister Mariano Rajoy will impose direct rule in Catalonia unless the region’s leader Carles Puigdemont retracts by 10 a.m. (0800 GMT) an ambiguous declaration of independence he made last week. Puigdemont told members of his Catalan Democratic Party on Wednesday night that not only he would not back down but that he would press ahead with a more formal declaration of independence if Rajoy suspends Catalonia’s political autonomy.

It is not yet clear how and when this declaration would take place and whether it would be endorsed by the regional assembly, though many pro-independence lawmakers have openly said they wanted to hold a vote in the Catalan parliament to make it more solemn. If Rajoy invokes Article 155 of the 1978 constitution, which allows him to take control of a region if it breaks the law, it would not be fully effective until at least early next week as it needs previous parliamentary approval, offering some last minute leeway for secessionists to split unilaterally. This prospect has raised fears of social unrest, led the euro zone’s fourth-largest economy to cut its growth forecasts and rattled the euro.

Medieval is the right word.

Now one businessman has warned enough is enough – as he insisted the Spanish government just “let Catalonia go” or risk being dragged down and destroyed by the enveloping crisis. Xavier Adam, a London-born financial investor who was brought up in Catalonia and considers himself to be a Spaniard, told Express.co.uk he was disgusted by the actions of the Spanish government and its police and military. The Managing Director of AMC network finance firm, Mr Adam says he has decided to cut a planned $450 million investment in Spanish real estate projects in protest at what he sees as Madrid’s “medieval” response to the crisis. He explained he feels his investment would be unsafe until the crisis is solved, as he believes Spain has undone 40 years of democratic progress with the actions of the police – and he warned the instability could send the already fragile country under.

Speaking exclusively to Express.co.uk today, he said: “It never had to be this way, going to beat up people in the streets just trying to vote, its been pandemonium. But Spain can’t come to terms with losing Catalonia, and losing the GDP it provides. “Madrid is being worse hit than Catalonia, it is really struggling. Madrid and Spain is facing a crisis. “Every day they’re threatening more violence and its just grubby, people think its just grubby. “It’s so hard to work with these people in government, they have got their ideas and they are fixed on them. “And Catalonia’s independence doesn’t feature in that, so they’re trying to teach them a lesson. “But there will be more and more of these demos and more and more protests and something is going to happen.

“Spain is going down and this government has to go. It is too volatile – you don’t know when it is going to blow.” Mr Adam, 40, says he was so enraged by the response to the referendum, he even wrote to Carlos Bastarreche, Spain’s ambassador to the UK, saying: “As an international investor of some repute and an expert on the Spanish economy, I write to say how appalled I am by the way your country has behaved in Catalonia. “It appears to me, a failure to listen to the will of the Catalan people, state sponsored violence against civilians and a manipulation of the Spanish public and media are ways Spain wants to move through the 21st Century.

From site of Domain, huge real estate firm. They’re not ready yet to let the bubble pop.

• Australia’s First Home Super Scheme Passes The Lower House (D.)

The federal government insists its plan to allow first-home buyers to save for a deposit through their superannuation won’t undermine Australia’s retirement savings system. The coalition used its numbers in parliament’s lower house to pass the measure – announced in the May budget – on Wednesday. The legislation also allows older Australians to contribute the proceeds of the sale of their family home to their super. Labor and the Greens are against the proposal, with the opposition claiming it will do nothing to address housing affordability. Shadow treasurer Chris Bowen argues it will instead work to undermine the country’s superannuation system, labelling it a “sham”. Assistant minister to the treasurer, Michael Sukkar, accused Labor of deliberately peddling misconceptions about the scheme.

He told MPs it was not an attack on superannuation but simply provides people with an opportunity to save more money that wouldn’t otherwise be used for super. “It’s quite shocking and surprising to see any political party take a view that a tax cut for first home buyers is something that they cannot support,” Mr Sukkar said. Labor, however, said it won’t stand in the way of two other housing affordability bills, both of which were announced in the 2017 budget. They include limiting deductions investors can claim in relation to residential properties and imposing an annual fee on foreign owners if their property is vacant for at least six months during a one-year period. Mr Bowen said there was nothing to oppose because the measures were ineffective. “What we see here is some minor tinkering which won’t do anything for housing affordability,” he told parliament.

This should really make us think. We don’t survive if insects don’t.

• Warning Of ‘Ecological Armageddon’ After 75% Plunge In Insect Numbers (G.)

The abundance of flying insects has plunged by three-quarters over the past 25 years, according to a new study that has shocked scientists. Insects are an integral part of life on Earth as both pollinators and prey for other wildlife and it was known that some species such as butterflies were declining. But the newly revealed scale of the losses to all insects has prompted warnings that the world is “on course for ecological Armageddon”, with profound impacts on human society. The new data was gathered in nature reserves across Germany but has implications for all landscapes dominated by agriculture, the researchers said. The cause of the huge decline is as yet unclear, although the destruction of wild areas and widespread use of pesticides are the most likely factors and climate change may play a role.

The scientists were able to rule out weather and changes to landscape in the reserves as causes, but data on pesticide levels has not been collected. “The fact that the number of flying insects is decreasing at such a high rate in such a large area is an alarming discovery,” said Hans de Kroon, at Radboud University in the Netherlands and who led the new research. “Insects make up about two-thirds of all life on Earth [but] there has been some kind of horrific decline,” said Prof Dave Goulson of Sussex University, UK, and part of the team behind the new study. “We appear to be making vast tracts of land inhospitable to most forms of life, and are currently on course for ecological Armageddon. If we lose the insects then everything is going to collapse.”

The research, published in the journal Plos One, is based on the work of dozens of amateur entomologists across Germany who began using strictly standardised ways of collecting insects in 1989. Special tents called malaise traps were used to capture more than 1,500 samples of all flying insects at 63 different nature reserves. When the total weight of the insects in each sample was measured a startling decline was revealed. The annual average fell by 76% over the 27 year period, but the fall was even higher – 82% – in summer, when insect numbers reach their peak. Previous reports of insect declines have been limited to particular insects, such European grassland butterflies, which have fallen by 50% in recent decades. But the new research captured all flying insects, including wasps and flies which are rarely studied, making it a much stronger indicator of decline.

Home › Forums › Debt Rattle October 19 2017