René Magritte Youth 1924

As I’ve said 1000 times.

• Fed Flunks Econ 101: Understanding Inflation (MW)

The Federal Reserve’s illusive quest to achieve 2% inflation over the medium term is becoming a long-term problem. The institutional anxiety over the chronic inflation undershoot is evident in daily news stories, Fed speeches and the increased focus in internal discussions, as reflected in the minutes of the Sept. 19-20 meeting of the Federal Open Market Committee (FOMC). One doesn’t have to read between the lines to appreciate the degree to which policy makers fear the onset of the next recession without adequate “room” to lower interest rates. Hence, normalizing interest rates is “on track,” as the headline above noted, even though the relationship — between unemployment and inflation — is decidedly off track.

So what gives? The persistence of sub-2% inflation in the face of nine years of near-zero interest rates and an economy at what is perceived to be full employment has led to an array of silly explanations, embarrassing excuses and a host of pseudo-theories. Just maybe the Fed’s internal guidance system is flawed. The inverse correlation between unemployment and wages in the U.K. from 1861 to 1957 initially observed by New Zealand economist A.W. Phillips has morphed into a model of causation for Fed chief Janet Yellen and the current crop of U.S. policy makers. It’s not clear why. Just eyeballing the graph of the Fed’s preferred inflation measure and the civilian unemployment rate, one might conclude that the relationship broke down in the 1970s and has yet to reassert itself. Is a half-century malfunction enough to declare a theory null and void?

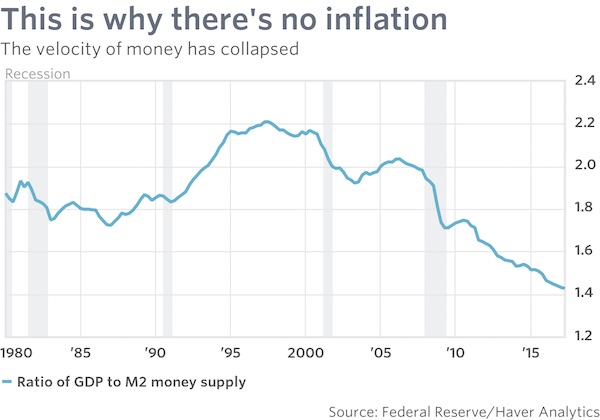

One would think so. Yet the notion of cost-push inflation as (supposedly) expressed by Phillips Curve lives, although faith in it has started to wane, even among ardent devotees like labor-economist Yellen. Instead, we are confronted with headlines such as, “Nobody seems to know why there is no inflation.” Really? Have they all forgotten Milton Friedman’s axiom that inflation is always and everywhere a monetary phenomenon? When the central bank creates more money than the public wants to hold, people spend it. The increased demand for goods and services eventually exceeds the economy’s ability to produce or provide them. The result is higher economy-wide prices, or inflation.

That isn’t happening, not just in the U.S. but across the globe. For all the sturm und drang about the Fed debasing the dollar and sowing the seeds of the next great inflation, the public’s demand for money has increased. The increased desire to hold cash and checkable deposits has risen to meet the increased supply. Velocity, or the rate at which money turns over, has plummeted.

“.. it’s central banks that typically end the party. And central banks are telling you it’s last call.”

• Meet The Bears Predicting Stock Market Doom (CNN)

The red-hot stock market may continue its rapid ascent, especially if Trump delivers his promise for “massive” corporate tax cuts. And even if not, healthy economic fundamentals and corporate profits should continue to support stocks. Nonetheless, some bears are fighting the herd mentality on Wall Street by warning of serious trouble brewing just beneath the surface of the stock market. These market skeptics are reassured by the fact that betting against stocks wasn’t popular in 2007, either. “The best time to be a bear is the loneliest time,” Jesse Felder, a money manager and founder of The Felder Report, told CNNMoney. Here are some of the red flags these bears are warning about, including similarities between now and 30 years ago:

In 2007 and 2008, Chris Cole presciently bet that market volatility would skyrocket to levels no one had seen before. He took those crisis-era winnings and started Artemis Capital, a hedge fund that has amassed $210 million. Today, the stock market is unusually quiet. The VIX, a popular barometer of market fear, recently hit a record low. Cole thinks it’s a mirage, partly because popular trading strategies allow investors to bet on the low volatility itself. All those bets lead to even lower volatility – until something unexpected happens, like suddenly higher interest rates. “Any shock to the system could cause this to unravel in the opposite direction, where higher volatility drives higher volatility,” Cole told CNNMoney. “This is a massive risk to the system. The only thing we’re missing is a fire.” [..] “This is a disaster waiting to happen,” said Cole. “In the event there is a fire, this can cause a massive explosion.”

Kyle Bass, founder of Hayman Capital Management, is also having a flashback to 30 years ago. “If you look at the all of the different constituencies of the market today, it resembles the portfolio insurance debacle of 1987 on steroids,” Bass told Real Vision TV in an interview released on Wednesday. Bass fears that, once stock prices decline 4% to 5%, that will quickly morph into a 10% to 15% plunge. He isn’t sure about timing, but pointed to geopolitical trouble and central banks as potential triggers. “Buckle up, because I think you’re going to see a pretty interesting air pocket. And I don’t think investors are ready for that,” he said.

Peter Boockvar, chief market analyst at The Lindsey Group, predicts the “overvalued” stock market will run into serious trouble as central banks hit the brakes on the stimulus measures they used to prop up economies after the crisis. He pointed to the Federal Reserve shrinking its balance sheet and the European Central Bank slowing its bond purchases. “Historically speaking, central banks put us into recessions and bear markets. The same will happen this time,” Boockvar said. He estimates that central banks will be pumping $1 trillion less money into markets. “The liquidity spigot is going to be dripping instead of flowing. That’s a really big deal,” said Boockvar. He conceded that stocks could run higher before eventually reversing. “When it happens, I’m not sure,” Boockvar said. “But it’s central banks that typically end the party. And central banks are telling you it’s last call.”

Chaos.

• Catalan Groups Call For Mass Withdrawal Of Money From Bank ATMs (CN)

Civil society organizations in Catalonia call for a mass withdrawal of money from bank ATMs on Friday at 8am in order to pressure the Spanish government. Organizers don’t especify how much money should be taken out nor what to do with it. The action targets the five main banks in Catalonia: Caixa Bank, Sabadell, Bankia, BBVA and Santander. Organizers call on clients of Caixa Bank and Sabadell to show their disagreement with the banks’ recent decision to move their headquarters out of Catalonia due to the escalating political crisis between governments in Barcelona and Madrid.

This is the first “direct and peaceful” action organized by Crida per la Democràcia (Call for Democracy). This is an umbrella group which includes among others the two main pro-independence organizations in Catalonia: the Catalan National Assembly (ANC) and Òmnium Cultural. The mass withdrawal is also aimed at condemning the imprisonment of ANC and Òmnium presidents, Jordi Sánchez and Jordi Cuixart, held in custody on sedition charges since Monday.

All’s not well in crypto land.

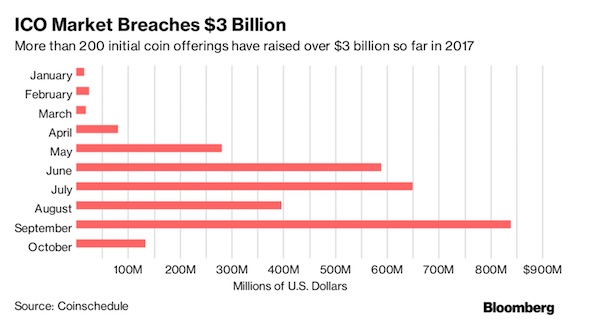

• The World’s Largest ICO Is Imploding After Just 3 Months (ZH)

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public, demand soared as investors greedily bought up tokens in spite of glitches that threatened to derail the sale early on. By the end of its weeks-long token sale in July, Tezos had sold more than $230 million. Now, Tezos is proving that authorities in the US and China were on to something when they decided to crack down on the ICO market, which has become a cesspool of fraud and abuse.

To wit, the company’s management revealed this week that progress on its vaunted product has stalled as it has struggled to recruit engineering talent, and an acrimonious dispute between several of the company’s leading figures has spilled out into the open. As WSJ’s Paul Vigna reports, “a battle between the founders of the company and the head of the Swiss foundation they installed to give it more independence has put most trading of Tezos coins on ice, possibly until early next year.” The shakeup started after Tezos founders Arthur and Kathleen Breitman reported the delays in a blog post published Wednesday. But even more alarming, the pair accused Johann Gevers, the head of a Swiss foundation which oversees their funds, of attempting to overpay himself using the massive pot of investor capital – despite the fact that the company will likely blow through its promised deadline of allocating tokens to buyers by December (the tokens have yet to be created).

In early September we became aware that the president of the Tezos Foundation, Johann Gevers, engaged in an attempt at self-dealing, misrepresenting to the council the value of a bonus he attempted to grant himself. We have been working with the Tezos foundation to resolve the matter and have advocated for his removal from the foundation council. We are confident in the council’s ability to handle this sensitive matter with care and diligence. In the meantime, Johann’s operational role in the foundation has been suspended, pending an investigation by the council’s auditor. The news sent Tezos futures contracts trading on BitMex, an exchange known for its cryptocurrency futures products, tumbling more than 50% as traders unwound bets the project would be launched before the end of the year, as Bloomberg pointed out.

The final nail in the Made in Japan coffin.

• Scandal-Hit Nissan Suspends All Production For Japan Market (AFP)

Nissan said Thursday it was suspending all production destined for the local market, as Japan’s number-two automaker grapples with a mounting inspection scandal that has already seen it recall some 1.2 million vehicles. “Nissan decided today to suspend vehicle production for the Japan market at all Nissan and Nissan Shatai plants in Japan,” it said in a statement, referring to an affiliate. The announcement comes weeks after the company announced the major recall as it admitted that staff without proper authorisation had conducted final inspections on some vehicles intended for the domestic market before they were shipped to dealers. On Thursday, it said a third-party investigator found the misconduct had continued at three of its six Japanese plants even after it took steps to end the crisis.

“Nissan regards the recurrence of this issue at domestic plants – despite the corrective measures taken – as critical,” it said. “The investigation team will continue to thoroughly investigate the issue and determine measures to prevent a recurrence.” Nissan president Hiroto Saikawa offered a blunt assessment, saying that “old habits” were to blame. “You might say it would be easy to stop people who are not supposed to inspect from inspecting,” he told reporters Thursday. “But we are having to take (new measures) in order to stop old habits that had been part of our routine operations at the factories.”

Lost skills.

• End Of Australia Auto-Making Sector As Holden Closes Doors (AFP)

The last car rolled off the production line of Australian automaker Holden on Friday, marking the demise of a national industry unable to stand up to global competition. The closure of the Elizabeth plant in South Australia is the end of an era for Holden, which first started in the state as a saddlery business in 1856 and made the nation’s first mass-produced car in 1948. The brand has long been an Australian household name, with 1970s commercials singing that “football, meat pies, kangaroos and Holden cars” were part of the nation’s identity. “I feel very sad, as we all do, for it’s the end of an era, and you can’t get away from the emotional response to the closure,” Prime Minister Malcolm Turnbull told Melbourne radio station 3AW on Friday.

Holden was marketed as “Australia’s Own Car” and became a symbol of post-war prosperity Down Under despite being a subsidiary of US giant General Motors. At its peak in 1964, Holden employed almost 24,000 staff. But just 950 were able to watch the final car leave the factory floor Friday. “There are a number of people who have been here since the seventies and today will be a very emotional day for some people and a very sad day,” Australian Manufacturing Workers Union state secretary John Camillo told reporters. The union blamed the federal government for causing the closure by withdrawing support to the auto sector. The death of the industry was always on the cards after subsidies were cut off in 2014. Some Aus$30 billion (US$24 billion) in assistance was handed out between 1997 and 2012, according to the government’s Productivity Commission.

The rich get scared. It’s about power as much as money.

• Top Startup Investors See Mounting ‘Backlash’ Against Tech (R.)

Two of the technology industry’s top startup investors took to the stage at a conference on Wednesday to decry the power that companies such as Facebook had amassed and call for a redistribution of wealth. Bill Maris, who founded Alphabet’s venture capital arm and now runs venture fund Section 32, and Sam Altman, president of startup accelerator Y Combinator, said widespread discontent over income inequality helped elect U.S. President Donald Trump and had put wealthy technology companies in the crosshairs. “I do know that the tech backlash is going to be strong,” said Altman. “We have more and more concentrated power and wealth.” The market capitalization of the so-called Big Five technology companies – Alphabet, Apple, Amazon, Microsoft and Facebook – has doubled in the last three years to more than $3 trillion.

Silicon Valley broadly has amassed significant wealth during the latest tech boom. Altman and Maris spoke on the final day of The Wall Street Journal DLive technology conference in Southern California. Facebook’s role in facilitating what U.S. intelligence agencies have identified as Russian interference in last year’s U.S. presidential election is an example of the immense power the social media company has amassed, the investors said. “The companies that used to be fun and disruptive and interesting and benevolent are now disrupting our elections,” Maris said.

Altman said people “are understandably uncomfortable with that.” Altman, who unequivocally rebuffed rumors that he would run for governor of California next year, said he expects more demands from both the public and policy makers on data privacy, limiting what personal information Facebook and others can collect. Maris said regulators would have good cause to break up the big technology companies. “These companies are more powerful than AT&T ever was,” he said. [..] Altman and Maris offered few details of how to accomplish a redistribution of wealth. Maris proposed shorter term limits for elected officials and simplifying the tax code. Altman has advocated basic income, a poverty-fighting proposal in which all residents would receive a regular, unconditional sum of money from the government.

Curious legal battle.

• Native American Tribe Holding Patents Sues Amazon And Microsoft (R.)

A Native American tribe sued Amazon.com and Microsoft in federal court in Virginia on Wednesday for infringing supercomputer patents it is holding for a technology firm. The Saint Regis Mohawk Tribe was assigned the patents by SRC Labs LLC in August, in a deal intended to use the tribe’s sovereign status to shield them from administrative review. SRC is also a plaintiff in the case. The tribe, which would receive a share of any award, made a similar deal in September to hold patents for Allergan on its dry eye medicine Restasis. SRC and Allergan made the deals to shield their patents from review by the Patent Trial and Appeal Board, an administrative court run by the U.S. patent office that frequently revokes patents.

The tribe would get revenue to address environmental damage and rising healthcare costs. Companies sued for patent infringement in federal court often respond by asking the patent board to invalidate the asserted patents. Both Microsoft and Amazon have used this strategy to prevail in previous disputes. A federal court in Texas separately invalidated Allergan’s Restasis patents on Monday. The company responded that it would appeal that ruling.Allergan’s deal with the tribe has drawn criticism from a bipartisan group of U.S. lawmakers, some of whom have called it a “sham.” Missouri Senator Claire McCaskill on Oct. 5 introduced a bill to ban attempts to take advantage of tribal sovereignty.

“The biggest mistake our country made was that we put too much trust in you; and your mistake was that you saw this trust as a lack of power and you abused it..”

• Putin Slams West for Lack of Respect and Broken Trust (BBG)

President Vladimir Putin has yet to declare his candidacy for re-election next year, but on Thursday the outlines of his campaign were clear, beginning from his strongest suit as the man who restored power and respect to Russia. Putin spent much of his address to an annual gathering of foreign-policy specialists from Russia and abroad recounting his country’s perceived humiliation following the collapse of the Soviet Union, singling out the West and the U.S. for special criticism. “The biggest mistake our country made was that we put too much trust in you; and your mistake was that you saw this trust as a lack of power and you abused it,’’ he said during a question-and-answer session that was carried on national television. What was needed, he said, was “respect.’’

In its portrayal of the U.S., “it was the most negative speech Putin has given’’ at the annual Valdai Club meeting, said Toby Gati, a former U.S. National Security Council and State Department official who is a regular at the event. At the same time, the Russian leader appeared to leave a door open to a rapprochement with U.S. President Donald Trump, saying that he, too, deserved respect as the elected choice of the American people. [..] Even during the Cold War, the U.S. and the Soviet Union had always treated each other with respect, said Putin, lamenting how the Russian flag was recently torn from the country’s consulate in California. “Respect has been the underbelly of the whole conference,’’ said Wendell Wallach, chairman of technology and ethics studies at Yale University.

The only leftist in Europe left standing. Oh irony.

• Ditch Neoliberalism To Win Again, Jeremy Corbyn Tells EU’s Center-Left (Ind.)

Jeremy Corbyn has warned centre-left parties across Europe that they must follow his lead and abandon the neoliberal economics of the imagined “centre ground” if they want to start winning elections again. The Labour leader was given a hero’s welcome at the Europe Together conference of centre-left parties in Brussels, where he was introduced as “the new Prime Minister of Britain” and received two standing ovations from a packed auditorium. Continental centre-left leaders are looking to Mr Corbyn’s Labour as a model to reinvigorate their movement. Across Europe from France to Germany, Austria to Netherlands, and Spain to Greece, once powerful social-democratic parties have been reduced to a shadow of their former selves – with Labour a notable exception.

Mr Corbyn said low taxes, deregulation, and privatisation had not brought prosperity for Europe’s populations and that if social democratic parties continued to endorse them they would continue to lose elections. He berated the longstanding leadership of the centre-left, telling delegates from across the EU: “For too long the most prominent voices in our movement have looked out of touch, too willing to defend the status quo and the established order. “In a desperate attempt to protect what is seen as the centre-ground of politics: only to find the centre ground has shifted or was never where the elites thought it was in the first place.” Citing the rise of the far-right in countries like Austria and France, Mr Corbyn said the abdication of the radical end of politics by the left had created space for reactionary parties.

“Our broken system has provided fertile ground for the growth of nationalist and xenophobic politics,” he said. “We all know their politics of hate, blame and division and not the answer, but unless we offer a clear and radical alternative of credible solutions for the problem we face, unless we offer a chance to change the broken system, and hope for a more prosper future we are clearing the path for the extreme right to make even more far-reaching inroads into our communities. Their message of fear and division would become the political mainstream of our discourse. But we can offer a radical alternative, we have the ideas to make progressive politics the dominant force of this century. But if we don’t get our message right, don’t stand up for our core beliefs, and if we don’t stand for change we will founder and stagnate.”

Does Angela not like what Corbyn has to say?

• Merkel Comes to May’s Aid on Brexit (BBG)

German Chancellor Angela Merkel offered Theresa May the political cover she’s been asking for to take further steps in Brexit talks, calling on both sides to move so that a deal can be reached by year-end. The U.K. prime minister signaled she’s willing to offer more on the divorce bill, according to a U.K. official. May urged leaders at a European summit to help her find a deal she could sell to skeptics at home, and her counterparts responded with words of encouragement – though no concrete concessions. Merkel said there’s “zero indication” that Brexit talks won’t succeed and she “truly” wants an agreement rather than an “unpredictable resolution.” She welcomed the concessions May made in a landmark speech in Florence last month and said she’s “very motivated” to get talks moved on from the divorce settlement to trade by December.

“Now both sides need to move,” she told reporters after hearing May speak at dinner, in a shift of rhetoric for the EU side, which has previously insisted that it’s up to the U.K. alone to make the next move. [..] he chancellor’s upbeat tone on Brexit was in marked contrast to Germany’s portrayal in the U.K. media as the principle obstacle to Britain’s attempts to shift negotiations onto trade and a transition period. In reality, Merkel has rarely commented on Brexit in the past two months or more as she fought for re-election to a fourth term. Even when she has weighed in, the chancellor tended to adopt a matter-of-fact approach that stuck to the facts. “So what I heard today was a confirmation of the fact that, in contrast to what you hear in the British press, the process is moving forward step by step,” Merkel said. “You get the impression that after a few weeks you already have to announce the final product, and I found that – to be very clear – absurd.”

it’s not about borders, but about decentralizing power. Unstoppable.

• Italian Regions To Vote In Europe’s Latest Referendums On Autonomy (G.)

Two of Italy’s richest regions are holding referendums on greater autonomy on Sunday, in the latest push by European regions to wrest more power from the centre. Lombardy and Veneto, between them home to a quarter of Italy’s population, are seeking semi-autonomy, giving them more control over their finances and administration. Although legally non-binding, the exercise is the latest ripple in a wave of votes on greater autonomy across Europe in recent years, from Scotland in 2014 to Brexit last year and Catalonia in September. Although both regions have in the past campaigned for complete independence from Rome, their leaders have made it clear the ballots are about autonomy and not secession.

Some insight into the dynamics can be gleaned from the example of Sappada, a mountainous town in Veneto that straddles the regional border with Friuli-Venezia Giulia. A skiing and hiking paradise, the town is on the verge of becoming the first in Italy to switch regions to become part of Friuli-Venezia Giulia, one of Italy’s five semi-autonomous regions. The plan was approved by the Italian government in September after a lengthy bureaucratic process. “The reasons for people wanting to be part of Friuli are varied: we have our own dialect, which originates from German, and culturally we feel closer to Friuli,” Manuel Piller Hoffer, the mayor of Sappada, told the Guardian. “But the main one is economic: living next door to a semi-autonomous region, people see advantages that they don’t have. They see finances being controlled better, a better health service and sustainable investments being made – they see a better standard of living.”

Do you need to call it a ‘handout’, Reuters?

• Greece Plans Billion Euro Handout For The Poor (R.)

Greece plans to offer handouts worth 1 billion euros to poor Greeks who have suffered during the seven-year debt crisis after beating its budget targets this year, the government said on Thursday. Greece expects to return to nearly 2% growth this year and achieve a primary surplus – which excludes debt servicing costs – of 2.2% of GDP, outperforming the 1.75% bailout target. “The surplus outperformance which will be distributed to social groups that have suffered the biggest pressure during the financial crisis, will be close to 1 billion euros,” government spokesman Dimitris Tzanakopoulos told reporters. It is not yet clear who would be eligible for what the leftist-led government calls a “social dividend.” Hundreds of thousands of Greeks have lost their jobs during a six-year recession that cut more than a quarter of the country’s GDP.

With unemployment 21.3% and youth unemployment at 42.8% many households rely on the income of grandparents – although they have lost more than a third of the value of their pensions since 2010, when Athens signed up to its first international bailout. The government will make final decisions in late November, once it gets full-year budget data, Tzanakopoulos said. Greece’s fiscal performance this year and its 2018 budget is expected to be discussed with representatives from its European Union lenders and the International Monetary Fund next week when a crucial review of its bailout progress starts. Tzanakopoulos reiterated that Athens aims to wrap up the review as soon as possible, ruling out new austerity measures.

We’re really going to see this play out all over again?

• Tensions Rise On Aegean Islands As Migrants Continue To Arrive (K.)

As dozens of migrants continue to land daily on the shores of eastern Aegean islands, and tensions rise in reception centers, local communities are becoming increasingly divided over growing migrant populations. A total of 438 people arrived on the islands aboard smuggling boats from Turkey in the first three days of the week, with another 175 people arriving on the islet of Oinousses yesterday morning. The latter were transferred to a center on nearby Chios which is very cramped with 1,600 people living in facilities designed to host 850. The situation is worse on Samos, where a reception center designed to host 700 people is accommodating 2,850.

The Migration Ministry said around 1,000 migrants will be relocated to the mainland next week. But island authorities said that this will not adequately ease conditions at the overcrowded facilities. Samos Mayor Michalis Angelopoulos on Thursday appealed for European Union support during a meeting of regional authority officials in Strasbourg. He said the Aegean islands “cannot bear the burden of the refugee problem which is threatening to divide Europe.” There are divisions on the islands too. On Sunday rival groups are planning demonstrations on Samos – far-right extremists to protest the growing migrant population and leftists to protest the EU’s “anti-migrant” policy.

When you think money is more valuable than life.

• Global Pollution Kills Millions, Threatens ‘Survival Of Human Societies’ (G.)

Pollution kills at least nine million people and costs trillions of dollars every year, according to the most comprehensive global analysis to date, which warns the crisis “threatens the continuing survival of human societies”. Toxic air, water, soils and workplaces are responsible for the diseases that kill one in every six people around the world, the landmark report found, and the true total could be millions higher because the impact of many pollutants are poorly understood. The deaths attributed to pollution are triple those from Aids, malaria and tuberculosis combined. The vast majority of the pollution deaths occur in poorer nations and in some, such as India, Chad and Madagascar, pollution causes a quarter of all deaths. The international researchers said this burden is a hugely expensive drag on developing economies.

Rich nations still have work to do to tackle pollution: the US and Japan are in the top 10 for deaths from “modern” forms of pollution, ie fossil fuel-related air pollution and chemical pollution. But the scientists said that the big improvements that have been made in developed nations in recent decades show that beating pollution is a winnable battle if there is the political will. “Pollution is one of the great existential challenges of the [human-dominated] Anthropocene era,” concluded the authors of the Commission on Pollution and Health, published in the Lancet on Friday. “Pollution endangers the stability of the Earth’s support systems and threatens the continuing survival of human societies.”

Prof Philip Landrigan, at the Icahn School of Medicine at Mount Sinai, US, who co-led the commission, said: “We fear that with nine million deaths a year, we are pushing the envelope on the amount of pollution the Earth can carry.” For example, he said, air pollution deaths in south-east Asia are on track to double by 2050. Landrigan said the scale of deaths from pollution had surprised the researchers and that two other “real shockers” stood out. First was how quickly modern pollution deaths were rising, while “traditional” pollution deaths – from contaminated water and wood cooking fires – were falling as development work bears fruit. “Secondly, we hadn’t really got our minds around how much pollution is not counted in the present tally,” he said. “The current figure of nine million is almost certainly an underestimate, probably by several million.”

Home › Forums › Debt Rattle October 20 2017

Tagged: INFLATION