Henri Matisse Reading woman in violet dress 1898

Seneff long term effects

Senior MIT research scientist Stephanie Seneff – flabbergasting if true… pic.twitter.com/9HlCOMycvl

— Camus (@camus37) July 23, 2021

Lee Merritt – Synthetic Spike Protein Affects Every Cell

– start at 50 min

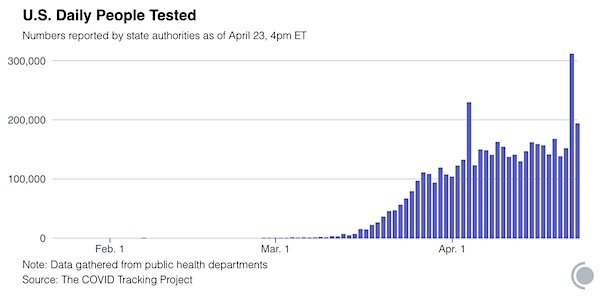

In case you were wondering why there are no flu cases left.

Google translated.

Note: Bill Gates and George Soros bought UK testing firm Mologic just days ago.

• CDC Withdraws PCR Tests: “They Can’t Tell SARS-CoV-2 from Influenza” (GN)

On 21 July 2021, the 18 lines that rewrite the history of the Covid-19 pandemic were published. The CDC (Centers for Disease Control and Prevention) of the USA, the highest health authority of the American government for monitoring diseases and in particular infectious ones, has launched an alert that assumes the range of a nuclear missile against the rubber wall of the international narrative on the emergency caused by the SARS-Cov-2 virus ( believed to have been built in the laboratory by many scientific researches now ).

“After December 31, 2021, the CDC will withdraw the application to the US Food and Drug Administration (FDA) for the Emergency Use Authorization (EUA) of the CDC 2019-Novel Coronavirus (2019-nCoV) Real-Time RT-PCR Diagnostic Panel, the test first introduced in February 2020 for the detection of SARS-CoV-2 only. CDC provides this notice in advance to clinical laboratories to allow sufficient time to select and implement one of the many alternatives authorized by the FDA.”

This is the “Lab Alert” launched by the Division of Laboratory System (DLS), the specialized section of the CDC ( link at the bottom of the article ). Alone, it would already be enough to confirm all the investigations carried out in recent months on 97% unreliable tampons, as claimed by various scientific researches and international judicial authorities . But the official communication of the CDC (branched body in all the confederate states) states between the lines something already shocking, anticipated by Gospa News already last year: that is the risk that the nasopharyngeal swabs PCR, subject to cycles of variable amplifications , may not distinguish Covid-19 from a simple flu.

Visit the FDA website for a list of authorized COVID-19 diagnostic methods. For a summary of the performance of FDA-cleared molecular methods with an FDA reference panel. In preparation for this change, CDC recommends clinical laboratories and testing sites that have used the CDC 2019-nCoV RT-PCR assay to select and begin transitioning to another FDA-cleared COVID-19 assay. The CDC encourages laboratories to consider adopting a multiplex method that can facilitate the detection and differentiation of SARS-CoV-2 and influenza viruses.Such tests can facilitate the continuation of testing for both influenza and SARS-CoV-2 and can save time and resources as we head into the flu season. Laboratories and test sites must validate and verify the selected test within their facility before starting clinical trials. ”

The Real time PCR – also known as Quantitative PCR , abbreviated qPCR – is a method that simultaneously amplifies (polymerase chain reaction or PCR) and quantifies the DNA , similar but not to be confused with the RT-PCR method (Reverse Transcriptase -PCR ) . DNA is amplified by DNA-polymerase chain reactions. After each round of amplification, the DNA is quantified. Common methods of quantification include the use of fluorescent stains that intercalate with double-stranded (ds) DNA and modified DNA oligonucleotides (called probes) which are fluorescent when hybridized with a DNA. Real-time PCR is often combined with Retro Transcriptional PCR (RT-PCR) to quantify the expression levels of specific RNA: retro-transcription (or reverse transcription) produces single-stranded complementary DNA called cDNA (complementary DNA) keeping the relative concentration ratios of the different RNA species unchanged. In this way it is possible, for example, to measure the relative expression of a gene at a particular time, either in a cell or in a particular type of tissue.

Fully impartial.

• Bill Gates Primary Funder Of MHRA, Owns Major Shares In Pfizer & BioNTech (DE)

An investigation has revealed that the Bill & Melinda Gates Foundation are the primary funders of the UK’s Medicine & Healthcare products Regulatory Agency, and that the Foundation also owns major shares in both Pfizer and BioNTech. The Medicine & Healthcare products Regulatory Agency (MHRA) extended the emergency authorisation of the Pfizer/BioNTech mRNA jab in the UK to allow it to be given to children between the ages of 12 – 15 on the 4th June 2021. At the time, the Chief Executive of the MHRA, Dr June Raine said the MHRA had “carefully reviewed clinical trial data in children aged 12 to 15 years and have concluded that the Pfizer vaccine is safe and effective in this age group and that the benefits outweigh any risk”.

We are left wondering if Dr June Raine and the MHRA have even read the results of the extremely short and small study. If they have then they would have seen that 86% of children in the study suffered an adverse reaction ranging from mild to extremely serious. Just 1,127 children took part of the trial, however only 1,097 children completed the trial, with 30 of them not participating after being given the first dose of the Pfizer jab. The results do not state why the 30 children did not go on to complete the trial. The information is publicly available [..] There was never any doubt that the MHRA would give emergency authorisation for the Pfizer/BioNTech vaccine to be used in children when you consider that a certain Mr Bill Gates owns shares in both Pfizer and BioNTech and is the primary funder of the MHRA.

The Bill & Melinda Gates Foundation bought shares in Pfizer back in 2002, and back in September 2020 Bill Gates ensured the value of his shares went up by announcing to the mainstream media in a CNBC interview that he viewed the Pfizer jab as the leader in the Covid-19 vaccine race. “The only vaccine that, if everything went perfectly, might seek the emergency use license by the end of October, would be Pfizer.” The Bill & Melinda Gates Foundation also “coincidentally” bought $55 million worth of shares in BioNTech in September 2019, just before the alleged Covid-19 pandemic struck.

The MHRA received a grant from the Bill & Melinda Gates Foundation in 2017 to the tune of £980,000 for a “collaboration” with the foundation. However, a Freedom of Information request which the MHRA responded to in May 2021 revealed that the current level of grant funding received from the Gates Foundation amounts to $3 million and covers “a number of projects”.

“More than 97% of people hospitalised for COVID-19 are unvaccinated..”

Because the vaccinated are no longer tested.

NYT going after Mercola big time. Who’s next? They’ll pick them off one by one.

• Little Known Osteopath In The Spotlight As An Anti-vaxx Superspreader (NYT)

The article that appeared online February 9 began with a seemingly innocuous question about the legal definition of vaccines. Then over its next 3400 words, it declared coronavirus vaccines were “a medical fraud” and said the injections did not prevent infections, provide immunity or stop transmission of the disease. Instead, the article claimed, the shots “alter your genetic coding, turning you into a viral protein factory that has no off-switch”. Its assertions were easily disprovable. No matter. Over the next few hours, the article was translated from English into Spanish and Polish. It appeared on dozens of blogs and was picked up by anti-vaccination activists, who repeated the false claims online. The article also made its way to Facebook, where it reached 400,000 people, according to data from CrowdTangle, a Facebook-owned tool.

The entire effort traced back to one person: Joseph Mercola. Mercola, 67, an osteopathic physician in Cape Coral, Florida, has long been a subject of criticism and government regulatory actions for his promotion of unproven or unapproved treatments. But most recently, he has become the chief spreader of coronavirus misinformation online, according to researchers. An internet-savvy entrepreneur who employs dozens, Mercola has published more than 600 articles on Facebook that cast doubt on COVID-19 vaccines since the pandemic began, reaching a far larger audience than other vaccine sceptics, an analysis by The New York Times found. His claims have been widely echoed on Twitter, Instagram and YouTube.

The activity has earned Mercola, a natural health proponent with an Everyman demeanour, the dubious distinction of the top spot in the “Disinformation Dozen,” a list of 12 people responsible for sharing 65 per cent of all anti-vaccine messaging on social media, said the nonprofit Centre for Countering Digital Hate. Others on the list include Robert F. Kennedy jnr, a longtime anti-vaccine activist; and Erin Elizabeth, founder of the website Health Nut News, who is also Mercola’s girlfriend. “Mercola is the pioneer of the anti-vaccine movement,” said Kolina Koltai, a researcher at the University of Washington who studies online conspiracy theories. “He’s a master of capitalising on periods of uncertainty, like the pandemic, to grow his movement.”

Some high-profile media figures have promoted scepticism of the vaccines — notably, Tucker Carlson and Laura Ingraham of Fox News, though other Fox personalities have urged viewers to get the shots. Now Mercola and others in the “Disinformation Dozen” are in the spotlight as vaccinations in the United States slow, just as the highly infectious delta variant has fuelled a resurgence in coronavirus cases. More than 97% of people hospitalised for COVID-19 are unvaccinated, according to the Centres for Disease Control and Prevention. President Joe Biden has blamed online falsehoods for causing people to refrain from getting the injections. But even as Biden has urged social media companies to “do something about the misinformation,” Mercola shows the difficulty of that task. Over the last decade, Mercola has built a vast operation to push natural health cures, disseminate anti-vaccination content and profit from all of it, said researchers who have studied his network. In 2017, he filed an affidavit claiming his net worth was “in excess of $US100 million”.

In religion, credibility is not a factor.

• CDC ‘Actively’ Considering Face Cover Advisory For Vaccinated: Fauci (RT)

White House health advisor Dr. Anthony Fauci has revealed that the Centers for Disease Control and Prevention (CDC) could soon reconsider its guidelines, recommending vaccinated Americans to mask up again. Top health officials have reportedly been having preliminary talks about revising mask recommendations for vaccinated Americans due to a rise in cases and concerns over the more infectious Delta variant of Covid-19. According to current guidance, those vaccinated against the virus do not need to wear masks in most public spaces. The revision of the mask guidance is indeed “under active consideration,” Fauci confirmed to CNN on Sunday. The infectious disease expert did not give a timeframe for when the federal guidance could change, but he praised those state officials who had already rushed ahead to reinstate local mask mandates in response to rising coronavirus cases.

“If you look at what’s going on locally in the trenches, in places like L.A. County,” Fauci said, “the local officials have the discretion, and the CDC agrees with that ability and discretion capability to say, you know, you’re in a situation where we’re having a lot of dynamics of infection, so even if you are vaccinated, you should wear a mask.” Fauci and other White House officials have used the uptick in cases to continue pushing unvaccinated Americans to get inoculated. Recent polling, however, has signified that those who have refused getting vaccinated thus far have little to no interest in changing their minds.

Great video.

• The Other Side of the COVID Vaccination Argument (CTH)

There is a lot of incoming information from government and the private sector promoting the vaccine. Recently, there has been a significant uptick in compulsory demands for taking the COVID vaccine. This forced vaccination approach has made many people start to question why this coordinated pressure campaign has increased with such ferocity. As a result of such one-side information, people are increasingly skeptical. In this video below you can review the counter-position for why people do not want to take the vaccination shot.

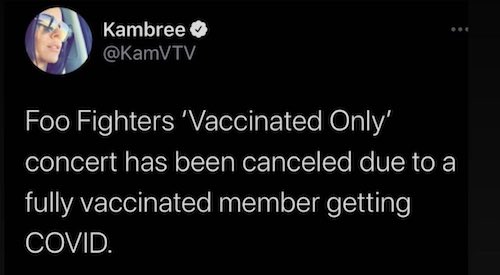

Very rare.

• 159 Dead, 593 Hospitalized in Illinois Breakthrough COVID Cases (NBC)

More than 150 people have died and nearly 600 have been hospitalized in Illinois due to COVID-19 in “breakthrough” cases after they were fully vaccinated, according to state health officials. According to data updated Wednesday by the Illinois Department of Public Health, 159 people in Illinois have died due to COVID-19 or complications after being fully vaccinated. That figure equates to 2.3% of COVID-19 deaths in the state since Jan. 1, officials said. At least 593 fully vaccinated people have been hospitalized in Illinois, IDPH said. The state only reports breakthrough infections among those who have been hospitalized or died, following guidance from the Centers for Disease Control and Prevention, IDPH said.

Those totals mean eight more fully vaccinated individuals have died and 30 more have been hospitalized in the past week since the state last updated its reported numbers. The state does not publicize the number of residents who tested positive after being fully vaccinated but did not die or require hospitalization in order to “help maximize the quality of the data collected on cases of greatest clinical and public health importance,” IDPH’s website reads.

He’s a made man.

• Biden DOJ Drops Civil Rights Probe Of Gov. Cuomo Over Nursing Homes (NYP)

The Department of Justice has decided not to investigate whether the civil rights of residents in New York’s government-run nursing homes were violated by Gov. Andrew Cuomo’s controversial admission policy related to the COVID-19 pandemic. In a letter Friday, the DOJ’s Office of Legislative Affairs told US Rep. Steve Scalise (R-La.), ranking member of that House Subcommittee on the Coronavirus Crisis, that New York was off the hook in connection with potential violations of the Civil Rights of Institutionalized Persons Act. In August, the DOJ’s Civil Rights Division requested information from New York in connection with a March 25, 2020, order from the state Department of Health that required nursing homes to admit “medically stable” COVID-19 patients discharged from hospitals.

It also sought records from Pennsylvania, Michigan and New Jersey, which adopted similar rules that the DOJ said “may have resulted in the deaths of thousands of elderly nursing home residents.” “We have reviewed the information provided by these states along with additional information available to the Department,” Deputy Assistant Attorney General Joe Gaeta wrote Friday. “Based on that review, we have decided not to open a CRIPA investigation of any public nursing facility within New York, Pennsylvania, or Michigan at this time.” In a prepared statement, Scalise called it “outrageous that the Department of Justice refuses to investigate the deadly ‘must admit’ orders issued by governors in New York, Pennsylvania, and Michigan that resulted in the deaths of thousands of senior citizens.”

“Where is the justice for nursing home victims and their grieving families? These deadly orders contradicted the [Centers for Disease Control and Prevention’s] guidance, and needlessly endangered the most vulnerable among us to the deadly COVID-19 virus,” Scalise said. “Even worse, Governor Cuomo in New York intentionally tried to cover up the true death toll resulting from his mandate. Grieving families deserve answers and accountability. It’s unconscionable that Biden’s Department of Justice refuses to investigate the deadly actions that went against CDC’s medical guidance taken in these states.”

Oh sure. As the media scream Armageddon.

• UK Economy Growing At Fastest Rate In 80 Years (G.)

The British economy is growing at its fastest pace in 80 years and could recover its pre-pandemic size by the end of this year, according to a leading economic forecaster. Buoyed by the vaccine rollout and a bounce back in consumer spending, the EY Item Club said it now expected GDP to grow by 7.6% – which would be the fastest annual growth in national income since 1941. The UK economy shrank by 9.8% in 2020, the worst performance in the G7. The optimism comes despite the chaos caused by widespread staff shortages as workers self-isolate en masse after being pinged by NHS test and trace. The “pingdemic” is affecting the running of shops, restaurants, factories and even railway services as bosses struggle to find staff to cover shifts.

Although the economy has proved increasingly resilient through lockdowns, the EY Item Club report came with the health warning that the “future pattern of the pandemic and any renewed pandemic-related restrictions will have a significant bearing on whether the forecast is achieved”. The UK economy is more dependent on consumer spending on services, such as recreation and leisure activities, which meant that the lockdowns had a greater economic impact than in other countries, said Martin Beck, the EY Item Club’s senior economic adviser. The reopening of these “face-to-face parts of the economy means the UK should have a correspondingly faster recovery”, he said. In the spring, the group of economists, which is the only non-government forecasting organisation to use the Treasury’s modelling of the economy, pencilled in growth of 6.8%.

This is the second time this year it has upgraded its forecast, putting the economy on track to attain its pre-pandemic peak by the end of 2021. That milestone would now be reached some six months sooner than when it last crunched the numbers in April, with the UK’s successful vaccine programme a key factor. Recent surveys of economic activity have, however, been less encouraging, leading to concerns that the recovery is stalling. The IHS Markit and the Cips survey showed growth at its slowest since March, which was attributed to wide-ranging staff shortages, rising Covid cases and thousands of workers having to isolate owing to the pingdemic. It also highlighted a new mood of caution among the public triggered by the rapidly rising infection rates.

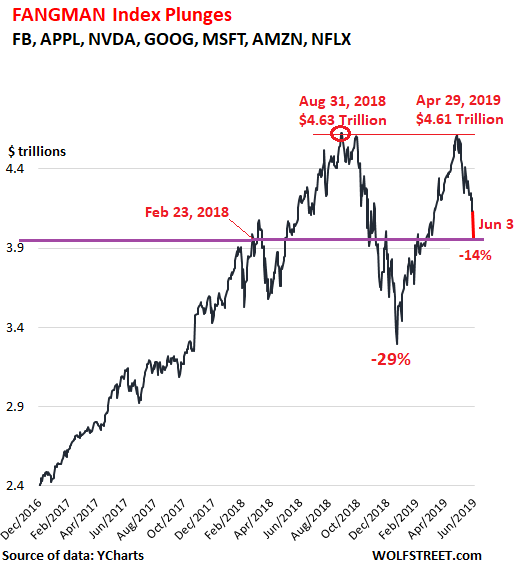

Because the Fed is one? Because the market makers are?

• Judge Refuses To Identify 5 Market Participants In VIX Manipulation (ZH)

[..] on Feb 5, 2018 the steamroller woke up with a vengeance, and shortly after the close, the infamous volmageddon event took place when a handful of the most popular inverse VIX strategies crashed from near record highs to zero in a manner of minutes as ETN liquidation triggers were activated, sending the VIX briefly to record highs and wiping out billions in value and leaving countless retail investors stunned and facing total losses. Yet while to retail investors losses were in the hundreds or, at most, thousands of dollars (recall this was in the pre-stimmy stage when people cared about their money), some hedge funds got completely wiped out. One among them was LJM Partners, a Chicago-based fund that lost $446.8 million in one day from the market moves, wiping out 86.5% of its assets in seconds.

And so LJM and more than two dozen other investors and fund managers sued over the next year to recover losses, claiming unidentified market participants that rigged the index “repeatedly posted and immediately canceled” tens of thousands of quotes for S&P 500 options, whose prices are used to calculate the VIX. The plaintiffs, understandably furious at the events of Feb 5, claiming that unidentified market participants manipulated the VIX by posting S&P 500 options quotes that only stayed in the order book for milliseconds, not long enough for anyone to trade against but enough time for them to be incorporated into the value of the VIX.

That technique, known as “flashing” and popularized back in 2009 first by this website, was unrelated to any legitimate positions the unidentified market participants held or wished to hold, but successfully manipulated the price of S&P 500 options and futures contracts, LJM claimed, even though the CBOE which is the Chicago-based owner of the VIX and the exchange where S&P 500 options trade, has repeatedly dismissed claims of manipulation of the index. And while LJM has yet to recover any funds, on Friday the defunct fund suffered another setback, when a federal judge refused to identify five market participants accused in the lawsuit of manipulating the VIX index.

US District Judge Manish S. Shah, during a telephone conference Friday in Chicago, said the plaintiffs had failed to provide enough evidence of actual manipulation to justify revealing the names of the market participants, who were identified only by code names in exchange records. “Plaintiffs have not demonstrated good cause” for the disclosure, said Shah, who had earlier authorized the release of exchange data to help them make their case. “Rather than specific allegations of manipulation, plaintiffs’ complaints offer a menu of what they characterize as potentially manipulative conduct that may have occurred on February 5 and 6, 2018,” the market participants said in a court filing.

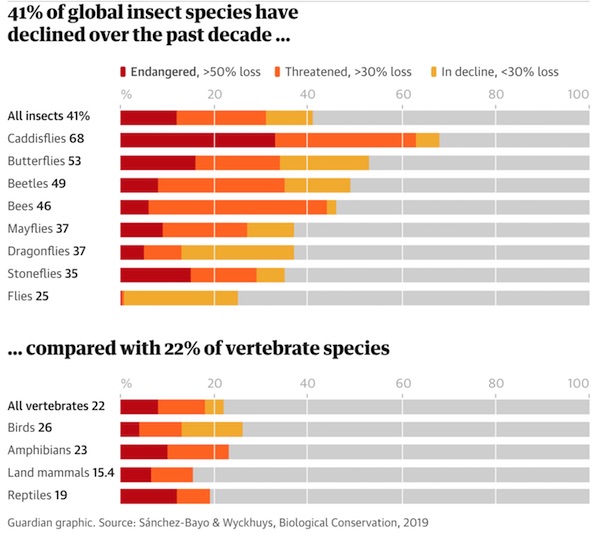

Many people asking where the bugs on their windshields went. Which is a typical “connection” with nature.

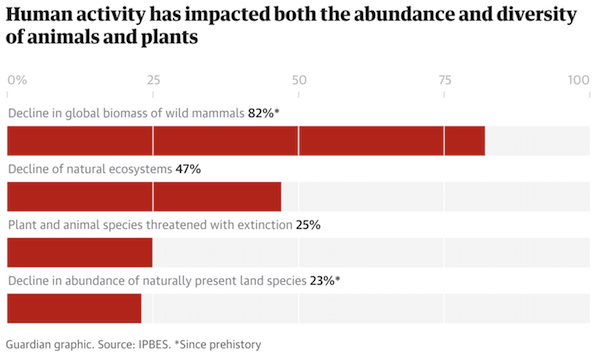

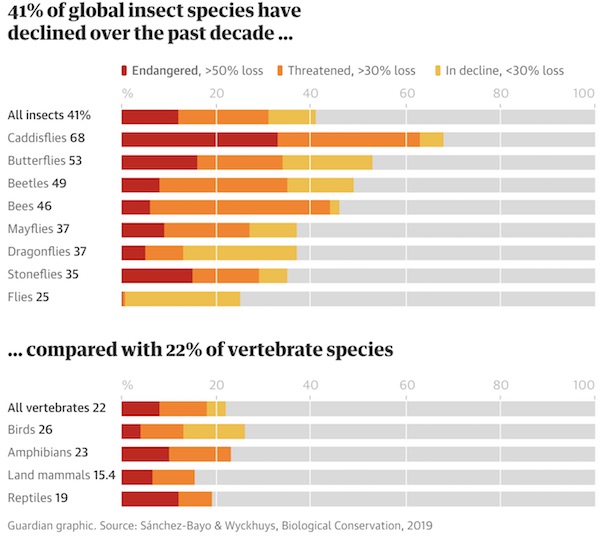

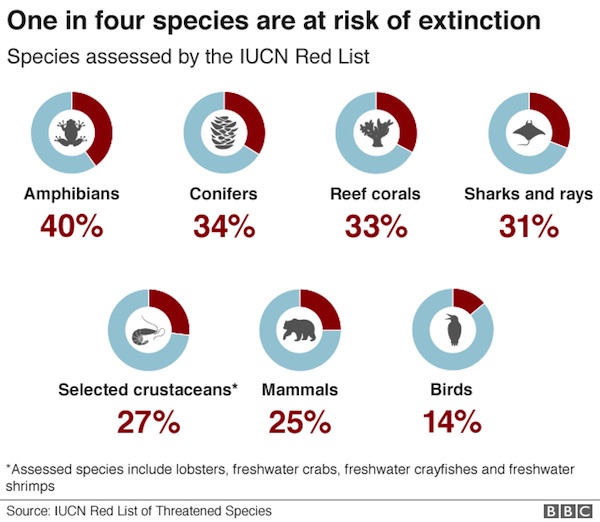

• The Insect Apocalypse: ‘Our World Will Grind To A Halt Without Them’ (G.)

In 2015 I was contacted by the Krefeld Society, a group of entomologists who, since the late 1980s, had been trapping flying insects on nature reserves scattered across Germany. They had amassed insects from nearly 17,000 days of trapping across 63 sites and 27 years, a total of 53kg of insects. They sent me their data to ask for my help in preparing it for publication in a scientific journal. In the 27 years from 1989 to 2016 the overall biomass (ie weight) of insects caught in their traps fell by 75%. In midsummer, when in Europe we see the peak of insect activity, the decline was even more marked, at 82%. I thought initially that there must have been some sort of mistake, because this seemed too dramatic a drop to be credible. We knew that wildlife in general was in decline, but for three-quarters of insects to have disappeared so rapidly suggested a pace and scale of decline that had previously not been imagined.

In October 2019 a different group of German scientists published their findings from a study of insect populations in German forests and grasslands over 10 years from 2008 to 2017. The study’s results were deeply troubling. Grasslands fared worst, losing on average two-thirds of their arthropod biomass (the insects, spiders, woodlice and more). In woodlands, biomass dropped by 40%. What about elsewhere? Is there something peculiar going on in Germany? It seems highly unlikely. Perhaps the best-studied insect populations in the world are the UK’s butterflies. They are recorded by volunteers as part of the Butterfly Monitoring Scheme, the largest and longest-running scheme of its kind in the world. The trends it reveals are worrying. Butterflies of the “wider countryside” – common species found in farmland, gardens and so on, such as meadow browns and peacocks – fell in abundance by 46% between 1976 and 2017.

Meanwhile, habitat specialists, fussier species that tend to be much rarer, such as fritillaries and hairstreaks, fell by 77%, despite concerted conservation efforts directed at many of them. Worldwide, although the bulk of insect species – the flies, beetles, grasshoppers, wasps, mayflies, froghoppers and so on – are not systematically monitored, we often have good data on population trends for birds that depend on insects for food, and these are mostly in decline. For example, populations of insectivorous birds that hunt their prey in the air (ie the flying insects that have decreased so much in biomass in Germany) have fallen by more than any other bird group in North America, by about 40% between 1966 and 2013. Bank swallows, common nighthawks (nightjars), chimney swifts and barn swallows have all fallen in numbers by more than 70% in the past 20 years.

In England, populations of the spotted flycatcher fell by 93% between 1967 and 2016. Other once-common insectivores have suffered similarly, including the grey partridge (-92%), nightingale (-93%) and cuckoo (-77%). The red-backed shrike, a specialist predator of large insects, went extinct in the UK in the 1990s. Overall, the British Trust for Ornithology estimates that the UK had 44m fewer wild birds in 2012 compared with 1970. All the evidence above relates to populations of insects and their predators in highly industrialised, developed countries. Information about insect populations in the tropics, where most insects live, is sparse. We can only guess what impacts deforestation of the Amazon, the Congo, or south-east Asian rainforests has had on insect life in those regions. We will never know how many species went extinct before we could discover them.

“The strawberries. The strawberries. The strawberries. That’s what makes it work! Airplanes!”

• CNN Airs Hour-Long Public Service Message On Dementia (BBee)

As part of a campaign to raise awareness and improve public knowledge on treatment options, CNN aired an hour-long public service announcement on the warning signs of dementia Wednesday night. The PSA, which ran over an hour, showed tragic footage of an old man ranting and making nonsensical, confusing statements. CNN says they hope the footage will encourage family members of the elderly to get them tested for the early warning signs of dementia. The cable news channel displayed a phone number for a hotline people can call if they believe someone they know might be suffering from symptoms of the condition.

“If you or a loved one act like this man,” said Don Lemon, “please, we beg you, get help. Slurred speech, inaccurate statements, an inability to remember where you are—these are all signs that your loved one might be suffering from dementia, whether he’s retired or the president of the United States.” “… and we’d take the rhubarb and we’d put it in the pie, right in the ol’ pie,” the old man said suddenly, in a rare moment of lucidity. “It was incredible. You wouldn’t think rhubarb would taste good, but it’s the sweetness. The strawberries. The strawberries. The strawberries. That’s what makes it work! Airplanes! Airplanes are neat, you know, but they’re a myth. How do they get them up there? They don’t—d-d-don’t even have feathers.” Many of the attendees were touched by both the PSA and the old man.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

The further a society drifts from the truth, the more it will hate those that speak it

George Orwell

Melenchon

https://twitter.com/i/status/1419092425226678276

You

Dan Andrews: “I don’t know what half of them are protesting against.”Reporter: “You.” pic.twitter.com/rSfpNzxhiy

— Camus (@camus37) July 25, 2021

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.