Fan Ho Obsession 1964

A point I made again recentlly “It will continue to go up, but I will get out in time.» People overestimate their ability to get out in time. Who will be there to buy when everyone wants to sell? That’s wishful thinking.”

• Who Will Be There To Buy When Everyone Wants To Sell? – Howard Marks (FuW)

It would be a dangerous bet to say interest rates are going to stay low forever, but I don’t see many people taking that bet. And you see, even if interest rates were to stay where they are, that would argue for P/E ratios to stay where they are. And if they do, then stocks will only appreciate at the same rate as earnings, which is not really fast; there would be no multiple expansion. This market is not built on some euphoric view of the future, but mainly on the unwillingness to accept zero or negative returns on cash and safe instruments. It’s based on the view that there is no alternative: people are afraid to be out of the market. But then again, a perceived lack of alternatives is not a good argument for chasing yield and taking big risks. That’s why I think this is the time to turn cautious.

It’s not smart, but people think that’s what they have to do now. You remember Chuck Prince, the CEO of Citigroup, who in July of 2007 said «when the liquidity dries up, this will end badly, but as long as the music is playing, you have to dance?» What does that even mean? People always say they’ll stay in the market, thinking it has further to go, but if it starts to turn down they will get out. Maybe that’s what people are thinking in today’s stock market: «It will continue to go up, but I will get out in time.» People overestimate their ability to get out in time. Who will be there to buy when everyone wants to sell? That’s wishful thinking.

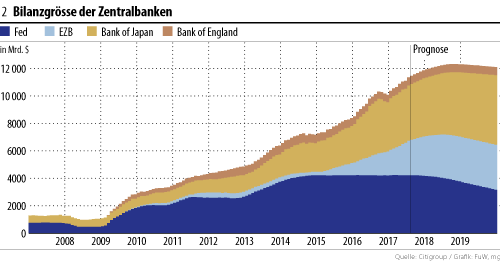

[..] I see a lot of worries. One example: What’s going to happen when central banks start unwinding their balance sheets? We have no clue. There is no historical precedent for the measures they used to stimulate the economies in the past years, so we don’t know what will happen when they unwind them. If QE was stimulative, won’t the unwinding of it be the opposite of stimulative? I don’t know where the money came from for the QE programs, and I don’t know where the money will go to next. We don’t know what it will mean for interest rates and inflation.

Another worry is the low economic growth, combined with politics. All these right-wing populist movements – what are the implications of that? This is not imaginary. Where will the person with a low education level get a job in ten or twenty years, when all the cars are self-driving and all the stores have no clerks? I don’t know what the solution is. But I see a lack of political leadership around the world. Another worry concerns our pension systems. In the US and in other countries, defined benefit systems are hundreds of billions of dollars in the red. What’s going to happen to the people who expect to get their promised retirement payments? But today, nobody’s talking about the problems in our pension systems.

“..when markets can no longer price risks, they cannot price anything at all because the price of risk underlies all prices in the financial markets.”

• The Pricing of Risk is Kaput (WS)

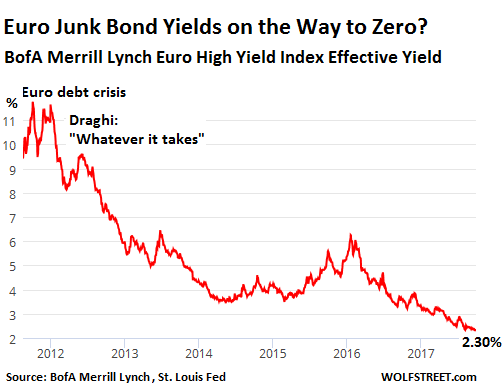

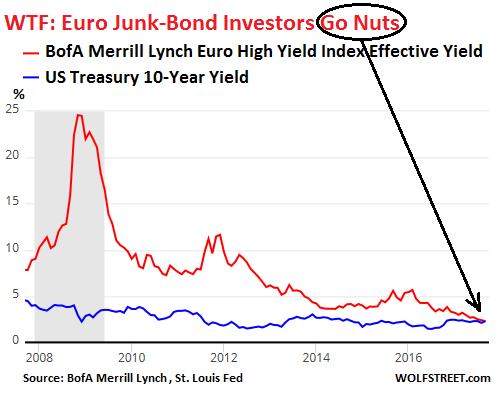

US Treasury Securities with longer maturities fell this morning, with the 10-year Treasury yield rising above 2.37% early on and currently trading at 2.34%. This is still low by historical standards, and it’s still in denial of the Fed’s monetary tightening: Four rate hikes since it started this cycle, and the QE unwind has commenced as of today. But it cannot hold a candle to the Draghi-engineered negative-yield absurdity still unfolding in the Eurozone. The average yield of junk bonds denominated in euros hit a new all-time record low at the close on Friday of 2.30%. Let that sink in a moment. These euro corporate bonds are rated below investment grade. Companies, unlike the US, cannot print their own money to prevent default.

There is little liquidity in the junk bond market, and selling these bonds when push comes to shove can be hard or impossible. The reason they’re called “junk” is because of their high risk of default. And yet, prices of these junk bonds have been inflated by the ECB’s policies to such a degree that their yield, which falls as prices rise, is now lower than that of 10-year US Treasury securities that are considered the most liquid securities with the least credit risk out there. The average yield of the euro junk bonds is based on a basket of below-investment-grade corporate bonds denominated in euros. Issuers include junk-rated American companies with European subsidiaries – in which case these bonds are called “reverse Yankees.”

They include the riskiest bonds. Plenty of them will default. Losses will be painful. Investors know this. It’s not a secret. But they don’t mind. They’re institutional investors plowing other people’s money into these bonds, and they don’t need to mind, but they have to buy these bonds because that’s their job. This chart, based on BofA Merrill Lynch Euro High Yield Index Effective Yield via the St. Louis Fed, shows that the average euro junk bond yield is on the way to what? Zero?

During the peak of the Financial Crisis, the average junk bond yield hit 25%. During the dog days of the euro debt crisis in the summer of 2012, when Draghi pronounced the magic words that he’d do “whatever it takes,” these bonds yielded about 9%. The yield dropped below 5% in October 2013, for the first time ever. This juxtaposition of the already low 10-year US Treasury yield and the even lower euro junk bond yield creates one of the most fascinating WTF-charts for our amusement at central-bank absurdist policies – and we’d be laughing at these bond investors gone nuts, if it weren’t so serious:

.. this is Draghi’s ultimate accomplishment in his nutty bailiwick: The total destruction of the market’s risk-pricing mechanism at the expense of other people’s money – this includes pension funds and life insurance companies that play a large role in Europe’s private pension system. They have to buy corporate bonds. Their beneficiaries that paid into the systems will have to bear the costs in future years. And then there’s the comforting thought that when markets can no longer price risks, they cannot price anything at all because the price of risk underlies all prices in the financial markets.

“..when we had the taper tantrum they hadn’t even done anything yet, they’d just threatened to taper..”

• Art Cashin: “I’ve Never Seen Anything Like Today’s Market Before” (ZH)

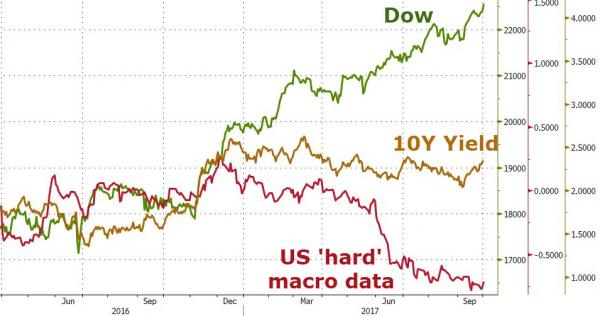

Market veteran Art Cashin, the head of NYSE floor operations for UBS, made an interesting observation earlier today just minutes before the close, as US stocks headed for another record finish after shrugging off the worst mass shooting in US history. Asked by CNBC’s Kelly Evans to explain how US stocks have continued to outperform while the 10-year Treasury yield has remained anchored below 2.5%, Cashin acknowledged that, during a career that’s spanned more than six decades, he’s never seen anything like today’s market. “I’ve been doing this for over 50 years and I’ve never seen anything like it so it is rather odd.” And given global stocks’ strong performance this year, with markets weathering a series of political crises, natural disasters, terror attacks and other nominally destabilizing events (with a little help from central banks, of course) – Cashin says the outlook isn’t as dire as some would believe.

“Right now, Europe’s doing all right emerging markets are okay, and maybe they’re not going to take away the punchbowl that quickly – so we’ll see,” Cashin said. In September, the Fed suggested that while it would likely raise interest rates more quickly than previously believed during the coming quarters, median forecasts for the Fed funds rate in 2019, as well as the longer-run median target, declined compared with a set of forecasts released in July. Looking ahead to the fourth quarter, the most pressing questions that investors should be asking themselves is ‘is this the quarter where tapering – or the expectation of further tapering – finally triggers a market correction.

“What’s really going to be interesting to watch in this final quarter, is will there be an impact of quantitative tightening. As Peter Boockvar points out…it’s only going to be a token amount. But when we had the taper tantrum they hadn’t even done anything yet they’d just threatened to taper. When asked what it would take to spark a meaningful correction in stocks, Cashin said he expects investors will take notice once the 10-year yield climbs above 3%. “I think we’ve got to get a bit higher. Probably up around 3% you start to get everybody’s attention and you’ll start to hear that in the conversation more and more.”

Are you rational? Economics is not.

• What You Are Not Being Told About The Economy – Steve Keen (RT)

As Karl Marx’s ‘Das Kapital’ turns 150 and the global financial crisis enters its tenth year, we ask why it is that we are still no closer to creating an economy that actually works. Perhaps more importantly, why do mainstream economists continue to miss the fundamental drivers of financial instability? Host Ross Ashcroft talks about what’s next for the global economy with Professor Steve Keen, an economist who correctly predicted the financial crisis and the author of ‘Debunking Economics.’

“Economists can’t see it. They can’t model money and credit. ”

• An Accountant Smells a Rat in Our Global Credit Bubble (WS)

Twenty years ago Doug Noland was so worried about imbalances surrounding the dot.com boom that he began to title his weekly reports “The Credit Bubble Bulletin. Years later, he warned the world about the impending 2008 crisis. However a coming implosion, he says, could be the biggest yet. “We are in a global finance bubble, which I call the grand-daddy of all bubbles,” said Noland. “Economists can’t see it. They can’t model money and credit. However, to those outside the system, the facts are increasingly clear.” Noland points to inflating real estate, bond and equity prices as key causes for concern. According to the Federal Reserve’s September Z.1 Flow of Funds report, the value of US equities jumped $1.5 trillion during the second quarter to $42.2 trillion, a record 219% of GDP.

Noland may be right. A report by the International Institute of Finance released in June estimated that global government, business and personal debts totaled $217 trillion earlier this year. That’s more than three times (327%) higher than global economic output. Adding to the complexity is the fact that not all debts are fully recorded. For example, according to a World Economic Forum study, the world’s six largest pension saving systems – the US, UK, Japan, Netherlands, Canada and Australia – are expected to experience a $224 trillion funding shortfall by 2050. Noland’s warnings come during a time of exceptional public trust in governments, central banks, regulators and other institutions. Market volatility is trending at near record lows. In June, Federal Reserve Chair Janet Yellen spoke for many when she said that she did not see a financial crisis occurring “in our lifetimes.”

So why would Noland, who during his day job runs a tactical short book at McAlvany Wealth Management, see things that government, academic, and central bank economists don’t? One possibility is because Noland, who studied accounting and finance in college and began his career as a CPA at Price Waterhouse, is not an economist. He is thus not burdened with the “dismal science’s” limitations. Although Noland eventually completed an MBA and some doctoral studies, he was never forced to buy into the econometrics groupthink that plagues the profession. Noland is thus free to incorporate historical, financial, geographical and other data into his analyses. Another possible reason is that Noland (unlike almost all professional economists who missed both major market implosions/recessions of the last two decades) doesn’t hide it when he makes a bad call.

But Australians won’t believe it until it hits them in the head.

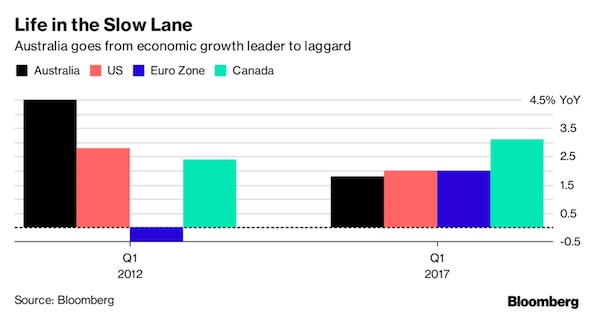

• 26 Recession-Free Years Hide a Darker Picture for Australia (BBG)

The global crown for the longest stretch of uninterrupted economic growth is within sight for Australia. But it’s limping to the line as policy paralysis weighs on the nation’s prospects. Twenty-six years without recession have put Australia within two years of overtaking the Netherlands’ record growth streak and government, central bank and economist forecasts all suggest it’ll take the mantle. After all, the economy has a head start with 2.5% growth virtually baked in – 1.5% from population gains that are among the developed world’s quickest and 1% from resource exports feeding Asia’s giant economies. Yet the reliance on rapid immigration is straining infrastructure, while mining profits fuel riches for stakeholders but do little for the vast majority of Australians living in major cities.

Meantime, wages are barely growing, households carry some of the world’s heaviest debt loads, and productivity gains from the economic reforms of the 1980s and early 1990s have petered out. There’s been no major economic reform since the turn of the century, with just about every attempt reversed or cannibalized by toxic politics. And the impact is starting to show. Just when the economy needs growth drivers outside of mining, a slide in global rankings for innovation and education suggest living standards could decline. The miracle economy that shrugged off the global recession is turning mediocre. “Now that we don’t have the benefit of the mining boom, there’s nothing really that replaces it in terms of driving economic activity,” said Jeremy Lawson, chief economist at Aberdeen Standard Investments in Edinburgh and a former Reserve Bank of Australia economist.

“The really big task of governments over the next 5 to 10 years is to deal with these big structural issues that Australia is facing. Potential growth is relatively weak.” A decade of political infighting has seen the nation change prime ministers five times since 2007 and sidelined substantive policy debate. Meanwhile, attempts at reform have been held hostage by populists and single-issue parties who’ve harnessed voter frustration with mainstream politicians to take the balance of power in parliament’s upper house. That political dysfunction is threatening the nation’s prospects. A policy vacuum around energy has seen electricity prices surge to among the highest in the world, despite Australia holding some of the largest coal and gas reserves on the planet.

“The gold rush is allowing the Bank of Russia to continue growing its reserves while abstaining from purchases of foreign currency for more than two years. ”

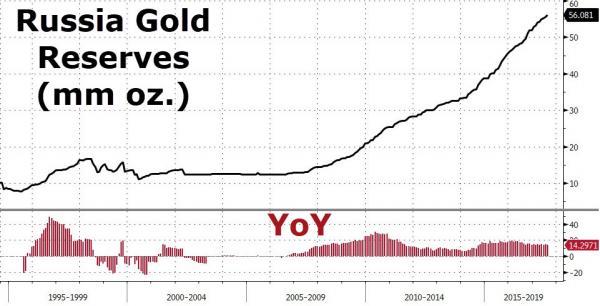

• Russia’s Rush For Gold Sees Record Reserves For Putin Era (II)

Vladimir Putin is doing his part to keep the upswing in gold alive. Since the Russian president went on a geopolitical offensive in Ukraine in 2014, the haven asset had its first annual gain in four years in 2016 and is on track for another in 2017. A beneficiary of economic and political perils from North Korea to Brexit, it’s among the top-performing commodities this year. Meanwhile, the Bank of Russia has more than doubled the pace of gold purchases, bringing the share of bullion in its international reserves to the highest of Mr Putin’s 17 years in power, according to World Gold Council data. In the second quarter alone, it accounted for 38pc of all gold purchased by central banks. The gold rush is allowing the Bank of Russia to continue growing its reserves while abstaining from purchases of foreign currency for more than two years.

It’s one of a handful of central banks to keep the faith as global demand for the precious metal fell to a two-year low in the second quarter. But what may matter most is that gold is as geopolitics-proof an investment as any in the age of sanctions and a deepening rift with the US. “Gold is an asset that is independent of any government and, in effect, given what is usually held in reserves, any Western government,” said Matthew Turner, metals analyst at Macquarie Group in London. “This might appeal given Russia has faced financial sanctions.” Besides being the largest official buyer of gold, Russia is also among the world’s three biggest producers, with the central bank purchasing from domestic miners through commercial banks and not in the open market. Since starting to accelerate bullion purchases in 2007, Russia’s holdings have more than quadrupled to 1,556 tonnes at the end of June, just behind China and more than Turkey, India and Mexico combined, bringing its share in Russia’s $427bn (€361bn) reserves to near 17pc.

“Trump travels there this week. That may be exactly the moment that the Deep State moves to take him down.”

• Fall of the Great Pumpkin (Jim Kunstler)

Welcome to the witching month when America’s entropy-fueled death-wish expresses itself with as much Halloween jollity and merriment as the old Christmas spirit of yore. The outdoor displays alone take on a Babylonian scale, thanks to the plastic factories of China. I saw a half-life-size T-Rex skeleton for sale at a garden shop last week surrounded by an entire crew of moldering corpse Pirates of the Caribbean in full costume ho-ho-ho-ing among the jack-o-lanterns. What homeowner in this sore-beset floundering economy of three-job gig-workers can shell out four thousand bucks to decorate his lawn like the set of a zombie movie? The overnight news sure took on that Halloween tang as the nation woke up to what is probably a national record for a civilian mad-shooter incident.

So far, fifty dead and two hundred wounded at the Las Vegas at the Route 91 Harvest Festival (one up in fatalities from last year’s Florida Pulse nightclub massacre, and way more injured this time). The incident will live in infamy for maybe a day and a half in the US media. Stand by today as there will be calls far and wide, by personas masquerading as political leaders, for measures to make sure something like this never happens again. That’s rich, isn’t it? Meanwhile, the same six a.m. headlines declared that S &P futures were up in the overnight markets. Nothing can faze this mad bull, apparently. Except maybe the $90 trillion combined derivatives books of CitiBank, JP Morgan, and Goldman Sachs, who have gone back whole hog into manufacturing the same kind of hallucinatory collateralized debt obligations (giant sacks of non-performing loans) that gave Wall Street a heart attack in the fall of 2008.

Europe’s quaint doings must seem dull compared to the suicidal potlatch of life in the USA, but, believe me, it’s a big deal when the Spanish authorities start cracking the heads of Catalonian grandmothers for nothing more than casting a ballot. The video scenes of mayhem at the Barcelona polls looked like something out of the 1968 Prague uprising. And now that the Catalonia secession referendum passed with a 90% “yes” vote, it’s hard to imagine that a good deal more violent mischief will not follow. So far, the European Union stands dumbly on the sidelines. (For details, read the excellent Raul Ilargi Meijer column on today’s TheAutomaticEarth.)

[..] Finally — well, who know what else may pop up now — there is the matter of Puerto Rico. Halloween there is not like New England, with our nippy fall mornings, steaming mugs of hot cider, and quickening fall color. It will remain 90-degrees-plus down there in the fetid, stinking ruins, with lots of still-standing water, broken communications, shattered supply lines, and very little electricity. FEMA and the US Military may be doing all they can now, but they must be on watch for the ominous blossoming of tropical disease epidemics. The story there is far from over. Trump travels there this week. That may be exactly the moment that the Deep State moves to take him down.

Catalonia wants to talk. But it will no longer accept many of the things it would have before Sunday.

• Spain’s Crisis Deepens as Catalonia Secession Clock Ticks Down (BBG)

In Madrid, Barcelona, Bilbao and beyond, the question is the same: Now what? Sunday’s vote for independence in Catalonia, one of Spain’s most populous and prosperous regions, has thrust the country into its gravest political crisis since the days of the dictator Francisco Franco. Few see an easy way out. The results of the referendum give Prime Minister Mariano Rajoy stark choices – try to deal a blow to the independence movement by suspending Catalonia’s semi-autonomous status, or meet the secessionists halfway and start talks with Catalan President Carles Puigdemont. Puigdemont said the vote, rejected by the central government as illegal, justifies a unilateral declaration of independence. That could come by the end of the week, if the regional parliament agrees.

The European Union refused to recognize the rebel region’s bid, but Spanish bonds and stocks fell Monday as the risks of a breakaway rose. The clash puts Rajoy in a tight corner. Head of a minority government that relies on support from regional parties to rule, he has pledged to protect Spain’s territorial integrity. His main ally in parliament, Ciudadanos party leader Albert Rivera, called on the prime minister to invoke a never-before-used article of the 1978 constitution and pull Catalonia’s special regional standing, which gives it certain administrative powers. “It’s the moment to act with calm but with firmness,” said Rivera, who is Catalan, after meeting with Rajoy on Monday. Rivera said an independence declaration may be 72 hours away and suggested invoking Article 155 would cut off any attempt to make such a move.

But Pedro Sanchez, head of the main Socialist opposition party, said after his own meeting with Rajoy that the central government should hold talks with the secessionists. While Sanchez made no mention of Article 155 in the statement he issued, socialists in Catalonia said the party wouldn’t support the prime minister taking that step. That means Rajoy will have little political cover if he opts to suspend Catalan self-government – the most powerful card he has left. The crisis has already caused him problems: Last week, he had to withdraw plans to present his 2018 budget after allies in the Basque PNV party withheld their support as they criticized his position on Catalonia.

The Guardia Civil will have to leave Catalonia at some point. And what then?

• Catalonia Set For General Strike Over Independence Poll Violence (AFP)

Large numbers of Catalans are expected to observe a general strike on Tuesday to condemn police violence at a banned weekend referendum on independence, as Madrid comes under growing international pressure to resolve its worst political crisis in decades. Flights and train services could be disrupted as well as port operations, after unions called for the stoppage to “vigorously condemn” the police response to the poll, in which Catalonia’s leader said 90% of voters backed independence from Spain. Barcelona’s public universities are expected to join the strike, as is the contemporary art museum, football club FC Barcelona and the Sagrada Familia, the basilica designed by Antoni Gaudi and one of the city’s most popular tourist sites. “I am convinced that this strike will be widely followed,” Catalan leader Carles Puigdemont said ahead of the protest.

The central government has vowed to stop the wealthy northeastern region, which accounts for a fifth of Spain’s GDP, breaking away from Spain and has dismissed Sunday’s poll as unconstitutional and a “farce”. Violent scenes played out in towns and cities across the region on Sunday as riot police moved in on polling stations to stop people from casting their ballots, in some cases charging with batons and firing rubber bullets to disperse crowds. UN rights chief Zeid Ra’ad Al Hussein said he was “very disturbed” by the unrest while EU President Donald Tusk urged Madrid to avoid “further use of violence”. The European Parliament will hold a special debate on Wednesday on the issue. “We call on all relevant players to now move very swiftly from confrontation to dialogue. Violence can never be an instrument in politics,” European Commission spokesman Margaritis Schinas said, breaking weeks of virtual EU silence on the Catalan issue.

“Florida Gov. Rick Scott has declared a state of emergency in Florida..”

• 100,000s Of Puerto Ricans To Flee To Florida, New York (ZH)

As mayors of cities with large Puerto Rican populations continue to advocate for federal assistance to help with the resettlement of hundreds of thousands of Puerto Ricans who are expected to temporarily seek shelter with friends and families in the US, Florida Gov. Rick Scott has declared a state of emergency in Florida, allowing state agencies to take extraordinary measures to assist families that will soon be arriving in droves to cities like Orlando and Miami, both of which feature large Puerto Rican populations. The Orlando Sentinel reports that Scott announced that disaster relief centers will be set up at Orlando International Airport and in Miami to help those seeking refuge in Florida. “Puerto Rico is absolutely devastated and so many families have lost everything,” Scott said in a released statement.

“Our goal is to make sure that while [Puerto Rican] Governor [Ricardo] Rosselló is working to rebuild Puerto Rico, any families displaced by Maria that come to Florida are welcomed and offered every available resource from the state.” The relief center at OIA, and two others at Miami International Airport and the Port of Miami, open Tuesday, according to a release from Scott’s office, just days after Puerto Rican airports reopened following the devastation caused by Hurricane Maria. [..] Scott’s emergency order will allow state agencies broad autonomy to waive regulations and do whatever is necessary to help Puerto Ricans. Importantly, it could also help bring more federal funding to help the state cope with aid efforts.

State lawmakers have said they expect at least 100,000 Puerto Ricans to flee to Florida because of Maria, forcing the state to step up its education, housing and job-placement offerings. It’s expected that some of those displaced by the storm could resettle permanently, as the reconstruction effort in Puerto Rico is expected to take months, if not years. State Rep. Carlos Guillermo Smith, D-Orlando, said the Legislature should hold a special session, as he estimates hundreds of thousands of Puerto Ricans are coming to Florida. The 2018 regular session starts in January. “FL needs 2 deal w/humanitarian crisis + over 100K Boricuas who’ll seek refuge here right now, not in Jan.,” he tweeted.

We now wait to hear from New York Gov. Andrew Cuomo and New York City Mayor Bill De Blasio. NYC officials have said more than 100,000 Puerto Ricans could arrive in NYC alone.

Home › Forums › Debt Rattle October 3 2017