Wynn Bullock Child on a Forest Road 1958

“No government willingly relinquishes power. If we continue down this road, there can be no surprise about what awaits us at the end.”

• The Emergency State (Whitehead)

The seeds of this present madness were sown several decades ago when George W. Bush stealthily issued two presidential directives that granted the president the power to unilaterally declare a national emergency, which is loosely defined as “any incident, regardless of location, that results in extraordinary levels of mass casualties, damage, or disruption severely affecting the U.S. population, infrastructure, environment, economy, or government functions. Comprising the country’s Continuity of Government (COG) plan, these directives, which do not need congressional approval, provide a skeletal outline of the actions the president will take in the event of a “national emergency.”

Mind you, that national emergency can take any form, can be manipulated for any purpose, and can be used to justify any end goal—all on the say so of the president. Just what sort of actions the president will take once he declares a national emergency can barely be discerned from the barebones directives. However, one thing is clear: in the event of a national emergency, the COG directives give unchecked executive, legislative and judicial power to the executive branch and its unelected minions. The country would then be subjected to martial law by default, and the Constitution and the Bill of Rights would be suspended. The emergency state is now out in the open for all to see. Unfortunately, “we the people” refuse to see what’s before us.

This is how freedom dies. We erect our own prison walls, and as our rights dwindle away, we forge our own chains of servitude to the police state. Be warned, however: once you surrender your freedoms to the government—no matter how compelling the reason might be for doing so—you can never get them back. No government willingly relinquishes power. If we continue down this road, there can be no surprise about what awaits us at the end.

“..scientists skeptical of lockdown policies have been “subjected to an extraordinarily unpleasant campaign of personal abuse”

• Supreme Court Judge: Covid Restrictions To Last For 10 Years (SN)

British former Supreme Court judge Lord Sumption has warned that “social controls” brought about by the coronavirus pandemic may be kept in place by governments for up to a decade. “It’s politically unrealistic to expect the Government to backtrack now,” commented Sumption, who has been highly critical of the government’s ‘totalitarian’ lockdown policies. The judge compared the reaction to rationing after the Second World War, which went on for nine years, adding that this time “I think it may be even longer.” “An interesting parallel is the continuation of wartime food rationing after the last war. People were in favour of that because they were in favour of social control,” he said during a ‘Sketch notes on’ podcast.

“In the 1951 general election, the Labour party lost its majority entirely because people with five years more experience of social control got fed up with it. Sooner or later that will happen in this country,” he added. Sumption’s warning comes in the wake of Public Health England officials stating that restrictions will remain in place for as long as other countries have not vaccinated everyone, a process likely to take years. England’s chief medical officer also recently asserted that the pandemic restrictions, which have been in place on and off for a year, have “improved life” for some people. Despite promising an end to restrictions in June, the UK government yesterday extended emergency COVID laws until October, with Health minister Matt Hancock refusing to say how long they will remain in place after that.

Lord Sumption also noted during the podcast that scientists skeptical of lockdown policies have been “subjected to an extraordinarily unpleasant campaign of personal abuse”. “I know a lot of people that would prefer not to put their head above the parapet,” He continued, adding “From the very moment I started to make these points I began to get emails from politicians who agreed with what I had to say but that they themselves didn’t dare to speak out. That I think is a very serious state of affairs.” The judge also argued that governments are using the virus politically, noting “They have consistently tried to maintain that the virus is indiscriminate when it is perfectly well-established that it primarily affects people with identifiable vulnerabilities, particularly in the elderly.”

Professor Jay Bhattacharya is one of the co-authors of the Great Barrington Declaration.

• Risk of Asymptomatic Spread Minimal. Variants Over-Hyped – Bhattacharya (LDS)

Why have the media, politicians and many scientists sought to panic the populace about SARS-CoV-2 far beyond what the evidence would warrant? The incentives include financial motives, political goals, the desire to protect professional reputations and many other factors. The virus is seasonal and late fall/winter is its season. It is very unlikely, given that this is the case, that the virus will spread very widely during the summer months. It is also the case that a large fraction of the UK population has already been infected or vaccinated and is immune, which will greatly reduce hospitalisation and mortality from the virus in coming months. There are tens of thousands of mutations of the SARS-CoV-2 virus. They mutate because the replication mechanisms they induce involve very little error checking. Most of the mutations either do not change the virulence of the virus, or weaken it.

There are a few mutations that provide the virus with a selective advantage in infectivity and may increase its lethality very slightly, though the evidence on this latter point is not solid. We should not be particularly concerned about the variants that have arisen to date. First, prior infection with the wild type virus and vaccination provide protection against severe outcomes arising from reinfection with the mutated virus. Second, though the mutants have taken over the few remaining cases, their rise has coincided with a sharp drop in cases and deaths, even in countries where they have come to dominate. Their selective infectivity advantage has not been enough to cause a resurgence in cases. Third, the age gradient in mortality is the same for the mutant and wild-type virus. Thus a focused protection policy is still warranted. If lockdowns could not stop the less infectious wild type virus, why would we expect them to stop the more infectious mutant virus?

[..] “The scientific evidence now strongly suggests that COVID-19 infected individuals who are asymptomatic are more than an order of magnitude less likely to spread the disease to even close contacts than symptomatic COVID-19 patients. A meta-analysis of 54 studies from around the world found that within households – where none of the safeguards that restaurants are required to apply are typically applied – symptomatic patients passed on the disease to household members in 18 per cent of instances, while asymptomatic patients passed on the disease to household members in 0.7 per cent of instances. A separate, smaller meta-analysis similarly found that asymptomatic patients are much less likely to infect others than symptomatic patients.

Asymptomatic individuals are an order of magnitude less likely to infect others than symptomatic individuals, even in intimate settings such as people living in the same household where people are much less likely to follow social distancing and masking practices that they follow outside the household. Spread of the disease in less intimate settings by asymptomatic individuals – including religious services, in-person restaurant visits, gyms, and other public settings – are likely to be even less likely than in the household.

The evidence that mask mandates work to slow the spread of the disease is very weak. The only randomised evaluation of mask efficacy in preventing Covid infection found very small, statistically insignificant effects [Danish mask study]. And masks are deleterious to the social and educational development of children, especially young children. They are not needed to address the epidemic. In Sweden, for instance, children have been in school maskless almost the whole of the epidemic, with no child Covid deaths and teachers contracting Covid at rates that are lower than the average of other workers.”

“An individual’s data is kept secure and confidential at all times.”

• Nation’s First ‘Vaccine Passport’ Coming To New York (NYP)

The nation’s very first “vaccine passport” is coming to the Big Apple. The program, dubbed the “Excelsior Pass,” is an app that will allow New Yorkers to prove their vaccination status, or recent history of a negative COVID-19 test, in order to gain entry to events and businesses, Governor Cuomo announced in a news release Friday. “Similar to a mobile airline boarding pass, individuals will be able to either print out their pass or store it on their smartphones using the Excelsior Pass Wallet app,” the news release explains. “Each Pass will have a secure QR code, which participating businesses and venues can scan using a companion app to verify proof of COVID-19 negative test results or proof of vaccination. An individual’s data is kept secure and confidential at all times.”

The app won’t show any health information when scanned — it’ll only show a green checkmark if the person has been vaccinated or tested negatively or a red “x” if they haven’t. Major venues, such as Madison Square Garden and the Times Union Center in Albany, will begin using the app next week and on April 2, Excelsior Pass will expand to “smaller arts, entertainment and event venues,” Cuomo’s office said. The app, which launched Friday, already works to prove vaccination status or negative test results and can be used to gain access to wedding receptions, which now require negative tests from attendees, and other events above the social gathering limit.

“New Yorkers have proven they can follow public health guidance to beat back COVID, and the innovative Excelsior Pass is another tool in our new toolbox to fight the virus while allowing more sectors of the economy to reopen safely and keeping personal information secure,” Cuomo said in a statement. “The question of ‘public health or the economy’ has always been a false choice — the answer must be both. As more New Yorkers get vaccinated each day and as key public health metrics continue to regularly reach their lowest rates in months, the first-in-the-nation Excelsior Pass heralds the next step in our thoughtful, science-based reopening.”

“It’s only an opinion; I’m allowed to have opinions now,” he added.”

• Former CDC Director Says COVID-19 Escaped From Wuhan Lab (ZH)

Former CDC Director Robert Redfield says that SARS-CoV-2, the virus which causes COVID-19, did not originate from a wet market in Wuhan, China, and instead escaped from a nearby lab which was performing gain-of-function research on bat coronaviruses to make them more easily infect humans. “I do not believe this somehow came from a bat to a human,” Redfield told CNN’s Sanjay Gupta in an interview set to air Sunday night at 9 p.m. ET. “Normally, when a pathogen goes from a zoonot to human, it takes a while for it to figure out how to become more & more efficient in human to human transmission.” “It’s only an opinion; I’m allowed to have opinions now,” he added.

When asked how he believes the lab was working to make the virus infect humans more efficiently, he said “Let’s just say, I have a coronavirus, and I’m working on it — most of us in the lab are trying to grow virus. We try to make it grow better and better and better and better, so we can do experiments and figure out about it. That’s the way I put it together.” Redfield, a virologist picked by former President Trump to lead the Centers for Disease Control, said he believes that the pandemic began as a localized outbreak in Wuhan in September or October of 2019, earlier than the official timeline, and that it spread to every province in China over the ensuing months.

“And while the rest of the world was told the only initial Covid-19 cases in China had originated from a wet market in Wuhan, Redfield is confident the evidence suggests that was simply not the case. According to Redfield, even his counterpart at the China CDC, Dr. George Gao, was initially left in the dark about the magnitude of the problem until early January. He described a private phone call he had with Gao in early January 2020, when Gao became distraught and started crying after finding “a lot of cases” among individuals who had not been to the wet market. Gao, Redfield says, “came to the conclusion that the cat was out of the bag.” The initial mortality rates in China were somewhere between “5-10%,” Redfield told me. “I’d probably be cryin’ too,” he added. …The United States wasn’t formally notified of the “mysterious cluster of pneumonia patients” until December 31, 2019. Those were critical weeks and months that countries around the world could’ve been preparing. -Dr. Sanjay Gupta via CNN

“Fauci’s organization sent $7.4 million taxpayer dollars to the Wuhan lab for research including “gain of function” research.”

“In 2019, with the backing of NIAID, the National Institutes of Health committed $3.7 million over six years for research that included some gain-of-function work. The program followed another $3.7 million, 5-year project for collecting and studying bat coronaviruses, which ended in 2019, bringing the total to $7.4 million.”

• Fauci Rejects Ex-CDC director’s Claim That COVID-19 Came From Wuhan Lab (NYP)

Dr. Anthony Fauci on Friday blew off claims from former Centers for Disease Control and Prevention Director Dr. Robert Redfield that SARS-CoV-2 was created in a Chinese lab, saying Redfield was merely expressing an “opinion.” During the White House coronavirus briefing, Fauci said the virus that causes COVID-19 was likely already spreading in China weeks before it was detected — which helped it become more contagious. “The alternative explanation … is that this virus was actually circulating in China, likely in Wuhan, for a month or more before they were clinically recognized at the end of December 2019,” Fauci explained. “If that were the case, the virus clearly could’ve adapted itself to a greater efficiency of transmissibility over that period of time up to and at the time it was recognized.”

In a new interview out Friday, Redfield — who oversaw the CDC at the peak of the deadly global pandemic — said it was his “opinion” as a top virologist that SARS-CoV-2 “escaped” from the laboratory in Wuhan. The highly contagious bug is widely accepted to have originated in animals before it adapted to humans. But Redfield said if that were the case, “it takes a while for it to figure out how to become more and more efficient in human-to-human transmission.” “I just don’t think this makes biological sense,” he added. Fauci, the nation’s top infectious disease expert, reiterated Redfield’s comments that he was just expressing an opinion. “So Dr. Redfield was mentioning that he was giving an opinion to a possibility,” Fauci said, “but again, there are other alternatives, others that most people hold by.”

‘I don’t think it’s healthy for a small group of people to be making all the public health recommendations. It’s good to have multiple voices..’

• Fauci Slammed For Denying The US Is Approaching Herd Immunity (DM)

A Johns Hopkins professor has slammed Dr. Anthony Fauci for denying that the United States is approaching herd immunity amid the coronavirus pandemic. Dr. Marty Makary, who is also a Fox News contributor, told Brian Kilmeade on Thursday that ‘it’s not healthy for a small group of people’ to be making all the health decisions for Americans. ‘I don’t think it’s healthy for a small group of people to be making all the public health recommendations. It’s good to have multiple voices,’ Makary said. He claims that the low rate of reinfections and high percentages of people showing antibodies indicate that the United States is approaching herd immunity through both vaccinations and natural immunity, which he claims Fauci has ignored.

There have been more than 133 million vaccines administered in the United States, according to the Centers for Disease Control and Prevention. As of Thursday, there have been 30,076,486 total infections with 546,507 deaths from COVID-19. The Johns Hopkins professor slammed Fauci’s track record throughout the pandemic and for initially missing the mark on how the virus is transmitted, the effectiveness of masks and mitigation. ‘His job is to prepare us for a pandemic and tell us how to manage it. He mostly missed the pandemic for the two months prior, never prepared us, was wrong on masks,’ Makary said. ‘We should have known that but the aerosolized transmission because Sars-CoV-2 behaves like Sars-CoV-1. That was aerosolized droplets as well. He was around for that.’

During the segment, Makary explained why he believed Americans have already started to reach herd immunity. ‘After you get the infection, your body develops antibodies. These are the same antibodies the vaccine is trying to trigger and create,’ Makary said. ‘When you have circulating antibodies, that means have you protection from the infection.’ The San Francisco Chronicle reported earlier this month that about 38% of Californians had antibodies against the coronavirus, according to figures presented during a virtual meeting hosted by the California Medical Association. During the webinar, researchers said that 45% of people in Los Angeles have these antibodies. The Bay Area and greater Sacramento region each recorded 32% of the population with COVID-19 antibodies.

Makary pointed to this data as evidence that Americans are approaching herd immunity. ‘That’s why infections are down 95% in Los Angeles over the last 10 weeks, their positivity rate is down to 1.6% right now,’ Makary said.

“As Mr. Biden would say, anyway… I’ve gone on too long about that….”

• “Where Am I Here?” (Kunstler)

I don’t know about you, but I was thrilled to hear Joe Biden tell America — with a faraway gleam in those ol’ blue Konstantin Chernenko eyes — that he’s expecting to run for a second term. The prospect must engross him, so effervescent was his campaign of 2020! Like all presidents, he’s learning on-the-job, but he’s already lapping Franklin Roosevelt in the hundred-day dash of executive action, showing those wicked CCP envoys who’s boss (why, they are, of course), and turning the depraved white supremacist state of Texas into a vibrant Honduras del Norte. As Mr. Biden would say, anyway… I’ve gone on too long about that….

Meanwhile, from offstage you could hear the crunch of his handlers chewing their Xanax, knowing that the game was a brain-fart away from disaster. Well, he only wandered away from the podium one time, and he dutifully followed the script. In fact, the script was right there in his hand the entire white-knuckle hour of this debut press conference, and he often appeared to be reading straight off the page. I’m sure he was making a funny when he said he came to the Senate 120 years ago. (Remember the battle over Wm. H Taft’s nomination to be Territorial Governor of the Philippines? And how, in the hearings, then-freshman Senator Ol’ Joe B produced three New Haven doxies who testified about Taft’s “abnormal appetites” during the nominee’s years at Yale?)

Traditionally, presidential press conferences are opportunities to inform the nation where things stand, and to send signals to the other nations (“friend and foe alike” as JFK used to say) about America’s intentions, especially in the nuclear age, with the world so nervously on edge. What did Americans learn from Mr. Biden’s debut? Mainly that an old dog can do some old tricks, follow a script, play the politician, fill a suit, run his mouth, and go through the motions — fulfilling people’s cynical expectation that some trip is being laid on them. Foreign observers will probably note that the executive branch is being run by a politburo more secretive even than the old gang who ran the USSR. No one in this country seems to notice.

Does this have legs?

• Hunter Biden Texts Shoot Down Secret Service Denial Over Gun Incident (NYP)

Hunter Biden sent a text message that said the Secret Service responded after his handgun disappeared in 2018 — contradicting the agency’s assertion that it wasn’t involved, The Post has learned. In a lengthy message sent the following year, President Biden’s son described the situation in detail, saying his former sister-in-law-turned-lover, Hallie Biden, tossed the firearm into a trash bin outside Janssen’s Market, a gourmet grocery store in Wilmington, Del. “She stole the gun out of my trunk lock box and threw it in a garbage can full to the top at Jansens [sic]. Then told me it was my problem to deal with,” Hunter wrote.

“Then when the police the FBI the secret service came on the scene she said she took it from me because she was scared I would harm myself due to my drug and alcohol problem and our volatile relationship and that she was afraid for the kids.” The Jan. 29, 2019, message adds: “Really not joking the cop kept me convinced that Hallie was implying she was scared of me.” In another message, sent closer to the incident, Hunter described the handgun as “my 38.” “Took from lock box of truck and put it IN PapER BAG AND Threw it in trash can at local high end grocer. For no reason,” he wrote on Dec. 6, 2018.

“And I freaked when I saw it was missing 10 minutes after she took it and when she went back to get it after I scared the s–t out of her it was gone which led to state police investigation of me. True story.” Both messages are contained on a hard drive obtained by The Post that holds the contents of a damaged laptop computer that was left at Wilmington repair shop by Hunter in April 2019 and never retrieved.

Well, look who just popped up. There are no coincidences here. Is it a deflection from the gun story?

• Hunter Biden and Family Join President On Weekend Away (DM)

Hunter Biden and his family joined President Joe Biden on Friday as he flew to his home in Delaware for the fourth weekend since taking office. The 51-year-old, his wife Melissa, and their baby son Beau were seen leaving the White House Friday afternoon as they traveled to Wilmington with his father. Hunter held his 12-month-old son in his arms with Melissa close behind him before boarding Marine One from the South Lawn. The Bidens flew to the Joint Base Andrews, Maryland where they then traveled to Wilmington on Air Force One. When Biden landed in Wilmington he spoke to reporters there and was asked about having Baby Beau on board. ‘It’s really great,’ the doting grandfather replied. The family getaway comes just two weeks after the White House press corps criticized the president for his frequent trips home during the coronavirus pandemic.

Press secretary Jen Psaki later defended the commander-in-chief saying: ‘The president lives in Wilmington. It’s his home. That’s where he’s lived for many, many years. ‘And as you know, as any president of the United States does, he takes a private airplane called Air Force One to travel there.’ Hunter was also reported to have been splitting his time between California and Delaware before moving into a family home in Venice earlier this year. The president’s embattled son made headlines once again this week after it was reported the Secret Service tried to intervene in a 2018 police investigation involving Hunter and his then-girlfriend, his brother’s widow Hallie. A report published by Politico revealed Hallie threw a gun she’d found in his car into a grocery store trash can because she thought he was going to kill himself with it.

No one in the Biden family was entitled to Secret Service protection at the time but Politico cites unnamed sources who say that agents from the Secret Service offices in Wilmington and Philadelphia kept an ‘informal’ role in protecting them after Joe left office as Vice President in 2017.

Nah, the entire honor goes to Slo’ Joe.

• Fast Food Giant Claims Credit For Killing $15 Minimum Wage (DP)

The parent company of some of America’s largest fast food chains is claiming credit for convincing Congress to exclude a $15 minimum wage from the recent COVID relief bill, according to internal company documents reviewed by The Daily Poster. The company, which is owned by a private equity firm named after an Ayn Rand character, also says it is now working to thwart new union rights legislation. The company’s boasts come just a few months after a government report found that some of its chains had among the highest percentage of workers relying on food stamps. Inspire Brands — which owns Jimmy Johns, Arby’s, Sonic, and Buffalo Wild Wings, plus recently acquired Dunkin’ Donuts for $11.3 billion in November — on Thursday sent employees and franchisees a review of its government lobbying activity that highlighted its success in keeping the $15 minimum wage out of Democrats’ American Rescue Plan, the COVID-19 relief bill President Joe Biden signed earlier this month.

“We were successful in our advocacy efforts to remove the Raise the Wage Act, which would have increased the federal minimum wage to $15 and eliminated the tip credit,” reads the report. Further down, the report notes the company’s ongoing lobbying campaign in the Senate against the PRO Act, which recently passed the House and contains a laundry list of organized labor’s goals, such as eliminating right-to-work laws and banning mandatory company-sponsored meetings that are designed to discourage union activity. “You get the impression that they’re actively spitting in our eye, saying ‘Yes, we worked to suppress wages of our employees and we’re just going to brazenly tell you,’” one Inspire Brands worker told The Daily Poster. “I really do think that a line was crossed. You’re just going to brazenly tell your employees, ‘not only did we work to kill wages, but going forward we’re also going to make sure that the PRO Act doesn’t pass either.’”

During the 2020 campaign, Democrats pledged to raise the minimum wage to $15 an hour, which would boost the wages of 32 million workers nationwide, according to a recent report by the Economic Policy Institute (EPI). However, efforts to include a $15 minimum wage in Biden’s pandemic aid bill failed after the Senate parliamentarian advised Democrats such a hike should not be passed by budget reconciliation and Vice President Kamala Harris declined to use her authority to override the decision. Inspire Brands’ success in eliminating the minimum wage hike from the bill follows Dunkin’ Brands’ then-CEO Nigel Travis saying in 2015 that a $15 wage would be “absolutely outrageous.” At the time, unions noted that Travis was being paid more than $4,000 every hour.

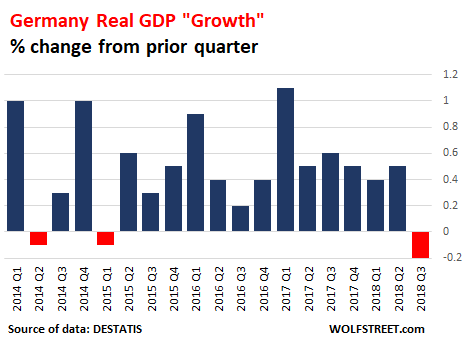

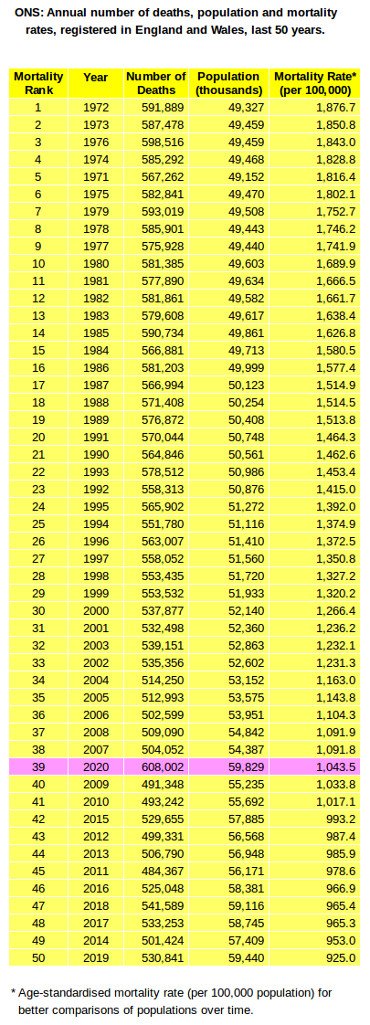

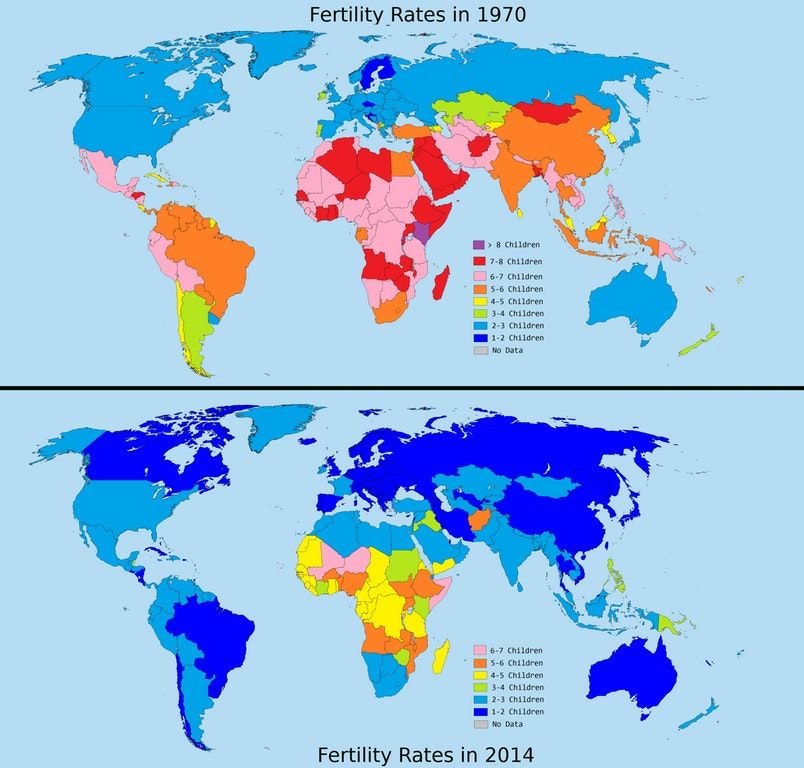

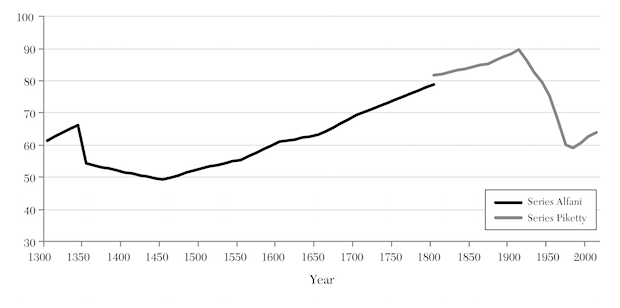

We’re back to 1340.

• The Top 10 Percent Through The Ages (AEA)

The COVID-19 pandemic may be increasing the gap between the rich and the poor. But how does today’s changing inequality compare to the past? In a paper in the Journal of Economic Literature, author Guido Alfani summarized the efforts of historians whose archival research has greatly increased economists’ knowledge of past wealth holdings. His work helps put today’s wealth polarization in perspective. Alfani’s estimates from the Economic Inequality across Italy and Europe (EINITE) database show that from 1300 to 1800 inequality grew steadily almost everywhere in Europe, with the exception of the century-long decline triggered by the Black Death. Figure 8 from his paper combines the estimates of the period 1300-1800 with estimates of inequality in postindustrial Europe.

The chart shows the average share of wealth held by the richest 10 percent in two separate regions of Europe. The black line is an average of the Sabaudian State (roughly modern Piedmont, Italy), the Florentine State, the Kingdom of Naples, and the Republic of Venice. The grey line is an average for France, the United Kingdom, and Sweden (sourced from Thomas Piketty’s Capital in the Twenty-First Century). Although the areas of Europe differ before and after 1800, there is a relatively smooth transition between the two series. The rate of growth of the share of the top 10 percent in the period 1810–1910 was nearly the same as the period 1550–1800. Only two episodes interrupted a steady growth in inequality—the Black Death of 1347–52 and the 1914–45 period of the World Wars.

The most fatal pandemic recorded in human history caused the top 10 percent to lose 15–20 percent of the overall wealth. And the global wars caused an even larger drop for the rich, from almost 90 percent in 1910 to 75 percent in 1950. (It is interesting to note that contrary to our perception that our societies are less unequal than those of the past, the share of wealth of the richest 10 percent in 2010 was about the same as it was in 1340.) Alfani goes on to explain that post–Black Death plagues were unable to produce inequality reduction due to institutional adaptation and human agency. This indicates that today’s policymakers do have control over the gap between the haves and the have-nots by designing institutions in a way that protects the general population from excessive greed.

The video is good. Sound on.

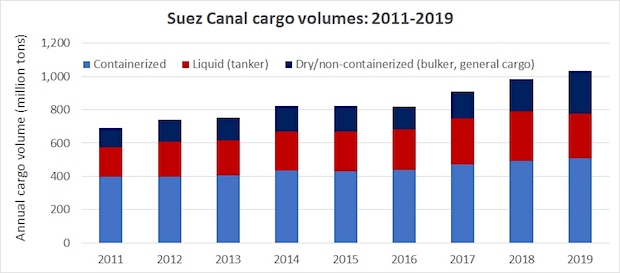

• Suez Canal Crisis: Here Are The Cargoes In The Crossfire (Miller)

The “slow boat from China” just got a lot slower. Shipping sentiment toward the Suez Canal grounding of the Ever Given has taken a major turn. Operators are now opting to bypass the traffic jam and take the long detour around Africa’s Cape of Good Hope. Ship-positioning data already confirms abrupt turns toward the cape by multiple ships. Container ships such as the HMM Rotterdam, Ever Greet, Maersk Skarstind and Hyundai Prestige; the crude tanker Marlin Santorini; and the liquefied natural gas (LNG) carrier Pan Americas, among others, have made beelines toward the cape. If the Ever Given is not refloated at high tide on Sunday, many more detours are expected. There were 237 ships stuck at anchor awaiting canal transits as of Friday, according to Egypt’s Leth Agencies. That’s up sharply from 156 the day before.

Global ocean trade is fluid. The Suez Canal closure doesn’t block cargo. It changes the arrival date. The extent of delays from rerouting depends upon port pairs and vessel speed. A container ship traveling at 17 knots passing India en route from China to Rotterdam would take nine more days on the cape route than using the canal. If its destination was Italy, it would take 13 more days. The double whammy of the canal queue and rerouting delays renders the global shipping network less efficient. The same ship capacity will not move the same cargo volume in the same time frame. This will have a wide range of effects — some bad, some good — for shippers, vessel operators and investors.

To gauge potential consequences, American Shipper analyzed historical data from the Suez Canal Authority (SCA) and obtained more recent data from trade-intelligence companies VesselsValue and Kpler. The SCA data is a year old but shows the long-term trends. American Shipper separated SCA’s cargo data into three categories: containerized volume, dry cargo volume (bulkers and general cargo) and liquid (tanker) volume.

Suez Canal Traffic Update – Audio on

The former traffic reporter in me couldn’t resist giving you a Suez Canal traffic update… pic.twitter.com/1CssLkQDty

— Jon Hansen (@JonHansenTV) March 26, 2021

Review of Killer Cartoons, edited by David Wallis, and White, by Bret Easton Ellis.

• The Death of Humor (Matt Taibbi)

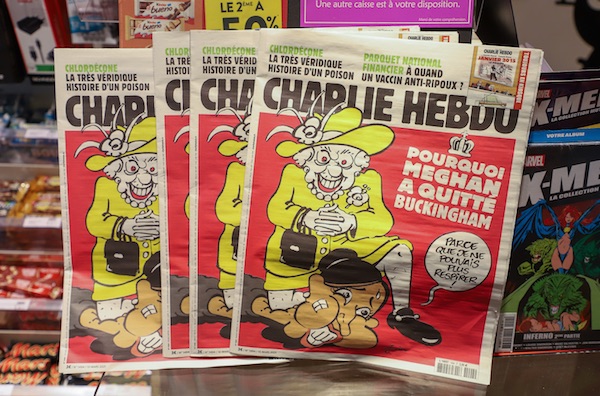

The French satirical magazine Charlie Hebdo won the condemnation of the whole world again, with the following cover:

Why Meghan quit Buckingham: Because I couldn’t breathe anymore.

Reactions ranged from “abhorrent” to “hateful” to “wrong on every level,” with many offering versions of the now-mandatory observation that the magazine is not only bad now, but “has always been disgusting.” This cover is probably an 8 or 9 on the offensiveness scale, and I laughed. It goes after everyone: Queen Elizabeth, depicted as a more deranged version of Derek Chauvin (the stubby leg hairs are a nice touch); Meghan Markle, the princess living in incomparable luxury whose victimhood has become a global pop-culture fixation; and, most of all, the inevitable chorus of outraged commentators who’ll insist they “enjoy good satire as much as the next person” but just can’t abide this particular effort that “goes too far,” it being just a coincidence that none of these people have laughed since grade school and don’t miss it.

Six years ago, after terrorists killed 10 people at Hebdo’s Paris offices in a brutal gun attack, the paper’s writers, editors, and cartoonists were initially celebrated worldwide as martyrs to the cause of free speech and democratic values. In France alone on January 11, 2015, over 3 million people marched in a show of solidarity with the victims, who’d been killed for drawing pictures of the Prophet Muhammad. Protesters also marched in defiance of those who would shoot people for drawing cartoons, especially since this particular group of killers also fatally shot four people at a kosher supermarket in an anti-Semitic attack. For about five minutes, Je Suis Charlie was a rallying cry around the world.

In an early preview of the West’s growing sympathy for eliminating heretics, cracks quickly appeared in the post-massacre defense of Charlie Hebdo. Pope Francis said that if someone “says a curse word against my mother, he can expect a punch.” Bill Donohoe, head of the American Catholic League, wrote, “Muslims are right to be angry,” and said of Hebdo editor Stephane Charbonnier, “Had he not been so narcissistic, he may still be alive.” New York Times columnist and noted humor expert David Brooks wrote an essay, “I Am Not Charlie Hebdo,” arguing that although “it’s almost always wrong to try to suppress speech,” these French miscreants should be excluded from polite society, and consigned to the “kids’ table,” along with Bill Maher and Ann Coulter.

Humor is dying all over, for obvious reasons. All comedy is subversive and authoritarianism is the fashion. Comics exist to keep us from taking ourselves too seriously, and we live in an age when people believe they have a constitutional right to be taken seriously, even if — especially if — they’re idiots, repeating thoughts they only just heard for the first time minutes ago. Because humor deflates stupid ideas, humorists are denounced in all cultures that worship stupid ideas, like Spain under the Inquisition, Afghanistan under the Taliban, or today’s United States.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.