Rembrandt van Rijn Portrait of his father 1628-29

I was following the numbers all afternoon, because I knew this was going to be the day that the US would become the no. 1. The no. 1 loser, that is. Here’s some of what I wrote in the Automatic Earth Comments section as we went along:

500,000 global cases was at noon EDT. 3.5 hours later there were another 20,000. [..] At 12.38 pm the US was 6,300 cases behind China. That is now 1,200.

God’s Own Country will take the definite no. 1 position sometime this afternoon, and then run away with it. The US has many fewer fatalities so far, but there, too, it will come out on top.

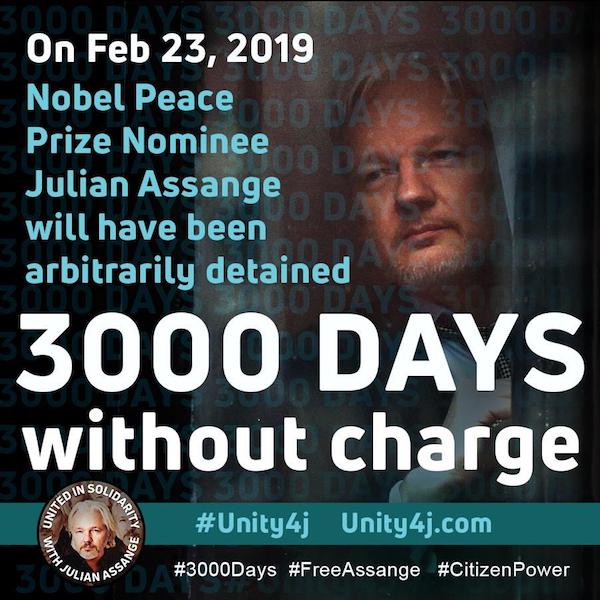

All this is why America pronounced Nicolas Maduro a drug trafficker and narco-terrorist today.

The US took the topspot at about 3pm. That done and achieved, I realize I’ve been so busy lately documenting the spread of the coronavirus and -some of- its consequences that the next steps in the demise, though clearly visible, risk going unnoticed.

But then I saw that the US is charging Venezuelan President Nicolas Maduro with drug trafficking (narco-terrorism?!), and I was wide awake again. Why does the US, on the verge of becoming the worst hit “corona country”, charge him now, of all possible times, when they could have done it any given day for the past 7 years? Well, exactly because of the corona threat.

And I don’t think this is Trump; he may take a political hit, but he only has to do better than Joe Biden, and anybody could do that. This smells much more like some deep state thing, Mike Pompeo and his crew.

In their phone alerts, CNN had a few real howlers as the day went by.

“Health officials say the peak is yet to come”

“Stocks see third day of gains”

Meanwhile, it took them hours to clue into the fact that the US had become the no. 1. But it’s that second point that warrants scrutiny. In the expectation and the “fulfillment” of the $6 trillion “stimulus” package, stocks managed to rise. Yay! But that no. 1 position won’t leave any of that standing. No sirree.

The US is no longer capable of formulating and negotiating adequate legislation even in times of real crisis. And it’s not that it’s GOP against Dems, and one would do everything so much better than the other. It’s one set of special interests against another, and in the end both win. And there is no escape left from that.

I said earlier about the stimulus that such a package in the US today is possible only provided that the rich get 1000 times what the poor get. That’s the only way to get those $1,500 checks to people who actually need them. For every such check a million bucks goes to the rich and powerful.

And if only they were also 1000 times more likely to catch the coronavirus, at least we would have a sense of justice. But no such luck.

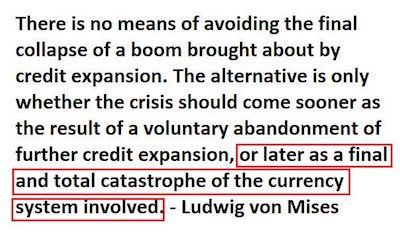

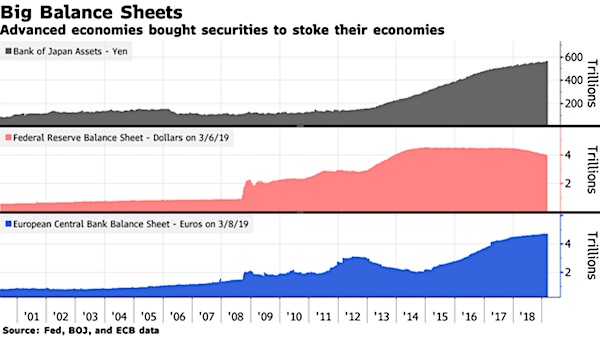

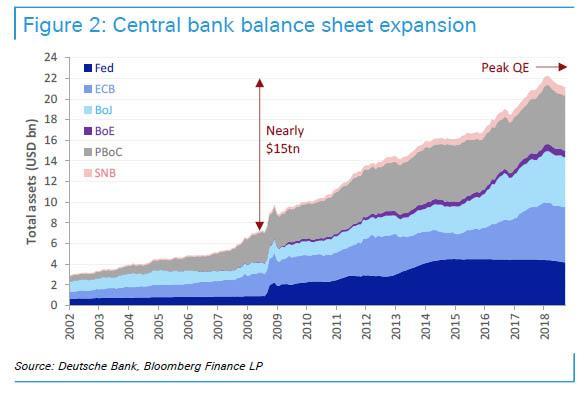

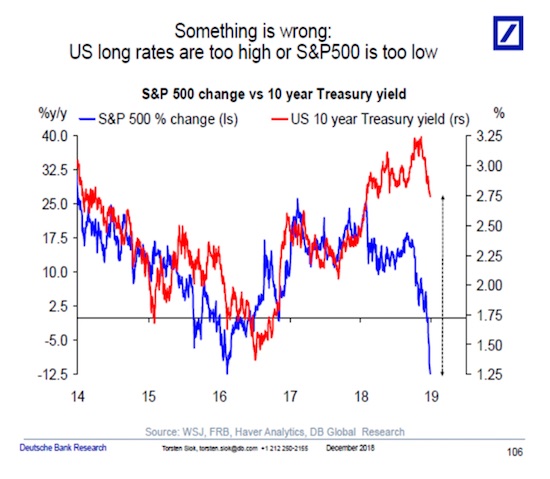

What the stimulus will really end up doing is it will expose the Fed. You can talk about unlimited QE all you want, but talk enough and it will lose all meaning. I’ve long said that there are no markets left because there is no price discovery, and lately I’ve seen many people saying exactly that, just much later.

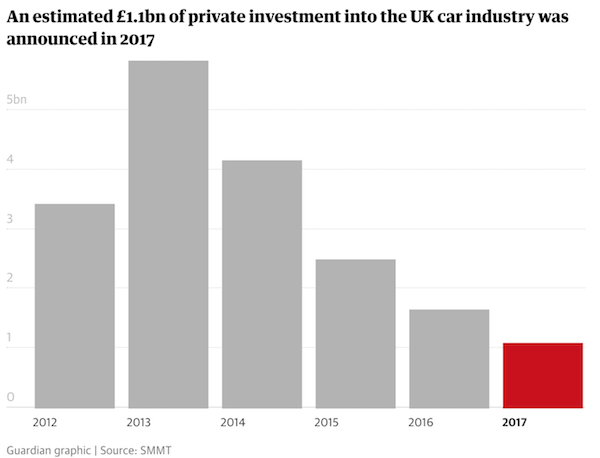

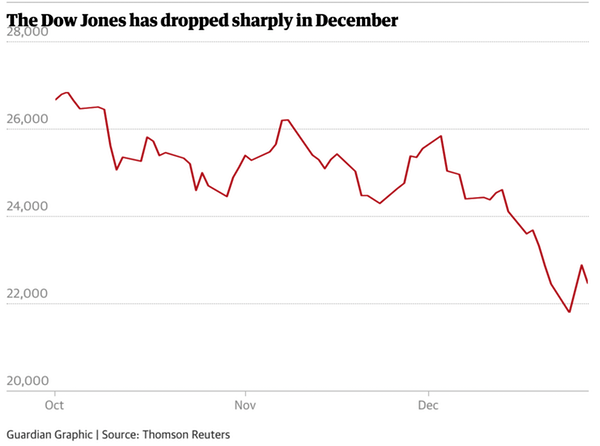

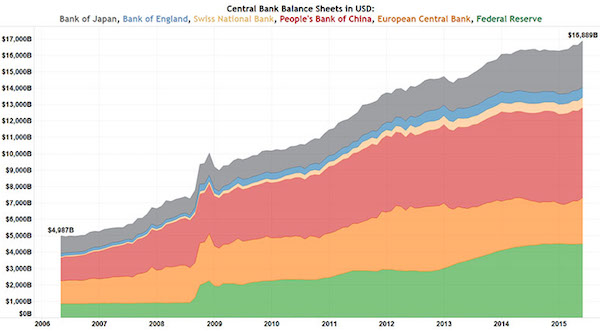

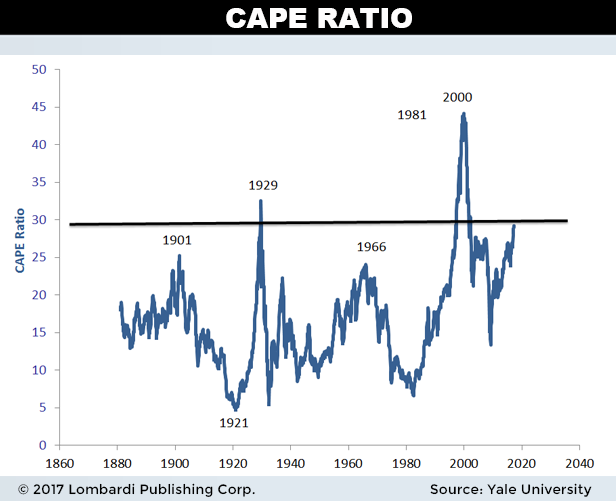

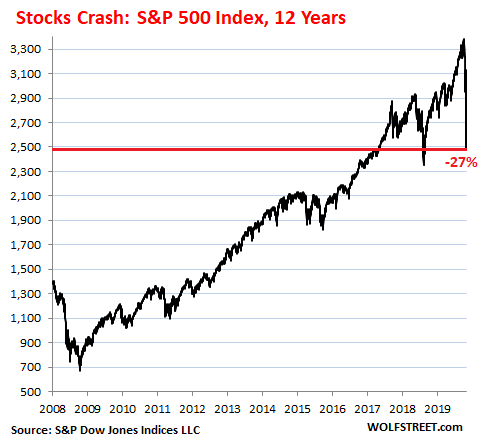

The stimulus really only serves to take even more price discovery away, if that was still possible. And that’s it. The rich will be handed hundreds of billions with nowhere to go. The losses in the stock “markets” lately have been staggering, trillions were lost. But then you look at a graph and you think holy sh*t, there’s so much more to go, so much more downside before we get to anything resembling normal. This was two weeks ago:

Markets as they -used to- exist under capitalism can be an awesome instrument, because there is such a multitude of participants. However, when you start trying to control the “markets” because sometimes they fall a little and you don’t like that, you unleash formidable forces that are also part of that instrument. Like so many natural phenomena, they will tend towards a balance, and you can’t stop that. Not for long.

The process that looks like it may end soon started under Alan Greenspan and the housing bubbles he blew, and the seeds of the demise were sown right then and there. Now that $6 trillion has been thrown at the wall that won’t stick, what is next?

The Fed policies (and I include most other central banks under that moniker) worked for a while because the QE’s and the ultra low rates supported banks and other enterprises that were essentially zombies. They also “zombified” many other companies that might have been able to survive without them. Look at Boeing.

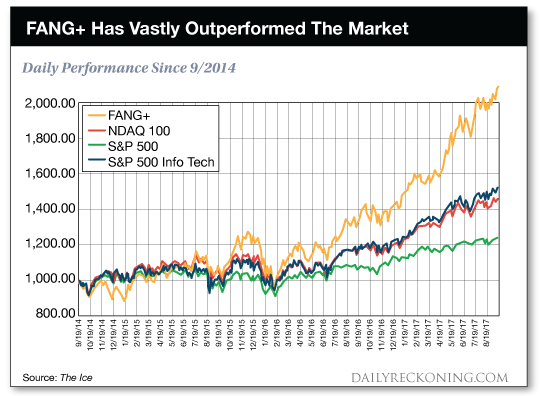

Look at Apple. They look like a great company but what are their shares worth? Nobody knows, because they bought back too many of them to make price discovery viable. So at least part of Apple looks great only because of trickery, not because of great products. Steve Jobs is turning in his grave as we speak.

And now the zombies may be killed off by a virus. Just not if the Fed can help it. But if America runs away with that top spot hard enough, if tens of thousands of new cases become a daily occurrence (we’re at 17,000 so far today), and the first ten thousand fatalities are counted, the country will be locked down and the “markets” will fall off a cliff.

Unless, and that what I’m starting to fear may happen, the powers that be see no other choice than to close the “markets”. That will mean the entire financial system is on the brink of collapse. It would be announced as temporary, but the damage would be done. Everything would turn into one giant margin call, banks would be forced to close, the works, a real depression.

Let’s hope that none of this happens, but the signs are not favorable. America appears much less prepared for a pandemic than even Lombardy was, with too little or too late of everything, ventilators, masks, protective clothing, medicine, you name it. You can’t run an economy in a setting like that.

But at least you’ll be rid of the zombies. It’s a shame, really, that there is no virus that kills only zombies, that so much else must be destroyed with them. The thing is, we did have these instruments to kill zombies, they were called central banks. Should have used them when we had the chance.

Our readership is up a lot, but ad revenue only keeps dropping. I’ve said it before, it must be possible to run a joint like the Automatic Earth on people’s kind donations. These are no longer the times when ads pay for all you read, your donations have become an integral part of it. It has become a two-way street; and isn’t that liberating, when you think about it?

You heard it here first, like so many other things. And no, though it would be far more lucrative financially, the Automatic Earth will not adopt any paywalls, not here and not on Patreon. But you can still support us there, as well as right here. It’s easy. Thanks everyone for your donations overnight.

Support us in virustime. Help the Automatic Earth survive. It’s good for you.