Salvador Dalí Figure at a window 1925

Eric Peters gets points for style.

• The Next Market Cleanse Will Be Sharp, Deep, Fast (Peters)

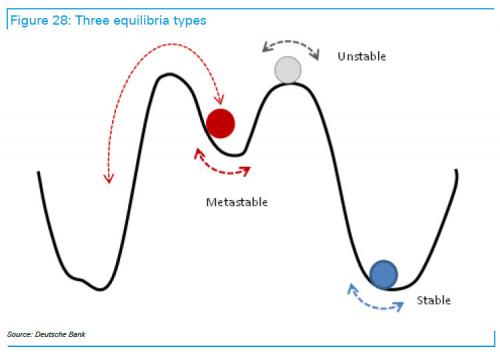

Anecdote: “The most common example is a ball sitting atop a hill,” she said, polished accent, hint of condescension. “Locally stable, but one nudge and it’s all over.” She drove terribly fast, discussing Minsky Moments; the idea that persistent stability breeds instability. “Naturally each cycle is different in key respects, and that’s because you’re far better at preventing past problems from recurring than new ones from arising.” I smiled, amused, insulted. “Despite knowing this all too well, you humans remain inexplicably fixated on the rearview mirror. And this blinds you to all manner of hazards ahead.”

She initiated a few perfect turns of the Tesla, dodging a squirrel or two, tumbling, unhurt. “The source of instability in this cycle is your dissatisfaction with ultra-low bond yields.” $8trln of sovereign debt carries a negative yield, still our central bankers buy. “You should logically respond to this historic rise in valuations across asset classes with a reduction in your expectations for future returns.” I nodded. “But instead you respond with indignation.” So I explained to her that without robust growth and a compounding stream of uninterrupted 7.5% returns, our entitlement systems will implode. They probably will anyway. And lacking the stomach for an honest accounting of this predicament, we prefer to pretend it doesn’t exist.

“Is this humor or sarcasm?” she asked. “Both,” I answered. “Fascinating, anyhow, you then demand that we algorithms produce mathematically impossible returns. So we apply leverage, which makes nearly anything possible, even at valuations that are 99th percentile in all of human history. The more leverage we apply, the more stable your system appears. The flatter your hilltop. Naturally, we ensure that today’s leverage looks different from yesterday’s disaster, recognizing your powerful aversion to repeating recent mistakes.” And I stared out the window, lost in thought, fall’s kaleidoscope whizzing by.

Not done yet.

• Round-Up Of Saudi Princes, Businessmen Widens, Travel Curbs Imposed (R.)

An anti-corruption probe that has purged Saudi Arabian royals, ministers and businessmen appeared to be widening on Monday after the founder of one of the kingdom’s biggest travel companies was reportedly detained. Shares in Al Tayyar Travel plunged 10 percent in the opening minutes of trade after the company quoted media reports as saying Nasser bin Aqeel al-Tayyar, who is still a board member, had been held by authorities. The company gave no details but online economic news service SABQ, which is close to the government, reported Tayyar had been detained in an investigation by a new anti-corruption body headed by Crown Prince Mohammed bin Salman.

Dozens of people have been detained in the crackdown, which has consolidated Prince Mohammed’s power while alarming much of the traditional business establishment. Billionaire Prince Alwaleed bin Talal, Saudi Arabia’s best-known international investor, is also being held, officials said at the weekend. The front page of Okaz, a leading Saudi newspaper, challenged businessmen on Monday to reveal the sources of their assets, asking: “Where did you get this?” in a bright red headline. Pan-Arab newspaper Al-Asharq Al-Awsat reported that a no-fly list had been drawn up and security forces in some Saudi airports were barring owners of private jets from taking off without a permit.

Among those detained are 11 princes, four ministers and tens of former ministers, according to Saudi officials. The allegations against the men include money laundering, bribery, extorting officials and taking advantage of public office for personal gain, a Saudi official told Reuters. Those accusations could not be independently verified and family members of those detained could not be reached. A royal decree on Saturday said the crackdown was in response to “exploitation by some of the weak souls who have put their own interests above the public interest, in order to, illicitly, accrue money”.

The big fear is that it’s all a set-up to go after Iran. Which just signed a $30 billion energy deal with Russia.

• Saudi Arabia Seals Yemen Borders, Accuses Iran Over Missile Strike (AFP)

The Saudi-led coalition battling Shiite Huthi rebels in Yemen closed the country’s air, sea and land borders Monday and accused Iran of being behind a weekend missile attack on Riyadh, saying it “may amount to an act of war”. Saudi Arabia intercepted and destroyed the ballistic missile, which was launched from Yemen as rebels appeared to escalate hostilities, near Riyadh’s international airport on Saturday. The missile was the first aimed by the Shiite rebels at the heart of the Saudi capital, underscoring the growing threat posed by the raging conflict. “The leadership of the coalition forces therefore considers this… a blatant military aggression by the Iranian regime which may amount to an act of war,” the official Saudi news agency SPA said in a statement.

Smouldering debris landed inside the King Khalid International Airport, just north of Riyadh, after the missile was shot down but authorities reported no major damage or loss of life. Yemen’s complex war pits the Saudi-backed government of President Abedrabbo Mansour Hadi against former president Ali Abdullah Saleh and his Iran-backed Huthi rebel allies. The Saudi statement said that the borders were being closed “to fill the gaps in the inspection procedures which enable the continued smuggling of missiles and military equipment to the Huthi militias loyal to Iran in Yemen”. Despite the temporary closure of the air, sea and land ports, Saudi would protect “the entry and exit of relief and humanitarian personnel”. “The coalition… affirms the kingdom’s right to respond to Iran at the appropriate time and in the appropriate form,” it added.

Most of this is legal. But what are the Queen, Bono, Trudeau thinking?

• Paradise Papers Leak Reveals Secrets Of The World Elite’s Hidden Wealth (G.)

The world’s biggest businesses, heads of state and global figures in politics, entertainment and sport who have sheltered their wealth in secretive tax havens are being revealed this week in a major new investigation into Britain’s offshore empires. The details come from a leak of 13.4m files that expose the global environments in which tax abuses can thrive – and the complex and seemingly artificial ways the wealthiest corporations can legally protect their wealth. The material, which has come from two offshore service providers and the company registries of 19 tax havens, was obtained by the German newspaper Süddeutsche Zeitung and shared by the International Consortium of Investigative Journalists with partners including the Guardian, the BBC and the New York Times. The project has been called the Paradise Papers. It reveals:

• Millions of pounds from the Queen’s private estate has been invested in a Cayman Islands fund – and some of her money went to a retailer accused of exploiting poor families and vulnerable people. • Extensive offshore dealings by Donald Trump’s cabinet members, advisers and donors, including substantial payments from a firm co-owned by Vladimir Putin’s son-in-law to the shipping group of the US commerce secretary, Wilbur Ross. • How Twitter and Facebook received hundreds of millions of dollars in investments that can be traced back to Russian state financial institutions. • The tax-avoiding Cayman Islands trust managed by the Canadian prime minister Justin Trudeau’s chief moneyman. • A previously unknown $450m offshore trust that has sheltered the wealth of Lord Ashcroft.

• Aggressive tax avoidance by multinational corporations, including Nike and Apple.• How some of the biggest names in the film and TV industries protect their wealth with an array of offshore schemes. • The billions in tax refunds by the Isle of Man and Malta to the owners of private jets and luxury yachts.• The secret loan and alliance used by the London-listed multinational Glencore in its efforts to secure lucrative mining rights in the Democratic Republic of the Congo. •The complex offshore webs used by two Russian billionaires to buy stakes in Arsenal and Everton football clubs.

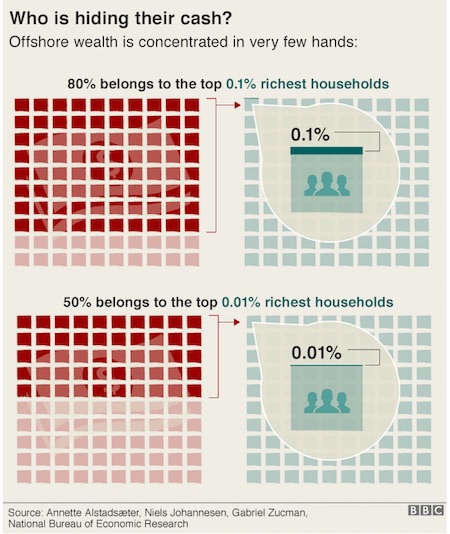

The disclosures will put pressure on world leaders, including Trump and the British prime minister, Theresa May, who have both pledged to curb aggressive tax avoidance schemes. The publication of this investigation, for which more than 380 journalists have spent a year combing through data that stretches back 70 years, comes at a time of growing global income inequality. Meanwhile, multinational companies are shifting a growing share of profits offshore – €600bn in the last year alone – the leading economist Gabriel Zucman will reveal in a study to be published later this week. “Tax havens are one of the key engines of the rise in global inequality,” he said. “As inequality rises, offshore tax evasion is becoming an elite sport.”

No. Hell no.

• Are We Taming Offshore Finance? (BBC)

The offshore finance industry puts trillions of dollars worldwide beyond the taxman’s reach. Bringing it to heel is like taming a cat; not just a normal moggy – a thankless task in itself – but a Cheshire Cat: nebulous, hard to pin down, disappearing and reappearing when it likes. No-one can actually agree on what a tax haven is. Or even on the name: one person’s tax haven is another’s “offshore financial centre”. No-one can agree on how many there are. Nor on exactly how much money is stashed offshore. No statistics are fully reliable. And this suits those who operate in offshore finance, from the owner of the wealth to the lawyer or accountant middlemen who manage the funds, to the often sun-kissed beaches of the jurisdictions where they are secluded or pass through. The industry’s key word is privacy. Or secrecy – a word it doesn’t like so much.

One adage cited by the taxation author and expert Nicholas Shaxson sums it up: “Those who know don’t talk. And those who talk don’t know.” But do we really not know how much is stashed offshore? A report this September, co-authored by the economist Gabriel Zucman, estimates about 10% of global GDP – the way we measure the size of the world’s economy – is held offshore, about $7.8tn (£6tn) . The Boston Consulting Group reported it last year at about $10tn. If you are thinking, wow, that’s bigger than Japan’s economy, you’d be right. But if you want a real wow, try $36tn – the estimate offered by James Henry, author of the book Blood Bankers. That’s twice as big as the US economy.

But no-one really knows. And here’s another wow. Remember the slogan “we are the 99%” coined by the Occupy movement to lambast the top 1% of the population for their disproportionate share of wealth? Well, the Zucman report says 80% of all offshore cash is owned by 0.1% of the richest households, with 50% held by the top 0.01%. So if you read this and are thinking, if you can’t beat them… quite frankly, it’s unlikely you will ever join them.

This cannot be. Many Britons are miserable, and their Queen dodges taxes. As someone suggested, she should go live where her money is stashed.

• Queen’s Private Estate Invested Millions of Pounds Offshore (G.)

Millions of pounds from the Queen’s private estate has been invested in a Cayman Islands fund as part of an offshore portfolio that has never before been disclosed, according to documents revealed in an investigation into offshore tax havens. Files from a substantial leak show for the first time how the Queen, through the Duchy of Lancaster, has held and still holds investments via funds that have put money into an array of businesses, including the off-licence chain Threshers, and the retailer BrightHouse, which has been criticised for exploiting thousands of poor families and vulnerable people. The duchy admitted it had no idea about its 12-year investment in BrightHouse until approached by the Guardian and other partners in an international project called the Paradise Papers.

Though the duchy characterised its stake in BrightHouse as negligible, it would not disclose the size of its original 2005 investment, which coincided with a boom in the company’s value. BrightHouse has since been accused of overcharging customers, and using hard sell tactics on people with mental health problems and learning disabilities. Last month, it was ordered to pay £14.8m in compensation to 249,000 customers. Critics are likely to ask why the Queen had money in there in the first place, and the duchy may face awkward questions about whether there was enough oversight and management of the Queen’s “onward investments” to ensure they remained ethical. The duchy has also disclosed investments in “a few overseas funds”, including one in Ireland, and will be under pressure to give details of where the money is being held.

This is Britain’s reality….

• UK Families Thousands Of Pounds Worse Off After Years Of Cuts (G.)

Seven years of cuts to tax credits and universal credit have hugely eroded their role in supposedly rewarding people for working, leaving many families thousands of pounds a year worse off, a study has concluded. Ministers’ promises that the systems would benefit families for taking on more work had effectively been broken because of the cuts, according to the report by the Child Poverty Action Group (CPAG) and the Institute for Public Policy Research thinktank. The study, titled Austerity Generation, details what it says are the huge numbers of families with children pushed into poverty due to cuts and freezes to benefits, as well as measures such as the new two-child limit for payments. It calls for the chancellor, Philip Hammond, to tackle the issue in next month’s budget by restoring previous levels of universal credit work allowances, the amount of monthly income that can be earned without penalty. These were cut in April 2016.

It also seeks a pension-style triple lock of the child benefit and child credit element of universal credit, ensuring it kept pace with prices and earnings. This alone, the report argues, would keep 600,000 children out of poverty. Introduced in 2003, working tax credits are intended to top up low earnings. It is among a series of benefits replaced by universal credit, which is gradually being rolled out nationally and is intended to incentivise working. But, according to the report, cuts have eroded much of this effect for families. It calculates that a couple with two young children, one working full-time and the other part-time on the national living wage, will lose more than £1,200 a year due to universal credit cuts. Another example given is that of a single parent with two young children who starts work at 12 hours a week on the national living wage and will have an effective hourly wage of £4.18, as opposed to £5.01 before the cuts.

… and this is what its central bank chief thinks it is instead.

• Britain ‘Would Be Booming’ If It Wasn’t For Brexit – Mark Carney (Tel.)

Britain’s economy would be “booming” if not for Brexit, the Governor of the Bank of England has said. Mark Carney said businesses were waiting for the outcome of Theresa May’s negotiations with the EU before making investment decisions, which was slowing down economic growth. He said the bank’s predictions for foreign investment in Britain was now 20 per cent lower than they estimated in the month before the referendum. Speaking to Peston on Sunday, he said: “Since the referendum, what we’re seeing is that business investment has picked up, but it hasn’t picked up to any of the extent that one would have expected given how strong the world is, how easy financial conditions are, how high profitability is and how little spare capacity they have. Despite acknowledging the strength of economy, Mr Carney warned: “It should really be booming, but it’s just growing.

“I think we know why that’s the case, because they’re waiting to see the nature of the deal with the European Union. “It’s the most important investment destination and [businesses] need to know transition and end state, everybody knows this, the government knows it and is working on it, UK businesses know it and the Europeans know it.” Asked if the economy would take a hit if the UK left the EU without a Brexit deal, he said: “In the short term, without question, if we have materially less access (to the EU’s single market) than we have now, this economy is going to need to reorient and during that period of time it will weigh on growth.” He added that in the event of a bad Brexit deal, the bank would not be able to cut future interest rates because of that inflationary pressure.

Uncertainty.

• Most EU Firms Plan Retreat From UK Suppliers (R.)

Most European businesses plan to cut back orders from British suppliers because of the slow progress of Brexit talks, a survey of company managers showed on Monday. 63% of non-British European companies expect to move some of their supply chain out of Britain, up from 44 percent in May, the Chartered Institute of Procurement and Supply (CIPS) said. With only 17 months left until Britain is due to exit the EU, the lack of clear progress in the negotiations has raised fears among executives of an abrupt departure with no transition. Monday’s survey raised the prospect of disruption for British manufacturers with EU clients. On Sunday, the Confederation of British Industry said almost two in three British firms will have implemented Brexit contingency plans by March if Britain and the rest of the EU have not struck a transitional deal by then.

Britain and the EU said last week they were ready to speed up talks, but CIPS said it was already too late for scores of businesses that look likely to be dropped by European customers. “British businesses simply cannot put their suppliers and customers on hold while the negotiators get their act together,” said Gerry Walsh, CIPS’ group CEO. “The lack of clarity coming from both sides is already shaping the British economy of the future – and it does not fill businesses with confidence.” British finance minister Philip Hammond said last month that a transition deal needed to be struck by early 2018. CIPS said a fifth of British businesses were struggling to secure contracts that extend beyond March 2019, the date Britain is due to leave the EU.

“Offenders can also theoretically be confined to a room in the Big Ben clock tower, although this power has not been used since 1880.”

• UK Ministers ‘Could Be In Contempt Of Parliament Over Brexit Papers’ (G.)

Labour is to warn ministers on Monday that they risk being held in contempt of parliament if they do not immediately release dozens of papers outlining the economic impact of Brexit. The government conceded last week that it had to publish the 58 studies covering various parts of the economy after the move was supported in a Labour opposition motion that was passed unanimously on Wednesday. While normal opposition motions are advisory, Labour presented this one as a “humble address”, a rare and antiquated procedure which the Speaker, John Bercow, advised was usually seen as binding. The leader of the Commons, Andrea Leadsom, said on Thursday that the government accepted the motion as binding, and that “the information will be forthcoming”.

However, she gave no timescale – the government has previously said it will respond to opposition motions within 12 weeks – and indicated some elements of the papers would need to be redacted to avoid “disclosing information that could harm the national interest”. The Labour motion called for the papers to be released immediately to the Brexit select committee, which has a majority of Conservative MPs, and which would then decide what elements should not be published more widely. The shadow Brexit secretary, Keir Starmer, has warned that Labour will refer the matter to Bercow over possible contempt if the studies are not passed to the committee before parliament’s one-week recess begins on Tuesday.

The parliamentary rulebook, known as Erskine May after its 19th-century author, says actions that obstruct or impede the Commons “in the performance of its functions, or are offences against its authority or dignity, such as disobedience to its legitimate commands” be can viewed as contempt. MPs held in contempt can be asked to apologise, suspended or even expelled by their fellows. Offenders can also theoretically be confined to a room in the Big Ben clock tower, although this power has not been used since 1880.

Yeah, yeah, but: “core shadow banking activity,” including entrusted loans, trust loans, and undiscounted bankers’ acceptances, continues to expand…”

• China’s Shadow Banking Halts as Regulation Bites – Moody’s (BBG)

China’s shadow banking sector, estimated by some analysts to be worth 122.8 trillion yuan ($18.5 trillion), stopped growing in the first half of the year as issuance of wealth management products declined, according to Moody’s Investors Service. For the first time since 2012, China’s gross domestic product grew faster than shadow banking assets in the six-month period, Moody’s said in a statement Monday. Following last month’s Communist Party Congress, further regulation will continue to rein in shadow banking and address some of the key systemic imbalances, Moody’s said. While Moody’s assessment offers some evidence that China’s crackdown on shadow financing is starting to bite, authorities continue to sound the alarm on high debt levels.

In an article on the People’s Bank of China’s website late Saturday, Governor Zhou Xiaochuan pointed to latent risks that are “hidden, complex, sudden, contagious and hazardous.” Government, household and corporate debt adds up to about 260 percent of the economy, according to Bloomberg Intelligence. Moody’s said that shadow banking assets accounted for 83 percent of GDP on June 30, down from a peak of 87 percent in 2016. Michael Taylor, the company’s chief credit officer for the Asia-Pacific region, said “core shadow banking activity,” including entrusted loans, trust loans, and undiscounted bankers’ acceptances, continues to expand even as regulation has had an effect.

The pressure on the judge(s) must be deafening.

• Catalonia’s Puigdemont Conditionally Released By Belgian Judge (G.)

A Belgian judge has released the ousted Catalan leader, Carles Puigdemont, and four of his ministers under certain conditions after a hearing lasting more than 10 hours. Puigdemont, who faces charges of misuse of public funds, disobedience and breach of trust relating to the secessionist campaign, turned himself in to Belgian police earlier on Sunday. The judge decided to grant them conditional release late in the evening pending a ruling by a court within the next 15 days whether to execute the European arrest warrant issued by Spain. The five have been told they must not leave the country and stay in a fixed address. “The request made by the Brussels’ Prosecutor’s Office for the provisional release of all persons sought has been granted by the investigative judge,” a statement from the federal prosecutor’s office said.

On Friday, the Spanish government had issued European arrest warrants against Puigdemont, Antoni Comín, Clara Ponsatí, Meritxell Serret and Lluís Puig for trying to “illegally change the organisation of the state through a secessionist process that ignores the constitution”. The formal charges, punishable by 30 years in prison, are rebellion, sedition, embezzlement of public funds and disobedience to authority, for their role in organising the referendum on Catalan independence on 1 October. The secessionist politicians fled to Belgium on Monday after the Spanish authorities removed Puigdemont and his cabinet from office for pushing ahead with a declaration of independence following an illegal referendum. From his self-imposed exile, Puigdemont claimed he would not receive a fair trial in Spain but promised to cooperate with the Belgian justice system.

[..] In a sign of the growing headache the crisis is causing the Belgian coalition government, the country’s deputy prime minister, Jan Jambon, from the Flemish nationalist party, questioned Spain’s handling of the crisis in Catalonia and suggested the EU should intervene. “When the police hit people, we can still ask questions,” he said. “When the Spanish state has locked two opinion leaders, I have questions. And now the Spanish government will act in the place of a democratically elected government? “Members of a government are put in prison. What have they done wrong? Simply apply the mandate they received from their constituents.”

Home › Forums › Debt Rattle November 6 2017