Edward S. Curtis Navajo weaver c. 1907

Was there a coup? If so, who against who? Jared Kushner just came back from one of his secretive trips to Saudi a few days ago. He’s allegedly close with MBS. Osama Bin Laden’s older brother also arrested. Too much money floating around. And too many princes.

• Senior Princes, One Of World’s Richest Men Arrested In Saudi Crackdown (BBG)

Saudi Arabia’s King Salman removed one of the royal family’s most prominent princes from his ministerial role and arrested other royals and top officials in an anti-corruption drive that clears any remaining obstacles to his son’s potential ascension to the throne. Acting on orders from a newly established anti-corruption committee, headed by Crown Prince Mohammed bin Salman, police arrested 11 princes, four ministers and dozens of former ministers, the Saudi-owned Al Arabiya television said. Prince Miteb, son of the late King Abdullah, was removed from his post as head of the powerful National Guards. Prince Alwaleed bin Talal, one of the world’s richest men and a shareholder of Citigroup and Twitter, was among those detained, according to a senior Saudi official who spoke on condition of anonymity.

“Laws will be applied firmly on everyone who touched public money and didn’t protect it or embezzled it, or abused their power and influence,” King Salman said in comments shown on state TV. “This will be applied on those big and small, and we will fear no one.” Prince Miteb was replaced by Prince Khaled Ayyaf, according to a royal decree. Before his ouster, Prince Miteb was one of the few remaining senior royals to have survived a series of cabinet shuffles that promoted allies of the crown prince, who is the direct heir to the throne. King Salman had already sidelined other senior members of the royal family to prevent any opposition to the crown prince, 32-year-old Prince Mohammed, known as MBS among diplomats and journalists, who replaced his elder cousin, Muhammed bin Nayef, in June.

That maneuver removed any doubt of how succession plans will unfold following the reign of King Salman, now 81. “The hardline approach is risky because it will solidify the dislike many powerful Saudis have for the crown prince, but it is likely that MBS succeeds, and emerges from this episode more empowered,” Hani Sabra, founder of Alef Advisory, a Middle East political risk practice, wrote in a note. “We can’t confidently project when a leadership transition will take place, but today’s developments are a signpost that MBS is moving toward the role of king.”

From Middle East Eye.

• Saudi Arabia Detains Princes, Ex-Ministers After Cabinet Reshuffle (MEE)

Saudi Arabia has detained 11 princes and dozens of former ministers through its newly formed anti-corruption committee, including erstwhile national guard minister Mutaib bin Abdullah. According to an MEE source in Riyadh, Mutaib was arrested along with his brother Turki. Famous multi-billionaire prince Al-Waleed bin Talal bin Abdulaziz and a number of former ministers and businessmen were also arrested. Both Mutaib bin Abdullah and Al-Waleed bin Talal are senior members of Saudi’s royal family. Also among the arrested were Waleed al-Ibrahim, founder of the MBC broadcasting group, and billionaire businessman Saleh Kamel. The arrests came hours after Saudi appointed new ministers. Economy minister Adel Fakieh was replaced by Mohammed al-Tuwaijri while Khaled bin Ayyaf replaced Mutaib, son of the late King Abdullah, as national guard minister.

The new anti-corruption committee, headed by Crown Prince Mohammed bin Salman, was formed by royal decree earlier on Saturday. The arrests and dismissals came just two months after King Salman replaced his nephew Mohammed bin Nayef with his son Mohammed as the country’s crown prince. The move consolidates Mohammed’s control of the kingdom’s security institutions, which had long been headed by separate powerful branches of the ruling family. “Since Mohammed bin Salman became the crown prince in June, we’ve seen a lot of upheaval,” Ian Black, of the London School of Economics, told Al Jazeera. “We’ve seen the announcement of this very ambitious Saudi plan to transform the Saudi economy, Vision 2030.” “The breadth and scale of the arrests appears to be unprecedented in modern Saudi history,” said Kristian Ulrichsen at Rice University.

In September the authorities arrested about two dozen people, including influential clerics, in what activists denounced as a coordinated crackdown. Analysts said many of those detained were resistant to Prince Mohammed’s aggressive foreign policy that includes the boycott of Gulf neighbour Qatar as well as some of his bold policy reforms, including privatising state assets and cutting subsidies.

“Everybody will be worried now. Some of these names have been there for 30 years.”

• Shakeup Stuns Analysts Who Say It Shows Saudis Mean Business (BBG)

Saudi Arabia’s unprecedented decision to arrest senior princes and billionaires shocked analysts across the region, but to some it’s a sign the kingdom is serious about change. The nation’s stocks declined. A newly formed anti-corruption committee, headed by Crown Prince Mohammed bin Salman, instructed police to arrest 11 princes, four ministers and dozens of former ministers, the Saudi-owned Al Arabiya television said. The decision comes about two weeks after the kingdom announced a series of projects, including a $500 billion city, as part of a plan to overhaul an economy that has been almost entirely dependent on oil revenue for decades. The Tadawul All Share Index fell 1.8% as of 10:04 a.m. in Riyadh.

Purges haven’t “been done at this scale or in this public manner before,” said Mohammed Ali Yasin, CEO of Abu Dhabi-based NBAD Securities. “Accountability has been introduced, no one is immune. Everybody will be worried now. Some of these names have been there for 30 years. This affects Kingdom Holding, Saudi Airlines and the Finance Ministry.” A plunge in crude prices has forced Saudi Arabia to face the shortcomings of its $650 billion economy. Part of its plan to prepare for life after oil is to sell shares in oil giant Aramco in 2018 and transform its stock market to a gateway into Saudi Arabia. “There should be some initial speculation in general as people are just concerned about what happened, this will be priced in,” said Mazen Al-Sudairi, the head of research at Al Rajhi Capital in Riyadh. “But if you look on the long term, this should be seen as a positive measure that is good for the country and the market.”

More Saudi.

• Lebanon PM Resigns, Bringing Saudi-Iran Proxy Conflict to the Fore (BBG)

Lebanese Prime Minister Saad al-Hariri unexpectedly resigned on Saturday in a televised speech from Saudi Arabia, saying he feared for his life and accusing Iran and its proxies of destabilizing his country and the region. Hariri, a pro-Saudi Sunni politician, said Lebanon has suffered enough because of the Iranian-backed Hezbollah and its grip on domestic politics. “I want to say to Iran and its followers that they are losing in their interference in the affairs of Arab nations, and our nation will rise as it did before – and the hands that are extended to it with evil will be cut off,” he said. The resignation raises the prospect of a renewed political confrontation between Iran and Saudi Arabia in Lebanon at a time when the Islamic Republic and its allies are widely seen to have won the proxy war against Sunni powers in neighboring Syria.

Saudi Arabia and Iran are on opposite ends of other regional conflicts such as Yemen and Iraq. The Lebanese government includes Hezbollah members, and Hariri’s decision aims to weaken the group’s legitimate representation, said Sami Nader, head of the Beirut-based Levant Institute for Strategic Affairs. “It’s part of an all-out Saudi confrontation with Iran,” he said. As the war against Islamic State in Syria and Iraq winds down, analysts are warning against a surge in other conflicts as regional and global powers seek to divide spheres of influence. And while Saudi Arabia failed in its pursuit to remove Syrian President Bashar al-Assad, an ally of Iran, from power, the kingdom has found a backer in U.S. President Donald Trump in his focus on containing Iran’s clout in the Middle East.

And yet more Saudi.

• Trump Urges Saudi Aramco to List on New York Stock Exchange (BBG)

President Donald Trump, raising the political stakes in what would be the largest initial public offering, said the U.S. would “very much appreciate” if Saudi Arabia’s government lists the Saudi Arabian Oil Co. on the New York Stock Exchange. “Important to the United States!” Trump said in a Twitter post from Honolulu early Saturday. Trump’s tweet, sent hours before he was set to depart for an 11-day tour of Asia, came out of the blue for Aramco, according to a person familiar with the company, who asked not to be named. But the move is consistent with a growing push by American regulators to lure companies to U.S. stock exchanges. Trump told reporters later Saturday aboard Air Force One that he was motivated to send the tweet because the Aramco IPO “will be just about the biggest ever” and the U.S. wants “to have all the big listings.”

The Saudis were not currently looking at listing on a U.S. exchange “because of litigation risk, and other risk, which is sad,” he said. “I want them to very strongly consider the New York Stock Exchange or NASDAQ or frankly anybody else located in this country,” Trump said. He added that he had recently spoken to King Salman. The tweet was “energy geopolitics in action,” said Jason Bordoff, director of the Center on Global Energy Policy at Columbia University and a former senior oil official in the Obama administration. “At a time when the Saudis are looking for the U.S. to get tougher on Iran, the Saudi-Russian relationship is warming, the Saudis are trying to attract international private capital, and the Chinese are rumored to be considering taking a piece of Aramco, Trump’s personal plea to list in N.Y. raises the diplomatic stakes of Aramco’s decision.”

“Latent risks are accumulating, including some that are “hidden, complex, sudden, contagious and hazardous..”

• China’s Zhou Warns on Rising Financial Risk in Blunt Article (BBG)

China’s financial system is getting significantly more vulnerable due to high leverage, according to central bank governor Zhou Xiaochuan, who also flagged the need for deeper reforms in the world’s second-biggest economy. Latent risks are accumulating, including some that are “hidden, complex, sudden, contagious and hazardous,” even as the overall health of the financial system remains good, Zhou wrote in a lengthy article published on the People’s Bank of China’s website late Saturday. The nation should toughen regulation and let markets serve the real economy better, according to Zhou. The government should also open up financial markets by relaxing capital controls and reducing restrictions on non-Chinese financial institutions that want to operate on the mainland, he wrote.

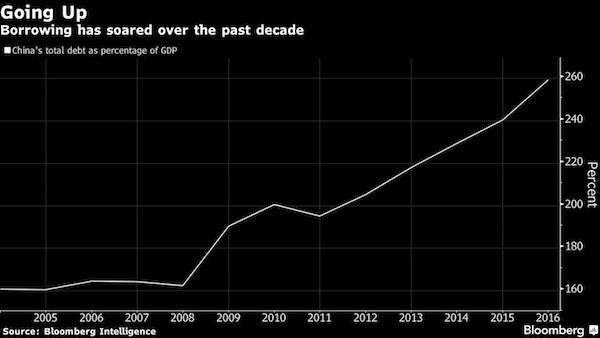

“High leverage is the ultimate origin of macro financial vulnerability,” wrote Zhou, 69, who is widely expected to retire soon after a record 15-year tenure. “In sectors of the real economy, this is reflected as excessive debt, and in the financial system, this is reflected as credit that has been expanding too quickly.” Zhou’s comments signal that policy makers remain committed to a campaign to reduce borrowing levels across the economy. Concern that regulators may intensify the deleveraging drive after the twice-a-decade Communist Party Congress has helped push yields on 10-year government bonds to a three-year high. Still, measures of credit continue to show expansion, with aggregate financing surging to a six-month high of 1.82 trillion yuan ($274 billion) in September. China’s corporate debt surged to 159% of the economy in 2016, compared with 104% 10 years ago, while overall borrowing climbed to 260%.

Hard not to see Saudi and China doing the same thing.

• China To Expand Corruption Supervision Pilot Scheme Nationwide (R.)

China will expand a pilot project for anti-graft supervision reforms nationwide next year that will consolidate existing corruption agencies, state-run news agency Xinhua reported, as President Xi Jinping expands his signature policy drive. Xinhua said in a report published late on Saturday China’s top legislature adopted a decision calling for new supervisory commissions to be set up by the People’s Congresses at provincial, city and county-levels to “supervise those exercising public power”. Xi’s signature anti-graft drive has jailed or otherwise punished nearly 1.4 million Communist Party members since 2012. The leader, who began his second five-year term in October, has vowed to maintain the “irreversible” momentum of the campaign to root out corruption.

China aims to pass a national supervision law and set up a new commission at the annual parliament meetings early next year. The new National Supervision Commission will work with the Communist Party’s anti-graft body, the Central Commission for Discipline Inspection, expanding the purview of Xi’s anti-graft campaign to include employees at state-backed institutions. Xinhua said the commissions to be set up nationwide under the China legislature’s new directive will have the power to investigate illegal activities such as graft, misuse of authority, neglect of duty, and wasting public funds.

if you didn’t get yet what a catastrophe the Democratic party has become.

• Donna Brazile Considered Replacing Hillary Clinton With Joe Biden (G.)

The former head of the Democratic National Committee says she considered initiating effort to replace Hillary Clinton as the party’s presidential nominee with then vice-president Joe Biden. Donna Brazile makes the revelation in a memoir being released on Tuesday entitled Hacks: The Inside Story of the Break-ins and Breakdowns that Put Donald Trump in the White House. Brazile writes that she considered initiating Clinton’s removal after she collapsed while leaving a 9/11 memorial service in New York City. Clinton later acknowledged she was suffering from pneumonia. But Brazile says the larger issue was that her campaign was “anemic” and had taken on “the odor of failure”.

After considering a dozen combinations to replace Clinton and her running mate, Tim Kaine from Virginia, Brazile writes that she settled on Biden and Cory Booker of New Jersey as those with the best chance of defeating Trump. Ultimately, the former DNC head says, “I thought of Hillary, and all the women in the country who were so proud of and excited about her. I could not do this to them.”

“In higher education, every party you meet, from the moment you first set foot on campus, is in on the game.”

• The Great College Loan Swindle (Taibbi)

Horror stories about student debt are nothing new. But this school year marks a considerable worsening of a tale that ought to have been a national emergency years ago. The government in charge of regulating this mess is now filled with predatory monsters who have extensive ties to the exploitative for-profit education industry – from Donald Trump himself to Education Secretary Betsy DeVos, who sets much of the federal loan policy, to Julian Schmoke, onetime dean of the infamous DeVry University, whom Trump appointed to police fraud in education. Americans don’t understand the student-loan crisis because they’ve been trained to view the issue in terms of a series of separate, unrelated problems. They will read in one place that as of the summer of 2017, a record 8.5 million Americans are in default on their student debt, with about $1.3 trillion in loans still outstanding.

In another place, voters will read that the cost of higher education is skyrocketing, soaring in a seemingly market-defying arc that for nearly a decade now has run almost double the rate of inflation. Tuition for a halfway decent school now frequently surpasses $50,000 a year. How, the average newsreader wonders, can any child not born in a yacht afford to go to school these days? In a third place, that same reader will see some heartless monster, usually a Republican, threatening to cut federal student lending. The current bogeyman is Trump, who is threatening to slash the Pell Grant program by $3.9 billion, which would seem to put higher education even further out of reach for poor and middle-income families. This too seems appalling, and triggers a different kind of response, encouraging progressive voters to lobby for increased availability for educational lending.

But the separateness of these stories clouds the unifying issue underneath: The education industry as a whole is a con. In fact, since the mortgage business blew up in 2008, education and student debt is probably our reigning unexposed nation-wide scam. It’s a multiparty affair, what shakedown artists call a “big store scheme,” like in the movie The Sting: a complex deception requiring a big cast to string the mark along every step of the way. In higher education, every party you meet, from the moment you first set foot on campus, is in on the game.

Fear of Christmas.

• Santa Claus May Be Coming To Town, But Will The Shoppers Go Too? (G.)

Christmas is still seven weeks away, but, unsurprisingly, that does not stop retailers getting into the festive spirit early in the hope to attract crowds to the tills. On Tuesday, singer Rita Ora will turn on the Christmas lights on Oxford Street to mark the beginning of the festivities, close to Marks & Spencer’s Marble Arch branch. But will it be a merry Christmas for retailers? This week both M&S and Sainsbury’s will announce half-year results at an uncertain time for the high street. A recent survey from the CBI showed high street sales falling at their fastest rate since the height of the recession in 2009 as inflation causes households to put the brakes on spending. The cost of groceries, clothes and electronics has been rising since the Brexit vote last year, piling pressure on shoppers.

Recently, Asda’s income tracker found that there has been a slump on the spending power of the average household, while research from Lloyds Bank found that families are feeling the strain of the rising costs of living compared with a year ago. All of which could add up to a grim Christmas for retailers as shoppers struggle to deal with the post-Brexit economy. A further warning was sounded last week when Next reported a fall in October high street sales. Retailers will be hoping that Rita Ora will be able to instil some festive cheer to start off the shopping season.

Same story all over the world.

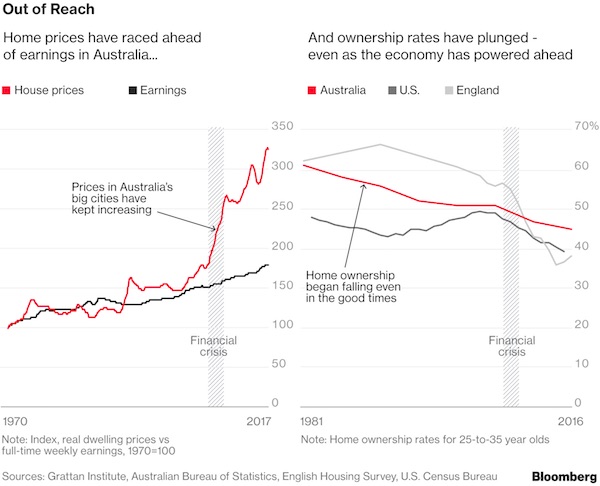

• In the World’s Most Livable Cities, Hardly Anyone Can Afford a Home (BBG)

Home ownership among young Australians has fallen to the lowest level on record, as an explosive property boom squeezes out all but the wealthiest. Supercharged by record low interest rates, a lack of supply and a tax system that favors property investors, home prices have surged more than 140% in the past 15 years, propelling Sydney past London and New York to rank as the world’s second-most expensive housing market. Melbourne, ranked the world’s most livable city the past seven years by the Economist Intelligence Unit, is now the planet’s sixth-most expensive place to buy a house. In response, home ownership among the young has plunged: only 45% of 25-to-34 year-olds own their own home, down 16%age points from the 1980s, with almost half the decline coming in the past decade.

At the same time, hefty mortgages have pushed household debt to a record, acting as a drag on the economy’s 26 years of unbroken growth. As more people retire still owing a mortgage, or renting, they are more likely to qualify for government welfare, undermining the A$2.3 trillion ($1.8 trillion) pension savings system. “The great Australian dream of home ownership is becoming a nightmare,’’ said Brendan Coates, a housing policy expert at the Grattan Institute. “It’s down to a collective failure of government policy that will take at least two decades to fix.” Voter angst over housing affordability is mounting: almost 90% of Australians fear future generations won’t be able to buy a home, according to an Australian National University survey.

Failure to address the issue is heaping pressure on a government already under fire for the botched rollout of a A$49 billion national high-speed internet network, and energy-policy bungling that’s sent power bills soaring and triggered fears of blackouts this summer. One of the biggest flashpoints are tax incentives that have turned housing into a speculative financial asset. First-home buyers complain they can’t compete against investors, who through a perk known as negative gearing can claim the costs of owning a property-for-rent – including mortgage interest – as a tax deduction against other income. The allure of property investment was turbocharged in 1999, when capital gains tax was halved. With housing prices seen as a one-way bet, investors piled in.

People deserve to go to jail for what Australia has done to these people.

• Australia -Again- Snubs New Zealand Offer To Take Refugees (AFP)

Australia Sunday snubbed New Zealand’s renewed offer to resettle 150 refugees held at remote Pacific camps, despite the closure of one detention centre in Papua New Guinea which has triggered a stand-off between detainees and the authorities. Canberra has been forced on the defensive by the move from Wellington’s new government, with Prime Minister Malcolm Turnbull saying Australia would instead prioritise a similar deal with the US to resettle refugees in America, despite slow progress. The issue re-emerged when the conservative Australian prime minister met his centre-left New Zealand counterpart Jacinda Ardern for the first time Sunday in Sydney. Pressure to resettle refugees increased after the Australian centre on PNG’s Manus Island was shut Tuesday after the nation’s Supreme Court ruled it unconstitutional.

About 600 detainees are refusing to leave citing safety fears if they move to transition centres where locals are reportedly hostile. But conditions in the camp are deteriorating with limited food and water and electricity cut off, with the United Nations warning of a humanitarian emergency. Under its tough immigration policy, Canberra sends asylum seekers who try to reach Australia by boat to two camps, in Manus and Nauru, and they are barred from resettling in Australia. Australia has struggled to move the refugees to third countries such as Cambodia or PNG. “The offer is very genuine and remains on the table,” Ardern told reporters after meeting Turnbull. But the Australian leader replied that while he appreciated the offer – first made by Wellington in 2013 – “we are not taking it up at this time”.

Home › Forums › Debt Rattle November 5 2017