Lewis Wickes Hine Italian family in the baggage room, Ellis Island, New York 1905

For now, I doubt it.

• Currency Investors Are Bracing for a Full-Blown Trade War (BBG)

In foreign-exchange markets, investors aren’t waiting to find out if all the tariff threats being thrown around lead to a full-blown trade war. Some money managers have begun piling into traditional havens like the yen; others are trimming currency exposure altogether; and even those who’re betting not much will come from the row are hedging just in case. The concern is that Trump’s plan to impose steel and aluminum tariffs will trigger a wave of retaliatory levies that derail the worldwide economic expansion. The EU has already responded, preparing punitive steps on iconic U.S. goods should Trump go through with his threats.

Gary Cohn’s resignation Tuesday drove home investors’ skittishness: the yen surged, while the peso and Canadian dollar sank. “Currencies can be very small but sharp objects, where a little exposure can have a large impact,” said Gene Tannuzzo, a portfolio manager at Columbia Threadneedle Investments. “So you could see more and more managers just not really stick their neck out as it relates to FX exposure.”

There will have to be negotiations.

• Trump Sticks With Tariff Plan, Warns EU On Trade (R.)

U.S. President Donald Trump reiterated on Tuesday his plan to slap big tariffs on imports of steel and aluminum, warning the EU it would get hit with a “big tax” for not treating the United States well when it comes to trade. “They make it almost impossible for us to do business with them and yet they send their cars and everything else back into the United States,” Trump said of the EU at a news conference with Swedish PM Stefan Lofven, whose country is an EU member. Trump said the EU was taking advantage of the United States on trade, adding: “They can do whatever they’d like, but if they do that, then we put a big tax of 25% on their cars – and believe me they won’t be doing it very long.”

Trump said on Friday he would impose a duty of 25% on imported steel and 10% on aluminum, a plan that sparked cries of foul from U.S. trading partners and warnings from U.S. lawmakers and businesses of the potential for a tit-for-tat trade war that could hurt the U.S. economy. Trump repeated his belief that the United States could win such a war, since it was running such a large trade deficit. “When we’re behind on every single country, trade wars aren’t so bad,” he told reporters at the White House. Lofven offered a warning of sorts to the U.S. president, saying: “I am convinced that increased tariffs hurt us all in the long run.”

What’s the phrase? Do as they do, not as they say?

• Europe Renews Tariffs On Chinese Steel Pipes As High As 72% (ZH)

As the world watches breathlessly if Trump will follow through with his threat to slap steel and aluminum import tariffs, Europe continues to quietly ratchet up its own trade war with China and nobody seems to mind. On Tuesday, as China was trying to define its future trade relations with the US, it was delivered a broadside from the European Commission after Brussels announced it had renewed tariffs on Chinese steel imports, some as high as 71.9%, saying producers in France, Spain and Sweden face a continued risk of imports from China at unfairly low prices. Ironically, that’s the same thing that Trump is saying. The original measures, imposed last April, saw Europe setting anti-dumping duties on imports of hot-rolled flat steel products from China at a higher rate than the preliminary tariffs already in place.

The European Commission explained it had set final duties of between 18.1% and 35.9% for five years for producers including Bengang Steel Plates, Handan Iron & Steel and Hesteel. This compared with lower provisional rates in place of 13.2 to 22.6%, following a complaint by EU producers ArcelorMittal, Tata Steel and ThyssenKrupp. Fast forward to today when Bloomberg reported that the European Commission reimposed for another five years the duties, which punish Chinese exporters including Huadi Steel for allegedly dumping pipes and tubes in Europe; the levies range from 48.3% to 71.9%, depending on the Chinese exporter.

“The repeal of the measures would in all likelihood result in a significant increase of Chinese dumped imports at prices undercutting the union industry prices,” the commission – the 28-nation EU’s executive arm in Brussels – said in the Official Journal; the five-year renewal will take effect on Wednesday. And even though China’s share of the EU market for stainless steel seamless pipes and tubes has been negligible, and hovering at around 2% since 2013, Brussels had no problem with pursuing what it thought was fair remedies, oblivious of the blowback. And now we turn our attention back to Washington, and whether Trump will do the same.

Perhaps most interesting: Cohn’s resignation weakens Wall Street’s voice.

• US Considers Broad Curbs on Chinese Imports, Takeovers (BBG)

The Trump administration is considering clamping down on Chinese investments in the U.S. and imposing tariffs on a broad range of its imports to punish Beijing for its alleged theft of intellectual property, according to people familiar with the matter. An announcement following an investigation by the U.S. Trade Representative’s office into China’s IP practices is expected in the coming weeks, potentially handing President Donald Trump further cause to impose trade restrictions. His announcement last week of tariffs on steel and aluminum imports has already ratcheted up global trade tensions – and led to the resignation Tuesday of his chief economic adviser Gary Cohn, who opposes such measures. Trump tweeted he’ll be making a decision on a replacement soon and that there are “many people wanting the job.”

The dollar fell and the yen – often a haven in turmoil – jumped as much as 0.6% to 105.46 per dollar, approaching a 16-month high set last week. Asian equities declined. The president is now fighting trade offensives on multiple fronts, from targeting strategic rival China to angering allies like Canada and the EU with threats to erect fresh barriers. While his counterparts have threatened retaliation, concrete action that would herald the start of an all-out trade war has yet to come. Liu He, President Xi Jinping’s top economic adviser who met with Cohn in Washington last week, told delegates at the National People’s Congress in Beijing that both sides had expressed a desire to avoid a trade war. Chinese officials – who have been studying curbs on U.S. products such as soybeans according to past reports – were otherwise largely quiet on the tariff question Wednesday.

Depends on who succeeds Cohn.

• With Cohn Gone, Peter Navarro Is Unleashed At White House (CNBC)

Peter Navarro suffered any number of humiliations in his first year in the White House, where the trade advisor was out of favor with President Donald Trump and his superiors for months. But nothing was more degrading than an order handed down by White House Chief of Staff John Kelly: Navarro had to copy his boss, Gary Cohn, on every single email he sent at the White House. “The chief wanted him under control,” a senior administration official told CNBC on Tuesday, referring to Kelly. But now the free-trading Cohn is stepping down as National Economic Council director, and Navarro’s brand of protectionist nationalism is in the ascendency. Presumably, there will be no one else at the White House looking over Navarro’s email now.

“Peter was quietly effective for nine months,” said an administration official. “He helped his reputation by keeping a low profile and being a model prisoner during his period of captivity. And when his opportunity came, he took it and he won.” Another administration official told CNBC that Cohn’s resignation is “a huge victory for the nationalists.” “Peter Navarro won the trade battle and now Gary’s given up,” that administration official said. “It literally reestablishes the intellectual framework and the personnel who were originally envisioned after Trump won the election. We can let Trump be Trump.” Navarro and Larry Kudlow, a prominent conservative and CNBC contributor, will likely be candidates for Cohn’s job. The second administration official played down the likelihood of Kudlow assuming the economic advisor role, however. Kudlow has been vocal in his opposition to the president’s planned tariffs on steel and aluminum.

Add China’s Monopoly money to that mix.

• It’s Not Bad Trade Deals, It’s Bad Money – Part 2 (Stockman)

In Part 1 we made it clear that the Donald is right about the horrific results of US trade since the 1970s, and that the Keynesian “free traders” of both the saltwater (Harvard) and freshwater (Chicago) schools of monetary central planning have their heads buried far deeper in the sand than does even the orange comb-over with his bombastic affection for 17th century mercantilism. The fact is, you do not get an $810 billion trade deficit and a 66% ratio of exports ($1.55 trillion) to imports ($2.36 trillion), as the US did in 2017, on a level playing field. And most especially, an honest free market would never generate an unbroken and deepening string of trade deficits over the last 43 years running, which cumulate to the staggering sum of $15 trillion.

Better than anything else, those baleful trade numbers explain why industrial America has been hollowed-out and off-shored, and why vast stretches of Flyover America have been left to flounder in economic malaise and decline. But two things are absolutely clear about the “why” of this $15 trillion calamity. To wit, it was not caused by some mysterious loss of capitalist enterprise and energy on America’s main street economy since 1975. Nor was it caused – contrary to the Donald’s simple-minded blather – by bad trade deals and stupid people at the USTR and Commerce Department. After all, American capitalism produced modest trade surpluses every year between 1895 and 1975. Yet it has not lost its mojo during the 43 years of massive trade deficits since then. In fact, the explosion of technological advance in Silicon Valley and on-line business enterprise from coast-to-coast suggests more nearly the opposite.

[..] What changed dramatically after 1975, however, is the monetary regime, and with it the regulator of both central bank policy and the resulting expansion rate of global credit. In a word, Tricky Dick’s ash-canning of the Bretton Woods gold exchange standard removed the essential flywheel that kept global trade balanced and sustainable. Thus, without a disciplinary mechanism independent of and external to the central banks, trade and current account imbalances among countries never needed to be “settled” via gains and losses in the reserve asset (gold or gold-linked dollars).

China’s behind a few decades, just in time for 1984.

• China Dramatically Boosts Spending On Internal Security (WSJ)

China has substantially increased spending on domestic security, official figures show, reflecting mounting concern about threats inside its borders as President Xi Jinping moves to acquire more power and reassert the authority of the Communist Party. Beijing’s budgets for internal and external security have grown faster than the economy as a whole for several years, but domestic security spending has grown far faster — to where it exceeds the national defense budget by roughly 20%. Across China, domestic security accounted for 6.1% of government spending in 2017, the Ministry of Finance said. That translates into 1.24 trillion yuan ($196 billion) and compares with 1.02 trillion yuan in central-government funding for the military.

The numbers, revealed in an annual budget report released this week, help illustrate the scale of a recent intensification of security and surveillance across China, particularly in Xinjiang and Tibet, minority-heavy areas on the country’s periphery. In Xinjiang the government has woven a web of surveillance, with checkpoints, high-definition cameras, facial scanners and street patrols; the region spent $9.1 billion on domestic security in 2017, a 92% increase from 2016, according to local government budget data.

Any questions?

• Greater Toronto Home Sales Down 35% From February 2017 (CBC)

The number of Toronto-area homes sold last month fell nearly 35% and the average selling price dropped more than 12% from historically high levels set last year, the Toronto Real Estate Board reported Tuesday. There was a total of 5,175 residential transactions through the board’s MLS system last month, down 34.9% compared to the 7,955 sales in February 2017. The region’s average selling price, covering all types of residential resales, was down 12.4% to $767,818 — still one of the most expensive in Canada. Detached houses — the most expensive of the major categories tracked by TREB — showed the biggest declines in both the number sold and sales price compared with last year.

The detached category had also been the driving force behind a spike in prices in the early months of 2017 that prompted the Liberal provincial government to introduce a package of measures last April to cool the market. That was followed by a financial stress test for buyers, which officially came into effect on Jan. 1 for federally regulated lenders, following an October announcement by the Office of the Superintendent of Financial Institutions. “When TREB released its outlook for 2018, the forecast anticipated a slow start to the year compared to the historically high sales count reported in the winter and early spring of 2017,” TREB president Tim Syrianos said Tuesday. “Prospective home buyers are still coming to terms with the psychological impact of the Fair Housing Plan, and some have also had to re-evaluate their plans due to the new OSFI-mandated mortgage stress test guidelines and generally higher borrowing costs.”

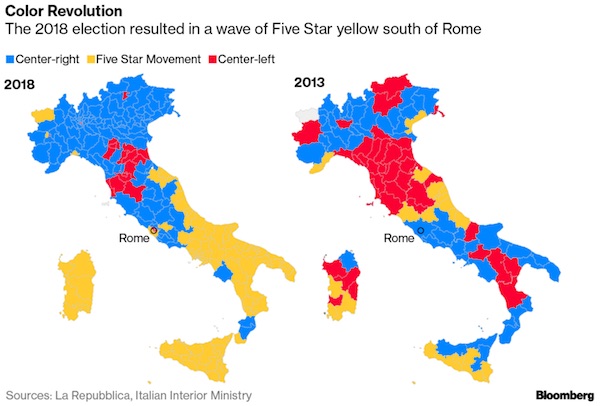

It really is north and south now, Italy’s age-old dividing line between rich and poor.

• Italy’s Populists Split The Country in Half (BBG)

Italy’s political map is a lot less colorful than it used to be. Whereas in previous elections the main parties had pockets of support across the peninsula, the March 4 vote resulted in a wave of anti-establishment Five Star yellow south of Rome and in the islands, and a sea of blue for the center-right coalition in the north, led by a strong showing on the part of the anti-immigrant League. “The South voted for the Five Star Movement and the North voted for the Lega, but both sides of the country expressed a vote of protest,” Luigi Zingales, professor at the University of Chicago’s Booth School, told Bloomberg TV.

The center-left, which used to dominate the central part of the country, was reduced to a few pockets in its former strongholds and to a handful of prosperous districts in the north. Big cities like Rome and Milan were small red dots isolated from the rest of their regions. The 2013 vote wasn’t so clear cut. It was Five Star’s first ever national election and it did well in Sicily and parts of the center and south, but the traditional parties still held on to some of their fiefdoms. Things went differently this time around. Five Star won every district in Sicily, Sardinia, Puglia, and Molise, and all but one in Campania. Large swathes of Tuscany and Emilia-Romagna and all of Umbria, which had voted left for generations, were won by the center-right.

What a sad world we live in. Or rather, what sad completely different worlds. Universes even.

• In The Alps, Traffickers Prey On Migrants And Rescuers Alike (AFP)

Five African migrants stumble through the snow, exhausted and numb, abandoned hours earlier by a smuggler who left them to make their own way down the mountain from Italy into France. They are among dozens who have been tricked in recent weeks into paying hundreds of euros to people traffickers who promised them a comfortable car ride across the border. The Montgenevre Pass isn’t steep, but the snow is deep, and the young men’s trainers and jeans do nothing to protect them against the biting minus 10ºC (14ºF) chill. If they get lost, it might take hours to cross – long enough to freeze to death. By the time members of the French volunteer group Tous Migrants (We Are All Migrants) come to their rescue in the black of night, the youths are broken.

[..] Thousands of young men from francophone west Africa have trudged across these mountains over the past two years, dreaming of jobs in France. In recent months, as news about the route filters back to Africa, the arrivals have gained pace. Since July, nearly 3,000 have passed through a modest shelter run by Tous Migrants [..] The smugglers, who are also French-speaking west Africans, charge up to €350 euros ($430) to sneak people into France. But once the group reaches the Italian border village of Claviere by train and bus, the car that is supposed to carry them on the last leg of their journey to Paris never materialises. The smugglers instead call the French volunteers to notify them that a group of Africans is heading their way – and then turn on their heels.

One more piece arguing Greece needs to ‘reform’ to recover. BS.

• Europe’s Recurring Financial Crisis Has Not, Repeat, Not Ended (F.)

It will happen again. Europe will go through another financial crisis, probably centered in Greece but not necessarily. It has had several already, because from the start few of the troubled countries have made the fundamental reforms needed to meet their obligations. Instead, the richer parts of the currency union, Germany in particular, have advanced funds on conditions of austerity that not only ignore the fundamentals but are otherwise counterproductive. The recipients pretend that they will abide by German conditions, and Berlin, to duck the disruption of a prolonged financial crisis, pretends to believe them. Rescue loans flow, and then, when another failure looms, the show repeats according to the same script. It will happen again.

The most resent run of this show was performed in spring of 2015. Greece, which had starred in the original pilot back in 2010, could not meet the payments due on its debt. German Finance Minister Wolfgang Schaeuble first lectured Greece on its spendthrift ways and then, according to script, said that Berlin would block any aid until Athens increases taxes and cuts spending sufficiently for its budget to run what is called a “primary surplus” (revenues less costs excluding the expense of debt service) equal to 3.5% of GDP. Greek Prime Minister Alexis Tsipras, also according to script, refused, pointing out, correctly too, that past such efforts have imposed unsupportable hardships on the Greek people. At the last moment, again according to script, he caved into Schaeuble’s demands. Berlin allowed Europe to extend the loan, and the crisis quieted as past crises have at this point of the show.

New lapdog.

• New Eurogroup Chief Warns Of Greek Vulnerability (K.)

Greece remains vulnerable to domestic and external shocks, the head of the Eurogroup, Mario Centeno, warned on Tuesday. The Portuguese finance minister also told the Athens-Macedonian News Agency that restoring its credibility in the credit market will be a gradual and not automatic process for this country. Centeno called on Athens to continue implementing the reforms of the bailout program even after its completion, adding that the eurozone will examine its strategy regarding the post-program framework later, along with the easing of Greece’s debt. The Portuguese official stopped short of making any pledges about the debt lightening, sticking to the letter of the Eurogroup decision.

Referring to the country’s access to the markets, Centeno stated that “if the conditions are fulfilled for the further easing of the debt at the end of the program, the Eurogroup – as has unequivocally been agreed – is ready to assist in this process.” He added that “all additional measures on the debt will have to be analyzed at a technical level. They will only be adopted if the two conditions are fulfilled: The program has to be completed successfully and the debt easing will have to be necessary for the Greek debt to be considered sustainable. This is why we need an integrated analysis by the institutional bodies; at the moment that has not come.”

Centeno said Greece is a “unique case in the eurozone,” implying that it is in this context that its exit from the bailout program will be examined. He added that “the end of the program will constitute a new political reality for Greece. Whatever the framework of monitoring agreed, Greece will regain control of its policies. Yet just as with every other European [Union] country, such policies will have to be compatible with the European framework.” He said he is not interested in Greek election results, but revealed that the EU is concerned about the political agenda in Greece: “I would just recommend to Greece to continue on its own reform agenda,” Centeno stated.

Erdogan plays to cheap nationalist sentiments. Which can be fired up much higher by shooting at something. Where’s NATO, US, Germany?

• Why Turkey Wants to Invade the Greek Islands (Bulut)

There is one issue on which Turkey’s ruling Justice and Development Party (AKP) and its main opposition, the Republican People’s Party (CHP), are in complete agreement: The conviction that the Greek islands are occupied Turkish territory and must be reconquered. So strong is this determination that the leaders of both parties have openly threatened to invade the Aegean. The only conflict on this issue between the two parties is in competing to prove which is more powerful and patriotic, and which possesses the courage to carry out the threat against Greece. While the CHP is accusing President Recep Tayyip Erdogan’s AKP party of enabling Greece to occupy Turkish lands, the AKP is attacking the CHP, Turkey’s founding party, for allowing Greece to take the islands through the 1924 Treaty of Lausanne, the 1932 Turkish-Italian Agreements, and the 1947 Paris Treaty, which recognized the islands of the Aegean as Greek territory.

In 2016, Erdogan said that Turkey “gave away” the islands that “used to be ours” and are “within shouting distance.” “There are still our mosques, our shrines there,” he said, referring to the Ottoman occupation of the islands. Two months earlier, at the “Conference on Turkey’s New Security Concept,” Erdogan declared: “Lausanne… has never been a sacred text. Of course, we will discuss it and struggle to have a better one.” Subsequently, pro-government media outlets published maps and photos of the islands in the Aegean, calling them the territory that “Erdogan says we gave away at Lausanne.”

Borders between Greece and Turkey after 1923 Lausanne Treaty

Ilargi: This may seem extreme, but original plans proposed by the -rejected- 1920 Sèvres Treaty went even further, giving Greece large parts of mainland Turkey as well. This was negotiated after the Ottoman empire lost WWI. The discussions also included claims to the likes of Palestine, Syria and Lebanon. Both treaties were negotiated -and signed- by the Ottoman Empire and the Allied French Republic, British Empire, Kingdom of Italy, Empire of Japan and the Kingdom of Romania. Somewhat ironially, the Kingdom of Greece was the only party not to sign Sèvres. Which was also heavily contested by Kemal Atatürk in Turkey. Wiki: ‘Atatürk led Turkish nationalists to defeat the combined armies of the signatories of the Treaty’ in the Turkish Independence War (1919-1923)

Borders between Greece and Turkey proposed by -rejected- 1920 Sèvres Treaty

We read this. And then we all get in our cars.

• Arctic Has Warmest Winter On Record (AP)

The Arctic [..] experienced its warmest winter on record. Sea ice hit record lows for the time of year, new US weather data revealed on Tuesday. “It’s just crazy, crazy stuff,” said Mark Serreze, director of the National Snow and Ice Data Center in Boulder, Colorado, who has been studying the Arctic since 1982. “These heat waves – I’ve never seen anything like this.” Experts say what’s happening is unprecedented, part of a global warming-driven cycle that probably played a role in the recent strong, icy storms in Europe and the north-eastern US. The land weather station closest to the North Pole, at the tip of Greenland, spent more than 60 hours above freezing in February.

Before this year, scientists had seen the temperature there rise above freezing in February only twice before, and then extremely briefly. Last month’s record-high temperatures have been more like those typical of May, said Ruth Mottram, a climate scientist at the Danish Meteorological Institute. Of nearly three dozen different Arctic weather stations, 15 of them were at least 10F (5.6C) above normal for the winter. “The extended warmth really has staggered all of us,” Mottram said. In February, Arctic sea ice covered 5.4m square miles, about 62,000 square miles smaller than last year’s record low, the ice data center reported, and it was 521,000 square miles below the 30-year normal.

Home › Forums › Debt Rattle March 7 2018