Vincent van Gogh Le Moulin à Poivre, Montmartre 1887

Trump said ‘if you don’t have steel, you don’t have a country’. Is he all that wrong?

• EU Proposes Retaliatory Tariff of 25% Against U.S. Goods (BBG)

The EU is preparing punitive tariffs on iconic U.S. brands produced in key Republican constituencies, raising political pressure on President Donald Trump to ditch his plans for taxing steel and aluminum imports. Targeting $3.5 billion of American goods, the EU aims to apply a 25 percent tit-for-tat levy on a range of consumer, agricultural and steel products imported from the U.S. if Trump follows through on his tariff threat, according to a list drawn up by the European Commission and obtained by Bloomberg News. The list of targeted U.S. goods – including motorcycles, jeans and bourbon whiskey – sends a political message to Washington about the potential domestic economic costs of making good on the president’s threat.

Paul Ryan, Republican speaker of the House of Representatives, comes from the same state – Wisconsin – where motorbike maker Harley-Davidson is based. Earlier this week, Ryan said he was “extremely worried about the consequences of a trade war” and urged Trump to drop his tariff proposal. Other U.S. officials will also feel the pressure. Bourbon whiskey hails from Senate Majority Leader Mitch McConnell’s home state of Kentucky. San Francisco-based jeans maker Levi Strauss is headquartered in House Minority Leader Nancy Pelosi’s district. The EU’s retaliatory list targets imports from the U.S. of shirts, jeans, cosmetics, other consumer goods, motorbikes and pleasure boats worth around €1 billion; orange juice, bourbon whiskey, corn and other agricultural products totaling €951 million; and steel and other industrial products valued at €854 million.

Tariff on US cars exported to Europe is 25%. Tariff on EU cars imported in US is 10%. Looks like there is room for talks there.

• Trump’s Tariff Threat On European Cars Could Spell Big Trouble For Germany (CNBC)

The war of words between President Donald Trump and the EU could lead to some serious pressure on the German auto industry, one expert told CNBC. Trump threatened via Twitter on Saturday to hit back at any tariff measures from the European Union — floated in response to Trump’s recently announced global steel import tariffs — in kind. The billionaire businessman’s potential next target? European cars. And the biggest victim of them all may be Germany. “It would be quite severe if we were to face additional import duties to ship the cars into the U.S. — the Germans in particular are very, very exposed,” Arndt Ellinghorst, the head of global automotive research for advisory firm Evercore ISI, told CNBC Monday.

He noted the example of BMW, which sells about 350,000 cars in the U.S. annually, roughly 70% of which come from Europe. “That’s probably an $8 billion to $9 billion revenue stream, if you put a 5 to 10% additional cost on it, it would cost something like $400 million to $800 million. Some of that would be absorbed by the company, and some of it would have to be absorbed by the consumer in the U.S.” Ellinghorst did add that cars being shipped from the U.S. into Europe faced a 10% import duty while European cars into the U.S. faced a 2.5% import duty. “I think what the administration is talking about is to balance out this difference in tariffs to make it more of an equal playing ground for American and European carmakers,” he said.

Out of roughly six million cars exported by Europe in 2016, more than one million were absorbed by the U.S. — just over 16% — its largest country market by a wide margin. Meanwhile, of America’s $53.6 billion in car exports that same year, the value of its car exports into Europe was $11.8 billion, or roughly 22% of the total, according to the Observatory of Economic Complexity. The U.S. is the third-largest car exporter globally after Germany and Japan, accounting for 7.7% of total world exports. It ran a trade deficit of more than $151 billion overall with Europe in 2017.

The aftermath of the reurn of volatility.

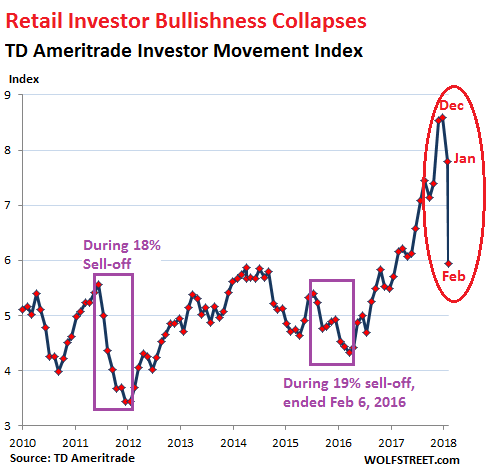

• Retail Investor Bullishness Collapses (WS)

TD Ameritrade’s Investor Movement Index – “designed to indicate the sentiment of retail investors” based on what they’re doing in their accounts and “how they are actually positioned in the markets” – plunged 23% in February to 5.95, the biggest month-over-month plunge in the history of the index, “as volatility returned to the market.” This comes after a 9% plunge of the index in January, the largest month-over-month plunge in three years, which occurred despite the final spurt of the rally that took the stock market indices to new highs on January 26. It’s as if retail investors, for once, smelled a rat. After which the sell-off started:

TDA Chief Market Strategist JJ Kinahan explained in an interview that TDA’s clients “didn’t want to be as exposed” in February to risk “as they were.” “What’s interesting is they were net buyers, and they were net buyers because of the February 9th move,” he said. “They bought a lot of stocks that day. But as the month went on, they just continued to sell those stocks back out, and then some. So it was a really interesting pattern that developed.” The stocks they bought had “lower beta than some of the stocks they sold,” he said. “So it was really and truly a risk-off trade. But the bigger part about it is they lightened up their exposure across the board. So one or two days truly of buying,… but after that, not only selling what they’d bought that day, but selling on top of it what they’d bought earlier” this year and last year.

Hard to gauge how much of a grip the Financial Stability Board has on the actual numbers. 2016 is the first time they include China. But what do they actually know, and how much is guesswork?

• World’s ‘Shadow Banks’ Continue To Expand (R.)

Growth in global bond, real estate and money market funds continued to swell the world’s“shadow banking” sector, a watchdog that coordinates financial regulation for the G20 big economies said on Monday. The Financial Stability Board said its“narrow” measure of shadow banking activities that could pose a threat to stability, rose 7.6% to $45.2 trillion in 2016, the latest year for which figures have been collated. It represents 13% of total financial system assets in the 29 jurisdictions surveyed. Data from China and Luxembourg were included in the measure for the first time. “Non-bank financing provides a valuable alternative to bank financing and helps support real economic activity,” the FSB said in its report. Nevertheless, increased reliance on non-bank funding could give rise to new risks, it said.

The so-called shadow banking sector, made up of companies other than banks that provide financial services, has been treated with suspicion by some regulators since the financial crisis a decade ago. Still, it has some champions among policymakers who say it helps keep capital markets more liquid. The European Union actively courts participants to diversify away from heavy reliance on bank loans for EU companies. Apart from debt investment funds, the measure of shadow banking also includes the repurchase and debt securitization markets as well as hedge funds involved in credit. Faced with few rules in the past, sub-sectors like securitization are now regulated and seen to pose less risk to stability.

Open-ended bond funds, hedge funds that offer credit and money market funds account for 72% of the narrow measure, and grew by 11% in 2016. Regulators have asked funds to have safeguards in place for extreme market turbulence to avoid instability from fire sales of assets if many investors ask for their money back. The United States accounts for 31% of the narrow measure, followed by China with 16%, the Cayman Islands at 10% and Japan at 6%. A broader measure, which includes all financial firms that are not central banks, banks, pension funds or insurers, rose 8% to $99 trillion to represent 30% of global financial assets, its highest level since at least 2002, the FSB said.

How transparent are these shadows?

• China to Ease Bad-Loan Provision Rules to Support Growth (BBG)

China is relaxing rules governing how much banks must set aside to cover bad loans, people with knowledge of the matter said, a sign that regulators are comfortable the nation’s lenders are sound enough to extend additional credit and support the economy. The China Banking Regulatory Commission has issued a notice lowering the bad-loan coverage ratio to a minimum 120% from the previous 150%, the people said, asking not to be identified as the matter isn’t public. Relaxed bad-loan coverage rules will allow banks to extend more credit, supporting an economy the government expects to expand about 6.5% this year, a slower pace than in 2017. Additional lending from giants such as Industrial & Commercial Bank of China would also counter some of the effects on the economy of President Xi Jinping’s campaign to curb financial risk, one of the government’s top priorities.

The changes also indicate regulators are confident that they’ve come to grips with a bad-loan epidemic that plagued lenders over the past few years. In 2016, when problem loans at Chinese banks were on the rise, the CBRC resisted lobbying from the nation’s lenders to relax the provisioning thresholds. The timing of the CBRC move suggests that “nonperforming loans are not a problem,” analysts at Shenwan Hongyuan said in a research note. [..] According to the notice, the CBRC will differentiate the amount of provisions an individual bank must hold within the new band of 120% to 150%, based on the level of its capital, the accuracy of its loan classification policies and its proactiveness in handling nonperforming loans, the people said.

China’s banking industry has a bad loan coverage ratio above 180%, CBRC official Xiao Yuanqi said at a briefing last week, indicating banks have plenty of room to reduce provisions. As well as lowering the threshold, the CBRC notice said it will reduce the amount of provisions banks must hold against their total loan book, including healthy loans, to as low as 1.5% from the previous 2.5% minimum.

They can’t have it all.

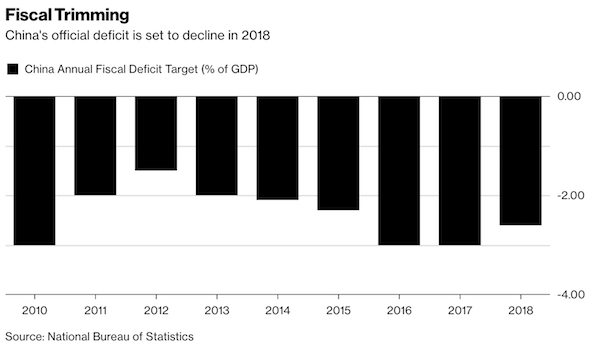

• China Faces an ‘Impossible Challenge’ on Budget, Tax and GDP (BBG)

Premier Li Keqiang has an “impossible challenge” if he wants to slash China’s budget deficit target, deleverage the economy, and cut taxes, according to Pantheon Macroeconomics. Li on Monday said this year’s deficit goal was cut to 2.6% of gross domestic product, from 3%, the first reduction since 2012. At the same time, he pledged tax cuts of 800 billion yuan ($126 billion) for companies and individuals and set a 6.5% annual economic growth target – the same as last year’s target but slower than the actual performance of 6.9%. “These targets suggest tight monetary conditions and tight fiscal policy, with GDP growth holding up, despite an intensified deleveraging campaign,” said chief Asia economist Freya Beamish in London. “Something’s got to give. We reckon it’s fiscal policy, though monetary policy could also turn out on the easier side, with the yuan also set to weaken.”

[..] While China is aiming for a narrower official deficit, leaders still plan to expand the issuance of special purpose bonds, which are sold by local governments to finance items that aren’t included in the general public budget and not counted in the deficit ratio released annually. Local governments have used special bonds to help pay for highways, railroads and other construction projects in recent years, and the securities are designed to be covered by returns of the projects rather than general revenues. Special purpose bond issuance will jump to 1.35 trillion yuan this year to prioritize “supporting ongoing local projects to see them make steady progress,” the Finance Ministry said Monday. That’s up from 800 billion yuan in 2017 and 400 billion yuan in 2016.

An entire series of companies guaranteeing each other’s debt. How does that surface in those shadow reports?

• China’s Coming Meltdown Will Rapidly Spread to US (Rickards)

The coming credit crisis in China is no secret. China has $1 trillion or more in bad debts waiting to explode. These bad debts permeate the economy. Some are incurred by Chinese provincial authorities trying to get around spending limitations imposed by Beijing. Some are straight commercial loans on bank balance sheets. Some are external dollar-denominated debts owed to foreign creditors. The most dangerous type of debt involves a daisy chain of insolvent corporations buying debt from each other. A single cash advance of $100 million can be passed from corporation to corporation in exchange for a new promissory note, used to extinguish an old unpayable promissory note. Repeated enough times, the $100 million can be used as window dressing to prop up $1 billion or even $2 billion of bad debts.

These kinds of accounting tricks will land you in jail in the U.S., but it’s an accepted practice in China as long as the corporate CEO is a “Princeling” (a politically connected Communist Party insider descended from the old guard) or an oligarch willing to pay bribes. This state of affairs has existed for years. The question investors keep asking is, “How long can this last?” How long can the daisy chain keep operating to gloss over a sea of bad debt and give the Chinese economy an appearance of good health? Well, the answer is the Ponzi will not likely last much longer. Even compliant Chinese regulators are starting to blow the whistle on bad loans and the banks that cover them up. So the good news is that China is starting to address the problem. The bad news is that if China gets serious about cleaning up bad debts, their growth will slow significantly and so will world economic growth.

That’s bad news for global stock markets. Essentially, China is on the horns of a dilemma with no good way out. On the one hand, China has driven growth for the past eight years with excessive credit, wasted infrastructure investment and Ponzi schemes like wealth management products (WMPs). The Chinese leadership knows this, but they had to keep the growth machine in high gear to create jobs for millions of migrants coming from the countryside to the city and to maintain jobs for the millions more already in the cities. The Communist Chinese leadership knew that a day of reckoning would come. The two ways to get rid of debt are deflation (which results in write-offs, bankruptcies and unemployment) or inflation (which results in theft of purchasing power, similar to a tax increase). Both alternatives are unacceptable to the Communists because they lack the political legitimacy to endure either unemployment or inflation. Either policy would cause social unrest and unleash revolutionary potential.

Americans can’t get away from the money makes you happy syndrome.

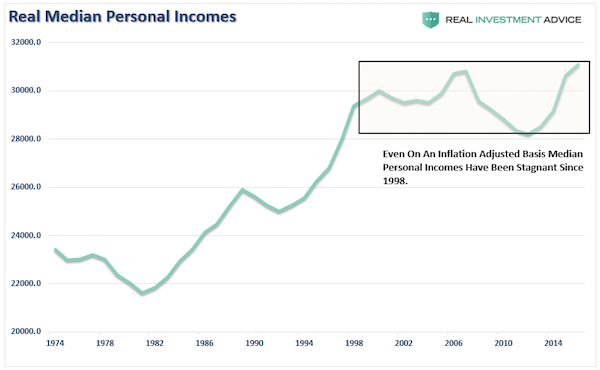

• Sex, Money & Happiness (Roberts)

“Sex” and “Money” are probably two of the most powerful words in the English language. First, those two words got you to look at this article. They also sell products, books, and services from “How To Have Better Sex” to “How To Make More Money” — ostensibly so you can have more of the former. Unfortunately, they are also the two primary causes of divorce in the country today. But “happiness,” is also an interesting word because it is ultimately derived from the ability to obtain money and the lifestyle with which it will afford. Researchers at Purdue University recently studied data culled from across the globe and found that “happiness” doesn’t rise indefinitely with income. In fact, there were cut-off points at which more annual income had a negative effect on overall life satisfaction.

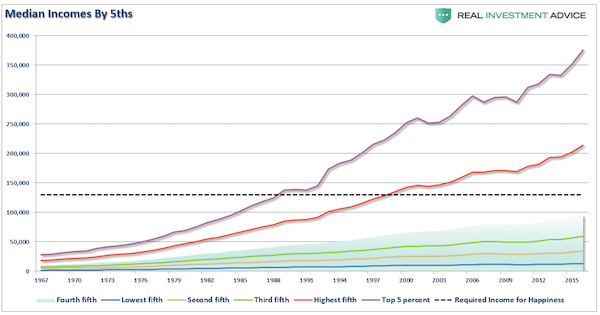

So, what’s that number? In the U.S., $65,000 was found to be the optimal income for “feeling” happy. In the U.S., despite higher levels of low income (now there’s an oxymoron), inflation-adjusted median incomes have remained virtually stagnant since 1998.

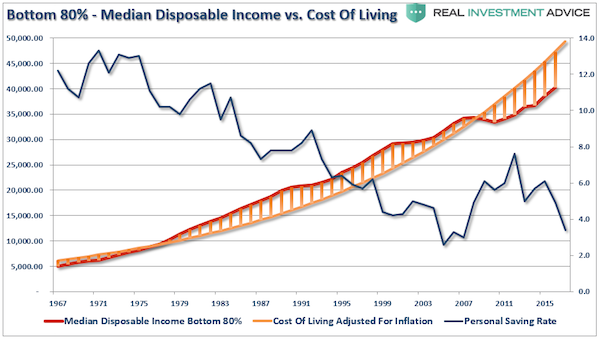

However, the chart above is grossly misleading because the income gains have only occurred in the Top 20% of income earners. For the bottom 80%, they are well short of the incomes needed to obtain “happiness.”

For most American “families”, who have to balance their living standards to their income, the “experience” of “happiness” is more of a function of “meeting obligations” each and every month. Today, more than ever, the walk to the end of the driveway has become a dreaded thing as bills loom large in the dark crevices of the mailbox. If they can meet those obligations, they are “happy.” If not, not so much.

In my opinion, what the study failed to capture was the “change” in what was required to achieve “perceived” happiness following the “financial crisis.” Just as with “The Great Depression,” individuals forever altered their feelings about banks, saving and investing after an entire generation had lost “everything.” It is the same today as sluggish wage growth has failed to keep up with the cost of living which has forced an entire generation into debt just to make ends meet. As the chart below shows, while savings spiked during the financial crisis, the rising cost of living for the bottom 80% has outpaced the median level of “disposable income” for that same group. As a consequence, the inability to “save” has continued.

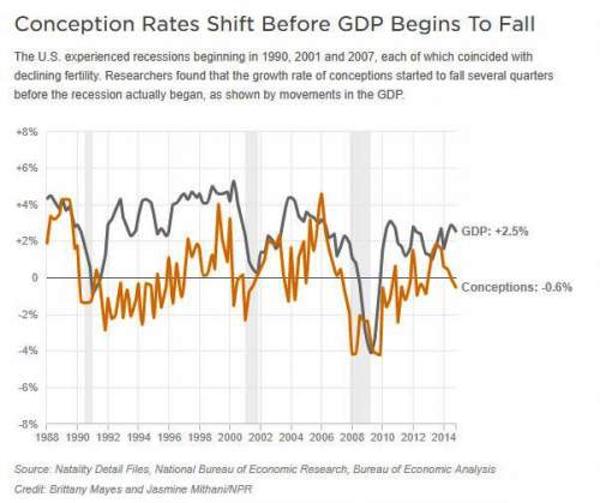

[..] Not surprisingly, the “financial stress” in American households is leading to other factors which are fueling the “demographic” problem in the future. The equation is very simple – when individuals are stressed over finances they are less active sexually. This was shown in a recent study by the National Bureau of Economic Research. Ahead of the past three US recessions, the number of conceptions began to fall at least six months before the economy started to contract. As the FT notes, while previous research has shown how birth rates track economic cycles, the scientific study is the first to show that fertility declines are a leading indicator of recessions. [..] To the researchers’ surprise, they found that falls in conceptions were a far better leading indicator of recessions than many commonly used indicators such as consumer confidence, measures of uncertainty, and purchases of big-ticket items such as washing machines and cars.

Sheer incompetence. Much more of that to come.

• British Can’t Deliver Promises Of Frictionless Trade (Fintan O’Toole)

In 2016, more than 310 million people and nearly 500 million tonnes of freight crossed the UK’s borders. If this continues to happen in a “frictionless” way after Brexit, the disturbances to the status quo in Ireland will be limited. If it doesn’t, hang on to your hats. Frictionless trade is the only condition under which Brexit can happen without inflicting a hard border on Ireland. It is almost certainly a political impossibility if the UK leaves the customs union. But even if it could somehow be agreed in principle, there is another enormous obstacle: the actual capacity of the British to handle it. On Friday, after Theresa May’s big set-piece speech on Brexit, the DUP leader Arlene Foster issued a glowing endorsement. She referred back to a paper issued by the UK government last August: “Those proposals can ensure there is no hard border between Northern Ireland and the Republic of Ireland after we exit the EU.”

Foster recognises how much unionism is staking on that document and on the ability of the UK’s bureaucracies to deploy technology to take the sting out of the potentially toxic irritant of the Irish Border. This forces us to consider something that would previously have been of little interest to Irish people: the recent and dismal history of the UK’s adventures in using digital technology to control its borders. In 2003, the British established a spanking new “e-borders” system which was meant to collect and analyse advance passenger information for people travelling into the UK. It had a generous timescale – the full programme was meant to be in place by 2011. In 2010, the Home Office admitted that e-borders was so useless it had to be abandoned. By then, it had spent £340 million (€380 million) on the programme.

The cancellation of the contract led to a legal settlement for another £150 million. The Home Office then spent another £303 million on a new programme, bringing expenditure to £830 million. In 2015, the National Audit Office reported that all of this expenditure “has failed, so far, to deliver the full vision” of what was supposed to be achieved. The current date for completion of the programme is 2019. The whole thing will have taken a mere 16 years. On the same timescale, the new post-Brexit systems on which the future of Ireland may hinge would be delivered in 2035. In 2015, 55 million UK customs declarations were made by 141,000 traders. Once Brexit happens, that will increase fivefold to 255 million. Leaving aside all the issues of political principle, this is the vast logistical challenge that will have to be dealt with if May and Foster are to get the Brexit they want.

The numbers are interesting, the political stance not so much.

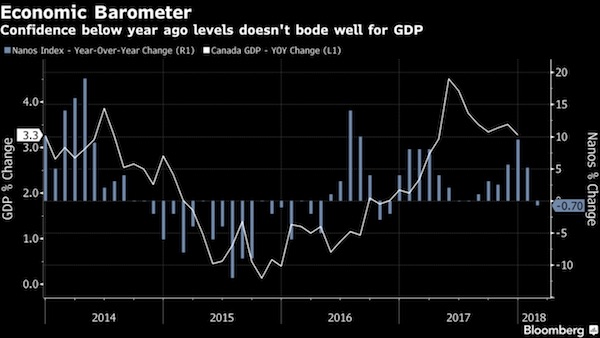

• Canada’s Looming Economic Meltdown (GT)

Canada’s Fourth Quarter economic growth was 1.7% following positive signs of growth earlier in the year. This growth, however modest, is attributable to easy credit and the increased consumer spending. At this time, Canadian households are facing one the largest indebtedness when compared to most other countries. For every $1.00 of income, consumers owe $1.68. This is the highest income to debt ratio in the world. For low-income Canadian households, the $1.00 disposable income to $3.33 debt ratio is even worst. Canada, along with other nations, especially emerging markets are carrying records levels of consumer debts, may be facing a serious crash as further growth becomes unsustainable.

Canada combined deficit rose to $18.1 billion in 2016, from $12.9 billion in the previous year. Higher debts and increased spending are causing serious concerns that the Canadian economy is on an unsustainable economic path. A considerable portion of Canada’s future economic growth has been predicated on strengthening and improving the country’s infrastructure. However, Prime Minister Trudeau’s policies are destined to strangle potential economic growth by shifting C$7.2 billion allocated to infrastructure improvements to government programs such as gender equality hiring opportunities. According to the Conference Board of Canada’s Craig Alexander: “This isn’t a budget that’s about growth, as much as it’s about equality and breaking down barriers to opportunity.”

Canada appears to be stunting its own economic growth as a matter of policy. Three major infrastructure projects, The Northern Gateway pipeline ($7.9 billion), the Pacific Northwest LNG project ($36 billion), and possibly the Energy East pipeline ($15.7 billion) would have been instrumental in guaranteeing economic growth for decades to come. However, these have been stymied in favor of Trudeau’s economic egalitarian vision. As a result, investors have been abandoning certain projects. The last time Canada’s saw such heavy-handed government interference in its economy was during the presidency of Trudeau’s father, Pierre Trudeau.

This could hurt.

• Coinbase Accused of Cheating Consumers in More Ways Than One (BBG)

Coinbase was slapped with a pair of lawsuits by disgruntled consumers, one alleging insider trading by employees at the giant digital currency exchange and the other accusing the company of failing to deliver cryptocurrencies to people who didn’t have accounts. The class-action suits come as Coinbase and other crypto startups are beefing up their staffs with regulatory experts to legitimize themselves as they prepare for government authorities to impose stricter rules. The first of the complaints filed in San Francisco federal court centers on Coinbase’s announcement in December that it would enable purchases of the bitcoin spinoff known as Bitcoin Cash. The customer who sued alleges that employees were tipped off a month in advance, allowing them to instantly swamp Coinbase with buy and sell orders and leaving other traders at a great disadvantage.

Coinbase CEO Brian Armstrong said at the time that the company would investigate an increase in the price of bitcoin cash in the hours before its Dec. 19 announcement and that any employee or contractor found to have violated internal policies would be terminated. “To date, neither Armstrong nor the company has disclosed the result of its purported investigation,” according to the March 1 lawsuit. In the other suit, two men claim that they were unable to redeem bitcoin that had been transferred to them through Coinbase via their email addresses in 2013. They allege that when they got reminder notices in February, they tried to recover the bitcoin only to discover that the links provided by Coinbase were broken. They accused the company of keeping their funds and say they want to represent “thousands” of other people in the same position.

As long as the press continue to ignore this, who cares really?

• US, UK Support World’s Worst Humanitarian Disaster In 50 Years (CP)

“The situation in Yemen – today, right now, to the population of the country,” UN humanitarian chief Mark Lowcock told Al Jazeera last month, “looks like the apocalypse.” 150,000 people are thought to have starved to death in Yemen last year, with one child dying of starvation or preventable diseases every ten minutes, and another falling into extreme malnutrition every two minutes. The country is undergoing the world’s biggest cholera epidemic since records began with over one million now having contracted the disease, and new a diptheria epidemic “is going to spread like wildfire” according to Lowcock. “Unless the situation changes,” he concluded, “we’re going to have the world’s worst humanitarian disaster for 50 years”.

The cause is well known: the Saudi-led coalition’s bombardment and blockade of the country, with the full support of the US and UK, has destroyed over 50% of the country’s healthcare infrastructure, targeted water desalination plants, decimated transport routes and choked off essential imports, whilst the government all this is supposed to reinstall has blocked salaries of public sector workers across the majority of the country, leaving rubbish to go uncollected and sewage facilities to fall apart, and creating a public health crisis. A further eight million were cut off from clean water when the Saudi-led coalition blocked all fuel imports last November, forcing pumping stations to close.

[..] As of late January, fuel imports through the country’s main port Hodeidah were still being blocked, with cholera cases continuing to climb as a result. And on 23rd January, the UN reported that there are now 22.2 million Yemenis in need of humanitarian assistance – 3.4 million more than the previous year – with eight million on the brink of famine, an increase of one million since 2017.

America’s fast becoming a cartoon nation.

It must be hard on The New York Times editors to set their hair on fire day after day in their effort to start World War Three. Today’s lead story, Russian Threat on Two Fronts Meets Strategic Void in the U.S., aims to keep ramping up twin hysterias over a new missile gap and fear of Russian “meddling” in the 2018 midterm elections. The Times’s world-view begins to look like the script of a Batman sequel with Vlad Putin cast in The Joker role of the cackling psychopath who must be stopped at all costs! America’s generals have switched on the Batman signal beacon, but Donald Trump in the role of the Caped Crusader, merely dithers and broods in the splendid isolation of his 1600 Penn Avenue Bat Cave, suffering yet another of his endless bipolar identity crises.

For God’s sake, The Times, shrieks, do something! The Russians are coming! (Gotham City’s Chief of Police Hillary said exactly that last week in a Tweet!) I think they misunderstood Mr. Putin’s recent message when he announced a new hypersonic missile technology that would, supposedly, cut through any imaginable US missile defense. The actual message, for the non mental defectives left in this drooling idiocracy of a republic, was as follows: Nuclear war remains unthinkable, so kindly stop thinking about it. Mr. Putin’s other strategic position is also misrepresented — actually, not even acknowledged — in Monday’s NYT propaganda blast, namely, to discourage the USA’s decades-long policy of regime change here, there, and everywhere on the planet, creating a debris trail of one failed state after another.

As a true-blue American, I must say these are two admirable propositions. Is it fatuous to add that atomic war is unlikely to benefit anyone? Or that the world has had enough of US military “meddling” in foreign lands? Of course the shopworn trope of Russian “meddling” in the 2016 election still occupies the center ring of the American political circus. Today’s Times story includes another clumsy attempt to set up expectations that the 2018 midterm elections will be hacked by Russia, in order to keep the hysteria at code-red level. As usual, the proposition assumes that the alleged 2016 hacking is both proven and significant when, going on two years, there is no evidence of hacking besides the obviously amateurish Facebook troll farm.

Sickening to watch.

• The Ocean Currents Brought Us In A Lovely Gift Today (G.)

A British diver has captured shocking images of himself swimming through a sea of plastic rubbish off the coast of the Indonesian tourist resort of Bali. A short video posted by diver Rich Horner on his social media account and on YouTube shows the water densely strewn with plastic waste and yellowing food wrappers, the occasional tropical fish darting through the deluge. The footage was shot at a dive site called Manta Point, a cleaning station for the large rays on the island of Nusa Penida, about 20km from the popular Indonesian holiday island of Bali. In a Facebook post on 3 March Horner writes how the ocean currents had carried in a “lovely gift” of jellyfish and plankton, and also mounds and mounds of plastic.

“Plastic bags, plastic bottles, plastic cups, plastic sheets, plastic buckets, plastic sachets, plastic straws, plastic baskets, plastic bags, more plastic bags, plastic, plastic,” he says, “So much plastic!” The video shows Horner swimming through the mess for several minutes and also how the waste coagulated on the surface, mixing in with some organic matter to form a slick of floating rubbish. Manta Point is regularly frequented by numerous manta rays that visit the site to get cleaned of parasites by smaller fish, but the video shows just one lone manta in the background. “Surprise, surprise, there weren’t many mantas there at the cleaning station today…” notes Horner, “They mostly decided not to bother.”

Several weeks ago thousands across Bali took part in a mass clean up, in attempt to rid the island’s beaches, rivers and jungles of waste, and raise awareness about the harmful impacts of trash. Rich Horner said that while divers regularly see “a few clouds of plastic” in the rainy season, the slick he identified is the worst yet. Divers returned to the site the next day, he reports, by which time the slick had already moved on, “continuing on its journey, off into the Indian Ocean..”

Home › Forums › Debt Rattle March 6 2018