Fred Stein Little Italy New York 1943

Money to Biden

https://twitter.com/seamusbruner/status/1310950906968649729

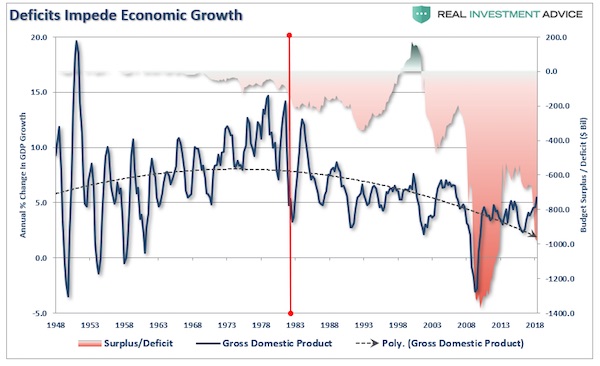

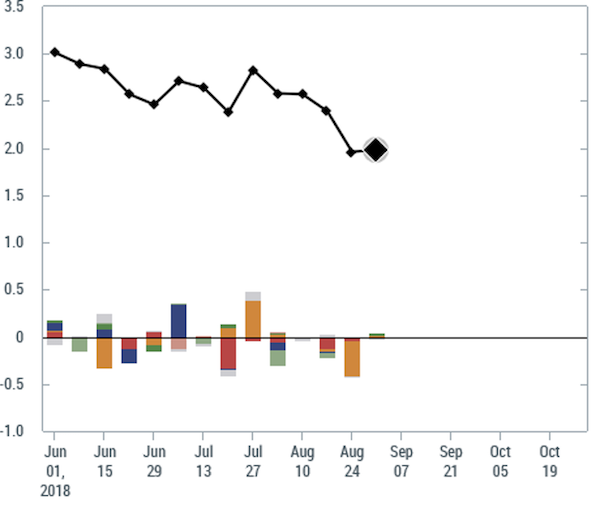

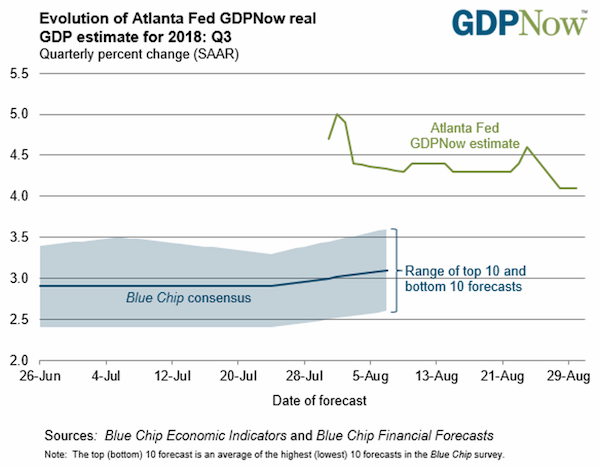

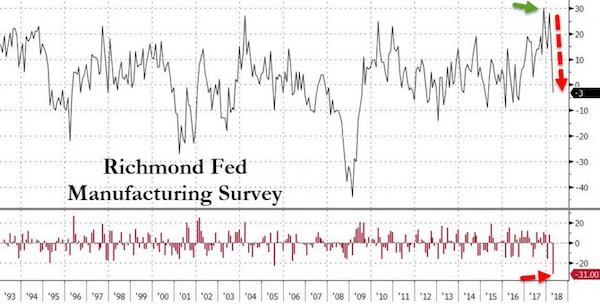

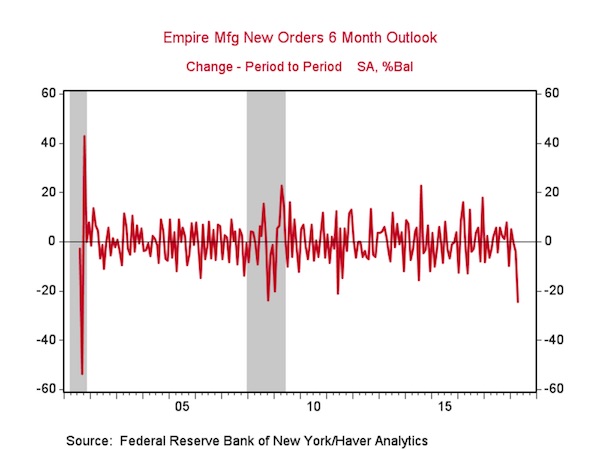

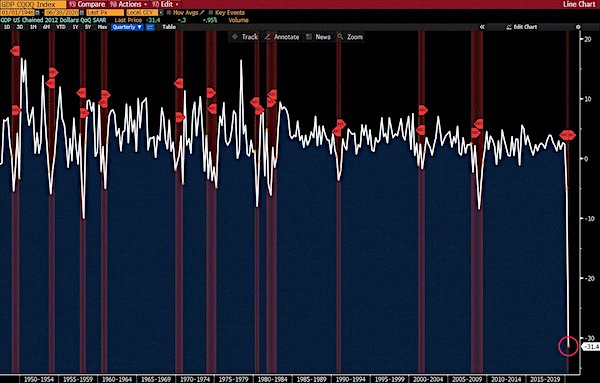

Sounds like a lot. But it’s annualized.

• US Economy Plunged Over 31% In Q2 (RT)

US GDP fell by a 31.4 percent annualized rate last quarter, marking the steepest drop in output since the government started keeping records in 1947, the Commerce Department said on Wednesday. The previous worst quarterly drop was observed in the first three months of 1958, when GDP fell 10 percent on an annualized basis. The new data reflects a slightly upward revision, with output previously reported to have contracted at a 31.7 percent pace during the period. “The decline in second quarter GDP reflected the response to COVID-19, as ‘stay-at-home’ orders issued in March and April were partially lifted in some areas of the country in May and June, and government pandemic assistance payments were distributed to households and businesses,” said the Bureau of Economic Analysis.

“This led to rapid shifts in activity, as businesses and schools continued remote work and consumers and businesses canceled, restricted, or redirected their spending,” it added. The US economy fell at a five percent rate in the first quarter, signaling an end to a nearly 11-year-long economic expansion, which was the longest in the nation’s history. Economists expect growth to slow significantly in the final three months of this year, to a rate of around four percent. The economy could plunge back into a recession if Congress fails to pass another stimulus measure, or if there is a resurgence of the coronavirus, they say.

Superspreaders appear real. But we don’t recognize them.

• This Overlooked Variable Is the Key to the Pandemic (Atl.)

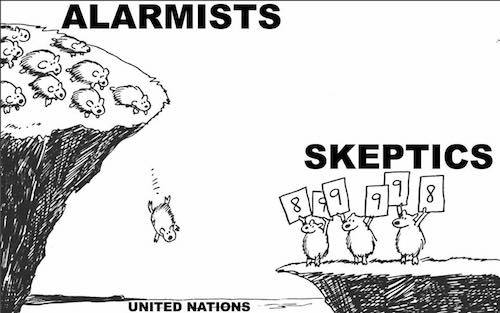

By now many people have heard about R0—the basic reproductive number of a pathogen, a measure of its contagiousness on average. But unless you’ve been reading scientific journals, you’re less likely to have encountered k, the measure of its dispersion. The definition of k is a mouthful, but it’s simply a way of asking whether a virus spreads in a steady manner or in big bursts, whereby one person infects many, all at once. After nine months of collecting epidemiological data, we know that this is an overdispersed pathogen, meaning that it tends to spread in clusters, but this knowledge has not yet fully entered our way of thinking about the pandemic—or our preventive practices.

The now-famed R0 (pronounced as “r-naught”) is an average measure of a pathogen’s contagiousness, or the mean number of susceptible people expected to become infected after being exposed to a person with the disease. If one ill person infects three others on average, the R0 is three. This parameter has been widely touted as a key factor in understanding how the pandemic operates. News media have produced multiple explainers and visualizations for it. Movies praised for their scientific accuracy on pandemics are lauded for having characters explain the “all-important” R0. Dashboards track its real-time evolution, often referred to as R or Rt, in response to our interventions. (If people are masking and isolating or immunity is rising, a disease can’t spread the same way anymore, hence the difference between R0 and R.)

Unfortunately, averages aren’t always useful for understanding the distribution of a phenomenon, especially if it has widely varying behavior. If Amazon’s CEO, Jeff Bezos, walks into a bar with 100 regular people in it, the average wealth in that bar suddenly exceeds $1 billion dollars. If I also walk into that bar, not much will change. Clearly, the average is not that useful a number to understand the distribution of wealth in that bar, or how to change it. Sometimes, the mean is not the message. Meanwhile, if the bar has a person infected with COVID-19, and if it is also poorly ventilated and loud, causing people to speak loudly at close range, almost everyone in the room could potentially be infected—a pattern that’s been observed many times since the pandemic begin, and that is similarly not captured by R. That’s where the dispersion comes in.

There are COVID-19 incidents in which a single person likely infected 80 percent or more of the people in the room in just a few hours. But, at other times, COVID-19 can be surprisingly much less contagious. Overdispersion and super-spreading of this virus is found in research across the globe. A growing number of studies estimate that a majority of infected people may not infect a single other person. A recent paper found that in Hong Kong, which had extensive testing and contact tracing, about 19 percent of cases were responsible for 80 percent of transmission, while 69 percent of cases did not infect another person. This finding is not rare: Multiple studies from the beginning have suggested that as few as 10 to 20 percent of infected people may be responsible for as much as 80 to 90 percent of transmission, and that many people barely transmit it.

A very strange performance. A few years ago, Comey said he remembered everything from his conversations with Trump. He wrote a book about the very things he now can’t remember, and he’s writing a second one.

“‘I don’t recall’ is the last defense of someone who has been painted into a corner.”

“All he is doing is putting himself in jeopardy or proving he was an incompetent director with no leadership skills..”

• James Comey’s ‘No Clue’ Routine On Russia Probe Exposes FBI In Distress (JTN)

Time and again on Wednesday under the intense glare of the political spotlight, Comey claimed he had been kept in the dark or did not remember anything about essential developments in the Russia collusion probe that implied President Trump’s innocence. “That doesn’t ring any bells with me,” Comey answered when Senate Judiciary Committee Chairman Lindsey Graham asked about a September 2016 referral to the FBI alleging Hillary Clinton and her campaign may have concocted the whole Russia collusion case against Trump to hide her own vulnerabilities. Similarly, Comey testified he either did not remember or was not told there were serious problems with the Christopher Steele dossier, that the dossier contained Russia disinformation, that Steele’s primary sub-source had disputed information in the explosive document or that the primary sub-source had previously been judged to be a possible Russian asset back between 2009 and 2011.

All those essential facts were kept from the FISA court, and Comey signed three FISA warrant applications approving surveillance targeting the Trump campaign and former adviser Carter Page without disclosing the flaws in the case. Senators reacted with incredulity. “Comey said he didnt kno abt problems w Page FISA b4 he approved again+again,” Sen. Charles Grassley (R-Iowa), one of the chamber’s longest serving members, tweeted in shorthand. “If true wheres his outrage that agents made him look foolish by w/holding details? I often tell new agency heads either u run agency or agency runs u Who ran FBI during Russiagate+Where is accountability?” Grassley repeatedly slammed Comey’s “no clue” answers as outrageous. Similarly, Graham repeatedly challenged Comey’s account, calling one of his answers “far-fetched.”

“A bunch of crap to be used against an American citizen,” Graham said, referring to now-disproven information in the Page FISA. “You don’t recall this?” “It doesn’t sound familiar,” Comey answered. Lawmakers weren’t the only ones in disbelief. Former senior executives of the FBI told Just the News that Comey’s testimony laid bare an institution in deep distress that either was keeping its director in the dark about one of the most explosive political cases of all time or engaging in a coverup of epic investigative misconduct that deceived the FISA court and the Congress. “‘I don’t recall’ is the last defense of someone who has been painted into a corner. If Comey was truly this ignorant of arguably the most consequential case in FBI history, then he was pathetically inept,” said Kevin Brock, the former assistant director for intelligence under Comey’s predecessor as director, Robert Mueller.

“But it is far more likely that he was provided with detailed briefings of such a high-profile case on a daily basis, as is routine tradition with FBI directors. Comey knows what he is forgetting,” he added. In his testimony, Comey chose to embrace the first theory — incompetence — telling senators the pattern of mistakes and misconduct identified in the Russia probe “reflects entirely on me” in his role as top executive at the FBI. When Sen. Ben Sasse (R-Neb.) called the problems identified in Justice Department Inspector General Michael Horowitz’s investigative report “really embarrassing,” Comey agreed while insisting none was intended to be criminal conduct.

Jeff Danik, a former supervisory FBI agent, said he fears Comey may have put himself in legal jeopardy with Wednesday’s testimony. “I do not understand him going on out there and putting himself in position where there are so many people who can claim you did know,” Danik said in an interview. “All he is doing is putting himself in jeopardy or proving he was an incompetent director with no leadership skills,” he added. “It’s like a general who says there was a battle plan and all these guys got killed, but it isn’t my fault, I’m just the general.”

Sean Davis Comey

Comey just claimed Trump is a Russian asset because Trump said he didn't trust the very same U.S. intelligence agencies that tried to frame him for treason, fueled by Russian disinformation and funded by Hillary Clinton and the DNC, in a coup that was led by Comey himself.

— Sean Davis (@seanmdav) September 30, 2020

Comey doesn’t remember anything

SUPERCUT!@Comey "can't recall" anything about the Russia probe he oversaw pic.twitter.com/WxYdih8KCE

— Tom Elliott (@tomselliott) September 30, 2020

The media make up accusations against Trump, that most people actually believe are true, and then they want to force him to deny them every single day, which keeps the attention on their made-up stories.

It worked miracles with the “very fine people” hoax, they still use that one. So why stop there?

Maybe Trump should have played it like Biden, and simply deny the Proud Boys exist.

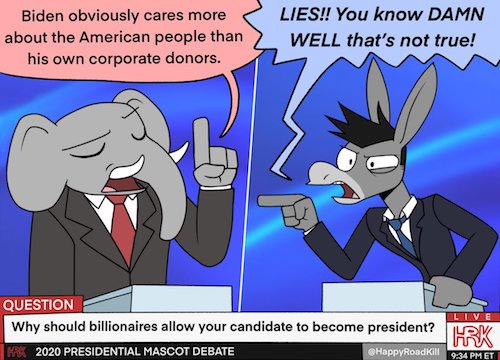

• Proud Boys & Antifa Are The Winners From The Presidential Debate (Turley)

Last night’s presidential debate left many of us in a deep depression over the state of our politics. Once again, the duopoly of power in this country has reduced a population of over 300 million to a two subpar choices. President Donald Trump’s conduct and comments have been rightfully denounced while Biden offered little beyond not being President Trump. There were however two clear and surprising winners last night: Proud Boys and Antifa. When pressed by moderator Chris Wallace on why he has not been more clear in calling for Democratic mayors and governors to crackdown on rioting (including the use of the National Guard), Biden simply said that he was not the president. However, not only is that irrelevant, Biden has been forceful in calling for other actions on these protests and other issues like the pandemic despite his private citizen status.

Yet, the most notable aspect of his exchange with Wallace was his reluctance to denounce Antifa. Instead, Biden referenced FBI Director Christopher Wray’s statement that Antifa was more of a movement than an organization. Biden simply dismissed the question with “Antifa is an idea, not an organization.” It was a telling and inaccurate statement. We previously discussed Wray statement. Wray was adamant: “Antifa is a real thing. It’s not a fiction” and, while it is not a conventional organization as opposed to a movement, they have arrested people who admit that they are Antifa.” I testified in the Senate on Antifa and its history of violence on our campuses and streets. As I have written, Antifa is indeed more of a movement than a specific organization, but it has members and associated groups.

Indeed, it has long been the “Keyser Söze” of the anti-free speech movement, a loosely aligned group that employs measures to avoid easy detection or association. Wray stated “And we have quite a number — and I’ve said this quite consistently since my first time appearing before this committee — we have any number of properly predicated investigations into what we would describe as violent anarchist extremists and some of those individuals self-identify with Antifa.” I have repeatedly emphasized that extreme right groups are also responsible for recent violence and Wray made clear that far right violence still dominates in terms of a threat profile. Moreover, I have opposed declaring Antifa a terrorist organization.

We have ample laws to deal with such extremist violence from the far left or far right. We do not need to rely on terrorism laws or most recently suggested sedition laws. Yet, Antifa is more than some “idea.” The Antifa Handbook discusses how it uses an association of groups, including self-identified Antifa groups, to carry out attacks on critics and those with opposing views. My greatest concern is that we need to take Antifa seriously as a virulent anti-free speech organization. There is a fair criticism of some politicians who have refused to denounce the group or even support it. Former Democratic National Committee deputy chair Keith Ellison, now the Minnesota attorney general, once said Antifa would “strike fear in the heart” of Trump. This was after Antifa had been involved in numerous acts of violence and its website was banned in Germany. His own son, Minneapolis City Council member Jeremiah Ellison, declared his allegiance to Antifa in the heat of the protests this summer.

Trump white supremacy

https://twitter.com/i/status/1311498659176108033

Check out those polling numbers and tell me how confident you are that what you think is correct.

• Wall Street Responds To The “Shitshow” Debate (ZH)

While Tuesday’s chaotic “shitshow” of a presidential debate between Trump and Biden revealed absolutely anything about either candidate’s core policies for the 2020-2024 period, it succeeded in raising analysts’ concerns about a bitter election and reinforced the view of slim prospects for further stimulus. As noted earlier, S&P futures fell as the debate left investors concerned that the election would indeed be bitterly contested well into the end of 2020 and perhaps into early 2021, however they have since erased all losses. This view was confirmed by Chris Weston, head of research at Pepperstone Group, who said that “what we’ve seen from the debate is the reinforcement that if Biden wins, Trump is not going to accept that. People positioned for an ugly contest afterwards have been validated….I don’t think we were expecting anything else from Trump. He continues to put that contested (result) risk premium back into the market.”

The confusion over the debate also meant confusion over who won. As Rabobank’s Michael Every writes, a CBS flash poll had Biden winning 48 – 41, and the CNN poll was 60 – 28. Yet a WGN poll, which is less partisan, saw Trump win 60 – 40, and Telemundo (US Spanish TV) viewers showed Trump winning 66 – 34 , all underlining that people see these things in very different ways. Rabo also quoted veteran Republican pollster Frank Luntz who tweeted that his sample group saw some undecided voters now convinced not to vote at all, with the most common refrain being “I’m so sad for our country.” Every also addressed the last question of the evening on the legitimacy of the upcoming election process, where Trump said “This will not end well,” talking of no winner for months, which “concluded the evening under the darkest cloud, suggesting political risk will linger on in the market’s mind.”

Cowen, Chris Krueger: Krueger wrote that he disagrees with the “notion that debate was a dumpster fire: by definition, dumpster fires are contained.” Biden cleared the low hurdle Trump set with “Sleepy Joe,” he said; “was it Romney vs. Obama in the first 2012 debate? No. But he didn’t fall off the stage like Bob Dole in the 1996 race either. So that — in 2020 — is a win.” He doesn’t see the election’s trajectory changing, as each side’s bases were appeased, and called another stimulus deal “very unlikely.”

“My guess is that this October, the Trump administration is going to release one piece of evidence after another showing that the Democrat party, from Hillary to Obama, and from the FBI to the CIA to the DOJ, and everywhere in between, engaged in a massive, seditious conspiracy to overturn the results of the 2016 election”

• Two Crucial Things Emerged From The First Presidential Debate (Widburg)

The short version of the debate is that Biden did well if one ignored that almost every other statement he made was a lie or fantasy; Trump dominated him, almost too aggressively; and Chris Wallace may have been the worst and most obviously biased moderator since Candy Crowley. Most significantly, though, Biden and Trump each made a critical point. Biden’s was a tacit admission that, if he is elected president, he will preside over the end of the filibuster, allowing Democrats to pack the courts and add two new Democrat-majority states. Trump’s point was that he’s holding damning evidence about the Democrats’ coup attempt.

[..][ You can see that Biden made a nonsense statement to avoid answering whether he will preserve the filibuster and the Supreme Court’s current system of nine justices. Shamefully, Wallace let him get away with not answering. Wallace surely understands that Biden’s handlers plan to end the filibuster so that they can pack the court and add D.C. and Puerto Rico as states. Packing the court ends the American experiment as we know it. It means that the Supreme Court will be a political body that will exist solely to put its imprimatur on Democrat policies. And for those who say, “Well, if they pack the Court, then Republicans will pack it more when they’re in power,” that’s sadly foolish.

If Democrats pack the Court, there are no more Republicans. The whole democratic republic will be over. Once Democrats pack the Court, they never again need to persuade American voters to support their policies. One of their first policies in that new era will be to add hard-left Washington D.C. and Puerto Rico as the 51st and 52nd American states. That means four more Democrat Senate votes and a permanent Democrat party majority. You see, the hard-left Democrat party views our American political system the same way Turkey president Recep Tayyip Erdogan viewed democracy before becoming a dictator for life: “Democracy is like a train. We shall get out when we arrive at the station we want.” This time around, once the Democrats win, they will change the rules so they can never lose again.

Heed this warning: If Biden wins, our constitutional America is gone. We will be a socialist country. If you don’t believe me, just read the Democrat platform. They’re not hiding their goals. Trump, though, might have some aces up his sleeve. When the subject of a “transition” came up (based on Biden’s assumption that he will win), Trump stated that he’d been denied a transition period. Instead, there was a coup attempt: ” There was no transition because they came after me trying to do a coup. They came after me spying on my campaign. They started from the day I won and even before I won. From the day I came down the escalator with our First Lady. They were a disaster. They were a disgrace to our country. And we’ve caught ‘em. We’ve caught ‘em all. We’ve got it all on tape. We’ve caught ‘em all”.

Maybe Trump’s exaggerating, but I don’t think so. And maybe he’s going to keep that evidence secret, but I don’t think that either. My guess is that this October, the Trump administration is going to release one piece of evidence after another showing that the Democrat party, from Hillary to Obama, and from the FBI to the CIA to the DOJ, and everywhere in between, engaged in a massive, seditious conspiracy to overturn the results of the 2016 election. Indeed, the information cascade has already begun with the release of DNI John Ratcliffe’s letter about Hillary’s conceiving of the Russia hoax.

Sean Davis Declassification

Federalist co-founder Sean Davis reports that CIA Director Gina Haspel is blocking releasing and declassifying critical documents related to Obama’s FBI surveilling the Trump campaign in 2016 pic.twitter.com/BSckBzRYNb

— Ryan Saavedra (@RealSaavedra) October 1, 2020

” People go into gold and store it away for the worst case scenario. If banks don’t survive, they have the gold.”

• Charles Nenner – We Are in a Very Dangerous Period (USAW)

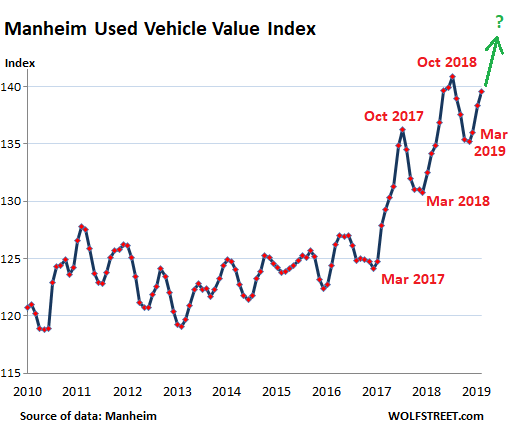

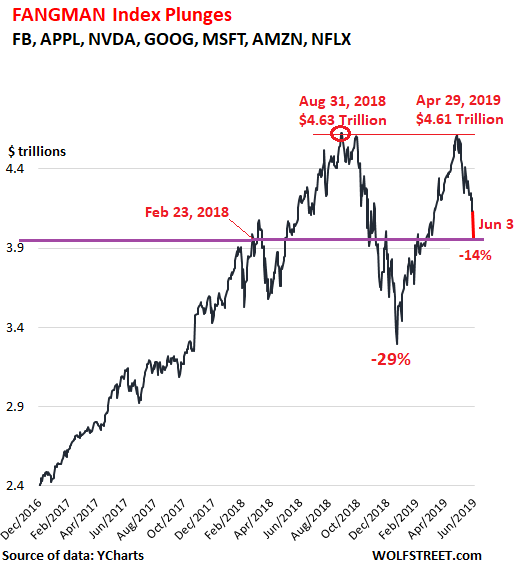

Renowned geopolitical and financial cycle expert Charles Nenner called this market just 2% from the top in January. What does he think now? He likes gold and says he “made more money in gold than in stocks” in the past few months. Nenner says, “We are playing the long term gold market. We went out at $2,100 (per ounce), and the price target was $1,850 (on the downside). We hit $1,850 a couple of days ago, so we bought back in. We get in and out for a couple of hundred points, and it’s worthwhile. So, the gold cycle is up for much longer. $2,500 is the first target, and it could be we get higher targets. I do not believe in the stock market, most of the markets we do nicely in are the gold market, silver market, crude oil market, bond market and the dollar. It’s all very simple and normal, and the stock market is not going to end very well.”

Nenner is long the stock market now until close to the end of November. Nenner says the rising market may be signaling a coming Trump win in November. Nenner is not sure, but what he is very sure about is the stock market is way overvalued just like it was earlier this year. Nenner explains, “As you know, the stock market is still very much overvalued. One of the reasons is the ‘Buffett Indicator,’ and that is the value of the stock market compared to the value of the entire GDP, and it’s extreme. I think it’s more extreme than the 2000 bubble. If you want to buy low and sell high, you have to have indicators of what is low and what is high, and, for me, this is high. This is based on the fundamentals, but on the cycles, we can try to test the highs one more time. This is not going to end well because everybody will try to get into the market, and then the whole thing is over.”

Nenner thinks with all the unemployment and businesses going under permanently, it is not an inflationary environment, at least not yet. Nenner says, “I still think we are going into a deflationary environment, and that still makes sense. That is also why gold is up. Most people don’t understand that because they always look for inflation for gold to go up. I show them that most of the bull markets in gold are deflationary periods and not inflationary periods. When you have deflation, there is nowhere to hide, and it’s very cheap to hold gold. You are afraid for the financial system, and that’s why gold goes up. . . . Look what happened in real estate. You thought you were safe in real estate. Companies are not buying malls, and companies are not paying rent anymore, or they negotiate and they are not going to pay anymore. So, that’s also not a safe place. So, there is not much left. People go into gold and store it away for the worst case scenario. If banks don’t survive, they have the gold.”

Not everybody has the gold, though.

• 56 Million Americans Depended on Food Banks During the Pandemic (MPN)

Amid a pandemic that has claimed the lives of over 209,000 Americans and caused widespread economic dislocation, tens of millions have been forced to rely on food banks to survive. A new report from the Pew Research Center found that 17 percent of the 13,200 people they surveyed said they had received food from a food bank or similar organization during the pandemic. Nationwide, that figure would amount to 56 million Americans. Unsurprisingly, those who identified themselves as “lower income” (35 percent) were far more likely to turn to food banks for help than those in the “upper income” bracket (1 percent). However, even 12 percent of “middle income” Americans admitted they needed outside help to put food on the table.

Black and Hispanic Americans were around three times more likely to need these services than white Americans. Pew’s research also sheds light on a number of other ways in which COVID-19 has harmed American society. 15 percent of respondents said that they had been made unemployed as a result of the fallout, with 25 percent of households having a member lose their job. One third of Americans have been forced to take a pay cut, 16 percent said they had had problems paying rent or mortgages, while a quarter could not pay other bills. As with food bank usage, these other problems were far more common among poorer households and people of color.

[..] Once only associated with enemy nations or with the Great Depression, bread lines have returned to the United States, although they often do not resemble classic images of lines of disheveled people. Today’s bread lines are as likely to be miles-long traffic jams or car parks filled with hungry drivers, sometimes waiting overnight for their turn at the drive through distribution centers. Overwhelmed charities work day and night, but have had to ration out deliveries. Even as food banks were cleaned out, fresh produce rotted on America’s farms. Many American farmers do not sell to a mass market. Instead, their produce is bought up by networks supplying universities, stadiums, or restaurants. But with many of those businesses shuttered, supply distribution networks broke down, leading to feast and famine.

The Fed studies the inequality it has created.

• Fed Study on Household Wealth Reveals Troubling Trends in American Inequality (MPN)

Millionaires and billionaires hold a remarkable 79.2 percent of the United States’ household wealth. That is according to a newly released triennial study into consumer and household finances from the Federal Reserve. The report paints a picture of an unequal America, where a small minority of the rich control the vast majority of household wealth. 11.9 percent of American households have at least $1 million in wealth. Overall, mean family wealth declined by three percent across the country between 2016 and 2019. However, the study notes, wealthy and highly educated families saw their fortunes rise, but households where the main breadwinner had not achieved a high school diploma saw their wealth fall.

In some parts of the country, one million dollars might not seem like an unusual price for a home. However, nationwide, the median home value dropped to $247,000 in 2020, with much more expensive properties rarer. Those merely having a mortgage on a million-dollar home do not qualify as owning $1 million in household wealth. At the same time, much of the country is living in serious poverty. Even before the COVID-19 pandemic, around 40 percent of Americans reported that they would be unable to cover a small $400 emergency such as a leaking roof or a car repair. In 2018, 14.3 million U.S. households were food insecure, meaning they had problems finding enough to eat. The coronavirus and the economic dislocation that it has caused has greatly exacerbated both poverty and inequality, meaning that the Federal Reserve’s study, based on data collected before the pandemic, is likely out of date and an underestimate of the problem’s severity.

In 2017, just three men — Bill Gates, Warren Buffet, and Jeff Bezos — held more wealth than the bottom half of America (164 million people). Since the pandemic began, all three have greatly increased their fortunes. Bezos, for example, has added over $73 billion to his since March alone. This is in stark contrast to tens of millions of people who lost their jobs, leading to a massive wave of de facto rent strikes across the country and a boom in demand for food banks.

Stoltenberg is evil, which makes him perfect for NATO.

• NATO Boss Stoltenberg Tells Georgia To ‘Prepare For Membership’ (RT)

NATO Secretary-General Jens Stoltenberg has urged Georgia to prepare to become a member of the US-led military bloc. On Tuesday, the premier of the former Soviet state Giorgi Gakharia was in Brussels to discuss closer cooperation. Georgia’s effort to join NATO began in 2005, just six years after it left the Russian-dominated CSTO. The integration of the Caucasus nation is seen by NATO leaders as having substantial strategic benefits, including extra Black Sea ports close to Russia. Earlier this year, an agreement between Tblisi and the bloc included joint exercises in the Black Sea and the sharing of more traffic radar data. “I urge [Georgia] to continue making full use of all the opportunities for coming closer to NATO and to prepare for membership,” Stoltenberg said, in a press conference.

“This is important for Georgia, and for NATO.”The secretary-general also noted that the bloc “supports Georgia’s territorial integrity,” calling on northern neighbor Russia to “end its recognition of the regions of Abkhazia and South Ossetia.” Abkhazia and South Ossetia are two de-facto states, recognized by most of the world as part of Georgia. According to Tbilisi, the two regions are actually occupied by Moscow.Speaking to RT, veteran Russian senator Aleksey Pushkov said that the potential induction of Georgia as a member means that NATO sees Russia as its main opponent. Pushkov, a member of the pro-Putin United Russia party, is the former chairman of the Duma’s Foreign Affairs Committee and is widely considered to be close to the Kremlin.

“U.S. intelligence agencies were reportedly pleased with the level communication that was illicitly intercepted, but encouraged UC Global staff to acquire more – pointing to Assange’s team of lawyers as a “top priority.”

• New Details Of Sophisticated Spying Operation On Julian Assange Emerge (TH)

The whistleblowers, henceforth referred to as Witness 1 and Witness 2, detailed the intricate workings of the sophisticated sting referred to by UC Global staff as “Operation Hotel” – they came forward with their testimonies after growing increasingly uneasy about its worsening criminality. Witness 2, an IT expert with the security firm, detailed how Morales had tasked him with replacing the CCTV cameras in the Knightsbridge-located embassy in May of 2017, instructing him to source cameras that allowed for clandestine audio-recording capabilities. His statement, which was produced at the Old Bailey in the fourth and final week of Assange’s U.S. extradition proceedings, reads: “In early December 2017, I was instructed by David Morales to travel with a colleague to install the new security cameras. I carried out the new installation over the course of several days.

“I was instructed by Morales not to share information about the specifications of the recording system, and if asked to deny that the cameras were recording audio. I was told that it was imperative that these instructions be carried out as they came, supposedly, from the highest spheres. “In fact, I was asked on several occasions by Mr. Assange and the Political Counsellor Maria Eugenia whether the new cameras recorded sound, to which I replied that they did not, as my boss had instructed me to do. Thus, from that moment on the cameras began to record sound regularly, so every meeting that the asylee held was captured. At our offices in UC Global it was mentioned that the cameras had been paid for twice, by Ecuador and the United States, although I have no documentary evidence to corroborate this assertion.”

Witness 2 also detailed how Morales had asked for him to arrange for the cameras to contemporaneously transmit the recordings so that UC Global’s “American friends” could have instant access. The whistleblower invented a number of excuses however, stating: “I did this because I did not want to collaborate in an illegal act of this magnitude.” Instead, the UC Global employee was instructed to travel to London every 15 days in order to collect the hard-drives, passing them to Morales who travelled to the U.S. just as frequently – often with his wife – in order to pass the recordings to contacts within the CIA. Morales was rumoured among staff to have been paid €200,000 EUR a month for carrying out the eavesdropping – colleagues noted how his spending had become lavish and noticeable, buying himself a new house and a number of flashy sports cars during the span of two years.

[..] U.S. intelligence agencies were reportedly pleased with the level communication that was illicitly intercepted, but encouraged UC Global staff to acquire more – pointing to Assange’s team of lawyers as a “top priority”. That was in addition to the airport-like screening equipment that was put in place, where every visitor into the Ecuadorean embassy had a photo of their passport taken, their belongings taken off them and sophisticated devices swiped data contained on their digital devices – all forwarded to a secure server somewhere in the United States.

Sheldon Adelson is above the law.

• Trump Associate Ordered Huge Surveillance Of Assange Inside Embassy (Age)

Witness One told the court that Morales exhibited a “real obsession” in monitoring Assange’s lawyers because “our American friends were requesting it”. Witness One terminated the relationship with Morales and sold all shares after realising the full scale of the operation. Witness Two, an IT expert who joined UC Global in 2015, said in a statement that once Trump had won the presidency, Morales won a contract to provide personal security to Adelson and personally provided services for the tycoon and his children when they visited Europe.Witness Two said in mid-2017, Morales asked him to establish a taskforce that would solely look after the technical aspects of the video surveillance network of the Ecuadorian embassy.

By the end of that year, Witness Two said he had installed new cameras in the embassy capable of recording sound and lied to Assange when he was asked if the new cameras picked up audio. The witness testified that orders were given to steal the nappy used on Assange’s son Gabriel because the Americans wanted to establish the baby’s paternity, correctly suspecting that it was Assange’s secret love-child. Witness Two refused and instead tipped off Stella Moris, Assange’s fiancee, to stop bringing the child to the embassy. Witness Two said in December 2017 Morales said that “the Americans were desperate” and had even suggested “that more extreme measures should be employed against the ‘guest’ to put an end to the situation of Assange’s permanence in the embassy”.

“Specifically, the suggestion that the door of the embassy could be left open, which would allow the argument that this had been an accidental mistake, which would allow persons to enter from outside the embassy and kidnap the asylee. “Even the possibility of poisoning Mr Assange was discussed, all of these suggestions Morales said were under consideration during his dealing with his contacts in the United States,” Witness Two said in the affidavit.

The world also appears to warm up more at night.

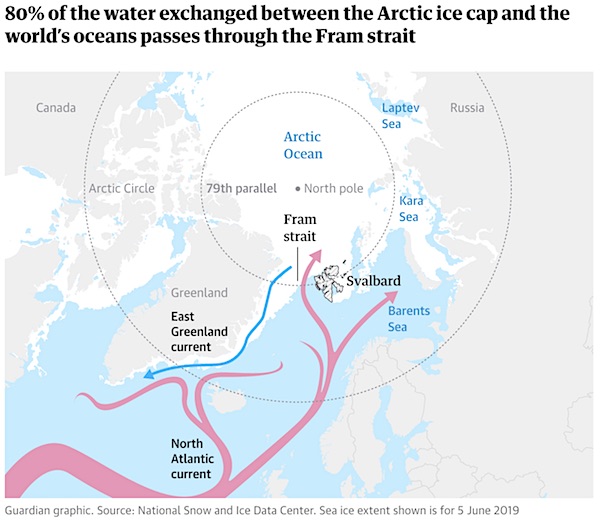

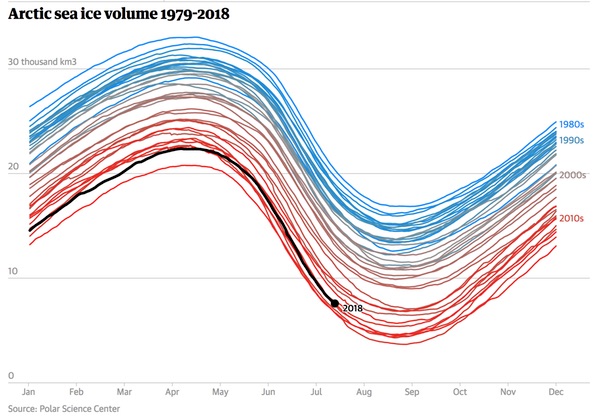

• The Arctic Hasn’t Been This Warm For 3 Million Years (PhysOrg)

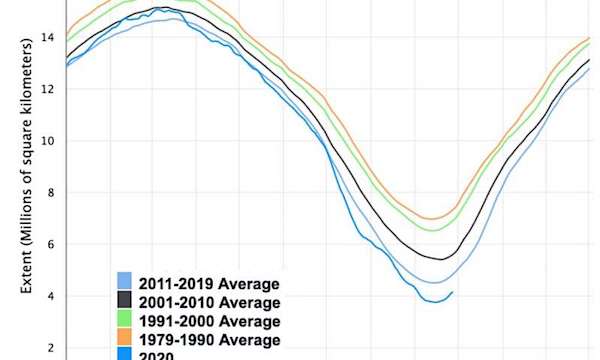

Every year, sea ice cover in the Arctic Ocean shrinks to a low point in mid-September. This year it measures just 1.44 million square miles (3.74 million square kilometers) – the second-lowest value in the 42 years since satellites began taking measurements. The ice today covers only 50% of the area it covered 40 years ago in late summer. As the Intergovernmental Panel on Climate Change has shown, carbon dioxide levels in the atmosphere are higher than at any time in human history. The last time that atmospheric CO2 concentrations reached today’s level – about 412 parts per million – was 3 million years ago, during the Pliocene Epoch.

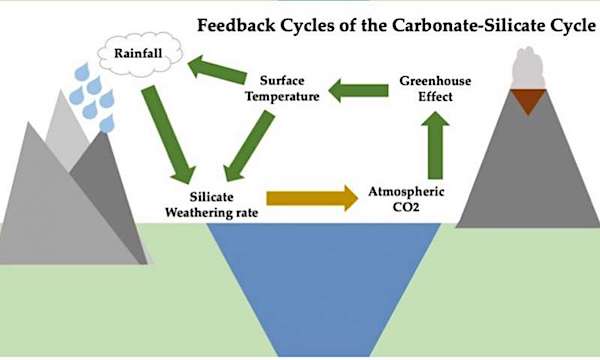

As geoscientists who study the evolution of Earth’s climate and how it creates conditions for life, we see evolving conditions in the Arctic as an indicator of how climate change could transform the planet. If global greenhouse gas emissions continue to rise, they could return the Earth to Pliocene conditions, with higher sea levels, shifted weather patterns and altered conditions in both the natural world and human societies. We are part of a team of scientists who analyzed sediment cores from Lake El’gygytgyn in northeast Russia in 2013 to understand the Arctic’s climate under higher atmospheric carbon dioxide levels. Fossil pollen preserved in these cores shows that the Pliocene Arctic was very different from its current state.

Today the Arctic is a treeless plain with only sparse tundra vegetation, such as grasses, sedges and a few flowering plants. In contrast, the Russian sediment cores contained pollen from trees such as larch, spruce, fir and hemlock. This shows that boreal forests, which today end hundreds of miles farther south and west in Russia and at the Arctic Circle in Alaska, once reached all the way to the Arctic Ocean across much of Arctic Russia and North America.

Because the Arctic was much warmer in the Pliocene, the Greenland Ice Sheet did not exist. Small glaciers along Greenland’s mountainous eastern coast were among the few places with year-round ice in the Arctic. The Pliocene Earth had ice only at one end—in Antarctica—and that ice was less extensive and more susceptible to melting. Because the oceans were warmer and there were no large ice sheets in the Northern Hemisphere, sea levels were 30 to 50 feet (9 to 15 meters) higher around the globe than they are today. Coastlines were far inland from their current locations. The areas that are now California’s Central Valley, the Florida Peninsula and the Gulf Coast all were underwater. So was the land where major coastal cities like New York, Miami, Los Angeles, Houston and Seattle stand.

Visualizing warming as elevation demonstrates the disproportionate rate of #ClimateChange change on the #Arctic. After we presented one static perspective, @g_fiske updated this map to underscore Arctic warming as a global issue. Data: KNMI Climate Explorer. pic.twitter.com/nS36zuPhp1

— Woodwell Climate Research Center (@WoodwellClimate) September 30, 2020

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

We humans lack imagination, to the point of not even knowing what tomorrow’s important things will look like.

– Nassim Nicholas Taleb

The opposite of education is not ignorance; it is education in social science.

– Nassim Nicholas Taleb

Support the Automatic Earth in virustime, election time, all the time.