Fenno Jacobs Schoolchildren staging a patriotic demonstration, Southington, CT 1942

What recovery? “The viability of the euro is contingent on the current recovery..”

• Fresh Recession Will Cause Eurozone Collapse, Warns Credit Suisse (Telegraph)

A recession in Europe could lead to the collapse of the eurozone, as the single currency would buckle under the political turmoil unleashed by a fresh downturn, a leading investment bank has warned. In a research note titled “Close to the edge”, economists at Swiss bank Credit Suisse warned the fate of monetary union hangs in the balance if Europe’s policymakers are unable to ward off another global slump and quell anti-euro populism. “The viability of the euro is contingent on the current recovery,” said Peter Foley at Credit Suisse. “If the euro area were to relapse back into recession, it is not clear it would endure.” Although the bloc’s nascent recovery was likely to persist in the coming months, Credit Suisse said there were worrying signs of deterioration emanating from Europe’s economies. These include heightened credit stress in the banking sector and market volatility.

“The near-term outlook for economic activity, as well as the risks around it, has shifted materially downwards,” said the seven-page report. The eurozone’s 19 member states only managed to grow by 0.3pc in the last three months of 2015, despite asset purchases from the European Central Bank and the collapsing price of oil. Unlike the US and UK, the eurozone’s GDP still lags below its pre-financial crisis peak. Italy, the euro’s third largest economy, was stagnant at the end of last year, while Greece has slipped back into recession. Growth in Europe’s dominant economic power Germany has steadied to just 0.3pc. Insipid growth has been coupled with a fresh fall into deflation in February, raising fears the continent is stuck in a low growth trap where it is unable to tackle mounting debts.

This has put pressure on the ECB to devise more stimulatory measures to revive economic fortunes and escalated calls for governments to deploy their fiscal policy tools to support growth. But a failure to fight off recessionary forces would cause “irrevocable damage” to the eurozone six years after the onset of the financial crisis, said Mr Foley. Rising unemployment, falling asset prices, and mounting costs of debt would embolden anti-euro populist forces across the continent, “radicalising” electorates, said the report. Europe’s fragile banks – which have been in the eye of a market storm since the start of the year – could also find themselves at the heart of a new financial crisis as their profitability is squeezed and lending to the economy grounds to a halt. “The capacity for a renewed downturn to push the euro area into a destructive negative economic, political and financial feedback loop is considerable,” added Mr Foley.

The Swiss bank’s warning comes ahead of a crucial meeting of ECB policymakers next week, when they are widely expected to unleash a new round of quantitative easing and interest rate cuts. Benoit Cœuré , executive board member at the ECB, said the central bank’s policy stance could not “become a source of uncertainty” for expectant markets. “In the still fragile environment we face today, what is essential is that policy works to reduce uncertainty,” Mr Cœuré said on Wednesday. He admitted that the ECB’s move into negative interest rates could have adverse effects on the continent’s lenders, hinting policymakers would mitigate the impact of its -0.3pc deposit rate on bank profitability. “We are well aware of this issue. We are monitoring it on a regular basis and we are studying carefully the schemes used in other jurisdictions to mitigate possible adverse consequences for the bank lending channel,” said Mr Cœuré .

Schengen exists in name only anymore.

• “If Schengen Disappears, It Will Never Come Back” (BBG)

The EU has no plan to even temporarily cut Greece out of its passport-free Schengen zone and any suspension of open travel means “it will never come back,” Luxembourg Foreign Minister Jean Asselborn said. With Europe likely to face increased migration from Syria and other conflict zones throughout the next decade, the 28-member bloc must immediately start giving more money, equipment and authority to its Frontex border forces, Asselborn said Wednesday during a visit to Prague. Sealing Greece’s northern borders with Former Yugoslav Republic of Macedonia (FYROM) and unilaterally reinstating border checks within the Schengen area is “not a solution,” he said. Tensions over the handling of the refugee crisis have escalated, with Austria and some eastern EU members pushing for sealing the Greek-FYROM border.

Austria began admitting only a limited number of migrants, triggering a chain reaction of closures in countries to the south that’s stoking fears that Schengen may cease functioning. Political divisions are widening ahead of an extraordinary summit of the EU leaders on March 7 called to take stock of efforts to secure the bloc’s external frontiers. German Chancellor Angela Merkel, who is defending her open-border policy in three regional elections in March, is pushing for EU states to share the burden of redistributing migrants in the face of opposition from countries who have rejected the plan. Some EU members including Slovakia, Hungary and Poland have called for a “Plan B” that would cut Greece out of the Schengen area, pointing to Greece’s inability to secure its Mediterranean shores. “There is no plan B,” Asselborn said. “If Schengen disappears, it will never come back.”

Without earnings, it ain’t much.

• Earnings Downgrades Turning Into Deluge as First Quarter Craters (BBG)

The pace at which earnings estimates are being cut is getting worse, not better. While bulls cling to predictions that profit growth will resume for S&P’s 500 Index companies in 2016, analysts just reduced income estimates for the first quarter at a rate that more than doubled the average pace of deterioration in the last five years. Forecasts plunged by 9.6 percentage points in the last three months, with profits now seen dropping the most since the global financial crisis, data compiled by Bloomberg show. Growing skepticism among analysts is another example of an economic truth, that once corporate income starts to fall across industries, it’s rarely temporary. Most of the downward revisions in projections came in January and February – a clue as to why equities staged their worst selloff to start a year since 2009 and almost $3 trillion was wiped from share prices at the worst point.

“S&P 500 is not immune from the malaise of the global economy and we’re seeing that translated into earnings figures,” said Ethan Anderson, a senior portfolio manager who helps oversee $1.5 billion at Rehmann Financial in Grand Rapids, Michigan. “With the strong dollar, it obviously makes that made-in-U.S.A. look less attractive. Couple that with the weakness that we’re seeing in the global economy, most notably China, some of these estimates had looked fairly rosy.” Once a key support that helped stocks navigate through financial and geopolitical turmoil, earnings have increasingly become a contributor to market volatility along with concerns ranging from the price of oil to the path of interest rates. The decline in corporate profits has worsened every quarter since mid 2015, coinciding with a period where the S&P 500 suffered two corrections after reaching an all-time high in May.

Forecasters see the stretch of profit contractions now lasting 15 months. In the seven times earnings have fallen at least that long since 1970, stocks slipped into a bear market in all but one instance, data compiled by Bloomberg and S&P Dow Jones Indices show. Skepticism is rising over the durability of a bull market approaching its seventh anniversary with valuations based on legendary investor Peter Lynch’s favored measure that now surpass levels seen in the previous two runs. Investors hoping for a quick bounce in earnings to ease the multiple pressure may find little comfort in analysts’ estimates.

“..Greece is quite capable of throwing the EU into crisis, conflict and even chaos, precisely at a time when the utmost solidarity is needed to help out the campaign against Brexit.”

• Negotiating Debt Relief for Greece in the Shadow of the Brexirendum (Howse)

I’ve been saying for some time now that Greek PM Alexis Tsipras is, contrary to conventional wisdom, a shrewd negotiator and tactician. These traits were clearly on display this last week, when Europe’s leaders met to broker a deal on which British Prime Minister David Cameron could base his case for staying in the EU when Brexit gets put to a vote in the UK this June. Tsipras threatened to veto the deal if Greece were not given assurance that it could remain in Schengen for the time being, despite concerns about the control of its border with Turkey during the ongoing refugee crisis. Not surprisingly, given the stakes,Tsipras won. Now let’s turn to Greece’s other crisis. The European institutions are stalling on approving further disbursements to Greece, stretching out the current review of Greece’s implementation of last summer’s bailout memorandum.

Debt relief, a key element in the deal, has also been postponed. In particular, with the complicity of the IMF, Greece has been pushed to make deep across the board cuts in public pensions. Some pensions in Greece are anomalously high, and the responsible minister, George Katrougalos, freely admits that restructuring the pension system and creating a modern, effective social welfare state in Greece is a necessity for economic recovery and good governance. But with sky-high unemployment and falling wages, for many, pensions have become a de facto safety net; whole families are living from the income of a single pensioner. In these circumstances, the kind of indiscriminate slashing that the institutions want would inflict extreme and unjustifiable human hardship. It is difficult to know what is behind the unreasonableness in dealing with Greece on this issue.

Is it just the usual Germanic pious cruelty, or is it a strategy to try to bring down the Tsipras government in the hope of being able to deal with a more pliable, conservative new regime? Recently, the IMF’s point man on Greece, Poul Thomsen, publicly defended the hard line on pensions, on the basis that this is the only way that Greece can meet its budgetary targets that are necessary for restoring debt sustainability. But Thomsen made a key admission, perhaps unwittingly: debt relief, he suggested, could have the same effect on sustainability as would slashing pensions. He thus essentially told the Greeks to their face that further hardship was being forced on them, not because of any deep economic logic, but just because the needed amount of debt relief was not forthcoming.

The current line in the mainstream financial press is that Tsipras has no real cards he can play to resist the demands of the institutions on pensions. I think that’s wrong. If the institutions won’t be reasonable and moderate their demands, he can always blow up the third programme and default on Greece’s official debt to Europe; one way to do that would be to draw up a final offer on pensions and related reforms, and put it to the people in a new referendum that if Europe doesn’t accept that offer, Greece should default. Now, you say, isn’t that exactly the “nuclear” option that Tsipras backed off from last summer, for fear of utter economic and social catastrophe in Greece, despite then winning a mandate for it by referendum? True enough, but certain things have changed since. Back then, it became painfully clear very quickly that Greece’s banking system would have collapsed had it been cut off from further support from Europe in the wake of default.

Now the banks have been recapitalized; and the problem of marginal,failing banks addressed by restructuring and consolidation. Secondly, Greece has, shrewdly, built a new friendship with Israel; Netanyahu, ever the savvy politician, sees the value of having a country in the Mediterranean amenable to Israel’s interests and point of view (and there are the mutual gains of cooperation on offshore gas as well). Israel may well have made some kind of promise to Greece to function as a lender of last resort if things get bad. But, most importantly, there is the looming referendum on Brexit (I call it Brexirendum for convenience). By defaulting but keeping the Euro, and perhaps also threatening non-cooperation on refugees, Greece is quite capable of throwing the EU into crisis, conflict and even chaos, precisely at a time when the utmost solidarity is needed to help out the campaign against Brexit.

“The German proposals are “pure folly,” and would amount to Italy “hitting itself over the head with a hammer..”

• German Demand To Cap Banks’ Sovereign Debt Throws Italy Under The Bus (BBG)

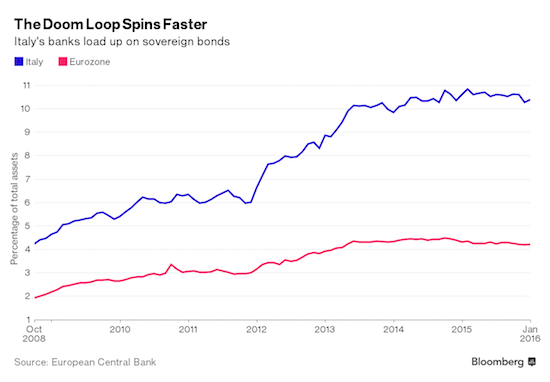

A drive to tighten rules over how much sovereign debt banks are allowed to own has raised the alarm in the home of the euro region’s largest bond market. Italy’s prime minister, Matteo Renzi, vowed last month to veto any attempt to cap holdings, putting him at odds with Germany. Italian government securities account for 10.4% of the country’s bank assets, the most among major European economies and compared with 3.2% in Germany, the latest ECB figures show. A limit would mean “altering the balance of the Italian banking system,” said Francesco Boccia, a lawmaker from Renzi’s Democratic Party who heads the budget committee in Italy’s lower house of parliament. “Banks are already struggling to lend money to small- and medium-sized companies,” he said. “This would be the final blow.”

In essence, the euro region’s biggest debtor is on a collision course with its biggest paymaster over how to fix the failures of the past. Having financial institutions willing to finance the government is vital to most countries, but especially in Italy. The country has outstanding debt of €2.17 trillion ($2.36 trillion), more than anywhere else in Europe. It amounts to 133% of its economic output, the largest ratio except for Greece. The problem in Berlin is that it highlights Europe’s “doom loop,” the too-tight connection between sovereigns and their lenders that fueled the debt crisis and landed Germany with the biggest bill. Chancellor Angela Merkel’s government has been leading the campaign to tackle the practice of banks treating the debt as risk-free.

Germany has resisted moving toward closer financial ties, including initiatives such as a common euro-area deposit insurance system, until progress is made on reducing risk. Among Germany’s proposals was an an automatic maturity extension for bonds of nations that apply for aid from the European Stability Mechanism crisis fund. Another possibility is a 25% limit on the sovereign bonds some banks can hold risk-free as a share of eligible capital, according to two people with knowledge of the deliberations. The German proposals are “pure folly,” and would amount to Italy “hitting itself over the head with a hammer,” said Mario Baldassarri, chairman of the Economia Reale think-tank and a former head of the Italian Senate’s finance committee.

“And when Germany falls, and it will, that’s when the panic begins to set in.”

• Germany Is The New PiiG (BI)

This is as good as it gets for Germany and Europe. Previously, it was the debt of the eurozone’s peripheral countries that was of concern to the markets. But in an interview with Business Insider, Geopolitical Futures founder George Friedman proclaimed that Europe now has a much bigger problem: Germany. And at the heart of the looming issue for Germany and Europe is the Italian banking system. “[Problems in Italian banks are] going to spill over into the Netherlands, it’s going to spill over into Germany,” Friedman said. “Germany is the new PIIG. Germany depends on exports and its markets are drying up.” The PIIGS economies — Portugal, Italy, Ireland, Greece, and Spain — were the main concerns during the European debt crisis of 2011 and 2012.

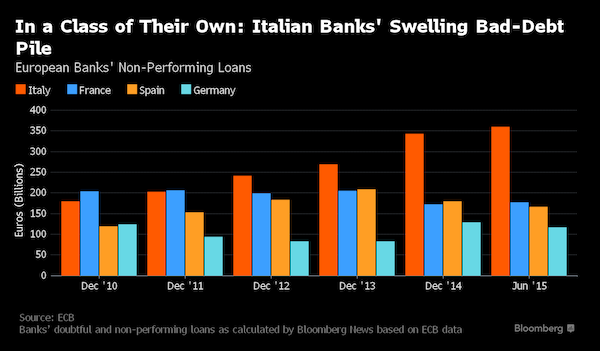

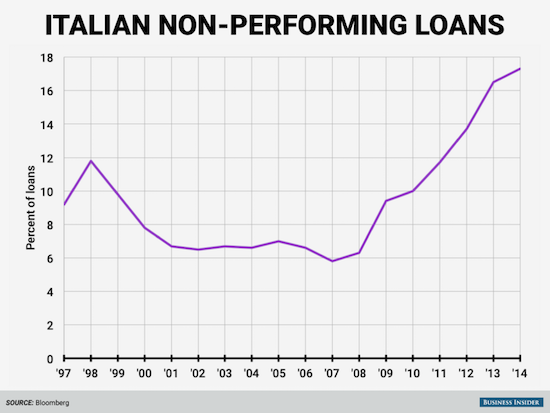

And with those crises seemingly having passed and Europe moving back towards a path to economic stability, Germany has been a big winner with its economy as strong as its been since re-unification and an unemployment rate down to 4.5%. Germany has, however, been running a structural trade surplus underpinned by a weak euro with its trade surplus hitting a record $23.9 billion in June. And Friedman thinks Germany’s export well is about to run dry. Friedman believes that the problems in the Italian banking system are going to take Germany — the strongest economy in the eurozone — down with it. Data released in late-2015 showed non-performing loans at Italian banks totaled €300 billion, 17.3% of outstanding loans.

That is a massive number considering the average for the euro zone is 6.8%, and Germany’s NPL’s are at just 2.3%. According to Friedman, this is a big deal because Italy is the 4th largest economy in Europe and the 8th largest economy in the world. Italy’s home to the largest banking system in Eastern Europe and there’s a lot of inter-connectivity in play. For example, Germany’s largest bank, Deutsche Bank, has an enormous amount of exposure to Italy, and so does the rest of Europe. Ultimately Friedman thinks it will be Germany that has to save Italy. And that will cost a lot of money. “It’s not the PIIGS one should worry about,” Friedman said. “Germany hasn’t even begun falling yet. And when Germany falls, and it will, that’s when the panic begins to set in.”

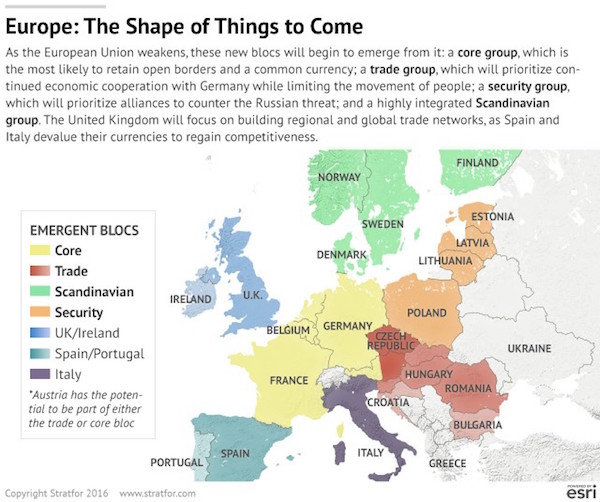

Not a big fan of Stratfor, but some things to think about here: “Perhaps the most likely scenario at this point would be for the EU to survive as a ghost of its former self, with its laws ignored..”

• Europe Without the Union (Startfor)

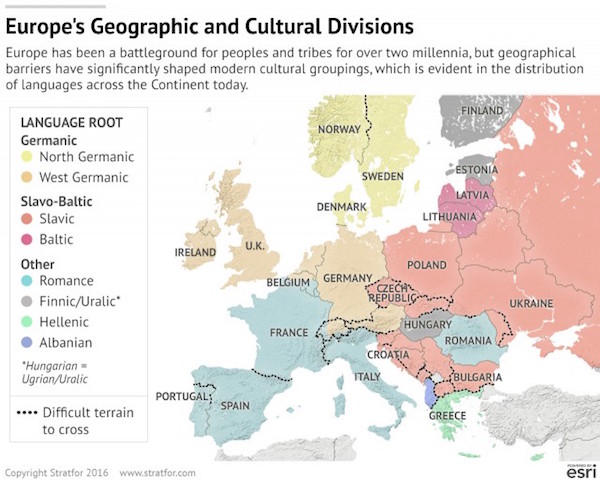

The European project was always bound to fail. Europe is a continent riven by geographic barriers. It has spent two millennia not only indulging in massive and constant internal wars, but also keeping written records of them, informing each generation of all the times their forebears were wronged. Over the centuries, great empires have risen and fallen, leaving behind distinct groups of people with different histories, languages and cultures. Any project attempting to fuse these disparate cultures into one monolithic state over the course of just 70 years was by its very nature doomed. It would inevitably encounter insurmountable levels of nationalistic resistance, and eventually the project would stall. That is the point at which we now find ourselves.

Crises abound, and though they all have different facades, each stems from the same underlying issue: Citizens ultimately prize their national and regional identities over the supranational dream. The sovereign debt crisis and repeating Grexit scares, born of the introduction of the euro in 1999, have exposed Northern Europe’s unwillingness to subsidize the south. The Brexit referendum, scheduled for June, can trace its roots to the 2004 enlargement of the EU, and the ensuing wave of Polish migration to the United Kingdom. Meanwhile, amid the ongoing immigration crisis, national leaders are appeasing their populations by bypassing European rules and re-erecting border controls to stem the flow of refugees across their territory. In all of these situations, the same factors are at work: The driving forces within Europe are national in nature, and countries will ultimately put their own interests first.

Today’s problems were both predictable and predicted. The next step, however, is harder to foresee. Having identified a system’s inherent flaw, one can very well state that it is unsustainable, but unfortunately the flaw provides no guide as to the exact circumstances of the system’s end. There are still many different ways that the demise of the European Union’s current form could come about. For example, the project could unravel via market forces, as it nearly did in 2012 when investors tested the commitment of the core to save the periphery and found it to be (barely) willing to do so. Or a disaffected populace could elect a nationalist party such as France’s National Front, which could either lead the country out of the EU or make the bloc so unmanageable that it ceases to function. Perhaps the most likely scenario at this point would be for the EU to survive as a ghost of its former self, with its laws ignored and stripped back to the extent that it holds only a loose grip on its members.

The exact circumstances of the European project’s end are not yet clear, but there are certain fixed, underlying truths that are sure to outlast the EU’s current form. With them, a forecast can still be made of the shape of things to come. These fundamental realities stem from deeper, unchanging forces that will bring countries together according to their most basic goals; they are the same forces that limited the European project’s lifespan in the first place. By looking at these underlying factors, one can predict which countries will emerge from a weakened or collapsed EU with close ties, and which are likely to drift apart in pursuit of their own interests once they are freed from the binding force of the EU and its integrationist ideals.

“..leaving a valley of brutal murder, protests, anger, suicide and regret.”

• Death and Despair in China’s Rustbelt (BBG)

In a snow-covered valley in northeast China, an hour from the North Korean border, a street with brightly-painted apartment blocks hides a story of fear and anger as dangerous to the country as its rollercoaster stock market or sliding currency. The frozen alluvial river plain that was once at the forefront of the Communist Party’s first attempt to build a modern economy, has now fallen behind, leaving a valley of brutal murder, protests, anger, suicide and regret. This is the city of Tonghua in China’s rustbelt, where a desperate handful of steelworkers has gathered each week outside the management office of their mill in freezing temperatures to demand months of wages they say they’re owed. The answer, according to interviews with workers and residents, is always the same: there is no money.

This is the last vestige of protests that once drew thousands, and which, one fateful day nearly seven years ago, ended with a manager being beaten to death. Since then, the city’s once-vaunted state-run steel mills have slipped inexorably into decline, weighed down by slumping global markets, a changing economy, and the burden of costs and responsibilities to the people of the town they fostered. Tonghua’s story is repeated across the country, where state-owned enterprises that were the bedrock of China’s industrial development have become its biggest burdens. Typically overstaffed, inefficient and heavily indebted, they offer President Xi Jinping a stark warning of what the country could face if the millions of workers who depend on these lumbering corporations should get thrown out of work with nothing to fall back on. Uprisings have started from less in China.

The country’s leaders have vowed to reduce excess industrial capacity and labor in state enterprises even as they battle the slowest economic growth in a quarter of a century. China will eliminate up to 150 million metric tons of steel-making capacity in the next five years, the State Council said after a Jan. 22 meeting. The council, China’s cabinet, said it will achieve the target through mergers and acquisitions, relocation or converting some plants to other industries. It pledged to set up special funds to subsidize companies and laid-off workers during the change, and to help lenders write down bad debts. “The market has forced our hands,” said the official Xinhua News Agency in a Jan. 24 commentary. “Local governments and companies will bear the main responsibility, while the central government will help.”

The real numbers: “..GDP in dollars, unadjusted for price changes, rose just 4.25% in the fourth quarter of 2015..”

• China’s Other Growth Figure Is Flashing a Warning (BBG)

Obscured by the focus on the accuracy of China’s growth figures is a tumble in estimates for the economy without adjusting for inflation – a slide that gives a clearer picture of why the country’s slowdown has stoked rising concern about its debt burden. GDP in dollars, unadjusted for price changes, rose just 4.25% in the fourth quarter of 2015 compared with the same period of 2014 – a gain of $439 billion. Just two years before, China added $1.1 trillion to the global economy, expanding 13% from a year earlier. “Looked at in this way, financial markets reaction to deteriorating Chinese data is more understandable,” said Arthur Kroeber at research firm Gavekal Dragonomics in Hong Kong. Weakening nominal growth makes debt servicing harder, forming the backdrop for moves this week by Moody’s Investors Service to lower its outlook on China’s credit rating and HSBC to cut its recommendations on the country’s big banks.

With Premier Li Keqiang’s cabinet having eased a deleveraging drive last year, investors will get fresh insights into the Communist leadership’s priorities at a gathering of the national legislature starting Saturday. Along with economic targets for 2016, officials will discuss the party’s new five-year plan. While in yuan terms the slowdown is more gradual, the decline in nominal GDP gains is still dramatic – to a 6.4% pace at the end of 2015 compared with 10.1% back in 2013 and in excess of 18% in 2010 and 2011. The slide highlights the need to follow through on slashing excess industrial capacity, eliminating unprofitable enterprises and revving up new drivers of expansion.

“The biggest problem with plunging nominal GDP growth is that the cash-flow growth to the corporate sector has declined at a time when growth in its debt servicing has accelerated,” said Victor Shih, a professor at the University of California at San Diego who studies China’s politics and finance. “Because debt is so much larger than the economy, debt servicing each year will still be two to three times the incremental growth of nominal GDP.” China’s debt-to-GDP ratio surged to 247% last year from 166% in 2007, propelled by a lending binge in the aftermath of the global financial crisis. Days before the National People’s Congress, the central bank this week lowered the ratio of deposits major banks must hold in reserve, letting them deploy more in lending.

To be honest, Osborne was funny too: “Varoufakis was recruited because Chairman Mao was dead and Mickey Mouse was busy.”

• George Osborne Has ‘Foot In Mouth’ Disease: Varoufakis (CNBC)

Yanis Varoufakis, the former Greek finance minister, has said that the U.K. finance minister has got a bad case of “foot in mouth disease” and is doing himself no favors by mocking him in parliament. On Wednesday, the U.K.’s Chancellor George Osborne ridiculed a report saying that Varoufakis was advising the opposition Labour party, telling the House of Commons that “Varoufakis was recruited because Chairman Mao was dead and Mickey Mouse was busy.” Responding to the slur, Yanis Varoufakis told CNBC that he was intrigued that George Osborne had “this foot in mouth disease.” “So when George Osborne comes out and pokes fun at me, obviously trying to luxuriate in the fact that I’m a defeated finance minister, yes, I am a defeated finance minister but in the hands of whom? Of an iron-clad European Union that decided to asphyxiate us using bank closures in order to impose upon us another extend and pretend bailout. The British people know that.”

“Does George Osborne really seriously believe that by mocking me he is doing himself any favors in his intellectual class?…I don’t think he is doing himself any intellectual favors.” “He seems unable to prevent own goals being scored all the time,” he added. Varoufakis said he was supporting the campaign for Britain to stay in the European Union (EU) but that he had been impressed with the “leave” arguments put forward by conservative politicians Boris Johnson and Michael Gove. They had, he said, “sounder intellectual ideas” than Osborne.

Earlier in the week it emerged that the Greek Marxist economist was going to advise the U.K.’s Labour party “in some capacity,” according to Labour leader Jeremy Corbyn. Varoufakis told CNBC that there was no formal contract and that he was “talking to everybody” including Caroline Lucas from the Green party and former Conservative Chancellor Normal Lamont. Talking to each other, he said, would help find common ground and a “common program to stop this slide into the abyss” in Europe. Asked whether he was receiving any money from the Labour party, he said: “Of course not. I have no such contract with anyone, let alone Jeremy Corbyn and the Labour party.”

“..pluto-populism”: the marriage of plutocracy with rightwing populism..”

• Donald Trump Embodies How Great Republics Meet Their End (Wolf)

What is one to make of the rise of Donald Trump? It is natural to think of comparisons with populist demagogues past and present. It is natural, too, to ask why the Republican party might choose a narcissistic bully as its candidate for president. But this is not just about a party, but about a great country. The US is the greatest republic since Rome, the bastion of democracy, the guarantor of the liberal global order. It would be a global disaster if Mr Trump were to become president. Even if he fails, he has rendered the unthinkable sayable. Mr Trump is a promoter of paranoid fantasies, a xenophobe and an ignoramus. His business consists of the erection of ugly monuments to his own vanity. He has no experience of political office. Some compare him to Latin American populists.

He might also be considered an American Silvio Berlusconi, albeit without the charm or business acumen. But Mr Berlusconi, unlike Mr Trump, never threatened to round up and expel millions of people. Mr Trump is grossly unqualified for the world’s most important political office. Yet, as Robert Kagan, a neoconservative intellectual, argues in The Washington Post, Mr Trump is also “the GOP’s Frankenstein monster”. He is, says Mr Kagan, the monstrous result of the party’s “wild obstructionism”, its demonisation of political institutions, its flirtation with bigotry and its “racially tinged derangement syndrome” over President Barack Obama. He continues: “We are supposed to believe that Trump’s legion of ‘angry’ people are angry about wage stagnation. No, they are angry about all the things Republicans have told them to be angry about these past seven-and-a-half years”.

Mr Kagan is right, but does not go far enough. This is not about the last seven-and-a-half years. These attitudes were to be seen in the 1990s, with the impeachment of President Bill Clinton. Indeed, they go back all the way to the party’s opportunistic response to the civil rights movement in the 1960s. Alas, they have become worse, not better, with time. Why has this happened? The answer is that this is how a wealthy donor class, dedicated to the aims of slashing taxes and shrinking the state, obtained the footsoldiers and voters it required. This, then, is “pluto-populism”: the marriage of plutocracy with rightwing populism. Mr Trump embodies this union. But he has done so by partially dumping the free-market, low tax, shrunken government aims of the party establishment, to which his financially dependent rivals remain wedded. That gives him an apparently insuperable advantage. Mr Trump is no conservative, elite conservatives complain. Precisely. That is also true of the party’s base.

A curious attempt to deny there’s a crisis in the first place. No, we’re ‘transitioning to a digital economy’, or something..

• Global Trade: Structural Shifts (FT)

The Port of Charleston spent most of the early 2000s enjoying double-digit growth as an accelerating wave of globalisation — fuelled by a rising China and a US consumer boom — brought robust volumes of cargo into the seaport. But those days are long gone. Jim Newsome, chief executive of the South Carolina Ports Authority, says he would be happy with 3% growth in Charleston this year, a goal he concedes may be too ambitious. In January, container traffic at the port fell 5.1% versus the same month of 2015, and the strong dollar is causing problems for US exporters. “Most of the exporters that I talk to are just not doing the same business that they were a year ago,” he says. The story is repeated and amplified far beyond Charleston.

Last year saw the biggest collapse in the value of goods traded around the world since 2009 – when the impact of the global financial crisis was at its worst. Major ports such as Hamburg and Singapore have also reported slowing growth and even declining volumes. Barring a spectacular turnround in the global economy, the subpar performance is likely to be repeated in 2016, making it the fifth straight year of lacklustre growth in global trade, a pattern not seen since the doldrums of the 1970s. “It has been a very long time since trade .. has grown this weakly”, says Robert Koopman, chief economist at the WTO. Much of this recent feeble performance is down to the economic slowdown in China and the knock-on effect that its declining appetite for commodities has had on other emerging markets.

An anaemic recovery in Europe adds to the headwinds hitting global commerce. While these factors explain part of the weakness in global trade, some say there are even bigger factors at work. A growing number of economists argue that the slowdown is not merely cyclical, but a sign that the forces that have driven globalisation for decades are beginning to shift. The first big transition is China’s attempt to rebalance from a manufacturing and export-led economy towards one focused on domestic consumption. And some economists note that the plateau in worldwide trade in goods and capital has coincided with a surge in data flows — an indicator, they say, that the digital economy of the 21st century is starting to overturn the old order.

One of my favorite people on the planet.

• In ‘Half Earth,’ E.O. Wilson Calls for a Grand Retreat (NY Times)

Why publish this book now? Because a lifetime of research has magnified my perception that we are in a crisis with reference to the living part of the environment.We now have enough measurements of extinction rates and the likely rate in the future to know that it is approaching a thousand times the baseline of what existed before humanity came along.

Reading your book, one senses you felt a great urgency to write it? The urgency was twofold. First, it’s only been within the last decade that a full picture of the crisis in biodiversity has emerged. The second factor was my age. I’m 86. I had a mild stroke a couple of years ago. I thought, “Say this now or never.” And what I say is that to save biodiversity, we need to set aside about half the earth’s surface as a natural reserve. I’m not suggesting we have one hemisphere for humans and the other for the rest of life. I’m talking about allocating up to one half of the surface of the land and the sea as a preserve for remaining flora and fauna.

In a rapidly developing world, where would such a reserve be? Large parts of nature are still intact — the Amazon region, the Congo Basin, New Guinea. There are also patches of the industrialized world where nature could be restored and strung together to create corridors for wildlife. In the oceans, we need to stop fishing in the open sea and let life there recover. The open sea is fished down to 2% of what it once was. If we halted those fisheries, marine life would increase rapidly. The oceans are part of that 50%. Now, this proposal does not mean moving anybody out. It means creating something equivalent to the U.N.’s World Heritage sites that could be regarded as the priceless assets of humanity. That’s why I’ve made so bold a step as to offer this maxim: Do no further harm to the rest of life. If we can agree on that, everything else will follow. It’s actually going to be a lot easier than people think.

Why? Because many problems of human occupancy that we once thought of as insoluble are taking care of themselves. Demographers tell us that the human population could stabilize at about 10 or 11 billion by the end of the century. High tech is producing new products and ways of living that are congenial to setting side more space for the rest of life. Instrumentation is getting smaller, using less material and energy. Moreover, the international discourse is changing. I’m very encouraged by the Paris Climate Accords. I was excited to see at the time of the Paris meeting that a consortium of influential business leaders concluded that the world should go for net zero carbon emissions. Towards that end, they recommended we protect the forests we have and restore the damaged ones. That’s consistent with the “Half Earth” idea.

It’s not just the war.

• Syria Drought ‘Likely Worst In 900 Years’ (Guardian)

The relentless flow of refugees from the Middle East into Europe continues to raise tensions across the region. This weekend, fires ignited at a refugee camp in Calais, France, and countries are beginning to tighten their borders as more than 1 million people have streamed into Europe in the past year. The 1 million refugees represent just a portion of the 4.2 million that have fled Syria in all directions. And that’s on top of the 7.6 million people internally displaced in Syria who are trapped in limbo in their home country. War has been the direct driver of the refugee flux and behind that is a complex mix of social and political factors both inside and outside the region. One fiercely studied and debated driver has been a recent dip into a series of severe droughts starting in the late 1990s.

Previous work has prescribed some of the drought — and its impact on the socioeconomic fabric in the Middle East — to climate change. New findings published in the Journal of Geophysical Research-Atmospheres put it in even starker context, showing that the drought is likely the worst to affect the region in 900 years. The Mediterranean as a whole has been subject to widespread drought at various points in the past 20 years. Climate models project that the region is likely to get drier in the future, which Ben Cook, a climate scientist at the NASA Goddard Institute for Space Studies, said drove the new line of inquiry. “These recent drought events have motivated a lot of concern that this could be an indication of climate change, with the eastern Mediterranean and Syrian droughts being the most obvious,” Cook said.

Using tree ring data that covered 900 years of drought history, Cook led a team of researchers to look at drought across different regions in the Mediterranean. Dry spells in parts of the western Mediterranean have been severe but still within the range of natural variability over that 900-year span. What stands out is the drought in the eastern Mediterranean, which includes war-torn Syria. Drought has had a firm grip on the region since 1998 and Cook’s findings show that the recent bone-dry spell is likely the driest period on record in 900 years and almost certainly the worst drought in 500 years. In either case, it’s well outside the norm of natural variability indicating that a climate change signal is likely emerging in the region.

“This is a really important study that increases our understanding of low frequency (decadal to multidecadal) natural variability over the past 900 years and provides strong evidence that the severity of the recent drying in the eastern Mediterranean/Levant is human induced,” Colin Kelley, a drought expert who authored previous research on the region, said.

Interesting angle. Officially, Albania’s borders are shut. But they’re not.

• Albania’s Crucial Role In The Refugee Crisis (Venetis)

With the border between Greece and the Former Yugoslav Republic of Macedonia (FYROM) closed, Greece appears to be isolated from the neighborhood and the European mainland. While the problems are growing, the government of Prime Minister Alexis Tsipras trying to improvise a solution and Brussels still looking, Greece seems again favored by geography. Among Greece’s long Greek borders with its Balkan neighbors, only the Greek-Albanian one cannot be controlled because it is mountainous and with a large number of accessible paths. Therefore, the government of Edi Rama may verbally express its opposition to the possibility of migration flows going through Albania but it is impossible to implement such a decision. The reasons are obvious. Nobody can stop the peaceful determination of populations to move.

Given Skopje’s policy of closed borders and the willingness of immigrants to move northwards, as well the failure of each transit country to provide them with the basics for a temporary stay, it should be viewed as certain that in the coming days and weeks, with the arrival of spring, the migrants now trapped in Greece will head towards the border with Albania. What will happen then? Albania will try to stop this flow through the Greek border stations of Krystalopigi, Mertziani and Kakavia – but in vain. No wall can be erected on uneven terrain. Parallel paths are not patrolled because they are numerous, anomalous and extensive. Therefore, the Albanian authorities will not be able to stop the flows peacefully. Albanians know this and although the prime minister has expressed his opposition, he has already ordered the construction of two reception centers for a total of 10,000 immigrants in Korce and Gjirokaster.

Such a development would essentially mean the cancellation of the Austrian refugee policy in the Balkans because immigrants will be able to access the FYROM territories and Kosovo from Albania and therefore to move northwards to Serbia, Montenegro and Bosnia. Additionally, the problem will be internationalized once more and put more pressure on Brussels to find an effective solution. Austria is expected to attempt to erect a new wall to the north, but to no avail, because the problem will be shared not only by Greece but the whole of the Balkans. The Albanian corridor can give Greece a chance to gain some time in dealing with the influx from Turkey, to relieve the Greek-FYROM border and to provide the EU with a final opportunity to prove that it is a union of friends and not enemies.

That’s been my point all along, and it’s too late already: “..you cannot buy back the lost dignity of the European Union..”

• Greece Risks Being ‘Concentration Camp’ For Refugees: Varoufakis (CNBC)

The refugee crisis is a “manifestation of the disintegration of the European Union,” Greece’s controversial former finance minister told CNBC on Thursday, as he warned against Turkey and Greece becoming a “large concentration camp for hapless refugees.” Yanis Varoufakis, who served as finance minister in 2015 under the ruling left-wing Syriza party, said Europe was “rich enough” to cope with the influx of refugees who have flooded to Europe in the wake of the turmoil in Syria. “The EU should be a proper union with borders, which we control in a humane way. When somebody knocks on your door and they’ve been shot at, they have kids that are dying or thirsty or hungry, you just open your door to them,” he told CNBC at the Global Financial Markets Forum in Abu Dhabi.

According to the UN, 131,724 refugees and migrants made the risky journey across the Mediterranean Sea during January and February. The large majority of these people, 122,637, landed in Greece. The EU, of which Greece is a member, has struggled to agree to a strategy to deal with the waves of people, particularly in the wake of terrorist attacks from the group that calls itself the “Islamic State.” However, on Wednesday, the EU launched a €700 million fund to help Greece cope with the crisis. “The fact that we are now spending some money on refugees is a good thing, but you cannot buy back the lost dignity of the European Union,” Varoufakis told CNBC.

“I don’t have an income but I have a child,” she said before handing out another balloon, while her sister distributed milk.”

• Austerity-Hit Greeks Help Refugees With Food, Toys, Time (Reuters)

Three Syrian children holding balloons follow Constantina Tsouklidou who is handing out toys and food to refugees sheltering by the hundreds in a ferry passenger terminal at the Greek port of Piraeus. “I don’t have an income but I have a child,” she said before handing out another balloon, while her sister distributed milk. Tsouklidou, 50, is one of thousands of Greeks volunteering their time to assist refugees and migrants stranded in Greece. She is also one of the legions of Greece’s unemployed. Greece, whose economy was struggling even before Europe’s migrant crisis and which has received more than 240 billion euros since its first international bailout in 2010, is in its eighth year of recession. More than a million people are unemployed, according to statistics agency ELSTAT, which put the latest jobless rate at 24.6%.

“Half of the Greek population has to a smaller or bigger extent assisted refugees. We are not like central Europe,” Tsouklidou told Reuters, referring to border closures through the Balkans. At least 25,000 people were stranded in Greece on Tuesday, their journey to wealthier central and northern European nations blocked by the failure of European nations to agree a common policy to deal with one of the worst humanitarian crises in decades. Austria and countries along the Balkans migration route have imposed restrictions on their borders, limiting the numbers able to cross. Many of the migrants hope to reach Germany. Macedonian police fired tear gas to disperse hundreds of migrants who stormed the border from Greece on Monday. “I am worried about what will happen if people keep coming in and the borders remain closed,” said Kyriakos Sarantidis, 65, who donates time cooking for refugees from a minivan parked at Pireaus port.

Greece’s migration minister said on Sunday the number of migrants trapped in Greece could reach up to 70,000 in coming weeks if the borders remain sealed, as refugees fleeing war and poverty in the Middle East and North Africa continue to arrive in Greece, mainly on small boats from Turkey. At Victoria Square, a downtrodden area of central Athens where many homeless refugees have converged, Greeks turned up in droves with bags of food, fruit and medicine after seeing images on television of families sleeping in the open, on cardboard boxes, on chilly winter nights. Eleftheria Baltatzi, a 73-year-old pensioner, was one of the many people who saw images of sick children on television and turned up at the square with medicine and food. “I made toasted cheese sandwiches,” she said. “We also have people who are hungry and need help, but these people have a bigger need.”

No longer a transit nation.

• Greece Prepares To Help Up To 150,000 Stranded Refugees (AP)

Greece conceded Wednesday it is making long-term preparations to help as many as 150,000 stranded migrants as international pressure on Balkan countries saw Macedonia open its border briefly for just a few hundred refugees. “In my opinion, we have to consider the border closed,” Greek Migration Minister Ioannis Mouzalas said. “And for as long as the border crossing is closed, and until the European relocation and resettlement system is up and running, these people will stay in our country for some time.” At the moment, some 30,000 refugees and other migrants are stranded in Greece, with 10,000 at the Idomeni border crossing to Macedonia. On Wednesday, hundreds of more people, including many families with small children, continued to arrive at two official camps by the border that are so full that thousands have set up tents in surrounding fields.

Greek police helped one man who fainted after being turned back by Macedonian authorities. Others waited stoically for rain covers, or food and other essentials in chilling temperatures [..] Mouzalas, the migration minister, met for several hours with mayors from across Greece, examining ways to ramp up shelter capacity. The ministers of health and education also held emergency talks to provide health care and basic schooling for children, who make up about a third of arrivals in Greece. Nikos Kotzias, the foreign minister, said the country could handle a capacity of up to 150,000. “No one in Europe predicted this problem would reach such a giant scale,” Kotzias told private Skai television. “But this is not a cause for panic. The problems must be addressed soberly.”

Macedonia intermittently opened the border Wednesday, letting hundreds of people in, as European Council President Donald Tusk arrived in the country as part of a tour of the region for talks on the migration crisis. Tusk, who is due to travel onto Greece and Turkey Thursday, is hoping to ease tension among European Union leaders — notably neighbors Austria and Germany — before they hold a summit on migration on Monday with Turkey. “We must urgently mobilize the EU and all member states to help address the humanitarian situation of migrants in Greece and along the western Balkan route,” he said. Greece has asked for €480 million in emergency aid from the EUto deal with the crisis. EU Humanitarian Aid Commissioner Christos Stylianides said he wants to swiftly push through a proposal to earmark €700 million in aid for the refugee crisis, with €300 million paid out this year.