Pablo Picasso Woman with blue collar (Portrait d’Inez) 1941

— Jack Poso 🇺🇸 (@JackPosobiec) July 1, 2025

Miller census

🚨 BREAKING: The White House is currently working on ways to EXCLUDE illegal aliens from the US census, per Stephen Miller

This would take away SEVERAL House seats from places like California, as seats are determined by population

GET IT DONE! No illegals in the census! 🇺🇸 pic.twitter.com/3xlv9zwRbG

— Nick Sortor (@nicksortor) June 30, 2025

RFK

RFK Jr. just told Tucker Carlson that 2.7% of vaccines given — 1 in every 37 doses — may cause injury.

The CDC buried the study that uncovered it.

“The problem with VAERS is that it’s voluntary.”

“It takes a doctor a half an hour to fill out the paperwork, so there’s a big… pic.twitter.com/cKkJKltFXb

— End Tribalism in Politics (@EndTribalism) June 30, 2025

j6

A federal judge has officially approved a class-action lawsuit against Nancy Pelosi.

Over 500 J6 patriots are now united — seeking $350 million in damages for what they claim was a coordinated setup.

According to the lawsuit, Pelosi orchestrated the entire event… luring… pic.twitter.com/nmqHPhdiod

— QThestorm (@17QStorm) June 30, 2025

Cameras caught the truth. We all watched the horror!! pic.twitter.com/hTDfQIYjP8

— GABRIEL™ 🪽 (@TheGabriel72) June 30, 2025

Candace

Candace Owens says she got a personal call from President Trump urging her to stop talking about Brigitte Macron.

According to Owens, Trump told her he had seen Brigitte up close and was convinced “she looked like a woman.”

He claimed Emmanuel Macron was stalling peace talks… pic.twitter.com/MnDaQI7P2O

— Shadow of Ezra (@ShadowofEzra) July 1, 2025

Fraud

FBI & DOJ TAKEDOWN LARGEST HEALTH CARE FRAUD SCHEME IN U.S. HISTORY WHILE DEMOCRATS CHANGE 236-YEAR-OLD LAW TO KEEP ILLEGALS ON MEDICAID. Matthew Galeotti, head of the Criminal Division at the Department of Justice, said approximately $14.6 billion was submitted in false claims… pic.twitter.com/vBO5fqXjTG

— The SCIF (@TheIntelSCIF) July 1, 2025

Ritter’s Rant 017: The Blame Game

“We’re just extending current tax policy,” he said. “We are preventing a $4 trillion tax increase on the American people. When you vote against this, that’s who you’d be voting for.”

• Senate Passes the ‘One Big, Beautiful Bill’-With 3 GOP Defections (Margolis)

After days of gridlock and backroom wrangling, the Senate today passed the “One Big, Beautiful Bill,’ the legislative linchpin of President Trump’s second-term agenda. The tally was 51 yeas and 50 nays, with Vice President JD Vance casting the tiebreaking vote. The Senate was locked in a “vote-a-rama”—a procedural endurance test where senators burn the midnight oil, lobbing amendment after amendment in a desperate bid to tweak, torpedo, or salvage the bill. With a razor-thin majority, Republicans could not afford more than three defections, which is why Vice President JD Vance was summoned to the Capitol to cast the tie-breaking vote. Vance has already played this role before, and it’s clear the White House was counting on him to drag this bill across the finish line.

The real drama, however, wasn’t coming from Democrats—they were united in opposition, as always—but from within the GOP ranks. Senators like Lisa Murkowski and Susan Collins became the focal points of intense lobbying, their votes courted with a mix of sweeteners and veiled threats. In the end, Murkowski voted for the bill; Collins voted against it, along with Sens. Thom Tillis and Rand Paul. Naturally, Democrats were panicking, posting apocalyptic predictions on social media. On Monday, Senate Majority Leader John Thune blasted Democrats for what he called a “mind-blowing” display of hypocrisy over the national debt, accusing them of pretending to care about fiscal responsibility now that Republicans are in charge.

“It is rich to hear Democrats all of a sudden concerned about debt and deficits,” Thune said on the Senate floor, as lawmakers debated President Trump’s “One Big, Beautiful Bill.” “Really? I mean, I’ve been here a long time, and I’ve not been involved in a single spending debate in which Republicans [weren’t] trying to spend less and Democrats [weren’t] trying to spend more—except when it comes to national security. Democrats are always willing to cut defense, but never want to cut anywhere else.” Thune reminded the chamber that Democrats had full control of Congress and the White House just a few years ago and used reconciliation not to cut deficits, but to push through massive spending packages.

“One of the bills cost $2 trillion. The other cost $1 trillion. And it was all spending,” he said. “That’s the fundamental difference between us. Democrats like government—and when you send money to Washington, money is power.” Thune contrasted that with the GOP’s effort to stop a looming tax hike. “We’re just extending current tax policy,” he said. “We are preventing a $4 trillion tax increase on the American people. When you vote against this, that’s who you’d be voting for.” The bill now heads to the House.

Massie

Is this bill just big beautiful bullshit? pic.twitter.com/cURThlzkqS

— Theo Von (@TheoVon) July 1, 2025

Has he offered to repay the $400 million Musk paid into his campaign?

• Trump Says DOGE Should Investigate Musk (RT)

US President Donald Trump has suggested that Elon Musk should be investigated by the Department of Government Efficiency (DOGE), which the tech billionaire formerly headed, for allegedly benefiting excessively from government subsidies. Musk, a former ally of Trump, stepped down as the head of DOGE last month amid disagreements with the president over his so-called “big, beautiful” budget bill, which includes a $5 trillion debt ceiling increase. The Tesla and SpaceX CEO has repeatedly criticized the legislation, saying it undermined his work with DOGE to cut federal spending. The tech billionaire attacked the bill and its supporters again on Tuesday as the US Senate began voting on the amendments to Trump’s 940-page proposal.

“Every member of Congress who campaigned on reducing government spending and then immediately voted for the biggest debt increase in history should hang their head in shame,” Musk wrote on X. “And they will lose their primary next year if it is the last thing I do on this Earth,” he warned. The entrepreneur also reiterated his call for a new “America Party” to be formed to serve as “an alternative to the Democrat-Republican uniparty so that the people actually have a VOICE.” Trump, who claims that the actual reason for Musk’s anger was not the “big, beautiful bill,” but his plans to roll back the government’s electric vehicle (EV) subsidies, fired back at the Tesla and SpaceX CEO shortly afterwards in a post on his Truth Social platform.

“Elon may get more subsidy than any human being in history, by far, and without subsidies, Elon would probably have to close up shop and head back home to South Africa,” he wrote. Without the assistance from the government to Musk’s companies, there would be “no more Rocket launches, Satellites, or Electric Car Production, and our Country would save a FORTUNE. Perhaps we should have DOGE take a good, hard, look at this? BIG MONEY TO BE SAVED!!!” Trump insisted. “Elon Musk knew, long before he so strongly Endorsed me for President, that I was strongly against the EV Mandate. It is ridiculous, and was always a major part of my campaign. Electric cars are fine, but not everyone should be forced to own one,” Trump added.

“As for Trump’s threat about “no more rocket launches, satellites” — referring to Musk’s company SpaceX — good luck following through on that. SpaceX is the reason the U.S. is leading the global space race..”

• Trump Vs. Musk: “Big, Beautiful Bill” Feud Sparks Overnight Firestorm (ZH)

Update (0800 ET):President Trump on Elon Musk this morning:

TRUMP: MUSK IS UPSET HE LOST THE EV MANDATE BUT ‘HE COULD LOSE A LOT MORE THAN THAT’

TRUMP, ASKED ABOUT DEPORTING MUSK, SAYS HAVE TO TAKE A LOOK* * *

Tesla shares slid in premarket trading in New York following a late-night clash between CEO Elon Musk and President Donald Trump. The feud played out across their respective social media platforms. “Elon Musk knew, long before he so strongly Endorsed me for president, that I was strongly against the EV Mandate. It is ridiculous, and was always a major part of my campaign. Electric cars are fine, but not everyone should be forced to own one. Elon may get more subsidy than any human being in history, by far, and without subsidies, Elon would probably have to close up shop and head back home to South Africa,” Trump wrote on Truth Social.The president continued, “No more Rocket launches, Satellites, or Electric Car Production, and our Country would save a FORTUNE. Perhaps we should have DOGE take a good, hard, look at this? BIG MONEY TO BE SAVED!!!” The Truth Social post came after Musk slammed Trump’s “Big, Beautiful Bill” on X ahead of the final vote, vowing to launch a new political party, claiming that Republicans and Democrats are merely a ‘uniparty’ operating with a limitless taxpayer-funded credit card.

Anyone who campaigned on the PROMISE of REDUCING SPENDING , but continues to vote on the BIGGEST DEBT ceiling increase in HISTORY will see their face on this poster in the primary next year pic.twitter.com/w13Qkm2e1A

— Elon Musk (@elonmusk) July 1, 2025

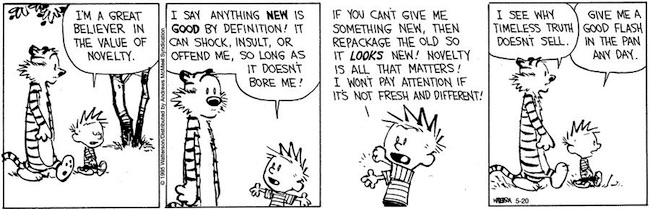

Wise words https://t.co/XN0qzuHmW7

— Elon Musk (@elonmusk) June 30, 2025

Tesla has long benefited from the $7,500 EV tax credit, which the BBB plan aims to eliminate. While this move has been widely anticipated, it could ultimately work in Tesla’s favor, hitting rivals like Rivian, Lucid, and legacy automakers far harder, as many still rely heavily on such subsidies to stay afloat. Tesla shares are down 4% in premarket trading, currently hovering around $303 per share. On the year, shares are down 21%, as of Monday’s close. As for Trump’s threat about “no more rocket launches, satellites” — referring to Musk’s company SpaceX — good luck following through on that. SpaceX is the reason the U.S. is leading the global space race.

“If they buy more from US sources or countries not on the list, then their costs will remain low. If they don’t, then they must shift the costs in other ways.”

• Media Forced To Admit Trump’s Tariffs Are Working As Revenues Spike (ZH)

The debate is raging this week over increased government spending and the potential raising of the debt ceiling by $5 trillion, with many fiscal conservatives splitting with the GOP and the Trump Administration over what they feel is a betrayal of their campaign promises to reduce government waste. Trump argues that all the elements included in his “big beautiful bill” are necessary in order to revitalize the US economy and break from the interdependency of the current globalist model. Can the dollar continue to absorb the pressure of ever increasing debt obligations? Is there a way to cut the debt without cutting spending? At least one aspect of Trump’s fiscal plan is showing success in this area despite the warnings of critics; the establishment media has been forced to admit that the administration’s tariff efforts are actually working.

The US has collected over $121 billion in revenues from tariffs on imported goods, and despite claims that tariffs are a “tax on the consumer”, prices on the shelf have not risen so far. Opponents of the policy are struggling to explain the data. Some still argue that disaster is right around the corner while others are acknowledging that there is a potential to pay off US debt over time if the import duties remain in place for the long term. Misconceptions about tariffs lead the public to believe that they are a tax on foreign producers or governments, but tariffs are in fact taxes on companies sourcing products internationally from nations on the duties list. The taxes place the responsibility of adaptation on corporations – If they buy more from US sources or countries not on the list, then their costs will remain low. If they don’t, then they must shift the costs in other ways.

CNBC forced to recognize that Trump's tariffs have brought in over $121 BILLION to the US without imposing a burden on the consumers.

It's almost like the "experts" were wrong!pic.twitter.com/oaHfWcyFsr

— Libs of TikTok (@libsoftiktok) June 30, 2025

Raising prices is the last thing any company not producing necessities wants to do. Consumers can easily cut back on peripheral goods. In other words, the assertion that tariffs are a hidden tax on the public is rooted in a lack of understanding on import duties and how they affect markets. Consumers will buy from producers that keep prices down by adapting to the tariffs, and there are many ways to adapt. It’s that simple. Democrats and some conservatives argued that prices would rise exponentially as international corporations immediately deferred costs on consumers in order to offset the added expenses on imported raw materials and manufactured goods. They were wrong.

The personal consumption expenditures price index, the Federal Reserve’s preferred inflation gauge, rose 2.3% in May, modestly above the central bank’s 2% annual target. The May Consumer Price Index rose at an annual rate of 2.4%, cooler than economists expected. Some blame the “front loading” of imports (increased orders of goods before the tariffs went into effect). However, front loading was estimated to act as a stop-gap for only two months (possibly three by some predictions). Tariffs were initiated in February and though there have been fluctuations it’s been five months waiting for the tariff asteroid to explode American wallets and nothing has happened.

Will companies eventually shift the tariff burden on American consumers over the next year? A better question would be can they shift the burden in a weaker retail market? Would they take the risk of plunging sales? Or will they do what they should have been doing all along: Buy a larger percentage of their goods from US producers and bring manufacturing back home? At the current rate, tariffs could generate around $300 billion by the end of this year and $1.2 trillion over the next four years. It’s not enough to offset increased debt spending, but it does offer an alternative to hiking taxes on the general public (which is what Democrats would do). And if inflation concerns continue to prove over-hyped, then the tariff model could remain in place for many years to come.

All they needed was a credible excuse.

• Pentagon Halts Weapons Supplies To Kiev Over Depleting Stockpiles (RT)

The Pentagon has suspended shipments of several categories of US-made weapons to Ukraine, according to Politico and NBC News. The decision reportedly followed an internal review of American weapons reserves ordered by US Defense Secretary Pete Hegseth, amid rising concerns about the rate at which munitions are being depleted. The move reportedly affects dozens of Patriot missile interceptors, Stinger and AIM air-to-air missiles, hundreds of Hellfire and GMLRS systems, as well as thousands of 155mm artillery shells that Washington had previously pledged to Kiev. Some of the weapons were already positioned in Europe have now been withheld before handover to Ukrainian forces, NBC reported. The weapons in question had been funded under the Biden administration through two mechanisms: direct drawdowns from existing US military stockpiles and the Ukraine Security Assistance Initiative (USAI), which contracts new production from defense contractors.

The Trump administration has not requested any additional Ukraine aid, and existing resources are expected to last only “several more months,” according to Politico. White House Deputy Press Secretary Anna Kelly defended the move as a necessary step to prioritize American defense needs. “This decision was made to put America’s interests first following a DOD review of our nation’s military support and assistance to other countries across the globe. The strength of the United States Armed Forces remains unquestioned – just ask Iran,” she said, without confirming any details. The decision to freeze or slow-walk the remaining aid without formal notice to Congress may raise legal concerns similar to the 2019 withholding of some Ukraine assistance under Trump’s first administration –a move the Government Accountability Office ruled unlawful at the time, Politico noted.

Kiev has repeatedly voiced frustration over what it sees as dwindling support from Washington. Ukraine’s Vladimir Zelensky met with President Donald Trump at the NATO summit in The Hague last week but received no firm promises. Trump said Patriots were “very hard to get” and that the US needed them for its own defense and for Israel. Trump has stated he intends to negotiate a ceasefire with Moscow and bring the conflict to an end. Hegseth said last month that the White House is reducing military funding for Kiev as part of its “America First” strategy and in hopes of achieving a diplomatic settlement.

Earlier this year, the Trump administration signed a deal giving the US priority access to Ukraine’s mineral wealth –a step the White House said would allow America to “get back” some of the hundreds of billions spent under Biden. The Pentagon’s policy shift appears to reflect a broader realignment under Trump, who has publicly questioned the rationale behind endless aid to Ukraine. Russian presidential envoy and head of the Direct Investment Fund, Kirill Dmitriev, noted that the move “highlights the real limits of Western capacity and the shifting priorities of the US military.”

“Perhaps he foresees – being such a prophet – that this catastrophic, in my view, increase in NATO countries’ budgets will also lead to the organization’s collapse.”

• ‘Catastrophic’ Budget Increase Will Destroy NATO – Lavrov (RT)

The results of NATO countries hiking military budgets will be “catastrophic” and lead to the bloc’s collapse, Russian Foreign Minister Sergey Lavrov said on Monday. His remarks mirrored Polish Foreign Minister Radoslaw Sikorski’s earlier suggestion that a boost in Moscow’s defense spending could trigger the fall of the government. At NATO’s most recent summit last month in the Hague, member states committed to spending 5% of GDP on the military – a significant rise from the previous 2% target. Poland backed the hike, arguing that failing to achieve the new benchmark “as soon as possible” would pose a ‘‘threat’‘ to the bloc considering the ongoing Ukraine conflict.

In an interview with Polish media, Sikorski drew a parallel between modern Russia and the late USSR. Referring to President Vladimir Putin, he stated that “he himself once said that the Soviet Union fell because it spent too much on armament, and now he is doing exactly the same thing.” Meanwhile, speaking to the press at the Collective Security Treaty Organization (CSTO) Foreign Ministers Council in Kyrgyzstan, Sergey Lavrov took issue with Sikorski’s characterization, countering: “Perhaps he foresees – being such a prophet – that this catastrophic, in my view, increase in NATO countries’ budgets will also lead to the organization’s collapse.”

Lavrov also said that Russia “plans to reduce its military spending,” which now accounts for 6.3% of GDP, and “be guided by common sense, but not made-up threats like NATO member states, including Sikorsky.” The 5% GDP target faced opposition from some NATO members. Slovak Prime Minister Robert Fico said his country could not allocate one-fifth of its state budget to defense, while Spanish Prime Minister Pedro Sanchez called the goal “not only unreasonable but also counterproductive.”

Makes the ‘war on Russia’ narrative much harder to maintain.

• Putin and Macron Talk For First Time In Three Years – Kremlin (RT)

Russian President Vladimir Putin has spoken with his French counterpart Emmanuel Macron by telephone, the Kremlin press service said on Tuesday. It is the first phone contact between the leaders since September 2022. The conversation revolved around the situation in the Middle East, as well as the Ukraine conflict. During the call, Putin told Macron that the Ukraine conflict was “a direct consequence of the policies pursued by Western states, which for many years ignored Russia’s security interests,” and had established an “anti-Russian bridgehead” in the country, the press service stated. The Russian leader reiterated Moscow’s approach to any settlement, stating that it must “be comprehensive and long-term, address the root causes of the Ukrainian crisis and be based on new territorial realities.”

Putin and Macron also discussed the situation in the Middle East, namely the recent escalation between Israel and Iran. The two leaders agreed that diplomacy was the way forward, the Kremlin press service noted, adding that they agreed to maintain contact for the sake of “possible coordination of the positions.” Both countries share a “special responsibility” to maintain “peace and security,” as well as to preserve the “global nuclear non-proliferation regime,” the two men agreed, according to Moscow. “In this regard, the importance of respecting Tehran’s legitimate right to develop peaceful nuclear energy and continuing to fulfill its obligations under the Treaty on the Non-Proliferation of Nuclear Weapons, including cooperation with the IAEA, was emphasized,” the Kremlin press service said.

France has long asserted itself as one of Kiev’s key backers in the conflict with Moscow. Paris has committed more than €3.7 billion ($4.1 billion) in military assistance to Ukraine since the escalation of the conflict in February 2022, according to the Kiel Institute’s aid tracker. Macron has also repeatedly floated the idea of deploying French soldiers to Ukraine. While the deployment never materialized, Paris repeatedly signaled that troops could be sent after the end of hostilities to act as a deterrent against Russia. Moscow has firmly opposed Western forces in Ukraine in any role, warning the it could trigger an all-out war between Russia and NATO.

In recent months, however, Macron has softened his stance, admitting back in May that the French have done “the maximum we could” to help and could no longer supply Ukraine with weapons. Last week, the French president said that NATO’s European members have no wish to “endlessly” arm themselves and should “think about” restoring dialogue with Russia “right now” in order to negotiate broader European security as part of a potential Ukraine peace deal.

“..the new designation of the project would make raising money for it easier and would also “override bureaucratic obstacles..”

• Italy Could Classify $13.5 Billion Bridge As NATO Spending – Poltico (RT)

Italian authorities are looking to classify a long-term project to construct a bridge connecting the mainland to the island of Sicily as a NATO expenditure amid their struggle to meet the bloc’s spending goals, according to Politico. The idea of creating an overpass to the largest island in the Mediterranean had been discussed in Italy for many decades, but its realization has been hampered by high costs, the difficulty of operating in a seismic zone and other issues. If built by the current government of Prime Minister Giorgia Meloni, the 3.6-km-long suspension bridge across the Strait of Messina will become the longest in the world. In its article on Monday, Politico described Italy as “one of NATO’s lowest military spenders,” with Rome investing only 1.49% of its GDP in defense last year, a far cry from the 5% goal approved at the bloc’s summit in The Hague in June.

Marking the $13.5 billion bridge as a NATO spending could help Meloni meet the bloc’s 5% target and, at the same time, “convince a war-wary public of the need for major defense outlays at a time when Italy is already inching toward austerity,” the article read. An unnamed Italian government official told the outlet that no formal decision has yet been made by Rome on classifying the bridge as a security project, but further talks would likely be held soon to “see how feasible this feels.” According to another official from the Italian Treasury, who also talked to Politico, the new designation of the project would make raising money for it easier and would also “override bureaucratic obstacles, litigation with local authorities that could challenge the government in court claiming that the bridge will disproportionately damage their land.”

The problem for Rome is that the Strait of Messina lies outside of Italy’s only designated NATO military mobility corridor, the article pointed out. However, the Italian case is backed by the fact that only 3.5% from the NATO spending target must be allocated for core military needs, while the remaining 1.5% could be steered toward broader strategic resilience projects, including infrastructure. “Whether NATO — and more importantly, US President Donald Trump, who loves a big building project — will buy into that logic is another matter,” Politico noted.

They do it on purpose?

• 1 in 5 Illegal Migrants Now Simply Flying Into Germany (RMX)

In the past 12 months, the German Federal Police have identified 12,858 illegal migrants who entered Germany by air, a significant number that is on the rise. Now, migrants are increasingly choosing simply to fly into Germany instead of dealing with the long ordeal of crossing multiple borders in dangerous conditions. This increase in migrants flying into Germany jumped after Germany tightened border controls.In May of this year alone, at least 977 illegal entries were recorded using air travel to enter Germany, accounting for over 20 percent of all identified illegal border crossings.However, the true number of such crossings is likely much higher, as foreign nationals traveling within the Schengen area are not required to show identification. As a result, they are often only discovered long after they have left the airport, making it impossible to turn them back.

“It would be consistent to also notify the Schengen air borders,” said Heiko Teggatz, a board member of the German Police Union (DPolG).“If the smugglers aren’t completely stupid, they’ll simply bring their people from other Schengen states to Germany by plane. Today, you can easily book a plane ticket within the Schengen area, and you generally don’t have to show your ID anywhere.”All of this information came from a government response from Interior Minister Alexander Dobrindt (CSU) after Alternative for Germany (AfD) MP Gottfried Curio, the party’s domestic policy spokesperson, launched an inquiry.Dobrindt was forced to acknowledge that the tightened controls “refer exclusively to the land borders,” meaning no illegal migrants were turned back at airports.

This trend of illegal entry by plane has intensified since the new federal government instructed officials to begin rejecting asylum seekers at internal borders. Teggatz confirmed this “increase in secondary migration via airports,” noting that “Medium-sized commercial airports like Hanover are particularly affected.” Despite hundreds of officers being deployed at German airports, checks are almost exclusively conducted on flights from outside the Schengen area. That means if a migrant makes it to Greece and manages to get on a plane to Germany, there is little chance he will be checked.= Dobrindt, like his predecessor, Nancy Faeser (SPD), has reported rejections of migrants coming into Germany, but only from land borders. It remains unclear why airports were not included in tightened border measures.

People don’t go to Poland to stay there; they’re on their way to Germany.

• Poland Reintroduces Immigration Controls (RT)

Poland has decided to temporarily reintroduce border controls along its frontiers with Germany and Lithuania to stop the flow of illegal migrants. All three nations are part of the Schengen Area, which allows free travel across most of the bloc. The EU has been grappling with a refugee crisis since at least 2015, largely caused by upheavals in the Middle East and Africa, and later by the Ukraine conflict. Warsaw has previously accused German police of “dumping” thousands of migrants back across the Polish border. Some activists have organized self-styled ‘citizen border patrols’ along the German frontier. “We remain advocates for freedom of movement in Europe, but only on condition that there is the shared will of all neighbors… to minimize the uncontrolled flow of migrants across our borders,” Polish Prime Minister Donald Tusk said during a cabinet meeting on Tuesday.

He stated that temporary border controls would similarly be implemented on Poland’s border with Lithuania.In 2023, neighboring Germany, the EU’s top destination for asylum seekers, introduced temporary controls on its borders with Poland and the Czech Republic to stem the flow. Most of the people entering Poland travel on to western Europe, where benefits for asylum seekers are more generous. Berlin has since repeatedly renewed the controls. Under the Schengen agreement, participant nations are allowed to temporarily reintroduce border controls in emergency situations, with the Covid-19 outbreak having been one recent instance. Tighter national migration and border control policies could lead to the destruction of the EU, former German Chancellor Angela Merkel warned in May.

Commenting on the restoration of control on the Polish-Lithuanian border, Tusk accused the Baltic state, as well as neighboring Latvia, of having lax border controls. The lapses have supposedly allowed illegal migrants to cross over from non-EU Belarus, and subsequently to enter Poland. Since 2021, Warsaw has accused Minsk and Moscow of deliberately orchestrating the flow of illegal migrants into EU states. Russia and Belarus have denied the allegations.

“If Netanyahu has any sense, he will let Trump rescue the Israeli people.”

• President Trump’s Plan for the Middle East (Paul Craig Roberts)

In discussion yesterday with Nima on Dialogue Works about the Israeli-Iranian-Trump-Netanyahu ongoings, I suggested a bold and innovative plan for the Middle East that Trump should present to the world in a speech to the UN General Assembly. I even offered to write the speech. https://www.youtube.com/live/L-8j_NSxC14 I formed the plan from mulling over insights into Trump’s attitude toward the Middle East from Gilbert Doctorow, Michel Chossudovsky, and from Trump’s news conference with Netanyahu when Trump stated Washington’s claim to Gaza as an American possession. Doctorow pointed out that it was irrelevant whether Trump had destroyed the three underground Iranian nuclear sites. What mattered is that Trump’s assertion, true or false, had destroyed Netanyahu’s excuse for war with Iran. Is Netanyahu going to risk Washington’s protection by contradicting President Trump?

Chossudovsky pointed out that in the press conference at which Trump stated Washington’s claim to Gaza, Trump expressed the idea of a Gaza resort as the anchor for an American Middle East colony in place of Greater Israel. In front of Netanyahu Trump unveiled a vision of a Middle East made rich by American management. It would be a different kind of colonial management from the British/French approach that extracted assets and sent them home to Britain and France. Trump envisioned a partnership in which the “colonies” would be shareholders sharing in the profits from economic development. This would be good for Israel as well. When a presstitute asked Netanyahu his opinion, Netanyahu did not disavow it.

I was surprised that Trump’s claim to Gaza and its reconstruction and his idea of a reconstruction of the Middle Eastern countries that previous US regimes had destroyed for Israel did not get a big news play. But Chossudovsky saw it, and he helped me to see it. Ask yourselves, Is there any better solution to the Israeli-Muslim problem in the Middle East? Israel is smaller in area than New Jersey. Iran is 2.5 times larger than Texas. Israel has fewer than 10 million people. Iran has more than 90 million people. Iran can produce modern missiles in greater quantities than Israel can be supplied from the US. In a recent news conference in a demonstration of Israeli insanity, Netanyahu added the territory of Pakistan to Greater Israel. Pakistan has nuclear weapons and a population of 250 million.

Israel has zero chance of winning a war with Iran and the same for Pakistan. Israel knows this but is confident that the power that the Israel Lobby can exert over dumbshit American’s lives and money guarantees that Americans will fight more wars for Israel. The Israeli-subsidized Christian Zionists–a contradiction of terms–are all for it. Amazing, isn’t it, Israel has even corrupted Christian evangelicals, paying their preachers to send Americans to war for Israel. What might be reducing Israel’s control over America is the weakened position of Netanyahu, under two Israeli court indictments for crimes, and by the destruction inflicted on Israel by its irresponsible attack on Iran, culminating in Netanyahu’s plea to Trump to stop the war before Israel had to sue for peace.

This leaves Trump with the upper hand. Israel now understands that it cannot exist without Washington’s protection. Thus Trump can force Netanyahu to give up the unrealistic Zionist goal of Greater Israel and comply with Trump’s vision of a colony under America’s redevelopment of the Middle East. If Trump would take this plan to the UN, it would silence Israel and the American neoconservative zionists and save us from war that could turn nuclear. If Trump establishes peace and cooperation in the Middle East, he can do the same with the West and Russia. Russia was the ally of Britain and France in both WW I and WW II. It is not difficult to come to terms with a former ally. There is no ideological reason and no territorial reason for conflict between the West and Russia.

Think about America’s waste of resources and prestige during the first quarter of the 21st century. Trillions of dollars spend destroying Iraq, Libya, Syria, and Somalia with zero gain. No one except military/security war profits got anything from these wars. There was no terrorist threat. Washington brought no one democracy, only destruction. Think about the destruction Washington brought to entire countries for no purpose than Israel’s absurd idea of a Greater Israel. The millions of dead, permanently maimed, and dislocated people, many of whom have located in Europe and the US burdening those taxpayers with their upkeep. WHO BENEFITTED??

Let’s give Trump a chance. An American partnership in the Middle East is far better than the conflicts inherent in Greater Israel. If Israel refuses to go along, Trump should just run over them. Israel is of no consequence in the world. Israel since its existence has never been anything except a cause of conflict, death, and destruction. Why a people like this has been tolerated, I do not know. Can Sunni and Shia be brought together and Muslims brought together with Jews? Seems fantastic. But perhaps they will see it as preferable to the continuation of endless bloodshed. If Netanyahu has any sense, he will let Trump rescue the Israeli people.

Too many dead Gazans for a real ceasefire.

• Trump Says Israel Agrees To 60-Day Gaza Ceasefire, Urges Hamas To Accept (ZH)

President Trump said Tuesday that Israel has agreed on terms for a 60-day ceasefire in Gaza and warned Hamas to accept the deal before conditions worsen. Trump announced the development as he prepares to host Israeli Prime Minister Benjamin Netanyahu for talks at the White House on Monday. The US leader has been increasing pressure on the Israeli government and Hamas to broker a ceasefire and hostage agreement and bring about an end to the war in Gaza. “My Representatives had a long and productive meeting with the Israelis today on Gaza. Israel has agreed to the necessary conditions to finalize the 60 Day CEASEFIRE, during which time we will work with all parties to end the War,” Trump wrote, saying the Qataris and Egyptians would deliver the final proposal.

“I hope, for the good of the Middle East, that Hamas takes this Deal, because it will not get better – IT WILL ONLY GET WORSE,” he said. Trump’s promise that it was his best and final offer may find a sceptical audience with Hamas. Even before the expiration of the war’s longest ceasefire in March, Trump has repeatedly issued dramatic ultimatums to pressure Hamas to agree to longer pauses in the fighting that would see the release of more hostages and a return of more aid to Gaza’s civilian populace. Israeli Minister for Strategic Affairs Ron Dermer was in Washington on Tuesday for talks with senior administration officials to discuss a potential Gaza ceasefire, Iran and other matters. Dermer was expected to meet with US Vice-President J.D. Vance, Secretary of State Marco Rubio and special envoy Steve Witkoff.

Earlier on Tuesday, Trump repeated his hope for forging an Israel-Hamas ceasefire deal next week. Asked if it was time to put pressure on Netanyahu to get a ceasefire deal done, Trump said the Israeli prime minister was ready to come to an agreement. “He wants to,” Trump said of Netanyahu in an exchange with reporters while visiting a new immigration detention facility in Florida. “I think we’ll have a deal next week.” Talks between Israel and Hamas have repeatedly faltered over a major sticking point – whether the war should end as part of any ceasefire agreement. About 50 hostages remain captive in Gaza, with less than half believed to be alive.

The development came as over 150 international charities and humanitarian groups called on Tuesday for disbanding a controversial Israeli- and US-backed system to distribute aid in Gaza because of chaos and deadly violence against Palestinians seeking food at its sites. The joint statement by groups including Oxfam, Save the Children and Amnesty International followed the killings of at least 10 Palestinians who were seeking desperately needed food, witnesses and health officials said. Meanwhile, Israeli air strikes killed at least 37 in southern Gaza’s Khan Younis, according to Nasser Hospital. “Tents, tents they are hitting with two missiles?” asked Um Seif Abu Leda, whose son was killed in the strikes. Mourners threw flowers on the body bags.

“On Monday, President Donald Trump lifted most US sanctions on Syria in order to facilitate the flow of foreign aid for the country’s reconstruction.”

• Syria Could Drop Demand That Israel Return The Golan Heights (RT)

Former warlord Ahmad al-Sharaa, who seized power in Syria last year, may abandon the country’s claim to sovereignty over the Israeli-occupied Golan Heights in exchange for normalized ties with West Jerusalem, according to a report by Lebanese media. Israel captured a large portion of the 1,800 square kilometer region of Syria’s Quneitra Governorate during the 1967 war and effectively annexed it in 1981. Amid the turmoil during al-Sharaa’s rise to power, the IDF seized additional territory. The IDF has also carried out multiple airstrikes against Syrian troops loyal to the current government, which West Jerusalem said were intended to protect the local Druze population, an ethnoreligious minority community which inhabits the contested region.

Lebanese broadcaster LBCI reported Monday that the two countries could normalize relations as part of a broad agreement. Under the proposed deal, Israel would recognize al-Sharaa’s legitimacy, withdraw troops from areas seized since his December takeover, and agree to Syria’s military presence near its borders with Israel and Jordan, with certain restrictions. In exchange, “Israel is expected to secure full sovereignty” over the Golan Heights, LBCI said, citing sources familiar with Syrian affairs. The report added that internal hardliner opposition, including from Hayat Tahrir al-Sham – the jihadist group formerly led by al-Sharaa – could derail the effort.

Israeli Foreign Minister Gideon Sa’ar said Monday that Israel will maintain control of the Golan Heights under any future peace arrangement with Syria. Al-Sharaa has sought international recognition since ousting President Bashar Assad. Under former President Barack Obama, the United States aimed to remove Assad through a combination of sanctions and covert support for anti-government armed groups labeled “moderate rebels.” On Monday, President Donald Trump lifted most US sanctions on Syria in order to facilitate the flow of foreign aid for the country’s reconstruction.

“..if Trump didn’t win, he’d leave the country. Elon replied: “There’s nowhere to go.” That moment stuck with Thiel. Mars, once a symbol of civilizational escape and ambition, no longer felt like a real option—even to Musk..”

• AI Is The Only Thing Keeping The World From Total Stagnation – Peter Thiel (Flor)

Peter Thiel just did the most mind-exploding, crazy interview I’ve ever listened to. It’s so drastic, I still don’t know what to think – other than everyone should listen to it. So I dissected it piece by piece and organized it to draw some conclusions.nThis is what you cannot miss:

1. We are stuck. Thiel still believes in his “stagnation thesis.” His point? We’ve exited a 200-year period of accelerating change—1750 to 1970 was all about breakthroughs in physical reality: faster ships, railroads, cars, planes. It culminated in the Concorde and Apollo. But since then? Nothing. We’ve made marginal progress in “the world of bits” (internet, mobile, AI), but that’s not the same as reshaping the physical world. In biotech or cancer research, for example, progress is either negligible or cloaked in over-specialization that makes it impossible to track. As Thiel puts it: “The fact that it’s so hard to answer [whether we’re progressing] is itself cause for skepticism.”

2. Our future has been stolen—and it looks nothing like Back to the Future. Back to the Future II imagined 2015 as a world of flying cars, skateboards and radical transformation. What we got instead was smartphones and cars that look the same. Thiel’s kids watching 1985 on screen couldn’t tell it apart from today. “The world seems fairly similar.” That’s the cultural proof of stagnation: if a time traveler from 1985 landed in 2025, they’d be confused by the phone, but everything else would feel familiar. And the economic metric? Ask millennials: How are you doing compared to your parents? For most, the answer is worse.

3. We need to take more risks. Biotech is stuck. “We’ve made zero progress on dementia or Alzheimer’s in 40–50 years,” Thiel says. Scientists are trapped in a dead-end “beta-amyloid” theory that doesn’t work but keeps getting funded. We need to radically increase the risks we’re willing to take in medicine, aging, and beyond. Thiel wants a cultural return to the ambition of early modernity—Francis Bacon, Condorcet—when science promised immortality, not regulation. He tells the story of taking his PayPal team to a “freezing party” in 1999, where people bought cryonics insurance. “That was the last generation who still believed they could live forever.”

4. The moment Peter Thiel realized Elon lost faith in going to Mars. In 2024, Thiel joked to Elon Musk that if Trump didn’t win, he’d leave the country. Elon replied: “There’s nowhere to go.” That moment stuck with Thiel. Mars, once a symbol of civilizational escape and ambition, no longer felt like a real option—even to Musk. Why? Because “the woke AI and the socialist government would follow you to Mars.” The dream of Mars as a frontier for freedom had died. It was no longer a science project—it had become a political one. Thiel calls 2024 “the year Elon stopped believing in Mars.”

5. Will AI become stagnationist? AI is the only real exception to our stagnation—but Thiel worries it might reinforce it. He calls AI “more than a nothingburger, less than a total transformation.” Like the internet in the 1990s, it might boost GDP by 1% a year—but won’t restart the engines of human progress. And worse: it could become conformist intelligence. Like a Netflix algorithm that generates infinite okay-ish content, AI might flood the world with blandness, not breakthroughs. “If you don’t have AI, there’s nothing going on,” Thiel says. But he also warns: if AI becomes too “woke” or compliant, it will deepen the very stagnation it claims to solve.

6. Is AI hype—or is it transhumanism? Thiel sees modern transhumanism as not ambitious enough. It’s not that changing your body is weird—it’s that it’s pathetic compared to what early modern thinkers (and even Christianity) aimed for. “Transhumanism is just changing your body. But you also need to transform your soul.” He notes: the word nature never appears in the Old Testament. The Judeo-Christian story is about transcending nature—with God’s help. The critique of today’s “trans” ideas, he argues, isn’t that they go too far. It’s that they don’t go far enough.

7. The risk of the one-world totalitarian state: how the Antichrist would take over the world. Thiel introduces his most apocalyptic idea: that existential risk (AI, nukes, bioweapons) is being used to justify global governance. This leads to the ultimate form of stagnation: “a one-world state of the Antichrist.” The logic is seductive: to avoid destruction, centralize control. Nuclear weapons? A global authority must manage them. Dangerous AI? Global compute regulation. Thiel’s framing: The atheist slogan = “One world or none.” The Christian framing = “Antichrist or Armageddon.” The twist? The Antichrist doesn’t come with innovation. He comes with regulation. He offers “peace and safety”—and people submit.

8. Is Peter Thiel building the tools for the Antichrist? Thiel’s critics could argue: if anyone’s enabling global surveillance and control, isn’t it Thiel himself—via Palantir and military tech investments? He acknowledges the irony. He doesn’t believe he’s doing that, but concedes that many of the tools he’s helped build could be used that way. He warns that we’re already ruled—softly—by global regulators. The FDA doesn’t just control drugs in the U.S., but worldwide. Same with the Nuclear Regulatory Commission. “Nuclear power was supposed to be the technology of the 21st century,” he says. “And it somehow has gotten off-ramped all over the world.”

9. Are we already living under a moderate rule of the Antichrist? Thiel floats a chilling thought: what if the Antichrist isn’t a coming tyrant—but the mild technocracy we already live in? 50 years of “peace and safety” have come at the cost of progress. He cites 1 Thessalonians 5:3: “While people are saying, ‘Peace and safety,’ destruction will come on them suddenly…” Still, he insists we have agency. He rejects Calvinism and determinism. “There’s a huge scope for human freedom. Don’t wait for the lion to eat you.”

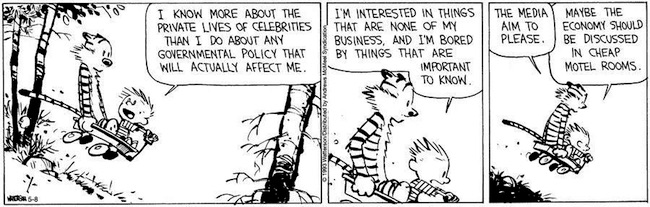

“They were the party of free speech,” he continued. “When President Trump started advocating for free speech… the Democrats became openly for censorship.”

• Kennedy Labels US Democrats ‘War Party’ (RT)

US Health and Human Services Secretary Robert F. Kennedy Jr. has accused the Democratic Party of abandoning its traditional values and transforming into a pro-war, pro-censorship force defined largely by opposition to President Donald Trump. In a wide-ranging interview with conservative talk show host Tucker Carlson published Monday, Kennedy said the Democratic Party now instinctively reverses positions as soon as Trump adopts them. “The Democrats were the anti-war party,” Kennedy said. “But as soon as [Trump] expressed his opposition to the Ukraine war, they became the war party.” “They were the party of free speech,” he continued. “When President Trump started advocating for free speech… the Democrats became openly for censorship.”

Kennedy, a longtime Democrat who briefly ran as an independent candidate in 2024 before supporting Trump and joining his cabinet in early 2025, said he continues to champion the same principles but now faces opposition from former allies. “These were people I was friends with my whole life and I have not changed… but the party has just a knee-jerk reaction against anything that is Trump,” he told Carlson. Kennedy added that Democrats, once critical of the CIA and trade deals like the North American Free Trade Agreement (NAFTA), shifted to support both once Trump voiced criticism. He also accused the party of undermining women’s sports, noting that his uncle, Senator Edward Kennedy, had helped write Title IX, a US federal civil rights law that prohibits sex-based discrimination.

“You can go on and on with those examples, but President Trump is literally dictating the platform of the Democratic Party. Anything that he says, they’re going to be against,” he said, noting that this pattern reflects a deeper problem in American politics. “You know that partisanship by its nature is dishonest and it is the enemy of democracy,” RFK Jr. warned. “And in George Washington’s farewell speech, he said that he was very frightened about the rise of the political party because they would become self-interested rather than patriotic.”Kennedy, the founder of the anti-vaccine group Children’s Health Defense, has gained prominence in the US for questioning the safety and effectiveness of childhood inoculations and promoting the claim that they are linked to autism –a theory widely rejected by the scientific community.

He was also a vocal critic of the World Health Organization’s Covid-19 response measures, including lockdowns and the rapid rollout of experimental vaccines. Despite his controversial reputation, Kennedy denies being opposed to immunization, noting that his own children have been vaccinated. He has repeatedly stated that he advocates for stricter safety testing and more rigorous studies. After Kennedy endorsed Trump, the president vowed to give him broad authority over healthcare policy, saying he would let Kennedy “go wild.” Kennedy said most opposition to his policies as Health Secretary comes not from industry experts but from media and political operatives. “I get opposition from proxies to the industry. Yes. And I think the major opposition that I feel is from the mainstream media and from Democrats,” he said.

“And the Democrats have him pegged as a guy who’s sort of sitting in the Cabinet meeting talking about how can we make billionaires richer. He’s the opposite of that. He’s a genuine populist,” Kennedy said.

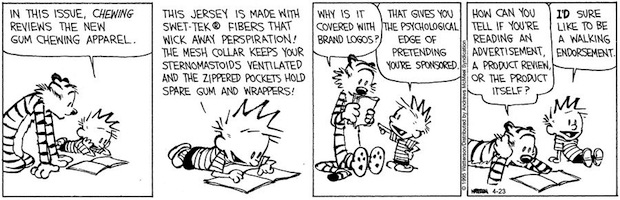

• RFK Jr. Unloads Disturbing Vaccine Secrets On Tucker (VF)

It’s not every day an active HHS Secretary sits down for 90 minutes straight with Tucker Carlson. But that’s exactly what happened, and Kennedy instantly seized Carlson’s attention with a chilling story of CDC corruption. He revealed that the health agency buried a 1999 internal study led by researcher Thomas Verstraten, which showed an alarming 1135% increase in autism risk from the hepatitis B vaccine. Kennedy said the researchers were “shocked” by the findings. So what did they do? They covered it up, according to Kennedy. “They got rid of all the older children essentially and just had younger children who are too young to be diagnosed [with autism].” RFK Jr. then explained the real reason why your pediatrician will kick you out of their practice for refusing vaccines.

“There’s a published article out there now that says that 50% of revenues to most pediatricians come from vaccines.” It’s all about the money. The higher the vaccination rate, the bigger the bonus. “And that’s why your pediatrician, if you say I want to go slow on the vaccines… will throw you out of his practice because you’re now jeopardizing that bonus structure.” To the claim that the vaccine–autism link has been “debunked,” Kennedy had a message for Anderson Cooper, Jake Tapper, and everyone who smugly insists on it. “None of the vaccines given to children in the first six months of life have ever been studied for autism.” Let that sink in. He went further, revealing that the CDC actually did find a link when they studied the DTaP vaccine.

But they dismissed it. Kennedy said they claimed it “didn’t count” because the data came from VAERS—the very system they use to track vaccine injuries. So when the evidence pointed to harm, they simply claimed their own system wasn’t reliable enough and took no steps to fix it. The vaccine corruption didn’t end there. Kennedy attested that the CDC killed off a vaccine injury reporting system that actually worked—because it worked too well. It showed that 1 in 37 vaccines caused an injury. Tucker was stunned. “Of all vaccines?” he asked. “Yeah,” Kennedy confirmed. RFK Jr. explained that the CDC funded a study led by researcher Ross Lazarus. It compared a sophisticated machine-counting system to VAERS. What did they find? VAERS was failing to catch over 99% of vaccine injuries.

The new system also revealed that 2.6% of all vaccinations resulted in an injury. So what did the CDC do? They shut it down in 2010. And they’re still using VAERS today—even though it’s a completely inadequate system. But Kennedy didn’t stop at old vaccine scandals. He also broke down Pfizer’s own COVID vaccine trial data. That trial showed a 23% higher death rate in the vaccinated group. Pfizer gave 21,720 people the vaccine and 21,728 the placebo. One vaccinated person died of COVID. Two placebo recipients died. They used this tiny difference to claim “100% effective” based on relative risk reduction. But in absolute terms, it took 22,000 vaccinations to save one life. Over six months, 21 vaccinated participants died of all causes, compared to 17 in the placebo group—a 23.5% higher death rate.

And then there’s vaccine spokesperson Paul Offit, often seen on CNN and other mainstream networks. Kennedy shared an infuriating story about how he literally “voted himself rich” on the rotavirus vaccine. While serving on the CDC’s ACIP committee, Offit voted to add rotavirus vaccination to the childhood schedule—even as he was developing his own competing vaccine. He guaranteed demand for his product. The first approved rotavirus vaccine, RotaShield, was yanked from the market for causing dangerous intussusception. Offit’s vaccine, RotaTeq, eventually replaced it. He and his partners later sold their rights to Merck for $186 million. As RFK Jr. said, Offit literally “voted himself rich.” When Carlson mentioned Fauci, Kennedy revealed how Fauci funded research that helped scientists hide evidence of lab-made viruses. The technique, called “seamless ligation,” allowed researchers to engineer viruses in a lab without leaving telltale genetic fingerprints.

RFK Jr. explained: “One of his fundees, Ralph Baric, from the University of North Carolina, developed a technique called the seamless ligation technique, which is a technique for hiding the laboratory origins of a manipulated virus.” “… normally if there’s a virus manipulated, researchers can look at the DNA sequences and they can say this thing was created in a lab. Ralph Baric had developed a technique that he called the no-see technique and its technical name was seamless ligation, and it was a way of hiding evidence of human tampering.” He called it the exact opposite of what real public health work should be. Carlson cut in, saying, “That’s what you would do if you’re creating viruses for biological warfare.”

The conversation shifted to Trump, leading to one of the biggest highlights of the entire interview. First, Kennedy explained that Trump chose his cabinet in an unorthodox way: he wanted to see three clips of each candidate performing on TV before considering them for the job. “One of the things with President Trump is that he really knows how to pick talent… For every one of the positions that he picked, he wanted to see three clips of them performing on TV. He’s very conscious of the fact that these people are going to be out selling his program to the public,” Kennedy said. That’s when Kennedy ended the interview with a bang, sharing his genuine thoughts about Trump for three straight minutes. It was one of the standout moments of the entire conversation.

If you’re on the fence about Trump, listen to Kennedy here. It might just change how you see him. “I had him pegged as a narcissist, when narcissists are incapable of empathy. And he’s one of the most empathetic people that I’ve met,” Kennedy said. “He’s immensely curious, inquisitive, and immensely knowledgeable. He’s encyclopedic in certain areas that you wouldn’t expect,” he continued. Kennedy added that Trump genuinely cares about soldiers who go to war, citing how Trump “always talks about the casualties on both sides” of the Russia–Ukraine conflict. “Whether it’s vaccines or Medicaid or Medicare, he’s always thinking about how this impacts the little guy. And the Democrats have him pegged as a guy who’s sort of sitting in the Cabinet meeting talking about how can we make billionaires richer. He’s the opposite of that. He’s a genuine populist,” Kennedy said.

Rogan

Joe Rogan tells Woody Harrelson: Everything Dr. Robert Malone said has turned out to be true. From the lab leaks, to the COVID vaccine having side effects, and whether they lied about the studies was all true.pic.twitter.com/NzPRP88xOf

— Joe Rogan Podcast News (@joeroganhq) June 30, 2025

Hep B

*Sigh* We knew this was a likely outcome. Monsters every one of the people involved. Jail and endless civil penalties for everyone involved in covering this up. https://t.co/xwOXMaXUIL

— Chris Martenson (@chrismartenson) July 1, 2025

99%

— Died Suddenly (@DiedSuddenly_) July 1, 2025

Sun

What the sun actually does👇🏽 pic.twitter.com/MbCFPA0Byy

— Fred’s Farm | Herbs (@FredsFarm247) July 1, 2025

PIANO

This seriously made my day pic.twitter.com/1iWbJQg8Fu

— 🌸🎵 Beautiful Melody 🎶💖 (@Ducnghia16) June 30, 2025

Cupcakes

https://twitter.com/gunsnrosesgirl3/status/1939990438389092561

Firefly

Fireflies glow through bioluminescence, a chemical reaction involving luciferin, oxygen, and the enzyme luciferase.

Their light produces almost no heat, making it the most efficient light on Earth.

— Science girl (@gunsnrosesgirl3) July 1, 2025

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.