Edward Hopper Folly Beach, Charleston, South Carolina 1929

The conversation has shifted away from corona for now. Is that a good thing?

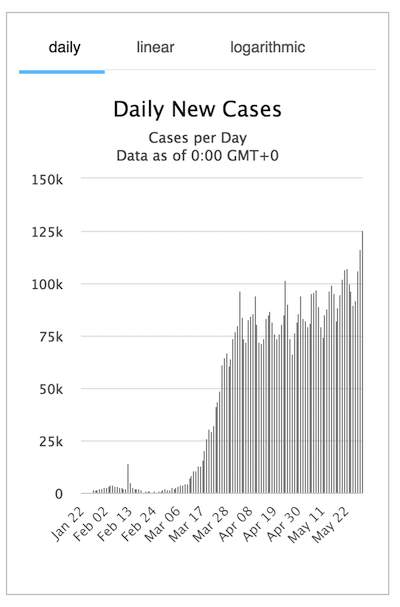

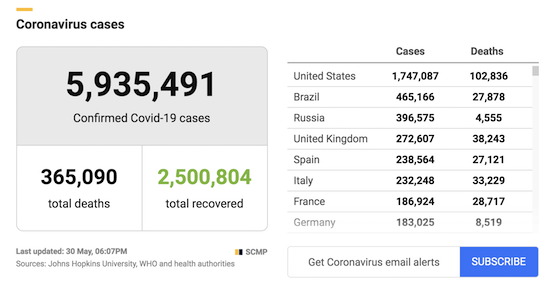

Total global cases pass 6 million as daily new cases set another record at 125,511.

New cases past 24 hours in:

• US + 25,069

• Brazil + 30,739

• Russia + 8,952

• UK 4,938

• India + 8,105

• Peru + 6,506

• Chile + 4,654

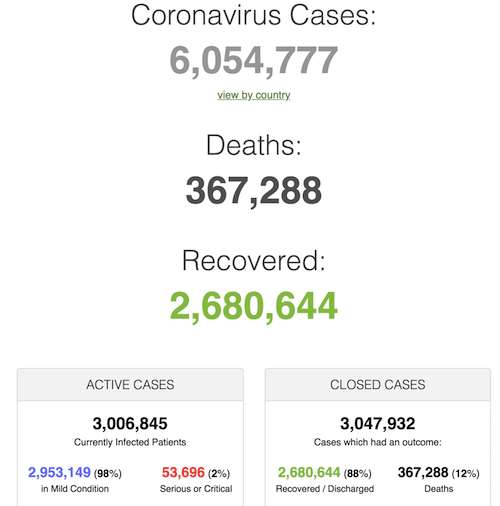

• Cases 6,054,777 (+ 122,597 from yesterday’s 5,932,180)

• Deaths 367,288 (+ 4,674 from yesterday’s 362,614)

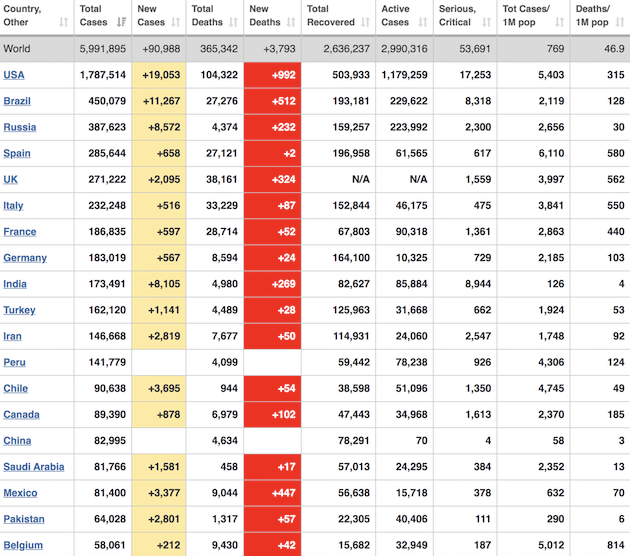

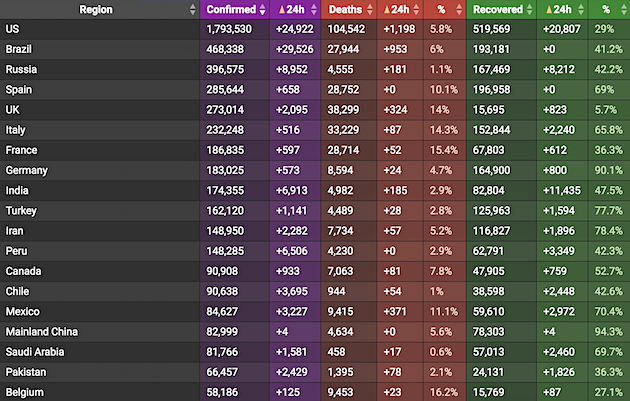

From Worldometer yesterday evening -before their day’s close-:

From Worldometer:

From SCMP:

From COVID19Info.live:

Atlanta Mayor Keisha Lance Bottoms says the violent demonstrations in Atlanta are “disgracing the life of George Floyd”: “When you burn down this city, you’re burning down our community. If you want change in America, go and register to vote.” https://t.co/N5oZfxvFs3 pic.twitter.com/us3whIQnqu

— CBS News (@CBSNews) May 30, 2020

"..it is a lynching at the highest level, and I thank God we have people in the streets" @CornelWest pic.twitter.com/fGUUNjkTje

— The Other Beth, who hates all of you (@BethLynch2020) May 30, 2020

Two sides prone to violence.

• Protests Spread Nationwide: Minnesota Curfew, White House Locks Down (JTN)

The anger over George Floyd’s death in Minneapolis police custody fueled intense protests coast to coast Friday night, as activists ignored a Minnesota curfew to set new fires while the White House temporarily locked down over security concerns just outside its gates. The arrest and murder charges filed earlier in the day against the police officer who allegedly knelt on Floyd’s neck did little to quell a swelling rage that drove protests in cities as diverse as New York and San Jose. In Atlanta, protesters spray-painted sayings and broke windows at CNN’s headquarters while tense officers in Brooklyn borough lined up to keep angry, chanting protesters from straying from street protests toward business.

The Secret Service on Friday evening put the White House on brief lockdown, sheltering reporters inside the press room, as several videos on social media showed unruly protesters outside of the Treasury Department, adjacent to the heavily fortified White House, and large groups of protesters walking from the city’s historically black U Street neighborhood chanting, “No peace, no justice.” The protests started Tuesday in Minneapolis, where weary residents and officers faced a fourth night of violence, rioting and fire setting. The Minnesota governor activated the national guard and a strict curfew for 8 p.m. was imposed in the Twin Cities, but it failed to keep large numbers of protesters from taking to the streets anew.

“..that’s the same brutality..”

• Unsanitized: Social Unrest When There’s Nothing to Lose (Dayen)

There’s a reason that Spike Lee set Do the Right Thing on the hottest day of the year in Brooklyn. The pressure from the heat simmered through the community and created sparks that ignited existing tensions. There was a triggering event, which led to a police chokehold and the death of Radio Raheem, and the destruction of Sal’s Pizzeria. The weather was the backdrop as events played out. That was 1989 and it couldn’t be more relevant right now. The death of George Floyd is obviously unforgivable on its own terms. There doesn’t need to be any context. Unreformed police murder in communities of color has been part of America since well before I was born. I have nothing to comment on about looters—at least eight people sent me this Onion headline, “Protestors Criticized For Looting Businesses Without Forming Private Equity Firm First.” (I guess my reputation precedes me.)

I can’t say anything about the burning of the 3rd police precinct. And I have a lot to say about the great misfortune of having Donald J. Trump in a leadership position during this moment, but most of it would be curse words. Decades of disinvestment and routinized brutality and structural racism created these conditions. The officer who killed George Floyd had enough history of violence alone to contribute mightily to this rage. (And yes, Amy Klobuchar declined to prosecute him and many others for these crimes.) But you cannot separate this outpouring of anger from two months of death, economic collapse, and the disproportionate pain raining down right now on communities of color.

Decades of environmental racism have created toxic vectors for spreading the virus; that’s the same brutality. Minority small business owners have had a harder time securing federal aid, owing to more distant relationships with local banks; that’s the same brutality. African Americans are more likely to be in “essential” jobs and unable to work from home and protect themselves; that’s the same brutality. They’re more likely to be in prisons under perhaps the worst conditions of this crisis; that’s definitely the same brutality. “Black Americans are 80 percent more likely than white people to have diabetes,” which puts them at higher risk from COVID-19; that’s the same brutality. Lack of decent food in communities of color, and access to healthcare, and the ability to rent enough space in shelter to physically distance—this is all brutality against a people, manifested today but going back 400 years.

When you are either out of work or on a hair trigger because you know you’re risking your life by going to work; when your business can’t get a bridge loan and you know everything you worked for is about to be extinguished; when you’re cut off from your friends and neighbors; when your source of sustenance is the food bank; when you have nothing to lose, and then on television you see a black man with his neck wedged between a police officer’s knee and the pavement until he chokes, and you hear he died in police custody after pleading “I can’t breathe,” and you remember how those words were spoken by Eric Garner, and you hear that the man was in custody for using counterfeit money and you don’t think that’s a sufficient reason to kill somebody, and you recall that the Minneapolis Police Department has had a really ugly history with the black community for a long time, and when you exhale a little because the cops involved were fired but then the local prosecutor says this murder of a black man doesn’t merit prosecution… what results from this injustice should meet your expectations.

It boils down to: how big of a threat is China? Opinionsvary.

• Trump Orders His Administration To Begin Eliminating Hong Kong Privileges (R.)

U.S. President Donald Trump said on Friday he was directing his administration to begin the process of eliminating special treatment for Hong Kong, in response to China’s plans to impose new security legislation in the territory. Trump made the announcement at a White House news conference, saying China had broken its word over Hong Kong’s autonomy. He said its move against Hong Kong was a tragedy for the people of Hong Kong, China and the world. “We will take action to revoke Hong Kong’s preferential treatment,” he said, adding that the United States would also impose sanctions on individuals seen as responsible for smothering Hong Kong’s autonomy.

Trump’s move follows Chinese plans to impose new national security legislation on the former British colony. Secretary of State Mike Pompeo has said the territory no longer warrants special treatment under U.S. law that has enabled it to remain a global financial center. Trump said he was directing his administration to begin the process of eliminating policy agreements on Hong Kong, ranging from extradition treatment to export controls. He said he would also issue a proclamation on Friday to better safeguard vital university research by suspending the entry of foreign nationals from China identified as potential security risks.

The WHO has failed/refused to reform the way Trump asked them to.

• Trump Says US To Withdraw From WHO. Does He Have The Authority To Do It? (NPR)

President Trump has announced that he is immediately halting the decades-long U.S. membership in the World Health Organization over its response to China’s handling of the coronavirus epidemic. In a press briefing Friday at the White House, Trump said, “We will be today terminating our relationship with the World Health Organization and redirecting those funds to other worldwide and deserving urgent global public health needs.” Trump said the decision came because WHO has “failed to make” reforms the U.S. requested. Last week, Trump sent a letter to WHO’s director-general, Tedros Adhanom Ghebreyesus, outlining his views on how the agency favors China and asking the organization to “commit to major substantive improvements within the next 30 days.”

It’s not clear what specific reforms the U.S. has requested, because those discussions have not been made public. Nor did Trump say why he acted on the threat after one week rather than waiting a month. The U.S. was a major force in founding WHO in 1948 and is the organization’s top funder, providing around $450 million a year, according to Trump. The level of funding the U.S. provides to WHO has been a sore spot for Trump, who complained at the briefing that the U.S. pays significantly more than China but does not wield more power in the agency. Global health experts said the president’s choice to leave the global health governing body during a pandemic is a dangerous call.

“This decision is really so short-sighted and ill-advised, and all it does is put American lives at risk,” said Dr. Howard Koh, former assistant secretary for health in the Obama administration and now a professor at Harvard’s T. H. Chan School of Public Health. “I disagree with the president’s decision,” said Sen. Lamar Alexander, R-Tenn., chairman of the Senate Health, Education, Labor and Pensions Committee, in a statement after the announcement. “Withdrawing U.S. membership could, among other things, interfere with clinical trials that are essential to the development of vaccines, which citizens of the United States as well as others in the world need. And withdrawing could make it harder to work with other countries to stop viruses before they get to the United States.”

It’s questionable whether the president can make a unilateral decision to withdraw from WHO. “It is an overreach of his constitutional powers,” said Larry Gostin, director of the O’Neill Institute for National and Global Health Law at Georgetown University. Gostin said he believes that the president may need congressional approval to terminate U.S. membership in the U.N. agency. “The only situation where he can do this is if Congress had agreed beforehand to give these powers to the president,” said Kelley Lee, a professor of public health at Simon Fraser University. “It is the role of legal advisers to inform the president on what authority he can exert. He is either not receiving good advice or not listening to it.”

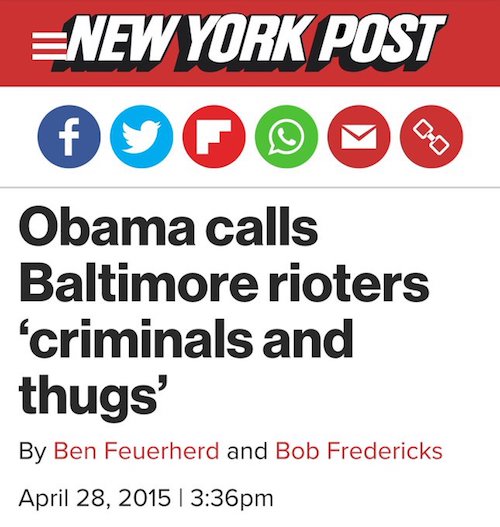

Thugs, huh?

• Twitter Targets Trump Again, Flagging Tweet After Executive Order (SAC)

Twitter flagged and hid a tweet posted by President Donald Trump’s early Friday morning after the president signed an Executive Order challenging the growing political bias in tech companies, whose platforms are meant to be neutral. Trump’s tweet was in response to the growing unrest and rioting in Minnesota, in response to the horrific death of George Floyd while in police custody. Thursday night the situation in Minneapolis escalated again when rioters overran a police precinct, forcing police officers, who were told not to respond by city officials, to evacuate before it was burned to the ground.

Trump signed the Executive Order Thursday aimed at social media giants he says, have been operating as biased publishers rather than platforms for free speech. Trump tweeted that these “THUGS are dishonoring the memory of George Floyd, and I won’t let that happen. Just spoke to Governor Tim Walz and told him that the Military is with him all the way. Any difficulty and we will assume control but, when the looting starts, the shooting starts. Thank you!”

The National Guard was sent to assist local authorities in containing the rioting. Earlier the president criticized the city’s mayor, who ordered the evacuation of the precinct saying, “the very weak radical left mayor Jacob Frey” if he didn’t bring the city under control. In response, Twitter flagged the President’s tweet and attached a notice saying “we have placed a public interest notice on this Tweet from @realDonaldTrump.” The tweet is actually hidden from public view but can be viewed if the reader so chooses to click on it. “This Tweet violated the Twitter Rules about glorifying violence,” said Twitter. “However, Twitter has determined that it may be in the public’s interest for the Tweet to remain accessible.”

Consumer spending is way down. Therefore, savings must be way up? is that so?

• Coronavirus Sinks US Consumer Spending As Savings Hit Record High (R.)

U.S. consumers cut spending by the most on record for the second straight month in April while boosting savings to an all-time high, and the growing frugality reinforced expectations the economy could take years to recover from the COVID-19 pandemic. The report from the Commerce Department on Friday also showed an economy highly reliant on the government, with financial aid checks from a historic fiscal package worth nearly $3 trillion driving a record surge in personal income. Together with news that monthly exports collapsed, the report left economists anticipating the largest contraction in gross domestic product in the second quarter since the Great Depression. Data has also been dismal this month on the labor market, manufacturing production and homebuilding.

“Right now, the economy is totally dependent upon the largesse of the government,” said Joel Naroff, chief economist at Naroff Economics in Holland, Pennsylvania. “Will the federal government keep sending out checks or will the household and business welfare payments dry up?” The Commerce Department said consumer spending, which accounts for more than two-thirds of U.S. economic activity, plunged 13.6% last month, the biggest drop since the government started tracking the series in 1959. It eclipsed the previous all-time decrease of 6.9% in March.

[..] Personal income surged a record 10.5% last month. Without the government money, income would have declined 6.3% with business closures pushing wages down 8.0%. The unprecedented economic upheaval saw the saving rate hitting a record 33%. “If the economy reopens quickly without consequence, the millions who lost jobs are hired back and have no reason to fear they will lose their jobs again, these savings represent considerable spending power in the second half,” said Chris Low, chief economist at FHN in New York. “If it takes longer to reopen the economy, these savings will be used for sustenance over the next few months. They will limit the decline, but not fuel a sharp rebound.”

[..] In a second report on Friday, the Commerce Department said goods exports tumbled 25.2% to $95.4 billion in April, a 10-year low. The broad decline in exports was led by a 65.9% collapse in shipments of motor vehicles and parts. That outpaced a 14.3% tumble in imports. As a result, the goods trade deficit widened 7.2% to 69.7 billion last month. The larger goods trade deficit is likely a drag on second GDP, which economists expect could drop at as much as a 40% rate, a pace not seen since the 1930s. The economy contracted at a 5.0% annualized rate last quarter, the deepest pace of decline in GDP since the 2007-09 recession. Consumer spending tumbled at a 6.8% rate, the sharpest drop since the second quarter of 1980.

Everyone buys Amazon, consumers and investors.

• Investors Eye Consumer Discretionary Stocks As US Reopens (R.)

Investors are taking a closer look at the market’s consumer discretionary companies as a reopening U.S. economy fuels hopes of a turnaround for some of the sector’s hardest-hit names. Many companies in the sector have been battered by the country-wide coronavirus-fueled lockdowns that have weighed on growth and damaged retail spending over the last several months, though the stocks of a few, like Amazon, have soared. A gradual lifting of lockdowns in some states has stirred hopes for a bounce back for the retailers that make up much of the sector.Some investors, however, say it may be months before consumers return to their previous shopping habits, making it unlikely that the companies will see a pickup in revenues in the near term.

Firms ranging from middle-income retailers such as Gap Iand American Eagle Outfitters to high-end destinations like Tiffany & Co and Vail Resorts Inc are expected to report results in the week ahead. “This particular group is full of landmines,” said Jamie Cox, managing partner for Harris Financial Group. “There is not going to be a lot of investor follow-through until we get some certainty with what future revenue prospects are going to be.” Shares of the Gap, for instance, are down 43% for the year to date. A recession that persists through the fourth quarter of this year would reduce the company’s revenues by 40%, according to a note by research firm Trefis.

Next Friday’s U.S. jobs report is expected to show that the unemployment rate rose to 19.8% in May, smashing April’s record 14.7%, according to a Reuters poll. Non-farm payrolls are expected to drop by 7.4 million, adding to the 20.5 million jobs lost the previous month. Cox is focusing on dominant players such as Amazon.com Inc, Walmart Inc and Target Corp, which have a mix of essential items such as groceries as well as electronics and games that can appeal to customers who may face extended lockdowns during a potential second wave of the virus. Overall, retail companies in the S&P 500 are up 12.9% for the year to date, a gain powered largely by Amazon’s 31% rally. Apparel companies, by comparison, are down 16.2% over the same time.

Yanis doesn’t want separate countries, though they are likely the best format in a pandemic. No, he wants globalization, just not the one we know. How practical is that?

• A Chronicle of a Lost Decade Foretold (Varoufakis )

To exorcise my worst fears about the coming decade, I chose to write a bleak chronicle of it. If, by December 2030, developments have invalidated it, I hope such dreary prognoses will have played a part by spurring us to appropriate action. Before our pandemic-induced lockdowns, politics seemed to be a game. Political parties behaved like sports teams having good or bad days, scoring points that propelled them up a league table that, at season’s end, determined who would form a government and then do next to nothing. Then, the COVID-19 pandemic stripped away the veneer of indifference to reveal the political reality: some people do have the power to tell the rest of us what to do. Lenin’s description of politics as “who does what to whom” seemed more apt than ever.

By June 2020, as lockdowns began to ease, left-wing optimism that the pandemic would revive state power on behalf of the powerless remained, leading friends to fantasize about a renaissance of the commons and a capacious definition of public goods. Margaret Thatcher, I would remind them, left the British state larger, more powerful, and more concentrated than she had found it. An authoritarian state was necessary to support markets controlled by corporations and banks. Those in authority have never hesitated to harness massive government intervention to the preservation of oligarchic power. Why should a pandemic change that? As a result of COVID-19, the grim reaper almost claimed both the British prime minister and the Prince of Wales, and even Hollywood’s nicest star. But it was the poorer and the browner that the reaper actually did claim. They were easy pickings.

[..] Just as cathedrals were the Middle Ages’ architectural legacy, the 2020s left us tall walls, electrified fences, and flocks of surveillance drones. The nation-state’s revival made the world less open, less prosperous, and less free precisely for those who had always found it hard to travel, to make ends meet, and to speak their minds. For the oligarchs and functionaries of Big Tech, Big Pharma, and other megafirms, who got on famously with the strongmen in authority, globalization proceeded apace.

The myth of the global village gave way to an equilibrium between great-power blocs, each sporting burgeoning militaries, separate supply chains, idiosyncratic autocracies, and class divisions reinforced by new forms of nativism. The new socioeconomic cleavages threw the prevailing features of each country’s politics into sharp relief. Like people who become caricatures of themselves in a crisis, whole countries focused on their collective illusions, exaggerating and cementing pre-existing prejudices.

Your daily dose of anti-remdesivir.

• Malaria Drug And Zinc, The Missing Link (Berry)

Mystery surrounds why an anti-malaria drug is not being tested as a Covid-19 treatment in combination with zinc, which doctors say is crucial for efficacy. As we reported recently, President Trump revealed he was taking hydroxychloroquine (HCQ) alongside zinc after reports that many doctors are doing the same to help ward off Covid-19. Criticism of the President rose sharply after a non-randomised study published in the Lancet said that HCQ provided no benefit to hospitalised Covid-19 patients while being linked to increased deaths. What the mainstream media did not point out is that the Lancet study failed to test HCQ with zinc. Other experts have found zinc to be vital for efficacy in this context.

Zinc, available as an over-the-counter supplement, has long been seen as an immune-system booster that helps develop immune cells, or antibodies, and can strengthen the body’s response to a virus. American infectious disease specialist Joseph Rahimian explained that, in relation to Covid-19, zinc ‘does the heavy lifting and is the primary substance attacking the pathogen’. HCQ is said to work as a delivery systemfor zinc in fighting coronavirus. Ironically, the Lancet study came out at the same time as it was reported that India’s premier health body had expanded use of HCQ as a preventive for key workers following three studies showing positive results.

[..] ..a study by the New York University Grossman School of Medicine published this month [..] found that those receiving the triple-drug combination (HCQ, with azithromycin and, crucially, zinc) ‘were 44 per cent less likely to die, compared with the double-drug combination (i.e. without zinc)’. As the study notes:‘This study provides the first in vivo evidence that zinc sulfate in combination with hydroxychloroquine may play a role in therapeutic management for Covid-19.’ The above makes the question of why zinc was not used in the Lancet study more baffling. And why don’t the media note that the combination of zinc and HCQ is crucial?

This sounds quite confused. “5G = communism”? Where do we start?

Yeah, 5G should be researched much more before it’s lanuched. But how can it turn COVID19 into a scam?

• Australian Anti-Vaxxers Label COVID19 a ‘Scam’ At Anti-5G Protests (AAP)

Hundreds of anti-vaccination protesters have defied social distancing measures at rallies in Sydney, Brisbane and Melbourne. Protesters claiming the Covid-19 pandemic was a “scam” gathered at the Royal Botanic Gardens in Melbourne on Saturday, and carried signs declaring they were against vaccines and 5G technology. Their placards claimed “5G = communism”, “Covid 1984” and “our ignorance is their strength”. They booed police – clad in gloves and face masks – who warned the crowd that they were breaching social distancing rules designed to slow the spread of coronavirus. In a statement, police said those found in breach of Covid-19 directions faced fines of $1,652 each.

In Sydney, up to 500 protesters voiced conspiracy theories regarding not only vaccination but also 5G telecommunication networks, fluoride and large pharmaceutical corporations. The group convened at Hyde Park in the CBD before holding a singalong of anti-vaccination songs and walking to NSW Parliament House. They chanted “freedom of choice” and “my body, my choice” on the march, with some attempting to raise the spectre of a “new world order”. The walk passed without incident or police intervention. When asked about the protest, Victoria’s chief health officer, Brett Sutton, said “there’s no message that can get through to people who have no belief in science”. “There’s probably no reaching them,” he earlier told reporters.

Anti-5G protesters gather in spot with the best 5G coverage in Brisbane. https://t.co/dJFGJRTrTP

— Brett Debritz (@debritz) May 30, 2020

Hey, you wanted a for-profit medical system.

• States Are Copying & Pasting Immunity Laws For Nursing Home Execs (Sirota)

To date, 19 states have enacted some form of immunity for the hospital and nursing home industries during the pandemic. In general, these new policies shield nurses, doctors and other frontline health care workers from liability when they are treating COVID patients. However, New York, Massachusetts and North Carolina go further: unlike other states, the identical language added to their laws explicitly define health care providers as including “a health care facility administrator, executive, supervisor, board member, trustee” or other corporate managers. That exact word-for-word clause appears in emergency legislation in all three states. In practice, it extends immunity to corporate officials who are not on the medical frontlines, but who are making life-and-death decisions across their companies.

“The new measures granting immunity to health care providers and professionals go well beyond protecting front-line workers from lawsuits — many also provide immunity to administrators who make unreasonable and dangerous, even lethal, decisions,” said Syracuse University law professor Nina Kohn. “New York, Massachusetts, and North Carolina take protection for corporate owners and executives to a whole new level by explicitly granting immunity to board members, trustees, and directors.” “This is extraordinary protection which is in no way in the public interest,” Kohn said. “These states are explicitly and unabashedly giving for-profit corporations and corporate executives the green light to make unreasonable decisions that put vulnerable people in imminent danger, and letting them know that they don’t have to worry about being held legally accountable for the avoidable human damage that results.”

Teaching the poor another lesson will always trump the pandemic.

• De Blasio Ramps Up Destruction Of Homeless Encampments (Gothamist)

Trudi and Rickey Reppi live in a tent on a triangular stretch of sidewalk between three lanes of traffic by the entrance to the Lincoln Tunnel. The tent serves as a headquarters of sorts for a community of homeless people and panhandlers. Dave, Rob, Richard, Russia, and Seven all often sleep outside, some on mattresses or chairs, some on cardboard and bundled-up clothing. Others drop by frequently throughout the day, accepting packaged meals Trudi and Rickey had picked up from an aid organization (“Homeless people help each other way more than anyone in these hundred thousand dollar cars ever help us,” Trudi says) or fanning out, cardboard signs in hand, to ask passing drivers for money for hours on end.

The police arrive at about 9 a.m, flanked by outreach and Sanitation workers forming a team of around a dozen city employees. Trudi and Rickey wearily begin the weekly routine of taking down their tent, bundling up all the possessions they can carry, and leaving everything else on the side of the street for the Sanitation workers to throw away. For years, Mayor Bill de Blasio’s administration has been sending joint teams of NYPD officers, Sanitation workers, and Department of Homeless Services staff to require that homeless people move from locations where they’ve set up shelter. The number of sweeps (also called “clean-ups”) per week has risen dramatically in the last six months, according to homeless people, advocates and case workers.

A DHS employee, who was not authorized to speak publicly, said that the team implementing the sweeps had increased last November from about 3 to about 40. The employee said that the clean-ups would be increasing to twice a week at most encampments; eventually, he suggested, homeless people would give in and accept shelter. Trudi says that she’s been subject to ten to fifteen sweeps in just the last three months. This count doesn’t include the nightly visits the NYPD has paid her in May, sending as many as nine police officers at 3 a.m. to demand that she take down her tent. “In my administration, we made a decision that from our point of view, it was unacceptable to have [a] single encampment anywhere in New York City and they had to be dismantled anytime they’re identified,” Mayor de Blasio said at a press conference earlier this month.

“And we’ve been doing that now for years and it’s really caused the encampments to become a rarity, but whenever we see a new one, we immediately take it down.” But the Center for Disease Control and Prevention has explicitly recommended against clearing encampments or displacing unsheltered homeless people during the pandemic. “If individual housing options are not available, allow people who are living unsheltered or in encampments to remain where they are,” the guidelines read. “Clearing encampments can cause people to disperse throughout the community and break connections with service providers. This increases the potential for infectious disease spread.”

The Netflix series on Epstein brings her to our attention again.

• Still No One Knows Where Ghislaine Maxwell Is (Esq.)

Though multiple survivors have alleged that Maxwell participated in Epstein’s alleged crimes, she’s never been criminally charged. One thing that could stymie potential efforts to level charges against Maxwell is the infamous 2008 plea deal that Epstein struck with the US Attorney for Miami, Alexander Acosta, which found him serving just 13 months in prison after initially facing charges that could have garnered him a life sentence. Jeffrey Epstein: Filthy Rich producer Joe Berlinger described the deal to Esquire as “unprecedented, unheard of sweetheart deal” that “included a non-prosecution agreement for named and unnamed co-conspirators.”

In April, an appeals court upheld the 2007 deal, writing in its opinion that the decision was “not a result we like, but it’s the result we think the law requires.” Maxwell is currently suing Epstein’s estate for money for her legal fees, and for the price of private security, alleging that her “prior employment relationship” with Epstein has caused to her be subjected to death threats. Though once a fixture of the global high-society, Maxwell has been spotted rarely in recent years. Last summer, she was photographed at a Los Angeles In-N-Out Burger, though the authenticity of the photo has been disputed. Her New York townhouse was sold in 2016.

This month, it was reported that lawyers for accusers seeking to file a civil suit against Maxwell have been unable to locate her. According to ABC news, one alleged victim’s “legal team dispatched process servers to five addresses previously connected to Maxwell, including a multi-million dollar brownstone on Manhattan’s Upper East Side, an apartment building in Miami Beach and Epstein’s mansion on Palm Beach Island.” Maxwell is also contending with other civil lawsuits filed by alleged survivors. Just this month, she won the right to delay her questioning in a suit filed by Annie Farmer, the sister of fellow Epstein accuser Maria Farmer, on the grounds that her testimony could be used against her in a current criminal investigation. But with the FBI allegedly investigating Maxwell, her story could be far from over.

We try to run the Automatic Earth on people’s kind donations. Since their revenue has collapsed, ads no longer pay for all you read, and your support is now an integral part of the interaction.

Thank you.

12/23/16 – Flynn relays his goals about the Russia/US relationship.

Flynn: "We will not achieve stability in the Middle East without working with each other against this radical Islamist crowd."

It was never about collusion. pic.twitter.com/xN3twZYa6H

— Techno Fog (@Techno_Fog) May 29, 2020

Nothing nefarious about these calls.

Flynn was concerned about fighting a common enemy: radical Islamists.

Flynn: "We need to be very steady about what we're going to do because we have absolutely a common threat in the Middle East right now." pic.twitter.com/H1a3gVrcDV

— Techno Fog (@Techno_Fog) May 29, 2020

Support the Automatic Earth in virustime.