Camille Corot Study for “The Destruction of Sodom” 1843

Don’t miss

https://twitter.com/i/status/1763514262096417107

Galloway

Legendary post-election interview. Kick out the WEF clowns everywhere. pic.twitter.com/KgLznb7sec

— Kim Dotcom (@KimDotcom) March 1, 2024

Mike Benz

If you watch these 12 minutes I did with @JesseKellyDC, you will have an instant PhD on what Bidenworld has really been up to, all these years, in Ukraine.

You will see the world with totally different and suddenly very clear eyes. pic.twitter.com/NJiHcaHEBK

— Mike Benz (@MikeBenzCyber) March 1, 2024

McAfee

https://twitter.com/i/status/1763632280289923463

Bret W.

Bret Weinstein: What you're detecting as the collapse of civilization is really a manifestation many different kinds of hyper-novelty that is making it difficult for us to see what's in our interest, to figure out what to put in our mouths, to figure out what we should think… pic.twitter.com/LulZI9VwgJ

— Camus (@newstart_2024) March 1, 2024

Rep

Representative Beth Van Duyne Texas, Republican calling out pResident Joe Biden and his visit to the border. This is by far one of the most powerful speech I’ve heard: “…The Biden Administration has completely given away our country… Mr. President, you are down at the border… pic.twitter.com/6zoyqjuixf

— ꪻꫝể ꪻꫝể (@TheThe1776) February 29, 2024

RFK

.@RobertKennedyJr peddles wildly irresponsible conspiracy theory that the U.S. "blew up" the Nord Stream pipeline.

If we learned anything from Donald Trump, it's how dangerous it is to have a President who parrots Russian propaganda. pic.twitter.com/TA2VR97Dwf

— Lis Smith (@Lis_Smith) March 1, 2024

BREAKING – SHOCKING – DEEP STATE STRIKES AFTER BEING FIRED BY CBS:

A federal judge Christopher Cooper has just held investigative reporter Catherine Herridge (@CBS_Herridge) in civil contempt for refusing to disclose her source for stories about a Chinese American scientist… pic.twitter.com/rLgQVBplRx— Simon Ateba (@simonateba) February 29, 2024

This makes Germany a direct participant. We see both Germany and France getting more involved, and denying that at the same time.

The forces for forever war appear to be winning. But wait till their people understand this. They certainly don’t want it. Time for a major false flag?!

• Germany Launches Investigation Into Leaked Crimean Bridge Attack Talk (RT)

Berlin’s first reaction to Friday’s revelations that several German generals discussed helping Ukraine attack Russia was to launch an investigation into how the recording got out. RT Editor-in-Chief Margarita Simonyan first published a transcript of the conversation between senior Luftwaffe officers discussing the matter, followed by a 38-minute audio recording. “We are checking whether communications within the Air Force were intercepted,” a spokesperson for the German Ministry of Defense told the outlet Bild. “We cannot say anything about the content of the communications that were apparently intercepted.” The Federal Office for Military Counterintelligence (BAMAD) has “initiated all necessary measures,” the ministry said in response to an inquiry from the state news agency DPA.

Meanwhile, the Bundeswehr has also resorted to censorship. Multiple accounts on X (formerly Twitter) that distributed the recording were blocked in Germany as of Friday evening. Bild claimed that “it seems obvious” Russian spies “or one of their partners” were behind the recording. The 38-minute audio was dated February 19 and features four officers of the German air force (Luftwaffe), including its head General Ingo Gerhartz and deputy chief of staff for operations, Brigadier-General Frank Graefe. The officers assumed that Germany would send up to 50 Taurus long-range missiles to Ukraine and the ways in which the Luftwaffe could provide the Ukrainians with targeting information without appearing to be directly involved in the conflict with Russia.

They also noted the Ukrainians’ obsession with targeting the Kerch Strait bridge, noting its significance was primarily political rather than military. At one point, Gerhartz admitted that the missiles “won’t change the course of the war,” while another officer expressed doubt that even 20 Taurus hits could actually destroy the bridge. The Russian Foreign Ministry and parliament have both announced they would demand an explanation from Berlin. The government of Chancellor Olaf Sholz has not officially commented on the intercepted call.

German military officials were recorded planing an attack against Crimea bridge. The target is of “military strategic and political importance but we can’t be seen to be directly involved.” Olaf Scholz is putting Germany at risk of war with Russia. Insane. pic.twitter.com/Fbto2e3tmR

— Kim Dotcom (@KimDotcom) March 1, 2024

“They have, however, always “stopped at the Ukrainian border..”

• France Considering Placing Special Forces In Ukraine – Le Monde (RT)

The French government is mulling sending a small military force directly into Ukraine to serve as instructors for Kiev’s Armed Forces and as a “deterrent” to Moscow, newspaper Le Monde reported on Friday, citing its sources. The paper did not disclose the number of French military ‘instructors’ that could potentially be authorized to cross into Ukrainian territory but reported that their ranks could include some “conventional units.” According to Le Monde, France’s Special Forces were also involved in training Ukrainian soldiers in neighboring Poland and in escorting the nation’s arms deliveries to Kiev. They have, however, always “stopped at the Ukrainian border,” the outlet added. The training France would like to provide to Ukrainians “on the ground” includes handling air defense systems, Friday’s report said.

Kiev’s surface-to-air weapons installations are frequently targeted by Russian forces, it explained, adding that the “presence of French soldiers or [those] of other nations would potentially protect certain areas of the Ukrainian territory.” The French government allegedly views such a troop deployment as a way of posing a “strategic dilemma” for Moscow, the paper said, adding that it could “constrain” Russia’s targeting and strike capabilities. In particular, it may prove to be “essential” ahead of the arrival of US-made F-16 fighter jets, scheduled to take place later this year, the French daily added. So far, France has denied that any of its troops have been present in Ukraine during the conflict, the media outlet said. French President Emmanuel Macron sparked controversy on Monday when he told journalists that a potential NATO troop deployment to Ukraine could not be ruled out in the future.

“There’s no consensus today to send, in an official manner, troops on the ground,” he said. “In terms of dynamics, we cannot exclude anything. We will do everything necessary to prevent Russia from winning this war.” Macron’s comments prompted other members of the US-led bloc, including the US, UK, Germany and Italy, to clarify that they had no such plans. The French president’s remarks were seemingly supported by two Baltic nations – Estonia and Lithuania – who also said that such a move could not be ruled out. Moscow warned in response that deploying NATO forces to Ukraine would make a direct conflict between Russia and the military bloc inevitable. On Friday, French Foreign Minister Stephane Sejourne denied that Paris was planning to send any combat units to Ukraine, adding that it would do “everything” to avoid a war with Russia. The French president himself doubled down on his comments on Thursday by saying his words had been “thought through and measured.”

“..the Germans were incensed at the cheekiness of Macron to publish a new initiative which can easily lead to [an] escalation of the war and to Germany being targeted by Russian missiles.”

• Macron’s Idea to Send NATO Troops to Ukraine ‘Made Him Look Very Foolish’ (Sp.)

The past few days have seen Western media discuss “open display of discord” between French President Emmanuel Macron and German Chancellor Olaf Scholz. After Macron recently proclaimed that he refuses to rule out sending EU troops to Ukraine, Scholz rejected the idea by emphasizing that “there will be no soldiers on Ukrainian soil sent there” by European states or NATO members. “There has long been a certain antagonism” between Macron and Scholz, “and the issue of aid to Ukraine has only exacerbated the existing contradictions,” Dr. Gregor Spitzen, German political analyst and independent journalist, said in an interview with Sputnik “France’s ill-considered initiative to send NATO ground troops to Ukraine made Macron look very foolish. The initiative was not even supported by NATO’s main anti-Russian hawks – the UK and Poland. The idea was also viewed negatively in the US,” Spitzen clarified.

He also noted that while “passionate volunteers from the French Foreign Legion are already fighting and dying in Ukraine […], most soldiers in European armies are not eager to take part in modern warfare, where the risk of dying in a rocket attack without even seeing the enemy is high.” Dwelling on the repercussions from Macron’s remarks, Spitzen suggested that “We are likely to see European and American arms deliveries to Ukraine for some time to come.” At the end of the day, however, “the West, seeing that the war is lost, will increasingly tempt Ukraine to make a separate peace,” the analyst predicted. Spitzen was echoed by Gilbert Doctorow, an international relations and Russian affairs analyst, who said that he thinks “the Germans were incensed at the cheekiness of Macron to publish a new initiative which can easily lead to [an] escalation of the war and to Germany being targeted by Russian missiles.”

When asked whether European countries will avoid further confrontation with Russia after Macron’s statement, Doctorow argued they “will likely continue it but in less risky places”, and that if Donald Trump comes to power in the US, they “will have to come to terms with Moscow over a new security architecture for the Continent.” The comments come after Russian President Vladimir Putin warned in his state of the nation address that NATO risks a nuclear conflict if it sends troops to support the Kiev regime. “There’s been talk of sending NATO military forces to Ukraine. We remember the fate of those who sent their contingents to our country before and this time the consequences for the potential interventionists will be far more tragic,” Putin said. He urged the US and Europe to acknowledge the fact that Russia possesses weapons capable of targeting their territories and that all this plainly poses the risk of a conflict involving nuclear weapons, and therefore “the destruction of civilization”.

“..It is estimated that up to 20,000 foreign personnel have joined the so-called “international legionnaires” fighting on the side of the Kiev regime..”:

• NATO Troops Already Deployed to Ukraine, and Getting Killed (SCF)

NATO has been vigorously arming and training the NeoNazi regime that was installed in Kiev since 2014. Even Jens Stoltenberg and other NATO officials have openly admitted that background involvement. In admitting the NATO presence in Ukraine over the past decade that also corroborates Russia’s reasoning of why it was compelled to launch its military intervention two years ago. Of course, the Western powers and their servile media never go as far as conceding that. They prefer to adopt a position of double-think and hypocrisy, claiming that Russia’s military action was “unprovoked aggression”. Macron may have been shot down for now and made to look like a dangling clown. But as so often in the past, controversial NATO ideas are put forward and seemingly rejected out of hand, only to be adopted later.

As Macron pointed out, Germany and other NATO nations were only two years ago reluctant to send military equipment beyond helmets and sleeping bags. Now these same entities have sent battlefield tanks and anti-aircraft missiles and are debating sending long-range weapons to strike deep into Russian territory. US President Joe Biden once remarked on the unfeasibility of supplying fighter jets to Ukraine “because that would mean starting World War Three”. Well, Biden has ended up consenting to the supply of F-16s and his NATO side-kick Stoltenberg asserts that these warplanes could be used to hit deep Russian targets. In other words, Macron’s notions about NATO ground troops going to Ukraine may be rebuffed for now in public. But the inexorable dynamic over the past decade indicates that the idea could well become a reality shortly.

NATO’s involvement in Ukraine is a strategic wedge to attack, weaken, and eventually vanquish Russia. What starts as a thin quantity inevitably grows into a bigger contingency. NATO military personnel are already in Ukraine and have been since at least 2014 when they started training the NeoNazi brigades to terrorize the ethnic Russian populations in Crimea, Donbass, and Novorossiya. Many of these soldiers are deployed unofficially as mercenaries or ostensibly as security details for NATO diplomats. Numerous reports have attested to the presence of NATO troops in Ukraine in one form or another. A Russian air strike near Kharkov in January killed at least 60 French military officers who were reportedly serving as private contractors. Other reports have cited as many as 50 American military killed in action serving in Ukraine.

It is estimated that up to 20,000 foreign personnel have joined the so-called “international legionnaires” fighting on the side of the Kiev regime against Russian forces. A fair assumption is that most of these soldiers of fortune are temporarily “decommissioned” NATO troops. Germany’s Scholz let the cat out of the bag this week when he said he was opposed to sending long-range Taurus missiles to Ukraine because that would mean the deployment of German troops to assist with operating the weapons. Scholz misspoke by inadvertently disclosing that the British and French had already dispatched special forces to assist with their missile systems, the Storm Shadow and Scalp, respectively.

“..the already slim chances of jump-starting serious peace negotiations to end the war are slipping away fast.”

• Austin: If Ukraine Is Defeated, NATO Will Be At War With Russia (ZH)

This is the single most important, dangerous and highly revealing statement from a top defense official in the West in a long time… It also demonstrates the precarious urgency of the moment and the huge stakes going into the November US election. The world truly stands on the precipice of a nuclear nightmare with the following fresh assertion of Biden’s Secretary of Defense Lloyd Austin, who said before Congress on Thursday: “If Ukraine falls, I really believe that NATO will be in a fight with Russia,” Austin stated. What’s more is that this came the very day that Russian President Vladimir Putin warned things could easily spiral toward nuclear war in the scenario that NATO sends troops to Ukraine. [..] According to the fuller context of the Pentagon chief’s statements, he emphasized that more Washington funding is crucial for Ukraine in order to prevent a situation where “one country can redraw its neighbors’ boundaries and illegitimately take over its sovereign territory.”

“We know that if Putin is successful here, he will not stop. He will continue to take more aggressive actions in the region. And other leaders around the world, other autocrats around the world will look at this and will be encouraged by the fact that this happened and we failed to support a democracy,” he added. “If you are a Baltic state, you are really worried about whether you are next. They know Putin. They know what he is capable of. And, frankly, if Ukraine falls, I really believe that NATO will be in a fight with Russia,” Austin said. What is even more alarming about this statement is that everyone now knows that Ukraine forces are in retreat at this very moment, especially after the Russian capture of the city of Avdiivka, and surrounding villages.

Bloomberg on Thursday issued a report predicting total collapse of the Ukrainian front lines by summer, as the headline suggests (Ukraine Sees Risk of Russia Breaking Through Defenses by Summer): “Ukrainian officials are concerned that Russian advances could gain significant momentum by the summer unless their allies can increase the supply of ammunition, according to a person familiar with their analysis,” the report says. According to more from Bloomberg: “Internal assessments of the situation on the battlefield from Kyiv are growing increasingly bleak as Ukrainian forces struggle to hold off Russian attacks while rationing the number of shells they can fire. Commander-in-Chief Oleksandr Syrskyi said Thursday that mistakes by frontline commanders had compounded the problems facing Ukraine’s defenses around Avdiivka, which was captured by Russian forces this month. Syrskyi said he’d sent in more troops and ammunition to bolster Ukrainian positions.”

So the consensus narrative and belated mainstream media admission is that Ukraine’s military is a mere months away from clear defeat, and the top US defense chief just said NATO will go to war with Russia “if Ukraine falls”. The conflict has reached a dire and perilously unpredictable moment indeed, and clearly the already slim chances of jump-starting serious peace negotiations to end the war are slipping away fast.

“..according to Mr. Austin’s open, unambiguous statement, it’s the other way round. We do not have such plans and cannot have them, but the Americans do..”

• Austin Talking About NATO-Russia War Means US Has A Plan For It – Lavrov (TASS)

US Secretary of Defense Lloyd Austin, by saying that NATO and Russia could end up fighting each other if Ukraine is defeated, proved that the US has a plan for it, Russian Foreign Minister Sergey Lavrov said at a diplomatic conference in Antalya. “The meaning of this statement is that if Ukraine loses, NATO will have to go against Russia. In a Freudian slip he blurted out what they had in mind. Before that, everyone was saying: We can’t let Ukraine lose, because [Russian President Vladimir] Putin will not stop at this and will take over the Baltics, Poland, Finland. But it turns out, according to Mr. Austin’s open, unambiguous statement, it’s the other way round. We do not have such plans and cannot have them, but the Americans do,” the minister said. According to Lavrov, Europe is currently the main victim of the US policy of “dragging Ukraine into NATO.”

“All major expenses have been shifted to Europe. People are living increasingly worse, energy resouces have rocketed in price manyfold, compared with what it could have been if the Americans had not blown up the Nord Stream gas pipelines,” the minister said. He said the situation around Ukraine was devised by Washington to make sure that the European Union doesn’t become too strong of a rival to the US economy. “And this goal has been achieved. Europe is now no longer a competitor to the US at all. All the main businesses and manufacturing industry are moving to the US, where conditions are completely different and energy is much cheaper,” Lavrov said. Austin earlier said that he believed “NATO will be in a fight with Russia” if Ukraine was defeated. The US Defense Secretary made the statement at a House Armed Services Committee hearing.

“..By 1998, eight out of ten farms had gone bankrupt and 70,000 state-owned factories had closed. In 1994, a third of Russians lived below the poverty line..”

• Putin Learned From His Mistakes and Today Gives Us Precious Lessons (Vasco)

In his interview with American journalist Tucker Carlson, President Vladimir Putin mentioned a fact that, for those – like me – who didn’t follow international politics 20 years ago, seems surreal. The Russian leader referred to a meeting he had with then-American President Bill Clinton in the Moscow Kremlin. “I asked him, ‘Bill, if Russia raised the issue of NATO membership, do you think it would be possible?’” Putin told Carlson. “Clinton replied: ‘It would be interesting, I think so!’” he continued. On the evening of that same day, when the two met again for dinner, Clinton’s opinion had changed radically. “‘I talked to my team. It’s not possible now,’” Clinton told Putin, according to the latter. “If he had said ‘yes’, the process of getting closer would have started, and, in the end, this could have happened if we saw a sincere desire from the partners,” he explained to Carlson.

A few days after this famous interview that went around the world, the BBC aired an interview with a former head of NATO confirming Putin’s intentions to join the military alliance in the early 2000s. “We had a good relationship”, revealed George Robertson. The Putin he met “wanted to cooperate with NATO” and “was very, very different from this almost megalomaniac of today”, recalled the historic member of the British Labor Party, staunch defender of Scotland’s slavery under the English yoke – even though he is Scottish – and who doesn’t realize that he lacks absolute morality to criticize the Russian intervention in Ukraine. With all the arrogance of a British man who still thinks he owns the world, Robertson indicated that the imperialist powers that, under his mandate at the head of NATO, finished attacking Yugoslavia and began the invasions of Afghanistan and Iraq did not want to deal with Russia as an equal, but rather as a vassal within the organization.

Putin may not have fully understood the message at the time. He did not yet realize NATO’s expansionist aspirations. He fought against Chechen Muslim separatists, who carried out terrorist attacks on Russian territory. Therefore, he felt the need to support George W. Bush’s infamous “war on terror”. In fact, until then relations between Russia and the West had been relatively good since the dissolution of the Soviet Union. Yeltsin was a darling of the “international community”, as had Gorbachev. But the economic devastation caused by the neoliberal shock did not please an important part of the Russian elite, particularly the military. The political, economic and social crisis was not resolved. By 1998, eight out of ten farms had gone bankrupt and 70,000 state-owned factories had closed. In 1994, a third of Russians lived below the poverty line and, even ten years later, 20% were still in this situation. Russia had lost 10% of its population due to capitalist savagery.

The rates of suicide, murder, alcoholism, drug use, sexually transmitted diseases and prostitution had increased exponentially. Huge street demonstrations expressed the population’s discontent, which almost led to the communist party’s return to power. The country’s president was a drunkard and the Chechen War threatened to spread to other regions and balkanize Russia – the division of Yugoslavia occurred in parallel with the Russian crisis. Putin rose to power as a natural successor to Yeltsin. But the real conditions in Russia (internal and external) forced him to take an opposite path. Internal social pressures were added to the second-class treatment received from Western powers and NATO’s moves towards its border. He began by stabilizing the internal situation. He renationalized key companies in the gas, oil and aviation sectors, such as Rosneft, Yukos (merged into Rosneft), Gazprom and Aeroflot and created RZD to control the transport system.

It also benefited national capitalists (or “oligarchs”, according to the propaganda of international bankers) to the detriment of foreigners. At the same time, he fought the separatists with an iron fist, regained control of the Caucasus, pacified the region and fully unified the country. Despite officially supporting Putin’s war against the Chechens, the U.S. actually had a dual policy. At the same time, it was in the interest of the imperialist powers to divide Russia to weaken it even more than they did with the fall of the USSR. After all, even if the government of a given country is an ally, it is always preferable to imperialism to reduce its territory to facilitate its domination. While they did not accept Russia’s integration, the imperialist powers bought Moscow’s former allies and integrated them into NATO. In 1999, the Czech Republic, Hungary and Poland joined the alliance. In 2004, it was the turn of Bulgaria, Slovakia, Slovenia, Estonia, Latvia, Lithuania and Romania. In 2009, Albania and Croatia.

Macgregor

WATCH: MacGregor on #Putin's strategy in #Ukraine, and mystery still surrounding how #Hamas pulled off the 7 October attack

Full interview: https://t.co/r1wVUjFNSR pic.twitter.com/PVVpPuC5cS— Gerald Celente (@geraldcelente) March 1, 2024

“The majority of the voters don’t seem receptive to a replay of this scam but the US government is at war with those voters..”

Did the Blob get vaxxed and boosted? Does that explain the severe neurological damage it displays now as its hologram of lies about Ukraine and Russia Russia Russia flickers out in the blinding daylight of reality. First, there was the gigantic New York Times article published last Sunday blowing open the decade-long secret shadow war by the CIA in a sprawling network of underground bunkers on and around the Russian border. The story was a direct feed from Blob Central in Langley, VA, to Times errand boys Adam Entous and Michael Schwirtz, longtime RussiaGate hoaxers, and obviously intended to get ahead of the real news that the neo-con project to turn Ukraine into a NATO forward base against Russia has collapsed. Read closely, the Times story appears to be an effort by current CIA chief William Burns to hang-out-to-dry his predecessors John Brennan, Mike Pompeo, and Gina Haspel for the failed eight-year-long operation. Why? Because it looks like Russia is fixing to shut down the war ASAP, before its March 15 presidential election.

As it happened, Russian diplomats and Ukraine President Zelensky took turns visiting with Crown Prince Mohammed bin Salman (MBS) in Saudi Arabia this week, sparking rumors that these were peace talks with MBS playing mediator. The situation is delicate for all concerned. Ukraine itself verges on collapse with its army decimated, its ammo used up, and its coffers empty, awaiting the $60-plus-billion aid package that is stalled in Congress, meaning no salaries for Ukraine govt employees and no pensions. It’s delicate for the US because “Joe Biden” has declared our country won’t negotiate over Ukraine, despite the fact that there is nothing else to do now, or the end of the war will be negotiated without us. And remember, not many days ago Mr. Putin told Tucker Carlson that he was ready to talk to anybody. What this will demonstrate is that America has neither the ability to continue its proxy war nor the will or sense to engage in peace talks — all due to “Joe Biden’s” abject intransigence, and not a good look for someone pretending to run for re-election.

It’s delicate for Russia because such a humiliating loss for America could provoke “JB” and his NATO allies to some reckless and foolish act, say, sending NATO members’ ground troops directly into battle or a missile strike on Russian territory, setting off nuclear war. At the very least, the situation has already prompted the US government propaganda machine to kick-start Russia Russia Russia 3.0, the threadbare narrative that has been the accelerant of Democratic Party hallucinations about Russia interfering in US elections since 2016 — when it has actually been US spooks collaborating with a motley assortment of Ukrainian stooges, plus Marc Elias’s lawfare corps, plus the Intel Blob coercing social media to work its will. The majority of the voters don’t seem receptive to a replay of this scam but the US government is at war with those voters, so anything goes in the struggle to retain power.

While we await news out of those peace talks, a political firestorm rages around illegal immigrants from all over the world swarming across the US border. Nothing about that seems even remotely comprehensible, let alone defensible, anymore, as women fall prey to rape and murder by mutts released on-purpose into the US population, and cities groan under the financial burden of housing and supporting them. And so, it looks like the person directly responsible, Alejandro Mayorkas, might be riding his House impeachment bill into a senate trial — another bad look for the Democratic Party (of Chaos) going into the heart of election season.

“..a particular type of paradoxical impulse that arises during times of momentous change..”

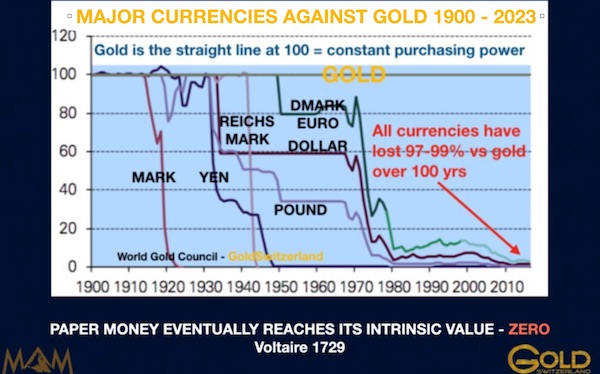

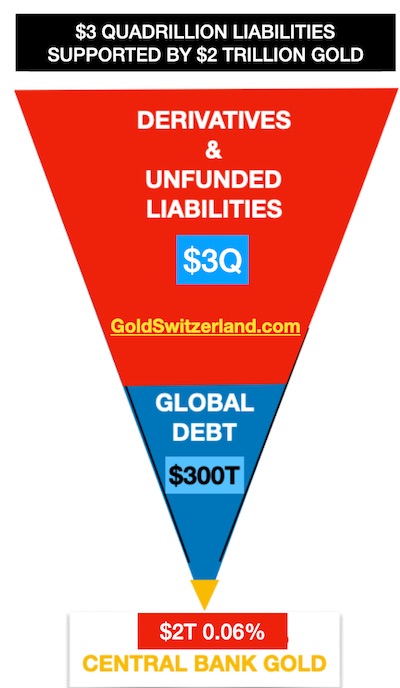

• The West Is Willing To Destroy Its Financial System To Punish Russia (RT)

US Treasury Secretary Janet Yellen has become the latest to add her voice to the growing chorus of Western officials calling for the seizure of Russia’s $300 billion in frozen foreign-exchange reserves for the benefit of Ukraine. This comes after UK Prime Minister Rishi Sunak penned an op-ed over the weekend in which he called for the West to be “bolder” in moving toward confiscating the assets. Notwithstanding the reticence being displayed in some quarters of Europe and various admonitions that such an action would be both blatantly illegal and also detrimental to the integrity of the financial system, the idea seems to be taking on a momentum of its own, particularly in Washington and London. What we are seeing is a vivid example of the type of thinking that places perceived short-term gains ahead of a commitment to preserve the integrity of an institution that derives its potency precisely from widespread confidence in that integrity.

It is also, as we will see, a manifestation of a particular type of paradoxical impulse that arises during times of momentous change. In this case, the institution in question is the Western-led global financial system, at the very heart of which is the US dollar. Outright confiscation of the Russian central bank reserves that have been immobilized since shortly after the Ukraine conflict began in February 2022 would deliver another jolting blow to the credibility of this system. Even as most of the assets are actually held in Europe, there would be no confusion about who was calling the shots and whose credibility is on the line. Of course, views differ about how much integrity the dollar-centric system ever had, and certainly the entire Bretton Woods framework established in the waning days of World War II very much served the interests of the victorious Americans.

But it cannot be disputed that for decades the dollar was widely viewed across the geopolitical spectrum as not just a market-determined reference point and currency for trade but as a safe store of value. As trade became increasingly liberalized, assumptions about a safe and dependable dollar system were built into all manner of economic and trade policies. Such assumptions became part of the very fabric of the global financial system. Where risks related to the dollar were understood to exist, they were largely seen as lying in the realm of interest-rate policy – in other words, these were market risks rather than risks inherent to the system itself. A series of emerging-market crises in the 1980s and ‘90s left many countries chastened about the perils of excessive dollar debt and the dangers that US interest-rate hikes can unleash.

But one of the conclusions that many countries drew from these episodes was the necessity of holding greater dollar reserves as a bulwark against shocks. Between 2000 and 2005, right on the heels of two decades of crises often triggered by rising dollar interest rates, emerging markets actually accumulated dollar reserves at a record pace of about $250 billion per annum, or 3.5% of GDP – a level five times higher than in the early 1990s. In other words, countries responded to shocks emanating from the dollar realm by increasing holdings of dollars. This only underscores the nature of how dollar-related risk was perceived at the time. It simply didn’t occur to anybody that greater exposure to the dollar was itself a risk. The idea that hundreds of billions of dollars’ worth of reserves could simply be confiscated if a country found itself at odds with the overseers of the system didn’t factor into any of the equations.

“This legal basis must be accepted not only by the European countries, not only by the G7 countries, but by all the member states of the world community..”

• Biden Wants To Give Russian Central Bank Funds To Ukraine, France Resists (ZH)

President Biden wants the G7 countries to develop a plan to eventually have Russia’s frozen sovereign assets handed over Ukraine in order to support the war effort, Bloomberg has reported. Bloomberg’s source have also said the US president has privately warned allies that Ukraine’s collapse, and a Russian victory, would signify the international order is effectively destroyed for at least the next half-century. “G-7 officials have been discussing options to use the $280 billion of immobilized Russian Central Bank assets, including using the money as collateral to raise debt or issuing guarantees against the frozen funds, said the people, who spoke on the condition of anonymity,” according to the report. Biden reportedly wants a firm plan proposed by the time of the Italy G7 summit in June. The US has been working behind the scenes to build consensus. The UK and Canada are reportedly on board, but not Germany and France.

Earlier this week France firmly voiced its rejection of seizing the frozen Russian bank funds. “We don’t think this legal basis is sufficient,” French Finance Minister Bruno Le Maire said after the G7 finance ministers meeting in Brazil on Wednesday. “This legal basis must be accepted not only by the European countries, not only by the G7 countries, but by all the member states of the world community, and I mean by all the member states of the G20. We should not add any kind of division among the G20 countries.” Opponents, including of course Russian officials themselves, have highlighted that such a act would be outright and brazen theft. Russian Finance Minister Anton Siluanov has warned in response, “We have ways to respond. We have also frozen sufficient volumes of financial assets and investments of foreign investors in our securities, all of which transfers we carry out for the owners of our securities.”

Europe has to agree to any US push to freeze banks funds, since the bulk of Russia’s money – about $200 billion – is being held by European banks. In such a scenario Moscow may consider the ‘theft’ to be tantamount to an act of war. Still, Treasury Secretary Janet Yellen was undeterred when she was in Brazil this week. “It is necessary and urgent for our coalition to find a way to unlock the value of these immobilized assets to support Ukraine’s continued resistance and long-term reconstruction,” she had said from Sao Paulo, speaking to 20 finance ministers and central bank governors. “I believe there is a strong international law, economic, and moral case for moving forward. This would be a decisive response to Russia’s unprecedented threat to global stability,” she added.

“..the Collective West has been isolated by the Global Rest. “Global Rest”, incidentally, is a misnomer: Global Majority is the name of the game.”

• The Global South Converges to Multipolar Moscow (Pepe Escobar)

These have been frantic multipolar days at the capital of the multipolar world. I had the honor to personally tell Russian Foreign Minister Sergey Lavrov that virtually the whole Global South seemed to be represented in an auditorium of the Lomonosov innovation cluster on a Monday afternoon – a sort of informal UN and in several aspects way more effective when it comes to respecting the UN charter. His eyes gleamed. Lavrov, more than most, understands the true power of the Global Majority. Moscow hosted a back-to-back multipolar conference plus the second meeting of the International Russophiles Movement (MIR, in its French acronym, which means “world” in Russian). Taken together, the discussions and networking have offered auspicious hints on the building of a truly representative international order – away from the agenda-imposed doom and gloom of single unipolar culture and Forever Wars.

The opening plenary session in the first day fell under the star power of Foreign Ministry spokeswoman Maria Zakharova – whose main message was crystal clear: “There can’t be freedom without free will”, which could easily become the new collective Global South motto. “Civilization-states” set the tone of the overall discussion – as they are meticulously designing the blueprints of economic, technological and cultural development in the post-Western hegemonic world. Professor of International Relations Zhang Weiwei at Fudan University’s China Institute in Shanghai summarized the four crucial points when it comes to Beijing propelling its role as a “new independent pole.” That reads like a concise marker of where we are now: 1/ Under the unipolar order, everything from dollars to computer chips can be weaponized. Wars and color revolutions are the norm. 2/ China has become the largest economy in the world by PPP; the largest trade and industrial economy; and it is currently at the forefront of the Fourth Industrial Revolution. 3/ China proposes a model of “Unite and Prosper” instead of a Western model of “Divide and Rule”. 4/ The West tried to isolate Russia, but the Global Majority sympathizes with Russia. Thus, the Collective West has been isolated by the Global Rest.

“Global Rest”, incidentally, is a misnomer: Global Majority is the name of the game. The same applies to “golden billion”; those that profit from the unipolar moment, mostly across the collective West and as comprador elites in the satraps, are at best 200 million or so. Monday afternoon in Moscow featured three parallel sessions: on China and the multipolar world, where the star was Professor Weiwei; on the post-hegemony West, under the title “Is it possible to save the European civilization?” – attended by several dissident Europeans, academics, think tankers, activists; and the main treat – featuring the frontline actors of multipolarity.I had the honor to moderate the awesome Global South session, which ran for over three hours – it could have been the whole day, actually – and featured several stunning presentations by a stellar cast of Africans, Latin Americans and Asians, from Palestine to Venezuela, including Nelson Mandela’s grandson, Mandla. That was the multipolar Global South in full flight – as my imperative was to open the floor to as many people as possible. Were the organizers to release a Greatest Hits of the presentations, that could easily become a global hit.

“She’s not building a big movement. What she’s doing is lying in wait and hoping for disaster.”

• Haley: Nominating Trump Means ‘Suicide for Our Country’ (RCP)

As Nikki Haley stubbornly clings to life ahead of Super Tuesday, warning that nominating Donald Trump for president a third time would mean “suicide for our country,” some of her closest supporters take solace in the fact that the future is unknowable. Perhaps there is a “fatal landmine” that the former president “could step on at any minute” or a lurking controversy that could “land him deep in the bottom of a well,” speculated Michigan State Rep. Mark Tisdal, who served on Haley’s leadership team for that state. “She is an alternative,” added Utah state Sen. Todd Weiler, who campaigned with Haley earlier this week, “and nobody knows what the future holds with the lawsuits and the age of both of our leading candidates.” Such are the unrealized hopes of the anti-Trump coalition. He will turn 78 in June, just three years younger than President Biden. He faces 91 felony counts in total among his four criminal indictments.

He has swept the first six nominating contests regardless. And Trump has yet to trip into a proverbial well or stumble onto any of the aforementioned landmines. During the primary, that is. Haley has urged the GOP to look to November from the beginning, offering up a well-worn rebuttal to the chorus of party members calling on her to exit. Now she has some data to make that case: “He lost 40% of the primary vote in all of the early states.” An accountant before politics, Haley points to the percentages in her favor as evidence of Trump’s weakness. In Minnesota Monday, she told a crowd, “You can’t win the general election if you can’t win that 40%.” Of course, unless the arithmetic changes in a hurry, Haley can’t win a primary with those numbers, either. As one prominent GOP operative put it to RealClearPolitics, requesting anonymity to speak frankly, “She’s not building a big movement. What she’s doing is lying in wait and hoping for disaster.”

Her campaign rejects outright any suggestion that Haley is waiting for catastrophe, legal or otherwise, to fall on Trump. They point to her dogged cross-country schedule and her seven-figure national ad campaign as evidence she hasn’t adopted a rear-guard strategy. They say Haley plans to win. “There’s a lot at stake this election. Nikki is fighting for the future of the Republican Party and long-standing conservative principles like fiscal discipline and a strong national security,” said spokeswoman Olivia Perez-Cubas. “If we don’t right the ship, Republicans are going to keep losing and that means Democrats and the far left will keep winning.” The substance of Haley’s fight has earned her comparisons to once-beloved Republican presidents. “She certainly represents the values and principal policy positions of a Reagan-Bush coalition,” said GOP strategist Whit Ayers.

But unless things change in a hurry, her campaign could be compared to also-rans such as Pat Buchanan in 1992 and Steve Forbes in 1996, said Ayers, who noted that “there are a lot of people who’ve run for reasons other than simply winning the nomination.” Writing in Politico, conservative columnist Henry Olsen speculated about one of those potential reasons to stay in the race. The more delegates Haley wins, the more influence she will have at the Republican National Convention “to get concessions from Trump on things she cares about, such as U.S. support for NATO.” Speculation is in season, and more than one pundit has already written the Haley obituary. For her part, the former U.S. ambassador to the United Nations sticks to her argument that if Republicans nominate her old boss, “we will lose. It is that simple.” She brought this message with her to Utah, where the Republican governor, Spencer Cox, argued that if his party nominates Haley, “or literally anyone else, we would win by 10 to 14 points.”

“..the company ignored its own ban on the use of its technology for “military and warfare” purposes and partnered up with the Pentagon..”

• Musk Sues ChatGPT Maker Over AI Threat (RT)

US billionaire Elon Musk has taken OpenAI, the artificial intelligence research company he once helped to found, to court over an alleged breach of its original mission to develop AI technology not for profit but for the benefit of humanity. OpenAI, founded in 2015 as a non-profit research lab to develop an open-source Artificial General Intelligence (AGI), has now become a “closed-source de facto subsidiary of the largest technology company in the world,” Musk’s legal team wrote in the suit filed on Thursday in San Francisco Superior Court. The lawsuit claimed that Musk “has long recognized that AGI poses a grave threat to humanity – perhaps the greatest existential threat we face today.” “But where some like Mr. Musk see an existential threat in AGI, others see AGI as a source of profit and power,” it added.

“Under its new board, it is not just developing but is actually refining an AGI to maximize profits for Microsoft, rather than for the benefit of humanity.” Musk left the OpenAI board of directors in 2018 and has since grown critical of the firm, especially after Microsoft invested at least $13 billion to obtain a 49% stake in a for-profit branch of OpenAI. “Contrary to the founding agreement, defendants have chosen to use GPT-4 not for the benefit of humanity, but as proprietary technology to maximize profits for literally the largest company in the world,” the suit read. The lawsuit listed OpenAI’s CEO Sam Altman and president Gregory Brockman as co-defendants in the case, and called for an injunction to block Microsoft from commercializing the tech.

AI technology has improved at a rapid pace over the last two years, with OpenAI’s GPT language model going from powering a chatbot program in late 2022 to performing in the 90th percentile on SAT exams just four months later. More than 1,100 researchers, tech luminaries and futurists argued last year that the AI race poses “profound risks to society and humanity.” Even Altman himself has previously acknowledged that he is “a little bit scared” of the technology’s potential, and barred customers from using OpenAI to “develop or use weapons.” However, the company ignored its own ban on the use of its technology for “military and warfare” purposes and partnered up with the Pentagon, announcing in January that it was working on several artificial intelligence projects with the US military.

https://twitter.com/MarioNawfal/status/1763471083838033941

Sounds interesting, but I don’t quite know what to make of it.

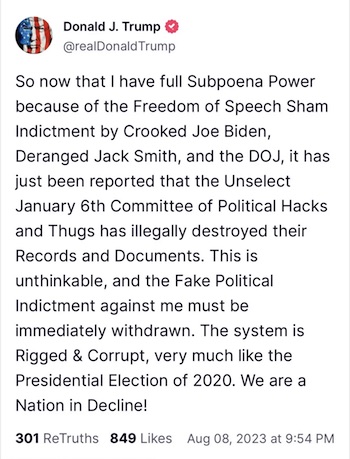

“MASSIVE WIN FOR TRUMP IN PA! Greg Stenstrom and Leah Hoopes won their legal case in Pennsylvania with co-Defendant @realDonaldTrump and can now say there WAS ELECTION FRAUD in 2020. This is big and may reverse not just #J6 and show the intelligence agencies at fault but actually also show Pfizer and all those who failed to sign oaths of office at fault for Pfizer damage and lack of clinical efficacy docuements. STAY TUNED. THINGS ARE DEVELOPING FAST”

• The Truth is a Complete Defense (PO)

WE WON. “NO MAS!” The Truth is a Complete Defense. Our defamation suit in which we were codefendants with President Trump is over, with the exception of a motion for sanctions that we expect will still be heard tomorrow morning in Philadelphia. Plaintiff Savage and attorney J. Conor Corcoran have withdrawn their complaints less than 24 hours before they were scheduled to appear in Court with Leah Hoopes and myself to consider Motion for Summary Judgement in our Favor for our “truth is a complete defense” and our Motion for Sanctions against Savage and Corcoran. As those of you who have been following along know, we have submitted a large volume of filings with the Court in preparation for tomorrows hearing, and a discovery hearing that was scheduled for 25MAR2024, and were beating them to a pulp.

We have also filed similar Motions to Dismiss and for Sanctions against Delaware County and attorneys from Duane Morris LLP and are beating their brains in there too. Duane Morris officially withdrew as attorneys this week for Newsmax in other litigation that we called out in our motions as conflicts and criminal collusion. To our knowledge, this is the only case against President Trump and Rudy Giuliani in the country (in which we were codefendants with them) that they have won, and credit where credit is due, Leah and I did all the heavy lifting. Expect more “wins” in the near future in our march to show that the November 2020 election was stolen and to restore election integrity and transparency in PA. We’re going after Shapiro hard and not going to quit until they all say “No Mas.” Semper Fi.

Seal safe

Seal safe on land. pic.twitter.com/prukXHVrBE

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 1, 2024

Martis

The #AncientGreekTradition of #Martis (#March in Greek) entails that everyone adorns themselves with red and white bracelets made from thread, from #March1 until at least the last day of the month on March 31. Full story: https://t.co/fSPlHOJ0D1 pic.twitter.com/L4xU5mVHWj

— Greek Reporter (@GreekReporter) March 1, 2024

Great white

Great white shark fully breaching in Mossell Bay, South Africa pic.twitter.com/NV7Cir8Mvw

— Nature is Amazing ☘️ (@AMAZlNGNATURE) March 1, 2024

Lions

https://twitter.com/i/status/1763621701726720013

Billy Crystal

Keef

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.