Paul Cézanne Village derrière des arbres, Île-de-France 1879

VDB

Dr. Geert Vanden Bossche: Mass Vaccination Was a Scientific 'Insult' to the World

"I think this word vaccines will be banned from the medical vade mecum (handbook) when the truth finally surfaces," professed virologist Dr. @GVDBossche.

"It [COVID] would have been over if we had… pic.twitter.com/heq8W68rR6

— Children’s Health Defense (@ChildrensHD) May 2, 2023

Assange

Julian Assange on free speech and monarchy pic.twitter.com/zcVzup6nC4

— WikiLeaks (@wikileaks) May 6, 2023

JFK Vietnam

Wow, I just found this footage of JFK saying in September 1963 that he's going to withdraw from Vietnam. This is why they killed him, only two months later!!! pic.twitter.com/hJPrcxue9R

— Michael Tracey (@mtracey) May 7, 2023

Bowie Lennon

DAVID BOWIE on his old friend JOHN LENNON.

“He was probably one of the brightest, quickest witted, earnestly socialist men I've ever met in my life. Socialist in its true definition, not in a fabricated political sense, a real humanist.”

— Michael Warburton (@MichaelWarbur17) May 7, 2023

What a take down video by @mazemoore pic.twitter.com/RovVnAkSnf

— MAGS (@TAftermath2020) May 7, 2023

Pepe on Twitter: “written on Thursday, BEFORE Prighozin’s deal with Kadyrov to wrap up Artemyovsk. Confirmed to me by top Donbass politico: fierce competition Wagner-MoD.”

• The Prighozin File: Twilight of the Gods or Maskirovka? (Pepe Escobar)

There’s no question: if Prighozin is essentially telling the truth, this is – literally – nuclear. Either Prighozin knows everything nearly everyone doesn’t, or this is a spectacular maskirovka. Yet facts on the ground since February 2002 seem to support his main accusation: the Russian army can’t properly fight because of a completely corrupt bureaucratic gang right at the very top of the MoD, all the way to Shoigu, all of them only interested in making a financial killing. And it gets worse: under a rigidly bureaucratized environment, commanders at the frontlines have no autonomy to take decisions and quickly adapt, and need to wait for orders from far away. That should be the main reason for the Kiev counter-offensive standing a chance of imposing dramatic upsets.

Prighozin is definitely not alone among Russian patriots in voicing his analysis. In fact there’s nothing new: he was just more forceful this time. Strelkov has been saying the exact same thing since the start of the war. That even coalesced into an “Angry Patriots Club” releasing an explosive video on April 19. So here we have a small but very vocal group bearing impeccable patriotic credentials sounding a serious alarm bell: Russia runs the risk of losing this proxy war entirely unless dramatic changes take place right away. Or, once again, this could be brilliant maskirovka – leaving the enemy totally misdirected. If that’s the case, it’s working like a charm. Kiev propaganda outlets triumphantly adopted Strelkov’s accusations with headlines such as “Russia is on the brink of defeat, Strelkov threatens the Kremlin with a coup.”

Strelkov keeps doubling down, insisting that the Russian state really does not take this war seriously and is planning to make a deal without really fighting, even ceding territory in Ukraine. His evidence: the “corrupt” (Prighozin) Russian army did not make any serious effort to prepare the economy, or public opinion, for an offensive – in terms of training and logistics. And that’s because the elites in the Kremlin and the army do not rally believe in this war, nor want it; they’d rather go back to the pre-war status quo. So here we go again. Maskirovka? Or a sort of Revenge of the MoD against Wagner? It’s a fact that at the start of the SMO the Russian army didn’t exactly get its act together, they really needed Wagner on the ground. But now it’s a different ball game, and the MoD may be engaged in gradually reducing Wagner’s role so Prighozin’s men do not capture all the blazes of glory when Russia starts going for the jugular.

And then right in the middle of this incandescent confrontation, we have the irruption in the dead of night of a couple of puny kamikaze drones over the Kremlin. This was no attempt to assassinate Putin: rather a cheap PR stunt. Russian intel must have pieced the whole story by now: the drones were probably launched from inside Moscow or its suburbs, by Ukrainian strike cells dressed in civilian clothing and sporting fake IDs. There will be more such PR stunts – anything from car bombs and booby traps to improvised landmines. Russia will have to step up internal security towards a real war footing. But what about the “response” to – in Kremlin terminology – a “terrorist attack”? Elena Panini from Russtrat.ru has offered a priceless, non-hysterical appraisal: “The purpose of the night strike, judging by the video footage, was not the Kremlin itself and not even the dome of the Senate Palace, but the flagpole on the dome with a duplicate of the standard of the President of the Russian Federation.

The game of symbolism is already purely British stuff. A kind of ‘reminder’ from London on the eve of the coronation of Charles III that the conflict in Ukraine is still developing according to the Anglo-Saxon scenario and within the framework set by them.” So yes: those neo-Nazi mutts in Kiev are just tools. The orders that matter always come from Washington and London – especially when it comes to breaching red lines. Panini argues it’s time for the Kremlin to seize the definitive strategic initiative. That should include upgrading the SMO to the status of a real war; declare Ukraine as a terrorist state; and implement what is already being discussed in the Duma: the transition to the use of “weapons that are capable of stopping and destroying the Kiev terrorist regime.” The puny double drone attack – a combined Anglo-Saxon neocon provocation – has offered Moscow the perfect gift: an unmistakable casus belli.

Putin?! No more withdrawal.

• Wagner Promised ‘As Much Ammo As We Need’ – Prigozhin (RT)

The Russian private military company Wagner Group, which is fighting Ukrainian troops in the Donbass city of Artyomovsk (Bakhmut), has been promised enough ammunition to continue the battle, the company’s head, Yevgeny Prigozhin said on Sunday.The statement comes after Prigozhin warned that his fighters would be forced to pull out of the city on May 10 unless ammunition shortages are addressed by Russia’s Defense Ministry. In a voice message posted on his Telegram channel, Prigozhin said that Wagner received “a military instruction … in which we were promised as much ammunition and weapons as we need to continue our activities.” “We were told that we can carry out activities in Artyomovsk as we deem necessary,” Prigozhin added.

He also said that Army General Sergey Surovikin, the deputy commander of Russia’s military operation in Ukraine, was tasked with “making all decisions related to the military activities of Wagner PMC in coordination with the Defense Ministry.” On Friday, Prigozhin said that Wagner personnel were suffering heavy losses because of what he described as a 70% shortage of ammunition. He later announced that the positions held by Wagner would be handed over to Akhmat, an elite unit from Russia’s Chechnya. The fierce and bloody battle for the mining city of Artyomovsk, known to Ukrainians as Bakhmut, has been raging for several months. Prigozhin claims his forces have taken control of nearly all of the city, while the Ukrainians are holding out in a small area in the western part. Capturing Artyomovsk, an important logistical hub, would allow Russian forces to make further advances in Donbass.

Bakhmut

⚡️With Wagner being less than 70 hours away from supposedly “withdrawing” from Bakhmut, I thought it would be cool to see what they’ve done in the past 279 days since the battle began.

Timeline of the historic “Battle of Bakhmut”: pic.twitter.com/q0XZcsxi0b

— War Monitor (@WarMonitors) May 7, 2023

“..China the dominant economic presence of the Eurasian landmass..”

• China, The Peacemaker? – McCoy (IC)

China has, in the last ten years, according to latest figures, expended a little over a trillion dollars in massive development loans. And they’ve done two things: They’ve laid a steel grid across the Eurasian landmass, for the first time actually overcoming that distance, and unifying Europe and Asia. So that, really, we shouldn’t speak of them as separate continents anymore; they were only divided by that great distance in the center. China has filled that distance with a steel grid of pipelines and rail links. And then, they’ve also ringed the whole world-island — that tricontinental world island of Europe, Asia, and Africa — with 40 ports, stretching from Sri Lanka, around the coast of Africa, and then ringing Europe, all the way from Piraeus in Greece to Hamburg in Germany.

And then, here we have to get almost metaphysical, a little bit mystical, OK? Because everybody talks about geopolitics. You know, you can pick up The Washington Post and New York Times and, probably, in every issue find the word “geopolitics” popping up all over the place. What is geopolitics? What might geopolitics mean? How might geopolitics actually make a difference? What’s the relationship between geographical formations and political events? And here’s what I think is happening, OK? That geopolitics is kind of like a substrate beneath the visible, tangible surface of events. Now, China has changed the Eurasian politics by investing this trillion dollars and laying down this infrastructure, so that China has an infrastructure for dominance of Eurasia. And then what happens? It’s kind of like the grinding of the tectonic plates beneath the earth’s surface that periodically manifests themselves in earthquakes or volcanic eruptions. When the liquid rock breaks through the earth’s surface and you get an enormous eruption, and then, suddenly, you realize that the tectonic plates are shifting.

Well, that’s what’s happened. China has changed the substrate of Eurasia’s geopolitics. And now, just now, after — It’s only been ten years that China’s been doing this. They started this in 2013, we’re in 2023. It’s [been] ten years. That’s not a long time. But they’ve done it fast, and they’ve done it, actually, pretty well, despite what you might read in the U.S. press about white elephant investments and all the rest. And so, there are all these manifestations. One was the U.S. withdrawal from Afghanistan in 2021. I mean, what China did was, they ran a geopolitical squeeze play around the U.S. position in Afghanistan. They signed very lucrative development deals with the six countries ringing Afghanistan, particularly Pakistan. And mind you, how does the U.S. military fight? We have troops on the ground and we have air support. And it’s that combination that’s absolutely central to all U.S. warfighting strategy. No planes, then no soldiers on the ground.

And where’d those planes come from? The nearest air base that they could fly from after this geopolitical squeeze play was the Persian Gulf. They had to fly 2,000 miles, which means their ability to loiter over the battlefield and provide close air support was very limited. They could refuel, of course, but it was impossibly inefficient, and it was dangerous for the troops on the ground. And that meant, bang, we had to get out of there as fast as we could. The next manifestation we saw which, you know, seemed to be absolutely unrelated — But, again, think of that substrate and the periodic eruption. The next eruption was this sectarian division, as deep as the history of Islam, over a thousand years between Sunni and Shia —Shia, Iran, Sunni, Saudi Arabia — locked in the confrontation. But China signed a $480 billion development deal with Iran, and China’s top source of oil — and it’s the world’s leading oil importer — was Saudi Arabia. And so, China suddenly was in a position, because of this change in the geopolitical substrate that makes China the dominant economic presence of the Eurasian landmass. They could mediate between them.

“.. the US Department of State and the CIA are skeptical of the idea and would like to see the result of the potential Ukrainian counteroffensive before taking any diplomatic steps..”

• Kiev Counteroffensive To ‘Pave The Way’ For Dialogue With Russia – WSJ (TASS)

The Kiev regime’s ostensibly possible counteroffensive may “pave the way” for peace talks between Russia and Ukraine by the end of the year with China being one of the mediators, the Wall Street Journal reported on Sunday citing European officials. According to the newspaper, key representatives from the US National Security Council support the idea of holding the negotiations between Kiev and Moscow. That said, the US Department of State and the CIA are skeptical of the idea and would like to see the result of the potential Ukrainian counteroffensive before taking any diplomatic steps. The Wall Street Journal also points out that this “shift in Western thinking” is occurring amid Western countries’ serious concern that they won’t be able to maintain the necessary level of military aid to the Kiev regime in the future.

That said, some Western states want to see whether China is capable of defusing the conflict which also indicates a change in the way the West sees Beijing’s role. Media conjecture about a potential counteroffensive by Ukrainian troops has been rife for several months running, with various potential trigger dates being publicly mooted. Earlier, the Russian Foreign Ministry highlighted that such open speculation within Western countries about expectations for an upcoming Ukrainian counteroffensive only serves to confirm these countries’ direct involvement in the conflict. On April 23, Ukrainian National Security and Defense Council Secretary Alexey Danilov rejected calls for dialogue on settling the conflict with Russia demanding more weapons from the West. Earlier, Russian Foreign Minister Sergey Lavrov said that Moscow always supported holding negotiations but dialogue on the situation around Ukraine is possible only if Russia’s legitimate interests and concerns are taken into account.

“Now that China has entered the negotiation, it will come to a head, I think by the end of the year..”

• Kissinger Makes Ukraine Peace Prediction (RT)

Former US Secretary of State Henry Kissinger has told CBS News that the conflict in Ukraine may be approaching a turning point, and that Chinese-brokered peace talks could begin by the end of 2023. “Now that China has entered the negotiation, it will come to a head, I think by the end of the year,” the 99-year-old diplomat told CBS in an interview broadcast on Sunday. By that time, he continued, “we will be talking about negotiating processes and even actual negotiations. With the release of its ‘Position on the Political Settlement of the Ukraine Crisis’ in February, China put itself forward as a potential mediator between Moscow and Kiev. The Chinese plan was rejected outright by the US and EU, while Russian President Vladimir Putin described some of its 12 points as “in tune” with Moscow’s position, and Ukrainian President Vladimir Zelensky welcomed only a handful of its points, but maintains that Kiev will not compromise with Russia in any way.

Zelensky’s refusal to negotiate with Putin’s government – the Ukrainian leader banned contact with the Kremlin in a decree last October – is just one stumbling block faced by China or any other potential middleman. Russia considers the conflict in Ukraine a proxy war between itself and NATO, and Russian Foreign Minister Sergey Lavrov said on Friday that any negotiations would not be held “with Zelensky, who is a puppet in the hands of the West, but directly with his masters.” In Washington, the administration of President Joe Biden publicly claims that it is up to Ukraine to decide when to seek peace. Zelensky has been offered no incentives by the US to do so, with Biden offering to continue supplying him with weapons “for as long as it takes” to achieve his war aims.

Among these aims is the capture of Crimea, a Russian territory since 2014. American military leaders have publicly admitted that the chances of this happening are slim to none. Kissinger drew the ire of Kiev last year when he suggested that Ukraine should accept a return to the “status quo ante,” or relinquish its territorial claims to Crimea and grant autonomy to the Donetsk and Lugansk People’s Republics, in the name of peace. He has since suggested that these territories become the basis of negotiations after a ceasefire and Russian withdrawal. Moscow has repeatedly said that it is open to talks with Kiev but only if Ukraine “recognizes the reality on the ground,” including the new status of the regions of Donetsk, Lugansk, Kherson, and Zaporozhye as parts of Russia. Otherwise, the Kremlin has stated, Russia will settle the conflict by military means.

“The best thing we could do would be to go to school to study Chinese..”

• EU Defenseless Against China – Berlusconi (RT)

Former Italian Prime Minister Silvio Berlusconi warns that the EU would be unable to defend itself if China decided to attack one of its member states. The veteran politician urged Brussels to adopt a robust military strategy and invest heavily in defense. Berlusconi made the remarks in a video interview recorded on Friday by Sky TG24 news channel. He is currently in the San Raffaele hospital in Milan and is being treated for leukemia, which was diagnosed in early April. The former prime minister said the EU is hardly a force to be reckoned with in the international arena, and should China decide to “occupy Italy, and maybe some other European country, we would absolutely not be able to counter it.” “The best thing we could do would be to go to school to study Chinese,” he added.

To improve its standing, Berlusconi said, the EU needs to adopt a “single military policy, with strong cooperation between the armed forces of all European countries.” He also advocated an increase in defense spending and the establishment of a 300,000-strong “emergency corps.” Politically, Berlusconi said he would like to see a “truly united continent” – something which would be more achievable if the bloc dropped its ‘unanimity principle’ in voting in favor of an 80-85% majority, he argued. He went on to stress that the EU can and must play a greater role in the world, including standing up to what Berlusconi described as “Chinese imperialism. Last month, Bloomberg reported that the current prime minister, Giorgia Meloni, was considering withdrawing from China’s Belt and Road infrastructure project.

According to sources cited in the article, however, there is a lack of consensus on the matter within the ruling coalition. Speaking in late March ahead of her visit to China, European Commission President Ursula von der Leyen said that while “decoupling” from Beijing is not in the EU’s interests, Brussels should become “bolder” in its relations with China – which is growing “more repressive at home and more assertive abroad,” she added. Commenting on Von der Leyen’s remarks, the Chinese ambassador to the EU, Fu Cong, said her message was incoherent and contradictory, while calling out the “misrepresentation and misinterpretation of Chinese policies and Chinese positions,” and advising the European Commission chief to find better speechwriters.

”..if Ukraine doesn’t join NATO, I think Russia will feel less threatened, and there will be no confrontation. But once the process is started, Russia will take preemptive action,..

• US Anti-Russia Actions Push Humanity Towards World War, Malaysia ex-PM (TASS)

The US authorities push humanity towards a world war by contributing to emergence of two hostile blocs, says Former Prime Minister of Malaysia Mahathir Mohamad. “The US will try to get other countries to join in the action against Russia, and Russia will also have to find friendly countries which will support it,” Mahathir, 97, said in an interview for the Global Times. “There will be confrontation between the Eastern bloc and Western bloc. And this will escalate and become a world war.” The expert noted that the conflict in Ukraine, provoked by the West, has already affected the entire world. He noted that the complicated situation has led to increased spending for essential goods around the world, negatively affecting grain shipments.

“The invitation to Ukraine to join NATO is a provocation. In fact, if Ukraine doesn’t join NATO, I think Russia will feel less threatened, and there will be no confrontation. But once the process is started, Russia will take preemptive action,” Mahathir said. He pointed out that NATO states are not directly involved in the Russian-Ukrainian conflict et, because Ukraine is not a member of the alliance. However, according to the ex-Prime Minister, the standoff with Russia harms NATO member states greatly. “In the end, they [Russia and Ukraine] will have to find some settlement. It is better for them to talk to each other, to discuss, to negotiate,” Mahathir said.

Feel safer?

• Kamala Harris To Run AI Taskforce (RT)

US Vice President Kamala Harris has been appointed to head a new artificial intelligence initiative in partnership with leading companies in the field, the White House announced in a press release on Thursday. Harris and other senior officials in the administration of President Joe Biden will meet with the CEOs of Alphabet, Anthropic, Microsoft, and OpenAI to remind them of their “responsibility to make sure their products are safe before they are deployed or made public.” The meeting is intended to keep the companies on track toward “driving responsible, trustworthy and ethical innovation with safeguards that mitigate risks and potential harms to individuals and our society,” according to the White House, which referenced recent executive orders and official statements reminding tech companies that their products were subject to civil rights law and other protections against unlawful discrimination.

The four companies, along with Hugging Face, NVIDIA, and Stability AI, will also submit to a public evaluation of their capabilities by thousands of industry experts and other curious members of the public at DEFCON 31, the Las Vegas hacking convention that has repeatedly put the insecurity of the US’ voting machines on display by giving children a chance to hack them. The White House also announced the creation of seven new National AI Research Institutes focusing on climate, agriculture, energy, public health, education, and cybersecurity, explaining the new institutes would “support the development of a diverse AI workforce” with $140 million in funding from the National Science Foundation. The administration is also giving the public the chance to weigh in on government AI policy starting this summer, according to the press release.

Tasked with stemming the flow of migrants over the US’ southern border upon taking office in 2021, Harris instead presided over a record amount of illegal immigration, earning her the lowest approval rating of any modern US vice president. Last year, she was assigned with developing a blueprint for fighting “disinformation,” harassment and abuse online despite having no experience in the technology sector. While hundreds of experts in the AI field have called for a moratorium on, or at least a dramatic slowdown of, AI development until internationally agreed-upon safety measures can be put in place, the US has thus far shied away from issuing any strong statements about the technology. Last month, Biden met with his Council of Advisors on Science and Technology to discuss the “risks and opportunities” in the field but declined to address the experts’ warnings while admitting AI “could be” dangerous.

“For all his faults, Fauci is no fool. One does not spend 54 years ensconced in the federal government without learning how to play politics.”

• Fauci’s Never-Ending Victory Tour (Pierre Kory)

What a dystopian nightmare watching “America’s Doctor” try to continue his Covid victory tour. It is both shocking and unsurprising that he would do this despite leaving a generation of children with lower IQ scores, a US life expectancy which dropped three years in the span of two, hundreds of thousands of deaths from the vaccines amongst working-age Americans (threatening the life insurance industry), millions of vaccine injured, skyrocketing disability rates, an explosion of cancers, and suddenly plummeting birth rates. So I went after him. Again. Maybe he will get the memo this time, particularly in light of the frosty receptions he has received of late from normally kid-gloved, obsequious interviewers. Enjoy. Dr. Anthony Fauci left government in December, but his media tour is going strong, albeit with a different tone and tenor.

The fawning adulation and questions about his exercise regimes and bobbleheads have been replaced by skepticism and outright doubt from outlets who never dared question the all-knowing man once dubbed “America’s doctor” by the New Yorker. Fauci recently appeared on CNN to complain about, “a personification of me as a person who essentially closed everything down.” He was responding to a lengthy sitdown with the New York Times where he declared, “Show me a school that I shut down and show me a factory that I shut down. Never. I never did. I gave a public-health recommendation that echoed the C.D.C.’s recommendation, and people made a decision based on that.” For all his faults, Fauci is no fool. One does not spend 54 years ensconced in the federal government without learning how to play politics.

Three years removed from the worst of the COVID pandemic, the longtime director of the National Institute of Allergy and Infectious Diseases knows the policy decisions guided by his medical recommendations are looking worse by the day. Herein lies his problem. When his ideas were in vogue, Fauci had no problem claiming responsibility. Now that the ugly consequences are coming due, he is eager to wash his hands. In the face of plummeting math and reading scores between 2020 and 2022, Fauci is especially quick to deny his role in the school shutdowns. Last fall, Fauci raised eyebrows for denying that school lockdowns, “forever irreparably damaged anyone.” Yet as late as September 2020, Fauci recommended that schools only open back up once the virus is “under control.”

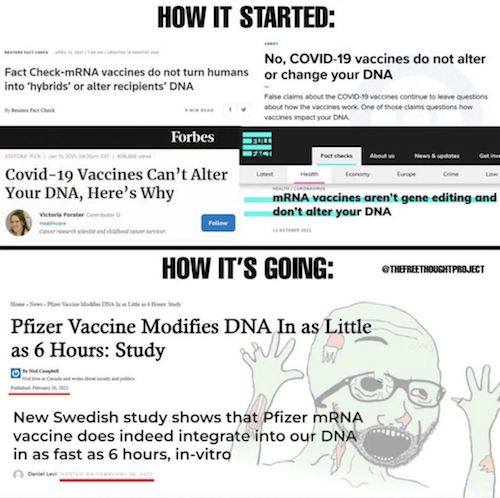

Earlier in the year, he had chastised Florida Governor Ron DeSantis, warning that premature reopening “likely” led to widespread student infection. Today, even left-leaning sources concede that, “kids are safe. They always have been.” Then came the vaccines. From the outset, Fauci’s entire COVID mitigation strategy was based on an experimental vaccine rushed to market under the branding “warp speed.” There had never been an mRNA-approved vaccine before, and now it was being pushed non-stop from the White House podium with the full support of the pharmaceutical industry. It was always highly illogical to deploy a static vaccine toward a mutagenic and constantly changing coronavirus. Then came the checks the vaccines couldn’t write. Fauci told us they would stop transmission. He implored us to “follow the science.”

“..knows where a lot of bodies are buried, and is ready to start drawing a map..”

• Tucker Carlson Squaring Off Against Fox – Axios (RT)

Conservative commentator Tucker Carlson is ready to go on the attack against Fox News if the network does not release him from his contract, Axios reported on Sunday, citing sources close to the pundit. Fox fired its number-one host last month just hours before he was scheduled to go on air, but has not released Carlson from his $20 million annual contract, which forbids him to work elsewhere in the industry until January 2025. While Carlson has made no public statement on his departure or his future plans, aside from a two-minute Twitter video promising his viewers that he would see them “soon,” he has retained entertainment lawyer Bryan Freedman to negotiate an exit to the contract. Sources claiming to be close to the newsman say he is losing patience with the network.

“His team is preparing for war. He wants his freedom,” a “close Carlson friend” told Axios, noting that Carlson had previously said he wanted to “get this done quiet and clean” but his team was now “going from peacetime to Defcon 1.” The conservative icon “knows where a lot of bodies are buried, and is ready to start drawing a map,” another insider source agreed. Carlson’s allies in the media are supposedly prepared to go on the offensive against Fox, and outlets including video platform Rumble and cable network Newsmax have reportedly offered to pay him even more than his previous employer. Even billionaire Twitter CEO Elon Musk is reportedly interested, though the two have not discussed the details of any arrangement. “The idea that anyone is going to silence Tucker and prevent him from speaking to his audience is beyond preposterous,” Freedman told Axios.

The network lost almost half of its audience in Carlson’s 8pm time slot in the week following his firing, and ratings for the network’s other shows have also declined precipitously – especially in the 25-54 age demographic desirable to advertisers. Carlson’s show drew over 3 million viewers per night, far more than the next most popular show. The exact reason for Carlson’s ouster has not been made public. Media critics including the New York Times point to leaked text messages from the anchor, specifically one in which Carlson admitted enjoying watching footage of an antifa protester being beaten by a group despite this not being “how white men fight,” then acknowledging the protester’s humanity. Other leaked texts revealed Carlson did not believe the claim that Dominion Voting Systems was flipping votes for Democrat Joe Biden. Fox settled Dominion’s defamation lawsuit for $787 million just days before firing the anchor.

https://twitter.com/i/status/1654966139074539520

https://twitter.com/i/status/1655321469541285889

“We’re going to disclose many of the different LLCs, many of the different transactions that all these different Biden family members have gotten from our adversaries around the world..”

• Rep. Comer Urges DOJ To Hold Possible Hunter Biden Indictment (Fox)

House Oversight Committee Chair James Comer, R-Ky., urged the Justice Department to hold on a potential Hunter Biden indictment until after Republicans hold a press conference unveiling additional details surrounding the Biden family’s business dealings. Comer warned officials to wait to charge the first son until they hear from congressional leaders, arguing that the possible indictment could be just a “slap on the wrist” compared to their upcoming revelations. “My message to the Department of Justice is very loud and clear. Do not indict Hunter Biden before Wednesday,” Comer said during “Sunday Morning Futures.” “When you have the opportunity to see the evidence that the House Oversight Committee will produce with respect to the web of LLCs, with respect to the number of adversarial countries that this family influence peddled in, and this is not just about the president’s son.

This is about the entire Biden family, including the President of the United States. So we believe there are a whole lot of tips that the IRS and the DOJ don’t know about because we don’t believe they’ve done a whole lot of digging in this, and we have.” “By all accounts from the media reports that we’re getting, what they’re looking at charging Hunter Biden on is a slap on the wrist. It’s a drop in the bucket,” he continued. “So Wednesday will be a very big day for the American people in getting the facts presented to them so that they can know the truth, and then the Department of Justice can finally do what they should have done years ago.” Federal prosecutors are reportedly nearing a decision on a potential Hunter Biden indictment stemming from a years-long probe into possible tax and gun-related violations.

But Republicans are set to hold a press conference on Wednesday presenting the American people with additional information on the Biden family’s bank records, a briefing that Comer argued will provide additional information into the investigation led by U.S. Attorney David Weiss. Comer warned the evidence they have further implicates the Biden family in a broader, criminal “pay-for-play” bribery scheme. “We’re going to present to the American people all the information that we’ve received thus far pertaining to bank records. We’re going to disclose many of the different LLCs, many of the different transactions that all these different Biden family members have gotten from our adversaries around the world,” he said. “We don’t believe this was just a coincidence that all these Biden family members were receiving money from these this Web of LLC into their personal bag.”

NEW: House Oversight Committee Chair James Comer says he will outline a money laundering and racketeering scheme involving President Joe Biden, nine Biden family members, and a web of shell companies.

"On Wednesday, we are going to present to the American people all the… pic.twitter.com/WooLag8y3Z

— KanekoaTheGreat (@KanekoaTheGreat) May 8, 2023

“uninsured depositor runs”

• Close to 190 US Banks Could Collapse, According To Study (USAT)

With the failure of three regional banks since March, and another one teetering on the brink, will America soon see a cascade of bank failures? Bloomberg reported Wednesday that San Francisco-based PacWest Bancorp is mulling a sale. Last week, First Republic Bank became the third bank to collapse, the second-largest bank failure in U.S. history after Washington Mutual, which collapsed in 2008 amid the financial crisis. After the demise of Silicon Valley Bank and Signature Bank in March, a study on the fragility of the U.S. banking system found that 186 more banks are at risk of failure even if only half of their uninsured depositors (uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run) decide to withdraw their funds.

Uninsured deposits are customer deposits greater than the $250,000 FDIC deposit insurance limit. Regional banks are failing because the Federal Reserve’s aggressive interest rate hikes to tamp down inflation have eroded the value of bank assets such as government bonds and mortgage-backed securities. Most bonds pay a fixed interest rate that becomes attractive when interest rates fall, driving up demand and the price of the bond. On the other hand, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, thus driving down its price. Many banks increased their holdings of bonds during the pandemic, when deposits were plentiful but loan demand and yields were weak. For many banks, these unrealized losses will stay on paper.

But others may face actual losses if they have to sell securities for liquidity or other reasons, according to the Federal Reserve Bank of St. Louis. “The recent declines in bank asset values very significantly increased the fragility of the U.S. banking system to uninsured depositor runs,” economists wrote in a recent paper published on the Social Science Research Network Of course, this scenario would play out only if the government did nothing. “So, our calculations suggest these banks are certainly at a potential risk of a run, absent other government intervention or recapitalization,” the economists wrote.

“What will generate a credit crunch is the destruction of capital in the asset base of most lenders.”

• A Credit Crunch Is Inevitable (Lacalle)

Federal Reserve data shows $98 billion of deposits left the banking system in the week after the Silicon Valley Bank collapse. Most of the money went to money-market funds, as the Bloomberg data shows that assets in this class rose by $121 billion in the same period. The data shows the challenges of the banking system in the middle of a confidence crisis. However, as many analysts point out, this is not necessarily the main factor that dictates the risk of a credit crunch. Deposit flight is certainly an important risk. Many regional banks will have to cut lending to families and businesses as deposits shrink, but in the United States bank loans are less than 19 percent of corporate credit according to the IMF, while in the euro area it is more than 80 percent. What will generate a credit crunch is the destruction of capital in the asset base of most lenders.

The slump in mark-to-market valuations of all asset classes from loans to investments is what will ultimately drive an inevitable credit contraction. Credit standards have tightened significantly already, and the credit impulse of the economy, both in the US and euro area, has deteriorated rapidly, according to the respective Bloomberg indices. Both are below the March 2021 low. We must remember that credit standards’ tightening was already a reality before the Silicon Valley Bank demise. But the reality check of capital destruction in the financial system’s asset base is far from done. Start-ups will most likely see the most severe crunch in financing as the tech bubble burst adds to the asset base capital destruction in private equity and venture capital firms, who have delayed all they could the required write-downs and face a sobering reality check.

Our internal estimate of capital destruction in the asset base of banks and private equity firms is between a 15 to 25 percent wipeout, which is consistent with the average decline in market value over the October 2021–March 2023 period. Real estate investments all over the US and Europe require a significant reevaluation now that real estate has underperformed the market for eighteen months, according to Morgan Stanley. The optimistic valuations of real estate and corporate investments in banks’ balance sheets will require a significant analysis and subsequent write-off that leads to much tighter credit standards and stringent investment conditions.

“..shifting at least part of its $3.2trn worth of foreign reserves held in dollars into other currencies. All of this would take a long time – one or two decades, perhaps.”

• China And Its Trading Allies Are Well Placed To Topple The Dollar (Münchau)

The dollar is the foundation of US global leadership, and the future of the dollar is therefore intricately linked to the debate about geopolitical fragmentation. Brazil’s president, Luiz Inácio Lula da Silva, asked during his recent visit to China: “Why should every country have to be tied to the dollar for trade?… Who decided the dollar would be the [world’s] currency?” These are good questions. The perhaps surprising answer is that he himself made that decision, together with the former leaders of the other “Brics” group of nations: Brazil, Russia, India, China and South Africa. Their economic-development models have succeeded but have also critically depended on the US dollar. During the period of hyperglobalisation – which I date from 1990 to 2020 – the US became the global importer of last resort, and let its trade deficit against the rest of the world increase.

China and many other fast-developing economies built up savings in the currency they were paid in – the US dollar. They invested those savings into US bonds and other assets. The willingness of the US to absorb the world’s savings surpluses was the engine of globalisation. It ensured that the dollar would maintain its status as the world’s leading currency. This mechanism explains what happened in the last 20 years, but it won’t tell us what will happen in the next 20. Yet the dollar fans assume that the geopolitical and geo-economic environment will stay broadly the same. f the five Brics countries wanted to end their dependence on the dollar, they would have to do more than just choose another currency to trade in. It is not a menu choice, as Lula suggested during the same speech. He and his fellow Brics leaders would have to change how they interact with the rest of the world, and with one another.

China is key. In 2021, the country derived 43 per cent of its GDP from investment. This is approximately twice the level of the US and other Western countries. If China managed to shift some of its GDP to consumption, it would reduce its external trade surplus, as consumers tend to buy more imported goods. If you wanted to be less reliant on the US dollar, this is where you would have to start. As a second step, China and the other Brics countries could start trading more with each other, become more self-reliant in their supply chains, and set up their own financial infrastructure. hanging economic models is hard. Three years after Brexit, the UK is still struggling to move away from a model that depended on close integration with the EU.

Germany is finding it hard to maintain competitiveness without cheap Russian gas and with impaired global supply. It takes decades to build industrial production lines and supply chains. In China, there are an awful lot of vested political interests at the regional level, which rely on the investment boom continuing. If President Xi Jinping was really keen to extricate China from the US dollar, he would need to impose policies that would meet with resistance from regional leaders. In parallel, China would also have to start a long process of shifting at least part of its $3.2trn worth of foreign reserves held in dollars into other currencies. All of this would take a long time – one or two decades, perhaps.

“Several former agents recalled being blocked by the agency from sharing intelligence about the hijackers with the rest of the FBI.”

• MSM Doesn’t Care That the CIA May Have Helped Cause 9/11 (Marcetic)

For all the ways the September 11 attacks continue to shape US culture and foreign policy, the event is still shrouded in a surprising amount of mystery. A recently unearthed bombshell court filing offers some possible clarity on the questions that continue to surround the attacks and their aftermath — and yet, like similar bombshells in recent years, it’s been studiously ignored by the media and political establishment. First reported by Rolling Stone contributing editor Seth Hettena on the Substack SpyTalk, the media project run by veteran former Newsweek national security reporter Jeff Stein, those potential answers come in the form of a signed affidavit from Guantanamo military commission investigator Don Canestraro. The affidavit outlines the findings of a 2016 investigation by Canestraro, a longtime veteran of the Drug Enforcement Administration (DEA), into Saudi and CIA complicity in the terrorist attacks, findings that are squarely at odds with the story given to the public in their wake.

Relaying the information gathered from dozens of interviews he conducted with former FBI and CIA personnel, members of the 9/11 Commission, and US government officials, Canestraro’s affidavit outlines a sequence of events that, if true, suggest a botched and illegal domestic CIA operation was at the heart of the intelligence failure that enabled the attacks. More than that, it suggests there was a concerted cover-up of the grave blunder after the fact by both the CIA and the George W. Bush administration. The affidavit outlines the overlapping claims of numerous agents that the CIA impeded law enforcement efforts that could have prevented the attacks. Several former agents recalled being blocked by the agency from sharing intelligence about the hijackers with the rest of the FBI.

The CIA knew from wiretaps that two of the hijackers, Nawaf al-Hazmi and Halid al-Mindhar, had multiple entry visas letting them travel to the United States, one former agent said, but didn’t pass it on to the bureau. Two other agents alleged that the CIA withheld information about the two men’s connection to the planner of the October 2000 al-Qaeda bombing of the USS Cole, which, if known, would have turned the case into a criminal investigation for the FBI to pursue. One of those agents recalled a meeting with the CIA in which they were shown photos of three suspected terrorists, two of which would turn out to be future hijackers al-Hazmi and al-Mindhar. When the agent, referred to in the affidavit as CS-12, asked who was placing border crossing alerts on the suspects, which would have notified law enforcement about their entry into the United States, they were told no one was.

“..he still cannot believe that the US was able to pull off the feat, but is now unable to..”

• Ex-Russian Space Boss Questions US Moon Landing (RT)

The former head of Russia’s Roscosmos space agency, Dmitry Rogozin, has expressed doubt that the US Apollo 11 mission really landed on the Moon in 1969, saying he has yet to see conclusive proof. In a post on his Telegram channel on Sunday, Rogozin said he began his personal quest for the truth “about ten years ago” when he was still working in the Russian government, and that he grew skeptical about whether the Americans had actually set foot on the Moon when he compared how exhausted Soviet cosmonauts looked upon returning from their flights, and how seemingly unaffected the Apollo 11 crew was by contrast. Rogozin said he sent requests for evidence to Roscosmos at the time.

All he received in response was a book featuring Soviet Cosmonaut Aleksey Leonov’s account of how he talked to the American astronauts and how they told him they had been on the Moon. The former official wrote that he continued with his efforts when he was appointed head of Roscosmos in 2018. However, according to Rogozin, no evidence was presented to him. Instead, several unnamed academics angrily criticized him for undermining the “sacred cooperation with NASA,” he claimed. The former Roscosmos chief also said he had “received an angry phone call from a top-ranking official” who supposedly accused him of complicating international relations.

Rogozin concluded by saying he still cannot believe that the US was able to pull off the feat, but is now unable to, despite the incredible progress in technology since the late 1960s. What he claims to have found out, however, was that Washington has “its people in [the Russian] establishment.” Apollo 11 was the first manned mission to the Moon, with Neil Armstrong and Buzz Aldrin going down in history as the first humans to walk on the lunar surface. The flight was preceded by the unmanned Soviet Luna 2 program, which blazed the trail for Moon exploration. Last April, President Vladimir Putin pledged to resume Russia’s lunar program.

A husky next to a wolf. Although wolf-like in appearance, huskies are no more closely related to wolves than poodles and bulldogs are. And the size says it all.

Kiss whale

https://twitter.com/i/status/1655267089551183875

Aqua puppy

https://twitter.com/i/status/1655210878101340167

We love little guy

— Nature is Amazing ☘️ (@AMAZlNGNATURE) May 7, 2023

The rainbow starfrontlet (Coeligena iris) is a species of hummingbird in the “brilliants” tribe Heliantheini. Males have a glittering yellow-green forecrown that transitions through golden yellow to blue on the crown Jorge Luis Cruz Alcivar

Chick

https://twitter.com/i/status/1655043864279785473

A video of a giant Squid. This specimen, found in Toyama Bay, measured approximately 3.7 meters in length. However, estimates place their maximum size at about 12-13 meters.

A video of a giant Squid. This specimen, found in Toyama Bay, measured approximately 3.7 meters in length. However, estimates place their maximum size at about 12-13 meters.pic.twitter.com/RKxvqCz5t3

— Fascinating (@fasc1nate) May 7, 2023

Secretary bird

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.