NPC “Poli’s Theater, Washington, DC. Now playing: Edith Taliaferro in “Keep to the Right” 1920

Yeah, recovery. Sure. “Jobs gained since the recession are paying 23% less than jobs lost..”

• Half The Country Is Either Living In Poverty Or Damn Near Close To It (AN)

Recent reports have documented the growing rates of impoverishment in the U.S., and new information surfacing in the past 12 months shows that the trend is continuing, and probably worsening. Congress should be filled with guilt — and shame — for failing to deal with the enormous wealth disparities that are turning our country into the equivalent of a 3rd-world nation.

Half of Americans Make Less than a Living Wage According to the Social Security Administration, over half of Americans make less than $30,000 per year. That’s less than an appropriate average living wage of $16.87 per hour, as calculated by Alliance for a Just Society (AJS), and it’s not enough — even with two full-time workers — to attain an “adequate but modest living standard” for a family of four, which at the median is over $60,000, according to the Economic Policy Institute. AJS also found that there are 7 job seekers for every job opening that pays enough ($15/hr) for a single adult to make ends meet.

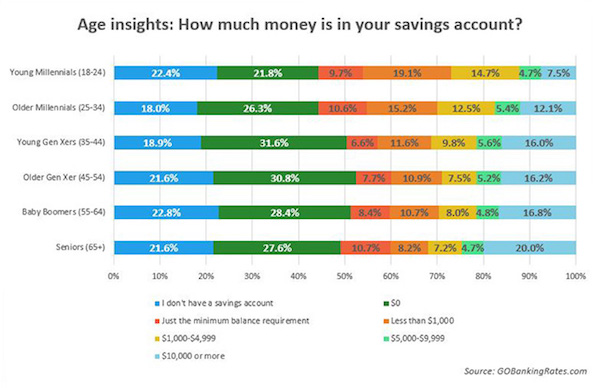

Half of Americans Have No Savings A study by Go Banking Rates reveals that nearly 50% of Americans have no savings. Over 70% of us have less than $1,000. Pew Research supports this finding with survey results that show nearly half of American households spending more than they earn. The lack of savings is particularly evident with young adults, who went from a five-percent savings rate before the recession to a negative savings rate today. Emmanuel Saez and Gabriel Zucman summarize: “Since the bottom half of the distribution always owns close to zero wealth on net, the bottom 90% wealth share is the same as the share of wealth owned by top 50-90% families.”

Nearly Two-Thirds of Americans Can’t Afford to Fix Their Cars The Wall Street Journal reported on a Bankrate study, which found 62% of Americans without the available funds for a $500 brake job. A Federal Reserve survey found that nearly half of respondents could not cover a $400 emergency expense. It’s continually getting worse, even at upper-middle-class levels. The Wall Street Journal recently reported on a JP Morgan study’s conclusion that “the bottom 80% of households by income lack sufficient savings to cover the type of volatility observed in income and spending.” Pew Research shows the dramatic shrinking of the middle class, defined as “adults whose annual household income is two-thirds to double the national median, about $42,000 to $126,000 annually in 2014 dollars.” Market watchers rave about ‘strong’ and even ‘blockbuster’ job reports.

But any upbeat news about the unemployment rate should be balanced against the fact that nine of the ten fastest growing occupations don’t require a college degree. Jobs gained since the recession are paying 23% less than jobs lost. Low-wage jobs (under $14 per hour) made up just 1/5 of the jobs lost to the recession, but accounted for nearly 3/5 of the jobs regained in the first three years of the recovery. Furthermore, the official 5% unemployment rate is nearly 10% when short-term discouraged workers are included, and 23% when long-term discouraged workers are included. People are falling fast from the ranks of middle-class living. Between 2007 and 2013 median wealth dropped a shocking 40%, leaving the poorest half with debt-driven negative wealth. Members of Congress, comfortably nestled in bed with millionaire friends and corporate lobbyists, are in denial about the true state of the American middle class. The once-vibrant middle of America has dropped to lower-middle, and it is still falling.

Damning.

• Most Americans Have Less Than $1,000 In Savings (MarketWatch)

Americans are living right on the edge — at least when it comes to financial planning. Approximately 62% of Americans have less than $1,000 in their savings accounts and 21% don’t even have a savings account, according to a new survey of more than 5,000 adults conducted this month by Google Consumer Survey for personal finance website GOBankingRates.com. “It’s worrisome that such a large%age of Americans have so little set aside in a savings account,” says Cameron Huddleston, a personal finance analyst for the site. “They likely don’t have cash reserves to cover an emergency and will have to rely on credit, friends and family, or even their retirement accounts to cover unexpected expenses.”

This is supported by a similar survey of 1,000 adults carried out earlier this year by personal finance site Bankrate.com, which also found that 62% of Americans have no emergency savings for things such as a $1,000 emergency room visit or a $500 car repair. Faced with an emergency, they say they would raise the money by reducing spending elsewhere (26%), borrowing from family and/or friends (16%) or using credit cards (12%). And among those who had savings prior to 2008, 57% said they’d used some or all of their savings in the Great Recession, according to a U.S. Federal Reserve survey of over 4,000 adults released last year. Of course, paltry savings-account rates don’t encourage people to save either.

In the latest survey, 29% said they have savings above $1,000 and, of those who do have money in their savings account, the most common balance is $10,000 or more (14%), followed by 5% of adults surveyed who have saved between $5,000 and just shy of $10,000; 10% say they have saved $1,000 to just shy of $5,000. Just 9% of people say they keep only enough money in their savings accounts to meet the minimum balance requirements and avoid fees. But minimum balance requirements can vary widely and be hard to meet for some consumers. They can vary anywhere between $300 a month and $1,500 a month at some major banks.

Some age groups are less likely to have savings than others. Some 31% of Generation X — who are roughly aged 35 to 54 for the purpose of this survey — while being older and presumably more experienced with money than their younger cohorts, actually report a savings account balance of zero, which is the highest%age of all age groups. Around 29% of millennials — aged 18 to 34 — and 28% of baby boomers — aged 55 to 64 — said they have no money in their savings account. Baby boomers (17%) and seniors aged 65 and up (20%) have the most money saved of any age group while less than 10% of millennials and approximately 16% of Generation X have $10,000 or more saved.

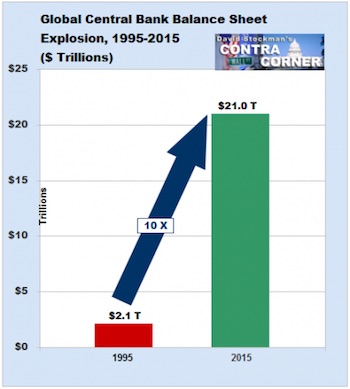

“High powered central bank credit has exploded from $2 trillion to $21 trillion since the mid-1990’s..”

• The Keynesian Recovery Meme Is About To Get Mugged, Part 2 (Stockman)

Our point yesterday was that the Fed and its Wall Street fellow travelers are about to get mugged by the oncoming battering rams of global deflation and domestic recession. When the bust comes, these foolish Keynesian proponents of everything is awesome will be caught like deer in the headlights. That’s because they view the world through a forecasting model that is an obsolete relic – one which essentially assumes a closed US economy and that balance sheets don’t matter. By contrast, we think balance sheets and the unfolding collapse of the global credit bubble matter above all else. Accordingly, what lies ahead is not history repeating itself in some timeless Keynesian economic cycle, but the last twenty years of madcap central bank money printing repudiating itself.

Ironically, the gravamen of the indictment against the “all is awesome” case is that this time is different – radically, irreversibly and dangerously so. High powered central bank credit has exploded from $2 trillion to $21 trillion since the mid-1990’s, and that has turned the global economy inside out. Under any kind of sane and sound monetary regime, and based on any semblance of prior history and doctrine, the combined balance sheets of the world’s central banks would total perhaps $5 trillion at present (5% annual growth since 1994). The massive expansion beyond that is what has fueled the mother of all financial and economic bubbles. Owing to this giant monetary aberration, the roughly $50 trillion rise of global GDP during that period was not driven by the mobilization of honest capital, profitable investment and production-based gains in income and wealth.

It was fueled, instead, by the greatest credit explosion ever imagined – $185 trillion over the course of two decades. As a consequence, household consumption around the world became bloated by one-time takedowns of higher leverage and inflated incomes from booming production and investment. Likewise, the GDP accounts were drastically ballooned by a spree of malinvestment that was enabled by cheap credit, not the rational probability of sustainable profits. In short, trillions of reported global GDP – especially in the Red Ponzi of China and its EM supply chain – represents false prosperity; the income being spent and recorded in the official accounts is merely the feedback loop of the central bank driven credit machine.

More casino. That’s all that‘s left.

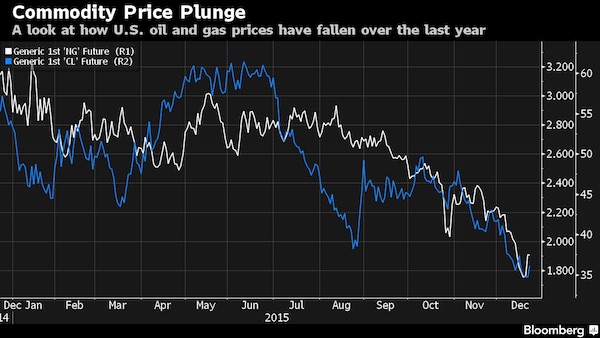

• Extreme Oil Bears Bet on $25, $20 and Even $15 a Barrel in 2016 (BBG)

Oil speculators are buying options contracts that will only pay out if crude drops to as low as $15 a barrel next year, the latest sign some investors expect an even deeper slump in energy prices. The bearish wagers come as OPEC’s effective scrapping of output limits, Iran’s anticipated return to the market and the resilience of production from countries such as Russia raise the prospect of a prolonged global oil glut. “We view the oversupply as continuing well into next year,” Jeffrey Currie, head of commodities research at Goldman Sachs Group Inc., wrote in a note on Tuesday, adding there’s a risk oil prices would fall to $20 a barrel to force production shutdowns if mild weather continues to damp demand.

The bearish outlook has prompted investors to buy put options – which give them the right to sell at a predetermined price and time – at strike prices of $30, $25, $20 and even $15 a barrel, according to data from the New York Mercantile Exchange and the U.S. Depository Trust & Clearing. West Texas Intermediate, the U.S. benchmark, is currently trading at about $36 a barrel. The data, which only cover options deals that have been put through the U.S. exchange or cleared, is viewed as a proxy for the overall market and volumes have increased this week as oil plunged. Investors can buy options contracts in the bilateral, over-the-counter market too. Investors have bought increasing volumes of put options that will pay out if the price of WTI drops to $20 to $30 a barrel next year, the data show. The largest open interest across options contracts – both bullish and bearish – for December 2016 is for puts at $30 a barrel.

2016 will be a very bad year for US energy lenders. And that’s not just the banks.

• US Banks Hit By Cheap Oil As OPEC Warns Of Long-Term Low (FT)

US banks face the prospect of tougher stress tests next year because of their exposure to oil in a sign of how the falling price of crude is transforming the outlook not just for energy companies but the financial sector. OPEC on Wednesday lowered its long-term estimates for oil demand and said the price of crude would not return to the level it reached last year, at $100 a barrel, until 2040 at the earliest. In its World Oil Outlook it said energy efficiency, carbon taxes and slower economic growth would affect demand. Crude oil’s price on Tuesday hit an 11-year low below $36, piling further pressure on banks that have large loans to energy companies or significant exposure to oil on their trading books.

The US Federal Reserve subjects banks with at least $50bn in assets, including the US arms of foreign banks, to an annual stress test, that is designed to ensure they could keep trading through a deep recession and a big shock to the financial system. Today’s oil prices are about 55% below their level when the Fed set last year’s stress test scenarios in October 2014. That test included looking at how banks’ trading books would fare if there was a one-off 68% fall in oil prices sometime before the end of 2017. Banks’ loan books were not tested against falls in oil prices. Banks including Wells Fargo have recently spoken about the dangers of low oil prices that could make exploration companies and oil producers unable to pay their loans.

There are now five times as many oil and gas loans in danger of default to the oil and gas sector as there were a year ago, a trio of US regulators warned in November. Michael Alix, who leads PwC’s financial services risk consulting team in New York, warned the price of oil would weigh much more heavily on the assessors when drawing up next year’s bank stress tests. “It would test those institutions [banks] for both the direct effects [of oil price falls] on their oil or commodity trading business but importantly the indirect effects [of] lending to energy companies, lending in areas of the country that are more dependent on energy companies and energy-related revenues.”

No kidding: “You can’t have a $2 million Christmas party while at the same time laying off half your workforce..”

• Oil Crash Is a Party Pooper as Holiday Affairs Lose Their Luster (BBG)

The Grinch nearly stole Christmas in the oil patch this year. Thanks to the lowest crude and natural gas prices in more than a decade, Norwegian oil and natural gas producer Statoil cut its holiday party budget by about 40% from 2014. KBR Inc. and Marathon Oil opted for smaller affairs with less swank. One Houston hotel said its seasonal party business is down 25% from 2014. Pricey wine and champagne are off the menu. The industry has shed more than 250,000 jobs and idled more than 1,000 rigs as crude prices fell by more than half since last year. Oil services, drilling and supply companies are bearing the brunt of the downturn and account for more than three quarters of the layoffs, according to industry consultant Graves & Co. “You can’t have a $2 million Christmas party while at the same time laying off half your workforce,” said Jordan Lewis at Sullivan Group, a Houston event planning company.

Independent power generators have also been stung by cheap electricity amid declining gas prices. The heating and power plant fuel slid recently to the lowest level since 1999, and is heading for the biggest annual drop since 2006 as the lack of demand leaves stockpiles at a seasonal record. The commodity rout and the layoffs that followed have dampened holiday festivities. Several hundred Statoil employees were invited earlier this month to Minute Maid Park, where Major League Baseball’s Houston Astros play, for a party that featured scaled back entertainment and décor, spokesman Peter Symons said. At the Houston-based oil and gas construction firm KBR, management canceled this year’s companywide party. Instead, individual departments were encouraged to hold their own gatherings from potlucks to group socials, spokeswoman Brenna Hapes said.

Like all the rest, they’ll go to war to hide their troubles.

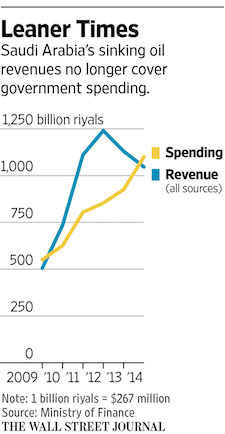

• New Saudi Budget Expected to Be Squeezed by Low Oil Prices (WSJ)

The drastic slide in global crude prices is expected to force Saudi Arabia, the world’s leading oil exporter, to slash spending and cut back on the billions of dollars it spends on generous benefits for its citizens in next year’s budget. The oil-rich kingdom spent hundreds of billions of dollars at home in the past decade to bolster its economy and dole out subsidies that provide cheap energy and food for its 30 million people, as it enjoyed years of high crude prices. But the price of oil has fallen by more than half since the middle of last year, forcing the government to dip into reserves, reassess its spending plans and look for ways to diversify sources of revenue. “I’m worried that prices would go up,” said a man waiting for his SUV to be filled in a gas station in northern Riyadh this week.

“There is a lot of talk but I think the government has put this into account,” he said, adding that he expects the increase in prices to be small. Saudi Arabia exports about seven million barrels of oil a day and those revenues make up around 90% of the government’s fiscal revenues, and around 40% of the country’s overall gross domestic product. Saudi Arabia sees the need to cut output to boost prices but so far has been reluctant to do it alone. Officials say that preserving the country’s share of the global market is more important. The 2016 budget, expected to be unveiled in the coming days, will be the first major opportunity for the government to publicly outline a strategy to cope with a prolonged period of cheap oil and soothe the nerves of both the public and investors in the Middle East’s largest economy.

It isn’t clear whether ambitious and sensitive policy changes—such as privatizations and the cutting of energy subsidies—will be included. But even if energy subsidies are cut, the government is unlikely to immediately target consumers, who have become accustomed to some of the lowest gas prices in the world. Any reduction would risk a backlash from the public. “My expectation is that it will start gradually, and that it will target non-consumers first,” said Fahad Alturki, chief economist at Riyadh-based firm Jadwa Investment, of potential subsidy cutbacks. “We won’t see a radical change….The change will be gradual, with a clear road map—and it may not be part of the budget.”

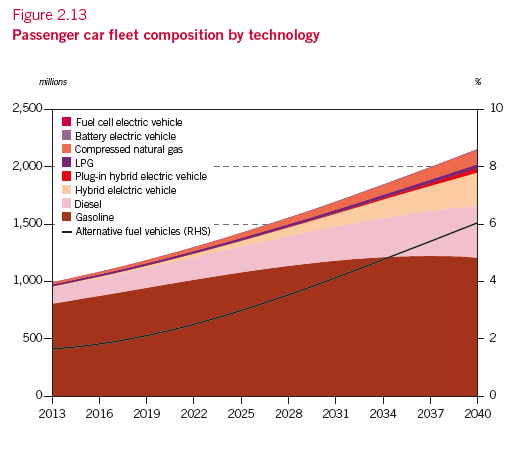

Ambrose is the posterchild for techno-happy. The thinking is that all it takes is for a lot of money to be thrown at the topic. Mind you, the projection is for the number of cars to double in 25 years. That is a disaster no matter what powers the cars. The magic word is ‘grid-connected vehicles’, but that grid would then have to expand, what, 4-fold?

• OPEC Faces A Mortal Threat From Electric Cars (AEP)

OPEC remains defiant. Global reliance on oil and gas will continue unchanged for another quarter century. Fossil fuels will make up 78pc of the world’s energy in 2040, barely less than today. There will be no meaningful advances in technology. Rivals will sputter and mostly waste money. The old energy order is preserved in aspic. Emissions of CO2 will carry on rising as if nothing significant had been agreed in a solemn and binding accord by 190 countries at the Paris climate summit. OPEC’s World Oil Outlook released today is a remarkable document, the apologia of a pre-modern vested interest that refuses to see the writing on the wall. The underlying message is that the COP21 deal is of no relevance to the oil industry. Pledges by world leaders to drastically alter the trajectory of greenhouse gas emissions before 2040 – let alone to reach total “decarbonisation” by 2070 – are simply ignored.

Global demand for crude oil will rise by 18m barrels a day (b/d) to 110m by 2040. The cartel has shaved its long-term forecast slightly by 1m b/d, but this is in part due to weaker economic growth. One is tempted to compare this myopia to the reflexive certainties of the 16th Century papacy, even as Erasmus published in Praise of Folly, and Luther nailed his 95 Theses to the door of Wittenberg’s Castle Church. The 407-page report swats aside electric vehicles with impatience. The fleet of cars in the world will rise from 1bn to 2.1bn over the next 25 years – topping 400m in China – and 94pc will still run on petrol and diesel. “Without a technology breakthrough, battery electric vehicles are not expected to gain significant market share in the foreseeable future,” it said. Electric cars cost too much. Their range is too short. The batteries are defective in hot or cold conditions.

OPEC says battery costs may fall by 30-50pc over the next quarter century but doubts that this will be enough to make much difference, due to “consumer resistance”. This is a brave call given that Apple and Google have thrown their vast resources into the race for plug-in vehicles, and Tesla’s Model 3s will be on the market by 2017 for around $35,000. Ford has just announced that it will invest $4.5bn in electric and hybrid cars, with 13 models for sale by 2020. Volkswagen is to unveil its “completely new concept car” next month, promising a new era of “affordable long-distance electromobility.” The OPEC report is equally dismissive of Toyota’s decision to bet its future on hydrogen fuel cars, starting with the Mirai as a loss-leader. One should have thought that a decision by the world’s biggest car company to end all production of petrol and diesel cars by 2050 might be a wake-up call.

Goldman Sachs expects ‘grid-connected vehicles’ to capture 22pc of the global market within a decade, with sales of 25m a year, and by then – it says – the auto giants will think twice before investing any more money in the internal combustion engine. Once critical mass is reached, it is not hard to imagine a wholesale shift to electrification in the 2030s. Goldman is betting that battery costs will fall by 60pc over the next five years, driven by economies of scale as much as by technology. The driving range will increase by 70pc. This is another world from OPEC’s forecast.

They’re all invested in hubris.

• The Trouble With Sovereign-Wealth Funds (WSJ)

Kazakhstan’s $55 billion sovereign-wealth fund helped pull the country through the global financial crisis and offered funding for the country’s bid to host the 2022 Winter Olympics. But the collapse in oil prices has hit Kazakhstan and its fund, Samruk-Kazyna JSC, hard. In October, the fund borrowed $1.5 billion in its first syndicated loan to help a cash-strapped subsidiary saddled with a troubled oil-field investment. “Our oil company lost lots of its revenues,” says the fund’s chief executive, Umirzak Shukeyev. “Currently, we are trying to adjust to the situation.” Funds like Samruk are at a critical juncture. For years, sovereign-wealth funds—financial vehicles owned by governments—swelled in size and number, fueled by rising oil prices and leaders’ aspirations to increase economic growth, invest abroad and boost political influence.

A new wave of sovereign funds came from African countries like Ghana and Angola. Asian nations joined in with funds like 1Malaysia Development Bhd., or 1MDB. The world’s sovereign-wealth funds together have assets of $7.2 trillion, according to the Sovereign Wealth Fund Institute, which studies them. That is twice their size in 2007, and more than is managed by all the world’s hedge funds and private-equity funds combined, according to JP Morgan. The number of funds tracked by the Institute of International Finance is up 44% to 79 since the end of 2007. Nearly 60% of sovereign-wealth-fund assets are in funds dependent on energy exports. Now, some funds are shrinking or are being tapped by governments as oil revenues fall.

That is forcing them to borrow or sell investments, potentially pressuring global markets just as other investors are pulling back from risk. Saudi Arabia’s central bank, which functions in some ways like a sovereign-wealth fund as it holds significant reserves that are invested widely, has sold billions in assets this year. Norway says it plans to tap its fund, the world’s largest, for the first time in 2016. The stress from low energy prices comes at a sensitive time. At least two funds are embroiled in controversy. 1MDB, which amassed $11 billion in debt, is the subject of at least nine investigations at home and abroad. One of its main financial backers was an Abu Dhabi fund. The head of South Korea’s fund stepped down in the wake of a public outcry over his plan to invest in the Los Angeles Dodgers baseball team.

Adnan Mazarei, deputy director of the IMF’s Middle East and Central Asia Department, says the worry is sovereign-wealth funds will be forced to sell during a period of already turbulent markets. “A withdrawal of assets by sovereign-wealth funds against the background of liquidity concerns could lead to large price movements,” he says. “Nobody knows how much or when but the concern is there.”

Behind the curve by a mile and a half: “China will roll out policy to transform 100 million farmers into registered urban residents..”

• China Tackles Housing Glut To Arrest Growth Slowdown (Xinhua)

China will continue to actively destock its massive property inventory over concerns that the ailing housing market could derail the economy.Along with cutting overcapacity and tackling debt, destocking will be a major task in 2016, according to a statement released on Monday after the Central Economic Work Conference, which mapped out economic work for next year.Attendees of the meeting agreed that rural residents that move to urban areas should be allowed to register as residents, which would encourage them to buy homes in the city. Property developers have been advised to reduce home prices, according to the statement.”Obsolete restrictive measures [in the property market] will be revoked,” said the statement, without specifying which “restrictive measures” it was referring to.

To rein in house prices, China has been trying to curb real estate speculation, with policies such as “home purchase restriction” that only allows registered residents to buy houses. It is believed the restrictive policies mainly affected the property markets in third- and fourth-tier cities, which saw the most supply glut. The property market took a downturn in 2014 due to weak demand and a supply glut. This cooling continued into 2015, with sales and prices falling, and investment slowing. Property investment’s GDP contribution in the first three quarters of this year hit a 15-year low of 0.04%. The property market is vital to steel and cement manufacturers, as well as furniture producers; its poor performance would breed financial risks.

GDP growth during the January-September period eased to 6.9%, down from 7.4% posted for the whole of 2014. Policymakers believe the housing inventory will be lessened as long as rural residents are encouraged to buy. Nearly 55% of the population live in cities but less than 40% are registered to do so. There are around 300 million migrant workers but most are denied “hukou” (official residence status). In addition to housing rights, a hukou gives the holder equal employment rights and social security services, and their children are allowed to be enrolled in city schools. Starting next year, China will roll out policy to transform 100 million farmers into registered urban residents, according to Xu Shaoshi, head of the National Development and Reform Commission, on Tuesday. No deadline for completion was specified.

Be that way: “Should you in any way present the accusation that my client manipulated its emissions data, we will act against you with all necessary sustainability and hold you responsible for any economic damage that my client suffers as a result.”

• German Emissions Scandal Threatens To Engulf Mercedes, BMW (DW)

The environmental group Deutsche Umwelthilfe (DUH) and German state broadcaster ZDF presented the results of nitric oxide tests they had conducted on two Mercedes and BMW diesel models. They appeared to show similar discrepancies between “test mode” and road conditions that hit Volkswagen earlier this year, triggering one of the biggest scandals in German automobile history. In response to the report released on December 15, a law firm representing Daimler, which owns Mercedes, sent a letter to the DUH that read, “Should you in any way present the accusation that my client manipulated its emissions data, we will act against you with all necessary sustainability and hold you responsible for any economic damage that my client suffers as a result.”

In defiance of another threat by the Schertz law firm, the DUH published the threatening letter in full on its website. “We have been massively threatened two more times, demanding that we take down the letter – we have told them we won’t,” DUH chairman Jürgen Resch told DW on Wednesday. “For me it’s a very serious issue, because in 34 years of full-time work in environmental protection, and dealing with businesses, I have never experienced a business using media law to try and keep a communication – and a threatening letter at that – secret. “How are we supposed to do our work as a consumer and environmental protection organization when industry forbids us from making public certain threats it makes?” an outraged Resch added. “I think the threat itself is borderline legal coercion.”

In a short documentary broadcast on December 15, ZDF tested three diesel cars – a Mercedes C200 CDI from 2011, a BMW 320d from 2009, and a VW Passat 2.0 Blue Motion from 2011 – and showed that all three produced more nitric oxide on the road than they did in an official laboratory test. “The measurement results show that the cars behave differently on the test dynamometer than when they are driven on the road,” said the laboratory at the University of Applied Sciences in Bern, Switzerland, which carried out the tests. The discrepancies researchers found were not small – while all three cars kept comfortably below the European Union’s legal nitric oxide limit (180 milligrams per kilometer) in the lab, they all went well over the standard on the road, where the BMW recorded 428 mg/km (2.8 times its lab result), the Mercedes hit 420 mg/km (2.7 times its lab result), and the VW Passat reached 471 mg/km (3.7 times its lab result).

Anything for a buck.

• Australia Approves Expansion of Barrier Reef Coal Terminal (WSJ)

Australia approved the expansion of a shipping terminal close to the Great Barrier Reef on Tuesday, drawing criticism from environmentalists who say an area of outstanding natural beauty is threatened by the decision. Environment Minister Greg Hunt said he would allow the extension the Abbot Point terminal—used to ship coal to markets in Asia—with 30 conditions to help protect the environment, including a requirement that dredge material be dumped on land instead of in water near the World Heritage-listed reef. The expanded port will serve one of the world’s largest coal mines that is being developed by Adani Group in Queensland, a state in eastern Australia where the Great Barrier Reef Marine Park is also located.

The Indian conglomerate aims to use the port to ship as much as 60 million tons of thermal coal annually to its power plants in India. “The port area is at least 20 kilometers from any coral reef and no coral reef will be impacted,” said a spokeswoman for Mr. Hunt, adding: “All dredge material will be placed onshore on existing industrial land.” The government of Queensland, which receives an estimated 6 billion Australian dollars (US$4.3 billion) a year from reef tourism, has yet to approve the expansion, but isn’t expected to block it with the government hoping to unlock a new wave of resource projects. The extension of Abbot Point will lead to the dredging of more than 1 million cubic meters of mud and rock nearby to the reef.

Environmentalists have been equally critical of Adani’s plans to build its Carmichael coal mine and associated infrastructure in the region—because of the potential impact on a native Australian lizard and another vulnerable species. Pro-environment groups said the federal government’s approval of the port expansion wouldn’t only harm wildlife, but also run counter to Australia’s pledge at the Paris global climate conference this month to work toward curbing emissions from fossil fuels such as coal, among the country’s top exports. “The Abbot Point area to be dredged is home to dolphins and dugongs which rely on the sea grass there for food,” said Shani Tager, a Greenpeace campaigner. “It’s also a habitat for endangered marine life like turtles and giant manta rays, and is in the path of migrating humpback whales. “It’s reckless and pointless to gouge away at a pristine habitat to build a port for a coal mine nobody needs,” she added.

One more accident away from civil war.

• Japanese Court Clears Way For Restart Of Nuclear Reactors (BBG)

A Japanese court has cleared the way for Kansai Electric Power to restart two of its nuclear reactors early next year. The Fukui District Court on Thursday removed an injunction preventing the operation of Kansai Electric’s Takahama No. 3 and No. 4 nuclear reactors, Tadashi Matsuda, a representative for the citizen’s group that initiated the case, said by phone. The court also rejected a demand by local residents to block the resumption of reactor operations at Kansai Electric’s Ohi plant. The ruling was earlier reported by broadcaster NHK. “We think that today’s decisions are a result of the understanding that safety at Takahama and Ohi is guaranteed,” Kansai Electric said in a statement. Residents of Fukui who oppose the restarts plan to appeal the ruling to a higher court, according to Matsuda.

Kansai Electric, the utility most dependent on nuclear power before the March 2011 Fukushima disaster, aims to restart Takahama No. 3 in late January or February, according to a company presentation last month. It is slated to be the third Japanese reactor to restart under post-Fukushima safety rules. Firing up both units will boost Kansai Electric’s profits by as much as 12.5 billion yen ($104 million) a month, according to Syusaku Nishikawa, a Tokyo-based analyst at Daiwa Securities. The two reactors at the Takahama facility, about 60 kilometers (37 miles) north of Kyoto, were commissioned in 1985 and have a combined capacity of 1,740 megawatts.

Operations of the units were suspended in the aftermath of the massive earthquake and tsunami in March 2011 that caused a meltdown at Tokyo Electric Power Co.’s Fukushima Dai-Ichi facility. The units received restart approval from the Nuclear Regulatory Authority in February, though court challenges stopped them from resuming operation. On Tuesday, Fukui prefecture Governor Issei Nishikawa granted his approval for the restarts. While not enshrined in law, local government approval is traditionally sought by Japanese utilities before they return the plants to service.

Very much worth reading by Dmitry. I can’t copy the whole thing, but do read it.

• On the 19th day of Christmas… [Am 19. Tag der Weihnachtszeit…] (Orlov)

You see, the Ukraine produces over half of its electricity using nuclear power plants. 19 nuclear reactors are in operation, with 2 more supposedly under construction. And this is in a country whose economy is in free-fall and is set to approach that of Mali or Burundi! The nuclear fuel for these reactors was being supplied by Russia. An effort to replace the Russian supplier with Westinghouse failed because of quality issues leading to an accident. What is a bankrupt Ukraine, which just stiffed Russia on billions of sovereign debt, going to do when the time comes to refuel those 19 reactors? Good question! But an even better question is, Will they even make it that far? You see, it has become known that these nuclear installations have been skimping on preventive maintenance, due to lack of funds.

Now, you are probably already aware of this, but let me spell it out just in case: a nuclear reactor is not one of those things that you run until it breaks, and then call a mechanic once it does. It’s not a “if it ain’t broke, I can’t fix it” sort of scenario. It’s more of a “you missed a tune-up so I ain’t going near it” scenario. And the way to keep it from breaking is to replace all the bits that are listed on the replacement schedule no later than the dates indicated on that schedule. It’s either that or the thing goes “Ka-boom!” and everyone’s hair falls out. How close is Ukraine to a major nuclear accident? Well, it turns out, very close: just recently one was narrowly avoided when some Ukro-Nazis blew up electric transmission lines supplying Crimea, triggering a blackout that lasted many days.

The Russians scrambled and ran a transmission line from the Russian mainland, so now Crimea is lit up again. But while that was happening, the Southern Ukrainian, with its 4 energy blocks, lost its connection to the grid, and it was only the very swift, expert actions taken by the staff there that averted a nuclear accident. I hope that you know this already, but, just in case, let me spell it out again. One of the worst things that can happen to a nuclear reactor is loss of electricity supply. Yes, nuclear power stations make electricity—some of the time—but they must be supplied with electricity all the time to avoid a meltdown. This is what happened at Fukushima Daiichi, which dusted the ground with radionuclides as far as Tokyo and is still leaking radioactive juice into the Pacific.

And so the nightmare scenario for the Ukraine is a simple one. Temperature drops below freezing and stays there for a couple of weeks. Coal and natural gas supplies run down; thermal power plants shut down; the electric grid fails; circulator pumps at the 19 nuclear reactors (which, by the way, probably haven’t been overhauled as recently as they should have been) stop pumping; meltdown!

And what is left is being sold to investor funds.

• Greek Banking Sector Cut In Half Since 2008 (Kath.)

The unprecedented crisis that has been squeezing the country since 2009 has seen domestic banks shrink to half the size they were seven years ago. According to data compiled by Kathimerini, some 50,000 jobs have been lost in the sector since 2008, of which 25,000 are in Greece and 25,000 abroad. The total number of branches has been reduced by 3,500 to 4,200 from 7,715 at the end of 2008. Local lenders have also halted operations at 1,700 branches in Greece as well as 2,175 cash machines. The number of branches in Greece has dropped by 42.3%, employees by 36% and ATMs by 28.7%. There are 49.3% fewer branches abroad and 51.7% fewer employees.

The storm within the banking system and the domestic economy is best reflected in the level of deposits and loans: The total deposits of €240 billion six years ago have now been cut in half to €120 billion. The sum of outstanding loans may be 35% less than in 2009 in theory, at €204 billion, but in reality the reduction is far greater, as €100 billion of that €204 billion is not being serviced. Therefore the real picture of the banking system shows deposits of 120 billion and serviced loans of less than €110 billion, meaning that the credit sector has halved since end-2008. Bank officials say that contraction was inevitable given the 25% decline of GDP from 2009 to 2015, with forecasts pointing to a greater recession in 2016.

If the troika wants it, it’ll happen anyway.

• No Further Cuts To Greek Pensions, Tsipras Tells Cabinet (Kath.)

Greek Prime Minister Alexis Tsipras has pledged there will be no further cuts to pensions adding that social security reform is necessary for the completion of the nation’s bailout program review by foreign creditors. “This red line is non-negotiable: we will not reduce main pensions for a 12th time,” Tsipras told his cabinet on Wednesday. Tsipras said the bailout agreement did not mandate fresh cuts to pensions. “What the agreement calls for is cuts in spending; it does not say that these will come by reducing pensions,” he said.

Previous cuts, Tsipras said, had brought Greek pensions down by an average 45%. However, they had failed to ensure the sustainability of the country’s social security system. The government is trying to build a viable system without disrupting social cohesion, the leftist PM said. Tsipras said that pension reform is the final prerequisite for wrapping up the assessment of the Greek program so that talks on debt relief can proceed. “The goal is to complete the first review as soon as possible while keeping in place a safety net for the weakest,” he said.

Well written.

• Donald Trump: An Evaluation (Paul Craig Roberts)

Donald Trump, judging by polls as of December 21, 2015, is the most likely candidate to be the next president of the US. Trump is popular not so much for his stance on issues as for the fact that he is not another Washington politican, and he is respected for not backing down and apologizing when he makes strong statements for which he is criticized. What people see in Trump is strength and leadership. This is what is unusual about a political candidate, and it is this strength to which voters are responding. The corrupt American political establishment has issued a “get Trump” command to its presstitute media. Media whore George Stephanopoulos, a loyal follower of orders, went after Trump on national television. But Trump made mincemeat of the whore.

Stephanopoulos tried to go after Trump because the world’s favorite leader, President Putin of Russia, said complimentary things about Trump, and Trump replied in kind. According to Stephanopoulos, “Putin has murdered journalists,” and Trump should be ashamed of praising a murderer of journalists. Trump asked Stephanopoulos for evidence, and Stephanopoulos didn’t have any. In other words, Stephanopoulos confirmed Trump’s statement that American politicians just make things up and rely on the presstitutes to support invented “facts” as if they are true. Trump made reference to Washington’s many murders. Stephanopoulos wanted to know what journalists Washington had murdered. Trump responded with Washington’s murders and dislocation of millions of peoples who are now overrunning Europe as refugees from Washington’s wars.

B ut Trumps advisors were not sufficiently competent to have armed him with the story of Washington’s murder of Al Jazerra’s reporters. Here is a report from Al Jazeera, a far more trustworthy news organization than the US print and TV media:

“On April 8, 2003, during the US-led invasion of Iraq, Al Jazeera correspondent Tareq Ayoub was killed when a US warplane bombed Al Jazeera’s headquarters in Baghdad. “The invasion and subsequent nine-year occupation of Iraq claimed the lives of a record number of journalists. It was undisputedly the deadliest war for journalists in recorded history.

“Disturbingly, more journalists were murdered in targeted killings in Iraq than died in combat-related circumstances, according to the group Committee to Protect Journalists. “CPJ research shows that “at least 150 journalists and 54 media support workers were killed in Iraq from the US-led invasion in March 2003 to the declared end of the war in December 2011.” “’The media were not welcome by the US military,’” Soazig Dollet, who runs the Middle East and North Africa desk of Reporters Without Borders told Al Jazeera. ‘That is really obvious.’”

A political candidate with a competent staff would have immediately fired back at Stephanopoulos with the facts of Washington’s murder of journalists and compared these facts with the purely propagandistic accusations against Putin which have no basis whatsoever in fact. The problem with Trump is the issues on which the public is not carefully judging him. I don’t blame the public. It is refreshing to have a billionaire who can’t be bought expose the insubstantialality of all the Democratic and Repulican candidates for president. A collection of total zeros. Unlike Washington, Putin supports the sovereignty of countries. He does not believe that the US or any country has the right to overthrow governments and install a puppet or vassal. Recently Putin said: “I hope no person is insane enough on planet earth who would dare to use nuclear weapons.”

3700 deaths in the Mediterranean in 2015. We don’t have enough shale or tears left to do them justice. We’re morally gone.

• 20 Refugees Drown; 2015 Death Rate Over 10 Human Beings Each Day (CNN)

The Turkish coast guard launched a search and rescue mission after at least nine migrants drowned off the nation’s coast. Eleven people remain missing and 21 have been rescued, the coast guard said Thursday. There was no information on their country of origin. The International Organization for Migration released a report this week saying more than a million migrants had entered Europe this year. The figures show that the vast majority – 971,289 – have come by sea over the Mediterranean. Another 34,215 have crossed from Turkey into Bulgaria and Greece by land. Among those traveling by sea, 3,695 are known to have drowned or remain missing as they attempted to cross the sea on unseaworthy boats, according to IOM figures. That’s a rate of more than 10 deaths each day this year.