Pierre Bonnard Nude in an Interior c1935

Jim Jordan

— Donald J. Trump (@realDonaldTrump) December 11, 2020

“..communities faced with epidemics or other adverse events respond best and with the least anxiety when the normal social functioning of the community is least disrupted.”

• “We Hadn’t Really Thought Through the Economic Impacts” ~ Melinda Gates (AIER)

In a wide-ranging interview in the New York Times, Melinda Gates made the following remarkable statement: “What did surprise us is we hadn’t really thought through the economic impacts.” A cynic might observe that one is disinclined to think much about matters than do not affect one personally. It’s a maddening statement, to be sure, as if “economics” is somehow a peripheral concern to the rest of human life and public health. The larger context of the interview reveals the statement to be even more confused. She is somehow under the impression that it is the pandemic and not the lockdowns that are the cause of the economic devastation that includes perhaps 30% of restaurants going under, among many other terrible effects.

She doesn’t say that outright but, like many articles in the mainstream press over this year, she very carefully crafts her words to avoid the crucial subject of lockdowns as the primary cause of economic disaster. It’s possible that she actually believes this virus is what tanked the world economy on its own but that is a completely unsustainable proposition. Further, her comments provide a perfect illustration of the core problem all along: most of the people who have been advocating lockdowns in fact have no actual experience in managing pandemics. To many of these, Covid-19 became their new playground to try out an unprecedented experiment in social and economic management: shutting down travel, businesses, schools, churches, and issuing stay-at-home orders that smack of totalitarian impositions. Here is what she says:

“You can project out and think about what a pandemic might be like or look like, but until you live through it, it’s pretty hard to know what the reality will be like. So I think we predicted quite well that, depending on what the disease was, it could spread very, very, very quickly. The spread did not surprise us. What did surprise us is we hadn’t really thought through the economic impacts. What happens when you have a pandemic that’s running rampant in populations all over the world? The fact that we would all be home, and working from home if we were lucky enough to do that. That was a piece that I think we hadn’t really prepared for.”

There are plenty of specialists who have lived through pandemics in the past and managed them by maintaining essential social and economic functioning. A major case in point is Donald A. Henderson, who as head of the World Health Organization is given primary credit for the eradication of smallpox. He wrote as follows in 2006: “Experience has shown that communities faced with epidemics or other adverse events respond best and with the least anxiety when the normal social functioning of the community is least disrupted. Strong political and public health leadership to provide reassurance and to ensure that needed medical care services are provided are critical elements. If either is seen to be less than optimal, a manageable epidemic could move toward catastrophe.”

Pfizer (and the producers of other vaccines), are immune from civil liability.

• Coronavirus Fact-Check #9: Is The Vaccine Safe? (OffG)

There are dozens of articles all over the mainstream reassuring us that the brand new Sars-Cov-2 vaccine is safe. In the UK the vaccine rolled out is being hailed as “V Day”, in a shameless attempt to draw a parallel with World War II. Matt Hancock went on Good Morning Britain and attempted to “cry”. On the other side of that coin, many experts in the field have vociferously called for all vaccine trials to be put on halt, some medical researchers are questioning the data and others counsel people to refuse the vaccine under any and all circumstances. So – is the vaccine safe? The only rational answer is “we don’t know”. It’s certainly true some people who have received it have experienced unexpected side effects.

It was recently revealed that 4 people involved in the US-based trial suffered partial facial paralysis. In the UK, two NHS staff who have received the vaccine suffered allergic anaphylactoid reactions, as a result the NHS is now not recommending the vaccine for anyone who “suffers from allergies”. They don’t know what caused the reaction, and as far as we know so far, the people involved were not allergic to anything in the vaccine. It seems it’s not about being allergic to the vaccine, so much as the vaccine potentially causing problems for anyone with a sensitive or dysfunctional immune system. It’s essentially recommended that no one who is allergic to anything, ie. other food or medication, should have the jab. We’ve already had “explainers” appearing the media, saying vaccine allergic reactions are “rare and shortlived”.

To be clear, as of December 10th, the vaccine either has never been tested on, or is not recommended for:

• People under sixteen years of age.

• Pregnant women (or women intending to become pregnant in the near future).

• People with serious co-morbidities.

• People already taking other medications.

• People who have allergies.

So the official line already cedes that the vaccine may be harmful to some or all of those people.Even on the fully-grown and totally healthy adults it was tested on, obviously, there has not been enough time to do any kind of long term studies on possible side-effects or complications It usually takes 5-10 years to fully develop and test a vaccine, where as this has been rushed out in less than 10 months. On top of that, of course, we have the fact all the vaccine producers have campaigned for – and won – total legal immunity in the UK, US and other nations around the world. In the event the vaccine does cause harm, Pfizer (and the producers of other vaccines), are immune from civil liability. Which means that, just like us, the producers themselves are well-aware the new vaccines might not be safe, and don’t want a repeat of 2009, when a rushed-out flu vaccine resulted in children suffering life-long complications and receiving millions in damages. In the final analysis, you have to ask yourself a simple question: Do you feel safer taking an untested vaccine, or risking getting a virus with a survival rate of over 99%?

Rob Swanda

Here I describe a brief overview of how the Pfizer/BioNTech or Moderna mRNA vaccines work. Taking a vaccine is one’s personal choice, and I hope this video can help someone make that decision rooted in science. pic.twitter.com/ZjFH0DH5ca

— Rob Swanda (@ScientistSwanda) December 7, 2020

Let the dice roll. If they come up zero, so be it. But let them roll.

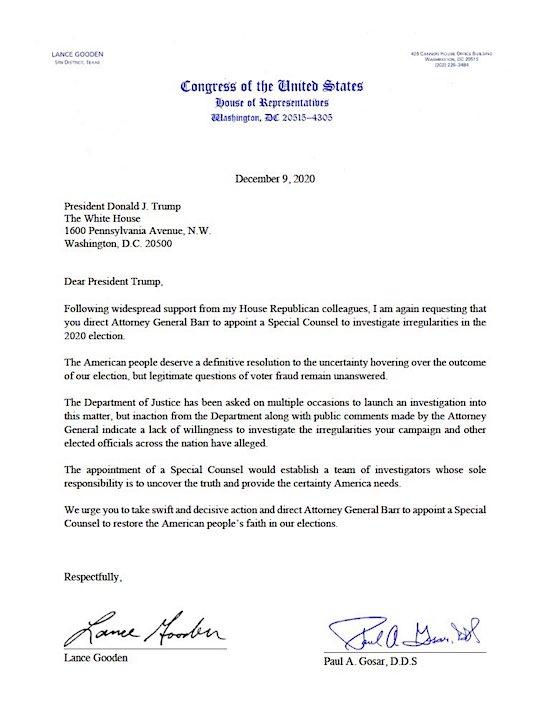

• Sidney Powell Plans to Appeal Dismissal of Arizona Election Lawsuit (ET)

The legal team led by attorney Sidney Powell plans to appeal the dismissal of an Arizona election lawsuit by an Obama-appointed federal judge on Dec. 9. Powell’s Arizona co-counsel Alex Kolodin told The Epoch Times in an interview that his team plans to fast-track the case to the Supreme Court and will file a petition for appeal in the coming days. The Arizona case, filed on Dec. 2 by former federal prosecutor Powell on behalf of the state’s 11 Republican electors and others, alleged that manipulation of election software and other fraud in the state resulted in violations of the U.S. Constitution and state election laws. The lawsuit also claimed that more than 412,000 votes were cast illegally in the state’s 2020 general election.

Arizona Secretary of State Katie Hobbs and Gov. Doug Ducey were named as defendants in the case, which highlighted what it said was an “especially egregious range of conduct” in Arizona’s Maricopa County, and other counties using Dominion Systems. The lawsuit alleges that Dominion Voting Systems violated election laws by having their machines connected to the internet. The case is supported by a redacted affidavit from a former electronic intelligence analyst, alleging that the voting system software was accessed by agents from China and Iran. Powell’s team also filed a temporary restraining order seeking to immediately block Ducey from delivering the certified election results to the Electoral College while the court hears the case. Arizona certified its presidential election results on Nov. 30.

Judge Diane Humetewa threw out the lawsuit on Dec. 9, saying that its allegations “are sorely wanting of relevant or reliable evidence” and that it sought extraordinary relief. “If granted, millions of Arizonans who exercised their individual right to vote in the 2020 General Election would be utterly disenfranchised,” Humetewa wrote. In dismissing Powell’s case, Humetewa said the lawsuit doesn’t contain a “plausible” allegation that Dominion Voting Systems voting machines were hacked in the state during the Nov. 3 election, however, she described the team’s allegations of fraud as “conceivable.” The proposed Trump electors “have not moved the needle for their fraud theory from conceivable to plausible,” the federal judge said. Kolodin told The Epoch Times that the chairwoman of the Arizona Republican Party granted his team approval to appeal the case to the Supreme Court, and that they plan to soon file a petition for a writ of certiorari asking for the case to be heard.

A petition for a writ of certiorari is a document that a losing party files with the Supreme Court asking it to review the lower court’s decision on its merits. The provision would request from the Supreme Court an emergency transfer and would allow the case to be heard without waiting for a decision from the U.S. Courts of Appeals. The Supreme Court is usually not under any obligation to hear such cases unless the case could have national significance, might harmonize conflicting decisions in the federal Circuit courts, or could have precedential value. “I thought she [Humetewa] took the case very seriously. She treated it very professionally, and she was very fair, but I disagree with her decision,” Kolodin said. “My clients disagree with her decision, and we’ve always known that this will ultimately be decided in the U.S. Supreme Court.”

Greg Kelly

— Donald J. Trump (@realDonaldTrump) December 11, 2020

From a local perspective.

• Judge Gives Benson OK To Intervene Antrim County Election Case (DN)

A Northern Michigan judge granted Secretary of State Jocelyn Benson permission to intervene in a case questioning results in Antrim County and the security of tabulators used there on Nov. 3. Judge Kevin Elsenheimer ruled Thursday that Attorney General Dana Nessel’s office could intervene on behalf of Benson, who had argued she had supervisory control over the Antrim County clerk, had an interest in any audit discussions the case may raise and was party to the county’s contract with Dominion Voting Systems. The Secretary of State’s office is concerned particularly with forensic imaging performed on Antrim County’s 22 Dominion tabulators earlier this week by a Village of Central Lake resident and Allied Security Operations Group, said Assistant Attorney General Heather Meingast.

“We’d like to know more about what was obtained, what the intent is for the use of the images obtained,” Meingast said, noting the disclosure of some elements of the tabulators could compromise their security in future elections. Elsenheimer, a Republican former lawmaker and member of former Gov. Rick Snyder’s administration, granted Meingast’s request but warned the case would proceed in haste. “I intend to move this matter quickly, aggressively,” Elsenheimer said. Benson shouldn’t be allowed to intervene because she had missed the opportunity to do so earlier and did not have direct involvement in local elections, said Matthew DePerno, a lawyer for Antrim County resident William Bailey. In fact, a state Court of Claims judge earlier this month dismissed a case against Benson on those grounds, DePerno said.

“The court concluded there was no relief to be granted because elections are local and run by local officials,” he said. DePerno said the investigation is ongoing and data are being reviewed. But based on what had been reviewed so far, Bailey would move to decertify the Antrim County certification and push the issue to the GOP-led Legislature, he said. “We think there are serious issues, and we’re preparing right now a motion to seek relief from the court from the protective order,” DePerno said. Elsenheimer last week granted Bailey’s request to take take forensic images of 22 tabulators and review those along with flash drives, software and a “master tabulator” that the county said does not exist. Bailey and members of the Allied Securities Operation Group spent about eight hours on Sunday at county offices obtaining the material.

Money laundering is a serious crime.

• AG Barr Concealed Hunter Biden Probes From Public During Election (ZH)

Attorney General William Barr knew about several investigations into Hunter Biden since at least this spring – and “worked to avoid their public disclosure during the heated election campaign,” according to the Wall Street Journal. According to ‘a person familiar with the matter,’ Barr “staved off pressure from Republicans in Congress for information into the investigations,” while President Trump and his allies pressured Barr into pursuing Joe and Hunter Biden. This week, Hunter Biden revealed the existence of one of the investigations after federal investigators served him with a subpoena seeking detailed financial information in connection with a criminal tax investigation by the Delaware US attorney’s office. The next day, CNN and Politico confirmed that the probe was wider than that, and covered potential money laundering and bribery in probes that date back to 2018, according to ‘people familiar with the matter.’ According to the report, none of the investigations implicate Joe Biden.

“It shouldn’t take subpoenas and confirmation from Hunter Biden himself to get the rest of the press to pay attention.”

• Sen. Grassley Blasts MSM Over Hunter Biden Hypocrisy (ZH)

Chuck Grassley is one pissed off Senator. After the Iowa Republican and Sen. Ron Johnson (R-WI) produced a long-awaited Senate report which concluded that Hunter Biden’s financial dealings with Ukrainian, Chinese and Russian businesses created “criminal financial, counterintelligence and extortion concerns” concerning everything from sex-trafficking to bribery – the MSM panned it as a partisan attack on a presidential candidate’s son. Now that Hunter has admitted he’s under investigation for tax fraud (and, as Politico and CNN have added, money laundering and accepting bribes), Grassley is having the last laugh. In Thursday remarks on the Senate Floor, Grassley blasted the media after months of covering for the Bidens.

“For over a year, Senator Johnson and I investigated the Biden financial family dealings,” said Grassley, adding “We found that they engaged in potential criminal financial deals across the globe, including China, which created counterintelligence concerns.” Grassley then turned his attention to the MSM, saying “Those same liberal outlets that disparaged our investigation now report that Hunter Biden’s financial deals in China raise counterintelligence concerns.” He went on to say that the media should have been covering concerns raised by Republicans instead of covering them up. “So you can understand why I think it’s very outrageous that the fourth estate would choose to ignore facts when they are uncovered by Republicans,” Grassley continued. “It shouldn’t take subpoenas and confirmation from Hunter Biden himself to get the rest of the press to pay attention.”

Would have to happen within 5 weeks or so. Just like the Special Counsel for election irregularities. Not sure I can see Barr comply.

• Sen. Cotton: Circumstances Warrant Special Counsel To Probe Hunter Biden (JTN)

Sen. Tom Cotton indicated during an interview Thursday on Fox News that he believes circumstances warrant a special counsel to investigate issues pertaining to Joe Biden’s son Hunter. Hunter Biden issued a statement Wednesday which noted that the U.S. attorney’s office in Delaware is looking into his “tax affairs.” “I learned yesterday for the first time that the U.S. attorney’s office in Delaware advised my legal counsel, also yesterday, that they are investigating my tax affairs,” the statement said. “I take this matter very seriously but I am confident that a professional and objective review of these matters will demonstrate that I handled my affairs legally and appropriately, including with the benefit of professional tax advisors.”

“I know the Biden campaign released details of a tax fraud investigation in Wilmington,” said Cotton during the Fox News interview. “I think that was just to show maybe the least damaging part of the investigation.” “There’s allegations of securities fraud and money laundering related to Hunter Biden’s Chinese businesses, a crooked hospital deal with Jim Biden, Joe Biden’s brother, out in western Pennsylvania. These investigations span multiple jurisdictions,” Cotton said, remarking that in the event that Joe Biden becomes the nation’s next president, “those prosecutors are in line to be fired next month. If there were ever circumstances that create a conflict of interest and called for a special counsel, I think those circumstances are present here.”

The Arkansas Republican said that the Biden family has leveraged Joe Biden’s government posts for their benefit in the past and would continue to do so if Biden serves as president. “Look, the Biden family has been trading on Joe Biden’s public office for 50 years. Valerie Biden Owens, his sister, and Jim Biden, his brother, and Hunter Biden his son,” he said. “Do we really think that that will change if Joe Biden becomes president, the highest office in the land?”

Predictable and terrible. She should be under investigation for Russiagate, not occupy some top job.

• Biden Taps Susan Rice For Top White House Domestic Policy Job (Pol.)

President-elect Joe Biden has tapped Barack Obama’s former national security adviser Susan Rice to run the White House Domestic Policy Council, according to people familiar with the decision.Rice, who also served as the U.S. ambassador to the United Nations, was vetted to serve as Biden’s vice president and was a contender to be secretary of State, a position that went to Antony Blinken. Democrats had concerns about Rice’s ability to get confirmed in a Republican-controlled Senate, and the director of the Domestic Policy Council is not a Senate-confirmed position. The Biden team had been looking to find a high-profile role for Rice, but the top domestic policy job comes as a surprise given her expertise and experience in foreign policy.

[..] In her position, Rice, 56, will play a large role in implementing Biden’s Build Back Better agenda, a wide-ranging set of policy proposals that would invest trillions of dollars in American infrastructure and manufacturing, clean energy, caregiving, education and racial equity.A person familiar with Biden’s thinking said he chose Rice for the role because of her deep experience in crisis management and interagency processes. The person said Biden does not see foreign, economic and diplomatic realms as separate and discrete and her deep knowledge of how the federal government works will be an asset to implementing his domestic policy agenda.

Biden officially announced Rice’s appointment Thursday morning, along with his nominations of Marcia Fudge to run the Department of Housing and Urban Development, Tom Vilsack as Agriculture secretary, Katherine Tai as U.S. trade representative and Denis McDonough as secretary of Veterans Affairs. “The roles they will take on are where the rubber meets the road — where competent and crisis-tested governance can make a meaningful difference in people’s lives, enhancing the dignity, equity, security, and prosperity of the day-to-day lives of Americans,” Biden said in a statement. Rice’s decision to take the domestic policy job also signals that she still harbors political ambitions. She floated the possibility of running for Senate in Maine against Susan Collins and was a finalist to serve as Biden’s running mate.

The top domestic policy job will fill out her foreign policy-heavy resume. Though Rice’s job does not require Senate confirmation, the Biden administration will need the support of Republicans to implement its far-reaching domestic policy agenda. Rice, however, has long been the target of the GOP because of he comments after the attack on a U.S. diplomatic facility in Benghazi and unmasking requests related to Donald Trump’s 2016 campaign and foreign interference. Rice has never been charged with doing anything improper, but she has been the subject of withering criticism from Republicans, which could complicate the administration’s efforts to pass policies in Congress.

The media has buried so many stories this year, who would notice another one?

• Is the Media Burying The Swalwell Story? (Turley)

We often discuss media coverage and accuracy on developing legal and political controversies. Much of this discussion recently has focused on the bias shown by the media in the last four years. I have worked for the media as a legal analyst and columnist for years, but I have never before seen this raw and open bias in major media. At the same time, academics are rejecting the very concept of objectivity in journalism in favor of open advocacy. This morning, Fox News called out all of the networks for zero coverage of the bombshell story from Axios that Rep. Eric Swalwell may have had a close relationship with a suspected Chinese spy who fled to China a few years ago. Many of us were struck by the lack of coverage, particularly given the position of Swalwell on the House Intelligence Committee and his former bid for the presidency.

It was particularly striking when the media is now reluctantly covering the Hunter Biden story after a long blackout before the election. Yet, the most stark comparison is with the exhaustive coverage given the highly analogous story involving an alleged spy, Maria Butina, who had an affair with a high-ranking figure in the National Rifle Association. Swalwell is alleged to have had a close relationship with Chinese national, Fang Fang or Christine Fang, who not only raised money for him but placed at least one intern in Swalwell’s congressional office, according to Axios. Bizarrely, Swalwell has refused to confirm or deny that he had an intimate relationship with his office claiming that such an answer could compromise classified information. Even that ridiculous comment did not prompt ABC, NBC, or CBS to cover the story.

Obviously, Fang and the Chinese already know if she had a sexual relationship with Swalwell. The only people in the dark are the voters. Swalwell himself explained why this is news. The congressman was one of the most vocal voices calling out a June 2016 meeting that President Trump’s son, Donald Trump Jr., with Natalia Veselnitskaya, who was accused of being an asset for the Russian government. Swalwell declared on MSNBC in January 2019: “Stated plainly, the President’s son met with a Russian spy. We now have the best evidence of that in our minority report the Democrats put out that Ms. Veselnitskaya was going all over the world and bumping into Dana Rohrabacher, which is a sign of a spy, someone who tries to create a coincidence encounter, and now we know that she was working at the behest of the Russian government.”

Not even the utter hypocrisy of Swalwell’s position or the lunacy of his classification claim was enough to generate minimal coverage. There is also no interest in Swalwell remaining on the intelligence committee given his ill-considered relationship.

He’s still on the House Intelligence Committee.

• Investigators Delve Into Suspected Chinese Spy Ties With Swalwell Staff (JTN)

The investigation into suspected Chinese spy Christine Fang’s relationship with Democrat Rep. Eric Swalwell included monitoring her activities with others in the California congressman’s office, according to security authorities. “There were concerns about who else in his office she was close to,” one intelligence official told Just the News. “Who could give her information or help her achieve her goals?” These concerns applied overall to people who worked for Fang’s suspected targets, the official said. “These were deeply cast nets,” the official said. The woman, also known as Fang Fang, reportedly infiltrated the inner circles of several U.S. politicians, mainly targeting those based in California. She is believed to have worked for years under a Communist Chinese spy boss in California, and also to have managed her own line of sub-agents, the official confirmed.

“There was considerable interest in learning who those agents were, and where they worked,” the official said. Swalwell would be a prime target for foreign spies because he sits on the House Intelligence Committee — where he remains so far — despite the recent revelations about his dealings with Fang. According to a report from Axios, Fang began her relationship with Swalwell early in his political career, while he was a city council member in Dublin, California. She helped raise funds for him, and came to know his family members in some capacity. In 2015, Fang fled the U.S. while the FBI was investigating her overall activities. Although Fang has not been charged with espionage, her behavior fits a suspicious pattern, according to one expert. “Christine Fang has left the U.S.,” said author Gordon Chang, who has studied China extensively. “She apparently left abruptly, which is an indication that she was working with Chinese intelligence.”

Set term limit, set age-limit. Easy.

• Dianne Feinstein ‘Seriously Struggling’ With Cognitive Decline (NYP)

Sen. Dianne Feinstein, the oldest member of the Senate at age 87 and the most senior Democrat on its powerful Judiciary Committee, is “seriously struggling” with cognitive decline, a new report says. People familiar with the California lawmaker’s situation told the New Yorker on Wednesday that Feinstein’s short-term memory has grown so poor that she “often forgets she has been briefed on a topic, accusing her staff of failing to do so just after they have.” Senate Minority Leader Chuck Schumer (D-NY) has had several “painful” discussions with Feinstein about stepping aside, but the octogenarian reportedly soon forgets about their talks, forcing Schumer to confront her again, one source said. “It was like Groundhog Day, but with the pain fresh each time,” the source said.

Overtures were also reportedly made to Feinstein’s billionaire husband, Richard C. Blum. Grumblings over Feinstein’s performance have grown increasingly loud, leading to her decision to step down last month as ranking member of the elite Judiciary Committee. Pundits were unhappy with Feinstein’s handling of the confirmation of President Trump’s most recent Supreme Court nominee, Amy Coney Barrett. The lawmaker bungled several questions and then caused a furor when she concluded Barrett’s hearings by hugging Judiciary Committee Chairman Lindsey Graham (R-SC) and praising him for “one of the best set of hearings that I have participated in.” Schumer was reportedly so concerned about Feinstein’s performance that he “installed a trusted former aide, Max Young, to ’embed’ in the Judiciary Committee to make sure the hearings didn’t go off the rails,” the New Yorker reported.

Inevitable when no-one can investigate the investigators.

• Sexual Misconduct Shakes FBI’s Senior Ranks (AP)

An assistant FBI director retired after he was accused of drunkenly groping a female subordinate in a stairwell. Another senior FBI official left after he was found to have sexually harassed eight employees. Yet another high-ranking FBI agent retired after he was accused of blackmailing a young employee into sexual encounters. An Associated Press investigation has identified at least six sexual misconduct allegations involving senior FBI officials over the past five years, including two new claims brought this week by women who say they were sexually assaulted by ranking agents. Each of the accused FBI officials appears to have avoided discipline, the AP found, and several were quietly transferred or retired, keeping their full pensions and benefits even when probes substantiated the sexual misconduct claims against them.

Beyond that, federal law enforcement officials are afforded anonymity even after the disciplinary process runs its course, allowing them to land on their feet in the private sector or even remain in law enforcement. “They’re sweeping it under the rug,” said a former FBI analyst who alleges in a new federal lawsuit that a supervisory special agent licked her face and groped her at a colleague’s farewell party in 2017. She ended up leaving the FBI and has been diagnosed with post-traumatic stress disorder. “As the premier law enforcement organization that the FBI holds itself out to be, it’s very disheartening when they allow people they know are criminals to retire and pursue careers in law enforcement-related fields,” said the woman, who asked to be identified in this story only by her first name, Becky.

The AP’s count does not include the growing number of high-level FBI supervisors who have failed to report romantic relationships with subordinates in recent years — a pattern that has alarmed investigators with the Office of Inspector General and raised questions about bureau policy. The recurring sexual misconduct has drawn the attention of Congress and advocacy groups, which have called for whistleblower protections for rank-and-file FBI employees and for an outside entity to review the bureau’s disciplinary cases. “They need a #MeToo moment,” said U.S. Rep. Jackie Speier, a California Democrat who has been critical of the treatment of women in the male-dominated FBI. “It’s repugnant, and it underscores the fact that the FBI and many of our institutions are still good ol’-boy networks,” Speier said. “It doesn’t surprise me that, in terms of sexual assault and sexual harassment, they are still in the Dark Ages.”

“Only three words spoil the entire positive message: “directing the market.”

• The “Great Reset” and Plans for a Global War on Savings (Lacalle)

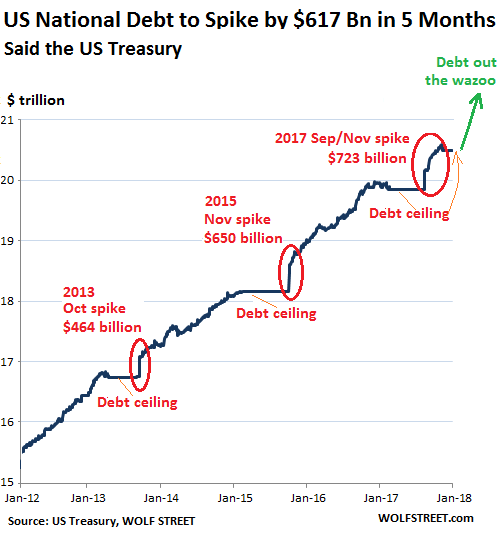

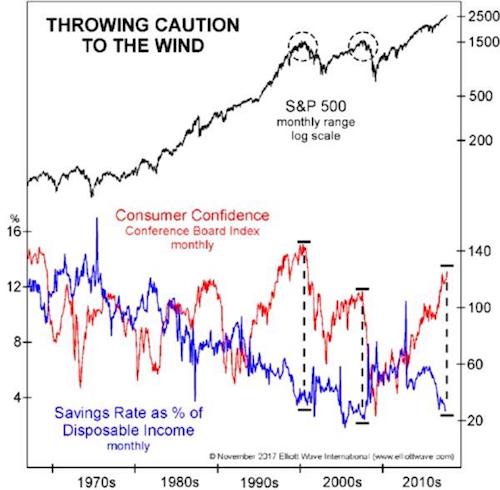

Global debt is expected to soar to a record $277 trillion by the end of the year, according to the Institute of International Finance. Developed markets’ total debt—government, corporate, and households—jumped to 432 percent of GDP in the third quarter. Emerging market debt-to-GDP hit nearly 250 percent in the third quarter, with China reaching 335 percent, and for the year the ratio is expected to reach about 365 percent of global GDP. Most of this massive increase of $15 trillion in one year comes from government and corporates’ response to the pandemic. However, we must remember that the total debt figure had already reached record highs in 2019, before any pandemic and in a period of growth. The main problem is that most of this debt is unproductive debt.

Governments are using the unprecedented fiscal space to perpetuate bloated current spending, which generates no real economic return, so the likely outcome is that debt will continue to rise after the pandemic crisis is ended and that the level of growth and productivity achieved will not be enough to reduce the financial burden on public accounts. In this context, the World Economic Forum has presented a roadmap for what has been called “the Great Reset.” It is a plan that aims to take the current opportunity to “to shape an economic recovery and the future direction of global relations, economies, and priorities.” According to the World Economic Forum, the world must also adapt to the current reality by “directing the market to fairer results, ensur[ing] investments are aimed at mutual progress including accelerating ecologically friendly investments, and [starting] a fourth industrial revolution, creating digital economic and public infrastructure.”

These objectives are obviously shared by all of us, and the reality shows that the private sector is already implementing these ideas, as we see technology, renewable investments, and sustainability plans thriving all over the world. We are witnessing in real time the proof that businesses adapt rapidly and provide better goods and services at affordable prices for everyone achieving a level of progress in environmental targets and welfare that would be unthinkable if governments were in charge. This crisis shows that the world has escaped the risk of scarcity and hyperinflation thanks to a private sector that has surpassed all expectations in a seemingly unsurmountable crisis.

The overall message of the World Economic Forum sounds promising. Only three words spoil the entire positive message: “directing the market.” The risk of governments taking these ideas to promote massive interventionism is not small. The idea of the Great Reset has been quickly embraced by the most bureaucratic and government-intervened economies as a validation of rising government implication in the economy. However, this is incorrect.

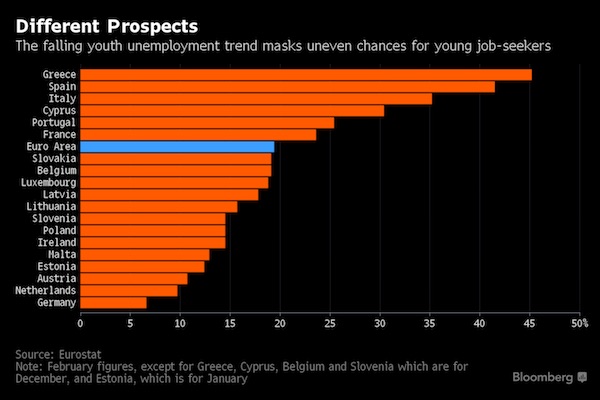

“The OECD has estimated that the unemployment rate will reach roughly 20 percent by the end of the year.”

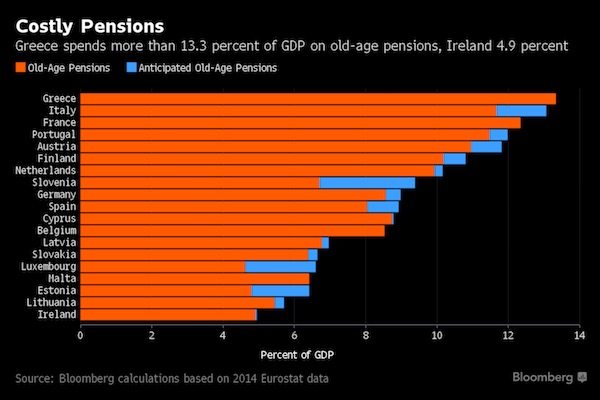

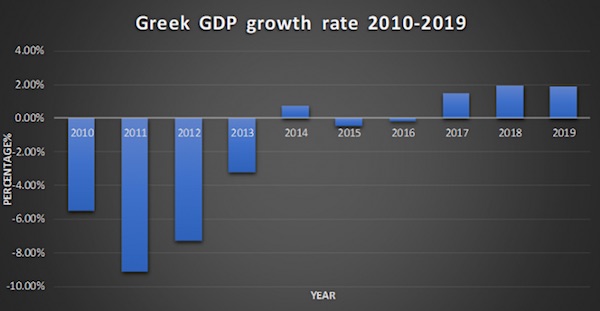

• Greece Is Setting Itself Up For Another Financial Crisis (Mises)

The Greek economy shrunk by a record 14 percent in the second quarter of 2020 while at the same time government efforts to ‘’cure’’ the economy have set the country on the road to cross the 200 percent debt-to-GDP ratio as the IMF forecasts. In the meantime, government budget deficits have reached new heights (around 7 percent). The Greek government tried to combat the economic downturn with a loose fiscal and monetary policy (through the European Central Bank). The initial aim was to support pretty much everyone from the public and private sector for the bad months of the covid-19 lockdown and hope for economic recovery when the summer arrived, with the tourist industry saving the day. It soon became evident, however, that this was wishful thinking.

People from the tourist industry admitted that it could take years for the industry to recover its past numbers. The situation looked even worse once people realized how dependent the whole economy is on tourism: it accounts for 20 percent of GDP and provides 22 percent of all employment in Greece. Furthermore, the Greek government’s solutions, like those of most of the other governments in Europe, were primarily demand-side policies. As I predicted in one of my past articles, these measures could only provide short-run relief, only postponing the pain until later. The unemployment rate saw a 1.2 percent increase from March to April, of 1.3 percent from April to May, and it saw a minor decrease during the summer tourist period. The OECD has estimated that the unemployment rate will reach roughly 20 percent by the end of the year.

The ECB’s balance sheet had a massive increase from 39 percent of the GDP to 54 percent during the summer. In comparison the Fed’s balance sheet is around 32 percent of GDP. The injections of liquidity via the ECB have effectively zombified a considerable number of companies in the EU, with corporate debts reaching new highs. In the case of Greece, the government has exploited its new, EU-sanctioned fiscal leeway, which has allowed it to perpetuate structural problems in its economy along with large deficits. During the tourist season, the costs were so high that a considerable segment of the tourist industry decided to not even work this summer since they would lose less money this way.

[..] People need to understand that when you have an economy with weak productivity that’s highly indebted, shutting down the economy two times in one year has repercussions that will be here to stay for years depending on the recovery policies. The economy needs major structural reforms. Labor laws need to be liberalized. Budget surpluses are indeed the correct goal, especially now, to avoid another debt crisis, but the surpluses need to come from cuts made in the public sector. Tax cuts need to become permanent and even bigger for the economy to grow and expand. Last but not least, making foreign and domestic investments easier, less expensive, and minimizing the potential risk is a matter of utmost urgency, since Greece is being outcompeted by neighboring countries.

Isn’t China merely replacing predatory IMF behavior with predatory Beijing behavior?

• US Hits Search & Destroy Against The New Silk Roads (Escobar)

Seven years after being launched by President Xi Jinping, first in Astana and then in Jakarta, the New Silk Roads, or Belt and Road Initiative (BRI) increasingly drive the American plutocratic oligarchy completely nuts. The relentless paranoia about the Chinese “threat” has much to do with the exit ramp offered by Beijing to a Global South permanently indebted to IMF/World Bank exploitation. In the old order, politico-military elites were routinely bribed in exchange for unfettered corporate access to their nations’ resources, coupled with go-go privatization schemes and outright austerity (“structural adjustment”). This went on for decades until BRI became the new game in town in terms of infrastructure building – offering an alternative to the imperial footprint.

The Chinese model allows all manner of parallel taxes, sales, rents, leases – and profits. This means extra sources of income for host governments – with an important corollary: freedom from the hardcore neoliberal diktats of IMF/World Bank. This is what is at the heart of the notorious Chinese “win-win”. Moreover, BRI’s overall strategic focus on infrastructure development not only across Eurasia but also Africa encompasses a major geopolitical game-changer. BRI is positioning vast swathes of the Global South to become completely independent from the Western-imposed debt trap. For scores of nations, this is a matter of national interest. In this sense BRI should be regarded as the ultimate post-colonialist mechanism.

BRI in fact bristles with Sun Tzu simplicity applied to geoeconomics. Never interrupt the enemy when he’s making a mistake – in this case enslaving the Global South via perpetual debt. Then use his own weapons – in this case financial “help” – to destabilize his preeminence.

Five Eyes only?

• Australia Sabotaged Its Own Interests in China Relations (CN)

The address to Federal Parliament by Chinese President Xi Jinping on Nov. 17, 2014, marked a highwater mark in bilateral relations. Xi was in Australia for the G-20 summit in Brisbane hosted by Prime Minister Tony Abbott. His theme was that China was committed to peace but ready to protect its interests. Since then, the relationship has gone downhill — first slowly and haltingly, but over the past two years with sickening acceleration. Now the relationship seems irretrievable. For educated Chinese, Australia is now an object lesson in Western arrogance, hypocrisy and betrayal of friendship. The dinner party has ended in upended chairs, shouts and bitter accusations as both sides angrily walk away. After the high symbolism of the Xi speech, all seemed well. In 2015 the Darwin Port was leased to a Chinese company for 99 years.

Growing numbers of Chinese students and tourist visitors to Australia were becoming mainstays of Australia’s thriving higher education, tourism and property sectors. China as an Australian export market grew steadily in significance: last year it represented nearly 50 percent of Australian commodity export earnings. Victoria in 2018 signed a memorandum of understanding with China to work with China’s Belt and Road Initiative. From the beginning, there were signs that powerful forces were determined to cripple Australian-Chinese engagement: and they have now seemingly won. The present breakdown is tragic for Australian economic and political interests. Many innocent Australians’ livelihoods are being harmed by our own government’s and political class’ stupidity. It is hard to see now how the damage done to Australia-China relations may be healed anytime soon.

Controversially, I contend that Australia has over the past six years lived through a textbook experiment of covert foreign policy interference by powerful Anglo-American influences, subtly working through local sympathizers in public life here. Australian political elites — already culturally predisposed to trust Anglo-American friends, and naive as to their power and guile — have been persuaded to adopt increasingly adversarial positions against China across a broad front. This essay can only hint at the breadth and skill of this classic Five Eyes information warfare operation: it would take a book to expose it fully.

“Five Eyes” intelligence network including the U.S., Canada, the U.K., Australia, New Zealand. (@GDJ, Openclipart)

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.