Rembrandt van Rijn Christ and St Mary Magdalene at the Tomb 1638

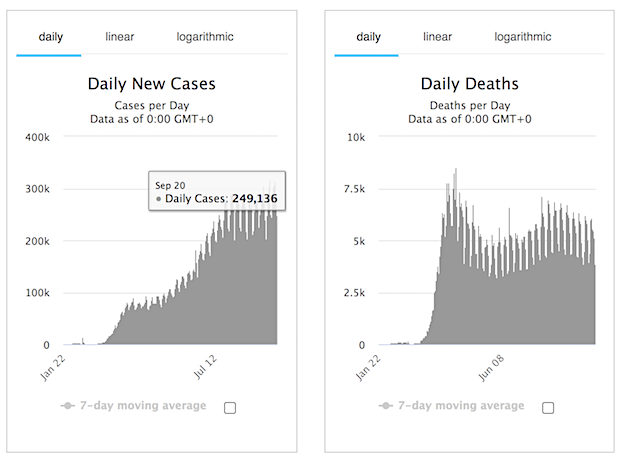

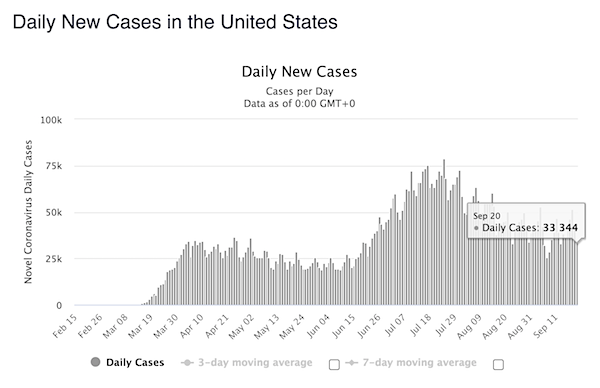

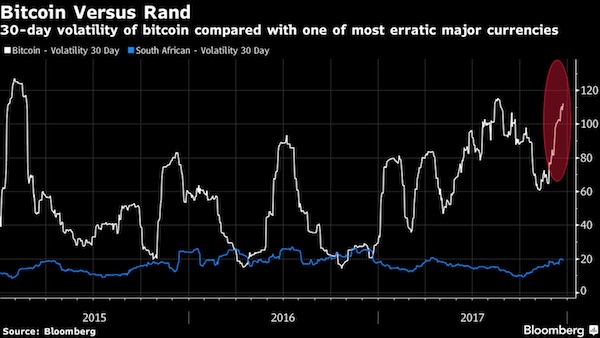

Flooding at a coal mine in one of the smallest of 61 counties in #Xinjiang #China shut down 35% of #Bitcoin’s global mining power this weekend.

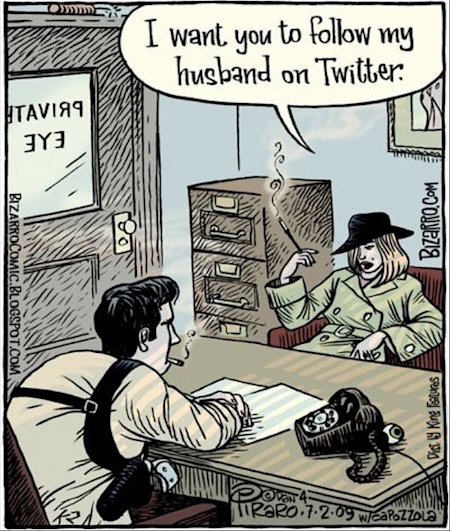

Not the Onion. But way over the top.

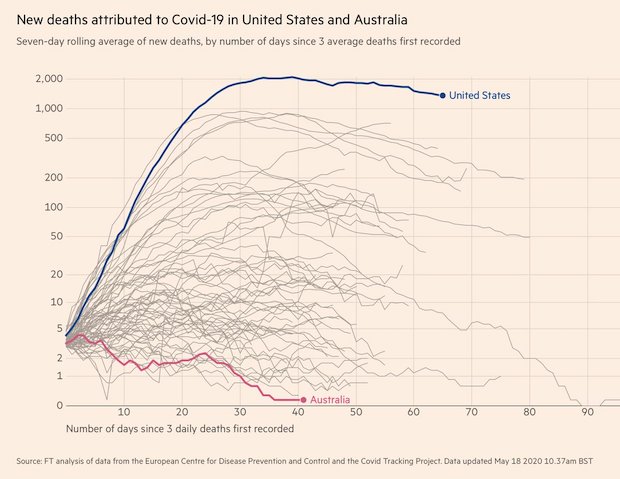

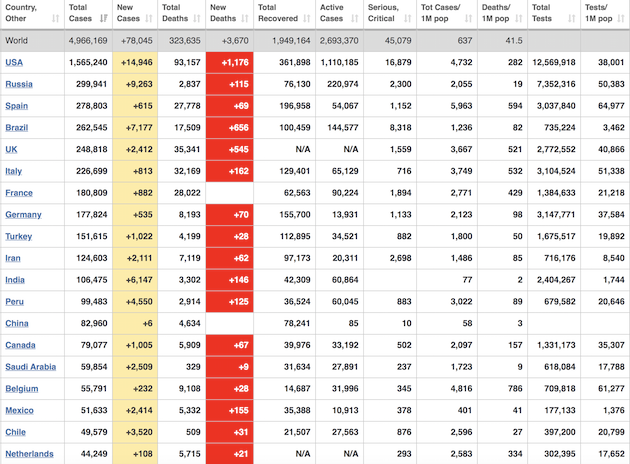

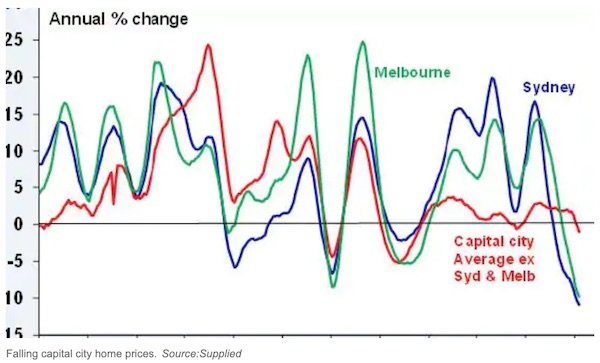

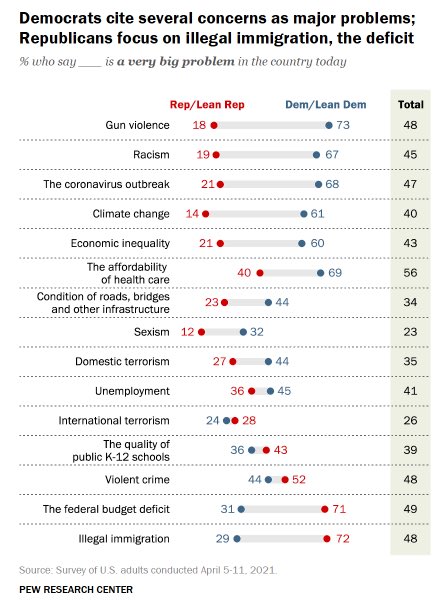

Big differences.

If you find yourself hopeful when seeing this, snap out of it. This is just a way to spend trillions of your money on greenwashing. Here is the pattern that will continue, again:

“..the Obama administration aimed to reduce emissions 26% to 28% below 2005 levels by 2025. Currently, the U.S. has not yet reached the halfway point in achieving that goal.”

Replacing one source of energy with another one is useless, only using -a whole lot- less energy works. For that, we will need to redesign our cities and homes. Not our cars. And that will cost a lot of money, which won’t be available anymore, because it’s been spent on grandiose plans for windmills and solar panels to one-on-one replace all present sources. And that’s just the first problem.

• Biden Vows To Cut Nearly Half Of Greenhouse Emissions By 2030 (SAC)

President Joe Biden on Earth Day vowed to slash U.S. greenhouse gas emissions by 50% to 52%—compared to 2005 levels—by 2030, as part of a broader goal of achieving net-zero emissions in the country by 2050. “These steps will set America on a path of a net-zero emissions economy by no later than 2050,” Biden told a virtual climate summit, attended by 40 leaders from around the world, Thursday morning as he announced the new emissions goal. “Scientists tell us that this is the decisive decade, this is the decade we must make decisions that will avoid the worst consequences of a climate crisis,” Biden said.

“This is a moral imperative. An economic imperative. A moment of peril, but also a moment of extraordinary possibilities,” the president added. The new greenhouse target more than doubles the United States’ previous target under the 2015 Paris climate agreement, when the Obama administration aimed to reduce emissions 26% to 28% below 2005 levels by 2025. Currently, the U.S. has not yet reached the halfway point in achieving that goal.

Biden energy boom

#EARTHDAY2021 President Biden predicts "climate energy boom" that will create jobs and innovation, advocates moving quickly for US interests and those of countries around the world pic.twitter.com/6VZfmvo5ER

— Forbes (@Forbes) April 22, 2021

Heretic.

• GOP Sen. Ron Johson Criticizes ‘Big Push’ To Get Everyone Vaccinated (F.)

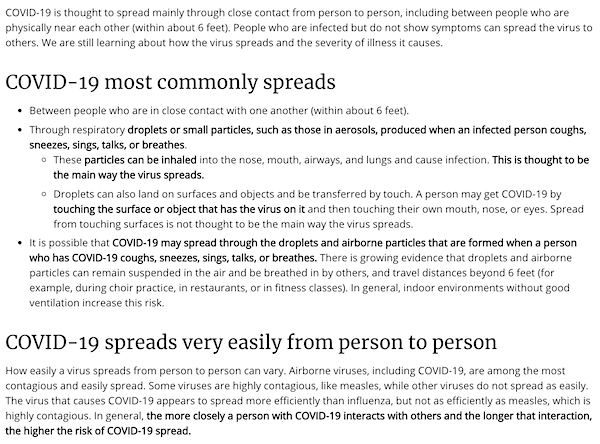

Sen. Ron Johnson (R-Wisc.) on Thursday questioned the “big push” to ensure everyone is vaccinated against coronavirus, putting him at odds with many of his Senate Republican colleagues who have attempted to close the partisan gap in vaccination rates. In an interview with conservative Wisconsin radio host Vicki McKenna, herself a vocal coronavirus vaccine skeptic, Johnson launched into a condemnation of “vaccine passports,” a credential that would allow businesses to verify vaccination status. But Johnson also went a step further, declaring he sees “no reason to be pushing vaccines on people,” arguing their distribution should be “limited” to those most vulnerable to coronavirus, and asking, “if you have a vaccine, quite honestly, what do you care if your neighbor has one or not?”

Johnson said he is “getting highly suspicious” of the “big push to make sure everybody gets the vaccine,” stating it’s “not a fully approved vaccine” but also arguing that the fact it is 95% effective means only a limited number of people need to be vaccinated. The comments put Johnson at odds with Senate Majority Leader Mitch McConnell, who spent much of the last Senate recess urging Republican men to get vaccinated amid public opinion polling that shows they are the least likely to do so. Johnson is one of the Senate’s most prolific promoters of coronavirus pseudoscience, holding hearings last year as the chair of the Senate Homeland Security and Governmental Affairs Committee to promote unproven treatments like Hydroxychloroquine.

[..] Johnson has drawn outrage from lawmakers in both parties for some of his recent comments, particularly on the Jan. 6 attack, which he has routinely sought to downplay. He said the attack “didn’t seem like an armed insurrection to me” in February, and last month he said the attackers “truly respect law enforcement” and claimed he wasn’t concerned for his safety during the incident – but might have been if the attackers were affiliated with Black Lives Matter.

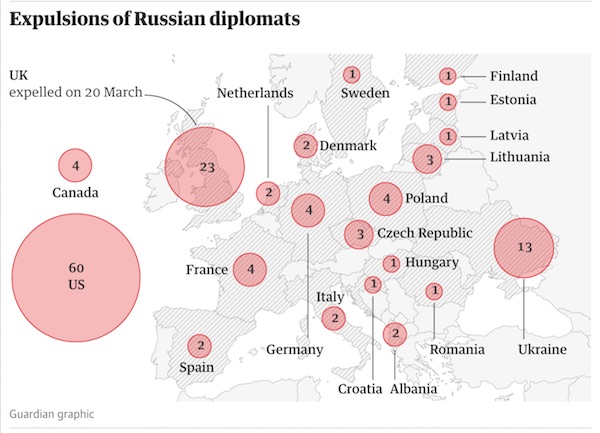

First time I’ve seen this. Many countries will follow. No investigation allowed.

• Greek Gov’t Legislates “Legal Impunity” For Epidemiologists’ Committee (KTG)

The Greek government has tabled a amendment to the Parliament to secure legal impunity for the committee of the epidemiologists advising the government on pandemic issues. The regulation comes amid pressure from the opposition to make the minutes of the meetings public. The introduction to provide impunity to infectious disease committee members in charge of the pandemic measures is for sure a unique worldwide. The amendment introduces impunity for the epidemiologists’ committee members from any form of prosecution or even questioning and protects them from having to testify if they were in “conflict of interest.”

The amendment was submitted by the Health Ministry in a legislation of Code of Judicial Officers of the Justice Ministry. It reportedly bears the signatures of the Health and Justice Ministers and other members of the government. It will be voted in the parliament later on Thursday. According to news website news247.gr, Article 4 of the amendment stipulates that members of the National Committee for the Protection of Public Health against the coronavirus disease Covid 19, the Committee for the Management of Public Health Emergencies by Infectious Diseases and the National Vaccination Committee are not liable, not prosecuted and are not examined for opinion they formulated or vote they gave in the exercise of their duties in the context of the operation of the above committees. Prosecution is allowed only for defamation or insult.

Particularly troubling, notes the website, is the provision that committee members are not prosecuted but can not even be questioned. It raises questions about what this means in the event that either a public prosecutor’s investigation or a possible pre-investigation committee of the Parliament is conducted in the future. In this case, it is possible that the members of the committee may not even be called as witnesses. It should be noted that this regulation comes after the intense pressure from the opposition to make public the minutes of the infectious disease committees and also in a period of the pandemic where the decisions of the committee are extremely important. At the same time, it comes in the middle of the vaccination process and also concerns the vaccination committee.

It is worth recalling that there have already been complaints from the opposition about conflicts of interest between members of the committee and their professional activities, notes news247. It should also be recalled that there has been recently a debate about the committee decisions and how much the members obey the government s plans to open or close activities than the scientific dictates. The gradual lifting of the lockdown and the opening of tourism in mid-May (unofficially on April 19) with daily infections are over 3000 and an average of 75 deaths per day while had many Greeks wonder why there was a 5.5 months lockdown anyway. [..] The government, ministers and lawmakers have immunity anyway.

Also: “Germany to buy 30 million doses of Russia’s Sputnik V vaccine”. EU Covid management is crumbling.

• Greece to Recognize Validity of Sputnik V Vaccine for Travelers (GR)

Greece is taking all possible necessary precautions to ensure a successful launch of the 2021 tourism season on May 14 to avoid last year’s losses — including accepting the validity of Russia’s “Sputnik V” vaccine in allowing Russians to visit the country. The vaccine, dubbed the “traveling companion,” has a 97.6% efficacy rate under trial conditions, according to its makers. This was based on data analysis on the infection rate among people receiving both shots of the vaccine. The Sputnik V vaccine was registered in 60 countries worldwide as of April 19, 2021 from Argentina and Mexico to Israel and the Philippines. Russian officials say they have signed deals to produce it in South Korea and India. Via a post on Twitter on April 6, 2021, the distributor confirmed that it could supply Greece with the vaccine for 500,000 people in May.

A soft opening of the tourism sector in Greece commenced on Monday, April 20, by lifting its seven-day quarantine requirements for international travelers arriving from the EU, the Schengen Area, the US, the UK, Israel, Serbia, and the United Arab Emirates upon proof of vaccination, immunity, or a negative PCR test on arrival. Expected in this is group is hundreds of thousands of tourists from Russia as a result of joint efforts to resume tourism activity between the two countries. However, the Sputnik V is still under review by the European Medicines Agency (EMA). There are not enough doses of other vaccines available in the EU to satisfy demand, so the desire for new options is substantial. The EU Green Passport regulation, due to be adopted soon, does not recognize vaccines that have not yet been approved by the EMA. However, it is flexible enough to allow EU member states to accept the validity of certain vaccines, such as Russia’s Sputnik V, on what it calls a “bilateral level.”

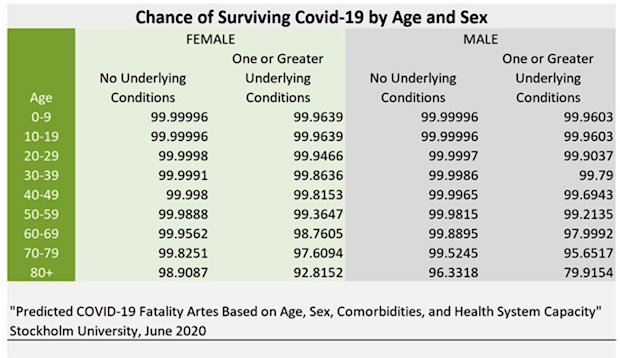

That’s less effective than ivermectin. Good thing they didn’t research that, so they can keep saying: well, there’s no research! The only way to keep the EUA.

• One Dose Of Pfizer Or Oxford Jab Reduces Covid Infection Rate By 65% (G.)

One shot of the Oxford/AstraZeneca or Pfizer/BioNTech vaccine reduces coronavirus infections by nearly two-thirds and protects older and more vulnerable people as much as younger, healthy individuals, a study has found. The results from Oxford University and the Office for National Statistics are a welcome boost to the vaccination programme and the first to show the impact on new infections and immune responses in a large group of adults in the general population. By driving down rates of infection the vaccines will not only prevent hospitalisations and deaths but help break chains of transmission and so reduce the risk of a damaging resurgence of disease as the UK reopens.

The researchers analysed Covid test results from more than 350,000 people in the UK between December and April. They found that 21 days after a first jab – the time it takes the immune system to mount a decent response – new Covid infections dropped by 65%. The vaccines were more effective against symptomatic than asymptomatic infections, reducing rates by 72% and 57% respectively, compared with those seen in the unvaccinated population. A second shot of the Pfizer vaccine boosted protection further, causing symptomatic infections to fall by 90% and asymptomatic infections by 70%. Because the Oxford vaccine was approved and rolled out later, it is too early to assess the impact of those second doses.

Scientists on the team said the findings supported the UK’s decision to prioritise giving first shots to elderly and more vulnerable people by delaying second doses. “There was no evidence that the vaccines were less effective among older adults or those with long-term health conditions,” said Dr Koen Pouwels, a researcher on the team.

“A majority of Japanese already oppose holding the Games this summer..”

• Japan Rolls Out Vaccine Slowly, Despite Looming Olympics (Y!)

Three months before it hosts the Olympics – the biggest international event since the pandemic began – Japan has fully vaccinated less than one percent of its population in a cautious, slow-moving programme. Olympic organisers and local officials stress vaccines are not a prerequisite for the Games. Participants will not have to be inoculated before arrival and there are no plans to prioritise vaccination of Japanese athletes or volunteers. But the slow rollout in the world’s third-largest economy, which experts say is driven by a mixture of caution and entrenched bureaucratic hurdles, is starting to weigh on public opinion. The government has emphasised caution to build trust in the vaccine, said Takakazu Yamagishi, director of the Center for International Affairs at Nanzan University, who researches health policy.

But, seeing speedy vaccinations elsewhere, “more and more people are realising that the delayed vaccination process has put Japan in a difficult position to hold the Olympics,” he told AFP. This could “weaken their support for the Games”. A majority of Japanese already oppose holding the Games this summer, and Prime Minister Yoshihide Suga, who faces a general election this year, has been under pressure for months over his coronavirus response. The country’s outbreak has been comparatively small so far, with fewer than 10,000 deaths. But several regions, including Tokyo, requested new virus states of emergency this week over a fresh wave of cases that has already overwhelmed some local healthcare systems.

Writing in the British Medical Journal this month, four health experts cited Japan’s “sluggish vaccine rollout” among other factors in urging plans to hold the Games “be reconsidered as a matter of urgency”. Polls show three-quarters of Japan’s public consider the rollout slow, with 60 percent saying they are dissatisfied with the programme. Olympic organisers insist the rollout’s pace will not impact the Games. “We’ll be able to deliver the Games even without vaccination,” Tokyo 2020 CEO Toshiro Muto told reporters on Wednesday.

A big nothing. But a warning at the same time.

• Russia To Withdraw Troops From Deployment On Border With Ukraine (RT)

Russian Defense Minister Sergey Shoigu has announced that troops deployed in the west and south of the country in recent days will soon begin returning to base, saying they have now passed tests of their combat readiness. The chief of the country’s military revealed on Thursday that a number of units of the regular army and airborne divisions had been transferred to the area, near the shared border with Ukraine, as part of surprise military exercises. The buildup had caused alarm in Kiev, and been cited by Western nations as a potential precursor to an invasion, which the Kremlin repeatedly denied.

According to Shoigu, “the goals of the sudden inspection have been fully achieved. The troops demonstrated their ability to ensure reliable defense of the country.” As a result, he has now ordered commanders to “plan and begin the return of troops to their places of regular deployment, beginning from April 23.” By the end of the month, the minister said, “the personnel of the 58th Army of the Southern Military District, the 41st Army of the Central Military District, the 7th, 76th Air Assault and 98th Airborne Divisions of the Airborne Forces” will return to their normal bases. However, he warned that the army would “react and respond adequately to all changes in the situation near Russian borders.”

“.. render foreign satellite navigation systems completely useless, disabling an enemy’s high-precision weapons.”

• Russia To Make Areas Of Airspace Inaccessible To Foreign Missiles, Drones (RT)

Russia’s electronic warfare specialists will practice creating ‘protection areas’ in the country’s airspace that could render foreign satellite navigation systems completely useless, disabling an enemy’s high-precision weapons. According to Moscow daily Izvestia, citing a source in the Defense Ministry, radio-electronic warfare troops will practice using the technology during exercises this year, with the practice to be held nationwide in 2022. The system, known as Field-21, creates interference that disorients foreign satellite navigation systems, including the American GPS NAVSTAR. According to experts, the creation of special zones could be used to protect military facilities, as well as industrial areas, making the airspace virtually impenetrable. They believe the new approach will radically increase national security.

With satellite navigation foiled, enemy high-precision weapons and drones will not be able to direct themselves towards their target. “Electronic warfare systems hit several cruise missile systems at once,” military historian Dmitry Boltenkov told Izvestia. “Satellite navigation interference causes them to get ‘lost’ in space and dramatically reduces their accuracy. If the radio altimeter signal is suppressed, the ammunition will also not be able to perform its combat mission as expected.” Radio-electronic troops have already been deployed in Syria, where an electronic warfare protection dome has been created over the areas of Tartus and Khmeimim, protecting the military from attacks by militant drones. Russia has been involved in the Syrian Civil War since 2015, when it was invited by the Damascus government, led by President Bashar Assad, to help fight against a terrorist insurgency in the country.

One thing about flimsy nonsensical narratives is you must keep feeding them. Then when someone asks for proof, you can point to all the other “cases” and say: see?! it fits a pattern.

• Russia Behind ‘Directed Energy’ Attacks On US Troops In Syria – Pentagon (ZH)

In the newest dramatic allegations against suspected Russian malfeasance, the Department of Defense (DoD) on Thursday revealed that it believes the Russian military targeted US troops in Syria with ‘directed energy attacks’ in order to make them ill and unable to conduct normal operations. Apparently some US troops occupying the country began reporting “flu-like symptoms” which caused the DoD to investigate possible linkage to microwave or directed energy weapons on the battlefield of Syria. Politico reports that “officials identified Russia as a likely culprit, according to two people with direct knowledge of the matter.” DoD officials said they briefed top lawmakers on intelligence which they say points to Russia being behind a series of these suspected high tech attacks.

This follows a major investigation being conducted since last year of similar mysterious attacks against US personnel across the globe. Controversy has raged since late 2016 into 2017 and the “Havana syndrome” story, which involved some 50 diplomatic officials working at the US Embassy in Cuba coming down with strange illnesses and symptoms which many blamed on high tech ‘sonic attacks’ of some sort. Personnel reported experiencing everything from vomiting to concussions to chronic headaches to minor brain injuries. But analysts and scientists have been deeply divided on the issue, with speculation ranging from high pitched sounds from crickets or even mass hysteria causing the illness.

But Politico reports of these newest allegations of the potential targeting of Americans in northeast Syria as follows: “The briefings included information about injuries sustained by U.S. troops in Syria, the people said. The investigation includes one incident in Syria in the fall of 2020 in which several troops developed flu-like symptoms, two people familiar with the Pentagon probe said.” The CIA is said to also be looking into these suspected attacks via its own task force. Strangely, the Politico report also included a denial that troops in Syria were ever found to be victims of such weapons by the Pentagon press spokesperson, strongly suggesting this is a continuation of the current, highly politicized “just blame Russia” climate in Washington…

A Pentagon spokesperson, however, said the department is not aware of directed-energy attacks against U.S. troops in Syria. The spokesperson declined further comment on the Pentagon’s interactions with Capitol Hill or any internal investigation. “The incidents of suspected directed-energy attacks by Russia on Americans abroad became so concerning that the Pentagon’s office of special operations and low-intensity conflict began investigating last year, according to two former national security officials involved in the effort. It’s unclear exactly how many troops were injured, or the extent of their injuries.”

Pretty brilliant exposé. By someone calling herself Covid Lie.

• Who Runs The World? Blackrock and Vanguard (Sardi)

If you’ve been wondering how the world economy has been hijacked and humanity has been kidnapped by a completely bogus narrative, look no further than this video by Dutch creator, Covid Lie. What she uncovers is that the stock of the world’s largest corporations are owned by the same institutional investors. They all own each other. This means that “competing” brands, like Coke and Pepsi aren’t really competitors, at all, since their stock is owned by exactly the same investment companies, investment funds, insurance companies, banks and in some cases, governments. This is the case, across all industries. As she says:

“The smaller investors are owned by larger investors. Those are owned by even bigger investors. The visible top of this pyramid shows only two companies whose names we have often seen…They are Vanguard and BlackRock. The power of these two companies is beyond your imagination. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. This gives them a complete monopoly. A Bloomberg report states that both these companies in the year 2028, together will have investments in the amount of 20 trillion dollars. That means that they will own almost everything. Bloomberg calls BlackRock “The fourth branch of government”, because it’s the only private agency that closely works with the central banks.

BlackRock lends money to the central bank but it’s also the advisor. It also develops the software the central bank uses. Many BlackRock employees were in the White House with Bush and Obama. Its CEO. Larry Fink can count on a warm welcome from leaders and politicians. Not so strange, if you know that he is the front man of the ruling company but Larry Fink does not pull the strings himself. BlackRock, itself is also owned by shareholders. Who are those shareholders? We come to a strange conclusion. The biggest shareholder is Vanguard. But now he gets murky. Vanguard is a private company and we cannot see who the shareholders are.

The elite who own Vanguard apparently do not like being in the spotlight but of course they cannot hide from who is willing to dig. Reports from Oxfam and Bloomberg say that 1% of the world, together owns more money than the other 99%. Even worse, Oxfam says that 82% of all earned money in 2017 went to this 1%. In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution. Why doesn’t everybody know this? Why aren’t there movies and documentaries about this? Why isn’t it in the news? Because 90% of the international media is owned by nine media conglomerates.

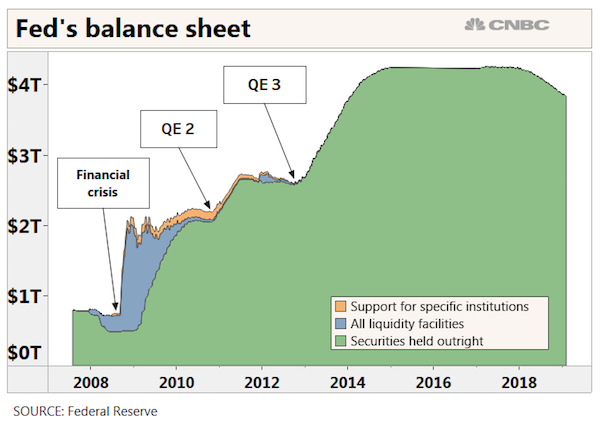

How did we get from austerity to spending trillions?

• Why The ‘Magic Money Tree’ Suddenly Appeared When Covid-19 Hit (RP)

Coronavirus has proven that austerity was a political choice and that the ‘Magic Money Tree’ really does exist, progressive economists have said. Whether it be Joe Biden’s $1.9trillion relief bill or Rishi Sunak’s £50billion furlough scheme, centrist and conservative governments have suddenly found a way to spend in the public’s interest. All it took was a pandemic. In an event for Let’s Talk It Over entitled ‘The Austerity Doctrine in the Time of Coronavirus’, Yanis Varoufakis, Stephanie Kelton, Naomi Klein and Brian Eno discussed whether the “pandemic has ended the reign of austerity as policy and mindset”. Stephanie Kelton, a former economic adviser to Bernie Sanders, said: “Everything was in a budgeting framework and then Covid happened.

“Governments started committing huge sums of money. So where does it come from? The CARE act, for example, was Congress’ way of ordering up $2.2billion from the Federal Reserve. “They can commit to spending money that they do not have. If the votes are there, then the money follows. “Almost no-one believes any longer that the ‘coffers’ can be empty. “Everyone can now see that the government no longer needs to keep its powder dry. As Kelton explains in her now famous tome, countries that print their own money can easily spend their way towards economic prosperity without any notion of paying it back – as long as the economic potential of the nation is not reached. In the US, the total federal debt is nearing $30trillion – but does it really matter? To enact austerity to ‘pay for’ a year of generous public spending would not achieve anything except for a downward economic spiral, Varoufakis said.

The former Greek Finance Minister added: “I’m calling in from the epicentre of austerity. If there was a New Deal in 2011, after we had lost 25 percent of our GDP (in the crisis), it would have been a majestic success. “But instead, we continued and had a downward spiral. “We need to have major debt restructuring at the public and private level for countries that don’t have the same privilege as the United States in printing their own money. “The nightmare of the powerful is that the weak have alternatives. So when they hear about Universal Basic Income and job creation schemes they think it will become a nightmare for them. “As oligarchs, they are following the right instincts. Using the ‘magic money tree’ to empower the power is seriously circumscribing their own power.”

In essence, the powerful adore austerity and malign public debt because anything close to Modern Monetary Theory would give working people too many alternatives, Varoufakis said. Naomi Klein claimed that tax rises after the pandemic are a necessity – but only on the rich. Modern Monetary Theory dictates that one of the roles of taxation, in addition to curbing inflation, is to reduce inequality. She explained: “In theory, we need to raise taxes on corporations and the wealthy not because we need to do it, but because of the levels of inequality. “It’s also a moral hazard for the wealthy to not have to live in the mess that they made. We’ve seen the wealthy retreat into their castles, as it were, and the pandemic has made this even more apparent. “Austerity is about disciplining a workforce.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.