Ben Shahn L.F. Kitts general store in Maynardville, Tennessee Oct 1935

It’s hard to see how the loss of familes can not be detrimental to human society.

• What the Economy Has Done to the Family (Bloomberg)

It could be a future diorama at New York’s Museum of Natural History: A human male and female who not only got married, but stayed married. Divorce among 50-somethings has doubled since 1990. One in five adults have never married, up from one in ten 30 years ago. In all, a majority of American adults are now single, government data show, including the mothers of two out of every five newborns. These trends are often blamed on feminists or gay rights activists or hippies, who’ve somehow found a way to make Americans reject tradition. But the last several years showed a different powerful force changing families: the economy. The effects of the Great Recession on families are hard to ignore. Births and marriages have plunged, as millions of millennials skip or delay starting traditional families. The economic uncertainty of the downturn dismantled job security which, in turned, ripped up many wedding plans.

Families that have made unconventional arrangements are the most financially fragile. An Allianz survey of 4,500 Americans included an extra sample of families outside the historical norm, including single parents, same-sex couples and blended families. These “modern families” were less financially secure than traditional families, the study found. They were 50% more likely to have unexpectedly lost their main form of income – and twice as likely to have declared bankruptcy. Rocky times rearrange plans and priorities. When women in their early 20’s face an economy with high unemployment, for example, they tend to have fewer children. The spike in unemployment starting in 2008 should result in 9.2 million young women giving birth to 430,000 fewer babies over their lifetimes, according to a 2014 National Academy of Science study.

Why would more unemployment mean fewer babies? When asked what they’d like in a potential spouse, single men’s top answer is “similar ideas about having and raising children,” a Pew Research survey found in September. But when women were asked, 78% said they wanted a spouse with “a steady job.”A man with a steady job is harder to find. Since the 1970s, men have been holding jobs for shorter and shorter periods of time. Women’s average job tenure hasn’t fallen, but that’s only because so many more joined the workforce in the ‘80s and ‘90s. Both sexes are working more temporary or contract gigs, have stagnant wages and enjoy fewer company benefits. The number of big companies offering pensions has dropped 57% in 10 years.

Wow. 1 in 40. Many western countries hide significant protions of unemployment behind ‘self-employment’. Peel off that fake layer, and you uncover a bitter reality.

• Full-Time Employee Jobs Account For Only 1 In 40 Created Since 2008 (Guardian)

Only one in every 40 new jobs created since the recession has been for a full-time employee, according to the Trades Union Congress. The share of full-time employee jobs – excluding self-employment – fell during the recession and has failed to recover since, falling from 64% in 2008 to 62% in 2014, the TUC said. That is equivalent to a shortfall of 669,000 full-time employees. Unemployment never reached the levels feared at the onset of the crisis, but the figures highlight that job creation between 2008 and 2014 has been dominated by rising self-employment and part-time work, not full-time employee jobs. Employment increased by 1.08m between January to March 2008 and June to August 2014, but only 26,000 were full-time employee roles. Frances O’Grady, TUC general secretary, said: “While more people are in work there are still far too few full-time employee jobs for everyone who wants one. It means many working families are on substantially lower incomes as they can only find reduced hours jobs or low-paid self-employment.”

While one in 40 of the net jobs added to the economy between 2008 and 2014 has been a full-time employee job, 24 in every 40 have been self-employed and 26 in every 40 have been part-time. The TUC said that although part-time work was an important option for many people, the number of part-time employees who say they want to work full-time is still almost double the number before the recession at 1.3m. The TUC also said that at least part of the increase in self-employment was driven by people unable to find employee jobs or those forced into false self-employment by companies seeking to evade taxes and avoid paying out entitlements such as holiday pay, sick pay and pensions. O’Grady said: “The chancellor has said he wants full employment, but that should mean full-time jobs for everyone who wants them. At the moment the economy is still not creating enough full-time employee jobs to meet demand.”

They’ll never come back. Detroit was merely a guinea pig.

• US Cities Struggle to Recover From Recession (Bloomberg)

Most big U.S. cities have struggled to restore revenue to pre-recession peaks amid lagging property-tax receipts and cuts in state and federal funds, according to a report from the Pew Charitable Trusts. Pew analyzed financial statements for the central cities of the 30 most-populous metropolitan areas and found that as of 2012 a majority still hadn’t recovered from the recession that ended in June 2009. Revenue of 18 municipalities declined in 2012 after adjusting for inflation, with eight logging the lowest collections since the economic slump started in 2007, a report released yesterday showed. Even with fiscal gains since 2012 from a growing national economy and rallying stocks, the governments are straining to balance costs for services such as police and fire protection with the expense of obligations to retirees. In Houston, the biggest increase in the proposed 2015 budget is a 21% boost in pension contributions, eclipsing spending on libraries, parks, trash and courts combined, Pew said.

“Cities are not out of the woods yet,” Mary Murphy, a Pew officer and one of the report’s authors, said in a conference call with reporters. “In spite of an ongoing national recovery, serious financial concerns remain for local leaders in many of the nation’s cities.” For Atlanta, Dallas, Detroit, Las Vegas, Phoenix, Pittsburgh and San Antonio, revenue declines in 2012 from 2011 were the largest since the recession began, Pew said. “The recovery hasn’t been evenly felt across the country, and these pockets of distress remain,” Murphy said in an interview from Washington. Researchers blamed a drop in property-tax collections, generally a city’s largest source of financing, and reduced funding by states and the federal government, for most of the revenue declines. Both categories fell by an average of 4% in 2012, the report said. While the national housing market has begun to rebound, municipal real-estate levy collections trail increases to assessments by at least a year, Pew said. Twenty-four cities reported declines in receipts from 2011.

The taper was never meant to hurt back profits. That should be very obvious by now.

• QE Isn’t Dying, It’s Morphing (Nomi Prins)

The Fed is already the largest hedge fund in the world, with a book of $4.5 trillion of assets. These will plummet in value if rates rise. Cue the banks that are gearing up their own (still small in comparison, but give them time) role in this big bamboozle. By doing so, they too are amassing additional risk with respect to interest rates rising, on top of all their other risk that counts on leveraging cheap money. Only the naïve could possibly believe that the Fed and its key banks haven’t been in regular communication about this US Treasury security shell game. Yet, aside from a few politicians, such as Ron Paul, Sherrod Brown, Bernie Sanders and Elizabeth Warren, the notion that Fed policy has helped bankers, rather than other people, remains largely divorced from bi-partisan political discussion. Adding more fuel to the central-private bank collusion fire, is the fact that the Fed is a paying client of the JPM Chase. The banking behemoth is bagging fees for holding and executing transactions on the $1.7 trillion New York Fed’s QE mortgage portfolio.

Wouldn’t it be convenient if JPM Chase was also trading this massive mortgage book for its own profits? Or rather – why wouldn’t they be? Who’s going to stop them – the Fed? Besides, they hold more trading assets than any other US bank, so why not trade the Fed’s securities ostensibly purchased to help the public – recover? According to call report data compiled by the extremely thorough website www.BankRegData.com, nearly 97% of all bank trading assets (including US Treasuries) are held by just 10 banks, led by JPM Chase with 43.80% and followed by Citigroup at 24.51% of all bank trading assets. Last quarter, US Treasuries were the fastest growing form of security bought by banks, increasing by 26.3% or $72 billion over the prior quarter. As the Fed tapered, banks stepped in to do their part in the coordinated Fed-private bank QE game. In the past year, banks have added $185.8 billion of US Treasuries to their books, more than doubling their share of government debt.

Sounds reasonable, except for the praise of Fisher and Plosser.

• A Few Central Bankers and Money Managers Get It, Yellen and Kuroda Don’t (Lee Adler)

It may be more than a few, but increasingly some central bankers like the courageous Richard Fisher of the Dallas Fed and Chuck Plosser of the Philly Fed are speaking up, joined by a few well known money managers. They’re echoing the complaints that I and others have made for years about the insane (and immoral) policies of ZIRP and QE that the world’s major central banks have been promulgating since 2008. At a meeting of central bankers held by the Banque du France in Paris last week, a few of those people spoke out.

Among the gripes: Central-bank stimulus has relieved pressure on governments to revamp their economies, punished savers, inflated asset bubbles and left financial markets overly reliant on liquidity [emphasis mine] and prone to volatility when it reverses.

– via Central Bankers Join Investors Warning on Easy Money – Bloomberg.That says it all in a nutshell. Finally a few people in the mainstream are expounding on those themes that I have hammered on in futility for years. In time, the longer that QE and ZIRP continue to fail in increasingly obvious ways, the more the groundswell against them will grow. Meanwhile, hidebound jackasses like Yellen and Kuroda remain in denial. Hey Janet! Hey Haruhiko! Riddle me this. If QE and ZIRP are so essential to stimulating growth, why with the BoJ’s balance sheet tripling in size and rates held at zero for years, is Japan’s GDP now no more than it was in 2006? Could it be that QE and ZIRP actually don’t stimulate growth? Could it be that the financial engineering, speculative excess, and labor suppression that results from QE and ZIRP are actually detrimental to real growth? Maybe, just maybe, higher interest rates would promote thrift, and rational, real investment that benefits everybody, not just the bankers, speculators, and corporate executives engaged in the constant easy money wealth transfer schemes that you promote and enable?

So when are we going to do something about it? I’ve seen zero attempts at that.

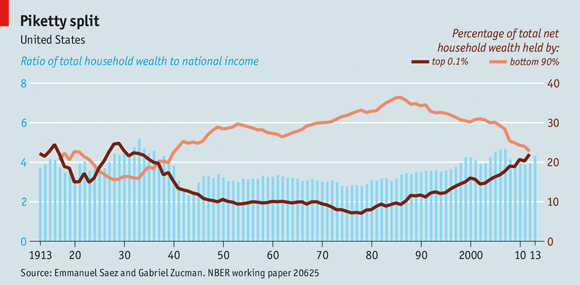

• It’s The 0.01% Who Are Really Getting Ahead In America (Economist)

Among the most controversial of Thomas Piketty’s arguments in his bestselling analysis of inequality, “Capital in the Twenty-First Century”, is that wealth is increasingly concentrated in the hands of the very rich. Rising wealth inequality could presage the return of an 18th century inheritance society, in which marrying an heir is a surer route to riches than starting a company. Critics question the premise: Chris Giles, the economics editor of the Financial Times, argued earlier this year that Mr Piketty’s data were both thin and faulty. Yet a new paper suggests that, in America at least, inequality in wealth is approaching record levels. Earlier studies of American wealth have tended to show only small increases in inequality in recent decades. A 2004 study of estate-tax data by Wojciech Kopczuk of Columbia University and Emmanuel Saez of the University of California, Berkeley, found an almost imperceptible rise in the share of wealth held by the top 1% of families, from about 19% in 1976 to 21% in 2000.

A more recent investigation of the Federal Reserve’s data on consumer finances, by Edward Wolff of New York University showed a continued but gentle increase in inequality into the 2000s. Mr Piketty’s book, which drew on this previous work, showed similarly modest rises in wealth inequality in America. A new paper by Mr Saez and Gabriel Zucman of the London School of Economics reckons past estimates badly underestimated the share of wealth belonging to the very rich. It uses a richer variety of sources than prior studies, including detailed data on personal income taxes (which the authors mine for figures on capital income) and property tax, which they check against Fed data on aggregate wealth. The authors note that not every potential source of error can be accounted for; tax avoidance strategies, for instance, could cause either an overestimation of the wealth share of the rich (if they classify labour income as capital income in order to take advantage of lower rates) or an underestimation (if they intentionally seek out lower yielding investments for their tax advantages).

Look, teh Saudis would never have enacted their latest policies without extensive delibeartions with the relevant Americans (which may well not include the President). Their 90-year old King is acutely aware of his family’s decades-long and still nigh-complete dependence on the US for its safety and its hold on power. Any discussion about today’s oil prices must always consider that.

• In New Oil Order, OPEC’s Choice Is Pricing Power or Sales (Bloomberg)

The decision OPEC faces at this month’s meeting isn’t just over whether to cut oil production. It’s a choice of whether the group is willing to fight to maintain the sway it has had over crude markets for decades. The Organization of Petroleum Exporting Countries, buffeted by plunging prices, could reassert control by cutting output, said Societe Generale SA, ceding more market share to U.S. shale oil producers. The alternative – waiting to see if lower prices choke off the North American shale boom – would usher in a “new oil order” where pricing power is handed to drillers in Texas and North Dakota, according to Goldman Sachs. “We’ve not seen a turning point like this in decades,” Mike Wittner, Societe Generale’s head of oil market research in New York, said by phone yesterday. “Is OPEC going to abdicate its role in the market? If the Saudis do exactly what they’re signaling, and just let the market take care of the overproduction, then it could certainly become irrelevant.”

Oil plunged into a bear market last month, the result of a surge in shale drilling that has lifted U.S. production to a three-decade high as well as slowing growth in global demand. The drop has caused financial pain for some OPEC members, prompting Ecuador, Venezuela and Libya to call for action to halt the slide. Nigeria’s currency slumped to an all-time low last week and Venezuela’s benchmark bond fell yesterday to 56.63 cents on the dollar, the lowest level since March 2009. The group’s data show shale output has trimmed a %age point from its market share and will take it to the lowest in more than 25 years during this decade. Reducing output is a tougher decision to make when there are more competitors ready to supply clients cut off by OPEC.

Duh!

• Shale Boom Masks Multiple Threats to World Oil Supply (Bloomberg)

The U.S. shale boom masks threats to global oil supply including Middle East turmoil, conflict in Ukraine and the difficulty of unconventional oil production beyond North America, the International Energy Agency said. “The global energy system is in danger of falling short of the hopes and expectations placed upon it,” the IEA said in its annual World Energy Outlook today. “The short-term picture of a well-supplied oil market should not disguise the challenges that lie ahead as reliance grows on a relatively small number of producers.” Global oil consumption will rise to 104 million barrels a day in 2040 from 90 million barrels a day in 2013, driven by demand for transport fuel and petrochemicals in developing countries, the report said. To meet that growth and replace exhausted fields will require about $900 billion a year in investment by the 2030s as oil companies develop fields from Canada’s oil sands to the deep waters off Brazil, the IEA said.

Oil prices slumped to a four-year low this month on concern that supply from U.S. unconventional fields is rising faster than global demand. The recent price slowdown is threatening investment in the industry as companies try to insulate profits from the price fall. While the near-term picture is secure, the development of capital-intensive areas outside North America is at risk, the IEA said. In the Canadian oil sands, among the most expensive oil deposits in the world to exploit, a slowdown is already evident and the IEA estimates about a quarter of projects are at risk as prices fall. Likewise, the complexity and capital intensity of developing Brazil’s deepwater fields could also contribute to a shortfall in investment. Replicating the U.S. shale oil boom outside of North America will also be a challenge, the report said. A lack of existing oil and gas infrastructure, environmental opposition to fracking, and uncertain geology are among the reasons unconventional drilling hasn’t spread.

And a lot. Please note that Fatih Birol is an absolute douche. And the IEA only pushes industry agendas, it has no use for objective research.

• Low Oil Prices To Bite Into 2015 US Shale Growth: IEA (Reuters)

Falling oil prices may cut investment in U.S. shale oil by 10% next year, the International Energy Agency (IEA) said, slowing growth in a sector that has turned the United States to a major global producer. The recent drop in oil prices “should not blind us to the problems that may be around the corner,” Fatih Birol, the IEA’s chief economist, told Reuters ahead of the launch of the agency’s 2014 World Energy Outlook. Benchmark oil prices have dropped by about 30% over the past four months to around $82 a barrel due mostly to increased supplies from the Middle East and North America, squeezing budgets of oil producing nations and oil companies.

“If prices remain at these lows, this may result in a decline in U.S. upstream capital expenditures by 10% in 2015, which will have implication for future production growth,” Birol said. U.S. oil production has risen by 1 million barrels per day (bpd) per year over the past year as strong oil prices led to a boom in shale oil production through fracking, a technique that uses high pressure to capture gas and oil trapped in deep rock. Production is set to grow by an additional 963,000 bpd in 2015, according to the U.S. Energy Information Administration.

That’s more than the $88 billion discussed yesterday, but then, that was only for exploration. Other reports talk about $5 trillion per year, see: Energy Costs – Necessity, Not Folly .

• Fossil Fuels With $550 Billion in Subsidy Hurt Renewables (Bloomberg)

Fossil fuels are reaping $550 billion a year in subsidies and holding back investment in cleaner forms of energy, the International Energy Agency said. Oil, coal and gas received more than four times the $120 billion paid out in subsidy for renewables including wind, solar and biofuels, the Paris-based institution said today in its annual World Energy Outlook. The findings highlight the policy shift needed to limit global warming, which the IEA said is on track to increase the world’s temperature by 3.6 degrees Celsius by the end of this century. That level would increase the risks of damaging storms, droughts and rising sea levels. “In Saudi Arabia, the additional upfront cost of a car twice as fuel efficient as the current average would at present take 16 years to recover through lower spending on fuel,” the IEA said. “This payback period would shrink to three years if gasoline were not subsidized.”

Renewable use in electricity generation is on the rise and will account for almost half the global increase in generation by 2040, according to the report. It said about 7,200 gigawatts of generating capacity needs to be built in that period to keep pace with rising demand and replace aging power stations. The share of renewables in power generation will rise to 37% in countries that are members of the Organization for Economic Cooperation and Development, according to the IEA. It said that globally, wind power will take more than a third of the growth in clean power; hydropower accounts for about 30%, and solar 18%. Wind may produce 20% of European electricity by 2040, and solar power could take 37% of summer peak demand in Japan, it said. The IEA singled out the Middle East as a region where fossil fuel subsidies are hampering renewables. It said 2 million barrels per day of oil are burned to generate power that could otherwise come from renewables, which would be competitive with unsubsidized oil.

It’s a dog eat dog world.

• Record Exports of Cheap Chinese Steel May Spark Trade War (Bloomberg)

Record steel exports from China are undercutting foreign rivals on price, triggering complaints from Seoul to South Africa that may signal the start of a trade conflict. China produces about half the world’s steel and exports are on pace to exceed 80 million tons this year, the most ever, according to the China Iron & Steel Association. That’s exacerbating trade tensions in the region as Japanese Prime Minister Shinzo Abe and President Barack Obama meet with Chinese President Xi Jinping this week in Beijing. With China’s economy slowing to levels not seen for more than two decades, producers are boosting shipments to other markets. “It’s certain the trend to export will continue next year,” said Luo Yongdong, head of imports and exports at the Panzhihua Iron & Steel Group, a unit of Anshan Iron & Steel Group, one of China’s largest steelmakers. “As a result, trade disputes will intensify.” Hebei Iron & Steel Group’s Tangshan unit said this week it will make its first shipments of auto sheet to Latin America, while its Xuancheng unit shipped hard steel wire to Japan on Nov. 7 for the first time.

In Japan, Tokyo Steel Manufacturing Managing Director Kiyoshi Imamura said the sheer scale of China’s exports puts it on pace to reach 100 million tons a year. That’s about equal to the entire output of Japan, the world’s second-largest producer. Japan’s Kobe Steel and South Korea’s Posco said they have complained to counterparts in China about the flood of metal that’s eating into their sales. Chinese steel is also piling up in ports in India and Africa, where local producers have asked governments to do something to stop it. The exports are reaching as far as the U.S., where imports of the metal rose more than 50% in September. Exports to Taiwan and India rose more than four-fold. In the Southeast Asia markets, China’s lower costs allow it to sell some types of steel at about $40 to $50 a ton less than South Korea and $100 lower than Japan, said Wei Zengmin, an analyst from Mysteel.com, the nation’s largest industry research company.

Abe will only do it if he knows he’ll win. Besides, who else wants to take over his bankrupt estate?

• Japan Snap-Election Potential Looms, Abenomics at Risk as Growth Stalls (Bloomberg)

A potential snap election in Japan next month clouds the outlook for the Abe administration’s economic program as the nation struggles to shake off the impact of this year’s sales-tax increase. Prime Minister Shinzo Abe is likely to call a general election on Dec. 14, according to two people with knowledge of the ruling Liberal Democratic Party’s strategy. His government favors delaying the next bump in the sales levy until April 2017, according to LDP lawmakers who asked not to be named. With steps such as opening Japan to casinos, scaling back labor regulations and reforming social security still to be taken, a parliamentary election in December risks putting off structural changes deeper into 2015. Any reduced majority for the ruling coalition could also open Abe’s reflation program to increased criticism. “It would be asking the voters to give an endorsement of Abenomics,” said Izumi Devalier, an economist at HSBC in Hong Kong. An election would also help Abe silence “fiscal hawks” in the party who want the tax hike, she said.

The Nikkei 225 Stock Average gained 0.4% today after jumping 2.1% yesterday amid speculation of a delay in the tax and a December election. The world’s third biggest economy contracted 7.1% in the second quarter, the most in more than five years, after the government increased the tax by 3 %age points to 8%. Abe adviser Etsuro Honda said today that the tax hike is out of the question if the economy grows less than 3.8% in the third quarter. Gross domestic product data will be released on Nov. 17, with the median of projections by economists for a rise of 2.8%. No decision has been made to postpone the tax rise, Finance Minister Taro Aso said today in parliament, adding that it would be very hard to fund Japan’s social welfare without increasing the tax to 10%, as planned.

Chasing yield shielded by the Fed. Or so they think.

• Junk Bond Risks Escalate With Leverage Back to ’08 Levels (Bloomberg)

The riskiest corporate debtors in the U.S. aren’t growing fast enough to pay down their borrowings, increasing the risk for bond investors at a time when valuations are already at about record highs. That’s the conclusion of Deutsche Bank, which estimates that the biggest jump in earnings in almost three years may be coming too late for speculative-grade borrowers as the amount of debt on balance sheets climbs back to levels seen in early 2008 before the financial crisis. To make matters worse, their ability to make interest payments is about where it was in 2007, even as the Federal Reserve has held its benchmark rate close to zero.

“We expect the next restructuring cycle will be dominated by companies with good operations but not able to grow into their balance sheets or refinance maturing debt,” Kenneth Buckfire, president of restructuring firm Miller Buckfire said. Investors have piled into junk bonds for their relatively high yields amid the suppressed rates. That has allowed the least creditworthy borrowers to raise $1.64 trillion in the bond market since the end of 2008, according to data compiled by Bloomberg. That led to average annual returns of 18.6% from 2009 through 2013, compared with 17.7% for stocks as measured by gains in the Bank of America Merrill Lynch U.S. High Yield Index and the Standard & Poor’s 500 Index.

Debt exceeds earnings before interest, taxes, depreciation and amortization by about four times at speculative-grade companies, near 2008 levels, Deutsche Bank strategists Oleg Melentyev and Daniel Sorid wrote in a Nov. 7 report. Leverage rose even as cash flow grew 12% at those companies that had reported third-quarter results, according to the New York-based analysts. The Fed has held its benchmark rate between zero and 0.25% since the end of 2008 to spur economic growth. Yields on junk-rated debt, which is rated below BBB- by S&P and less than Baa3 by Moody’s Investors Service, have fallen to 6.36%, from a peak of more than 22% at the end of 2008, according to Bank of America index data. Yields touched a record low 5.7% on June 23.

Not even 10 times that would be enough.

• Banks to Pay $3.3 Billion in FX-Manipulation Probe (Bloomberg)

Regulators in the U.S., Britain and Switzerland ordered five banks to pay about $3.3 billion to settle a probe into the manipulation of benchmark foreign-exchange rates. Switzerland’s UBS was ordered to pay the most at $800 million, according to statements from the U.S. Commodity Futures Trading Commission, Britain’s Financial Conduct Authority and Swiss Financial Market Supervisory Authority. Citigroup was ordered to pay $668 million, followed by JPMorgan at $662 million, the filings show. HSBC paid $618 million and Royal Bank of Scotland $534 million. “Countless individuals and companies around the world rely on these rates to settle financial contracts, and this reliance is premised on faith in the fundamental integrity of these benchmarks,” Aitan Goelman, the CFTC’s director of enforcement said in the statement. “The market only works if people have confidence that the process of setting these benchmarks is fair, not corrupted by manipulation by some of the biggest banks in the world.”

The settlements are the first since authorities around the world began investigating allegations last year that dealers at the biggest banks colluded with counterparts at other firms to rig benchmarks used by fund managers to determine what they pay for foreign currency. Probes have expanded to include whether traders used confidential information to take bets on unauthorized personal accounts, and whether sales desks charged clients excessive commissions in the $5.3 trillion-a-day foreign-exchange market. The FCA said it would “progress” its probe of Britain’s Barclays, which wasn’t fined today, to cover its wider foreign exchange trading business. “We will continue to engage with these authorities, including the FCA and CFTC, with the objective of bringing this to resolution in due course,” Barclays said in a statement.

FX trading eats people.

• Leverage Up To 50-1 Lures Mom-and-Pop FX Traders Who Mostly Lose (Bloomberg)

It’s a Saturday afternoon in March, and more than 500 people have tuned in for a two-hour webinar that tells them they can become rich trading foreign currencies. “Success in trading is not a fantasy; it’s a formula,” Jared Martinez, founder of Market Traders Institute, the oldest and largest such school in the U.S., tells his audience. “We have that formula.” The Lake Mary, Florida, company that Martinez founded in 1994 says it has educated 30,000 amateur foreign-exchange investors. “How many people would like to learn a skill where, within two days, they could make a thousand dollars?” Martinez asks that afternoon. “I’m here to tell you I can teach you how to trade consistently.” He introduces Jose Tormos, his son-in-law, who echoes Martinez’s advice, Bloomberg Markets will report in its December issue. “It is the easiest, most predictable and safest way to invest,” Tormos says. “Many of you are missing out on opportunities to build a retirement nest egg.” One person familiar with the webinar pitch is Dan Gratton, a 71-year-old retiree who lives on Social Security in Kingman, Arizona.

He says he’s been a student of the institute for two years and had hoped that taking its home-study classes and watching webinars would help him succeed with forex trading. That hasn’t happened. “Probably the most consistent thing is losing,” Gratton says. He’s right. Most retail currency investors lose money most of the time, according to the industry’s own data. Reports to clients by the two biggest publicly traded over-the-counter forex companies – FXCM and Gain Capital – show that, on average, 68% of investors had a net loss from trading in each of the past four quarters. These kinds of losses make for investor churn. The average OTC forex investor drops out of the market after just four months, according to the National Futures Association, an industry self-regulatory group. Retail forex investors, many of whom are well educated in fields other than finance, enter into a market that is lightly regulated, opaque and rife with conflicts of interest. They are enticed by pitches from coaches like Martinez, saying people can finance their retirements trading forex.

How did we get there from here?

• Environmentalists Sue To Protect Whales, Dolphins From Navy War Games (Fox)

Worried about collateral damage to whales, dolphins and other marine life, environmentalists are fighting the U.S. Navy in court in a bid to protect the creatures of the sea from war games in the Pacific Ocean. “The worst harm comes from the explosives going off,” said David Henkin, an attorney for EarthJustice. U.S. Navy testing and war games are underway in American waters off the coasts of California and Hawaii. The drills amount to critical practice for the military and last through 2018, but environmental groups like EarthJustice say hundreds of marine mammals will die or get injured by the time the Navy is through. They said they don’t want to stop the Navy from training – but change how they do it. The testing areas are home to nearly 40 marine mammal and five sea turtle species. According to the Natural Resources Defense Council, the Navy will conduct 500,000 hours of sonar testing between 2013 and 2018. During that time, 260,000 bombs, missiles and other explosives will be tested.

According to an analysis of the National Marine Fisheries Service, a division of the Department of Commerce charged with protecting mammals, the estimated damage to the marine life includes the deaths of 155 whales, dolphins and seals; 2,000 permanent injuries to marine mammals; and 9.6 million incidents of temporary hearing loss and behavior changes in areas like migration, nursing and feeding. But the Navy says fears are overblown and that war-gaming, which dates back to 1886, is a consistently reliable way to train for combat. “Despite decades of the Navy conducting very similar activities in these same areas, there is no evidence of these types of impacts,” Kenneth Hess, Navy spokesman, told FoxNews.com. “Bear in mind that the permits the Navy requires to conduct at-sea training and testing can only be issued if our activities will have no more than a negligible impact on marine mammal populations.”

Behold your children’s world.

• Sinking Jakarta Starts Building Giant Wall as Sea Rises (Bloomberg)

If you worry that rising sea levels may one day flood your city, spare a thought for Michelle Darmawan. Her house in Jakarta is inundated several times a year — and it’s 3 kilometers (1.9 miles) from the coast. Whenever there’s a particularly high tide or heavy rain, the Ciliwung River and its network of canals overflow, swamping thousands of homes in Indonesia’s capital. In January, a muddy deluge washed over Darmawan’s raised porch, contaminating her fresh-water tank and cutting off electricity for three days. “We were sitting on the second floor, looking down at the floods, calling out to neighbors to make sure they’re OK,” said Darmawan, 27, a marketing executive whose family had to store drinking water in buckets.

Jakarta, a former Dutch trading port, is one of the world’s megacities most at risk from rising sea levels. That’s because parts of the metropolis of almost 30 million people are sinking by as much as 6 inches a year, more than 10 times faster than the sea is rising. The Indonesian capital ranks eighth among the 30 biggest cities in the 2015 Climate Change Vulnerability Index compiled by Bath, England-based risk-assessment company Maplecroft. The index is led by Dhaka, Lahore in Pakistan, and Delhi. The government’s solution: a $40 billion land-reclamation project unveiled last month. It includes a 32-kilometer (20-mile) sea wall, a chain of artificial islands, a lagoon about the size of Manhattan – and a giant offshore barrier island in the shape of the national symbol, the mythical bird Garuda.

The first pile for the initial stage of the program – a barrier to strengthen existing sea defenses along 32 kilometers – was sunk at the Oct. 9 opening ceremony. “The whole city is sinking like Atlantis,” said Christophe Girot, principal investigator of the Jakarta Study at the Future Cities Laboratory research group in Singapore. “You see the absolute most miserable and poorest population living right by the river, and they know they’re going to get flooded and may be killed three or four more times a year.” The central and municipal governments will split the 3.2 trillion rupiah ($263 million) cost for the first 8 kilometers of the wall. Developers would put up the remaining 24 kilometers by 2030 in exchange for the right to build on reclaimed land. [..] .. the metropolis is home to almost 30 million people, making it the second-most-populous urban area in the world, after Tokyo-Yokohama,