Rembrandt van Rijn The Storm on the Sea of Galilee 1633

On March 18, 1990, the painting was stolen by thieves disguised as police officers. They broke into the Isabella Stewart Gardener Museum in Boston, Massachusetts, and stole this painting, along with twelve other works. The paintings have never been recovered, and it is considered the biggest art theft in history. The empty frames of the paintings still hang in their original location, waiting to be recovered.

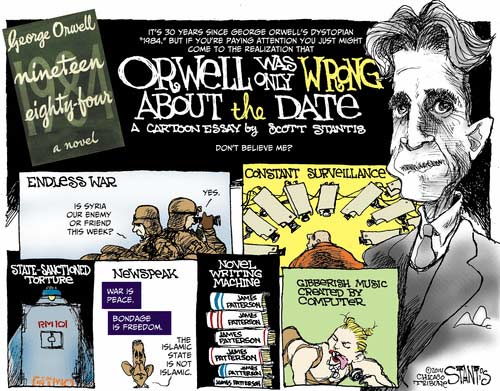

A Minister of Loneliness in Japannn. That is what the Lockdown Syndrome looks like. And when you weren’t looking because you were getting “vaccinated”, your freedoms were taken away one by one. The freedom to be where you want to be, the freedom to say what you want to say, and the freedom to read what you want to read.

The calls for all manner of censorship are coming fast and furious, including censorship of COVID and vaccine-related information. Because you are not supposed -or allowed- to know. But what’s the value of all these technologies, be they digital or medical, if they end up being used against us?

“We could even cure psychiatric disorders, like “antisocial personality disorder,” “oppositional defiant disorder,” and other “conduct disorders” and “personality disorders.” Who knows?”

• The Vaccine (Dis)Information War (CJ Hopkins)

So, good news, folks! It appears that GloboCap’s Genetic Modification Division has come up with a miracle vaccine for Covid! It’s an absolutely safe, non-experimental, messenger-RNA vaccine that teaches your cells to produce a protein that triggers an immune response, just like your body’s immune-system response, only better, because it’s made by corporations! OK, technically, it hasn’t been approved for use — that process normally takes several years — so I guess it’s slightly “experimental,” but the US Food and Drug Administration and the European Medicines Agency have issued “Emergency Use Authorizations,” and it has been “tested extensively for safety and effectiveness,” according to Facebook’s anonymous “fact checkers,” so there’s absolutely nothing to worry about.

This non-experimental experimental vaccine is truly a historic development, because apart from saving the world from a virus that causes mild to moderate flu-like symptoms (or, more commonly, no symptoms whatsoever) in roughly 95% of those infected, and that over 99% of those infected survive, the possibilities for future applications of messenger-RNA technology, and the genetic modification of humans, generally, is virtually unlimited at this point. Imagine all the diseases we can cure, and all the genetic “mistakes” we can fix, now that we can reprogram people’s genes to do whatever we want … cancer, heart disease, dementia, blindness, not to mention the common cold! We could even cure psychiatric disorders, like “antisocial personality disorder,” “oppositional defiant disorder,” and other “conduct disorders” and “personality disorders.” Who knows?

In another hundred years, we will probably be able to genetically cleanse the human species of age-old scourges, like racism, sexism, anti-Semitism, homophobia, transphobia, etcetera, by reprogramming everyone’s defective alleles, or implanting some kind of nanotechnological neurosynaptic chips into our brains. The only thing standing in our way is people’s totally irrational resistance to letting corporations redesign the human organism, which, clearly, was rather poorly designed, and thus is vulnerable to all these horrible diseases, and emotional and behavioral disorders.

But I’m getting a little ahead of myself. The important thing at the moment is to defeat this common-flu-like pestilence that has no significant effect on age-adjusted death rates, and the mortality profile of which is more or less identical to the normal mortality profile, but which has nonetheless left the global corporatocracy no choice but to “lock down” the entire planet, plunge millions into desperate poverty, order everyone to wear medical-looking masks, unleash armed goon squads to raid people’s homes, and otherwise transform society into a pathologized-totalitarian nightmare. And, of course, the only way to do that (i.e., save humanity from a flu-like bug) is to coercively vaccinate every single human being on the planet Earth!

OK, you’re probably thinking that doesn’t make much sense, this crusade to vaccinate the entire species against a relatively standard respiratory virus, but that’s just because you are still thinking critically. You really need to stop thinking like that. As The New York Times just pointed out, “critical thinking isn’t helping.” In fact, it might be symptomatic of one of those “disorders” I just mentioned above.

“All that remains is to topple a behemoth like Fox as a show of strength, leaving an untouchable Soviet-style union of Chuck Todds and Jennifer Rubins and Max Boots in charge of disseminating an approved™ top-down version of reality. “

• Censoring Fox News Is An Insanely Stupid Idea (Taibbi)

Two and a half years ago, when Alex Jones of Infowars was kicked off a series of tech platforms in a clearly coordinated decision, I knew this was not going to be an isolated thing. Given that people like Connecticut Senator Chris Murphy were saying the ouster of Jones was just a “good first step,” it seemed obvious the tactic was not going to be confined to a few actors. But corporate media critics insisted the precedent would not be applied more broadly. “I don’t think we are going to be seeing big tech take action against Fox News… any time soon,” commented CNN’s Oliver Darcy. Darcy was wrong. Just a few years later, calls to ban Fox are not only common, they’re intensifying, with media voices from Brian Stelter on CNN to MSNBC analyst Anand Giridharadas to former Media Matters critic Eric Boehlert to Washington Post columnists Max Boot and Margaret Sullivan all on board.

The movement crested this week with a letter from California House Democrats Anna Eshoo and Jerry McNerney, written to the CEOs of cable providers like Comcast, AT&T, Verizon, Cox, and Dish. They demanded to know if those providers are “planning to continue carrying Fox News, Newsmax, and OANN… beyond any contract renewal date” and “if so, why? The news comes in advance of Wednesday’s House Energy and Commerce Committee hearing on “traditional media’s role in promoting disinformation and extremism.” This sequence of events is ominous because a similar matched set of hearings and interrogations back in 2017 — when Senators like Mazie Hirono at a Judiciary Committee hearing demanded that platforms like Google and Facebook come up with a “mission statement” to prevent the “foment of discord” — accelerated the “content moderation” movement that now sees those same platforms regularly act as de facto political censors.

Sequences like this — government “requests” of speech reduction, made to companies subject to federal regulation — make the content moderation decisions of private firms a serious First Amendment issue. Censorship advocates may think this is purely a private affair, in which the only speech rights that matter are those of companies like Twitter and Google, but any honest person should be able to see this for what it is. [..] Press freedoms have been in steep decline for a while. Barack Obama’s record targeting of whistleblower sources (and in some cases, journalists themselves) using the Espionage Act was a first serious sign, followed by Donald Trump’s prosecution of Julian Assange. We progressed to a particularly dangerous new stage in recent years, with oligopolistic tech companies, urged on by politicians, engaging in anticompetitive agreements to suppress political voices on both the left and the right.

The so-called media reporters at major organizations like CNN and the New York Times have mostly either been silent or have played cheerleading roles during the most eyebrow-raising recent developments: the decision by Facebook and Twitter to block access to a pre-election New York Post story about Hunter Biden, the stunning exercise in monopoly influence by Amazon and Apple in swallowing up the “free speech” platform Parler, the banning of Socialist Worker Party accounts in England and the U.S., and the shutdown of livestream capability by alternative media outlets (and the removal of celebrated footage shot from the Capitol riot by people like Status Coup videographer Jon Farina), a story that amazingly only got major play at… Fox News.

They’re assaulting free speech. Not just press freedoms.

• House Democrats Are Assaulting Core Press Freedoms (Greenwald)

Not even two months into their reign as the majority party that controls the White House and both houses of Congress, key Democrats have made clear that one of their top priorities is censorship of divergent voices. On Saturday, I detailed how their escalating official campaign to coerce and threaten social media companies into more aggressively censoring views that they dislike — including by summoning social media CEOs to appear before them for the third time in less than five months — is implicating, if not already violating, core First Amendment rights of free speech. Now they are going further — much further. The same Democratic House Committee that is demanding greater online censorship from social media companies now has its sights set on the removal of conservative cable outlets, including Fox News, from the airwaves.

The House Energy and Commerce Committee on Monday announced a February 24 hearing, convened by one of its sub-committees, entitled “Fanning the Flames: Disinformation and Extremism in the Media.” Claiming that “the spread of disinformation and extremism by traditional news media presents a tangible and destabilizing threat,” the Committee argues: “Some broadcasters’ and cable networks’ increasing reliance on conspiracy theories and misleading or patently false information raises questions about their devotion to journalistic integrity.” Since when is it the role of the U.S. Government to arbitrate and enforce precepts of “journalistic integrity”? Unless you believe in the right of the government to regulate and control what the press says — a power which the First Amendment explicitly prohibits — how can anyone be comfortable with members of Congress arrogating unto themselves the power to dictate what media outlets are permitted to report and control how they discuss and analyze the news of the day?

[..] For the last four years, we were inundated with media messaging that Trump posed an unprecedented threat to press freedoms. The Washington Post even flamboyantly adopted a new motto to implicitly ratify that accusation (while claiming it was not Trump-specific). Other than the indictment of Julian Assange — which most Washington Democrats cheered — what did the Trump administration do in the way of attacking press freedoms that remotely compares to Democrats abusing their majoritarian power to force the removal of conservative cable outlets from the airwaves, just days after doing the same with dissident voices online?

There is not a peep of protest from any liberal journalists. Do any of the people who spent four years pretending to care so deeply about the vital role of press freedom have anything to say about this full frontal attack by the majority party in Washington on news outlets opposed to their political agenda and ideology?

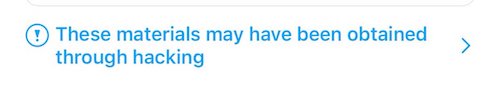

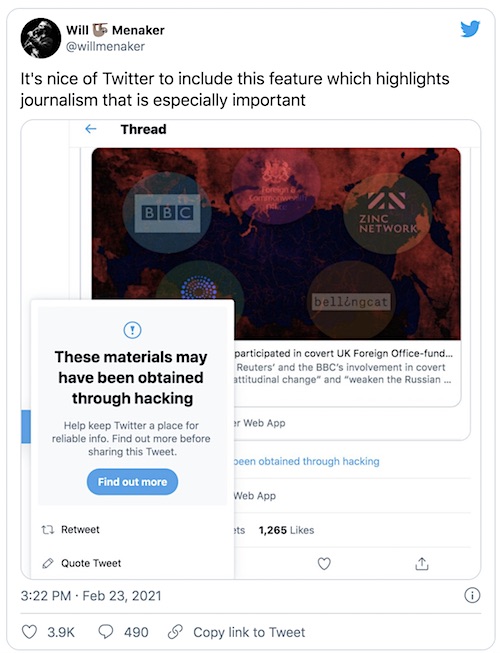

Twitter is full of tweets that MIGHT contain hacked materials.

• Twitter Adds Controversial ‘Hacked Materials’ Warning Label To Tweets (Mash.)

“These materials may have been obtained through hacking,” reads the disclaimer affixed to a tweet linking to a story from independent news outlet, The Grayzone. The tweet was originally posted on Feb. 20. However, three days later, users began to notice the label added to The Grayzone’s tweet. (It is not yet clear when exactly the label appeared.) Furthermore, readers discovered that an extra step was added when trying to retweet posts linking to The Grayzone’s story: A pop-up appeared reiterating the warning label and asking users to “help keep Twitter a place for reliable info.” A link is included which forwards users to Twitter’s “distribution of hacked materials” policy.

The Grayzone’s story sources recently hacked and leaked documents which allegedly show that the BBC and Reuters participated in a program created by the UK government to “weaken Russia’s state influence.” This appears to be the first instance of Twitter using this particular warning label on an English-language outlet. A search on the platform found one other instance of a version of the “hacked materials” warning label being used. This one was stamped on an Italian outlet’s tweet regarding Pfizer’s COVID-19 vaccine in January. “These materials may have been obtained through hacking or may be manipulated,” reads the earlier warning label on the tweet, which is in Italian.

”.. the United States is swiftly “moving into a coup situation, a police state..”

• Naomi Wolf Sounds Alarm At Growing Power Of ‘Autocratic Tyrants’ (Fox)

America is becoming a “totalitarian state before our eyes” under President Biden’s leadership, feminist author and former Democratic adviser Naomi Wolf told “Tucker Carlson Tonight” Monday. Wolf, who served as an adviser on Bill Clinton’s reelection campaign in 1996, told host Tucker Carlson that in her view, the United States is swiftly “moving into a coup situation, a police state” as a result of Biden’s ongoing coronavirus-related economic shutdowns. Wolf added that she believes the orders are being improperly extended under the “guise of a real medical pandemic.” “That is not a partisan thing,” Wolf told Carlson. “That transcends everything that you and I might disagree or agree on. That should bring together left and right to protect our Constitution.”

Wolf has ramped up her warnings against extended lockdowns on Twitter in recent months. In November, the author wrote on Twitter that Biden’s openness to reinstating additional shutdowns made her question her decision to vote for him. “The state has now crushed businesses, kept us from gathering in free assembly to worship as the First Amendment provides, is invading our bodies … which is a violation of the Fourth Amendment, restricting movement, fining us in New York state … the violations go on and on,” she said. The outspoken liberal, who previously authored a book outlining the ten steps that “would-be tyrants always take when they want to close down a democracy,” believes the United States is heading toward what she refers to as “step 10.”

“Whether they are on the left or the right, they do these same ten things,” Wolf explained, “and now we’re at something I never thought I would see in my lifetime … it is step 10 and that is the suspension of the rule of law and that is when you start to be a police state, and we’re here. There is no way around it.” Wolf said she has interviewed U.S. citizens of various backgrounds and political affiliations who are in a state of “shock and horror” as “autocratic tyrants at the state and now the national level are creating this kind of merger of corporate power and government power, which is really characteristic of totalism fascism in the ’20’s,” she told Carlson.

“..more powerful than QAnon and far more destructive.”

• Tucker Carlson Calls CNN a ‘Disinformation Network’ (Med.)

Fox News’ Tucker Carlson went after CNN on Tuesday night and called the cable news rival “more powerful” and “more destructive” than the QAnon conspiracy theory. Carlson brought up people on CNN talking about disinformation online and said they’re the ones who are really pushing disinformation, telling viewers that CNN is upset at the internet because “it’s exposing their scam.” In particular Carlson referred to coverage from CNN and others about issues of race and police shootings. “It’s worth finding out where the public is getting all this false information, this disinformation, as we will call it,” Carlson mockingly said. “So we checked. We spent all day trying to locate the famous QAnon, which in the end we learned is not even a website.

“If it’s out there, we could not find it. Then we checked Marjorie Taylor Greene’s Twitter feed because we have heard she traffics in disinformation, CNN told us, but nothing there.” He continued taking shots at CNN, and said the media talking about racism is meant to distract people from questions about Wall Street, before concluding with this: “It takes a sophisticated operator to lie this effectively, to take the central problem of American life, which is the agonizing death of our middle class and cover it with a smokescreen of manufactured race hatred, so that no one even realizes it’s happening. You’d really need to be a — as CNN would put it — a disinformation network to pull that off. And of course the irony is… CNN itself has become a disinformation network, more powerful than QAnon and far more destructive.”

Inevitable.

• 60 Years After Eisenhower’s Warning, The ‘Digital-Intelligence Complex’ (RCI)

In June 2019, Susan Gordon stood on a stage at the Washington Convention Center. Behind her loomed three giant letters, “AWS,” the abbreviation for Amazon Web Services, the cloud computing division of the giant Internet retailer. After three decades at the Central Intelligence Agency, Gordon had risen to one of the top jobs in the cloak-and-dagger world: principal deputy director of national intelligence. From that perch she publicly extolled the virtues of Amazon Web Services and the cloud services the tech giant provides the CIA. She told the crowd that the intelligence community’s 2013 decision to sign a multi-year, $600 million contract with AWS for cloud computing “will stand as one of those that caused the greatest leap forward.

… The investment we made so many years ago in order to be able to try and harness the power of the cloud with a partner who wanted to learn and grow with us has left us not only ready for today but positioned for tomorrow.”The agreement was also a “real game-changer,” said André Pienaar, founder and CEO of a tech firm called C5 Capital, whose business includes reselling AWS services. “When the CIA said they were going adopt the AWS cloud platform,” Pienaar said at another AWS event. “People said if the U.S. intelligence community has the confidence to feel secure on the AWS cloud, why can’t we?” Gordon left government in August 2019, two months after her AWS summit talk. In November 2019 she became senior advisor to a consultancy with close Amazon connections and in April joined the board of defense contractor with extensive AWS business.

Gordon is one of scores of former government officials who have landed lucrative work in Big Tech. The synergy between Washington and Silicon Valley can be seen as the latest manifestation of the Beltway’s revolving door. But the size and scope of Big Tech – and the increasing dependence of government on its products and talent – suggest something more: the rise of a Digital-Intelligence Complex. Like the Military-Industrial Complex that President Dwight D. Eisenhower warned against in 1961, it represents a symbiotic relationship in which the lines between one and the other are blurred.

They’re first going demand to see what he has and then silence him.

• Why a Durham Report Is Becoming Highly Unlikely (ET)

Republicans on the Senate Judiciary Committee say they want to know if President Joe Biden’s nominee for Attorney General Merrick Garland will allow Special Counsel John Durham’s investigation into the origins of the Federal Bureau of Investigation’s Crossfire Hurricane probe to continue. “I have no reason to think he should not remain in place,” Garland told Sen. Chuck Grassley Monday.In reality, if confirmed Garland will not allow Durham to stay in place, never mind issue a report. The prospect that Biden’s attorney general might allow Durham to indict former Barack Obama administration officials is ludicrous. Remember that documents released over the last year gave evidence that as vice-president Biden was not only aware of the spying operation against Trump officials but participated in it.

Biden not only knew that the FBI was framing incoming National Security Advisor Michael Flynn but suggested that the Department of Justice might charge Flynn for violating the Logan Act. In other words, the FBI officials that Durham is reportedly investigating are Biden’s co-conspirators. To allow them to be indicted would not only point to Biden’s guilt but also show that the most powerful man in the world is unable or unwilling to protect allies who have helped advance the cause of the party he now leads. That would show Biden to be weak. Garland understands that his primary duty as Biden’s chief law enforcement officer is not to oversee the fair and equal treatment of all Americans under the law, but to protect the president and the party he serves.

[..] Biden’s attorney general has an additional incentive to shut down Durham for good. Let’s say the special counsel has the evidence to indict the senior FBI officials he has been investigating. That would confirm what Republicans have been saying about Crossfire Hurricane since 2017—the FBI wasn’t investigating Russian interference, it was spying on a presidential candidate and then the commander-in-chief. To show that Biden’s party was lying about that would suggest that maybe the Democrats were lying about other things, too, maybe lying about everything. They lied about the phone call that got Trump impeached; they lied about the “mostly peaceful” George Floyd riots; they lied about the Jan. 6 protests by calling them an armed insurrection; and most importantly, they lied about the transparency and legitimacy of the 2020 election.

“The U.S. has seen its share of global semiconductor manufacturing capacity plummet in recent decades, according to Boston Consulting Group. What was 37% in 1990 is now down to 12%.”

• US And Allies To Build ‘China-free’ Tech Supply Chain (Nikkei)

U.S. President Joe Biden is set to sign an executive order as early as this month to accelerate efforts to build supply chains for chips and other strategically significant products that are less reliant on China, in partnership with the likes of Taiwan, Japan and South Korea. The document will order the development of a national supply chain strategy, and is expected to call for recommendations for supply networks that are less vulnerable to disruptions such as disasters and sanctions by unfriendly countries. Measures will focus on semiconductors, electric-vehicle batteries, rare-earth metals and medical products, according to a draft obtained by Nikkei.

The order states that “working with allies can lead to strong, resilient supply chains,” suggesting that international relationships will be central to this plan. Washington is expected to pursue partnerships with Taiwan, Japan and South Korea in chip production and Asia-Pacific economies including Australia in rare earths. The U.S. plans to share information with allies on supply networks for important products and will look to leverage complementary production. It will consider a framework for speedy sharing of these items in emergencies, as well as discuss securing stockpiles and spare manufacturing capacity. Partners could be asked to do less business with China.

The issue has taken on added urgency with a chip shortage this year that has hit automakers particularly hard. The U.S. has seen its share of global semiconductor manufacturing capacity plummet in recent decades, according to Boston Consulting Group. What was 37% in 1990 is now down to 12%. While it has asked Taiwan — which tops the list at 22% — to ramp up output, plants there are already operating at full blast, and there are few options for boosting supply in the short term.

You’re using the wrong test.

• Finland COVID-19 Variant Reportedly May Not Show Up In Tests (NYP)

Scientists fear that a new COVID-19 variant in Finland — different from the UK and South African strains — may be fueling the spread of the disease by not showing up in tests, according to reports. The Helsinki-based Vita Laboratories, which made the discovery, said it’s unlikely the variant emerged in Finland, given the Scandinavian country’s low rate of infection, the Evening Standard reported. “Vita Laboratoriot Oy and the Institute of Biotechnology at the University of Helsinki have detected a previously unknown variant of the coronavirus in a sample from southern Finland,” the lab said about the variant, dubbed “Fin-796H.”

“Mutations in this variant make it difficult to detect in at least one of the WHO-recommended PCR tests. This discovery could have a significant impact on determining the spread of the disease,” it added. Ilkka Julkunen, a professor of virology at the University of Turku, told the local news outlet Yle that the emergence of the variant was not a major concern yet. “I would not be hugely worried yet because we do not have clear information that this new strain would be more easily transmitted or that it would affect the immune protection brought about by already having had the virus or having received a vaccination,” he said, according to the Standard.

Lockdown Syndrome.

• Japan Appoints “Minister Of Loneliness” (ZH)

Japan like many other developed nations witnessed an alarming rise in suicides or attempted suicides over this past year of pandemic shutdowns and social distancing measures. The country was already at crisis levels even before the pandemic (though generally on a downward trajectory the prior decade), with recent studies showing it to be “the leading cause of death in men among the ages of 20-44 and women among the ages of 15 to 34.” To tackle the crisis, especially in the midst of this COVID-induced period of greater social isolation, Japan’s government has appointed a “Minister of Loneliness” after the UK became the first country to establish such a position in 2018.

The most recent numbers cited in Japanese media reports say that 879 women killed themselves in the country during the month of October, a figure that marks a whopping 70% increase compared to the same month from 2019. Officials have noted that the pandemic and oftentimes mandated social distancing measures have appeared to have a harsher impact on women. According to Japan Times, Prime Minister Yoshihide Suga earlier in the month appointed as the new Minister of Loneliness a 70-year old veteran politician named Tetsushi Sakamoto. It is a cabinet level position which aims to alleviate social isolation among citizens.

He’ll head up an ’emergency taskforce’ to battle the disturbing spike in suicides nationally as his first order of business. “With isolation tied to an array of social woes such as suicide, poverty and hikikomori (social recluses), the Cabinet Office also established a task force Friday that seeks to address the problem of loneliness across various ministries, including by investigating its impact,” Japan Times writes. “According to preliminary figures released by the National Police Agency, 20,919 people took their own lives in 2020, up 750 from the previous year and marking the first year-on-year increase in 11 years. The surge is largely attributed to a noticeable rise in suicides among women and young people,” the report pointed out.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.