Pablo Picasso The actor 1904

Myocarditis

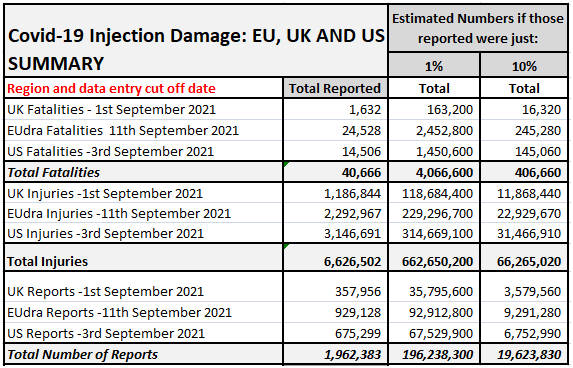

Horrifying… pic.twitter.com/BEj4Fap5eD

— Osler (@osler78) September 12, 2021

Ducky

I have been searching for the immunogenic epitopes in the Spike Protein in order to understand what areas of CD8 and CD4 response could be presented in the vaccines because they are only the Spike. So here is a thread of my work in progress. https://t.co/C0vkRYCrZ8 pic.twitter.com/EbCqZF7C5E

— Ducky (@Ducky68257909) September 12, 2021

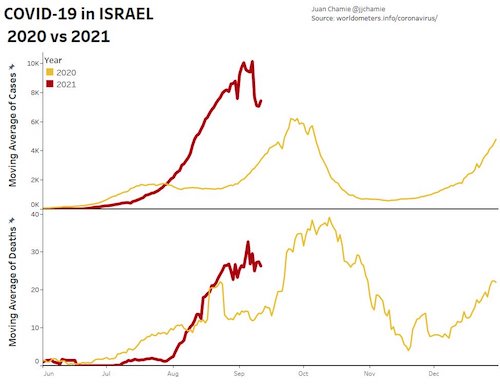

“..a death rate of .86 percent among the vaccinated and .17 percent among the unvaccinated..”

• High Death Rate Among Vaccinated Brings Vaccine Dystopia Into View (Hirschhorn)

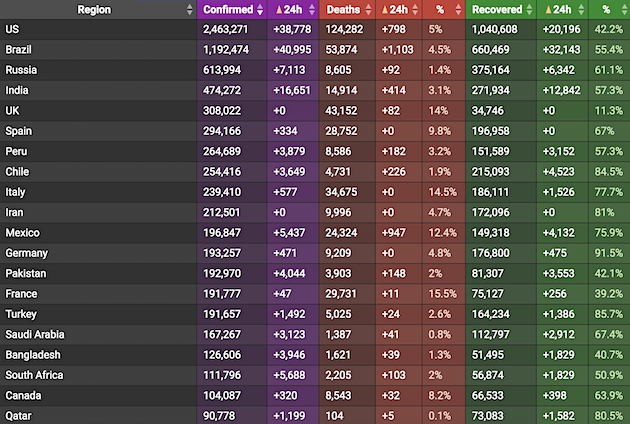

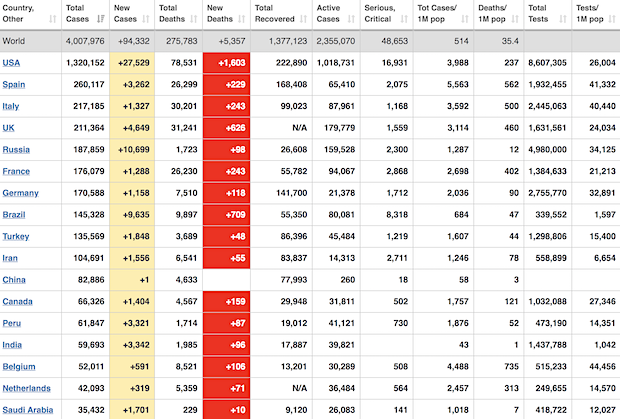

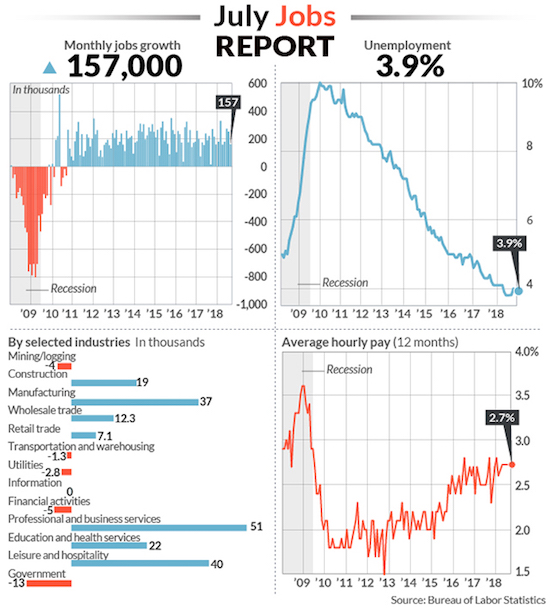

A new report with detailed data from Public Health England provides some startling numbers. For the period of February 1 through August 2 there were COVID Delta variant cases for 47,000 people who had received 2 vaccine doses, and for 151,054 people who were unvaccinated. In the first group of vaccinated people, there were a total of 402 deaths. In the second much larger group with more than three times unvaccinated people, there were just 253 deaths. In other words, of the total COVID deaths 61 percent were in fully vaccinated people.

To get the death rate you divide the number of deaths by the total number of infection cases. That gives a death rate of .86 percent among the vaccinated and .17 percent among the unvaccinated. That is an amazing difference. The death rate among vaccinated was just over five times greater than that for the unvaccinated. Five times greater! In other words, unvaccinated people who got infected were enormously safer from death. Proving that COVID vaccines are not safe. It should also be noted that it was determined that the measured viral load in both groups was the same. So, why are vaccinated people dying more frequently than the unvaccinated? Here are some plausible explanations.

First, there is something very dangerous and unsafe in the COVID vaccines associated with spike proteins that are causing people to die at a higher rate. For example, as discussed elsewhere, all current vaccines have been associated with serious blood problems, notably both large and microscopic blood clots. Many people have died from brain bleeds and strokes, for example. There are also many, many other types of adverse side effects causing a host of medical problems. Two famous virologists warned against using the current vaccines because they are fundamentally unsafe and could be killing people. They envisioned a vaccine dystopia and loudly proclaimed that the mass vaccination program should be halted. Instead, they advocated the use of treatments using generic medicines like ivermectin, as detailed in Pandemic Blunder.

Second, it is reasonable to believe that most unvaccinated people have acquired natural immunity from some prior COVID infection. And that natural immunity is far more protective than the artificial or vaccine immunity obtained from jabs. Their natural immunity translates to fewer deaths. Yet the US like many other countries does not give credit for natural immunity on a par with vaccine immunity when it comes to COVID passports and mandates. Though a few nations do the right thing by honestly following the science. Third, vaccinated people are susceptible to breakthrough infections, which means that they are not protected against infection after they have been originally infected. Phony and dangerous COVID vaccines do not destroy the virus, nor prevent transmitting it to others. Some breakthrough infections are lethal.

[..] The new data from England involving very large numbers of people should be headline news. But the biased and dishonest big media suppress this kind of critical data. Why? Clearly, if vaccinated people die at a much higher rate than unvaccinated people, then why should people be enthusiastic about being vaccinated for initial shots or later booster ones? They should not. This is especially true for the millions of people who have natural immunity. The data from England show that people need to question CDC data because CDC has converted some vaccinated deaths to unvaccinated ones. Hospitals are often not testing vaccinated people for COVID, so breakthrough cases that can result in deaths go unreported. People should question the safety of all the COVID vaccines even if they get fully approved by FDA.

Singapore, the shining city on the hill…

“..its highest daily COVID-19 infections in more than a year..”

• Singapore 80% Double-Vaxxed But Life Is Not Returning To Normal (ABC.au)

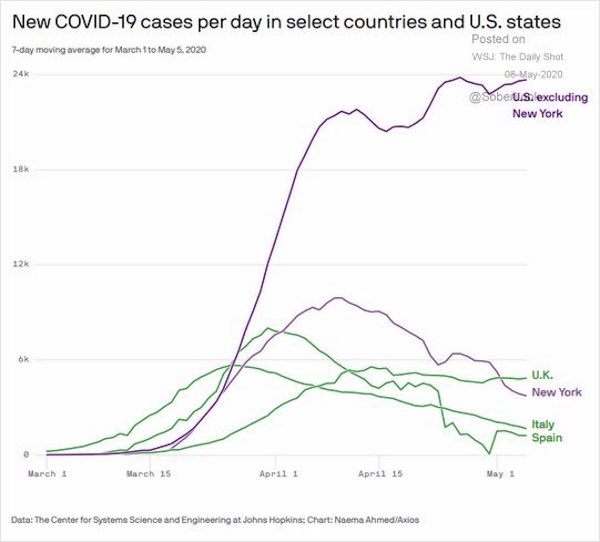

Having passed the 80 per cent double-vaccination mark last month, the example of Singapore suggests that achieving a milestone coveted by Australia is not a guarantee of returning to anything like pre-pandemic life. The island state reluctantly delayed reopening measures and re-imposed some restrictions last week after seeing its highest daily COVID-19 infections in more than a year. On Sunday, the nation of 5.7 million people reported 555 new local COVID-19 cases, the most since August 2020. A day earlier, it recorded its 58th death, a partially vaccinated 80-year-old man with a history of diabetes, hypertension and heart problems.

Singapore’s Ministry of Health last week banned social gatherings at workplaces after recent clusters in staff canteens and pantries, believed to have been caused by employees removing their masks in common areas. With Singaporeans told to limit social gatherings to one per day, Gan Kim Yong — co-chair of the multi-ministry task force — said the “worrying” spike in infections would “probably get to 2,000 new cases a day”, describing the next two to four weeks as “crucial”. Alex Cook, an infectious diseases modelling expert at the National University of Singapore, said life had not improved “by as much as we might have hoped”, despite Singapore being one of the world’s most vaccinated countries.

Infinite vaccines

Why is this so hard for billions of people to understand? IDGI

The Guy's Absolutely Right pic.twitter.com/J4DhoNwLTd

— Red Walrus (@_RedWalrus_) September 11, 2021

“..he and colleagues from 7 universities are suing the CDC for massive fraud..”

• Laboratories in US Can’t Find COVID-19 in One of 1,500 Positive Tests (Xander)

A clinical scientist and immunologist-virologist at a southern California laboratory says he and colleagues from 7 universities are suing the CDC for massive fraud. The reason: not one of 1500 samples of people tested “positive” could find Covid-19. ALL people were simply found to have Influenza A, and to a lesser extent Influenza B. This is consistent with the previous findings of other scientists, which we have reported on several times. Dr. Derek Knauss: “When my lab team and I subjected the 1500 supposedly positive Covid-19 samples to Koch’s postulates and put them under an SEM (electron microscope), we found NO Covid in all 1500 samples. We found that all 1500 samples were primarily Influenza A, and some Influenza B, but no cases of Covid. We did not use the bulls*** PCR test.’

‘When we sent the rest of the samples to Stanford, Cornell, and a couple of the labs at the University of California, they came up with the same result: NO COVID. They found Influenza A and B. Then we all asked the CDC for viable samples of Covid. The CDC said they can’t give them, because they don’t have those samples.’ ‘So we came to the hard conclusion through all our research and lab work that Covid-19 was imaginary and fictitious. The flu was only called ‘Covid,’ and most of the 225,000 deaths were from co-morbidities such as heart disease, cancer, diabetes, pulmonary emphysema, etc.. They got the flu which further weakened their immune systems, and they died.’ ‘I still need to find one viable sample with Covid-19 to work with. We who conducted the lab test with these 1500 samples at the 7 universities are now suing the CDC for Covid-19 fraud.

‘The CDC still has not sent us a viable, isolated and purified sample of Covid-19. If they can’t or won’t, then I say there is no Covid-19. It’s fictional.’ ‘The four research papers describing the genome extracts of the Covid-19 virus never managed to isolate and purify the samples. All four papers describe only small pieces of RNA that are only 37 to 40 base pairs long. That is NOT a VIRUS. A viral genome normally has 30,000 to 40,000 base pairs.’ ‘Now that Covid-19 is supposedly so bad everywhere, how come not one lab in the world has completely isolated and purified this virus? That’s because they never really found the virus. All they ever discovered were small pieces of RNA that were not identified as the virus anyway. So what we’re dealing with is just another flu strain, just like every year. Covid-19 does not exist and is fictitious.’

Merck.

• Grotesque Conflicts Of Interest On NIH Ivermectin Non-Recommendation (TSN)

The National Institutes of Health provided a non-recommendation for the use of ivermectin in COVID-19, stating that there was: “insufficient evidence … to recommend either for or against the use of ivermectin for the treatment of COVID-19.”The process for reaching that non-recommendation, however, is opaque. The Panel members responsible for therapy recommendations are disclosed and also that: “… working groups propose updates to the Guidelines based on the latest published research findings and evolving clinical information.” However, NIH has gone to extreme efforts to avoid stating whether a vote was held to endorse the ivermectin non-recommendation. This includes fighting a Freedom of Information Act request in federal court.

A deceptive non-vote would constitute an atrocity. NIH has also been secretive about the composition of the working group that proposed the ivermectin non-recommendation. The names of those individuals were redacted by the NIH from a document obtained through a Freedom of Information Act request for the agenda of a meeting considering ivermectin. However, the group responsible for the ivermectin non-recommendation has been discovered through a FOIA request to the Center for Disease Control and Prevention. The FOIA response shows that the working group has nine members. Three members of the working group, Adaora Adimora, Roger Bedimo, and David V. Glidden, have disclosed a financial relationship with Merck. Merck has campaigned against the use of ivermectin in COVID-19.

A fourth member, Susanna Naggie, had an extraordinary potential conflict of interest. She received a $155 million grant for the study of ivermectin following the non-recommendation. Funding for the study would have been difficult to justify if the drug was recommended for use in COVID-19. It is not known, however, if the panelist was aware of that opportunity or was planning to apply for that grant at the time of the deliberations on ivermectin. The deception and secrecy surrounding the NIH ivermectin non-recommendation should have raised serious doubts about its integrity. The grotesque conflicts of interest of Panel members should make it clear that the NIH, as the FDA with its slandering of ivermectin as a “horse dewormer,” should not be taken seriously.

“..this is so wildly improbable that I find it impossible to believe unless something really, really ugly is going on with these jabs.”

• Damnit, Not Again (Denninger)

There are times that the “F” word is absolutely appropriate. For example on August 6th, 1945, by the Mayor of Hiroshima: What the **** was that? This is one of those and so I’ll use it without reservation: ****. “A drive-by parade outside of Methodist Mansfield Medical Center last April was supposed to be Corey Ripe’s happy ending. The 47-year-old was headed home after a week on a ventilator battling COVID-19.” Ok, he got Covid, he got it bad in March/April 2020 before we knew what we were doing — but he lived. Then, January. “Three days later, they got confirmation that, in addition to pneumonia, Ripe had once again contracted the virus that had already nearly claimed his life.”

Really? What was the Ct on that test? You see, I read that linked article and it describes symptoms that don’t make a lot of sense for Covid-19. Certainly anything’s possible but the article does make sense for a whole bunch of other infections particularly if he had secondary bacterial pneumonia. What did the hospital give him? Nobody has said. There wasn’t an antibiotic in there by chance, was there? He then gets vaccinated post-recovery. Remember, the vaccine prevents severe disease and death, we’re currently told. We were previously told it prevented getting the virus (that was a lie), that it prevented symptoms (that was a lie), that it prevented giving the virus to others (that was a wild-eyed, entirely-unscientific claim with zero evidence and proved to be a crazy-faced lie as is now showing up everywhere including at all-vaccinated colleges) and now it’s “you won’t go to the hospital or die.”

OH REALLY? WHERE IS THIS GUY RIGHT NOW? “Still, Saturday night, though he’d shown no prior symptoms, Parris knew it had to be COVID-19 again when she heard the fluid in his lungs. She rushed him to the ER. And an hour later, Parris got a familiar call. Ripe was intubated and waiting for an available ICU bed.” I see. So here are my questions, since this is so wildly improbable that I find it impossible to believe unless something really, really ugly is going on with these jabs.

At his second alleged infection did the hospital check for both “S” and “N” antibodies at admission? They should have been present. You know they didn’t look. But let’s assume, for the sake of argument, the first infection really was Covid (it’s entirely plausible) and not the flu with a secondary bacterial infection that got him. I’m not sold on this because H1N1 was going around at that time, I got what I presume was that in January 2020, it did get into my lungs and it flattened me for a week with serious hanging-on symptoms, notably a nasty non-productive cough, that kept hanging on for a month and material cardio impairment for several more (it was worse than Covid-19 which I got first days of August of this year.) It was bad and I thought, after Covid-19 became known to be a “thing”, I might have had it. But it was not Covid-19; I know scientifically it was not because a few months later I sourced IgG antibody tests and I was negative.

After the second alleged infection but before he got vaccinated did anyone check for both “S” and “N” antibodies? You know the answer to that one too. Of course not. “If you’re recovered you should still get vaccinated” is what every ******* in the medical and political field has said even though there is zero evidence you get any benefit from doing so and, post-infection, the data is that your protection is many times (13x or more, to be exact) better than getting jabbed. In any event being an alleged “two-time winner” of the Covid-19 sweepstakes, a statistically unlikely thing to the extreme unless one of the two wasn’t actually Covid, he takes the (bad) advice and gets vaccinated. Ok, so now he should have both “N” antibodies (from previous infection) and a bunch of “S” ones.

Now a few months later he gets hammered. Again they say “Covid-19.” Did they look at admission time for those antibodies this time? You know damn well they did not and, much worse, this time was extremely rapid onset which strongly implies that VEI may be in the game here. Yet I’ll bet $1,000 they did not pull antibody titers for both “S” and “N” proteins on admission and given the history I’ll argue that’s not only personal malpractice it’s public-health malpractice and gross negligence.

Moderna has still not been “approved”.

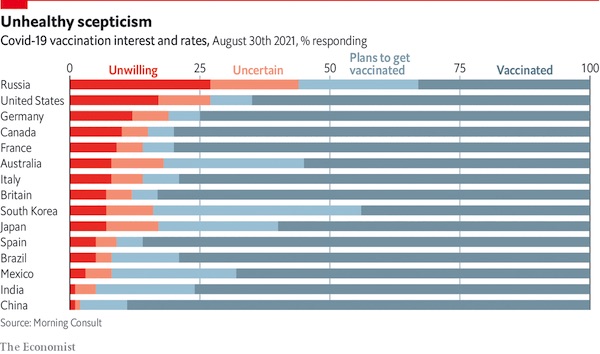

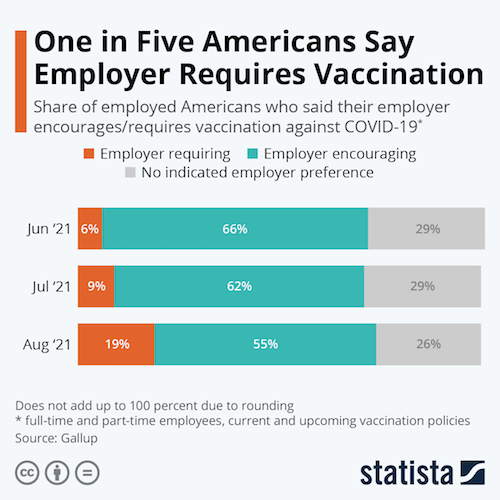

• One In Five Americans Say Employer Requires Vaccination (ZH)

The share of Americans who are required by their employer to get vaccinated against COVID-19 took a jump up in August to 19 percent, according to a Gallup poll. As Statista’s Katharina Buchholz notes, the number had been as low as 9 percent in July and 6 percent in June. Over the past couple of months, many major companies and government branches have released vaccination requirements and the type of employer issuing requirements goes beyond obvious ones like healthcare providers and the military. The full approval of the Pfizer vaccine on August 23 helped make the legal footing of employer-mandated vaccinations sounder.

According to Fortune, companies that require vaccinations for employees in order to work from their premises include Bank of America, Facebook, Google, Microsoft, Netflix and Uber. Three federal departments – those for defense, veteran affairs and health and human services – also require them without alternatives for frontline workers. Six states – Colorado, Maine, New York, Oregon, Rhode Island, and Washington – have released mandates for healthcare workers to get vaccinated or be terminated, while the more common mandates for state and local government employees normally leave the option of regular testing and sometimes masking for the unvaccinated.

The Equal Employment Opportunity Commission, an independent federal government agency, has said that it is legal for employers to require all employees who physically enter a workplace to be vaccinated against COVID-19, as long as the employers also comply with the Americans with Disabilities Act in order to accommodate those who cannot be vaccinated for medical reasons.

“practical matter, this policy may result in exacerbating the severe workforce shortage problems that currently exist.”

• Unvaxxed Kentucky Health Care Workers Force Hospital to Fire Them (GP)

Health care workers at Kentucky’s Med Center in Bowling Green refused to comply with the vaccine mandate or turn in their resignation. Instead, two workers showed up and refused to leave until someone told them that they are fired. The Med Center was the target of protests last month when they became one of the largest hospitals in the country to impose a vaccine mandate on their employees. On August 18, over 100 community members and health care workers demonstrated outside the campus holding signs with slogans such as, “my body my choice” and “medical freedom.” Leadership at the hospital had until August 9 to get vaccinated and all other employees had until September 1.

A healthcare worker named Ale Minnicks posted a video of herself two days after the mandate went into effect on TikTok and Facebook. Her and a coworker, who identified herself as Ashley Rich, were refusing the jab. They arrived at work and were unable to clock in — but the hospital refused to say that they were being fired. “The Medical Center in BG, KY was trying to quietly put over 350 out of a job without resignation or termination for not getting the vaccine,” Minnicks wrote, along with the hashtag “stop the mandate.” As they were told to leave the building, Minnicks kept reiterating that “I did not quit and I was not fired.” “You’re going to have to leave. We need your badge and we need you to leave,” a woman can be heard telling Minnicks. Still, they were initially careful with their wording and did not say the women were fired.

“There was a choice, you chose not to take the vaccine,” a man, who identifies himself as head of security, is heard saying. “So then fire us,” the women demand, asking for a termination letter in exchange for her badge. Eventually, they are told that they have been fired and both agree to leave. By refusing to quit and showing up for work, the women will have more options available when it comes to potential lawsuits and unemployment. There are currently massive staff shortages at hospitals across the country, leading the American Hospital Association to express concerns about the impending federal requirement for all healthcare staff to get the COVID-19 vaccine. AHA CEO Rick Pollack said in a statement that a “practical matter, this policy may result in exacerbating the severe workforce shortage problems that currently exist.”

Natural immunity has come to mean that after having been infected. Curious.

• Spectrum Health Workers Can Use Natural Immunity As Vaccine Mandate Exemption

Spectrum Health will grant temporary exemptions from its employee vaccine mandate to individuals who can prove they have naturally acquired immunity to COVID-19. The west Michigan hospital system, which is in the process of merging with Southfield-based Beaumont Health, will grant an exemption to those who have a positive PCR or antigen test for COVID-19 plus a positive antibody test from within the past three months, the health system said in a statement Thursday. The exemption, the first for a major health system in Michigan, was developed “as new research has emerged” on natural immunity.

“While we still recommend vaccination for people with prior COVID-19 infection, according to this new research, there is increasing evidence that natural infection affords protection from COVID-19 reinfection and severe symptoms for a period of time,” the statement said. “Current studies are not clear on how long natural immunity protects from reinfection.” The policy could be updated if future evidence shows naturally acquired protection is waning or longer lasting, or if there is a validated antibody test result showing immunity, the statement said. Spectrum announced in late July that it would require the COVID-19 vaccine within eight weeks of the Food and Drug Administration approving a vaccine, but noted it would consider some exemptions.

Those exemptions include religious exemptions and medical exemptions determined by a medical exemption committee. The hospital system’s medial exemption committee recommended the health system allow for a temporary exemption for naturally acquired immunity based on available research, the statement said.

“This is a job board for employers who are in favour of informed consent with regard to medical procedures, as per our constitution..”

• Jobs Without Jabs Australia (Sky)

Social media websites have begun to see an influx of groups dedicated to opposing mandatory vaccines for work, as Australia prepares for life beyond lockdown upon meeting the government’s 80 per cent target. Those who remain sceptical of the vaccine, or reject the push for employers to be given power to dismiss them over health issues, have been encouraged to share information about their particular industry’s stance on mandatory jabs for staff. The group “Jobs Without Jabs Australia” has attracted over 20,000 members, with employers regularly posting their intention to hire workers “with or without a jab”. “Freedom of choice without medical coercion. A free Australia for all, not a two tiered society. This is a job noticeboard to connect employers and employees,” the group’s description reads.

The public group features a number of posts from young workers in food chains worried about losing their financial stability, insisting they are “definitely not going to get the vaccination”. “We’ve just received a video from the founder of our company saying that everyone that visits our restaurant will have to have the jab which means all co-workers will also have to have it by early October. I can’t afford to lose my job as I’m under a lot of financial pressure right now, but I know I’m definitely not going to get the vaccination. Thank you,” one post read. “In 3 months I will be looking for marketing, sales, IT, finance, bookkeeping, admin, customer service, hospitality, events & various construction team members! No jab welcomed with open arms. (Melbourne Based),” another post read, collecting 260 reactions and 28 comments.

Several other posts encouraged anti-vaxxers considering leaving their industry due to vaccine mandates to simply “work for themselves”. “Get an ABN, do dump runs, start a delivery service, buy /sell second hand furniture, clean, busk, make products, sell online. Do whatever you have to to make it work,” one read. The group has already braced for its potential removal, setting up an alternative Telegram group. “If you’re on Telegram, join the group there also in case this gets taken down,” the group’s administrator posted. “This is a job board for employers who are in favour of informed consent with regard to medical procedures, as per our constitution, and for employees who have elected not to be vaccinated, to be able to find employment.”

What scared them?

• England Vaccine Passport Plans Ditched (BBC)

Plans to introduce vaccine passports for access into nightclubs and large events in England will not go ahead, the health secretary has said. Sajid Javid told the BBC: “We shouldn’t be doing things for the sake of it.” It was thought the plan, which came under criticism from venues and some MPs, would be introduced at the end of this month. Just a week ago, the vaccines minister had defended the scheme as the “best way” to keep the night industry open. No 10 stressed the plan – which had been set to be introduced at the end of this month – would be kept “in reserve” should it be needed over autumn or winter. Under the scheme, people would have been required to show proof – whether of double vaccination, a negative Covid test or finishing self-isolating after a positive PCR test – in order to gain entry to clubs and other crowded events.

The Night Time Industries Association had said the plans could have crippled the industry and led to nightclubs facing discrimination cases. The industry body welcomed Sunday’s announcement, saying it hoped businesses could now plan with some certainty and start to rebuild the sector. The Music Venue Trust, which aims to protect grassroots venues, also said it was glad vaccine passports would not be going ahead, describing them as “problematic”. There had been opposition from Tory MPs on the Covid Recovery Group as well as the Liberal Democrats, whose leader Ed Davey called vaccine passports “divisive, unworkable and expensive”. Speaking on The Andrew Marr Show, Mr Javid said: “We just shouldn’t be doing things for the sake of it or because others are doing, and we should look at every possible intervention properly.”

He said he had “never liked the idea of saying to people you must show your papers” to “do what is just an everyday activity”. “We’ve looked at it properly and, whilst we should keep it in reserve as a potential option, I’m pleased to say that we will not be going ahead with plans for vaccine passports,” he added. Mr Javid denied the government was “running scared” on the policy after criticism from its own backbenchers. He said the passports were not needed because of other things in the “wall of defence” including high vaccine uptake, testing, surveillance and new treatments. The move to scrap vaccine passports appears to be a sharp U-turn by the government. On the same TV programme last week, Vaccines Minister Nadhim Zahawi said the end of September was the right time to start the vaccine passport scheme for sites with large crowds because all over-18s would have been offered two jabs by then and it was the “best way” to keep the night industry open.

A lesson.

• The Polio Pandemic of 1949-52: No Closures, No Restrictions (Tucker)

World War II had ended four years earlier and the U.S. was trying to return to peace and prosperity. Price controls and rationing were ended. Trade was opening. People were returning to normal life. The economy started humming again. Optimism for the future was growing. Harry Truman became the symbol of a new normacy. From Depression and war, society was on the mend. As if to serve as a reminder that there were still threats to life and liberty present, an old enemy made its appearance: polio. It’s a disease with ancient origins, with its most terrifying effect, the paralysis of the lower extremities. It maimed children, killed adults, and struck enormous fear into everyone. Polio is also a paradigmatic case that targeted and localized policy mitigations have worked in the past, but society-wide lockdowns have never been used before. They weren’t even considered as an option.

Polio was not an unknown disease: its reputation for cruelty was well earned. In the 1916 outbreak, there were 27,000 cases and more than 6,000 deaths due to polio in the United States, 2,000 of which were in New York City. After the war, people had living memories of this horror. People were also used to adjusting their behavior. In 1918, people left cities for resorts, movie theaters were closed for lack of customers, groups cancelled meetings, and public gatherings dwindled. Children avoided swimming pools and public water fountains, fearing that it was transmitted through water. Whatever the therapeutic merit of this, these actions required no force; it happened because people do their best to adapt to risk and be cautious.

In 1949, the new polio epidemic appeared and swept through selective population centers, leaving its most tragic sign: children with wheelchairs, crutches, leg braces, and deformed limbs. For children with polio in the late 1940s, the disease caused paralysis in 1 in 1,000 cases of children aged 5 to 9. The rest had only mild symptoms and developed immunities. In the 1952 season, of the 57,628 cases reported, 3,145 died and a shocking 21,269 experienced paralysis. So while the infection, death, and paralysis rates seem “low” by comparison to the 1918 flu, the psychological impact of this disease became its most prescient feature. The “iron lung” that became widely available in the 1930s stopped asphyxiation of polio victims, and it was a triumph of innovation; it allowed a dramatic reduction in the death rate.

Finally, by 1954, a vaccine was developed (by private labs with very little government support subsidies) and the disease was largely eradicated in the U.S. twenty years later. It became a signature achievement of the medical industry and the promise of vaccines. Throughout the country, the quarantining of the sick was deployed in a limited way as one medical response. There were some shutdowns. The CDC reports that “travel and commerce between affected cities were sometimes restricted [by local officials]. Public health officials imposed quarantines (used to separate and restrict the movement of well people who may have been exposed to a contagious disease to see if they become ill) on homes and towns where polio cases were diagnosed.”

It’s not a strategy, it’s just a very deep hole.

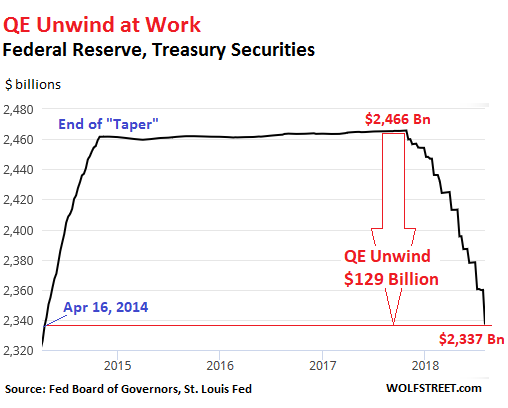

• The Eurozone Is Going Down The Japan Way (Lacalle)

The European Central Bank announced a tapering of the repurchase program on September the 9th. One would imagine that this is a sensible idea given the recent rise in inflation in the eurozone to the highest level in a decade and the allegedly strong recovery of the economy. However, there is a big problem. The announcement is not really tapering, but simply adjusting to a lower net supply of bonds from sovereign issuers. In fact, considering the pace announced by the central bank, the ECB will continue to purchase 100% of all net issuance from sovereigns. There are several problems in this strategy. The first one is that the ECB is unwillingly acknowledging that there is no real secondary market demand for eurozone countries’ sovereign debt at these yields. One would have to think of twice or three times the current yield for investors to accept many eurozone bonds if the ECB does not repurchase them. This is obviously a dangerous bubble.

The second problem is that the ECB acknowledges that monetary policy has gone from being a tool to help implement structural reforms to a tool to avoid them. Even with the strong GDP bounce that the ECB predicts, few governments are willing to reduce spending and curb deficits in a meaningful way. The ECB estimates show that after the massive deficit spending of 2020, eurozone government spending will rise again by 3.4% in 2021 only to fall modestly by 1.2% in 2022. This means that eurozone government spending will consolidate the covid pandemic increase with little improvement in the fiscal position of most countries. Indeed, countries like Spain and Italy have increased the structural deficit.

The third problem is that negative rates and high liquidity injections combined with elevated government spending have generated no real multiplier effect in the eurozone. We must remember that the main economies were in stagnation already in the fourth quarter of 2019, before the pandemic and despite large stimulus plans like the Juncker Plan, which mobilized hundreds of billions of euros in investments. The fourth challenge for the ECB is that it acknowledges being trapped by its own policy, it cannot stop it and normalize because governments and markets would suffer, and it cannot keep the current pace because inflation is putting even more pressure on growth.

The final challenge for the eurozone and the ECB is that they continue to implement policies that ignore demographics and structural burdens to growth. The eurozone has an aging population and monetary and fiscal policies seem to ignore the evidence of changing consumption patterns when citizens reach a certain age or retire. If we add to demographics a taxation system that increasingly hurts middle classes, businesses, and investment, we face an economy that seems to be following all the wrong policies that Japan implemented at the beginning of the 90s.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.