Jack Delano Diner along U.S. Highway No. 1 near Berwyn, Maryland 1940

Important

Truly incredible clip

pic.twitter.com/hjTgdoxX6G— Greg Price (@greg_price11) May 18, 2022

More on abortion

Rep. @BurgessOwens just gave one of the most powerful pro-life testimonies I've ever seen:

"For those who love the concept of equity in everything under the sun including test score outcomes, when it comes to the death of unborn, the abortion equity seems pretty racist to me." pic.twitter.com/E1fioH0ReQ

— Greg Price (@greg_price11) May 18, 2022

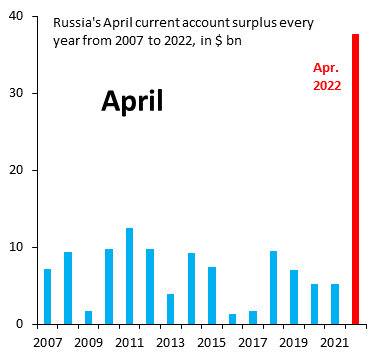

“The Russian GDP declined by two-thirds from 1989 to 2000.”

• The American Cause in Ukraine: Freedom or Empire? (Drake)

On the principle that historical analysis requires an attempt to understand the motives of all sides in a war, the Russian argument deserves a fair hearing. Roy Medvedev, one of Russia’s most distinguished historians and long a supporter of Vladimir Putin, gave an interview on March 2, 2022, to the Corriere della Sera. The ninety-six-year-old Medvedev succinctly expressed the Kremlin view of the Ukraine crisis as a clash involving far more than Putin’s concern about NATO expansion to his country’s borders. The metastasizing of NATO illustrated but did not define for Russia the fundamental issue, which had to do with the failure of America to understand that the unipolar moment of its rules-based order had ended. The time had come for a paradigm shift in international relations.

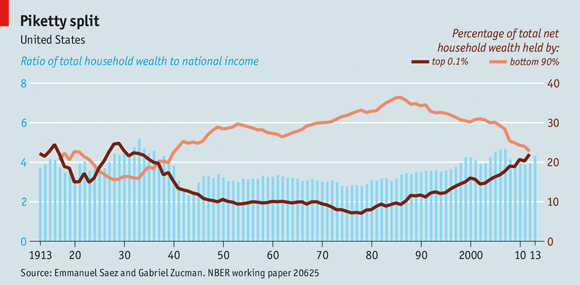

As an example of the American hegemony’s failures, Medvedev commented on the effects of Washington’s supervisory role in Russia’s transition to capitalism. He was referring to the misery befalling Russia at Cold War’s end and astringently described by the Nobel Prize-winning Columbia University economist Joseph Stiglitz in Globalization and Its Discontents (2002). In general, Stiglitz could find nothing moral or competent in the way globalization had been imposed upon the world by the International Monetary Fund, the World Bank, and the U.S. Treasury Department. Globalization had turned into an enrichment scheme for international elites implementing and benefitting from the neoliberal Washington Consensus.

When Stiglitz came to discuss the Russian economy’s American-led post-Cold War reconfiguration, which evolved along lines pleasing to the Chicago School of true-believing free-market capitalists, he showed in copious detail what Medvedev was alluding to in his interview with Italy’s leading newspaper. This crash course in free market economics had produced a harrowing increase in the nation’s poverty. The Russian GDP declined by two-thirds from 1989 to 2000.The standard of living and life expectancy fell while the number of people in poverty rose. Levels of inequality grew as oligarchs took advantage of insider information to strip the country of its assets, which they invested not in Russia, but in the U.S. Stock Market. Billions of dollars poured out of the country along with a swelling emigration of talented and educated young people who could see no future for themselves there.

“Why are these top Western military leaders running dangerous (and illegal) bioweapons operation in Ukraine?”

• Western Leaders Tied To Ukraine Bioweapons Labs (Woltz)

A military officer’s oath is for life, so one could rightly suspect that the crapstorm Trudeau’s Trevor Cadieu, The Biden Crime family’s, Admiral Eric Thor Olson, and BoJo’s LTC John Bailey just stirred up, was with their consent. Numerous headlines read, “U.S. Admiral Surrenders to Russia in Mariupol, Ukraine.” What they missed is that U.S. Lt. Gen. Roger Cloutier was also captured at Azovstal and is now headed for Moscow to be put on trial as an international terrorist as well. “Reports have been circulating much of today (Sunday, May 15, 2022) claiming that a U.S. Military Commander surrendered to Russian forces from the Azovstal Steel Mill in Mariupol, Ukraine.”

Not to be outdone in international Bioweapons Crimes against humanity, Boris Johnson’s lad, British Lieutenant Colonel, John Bailey—and four NATO military instructors—also surrendered to the Russian troops Sunday past from the depths of the Neo-Nazi tunnels beneath Azov Steel (Azovstal). There is also news of other officers still hiding in the tunnels under Azovstal—along with an estimated 600 Ukraine Neo-Nazis who can expect less cordial treatment by the Russian courts than the western brass. Russian tribunals will hold them responsible for the 14,000 dead Russian-speaking souls in Eastern Ukraine murdered by these men since 2014. Why are these top Western military leaders running dangerous (and illegal) bioweapons operation in Ukraine? I think the question answers itself.

The World Economic Forum’s ‘Great Reset’ glommed onto by the Bidens, the Trudeaus, the Johnsons, the Morrisons Down Under, Ardern in Kiwiland—as well as the Brussels crew in Europe—are losing. Their pandemic was not only ineffective in killing most of ‘us’ (so far) but their dirty bomb plot/bioweapons release from Ukraine planned for March 8th of this year was also a dud.

“A flurry of additional war games are planned for Germany, Finland, Poland and elsewhere in the coming months.”

• Major NATO War Games Set to Begin Miles From Russian Base (LI)

The North Atlantic Treaty Organization will soon conduct large-scale exercises in the Baltics, with thousands of troops from more than a dozen nations set to take part in war games just 40 miles from the nearest Russian military base. Dubbed “Hedgehog,” the drills will kick off later this week in Estonia and run until June 3, meant to simulate a Russian invasion. They will involve 15,000 troops from 14 countries – including the United States, Britain, Denmark, Estonia, Iceland, Latvia, Lithuania, the Netherlands and Norway, as well as non-NATO members Ukraine, Georgia, Sweden and Finland.

According to Major General Veiko-Vello Palm, deputy commander of the Estonian Defence Forces, the exercise will take place just 40 miles from a Russian military base, a facility hosting Moscow’s 76th Guards Air Assault Division in the border city of Pskov. The size of the war games – among the largest in the Baltics since the fall of the USSR – their proximity to the Russian border, and the inclusion of non-NATO states are likely to escalate tensions with Moscow. Though the exercises were planned before Russia’s invasion of Ukraine in February, they will no doubt serve as an additional show of force as NATO members flood the Ukrainian battlefield with billions of dollars in weapons and gear.

The drills come as US lawmakers move ahead on a massive $40 billion aid package for Kiev, around half of which will be devoted to arms shipments. That bill follows more than $14 billion in aid already delivered or authorized by the US government. The Hedgehog exercise will also overlap with two major NATO and allied military drills currently being held in the region, “Defender Europe” and “Swift Response,” which together involve around 18,000 soldiers from 20 countries. A flurry of additional war games are planned for Germany, Finland, Poland and elsewhere in the coming months.

“There was a Jewish prophet that once said, ‘The last war is going to take 8 minutes.’

• Third of Global Population Killed in Next War Cycle – Charles Nenner (USAW)

Renowned geopolitical and financial cycle expert Charles Nenner says his analysis shows the world will start a huge war cycle by 2023. This type of war is similar to WWII but much bigger. Nenner explains, “The cycle work I do on wars starts at the Mandarin Empire 3,000 years before Jesus came into this world. The long cycle only picks up the big wars. Wars in Korea and Iraq do not show up. So, I say the big War Cycle is up, and this is going to be a big war because the small ones don’t even show up. So, I am very worried. . . . There was a Jewish prophet that once said, ‘The last war is going to take 8 minutes.’ Nobody took this serious because how can a war last 8 minutes? Now we have an idea why a war can only take 8 minutes.

Things could calm down in the short term this summer. Then, next year, it can start full force again, and the whole thing is very dangerous.” How many casualties will there be in the next world war? Nenner estimates, “It’s very interesting how you calculate something like that. It’s the same way you calculate a cycle in IBM. When you see IBM going down, you can get an upside price target, which we have. You can do the same thing on the war cycle. About one third of the population is not going to survive in this world.” So, more than 2.5 billion people are going to die in the next world war that is just around the corner? Nenner says, “Yes, the numbers say if you have a world war, it’s going to take out 1/3 of the population.”

On the financial front, Nenner says, “There is a catastrophe going on in bonds. They lost their capital and are not going to get it back. It’s the same thing that is happening in stocks.” Nenner advised to get out of both the bond and stock markets at the beginning of the year, and he was on target. Nenner predicts it’s going to get worse for stocks and bonds. Nenner says the next downside target is “15,000 on the DOW,” and it will eventually hit around “5,000 on the DOW.”

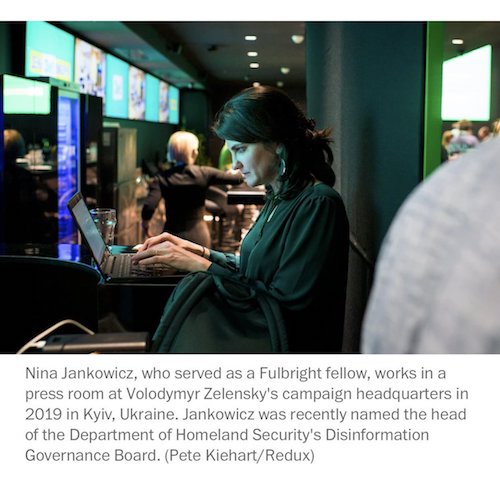

A clown show indeed. Straight from Zelensky’s PR team.

• Biden’s ‘Disinformation’ Clown Show ‘Paused,’ Scary Poppins Resigns (Celente)

Nina Jankowicz, the so-called disinformation ‘expert’ that was to lead President Joe Biden’s Disinformation Governance Board said in a statement that she was resigning from her post and that the entire project was “paused.” “With the board’s work paused and its future uncertain, and I have decided to leave DHS (the Department of Homeland Security) to return to my work in the public sphere,” she said in a statement obtained by a reporter for the Wall Street Journal. “It is deeply disappointing that mischaracterizations of the board became a distraction from the department’s vital work, and indeed, along with recent events globally and nationally, embodies why it is necessary.”

The Trends Journal was an outspoken critic of the board and Jankowicz’s position due to her her history of extreme views. Her past roles included stints at the Wilson Center and advising the Ukrainian Foreign Ministry (as part of the Fulbright-Clinton Public Policy Fellowship), according to Zerohedge.com. She also directed Russia and Belarus programs at the National Democratic Institute. Jankowicz did her best to discredit the Hunter Biden laptop as “Russian Disinformation” in the days and weeks before the 2020 Presidential election, according to Fox News. At one point she called it a “fairy-tale” of disinformation. She also called it a “Trump Campaign Product.” It has since been proved as authentic. If the media had reported on the laptop honestly, it likely would have severely damaged Joe Biden.

In 2020, she pushed for Twitter to go further in banning political criticism of Biden’s campaign; she said at the time that she “shudders to think about if free speech absolutists were taking over more platforms, what that would look like for the marginalized communities.” DHS told The Trends Journal that the board’s work protects free speech, civil rights, civil liberties, and privacy. “It was intended to ensure coordination across the Department’s component agencies as they protect Americans from disinformation that threatens the homeland – including malicious efforts spread by foreign adversaries, human traffickers, and transnational criminal organizations,” a spokesperson said. “The Board has been grossly and intentionally mischaracterized: it was never about censorship or policing speech in any manner. It was designed to ensure we fulfill our mission to protect the homeland, while protecting core Constitutional rights.”

And the life insurance people are the only ones worried enough to investigate?!

• Mortality Among White-Collar Workers Jumped 24% Between 2020 and 2021 (ET)

The increase in deaths not attributed to COVID-19 in the working-age population during the summer and into the fall of last year affected white-collar workers more than blue- and grey-collar employees, according to life insurance data. In the white-collar sector, mortality jumped 24 percent in the period covered by the data (April 2020–September 2021); less than 64 percent of those were attributed to COVID-19. Among blue-collar workers, mortality rose 19 percent, of which over 80 percent was attributed to COVID-19. As The Epoch Times previously reported, prime-age mortality was particularly elevated in the 12 months ending in October 2021, where there was an excess death spike of more than 40 percent in ages 18–49, compared with the same period in 2018–2019, based on death certificate data from the CDC.

The majority of the excess deaths weren’t attributed to COVID-19. A recent study by the Society of Actuaries, an international professional organization, corroborates the CDC data. It relies on a survey of group term life insurance providers that yielded data on claims made from 2017 to 2021 and reported to insurers by Sept. 30, 2021. The life insurance data show an increase in excess mortality since the second quarter of 2020, along with the COVID-19 pandemic, including a particularly sharp increase in the third quarter of 2021—39 percent above what would have been expected based on 2017–2019 data. That quarter was exceptionally devastating for age groups 25–34, 35–44, 45–54, and 55–64, in which mortality soared 81 percent, 117 percent, 108 percent, and 70 percent, respectively, above the baseline.

Deaths attributed to COVID-19 accounted for about three-quarters of the excess mortality during the 18 months reviewed in the study. But among those under the age of 45, COVID-19 accounted for less than 38 percent of the excess deaths, the study says. Among industries with the largest number of COVID-19 deaths, the worst hit was public administration with nearly 13,000 life insurance claims related to the disease. Yet those only accounted for less than 52 percent of the sector’s excess mortality.

Get rid of them before they can do more damage.

• Gates, Fauci Funded Experiments on Bird Flu (Mercola)

As news of the COVID pandemic winds down around the world, we’re suddenly seeing warnings of another pandemic brewing — bird flu, aka avian influenza (H5N1). In a March 30 CenterPoint interview, former Director for the U.S. Centers for Disease Control and Prevention, Dr. Robert Redfield, stated: “I believe the great pandemic still in the future, and that’s going to be a bird flu pandemic for man. It’s going to have significant mortality in the 10 to 50% range. It’s going to be trouble.” Anyone who knows a little about bird flu is likely to wonder where Redfield and other “experts” are getting their predictions from, as natural bird flu is notoriously harmless to humans. In early April, news of a highly pathogenic bird flu ripping through chicken and turkey flocks in the U.S., triggering the slaughter of millions of these animals, was reported.

Historically, however, the bird flu has never posed a threat to mankind — that is until scientists started tinkering with it, creating a hybrid with human pandemic potential. As reported by Alexis Baden-Mayer, political director for the Organic Consumers Association: “H5N1 kills more than half of the people who get it, but H5N1 has circled the globe for decades and there have only ever been 860 human infections worldwide. … “H5N1 isn’t transmitted person-to-person … There are no food safety risks associated with H5N1. If farm workers and meat packers don’t get bird flu in filthy factory farms or slaughterhouses, it’s no surprise the rest of us don’t get bird flu from eating raw eggs or handling raw chicken.” Despite that, the U.S. and other countries have already started stockpiling H5N1 vaccine, and the H5N1 vaccine Audenz is being marketed “for 2022.”

The approval for this vaccine was granted by the U.S. Food and Drug Administration in January 2020, followed by supplemental approval in 2021. As if on cue, the first-ever H5N1-positive case was identified in the U.S. at the end of April. By the looks of it, the only way human bird flu would appear would be if it was created, and wouldn’t you know it, Dr. Anthony Fauci, Director of the National Institutes of Allergy and Infectious Diseases has funded gain of function research with the intention to make H5N1 transmissible to humans, as has global vaccine profiteer Bill Gates, Baden-Mayer notes. Some of that research has been undertaken in Pentagon-funded biolabs in Ukraine. For more details on this, be sure to read Baden-Mayer’s extensive article.

Is that a question?

• Why Were So Many Adverse Events Reported as ‘Unrelated’ to Vaccine? (CHD)

The latest release of Pfizer-BioNTech COVID-19 vaccine documents raises questions about how frequently adverse events experienced by clinical trial participants were reported as “unrelated” to the vaccine. The 80,000-page document cache released May 2 by the U.S. Food and Drug Administration (FDA) includes an extensive set of Case Report Forms (CRFs) from Pfizer trials conducted at various locations in the U.S. The documents also include the “third interim report” from BioNTech’s trials conducted in Germany (accompanied by a synopsis of this report and a database of adverse events from this particular set of trials).

The FDA released the documents, which pertain to the Emergency Use Authorization (EUA) of the vaccine, as part of a court-ordered disclosure schedule stemming from an expedited Freedom of Information Act (FOIA) request filed in August 2021. Public Health and Medical Professionals for Transparency, a group of doctors and public health professionals, submitted the FOIA request. Pfizer conducted a series of vaccine trials at various locations in the U.S., including the New York University Langone Health Center, Rochester Clinical Research and Rochester General Hospital (Rochester, New York) and the J. Lewis Research, Inc. Foothill Family Clinic (Salt Lake City, Utah).

The Pfizer documents released this month by the FDA included a series of CRFs for patients who suffered some type of adverse event during their participation in the COVID-19 vaccine trials. As the documents reveal, despite the occurrence of a wide range of symptoms, including serious cardiovascular events, almost none were identified as being “related” to the vaccine. [..] The extant body of evidence indicates Pfizer “is hiding critical information from regulators,” Setty said: “The clincher is in the memorandum to the VRBPAC [Vaccines and Related Biological Products Advisory Committee] (Table 2, efficacy populations), where they show us that five times more people in the vaccine group were pulled out of the trial than the placebo within seven days of their second shot for ‘important protocol deviations.’

“In a trial that big the chances that could have happened coincidentally is infinitesimally small (less than 1 in 100,000). “Moreover, months later, the same thing happened in the pediatric trial (Table 12). This time, six times more children were pulled from the trial after their second dose. “There are, of course, procedural differences when administering a placebo versus the mRNA vaccine, but why didn’t it happen after the first dose as well? “Mathematically, that is about as close as you can get to eliminating any ‘shadow of doubt.’ With a formal allegation by a trial coordinator that states the same thing [referring to whistleblower Brook Jackson], we can be assured Pfizer is hiding critical information from regulators.”

The US cannot afford two separate justice systems.

• Sussmann Is Receiving Every Consideration Denied To Flynn (Turley)

Sussman’s trial for allegedly lying to the FBI is being heard in the same District of Columbia federal courthouse where former Trump national security adviser Michael Flynn and others faced the very same charge brought by another special counsel. The cases, however, could not be more different. Whereas Flynn’s prosecution was a no-holds-barred affair, Sussmann’s prosecution has been undermined by a series of unfavorable rulings by the court. Special prosecutor John Durham still may be able to eke out a conviction, but the difference in the treatment of Trump and Clinton associates is striking.

Sussmann is charged under 18 U.S.C. 1001 with lying to the FBI during a meeting with then-FBI general counsel James Baker when he came forward with what he claimed was evidence of possible covert communications between the Trump organization and Alfa, a Russian bank. Sussmann allegedly concealed that he was representing the Clinton campaign, which he billed for his efforts. Shaw told the jury that the FBI “should not be used as a political tool for anyone – not Republicans. Not Democrats. Not anyone.” She then added that the jurors themselves should not use this trial for their own political judgments. Looking at the jury box, one can understand Shaw’s unease. During jury selection, one juror admitted he was a Clinton donor and could only promise to “strive for impartiality as best I can.”

Prosecutors objected to his being seated, but Judge Christopher Cooper overruled them. In another exchange, a former bartender and donor to far-left Rep. Alexandria Ocasio-Cortez (D-N.Y.) was told by a Sussmann defense lawyer that neither Clinton nor Trump were on trial and then asked if she could be impartial. She responded, “Yes, knowing that” — which might suggest she would not be impartial if the campaigns were part of the trial. Other jurors include a woman who said she thought she was a Clinton donor but could not remember; a juror whose husband worked for the Clinton 2008 campaign; and a juror who believes the legal system is racist and police departments should be defunded.

You can’t have a fair trial in DC.

• Juror Donations, Judge’s Family Ties At Sussmann Trial (JTN)

The trial for 2016 Hillary Clinton presidential campaign lawyer Michael Sussmann this week in Washington, D.C., highlights the left-leaning of the nation’s capital — with as many as three jurors reportedly having donated to the Clinton campaign. A fourth juror on the 12-member panel supported New York Democratic Rep. Alexandria Ocasio Cortez, according to the New York Post. In addition, presiding federal judge Christopher Cooper says he and Sussmann were “professional acquaintances” while at the Justice Department in the 1990s. And the judge’s wife represents former FBI lawyer Lisa Page. Page exchanged text messages critical of then-GOP presidential candidate Donald Trump during the 2016 campaign with then-FBI agent Peter Strzok, with whom she was having an extra-marital affair.

The District of Columbia votes overwhelmingly for Democratic candidates, with Democrats outnumbering Republican voters 76.5% to 5.4%, according to the most recent figures from the city’s Board of Elections. In 2016, D.C. voters favored Clinton over Trump, 90.9% to 4.1%. Special Counsel John Durham’s team objected to putting one Clinton donor on the jury after the man said he would “strive for impartiality as best I can,” the Post also reported. However, the prosecutors were overruled by Cooper, of the U.S. District Court for the District of Columbia, who said the Clinton supporter “expressed a high degree of confidence” that he wouldn’t be biased.

Elias is the leader. No. 1 lawyer for both Hillary AND BLM.

• Clinton Campaign Lawyer Elias Testifies In 3rd Day Of Sussmann Trial (JTN)

Marc Elias, a top 2016 Hillary Clinton campaign attorney, began his testimony late Wednesday morning in the federal case against fellow and former campaign attorney and law firm partner Michael Sussmann – as the prosecution laid its groundwork for further questions about the firm’s relationship with opposition research firm Fusion GPS. Special counsel John Durham has charged Sussmann with lying to the FBI, alleging that in 2016, weeks before the presidential election, he pitched the FBI the Trump-Russia collusion plot without disclosing he was working for stakeholder clients, suggesting instead he was there as a good citizen. Sussmann provided evidence at the meeting that purported to prove communications between the Trump Organization and Russia’s Afla Bank, a back channel to the Kremlin.

Elias at the time was general counsel for the Clinton campaign and a partner with Sussmann at the Perkins Coie law firm. Before the court recess Wednesday, the prosecution established through Elias’ testimony that he had hired Fusion GPS for the Clinton campaign in spring 2016, when it looked like then-presidential candidate Donald Trump would become the GOP nominee. Elias said that he had weekly in-person meetings with the firm and daily check-ins over the phone regarding its efforts and progress. Most of what Fusion GPS focused on for the Clinton campaign was Trump-related litigation. The prosecution asked Elias who knew of the relationship between Fusion GPS and the Clinton campaign.

Elias explained that it was largely on a need-to-know basis so as to prevent people in the campaign from reaching out to Fusion GPS without having attorney-client privilege and to prevent leaks on the law firm side from getting out to the public that would hurt the client. Prosecutor Andrew DeFilippis also asked Elias about how Perkins Coie’s clients were billed, setting up a framework for later questioning regarding Sussmann’s purported billing of the Clinton campaign for his meeting with the FBI. The prosecution on Tuesday night had a listed at least five witnesses it intends to bring to the stand Wednesday – including Elias, fellow Clinton campaign lawyer Debbie Fine and Fusion GPS computer researcher Laura Seago.

Whaddaya know? There’s Elias again. The rats and the sinking ship.

BLM raised $90 million, and spent $60 million?!

• Clintonworld Steps Away From Black Lives Matter (WE)

Marc Elias and Minyon Moore, two longtime allies of Bill and Hillary Clinton who recently took up key roles with the national Black Lives Matter group, relinquished top spots with the embattled organization, according to new records filed just days before the group reveals what it did with the $90 million it raised in 2020. The Black Lives Matter Global Network Foundation revealed in February that the Elias Law Group, Elias’s namesake law firm, had taken control of its books and finances. But Elias Law Group is nowhere to be found in BLM’s latest registration filings submitted to Florida and Oklahoma on April 28, according to records obtained by the Washington Examiner.

While the new records show the Elias Law Group is no longer in control of BLM’s books, whatever continued involvement Elias’s firm may have with the embattled charity remains a mystery. The Elias Law Group declined to provide an on-the-record comment to the Washington Examiner. The Elias Law Group’s absence from BLM’s Florida and Oklahoma registrations submitted on the eve of the charity’s financial disclosure is telling, said Tom Anderson, the director of the Government Integrity Project at the National Legal and Policy Center watchdog group. “It is important to note the Elias Law Group is a firm with a laser focus on electing Democrats and pushing the progressive agenda,” Anderson told the Washington Examiner.

“This makes their disappearance from the latest BLM Global Network Foundation filings a pivotal moment, probably foreshadowing the total collapse of what is left of the organization.” BLM had disclosed in February that Elias’s law firm had taken control of its books and Moore had joined its board of directors. The filings were made public about two weeks after the BLM shut off its online fundraising streams amid legal threats from California and Washington over the charity’s lack of financial transparency. [..] Elias is best known for his funding of British ex-spy Christopher Steele’s discredited anti-Trump dossier while he served as Hillary Clinton’s 2016 campaign general counsel, and he is expected to be called by special counsel John Durham to testify at the false statements trial of his former Perkins Coie law firm colleague, Michael Sussmann, which begins [this] week.

Zuby

https://twitter.com/i/status/1526982406586224642

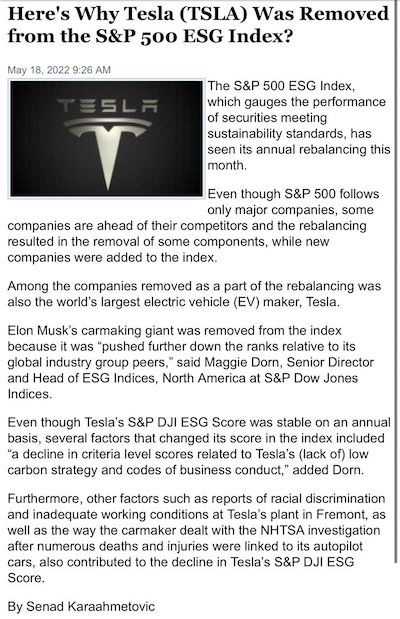

“The dirty tricks attacks will be next-level.”

• Elon Musk Announces He Will Vote Republican (JTN)

The world’s richest man, Elon Musk, on Wednesday announced he will vote Republican due to the “hate” in the Democratic Party. “In the past I voted Democrat, because they were (mostly) the kindness party,” Musk tweeted. “But they have become the party of division & hate, so I can no longer support them and will vote Republican,” he wrote. “Now, watch their dirty tricks campaign against me unfold …” Several hours before making the announcement, Musk posted, “Political attacks on me will escalate dramatically in coming months.” He followed up, “The dirty tricks attacks will be next-level.”

Musk secured a deal to purchase Twitter last month, in a move he says is intended to defend freedom of speech. The Tesla CEO has since said the deal is on hold pending the release of details about fake accounts on the platform. Some Twitter employees are upset with Musk’s possible acquisition of the platform. A video surfaced Tuesday from Project Veritas showing a Twitter executive mocking Musk’s Aspergers and support for free speech.

No chance anymore.

• Twitter Wants to Close Deal ‘Promptly’ and on ‘Agreed Price’ (ET)

Twitter announced Tuesday that it was filing a preliminary proxy statement with the U.S. Securities and Exchange Commission (SEC) in order to complete the Elon Musk buyout “on the agreed price,” and as “promptly as practicable.” Twitter wants the $54.20 per share in cash deal with Musk to go through, while the billionaire is hesitant following allegations that the social media platform is rife with spam or bot accounts. “The preliminary proxy statement contains important information including the background of, and reasons for, Twitter’s transaction with Mr. Musk,” the company said in a statement, adding that it expects the deal to close in 2022. Moreover, Twitter encouraged shareholders to vote in favor of the deal in the preliminary proxy statement.

The board of directors unanimously “determined that the merger agreement is advisable,” and that it is “in the best interests of Twitter and its stockholders.” Meanwhile, Musk has called on the SEC to investigate the actual number of users on the network. “Hello @SECGov, anyone home?” Musk wrote in a Twitter post on May 17 as a response to a suggestion for the regulatory authority to look into Twitter’s claims regarding the number of users. As the uncertainties continue, the stock price has fallen from $46.09 last Wednesday to close at $38.32 Tuesday, a decrease of over 16.8 percent.

Q: Could or should Musk have known this when he made his offer? But also: did Twitter know?

• Half of President Biden’s Twitter Followers Are Fake (JTN)

Nearly half of President Biden’s 22.2 million Twitter followers are fake accounts, according to an audit tool by software company SparkToro. Newsweek reports that the tool found that 49.3% of accounts following the U.S. president are fake followers based on a number of factors, including how recently the accounts were established, location issues and lack of profile images. The tool defines fake accounts as “accounts that are unreachable and will not see the account’s tweets (either because they’re spam, bots, propaganda, etc. or because they’re no longer active on Twitter).” Elon Musk, who is in the middle of attempting to purchase Twitter, says the deal cannot move forward until there is a better understanding of the number of fake accounts on the site.

If a crackdown on fake and bot accounts is ultimately implemented, the official @POTUS account could lose an enormous numbers of followers. On Tuesday, Musk said that the number of fake accounts on Twitter was close to 20%, four times what Twitter claims,” he wrote, and “could be *much* higher.” “My offer was based on Twitter’s [Security and Exchange Commission] filings being accurate. Yesterday, Twitter’s CEO publicly refused to show proof of <5%. This deal cannot move forward until he does,” he wrote. The Tesla CEO and current Twitter CEO, Parag Agrawal, traded some tweets Monday about the issue.“We suspend over half a million spam accounts every day, usually before any of you even see them on Twitter,” Agrawal posted. “We also lock millions of accounts each week that we suspect may be spam, if they can’t pass human verification challenges (captchas, phone verification, etc).” The Twitter CEO said that the company estimates each quarter that less than 5% of monetizable daily active users are spam accounts. Musk first responded to Agrawal’s lengthy thread with an excrement emoji, and then wrote, “So how do advertisers know what they’re getting for their money? This is fundamental to the financial health of Twitter.”

Q: How does Hunter pay “a team of more than 30 lawyers and investigators..?” That sounds costly.

• Hunter Biden’s Hollywood Lawyer Teases Counter-offensive vs Trump Allies (CBS)

The Hollywood lawyer working with Hunter Biden has recruited a team of more than 30 lawyers and investigators to probe the backstory of how a laptop containing years of personal and intimate emails and business records found its way to news reporters and authorities. The effort led by Kevin Morris, a maverick entertainment lawyer best known for crafting a 9-figure deal for the creators of the animated series “South Park,” appears to be part of an attempt to blunt the impact of an ongoing federal investigation into Hunter Biden’s tax records and business dealings. Morris and his team have been circulating provocative slides that tease a coming counter-narrative to political attacks against the president’s son.

An ongoing Republican-led investigation into Hunter Biden’s overseas business dealings is widely expected to escalate if the party takes control of the House or Senate and gains subpoena power. Republicans say the investigation aims to determine if Hunter Biden’s work created any conflicts for his father as a U.S. senator, vice president or presidential candidate. Both Hunter Biden and his father have maintained that they never communicated about the younger Biden’s business dealings, which included service on the board of a Ukrainian energy firm and dealmaking in China — work that has drawn scrutiny for the past several years.

Morris’s team includes investigators on the ground in Delaware, attorneys in multiple states, and forensic analysts who are attempting to determine if malicious content was added to Hunter Biden’s laptop — which has become the source of investigative reports and political attacks targeting the president’s son. But at least initially, the effort appears less focused on the content of the laptop than on how it surfaced in the first place. Based on Morris’ slides, several of which were viewed by CBS News, the attorney’s team of investigators is attempting to re-trace the path of Biden’s laptop and determine how it passed through the hands of the Bidens’ political opponents. Much remains unknown about how the younger Biden’s personal computer and its contents became public.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.