William Henry Jackson Tunnel 3, Tamasopo Canyon, San Luis Potosi, Mexico 1890

And the IMF worked hard to get it there.

• IMF Says World At Risk Of ‘Economic Derailment’ (BBC)

The IMF has warned that the global economy faces a growing “risk of economic derailment.” Deputy director David Lipton called for urgent steps to boost global demand. “We are clearly at a delicate juncture,” he said in a speech to the National Association for Business Economics in Washington on Tuesday. “The IMF’s latest reading of the global economy shows once again a weakening baseline,” he warned. The comments come after weaker-than-expected trade figures from China showing that exports in February plunged by a quarter from a year ago. With the world’s second largest economy often referred to as as “the engine of global growth”, weaker global demand for its goods is read as an indicator of the general global economic climate. The IMF has already said it is likely to downgrade its current forecast of 3.4% for global growth when it releases its economic predictions in April.

Last month, the international lender had warned that the world economy was “highly vulnerable” and called for new efforts to spur growth. In a report ahead of last month’s Shanghai G20 meeting, the IMF said the group should plan a co-ordinated stimulus programme as world growth had slowed and could be derailed by market turbulence, the oil price crash and geopolitical conflicts. In his Washington speech, Mr Lipton said “the burden to lift growth falls more squarely on advanced economies” which have fiscal room to move. “The downside risks are clearly much more pronounced than before, and the case for more forceful and concerted policy action, has become more compelling.” “Moreover, risks have increased further, with volatile financial markets and low commodity prices creating fresh concerns about the health of the global economy,” he added. The downbeat picture is one that has continuing ramifications for businesses and industries that bet on China’s growth story.

“..the whole of Europe is sitting on a bed of nitroglycerin..”

• Whole Of Europe Risks Spinning Into Crisis If Leaders Mishandle Brexit (AEP)

[..] Personally, I find talk about “retaliation” against Britain to be a little odd, though I do not rule it out. Any such madness would risk a political crisis in Denmark and Sweden, and ultimately spread to Germany. British withdrawal would be a thunderous shock to the EU project. The immediate imperative for Europe’s leaders at that point would be to patch things up and ensure a velvet divorce as quickly as possible to stop the crisis spinning out of control. France’s Marine Le Pen likens Brexit to the collapse of the Berlin Wall. “It will be the beginning of the end. If Britain knocks down part of the wall, it s finished, it’s over, she said. Whether she is right or wrong depends on the statecraft of Angela Merkel, Francois Hollande, Mateo Renzi and Poland’s Beata Szydlo. A report this week by Morgan Stanley spells out the grim price Europeans will pay if they mishandle this event.

Foreign investors would start to withdraw their $8.3 trillion of investments in the eurozone. There might be a bond run with Spain in the firing line. The bank’s base case for Brexit is that the MSCI Europe index of equities will fall 15pc-20pc, and 0.7 percentage points will be knocked off growth by late 2017. Its “high stress” scenario is a stock market crash of up to 30pc, a tightening in financial conditions by 200 basis points, severe contagion, and a 2pc blow to GDP that pushes the eurozone into recession, with “growing concerns around the sustainability of the entire European project”. Whether the eurozone could withstand a fresh shock of this force is an open question. The region already has one foot in deflation, with toxic effects on debt dynamics. Public debt ratios are massively higher than they were at the top of the last credit cycle in 2008, and pushing safe limits of 133pc of GDP in Italy and 129pc in Portugal.

The hysteresis effects of mass unemployment have done lasting damage to economic dynamism, lowering the eurozone’s speed limit for a decade to come. There is no fiscal union, and no genuine banking union. Little has been done to make monetary union viable. The ECB is running low on ammunition. Populist movements are simmering everywhere. I do not wish to gloss over the risks to the UK. These are real and have been widely aired, emphatically by the Bank of England recently. My point is that the whole of Europe is sitting on a bed of nitroglycerin. It is a fair bet that EU leaders would refrain from reprisals that would make their crisis infinitely worse, but it is only a bet. No level of folly can ever be excluded in the march of human affairs.

“These lines will converge..”

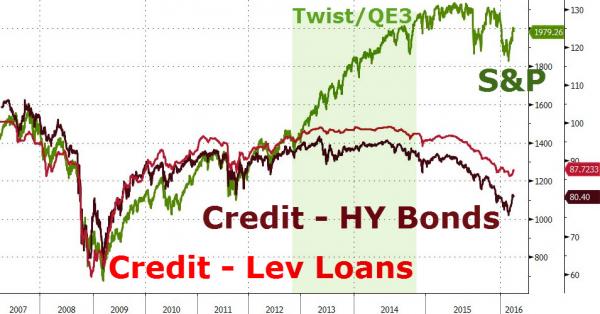

• This Is Jeff Gundlach’s Favorite -& Scariest- Chart (ZH)

According to DoubleLine’s Jeff Gundlach, this is his favorite chart – backing his persepctive that equity markets have “2% upside and 20% downside) from here. In his words: “These lines will converge…” It should be pretty clear what drove the divergence, and unless (and maybe if) The Fed unleashes another round of money-printing (or worse), one can’t help but agree with Gundlach’s ominous call.

Chart: Bloomberg

“We don’t want to play any more.” Sounds nice, but a ton of bankers, investors etc. MUST play.

• “However It Takes” #Draghi (BM)

Never has an ECB meeting been so eagerly anticipated, and yet so confused. In October’s meeting, we expected nothing. Instead we got that “things have changed” about “going into further negative territory”. Sell the Euro! Buy Euribors! In December’s meeting, we expected everything. But we thought we didn’t. So we got a market that was overly short of Euros/long of Euribors and forced to exit. Buy the Euro! Sell Euribors! In January’s meeting, we didn’t want to listen. But we had to, because this time Draghi didn’t leave it to the Q&A to deliver his own thoughts. He managed to shoehorn some kind of consensus towards further easing into the actual statement: ‘we decided to keep the key ECB interest rates unchanged and we expect them to remain at present or lower levels for an extended period of time’. Sell the Euro a bit! Buy Euribors a bit more!

Now the time has come. It’s the March meeting and they can present new staff forecasts as they indicate just how much lower, and for how much longer, the stimulus can continue. Are we buying or selling everything? There was an important step between 3 and 4, however, and that was the impact of the Bank of Japan moving into negative rates, as well as the ongoing cumulative bout of fear subsuming the markets. In February, we all decided that lower interest rates might not actually be very good for the banking system. Which is a bit of a shame, given that the banks are the transmission mechanism by which those super-stimulative rates are supposed to super-stimulate the economy. This now leaves us in this position:

• October: We forgot that Draghi always over-delivers!

• December: No, we didn’t, and EUR/USD has its biggest upmove of the year

• January: No, we were wrong again, he does want to over-deliver, here he is putting in his fresh order for a kitchen sink

• March: We don’t want to play any more.

Don’t think the ECB is done blowing bubbles.

• Senior European Bankers Voice Concerns Over ECB Cut (FT)

Some of Europe’s most senior bankers have warned the European Central Bank of the dangers of negative interest rates ahead of a widely anticipated cut at the bank’s policy meeting on Thursday. The ECB is expected to cut its deposit rate by 10 basis points to minus 0.4% as it takes further action in its struggles to lift persistently low inflation and boost economic growth back to normal levels. Bank leaders are alarmed by the crippling effect on their profits of negative rates which they cannot pass on to ordinary customers, adding to concerns about the fragility of financial stability in some parts of the eurozone. But any attempt by the ECB to shield lenders from the effects of negative rates could weaken the policy and open the central bank to claims that it is engaged in a beggar-thy-neighbour devaluation.

Andreas Treichl, chief executive of Austria’s Erste Bank, told the Financial Times that another cut could encourage financial bubbles, hurt economic growth and create “social disparity” by penalising savers. José García Cantera, Santander’s chief financial officer, added that the banks that would take the biggest hit to their profits if rates were cut again were those least able to bear it. Last week, Sergio Ermotti, UBS chief executive, warned that excessively low rates were prompting banks to extend too many risky loans because they “don’t know what to do” with deposits. The industry hopes to lay out concrete evidence of the detrimental impact negative rates are already having in mid-April, when the European Banking Federation will present the results of a review into how its members are being affected.

Nobody oversees 10 years in this climate.

• Markets Betting On Near-Zero Interest Rates For Another Decade (Reuters)

World markets may have recovered their poise from a torrid start to the year, but their outlook for global growth and inflation is now so bleak they are betting on developed world interest rates remaining near zero for up to another decade. Even though the U.S. Federal Reserve has already started what it expects will be a series of interest rate rises, markets appear to have bought into a “secular stagnation” thesis floated by former U.S. Treasury Secretary Larry Summers. The idea posits that the world is entering a peculiarly prolonged period in which structurally low inflation and wage growth – hampered by aging populations and slowing productivity growth – means the inflation-adjusted interest rate needed to stimulate economic demand may be far below zero.

As there’s likely a lower limit to nominal interest rates just below zero – because it’s cheaper to hold physical cash and bank profitability starts to ebb – then even these zero rates do not gain traction on demand. For all the debate about the accuracy of that view, it’s already playing out in world markets, with long-term projections from the interest rate swaps market showing developed world interest rates stuck near zero for several years. Take overnight interest rate swaps. They imply ECB policy rates won’t get back above 0.5% for around 13 years and aren’t even expected to be much above 1% for at least 60 years. Japan’s main interest rate won’t reach 0.5% for at least 30 years, they suggest, and even U.S. and UK rates are set to remain low for years. It will be six years before U.S. rates return to 1%, and a decade until UK rates reach that level.

Poetry in motion: “In China, you can see it visibly”, she said.”

• What’s In A Growth Target? For China, Hope And Simple Math (WSJ)

What’s in an economic growth target? When it comes to China, not all that much. That the government has a passion for setting targets is well-established; the nation’s top economic planning agency lists 59 in the appendix of its annual report to China’s parliament, of which it says it only undershot in four categories last year. Given that, one might assume that the policymakers of Beijing arrive at their numbers through reams of Excel sheets and several lecture-hall chalkboards worth of mathematical formula. Not so, according to Wu Xiaoling, deputy director of China’s congressional finance and economy committee. Ms. Wu is a former deputy governor of the central bank, the former head of its foreign-exchange regulator, and a respected thinker in China’s financial policy circles.

In explaining China’s current monetary policy, which is trying to strike a balance between providing enough money for growth without sparking another round of debt bingeing, Ms. Wu walked reporters through the steps the government takes to build its target for M2, the broadest measurement of money, capturing all the cash, savings and deposits flowing through an economy. M2 is an indicator that economists watch not just for its sheer size in China, but also because it s driving an accumulation of debt at twice the speed that the world’s second-largest economy is growing. M2’s growth is the result of deliberate government policy. Last year, it set a goal of 12%; the actual expansion came in at 13.3%. This year, Beijing is setting an expansion in the money supply by 13%. How did the officials arrive at these numbers? It begins, Ms. Wu says, with China s’all-important indicator: its economic growth target.

Last year, the gross domestic product expansion target was 7%. This year, as growth slows, the government has lowered the target to a range of 6.5% to 7%. That target is the minimum that would enable Beijing to accomplish a lofty government goal to double household income per capita between 2010 and 2020. The central bank then takes that GDP target and tacks on its expectations of consumer price inflation -3% both this and last year- and “then we add 2% or 3% points to take into account ‘uncertainty'”, Ms. Wu said earlier this week. The final sum becomes the government’s goal of monetary expansion for the year: 12% last year, and 13% this year, since the central bank this year chose to use the upper bound of the GDP growth range for its planning purposes. The nub of China’s M2 growth strategy isn t unique. Economists have long theorized that monetary supply can have a strong correlation with economic growth; managing M2 is therefore potentially a key way that central banks influence economic growth.

The problem, as Ms. Wu also acknowledged, is that an unbridled reliance on monetary expansion often drives debt and inflation. “In China, you can see it visibly”, she said. “Property prices have risen a lot since 2009.” The other major problem for China is that such an expansion in money supply is coinciding with a period of currency weakness fueled by worries over its economic slowdown and the ability of China s leaders to manage it that has led to an unprecedented rundown of its foreign-exchange reserves. Economists look at the correlation between broad money and foreign reserves for clues to how likely an economy is exposed to the risk of capital flight. The higher the M2-to-reserves ratio or conversely, the lower the reserves-to-M2 ratio the higher the likelihood of capital flight. In China s case, the reserves-to-M2 measurement is currently about 15%, which is about as low as Indonesia s when the Asian financial crisis struck in 1997. Indonesia saw capital flight, a plummeting currency and civil unrest.

Until truly nobody knows what anything is worth anymore. Just nationalize everything that smells bad.

• China To Allow Commercial Banks To Swap Bad Debt For Equity Stakes (Reuters)

China’s central bank is preparing regulations that would allow commercial banks to swap non-performing loans of companies for stakes in those firms, two sources with direct knowledge of the new policy told Reuters. The sources, who spoke on condition of anonymity, said the release of a new document explaining the regulatory change was imminent. On paper, the move would represent a way for indebted corporates to reduce their leverage, reducing the cost of servicing debt and making them more worthy of fresh credit. It would also reduce NPL ratios at commercial banks, reducing the cash they would need to set aside to cover losses incurred by bad loans. These funds could then be freed up for fresh lending for investment in the new wave of infrastructure products and factory upgrades the government hopes will rejuvenate the Chinese economy.

The sources said the new regulations would be promulgated with special approval from the State Council, China’s cabinet-equivalent body, thus skirting the need to revise the current commercial bank law, which prohibits banks from investing in non-financial institutions. In the past Chinese commercial banks usually dealt with NPLs by selling them off at a discount to state-designated asset management companies. The AMCs would turn around and attempt to recover the debt or resell it at a profit to distressed debt investors. The sources did not have further detail about how the banks would value the new stakes, which would represent assets on their balance sheets, or what ratio or amount of NPLs they would be able to convert using this method. Official data from the China Banking Regulatory Commission shows Chinese banks held NPLs and “special mention” troubled loans in excess of 4 trillion yuan ($614.04 billion) at the end of 2015.

Paul Singer won’t let them.

• Albany Can Solve the World’s Sovereign Debt Crisis (BBG)

In recent years, many countries – including Greece, Argentina and Ukraine – have found themselves indebted beyond their ability to pay. Argentina may now be on the brink of resolving a decade-long dispute with some of its creditors, but its predicament highlights a fundamental problem of sovereign debt. Unlike individuals and corporations, countries cannot use bankruptcy laws to restructure unsustainable debt. They are forced to try to separately renegotiate each of their debt contracts, which often fails because it requires unanimity. Although attempts have been made to try to bypass this requirement by including so-called collective action clauses in sovereign debt contracts, many contracts still lack them. Furthermore, most collective action clauses only bind a party to the particular contract that includes it.

The parties to any given sovereign debt contract, therefore, can act as holdouts in any debt restructuring plan that requires the parties to all of the country’s other debt contracts to agree to it. Recent judicial decisions interpreting New York law, which governed the relevant Argentine debt contracts, have made sovereign debt restructuring even harder; they allow “vulture funds” to extract ransom money by buying debt claims to block the ability of majority creditors to reach a settlement. These decisions broadly threaten New York’s dominance as the law that governs sovereign debt contracts. Yet New York has the unique ability not only to preserve its dominance but also to help solve the sovereign debt crisis. Because around half the world’s sovereign debt contracts are governed by New York law, the state could pass a measure to amend the voting requirements under those contracts.

For example, contracts that now require unanimity for revisions could be amended to allow changes that are approved by at least a supermajority of similarly situated creditors (even if those creditors’ claims arise under different debt contracts); such a law would overcome the major hurdle to sovereign debt restructuring. That, in turn, would give struggling nations the real prospect of equitably restructuring their debt to sustainable levels, thereby lowering sovereign borrowing costs and increasing creditor confidence by reducing uncertainty. This is a financially powerful opportunity for New York. Never before has a U.S. state had the power to influence the international community to such an extent. Being that New York City is the world’s financial center and home of the United Nations headquarters, it is fitting that circumstances have endowed the state with this power. Enactment of such a measure would also reinforce New York’s legitimacy as the governing law for future sovereign debt contracts.

Try tell that to the right wing.

• Germany Needs 470,000 Immigrants Per Year For Next 25 Years (GM)

German Chancellor Angela Merkel continues to receive both praise and criticism for her decision last year to open Germany’s doors to hundreds of thousands of the migrants arriving on Europe’s shores. ‘It goes without saying that we help and accommodate people who seek safe haven with us,’ she declared. However, while recent immigration has added enough people to offset any natural population shrinkage as a result of increasing death rates compared to birth rates, the next few decades are still likely to see the country’s increasingly elderly population go into a steady decline. Destatis, Germany’s national statistics office, estimates that the number of Germans between the ages of 20 and 66 is expected to shrink by a quarter – around 13 million people – between 2013 and 2040, while the number of people over 67 is expected to rise from 15.1 million to 21.5 million over the same time.

‘The shrinking of the population has consequences,’ explains Stephan Sievert, researcher at the Berlin Institute for Population and Development. ‘It has repercussions on the economy, on social security, and on infrastructure. A more gradual, incremental shrinking would be preferable to a rapid decline. The more time you have to adjust to the new situation, the more time you have to adapt the functioning of your society.’ Destatis confirms that immigration cannot be expected to make up this shortfall. It concludes that the country would require an estimated 470,000 immigrants ready to join the workforce every year between now and 2040 to prevent a significant demographic shift, a rate which the current unprecedented period of high immigration cannot be expected to sustain.

‘It’s not necessarily about the number of people, it’s about what they bring to the table,’ continues Sievert. ‘What kind of qualifications do they have? Can they find employment? Can they relieve some of the burden on the social security systems that increasingly more people are getting money out of than people are paying in to?’ He also raises the issue of where immigrants might settle spatially; whether they could help revive rural parts of the country where populations are dwindling. ‘It’s a different question to whether or not this would be desirable,’ he adds. ‘To have immigration on the scale that could make up for these losses, we’d be talking about more than half a million every year, and that doesn’t make the task of integration any easier.’

The animal man truly is.

• Record Number Of African Rhinos Killed In 2015 (Guardian)

A record number of rhinos were killed by poachers across Africa last year, driven by demand in the far east for their horn. The number slaughtered in their heartland in South Africa, which has four-fifths of the continent’s rhino, dipped for the first time since the crisis exploded nearly a decade ago. But increases in the number of rhino poached in Nambia and Zimbabwe offset the small signs of hope in South Africa, leading to a record 1,338 to be killed continent-wide. A total of 5,940 have been poached since 2008. Conservationists said it was possible that a clampdown by authorities in South Africa, where ministers have stepped up efforts against an illegal trade that they say threatens the tourism industry, have led to organised criminals moving their operations.

“They [poachers] operate like an amoeba so if you push in one place they expand elsewhere. What you may be seeing is a response at the regional level, where increased pressure in South Africa makes it more difficult for operatives to operate, having a response elsewhere,” said Mike Knight, chair of the respected International Union for the Conservation of Nature’s African rhino specialist group.

The legacy of the ‘developed’ world.

• Syrians Under Siege: ‘We Have No Children Any More, Only Small Adults’ (G.)

Sick children dying as lifesaving medicine waits at checkpoints, youngsters forced to survive on animal feed and leaves, and families burning their mattresses just to find something to keep them warm. Schools moving underground for shelter from barrel bombs, the crude, explosive-filled and indiscriminate crates that fall from the sky and are so inaccurate that some observers have said their use is a de facto war crime. The wounded left to die for lack of medical supplies, anaesthetics, painkillers and chronic medicine; children dying of malnutrition and even rabies due to the absence of vaccines, while landmines and snipers await anyone trying to escape. The scenes are not from second world war death camps or Soviet gulags.

They are the reality of life for more than a million Syrians living in besieged areas across the war-torn nation, according to a report by Save the Children. Tanya Steele, the charity’s chief executive, said: “Children are dying from lack of food and medicines in parts of Syria just a few kilometres from warehouses that are piled high with aid. They are paying the price for the world’s inaction.” At least a quarter of a million children are living in besieged areas across Syria, Save the Children estimates, in conditions that the charity describes as living in an open-air prison. The report is based on a series of extensive interviews and discussions with parents, children, doctors and aid workers on the ground in besieged zones.

It illustrates with startling clarity the brutality with which the conflict in Syria is being conducted, five years into a revolution-turned-civil-war that has displaced half the country and killed more than 400,000 people. The suffering of people in besieged areas in Syria is also an indictment of the failure of the international community to bring an end to the crisis. Less than 1% of them were given food assistance in 2015 and less than 3% received healthcare. Rihab, a woman living in eastern Ghouta near Damascus, which has been besieged by Bashar al-Assad’s regime, was quoted as saying: “Fear has taken control. Children now wait for their turn to be killed. Even adults live only to wait for their turn to die.”

Nice theory, though maybe a little farfetched.

• Did Michel Foucault Predict Europe’s Refugee Crisis? (Baele)

In March 1976, philosopher Michel Foucault described the advent of a new logic of government, specific to Western liberal societies. He called it biopolitics. States were becoming obsessed with the health and wellbeing of their populations. And sure enough, 40 years later, Western states are prodigiously promoting healthy food, banning tobacco, regulating alcohol, organizing breast cancer checks, and churning out information on the risk probabilities of this or that disease. Foucault never claimed this was a bad trend—it saves lives after all. But he did warn that paying so much attention to the health and wealth of one population necessitates the exclusion of those who are not entitled to—and are perceived to endanger—this health maximization program. Biopolitics is therefore the politics of live and let die.

The more a state focuses on its own population, the more it creates the conditions of possibility for others to die, “exposing people to death, increasing the risk of death for some people.” Rarely has this paradox been more apparent than in the crisis that has seen hundreds of thousands of people seeking asylum in Europe over the past few years. It is striking to watch European societies investing so much in health at home and, at the same time, erecting ever more impermeable legal and material barriers to keep refugees at bay, actively contributing to human deaths. The conflict in the Middle East is a deadly war. Most estimates suggest 300,000 have been killed in Syria alone. The conflict has shown us some of the most gruesome practices that war can produce, including the gassing of several thousands of civilians in Damascus in 2013.

Extremist groups such as the Islamic State display unimaginable levels of violence. They have beheaded people with knives or explosives, burned people locked in cages, crucified people, thrown people from the tops of buildings, or more recently exploded people locked in a car (a child supposedly detonated the bomb). This violence has been exported to Europe. Some of the biggest Syrian cities now look pretty much like Stalingrad in 1943. Inevitably, people escape—just like, for example, the Belgians who fled their country in the first years of World War I (250,000 to the UK alone, with up to 16,000 individuals arriving per day). This emigration is inevitable simply because normal life has become impossible in most parts of the country—and it will continue for almost as long as there are people living in this war-torn region. Jordan—a country just short of 10 million inhabitants—currently hosts more than a million refugees. Turkey hosts almost two million.

Faced with this disaster in its neighbourhood, what do the EU and its member states do? Exactly what Foucault predicted. Germany apart, they compete in imagination to design policies making sure refugees don’t arrive, and send ever-clearer deterrent signals. Austria has unilaterally fixed quotas on the number of asylum seekers that will be accepted at its border each day, effectively leaving bankrupt Greece to handle the burden of the influx alone. A week previously, French prime minister Manuel Valls announced that France and Europe “cannot accept more refugees.” His country originally agreed to receive 30,000 refugees over two years. To put that in perspective in terms of population size, if France was a village of 2,200 inhabitants, it would accept no more than a single person over that time.

Makes sense, but most won’t want to. Greek government indicates it wants to start moving people out of Idomeni as per Sunday. Reports of dozens of sick children.

• Refugees At Border Should Move To Camps, Says Greek Minister (AP)

Greece’s public order minister says refugees living in a squalid camp at the country’s border with Former Yugoslav Republic of Macedonia (FYROM) must accept that the border is shut and move to organized facilities. Nikos Toskas says the country can provide better conditions in other camps within 10-20 kilometers (6-12 miles) of the Idomeni crossing, where up to 14,000 people live in a waterlogged tent city. Toskas told state ERT TV Wednesday that Greece can offer “no serious support” to such a large number of people gathered in one spot. He said authorities will hand out fliers telling refugees seeking to reach central Europe that “there is no hope of you continuing north, therefore come to the camps where we can provide assistance.” More than 36,000 transient refugees and migrants are stuck in financially struggling Greece.

42,000 refugees stuck in Greece today. One week from now, it’ll be over 60,000.

• Conditions At Idomeni Refugee Camp Worsen By The Day (Kath.)

Refugees were still flowing into the Idomeni border camp in northern Greece Wednesday, despite the complete border closure by authorities in the Former Yugoslav Republic of Macedonia over the last few days, while torrential rain has made conditions even worse. “The situation is stifling as more people are arriving daily on foot,” the coordinator of the Hellenic Red Cross in northern Greece, Despina Filipidaki, told Kathimerini on Wednesday. “The biggest problem is that the bad living conditions are worsening the health problems,” she added. According to the latest estimates, more than 12,000 refugees are camped there in deplorable conditions while a further 3,050 are at Piraeus port, bringing the total number of migrants throughout Greece to 35,945.

Government sources told Kathimerini that the total cost of managing the crisis has risen to 278 million euros but that EU assistant funds are on the way. Giorgos Kyritsis, spokesman for the Coordinating Body for the Management of Migration, reiterated Wednesday that the main priority is to eventually evacuate Idomeni and “transfer people to structures affording better living conditions.” But, he said, it won’t be an easy task to convince the refugees. Nor will it be easy to overcome the reaction of locals in other areas where shelters are being erected.

No comment anymore.

• Five Iranians, Afghans Drown Trying To Reach Greece (Reuters)

Five migrants, including a baby, hoping to reach Europe via Greece drowned when their speedboat capsized off the Turkish coast, Dogan News Agency said on Thursday. The Turkish Coast Guard rescued nine people after they called for help late on Wednesday and recovered five bodies, it said. The group, comprised of Afghans and Iranians, were trying to reach the Greek island of Lesvos in the Aegean Sea. The EU has offered Turkey billions of euros in aid to curb illegal migration. Under a draft deal struck on Monday, Turkey agreed to take back all irregular migrants in exchange for more funding, faster visa liberalisation for Turks, and a speeding up of Ankara’s long-stalled EU membership talks. The aim is to discourage illegal migrants and break the grip of human smugglers who have sent them on perilous journeys across the Aegean. But migrants have continued to try to cross from Turkey’s coast in recent days.