NPC Pittsburg Water Heater Co., Washington DC 1920

Hendry finds trouble sticking to his bull position.

• Hugh Hendry: “If China Devalues By 20% The World Is Over” (ZH)

For now, as we showed just ten days ago, those short the Yuan have swung to wildly profitable to losing money as both the USD has slid and the Yuan has spiked, although both of these trades appear to be reversing now. Needless to say, Hendry disagrees with the China contrarians and believes that the way to fix the Chinese economy is through a stronger currency, even if there is no logical way how that could possibly work when China’s debt load is 350% of GDP while its NPLs are over 10% and rising.

So, borrowing form a favorite Keynesian trope, one where when the countrfactual to his prevailling – if incorrect – view of the world finally emerges, Hendry is convinced that a 20% devaluation would lead to global devastation; the same way if Paulson did not get Congress to sign off on his three page term sheet that would lead to the “apocalypse.” Only unlike Paulson who only hinted at a Mad Max world, for Hendry the alternative to him being right is a very explicit doomsday scenario, as he explains in the following excerpt from his RealVision interview:

Tomorrow we wake up and China has devalued 20%, the world is over. The world is over. Euro breaks up. The world is over. The euro breaks up. Everything hits a wall. There’s no euro in that scenario. The US economy, I mean everything hits a wall! Everything hits a wall!

The dollar strength that you imagined is devastation because you just eliminated dollars. They’re a scarce commodity. You’ve wiped them out. And China is a pariah state.

It’s a ‘Mad Max’ movie, right. OK, China gets to be the king in ‘Mad Max’ world. How appealing is that? There is no world after the tomorrow where China devalues by 20%. There is no world. Yeah, it’s looney tunes to believe that, people say, ‘oh wow, they needed to catch a break.’

Their share of world trade has never been higher. They’re facing no pressure, immense terms of trade improvement, and you would destroy world trade. World trade is down 25%. You would probably have passport restrictions, the world is over.

And while it is clear on which side of the Yuan Hugh is currently positioned (Hendry’s Eclectica is down 2.1% through March 18 and -5.9% YTD) either directly or synthetically, we can’t wait to see who is right in the end: China and its central bank (as well as Hugh Hendry) or reason and common sense (as well as some of the smartest hedge funds in the world).

Mike Maloney’s a TAE fan.

• The Great Deflation: Stocks To Plunge 80-90% – Harry Dent (Maloney)

Look out below.

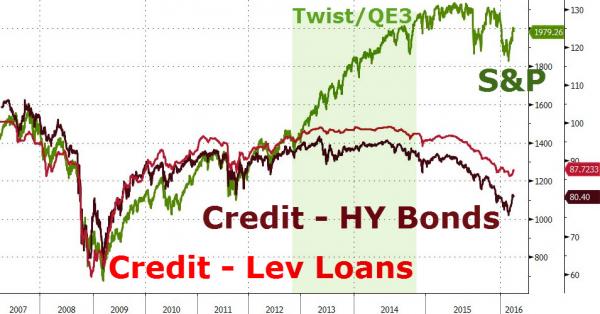

Buybacks blacked out, option expiration ramp over, and real investors fleeing… what happens next?

Dip, Jawbone, Rip… Repeat…

And close-up…

But this time it’s different, 150 days of almost perfect correlation and co-movement means nothing – right?

Insane that this is possible.

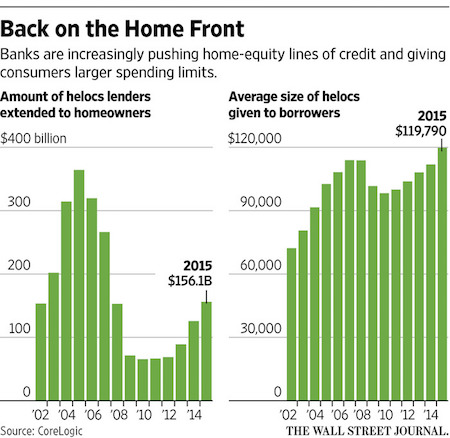

• US Banks Ramp Up Push for Home-Equity Lines (WSJ)

At hardware stores along the U.S. East Coast in recent weeks, TD Bank has been trying to persuade shoppers to think bigger than paint and plumbing supplies: The bank wants them to start taking cash out of their homes again. The TD Bank tour bus, equipped with a galley kitchen and iPads where homeowners can start the application process, is part of a marketing push unusual for the mortgage industry since the housing bust. As the broader mortgage market remains in the doldrums, banks are again touting home-equity lines of credit, which allow homeowners to draw down the equity in their home as they need the cash, as well as cash-out refinances, which involve taking cash out of a home while refinancing and ending up with a larger mortgage balance.

The effort is gaining steam as banks try to offset faltering mortgage originations and a refinancing wave that is fizzling out. Lenders are betting that offers for home-equity lines of credit, or helocs, will resonate with many borrowers whose home values are higher than they were just a couple of years ago and who need cash for renovations or other expenses after holding on to their homes for longer than expected. Lenders extended just over $156 billion in home-equity lines of credit last year, the largest dollar amount since 2007, the beginning of the housing bust, according to new figures from mortgage-data firm CoreLogic. That marks a 24% increase from 2014 and a 138% spike from 2010 when new approvals hit a low point. The average line amount extended to homeowners last year reached a record $119,790, according to the firm, which tracks the data back to 2002.

No. 1 worry.

• China Warns Officials: No Unrest, Or Lose Your Job (WSJ)

In China, the timing of an announcement is sometimes more significant than the announcement itself. The Communist Party’s Central Committee and the State Council, China’s cabinet, this week warned party and state officials that they will lose their jobs if they fail to control public unrest. That’s not altogether surprising: on one level,it’s just a restatement of longstanding practice. “For more than 10 years, one of the assessment criteria for promotion of regional officials is the extent to which they can minimize protests,” said Willy Lam, a China politics analyst at the Chinese University of Hong Kong. “So most local officials pull out all stops to prevent petitioners going to Beijing.” But this week’s announcement marks the first time authorities have come up with a definitive public statement explicitly warning party and state officials “at all levels” that their jobs are on the line, state media said.

Why the urgency? The policy announcement comes two weeks after hundreds of unpaid coal workers took to the streets in the gritty northeastern city of Shuangyashan, after their provincial governor claimed a troubled coal company there did not owe its miners any wages. The governor, Lu Hao, later said he misspoke. Mr. Lu remains in office. It’s quite likely the Shuangyashan incident was pivotal in galvanizing the State Council and the party’s Central Committee, Mr. Lam and others say. The incident, widely publicized in the media, came in the thick of China’s annual meeting of its top legislature in Beijing, where Mr. Lu made his comments. At the meeting, known as the lianghui or “two sessions,” a battery of top officials including Premier Li Keqiang repeatedly vowed that they would be able to navigate a sharp slowdown in the economy without seriously affecting workers caught in the transition.

Mr. Li’s public positioning percolates through to a wide swathe of policy in the immediate wake of the congress. “In China, the political calendar doesn’t start in January – it starts with the lianghui in March,” human rights activist Hu Jia said. Government officials are likely worried that the Shuangyashan incident and others could inflict a political cost on the leadership by highlighting issues such as the deficit of labor rights in China, Mr. Hu said. Party chiefs face a difficult task. Over the next five years, they need to shut down millions of tons of industrial capacity that’s making China’s economy inefficient. This means downsizing scores of steel, coal and other large industries that currently employ hundreds of thousands of workers. They have promised to do this without large-scale layoffs. Those displaced, Mr. Li said, would be given new jobs or government assistance.

These promises now hang in the balance. The Shuangyashan incident came amid a surge in other forms of public unrest. Data from labor rights watchdog China Labour Bulletin show a 200% increase in the number of strikes, industrial action and other protests occurring in China from July last year to January this year. Disparate groups of Chinese, from jobless migrant workers to angry taxi drivers have taken to the streets to protest a new era of economic dislocation. The slowing economy has wiped out at least 156 billion yuan ($24 billion) worth of investments in wealth management products across the country, mostly involving small investors. Many of these failures have sparked public protests. Dogged by the prospect of more layoffs and deepening economic woes, the question looms: How many officials will China axe?

Not because it wants to come clean.

• China Coal Use Slides Further On Weakening Industrial Demand (BBG)

China’s coal use is forecast to fall a third year as industrial output slows, adding force to President Xi Jinping’s drive to cut overcapacity and dimming the hopes of global miners for an uptick in demand by the world’s biggest consumer. Demand will slide 2% this year and prices will remain at a low level, according to the state-run Xinhua News Agency, citing Xu Liang, deputy secretary general of the China Coal Industry Association. Output by the world’s largest producer will also fall by 2%. Consumption has weakened amid a push to use cleaner fuels and shift a slowing economy away from heavy industry. Demand for coal, which accounted for 64% of the country’s total energy use last year, contracted 3.7% last year, following a 2.9% decline in 2014, according to the National Bureau of Statistics.

“This year’s coal situation is equally bleak,” Xinhua quoted Xu as saying. China’s easing coal appetite has helped push prices in Asia to their lowest since 2006, punishing mining companies and prompting the government to propose capacity cuts that threaten the jobs of 1.3 million coal miners. By cutting capacity in the next two to three years, production could fall to about 3.5 billion to 3.6 billion tons, balancing supply and demand, Xu said. The country aims to eliminate as much as 500 million metric tons of coal capacity by 2020, almost 9% of its total. Coal output dropped 3.3% to 3.75 billion metric tons last year, while consumption slipped to 3.965 billion tons, both sliding from record highs in 2013, according to Xu. Use of the fuel in power generation dropped 6.2% last year, while demand from industries including steel, cement and glass making declined.

“..when an economist talks of economic growth being above or below trend, he is talking about a measure that has no place in sound economic reasoning, and that is gross domestic product.

• Guessing The Future Without Say’s Law (Macleod)

With Japanese and Eurozone interest rates becoming increasingly negative, and the Fed backing off from at least some of the planned increases in the Fed funds rate this year, economists are reassessing the interest rate outlook. Economists lack consensus, with some expecting yet more easing, based on the apparent collapse in cross-border trade last year. The fact that the Bank of Japan and the European Central Bank see fit to pursue increasingly aggressive monetary reflation is taken as evidence of underlying difficulties faced in these key economies. And lingering doubts about the sustainability of China’s credit bubble point to a high risk of a credit-induced slump in the world’s growth engine.

Other economists, citing official US data and relying on the Fed’s statements, point out that unemployment levels have more than satisfied the Fed’s target, and that core inflation has picked up to the point where the Fed would be fully justified to increase interest rates over the course of this year, or risk overheating in 2017. These two opposite camps conflict in their forecasts, but where they fundamentally differ is in expectations of future economic growth. Far from displaying the highest levels of macroeconomic discipline, their diversity of opinion should alert us that their forecasts may lack sound theoretical foundation. The purpose of reasoned theory is to reduce uncertainty, not promote it. And the explanation for most of the failures behind modern macroeconomic thinking is the substitution of market-based economics by economic planning.

The fact that today’s macroeconomics dismisses the laws of the markets, commonly referred to by economists as Say’s law, explains all. Subsequent errors confirm. The many errors are a vast subject, but they boil down to that one fateful step, and that is denying the universal truth of Say’s law. Say’s law is about the division of labour. People earn money and make profits from deploying their individual skills in the production of goods and services for the benefit of others. Despite the best attempts of Marxism and Keynesianism along with all the other isms, attempts to override this reality have always failed. The failure is not adequately reflected in government statistics, which have evolved to the point where they actually conceal it. So when an economist talks of economic growth being above or below trend, he is talking about a measure that has no place in sound economic reasoning, and that is gross domestic product.

The CIA still has a lot of power to the south.

• Seven Ugly Latina Sisters In Deep Political Trouble (Bawerk)

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In either case, it’s going to be a classic example of too little too late where the seven ugly sisters have committed at least seven deadly sins when it comes to resource mismanagement over the past decade. This isn’t about whether crisis can be avoided, but how bad the impacts will be. Another ‘lost Latino decade’ beckons. The ugliest twins are obviously Brazil and Venezuela right now.

We firmly expect Rousseff to be impeached next month on the back of endless corruption scandals, and the drastically ill-judged return of Lula that poured far more oil on corruption cover up flames. Watch for Michel Temer to take over the reins of a coalition PMDB government, busily negotiating posts behind closed doors with other players to tee up a formal Worker’s Party split to form a caretaker government through to 2018. How much Temer can get done depends on how far the outstanding ‘car wash’ scandal still rubs off on PMDB factions for major economic reforms, where the rot still runs pretty deep. Initial rhetoric (and inevitable market lifts) on supposed ‘structural reforms’ and far broader liberalisation measures remain unlikely to play through. Although it’s possible Petrobras might push through 2017 licencing rounds purely for political appearances, it’s not going to deliver tangible results in current price environments.

Dig just ‘under the salt’, and Petrobras leverage will remain high; local content even higher. Until Brazil can properly clear its electoral decks in 2018 Mr. Temer is going to have a very limited mandate. If anything, his core challenge is trying to make sure his caretaker outfit doesn’t end up ‘washed out’ day one, given Temer is by no means beyond political reproach, with the PMDB basically as corrupt as the ruling PT. The smart move for Brazil would actually be calling fresh elections with the TSE (electoral authority) invalidating the entire Rousseff-Temer 2014 ticket to put a line under what currently shapes up to be the worst commodity driven economic crash Brazil has ever experienced. Regrettably, Brazilian politics has nothing to do with national interests at this stage, and everything to do with narrow self-preservation societies.

“..most proposals have the wage increasing about a dollar a year until it reaches $15 an hour”

• California Lawmakers, Unions Reach Deal for $15 an Hour Minimum Wage

California legislators and labor unions on Saturday reached an agreement aims to raise the state’s minimum wage to $15 from $10 an hour, a state senator said, a move that would make for the highest statewide minimum in the nation. Sen. Mark Leno (D., San Francisco) said the proposal would go before the Legislature as part of his minimum-wage bill that stalled last year. Mr. Leno didn’t confirm specifics of the agreement, but most proposals have the wage increasing about a dollar a year until it reaches $15 an hour. The Los Angeles Times, which first reported the deal, said the wage would rise to $10.50 in 2017, with subsequent increases to take it to $15 by 2022. Businesses with fewer than 25 employees would have an extra year to comply.

At $10 an hour, California already has one of the highest minimum wages in the nation along with Massachusetts. Only Washington, D.C., at $10.50 an hour is higher. The hike to $15 would make it the highest statewide wage in the nation by far, though raises are in the works in other states. The deal means the issue won’t have to go to the ballot, Mr. Leno said. One union-backed initiative has already qualified for the ballot, and a second, competing measure is also trying to qualify. Union leaders, however, said they wouldn’t immediately dispense with planned ballot measures. Sean Wherley, a spokesman for SEIU-United Healthcare Workers West, confirmed that his group was involved in the negotiations. But he said the group would continue pushing ahead with its initiative on the ballot. “Ours is on the ballot. We want to be certain of what all this is,” Mr. Wherley said.

The Econocene.

• The Church of Economism and Its Discontents (EI)

The global human population increased from approximately 1 billion in the year 1800 to 7 billion in 2011. Over this period, the field of economics emerged, transforming political discourse. The institutional conditions for market expansion were put in place, and the success of markets suppressed myriad other ways societies have organized themselves. Economic activity per capita increased somewhere between 10 and 30-fold, resulting in a 70 to 210-fold increase in total economic activity.1 Population growth has slowed significantly in recent decades, but both economic growth through market expansion and its attendant environmental destruction have only continued.

Econocene is a fitting term for this new era because it makes us think about the expanding market economy, the ideological system that supports it, and its impact on society and the environment. Reflecting on environmental boundaries led ecological economist Herman Daly to propose limits on material throughput. Environmental economists propose taxes on greenhouse gas emissions and the creation of markets to resolve environmental conflicts. While acknowledging the importance of making markets work within the limits of nature and for the common good, I will explore how this new dominance of economic thinking, which I will call economism, has reshaped the diverse cultures of the world and come to function as a modern secular religion.

An advantage of the term Econocene is that it evokes the everyday cosmos of modern people. Artifacts of the economy—towering buildings, sprawling shopping malls, and swirling freeways—surround the 50% of the globe’s population who live in cities. A combination of smog and bright lights now obliterates the starry heavens so important to humanity’s historic consciousness and so humbling to our species’s historic sense of importance, focusing our attention on the economic constructs all around us. The cosmos reflected in the term Econocene includes not only the material artifacts of the economy, but also the market relations that bind us and define our place in the system. Urban dwellers are now fully dependent on markets for material sustenance.

They awake to radio announcers discussing supposedly significant changes in exchange rates, stock markets, and the proportion of people looking for work. The dominance of the market is not just an urban phenomenon: its “invisible hand” guides rural life as well. The crops planted reflect expected future prices, and soils reflect their history of economic use. Farmers have become so specialized that they, too, buy most of their food in supermarkets. In order to grapple with the challenges of this new era, we need to give it a name that resonates with people’s lived experiences.

The role of Google and Facebook clearly warrants more scrutiny.

• The State Has Lost Control: Tech Firms Now Run Western Politics (Morozov)

[..] The grim reality of contemporary politics is not that it’s impossible to imagine how capitalism will end – as the Marxist critic Fredric Jameson once famously put it – but that it’s becoming equally impossible to imagine how it could possibly continue, at least, not in its ideal form, tied, however weakly, to the democratic “polis”. The only solution that seems plausible is by having our political leaders transfer even more responsibility for problem-solving, from matters of welfare to matters of warfare, to Silicon Valley. This might produce immense gains in efficiency but would this also not aggravate the democratic deficit that already plagues our public institutions? Sure, it would – but the crisis of democratic capitalism seems so acute that it has dropped any pretension to being democratic; hence the proliferation of euphemisms to describe the new normal (with Angela Merkel’s “market-conformed democracy” probably being the most popular one).

Besides, the slogans of the 1970s that were meant to bolster the democratic pillar of the compromise between capital and labour, from economic and industrial democracy to codetermination, look quaint in an era where workers of the “gig economy” cannot even unionise, let along participate in some broader management of the enterprise. There’s something even more sinister afoot though. “Buying time” no longer seems like an adequate description of what is happening, if only because technology companies, even more so than the banks, are not only too big too fail but also impossible to undo – let alone replicate – even if a new government is elected. Many of them have already taken on the de facto responsibilities of the state; any close analysis of what’s happening with “smart cities” – whereby technology firms become key gateways to essential services of our cities – easily confirms that.

In fact, technology firms are rapidly becoming the default background condition in which our politics itself is conducted. Once Google and Facebook take over the management of essential services, Margaret Thatcher’s famous dictum that “there is no alternative” would no longer be a mere slogan but an accurate description of reality. The worst is that today’s legitimation crisis could be our last. Any discussion of legitimacy presupposes not just the ability to sense injustice but also to imagine and implement a political alternative. Imagination would never be in short supply but the ability to implement things on a large scale is increasingly limited to technology giants. Once this transfer of power is complete, there won’t be a need to buy time any more – the democratic alternative will simply no longer be a feasible option.

Some questions must be asked. If nobody else does that, you get Trump.

• Trump Questions US Position On OPEC Allies, NATO, China (NY Times)

Donald J. Trump, the Republican presidential front-runner, said that if elected, he might halt purchases of oil from Saudi Arabia and other Arab allies unless they commit ground troops to the fight against the Islamic State or “substantially reimburse” the United States for combating the militant group, which threatens their stability. “If Saudi Arabia was without the cloak of American protection,” Mr. Trump said during a 100-minute interview on foreign policy, spread over two phone calls on Friday, “I don’t think it would be around.” He also said he would be open to allowing Japan and South Korea to build their own nuclear arsenals rather than depend on the American nuclear umbrella for their protection against North Korea and China. If the United States “keeps on its path, its current path of weakness, they’re going to want to have that anyway, with or without me discussing it,” Mr. Trump said.

And he said he would be willing to withdraw United States forces from both Japan and South Korea if they did not substantially increase their contributions to the costs of housing and feeding those troops. “Not happily, but the answer is yes,” he said. Mr. Trump also said he would seek to renegotiate many fundamental treaties with American allies, possibly including a 56-year-old security pact with Japan, which he described as one-sided. In Mr. Trump’s worldview, the United States has become a diluted power, and the main mechanism by which he would re-establish its central role in the world is economic bargaining. He approached almost every current international conflict through the prism of a negotiation, even when he was imprecise about the strategic goals he sought.

He again faulted the Obama administration’s handling of the negotiations with Iran last year — “It would have been so much better if they had walked away a few times,” he said — but offered only one new idea about how he would change its content: Ban Iran’s trade with North Korea. Mr. Trump struck similar themes when he discussed the future of NATO, which he called “unfair, economically, to us,” and said he was open to an alternative organization focused on counterterrorism. He argued that the best way to halt China’s placement of military airfields and antiaircraft batteries on reclaimed islands in the South China Sea was to threaten its access to American markets. “We have tremendous economic power over China,” he argued. “And that’s the power of trade.” He did not mention Beijing’s ability for economic retaliation.

Keep it peaceful.

• Greece Removes Migrants From FYROM Border Camp (AFP)

Greece has begun evacuating refugees from the main Idomeni camp on the Macedonia border, while the flow of refugees arriving on the Aegean islands has slowed to a trickle, officials said on Saturday. Eight buses transported around 400 refugees from Idomeni to nearby refugee camps on Friday, police sources said. A dozen more buses were waiting for migrants reluctant to leave the border, which has been shut down since earlier this month. “People who have no hope or have no money, maybe they will go. But I have hope, maybe something better will happen tomorrow, maybe today,” said 40-year-old Fatema Ahmed from Iraq, who has a 13-year-old son in Germany and three daughters with her in the camp. She said she would consider leaving the squalid Idomeni camp – where people are sheltering even on railway tracks – if the Greek government decides to give every migrant family “a simple house”.

Those persuaded to board the first buses were mainly parents with children who can no longer tolerate the difficult conditions. Janger Hassan, 29, from Iraqi Kurdistan, who has been at the Idomeni camp for a month with his wife and two young children, thinks he will probably leave. “There’s nothing to do here. “The children are getting sick. It’s a bad situation the last two days: it’s windy, sometimes it’s raining here,” he said. “We don’t have a choice. We have to move,” he said. Desperation was evident in the camp. One tent bore the slogan: “Help us open the border”. A total of 11,603 people remained at the sprawling border camp on Saturday, according to the latest official count. Giorgos Kyritsis, spokesman of the SOMP agency, which is coordinating Athens’s response to the refugee crisis, said the operation to evacuate Idomeni will intensify from Monday.

“More than 2,000 places can be found immediately for the refugees that are at the Idomeni camp and from Monday on, this number can double,” Kyritsis added, pledging to create 30,000 more places in the next three weeks in new shelters. Meanwhile, the flow of refugees arriving in Greece is slowing. Athens on Thursday said no migrants had arrived on its Aegean islands in the previous 24 hours, for the first time since the controversial EU-Turkey deal to halt the massive influx came into force at the weekend. The agreement, under which all migrants landing on the Greek islands face being sent back to Turkey, went into effect last Sunday. Despite the deal, 1,662 people arrived on Monday, but this fell to 600 on Tuesday and 260 on Wednesday.

“Today we had little people, but if we have all the people then we will succeed.”

• The Bar at the End of the Road (WSJ)

A tiny bar in a rundown train station in a remote Greek town has become the center of the universe for the migrants stuck at the border of Macedonia. When Macedonia shut its border to Greece in early March, the Greek border town of Idomeni, once a quick stopover for migrants on route to Europe became the end of the line for many. At least for now. But that isn’t stopping many migrants from trying to make their way across the border and beyond. On a recent cold and wet few days at the camp, migrants hang out in the bar for the warmth it provides and the food and friendship it offers. People talk over chips, pizza and beer, but mostly take solace in having a temporary escape from the misery of the camp. Out of their cold, muddy tents and playing games like checkers and backgammon, or connecting with distant relatives on their phones.

Groups are usually separated by nationality, but talking about how to get out of Greece and farther into Europe is a topic everyone discusses. One morning, someone had a plan to cross a fast-flowing, ice-cold river to the border, despite the fence and increased police presence. It was a dangerous plan, but any escape would do. Someone had a printout of a map showing the route across the river all the way to the border. People study it and take photos of it. Zakaria, a migrant from Aleppo, Syria, says, “I want to continue my studies. I don’t care which country. It can be Germany or another country so long as I can continue my studies. I will wait here until I cross somehow. I would go back home to Syria if I could. Believe me I don’t want to be here, I want to be home, but I don’t even have a home there. No country and no home.”

By noon that day, hundreds of people amassed at the meeting point on the map. Following the trail through forests and fields, this group of men and women, young and old carry their belongings and eventually come to the river. The water is freezing. People are yelling and crying. Children are terrified. But they made it across. They were lucky. Earlier that morning, a separate group attempted to cross and three people reportedly died attempting the cross. After resting, they continue to the border, but are turned back by the Macedonian army. Back at the camp, they are exhausted and downtrodden, but they have the bar, and talk soon turns to finding another way to escape. Sarwar, a migrant from Lahore, Pakistan, who has been in Idomeni for 16 days and just returned from trying to cross the border says, “They stop us today but we will try again. We are many, many people and more come now. Soon we can run through the fence. Today we had little people, but if we have all the people then we will succeed.”