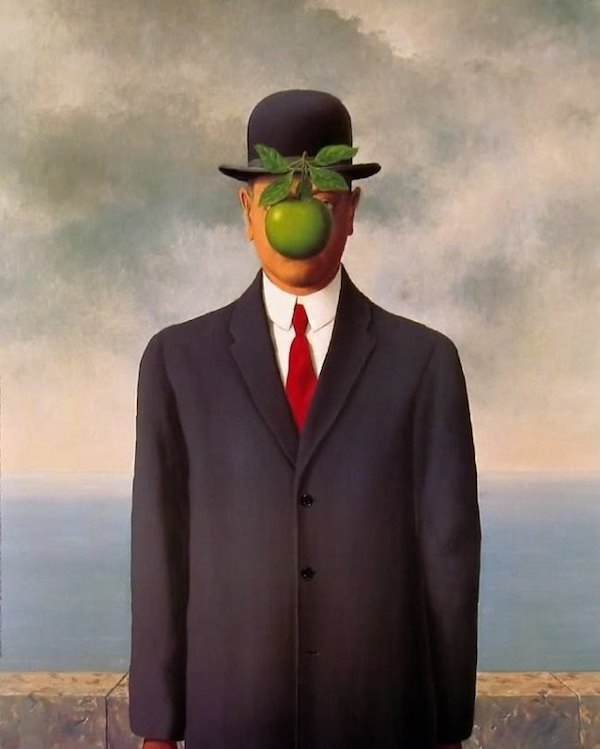

René Magritte The son of man 1946

We take John Hussman seriously.

• ‘Prophet Of Doom’ Predicts Stock Market Will Plunge More Than 50% (MW)

John Hussman, president of Hussman Investment Trust, describes himself as an economist, a philanthropist, and a “realist optimist often viewed as a prophet of doom” on his Twitter profile. That last bit may be the one investors care about on Monday as the stock market shows signs of unraveling on the back of the tech sector’s stumble. Hussman’s claim to fame includes forecasting the market collapses of 2000 and 2007-2008. Since then, however, he’s also become known as a permabear for his repeated calls for sharp stock market declines and his oft-repeated mantra of “overbought, overvalued, overbullish” as the bull market continues into its ninth year by some measures. Hussman says he’s learned from and addressed past errors.

In his most recent call, he argued that measured “from their highs of early-2018, we presently estimate that the completion of the current cycle will result in market losses on the order of -64% for the S&P 500 index, -57% for the Nasdaq-100 Index, -68% for the Russell 2000 index, and nearly -69% for the Dow Jones Industrial Average.” He admits the numbers seem extreme but says they are backed up what he refers to as the “Iron Law of Valuation.” “The higher the price investors pay for a given set of expected future cash flows, the lower the long-term investment returns they should expect. As a result, it’s precisely when past investment returns look most glorious that future investment returns are likely to be most dismal, and vice versa,” he writes.

Tech.

• Prepare For Biggest Stock-Market Selloff In Months – Morgan Stanley (MW)

The U.S. stock market has been partying all throughout July, and a hangover is coming. That is according to analysts at Morgan Stanley, who said that Wall Street’s rally is showing signs of “exhaustion,” and that with major positive catalysts for trading now in the rearview mirror, there’s little that could continue to propel equities higher. “With Amazon’s strong quarter out of the way, and a very strong 2Q GDP number on the tape, investors were finally faced with the proverbial question of ’what do I have to look forward to now?’ The selling started slowly, built steadily, and left the biggest winners of the year down the most. The bottom line for us is that we think the selling has just begun and this correction will be biggest since the one we experienced in February,” the investment bank wrote to clients.

The decline “could very well have a greater negative impact on the average portfolio if it’s centered on tech, consumer discretionary and small-caps, as we expect.” A correction is technically defined as a decline of at least 10% from a recent peak. Both the Dow Jones Industrial Average DJIA and the S&P 500 corrected in early February, on concerns that inflation was returning to markets. While the Dow remains in correction territory—meaning it hasn’t yet risen 10% from its low of the pullback—the S&P exited just last week, following its longest stint in correction territory since 1984. The Nasdaq Composite Index never fell into correction.

Infinity and beyond.

• US Treasury Raises 2018 Borrowing Need To $1.33 Trillion (ZH)

America’s funding needs are starting to grow at a dangerous pace. Even before the NYT reported of Trump’s startling suggestion of a further $100 billion tax cut in the form of an inflation-adjusted capital gains tax cost basis which mostly benefits the wealthy, earlier today the U.S. Treasury said it expects to borrow $56 billion more during the third quarter than previously estimated, while market participants expect shorter-dated Treasuries to absorb the brunt of the new supply as the Trump administration grapples with a mushrooming budget deficit.

In the Treasury’s latest quarterly Sources and Uses table, it revealed that it expects to issue $329 billion in net marketable debt from July through September, and $56 billion more than the $273 billion estimated three months ago, in April. assuming an end-of-September cash balance of $350 billion, matching its previous estimate. It also forecast $440 billion of borrowing in the final three months of the year, with a $390 billion cash balance on December 31. The borrowing estimate for the third quarter is the highest since the same period in 2010 and the fourth largest on record for the July-September quarter, according to Reuters. In the second quarter, net borrowing totaled $72 billion, slightly below the earlier prediction of $75 billion.

The US fiscal picture continues to darken as a result of rising social security costs, military spending and debt service expenses while corporate tax income is declining after last year’s tax reforms. As a result, the federal budget deficit is expected to reach $833 billion this year, up from $666 billion in the budget year ended last September, a number that is well below the net funding demands for the US Treasury. The new projections put total net borrowing at $769 billion for the second half of 2018 and a whopping $1.33 trillion for the whole year.

The Fed has been granted far too much power. We’re going to regret that.

• QE Turns Ten (Stephen Roach)

November 2018 will mark the tenth anniversary of quantitative easing (QE) — undoubtedly the boldest policy experiment in the modern history of central banking. The only thing comparable to QE was the US Federal Reserve’s anti-inflation campaign of 1979-1980, orchestrated by the Fed’s then-chair, Paul Volcker. But that earlier effort entailed a major adjustment in interest rates via conventional monetary policy. By contrast, the Fed’s QE balance-sheet adjustments were unconventional and, therefore, untested from the start.

[..] The most important lesson pertains to traction — the link between Fed policy and its congressionally mandated objectives of maximum employment and price stability. On this count, the verdict on QE is mixed: The first tranche (QE1) was very successful in arresting a wrenching financial crisis in 2009. But the subsequent rounds (QE2 and QE3) were far less effective. The Fed mistakenly believed that what worked during the crisis would work equally well afterwards. An unprecedentedly weak economic recovery – roughly 2% annual growth over the past nine-plus years, versus a 4% norm in earlier cycles – says otherwise. Whatever the reason for the anemic recovery – a Japanese-like post-crisis balance-sheet recession or a 1930s style liquidity trap – the QE payback was disappointing.

From September 2008 to November 2014, successive QE programs added $3.6 trillion to the Fed’s balance sheet, nearly 25% more than the $2.9 trillion expansion of nominal GDP over the same period. A comparable assessment of disappointing interest-rate effects is reflected in recent “event studies” research that calls into question the link between QE and ten-year Treasury yields. A second lesson speaks to addiction – namely, a real economy that became overly reliant on QE’s support of asset markets. The excess liquidity spawned by the Fed’s balance-sheet expansion not only spilled over into equity markets, but also provided support for the bond market. As such, monetary policy, rather than market-based fundamentals, increasingly shaped asset prices.

QE, tax cuts, it’s all just a great wealth transfer.

• Fruits of the Great 2017 GOP Tax Cut Scam (Lendman)

David Stockman estimates the great GOP tax cut heist will increase the federal debt to around $35 trillion by 2028. Most discretionary US spending goes for militarism, war-making, corporate welfare, and police state harshness. According to Americans for Tax Fairness (ATF), the fruits of last year’s great GOP tax cut heist were as follows: 4.3% of workers got wage hikes or bonuses – 6.7 million out of 155 million. Only a handful of employers provided them so far – 407 out of 5.9 million. Corporate predators are getting 11-fold as much in tax breaks as they’re giving workers in extra pay and bonuses – $77 billion v. $7 billion.

Corporate predators are spending 88 times the amount on stock buybacks as on worker wage hikes and bonuses – $7 billion v. $617 billion. Trump’s highly touted “middle class miracle” was a colossal Big Lie. It’s been a bonanza for corporate predators, high net-worth households, and real estate tycoons like himself – a scam for ordinary Americans. It’s ballooning the deficit, social benefits being slashed to help pay for it, a clearly transparent wealth transfer scheme. Economists know tax cuts don’t create jobs and stimulate growth unless benefits help workers substantially. When money is in the pockets of ordinary people, they spend it, best accomplished through higher wages, at least keeping pace with inflation.

Post-9/11, America has been thirdworldized to benefit corporate predators and high net-worth individuals at the expense of working households. Ordinary Americans have been scammed to make privileged ones richer. Separately, according to Americans for Tax Fairness (ATF), healthcare insurers intend instituting huge premium increases in 2019. They’ll range from around 12% to a whopping 91% requested by a Maryland insurer.

Credit Cards ‘R’ Us.

• Britain’s Borrowing Binge Continues As Brexit Looms (Ind.)

Britain’s credit card fuelled spending binge continues apace, according to the latest figures from the Bank of England. Lending via plastic rose by an annualised 9.5 in June, outpacing other forms of unsecured credit (8.5 per cent). Mortgage lending, by contrast, ticked up by a more modest 3.2 per cent. The release of the figures followed a report by the Office for National Statistics that last week found UK consumers collectively spent more than they earned in 2017, the first time that has happened in almost 30 years. It looks like we’re due a repeat this year. How much of a worry is this? Regulators say most people can afford to repay what they have borrowed.

However, the Prudential Regulatory Authority, that oversees institutions’ financial soundness, last year undertook a review of consumer lending that resulted in what could be read as a shot across the industry’s bows. The Financial Conduct Authority, meanwhile, tweaked its rules in July, making it clear that it wanted lenders to asses not just whether consumers can repay what they have borrowed but whether they can do so “affordably and without this significantly affecting their wider financial situation”. It follows a speech in March by Jonathan Davidson, the watchdog’s director of supervision, in which he said that “a firm whose business model is predicated on selling products to customers who can’t afford to repay them is not acceptable, nor is it a sustainable long-term strategy”.

Yeah, the UK is really in a position to utter threats.

• Brexit: UK Warns EU Of Tit-For-Tat Measures Over Financial Services (G.)

UK negotiators have told their counterparts in Brussels that about 7,000 European-based investment funds that rely on British clients for their cash and profits will be hit by regulators unless the EU changes its position on the City of London after Brexit. As frustration grows within Whitehall at what is seen as a dogmatic position taken by the EU’s chief negotiator, Michel Barnier, the British side has upped the ante by making an implicit threat to EU interests. A section of a UK presentation made to the European commission’s negotiators last week, and seen by the Guardian, says that unless Brussels allows all UK sectors of the City of London to continue to operate after Brexit as they do today, at least initially, obstacles to European financial interests operating in the UK could also be put in place.

The British government says the EU’s “equivalence regime”, under which UK providers would have the right to offer financial services in the European economic area after Brexit, does not cover enough sectors or provide adequate assurances to UK-based banks and fund managers. The UK also wants equivalence decisions to be made collaboratively between Brussels and Whitehall on whether parts of the financial sector will be able to continue to operate across the Channel as regulations diverge after Brexit. As it stands, a declaration of equivalencecan be easily revoked with only 30 days’ notice under existing EU legislation. The EU is resisting, and insists it will not offer a bespoke deal on financial services. It says that what works for US financial services providers will have to work for the UK.

Peace with Russia, peace with Iran, that’s not the playbook, Donald.

• Trump Offer To Meet Iran President Rouhani Dismissed By Both Sides (G.)

Donald Trump has said he would “certainly meet” Iranian president Hassan Rouhani without preconditions, a move that was later rejected by Trump’s own administration and one of Rouhani’s advisers. Speaking during a joint news conference with Italy’s prime minister, Giuseppe Conte, Trump said he would meet Iran “anytime they want to”. “I’ll meet with anybody,” he said. “There’s nothing wrong with meeting.” Asked whether he would set any preconditions, Trump was clear. “No preconditions, no. If they want to meet, I’ll meet any time they want,” he said. “Good for the country, good for them, good for us and good for the world. No preconditions. If they want to meet, I’ll meet.”

Trump’s apparently spontaneous overture marked a significant shift in tone and follows escalating rhetoric in the wake of his dumping in May of the landmark Iran nuclear accord. The administration is set next month to begin reimposing sanctions that had been lifted under the 2015 deal and has been ratcheting up a pressure campaign on the Islamic republic that many suspect is aimed at regime change. After the comment, secretary of state Mike Pompeo appeared to contradict Trump, listing preconditions that had to be met first. He told CNBC on Monday: “If the Iranians demonstrate a commitment to make fundamental changes in how they treat their own people, reduce their malign behaviour, can agree that it’s worthwhile to enter in a nuclear agreement that actually prevents proliferation, then the president said he’s prepared to sit down and have a conversation with him,” he said.

Murray on his time as a UK diplomat.

• The Ubiquity of Evil (Craig Murray)

I had served as First Secretary in the British Embassy in Poland, and bumped up startlingly against the history of the Holocaust in that time, including through involvement with organising the commemoration of the 50th anniversary of the liberation of Auschwitz. What had struck me most forcibly was the sheer scale of the Holocaust operation, the tens of thousands of people who had been complicit in administering it. I could never understand how that could happen – until I saw ordinary, decent people in the FCO facilitate extraordinary rendition and torture. Then I understood, for the first time, the banality of evil or, perhaps more precisely, the ubiquity of evil. Of course, I am not comparing the scale of what happened to the Holocaust – but evil can operate on different scales.

I believe I see it again today. I do not believe that the majority of journalists in the BBC, who pump out a continual stream of “Corbyn is an anti-semite” propaganda, believe in their hearts that Corbyn is a racist at all. They are just doing their job, which is to help the BBC avert the prospect of a radical government in the UK threatening the massive wealth share of the global elite. They would argue that they are just reporting what others say; but it is of course the selection of what they report and how they report it which reflect their agenda.

The truth, of which I am certain, is this. If there genuinely was the claimed existential threat to Jews in Britain, of the type which engulfed Europe’s Jews in the 1930’s, Jeremy Corbyn, Billy Bragg, Roger Waters and I may humbly add myself would be among the few who would die alongside them on the barricades, resisting. Yet these are today loudly called “anti-semites” for supporting the right to oppose the oppression of the Palestinians. The journalists currently promoting those accusations, if it came to the crunch, would be polishing state propaganda and the civil servants writing railway dockets. That is how it works. I have seen it. Close up.

Bye my friends. I’m going to miss you. Something bad.

• World’s Largest King Penguin Colony Has Declined By 90% (G.)

The planet’s largest colony of king penguins has declined by nearly 90% in three decades, researchers have warned. The last time scientists set foot on France’s remote Île aux Cochons – roughly half way between the tip of Africa and Antarctica – the island was blanketed by 2m of the penguins, which stand about a metre tall. But recent satellite images and photos taken from helicopters show the population has collapsed, with barely 200,000 remaining, according to a study published in Antarctic Science. Why the colony on Île aux Cochons has been so decimated remains a mystery.

“It is completely unexpected, and particularly significant since this colony represented nearly one third of the king penguins in the world,” said lead author Henri Weimerskirch, an ecologist at the Centre for Biological Studies in Chize, France, who first set eyes on the colony in 1982. Climate change may play a role. In 1997, a particularly strong El Niño weather event warmed the southern Indian Ocean, temporarily pushing the fish and squid on which king penguins depend south, beyond their foraging range. “This resulted in population decline and poor breeding success for all the king penguin colonies in the region,” Weimerskirch said.

This goes back to 2002. Nothing has changed.

• Charities Damned For ‘Abject Failure’ In Tackling Sexual Abuse (G.)

Charities have shown “complacency verging on complicity” in responding to sexual abuse that is endemic across the sector, according to a damning report by MPs. In the report, the international development committee (IDC) said the aid sector had a record of “abject failure” in dealing with longstanding concerns about exploitation by its own personnel and appeared more concerned for their reputations than for victims. The response to abuse claims has been reactionary and superficial, it added. MPs called for the establishment of an independent aid ombudsman to support survivors and for a global register of aid workers to prevent abusers moving through the system.

Stephen Twigg, the committee chairman, said the sector’s failure to deal with the issue had left victims at the mercy of those who sought to use power to abuse others. The report, published on Tuesday, also criticised the UN, which it said had failed to display sustained leadership in tackling abuse, and said the historical response of the UK’s Department for International Development (DfID) was disappointing. The committee launched its inquiry into sexual exploitation and abuse after revelations that Oxfam covered up claims that its staff had used sex workers while working in the aftermath of the 2010 Haiti earthquake. The sector has faced intense scrutiny, with further allegations of sexual misconduct emerging at Save the Children.

Twigg said the aid sector was first made aware of concerns in 2002, when a report by the UN agency for refugees (UNHCR) and Save the Children documented cases of abuse. Despite this, and a series of other warnings, little action was taken. “There are so many reports that go back over this period of 16 years and the system has failed to respond anything close to adequately over the period,” the Labour MP said. “This is 16 years of failure by the entire international system of governments, the UN and the aid sector.”