Caravaggio Nativity with St. Francis and St. Lawrence 1600

Bette Davis and Joan Crawford were not each other’s biggest fans

I kid you not: plenty people are blaming this on Trump, too.

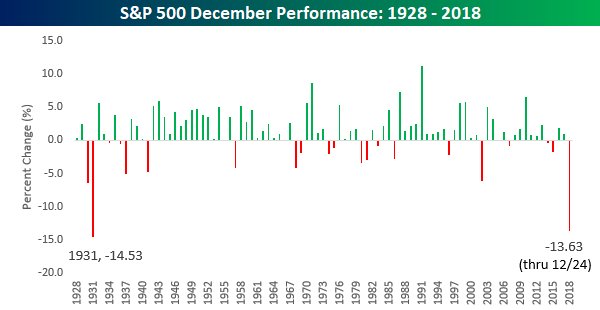

• The Stock Market Just Booked Its Ugliest Christmas Eve Plunge — Ever (MW)

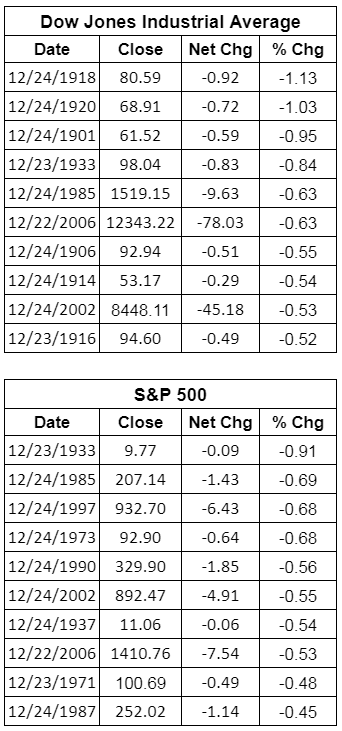

Never mind finding coal in your stocking for the holidays. Wall Street investors scored a rare — and unwanted — gift this year. The S&P 500 index fell by 2.7% Monday, marking the first session before Christmas that the broad-market benchmark has booked a loss of 1% or greater — ever. That statistic has been confirmed by Dow Jones Market Data, which said the largest decline in the index on the trading day before Christmas was Dec. 23 in 1933.

The Dow Jones Industrial Average finished down 653 points, or 2.9%, representing its worst decline on the session prior to Christmas in the 122-year-old blue-chip gauge’s history. Check out the table below from Dow Jones Market Data:

U.S. stock indexes ended trading at 1 p.m. Eastern Time on Christmas Eve and will be closed on Christmas. The current dynamic in the market has it set for its worst monthly and yearly decline in about a decade, amid nagging concerns that the Federal Reserve is normalizing interest rates too rapidly, and that a continuing tariff dispute between China and the U.S. could devolve and help lead to a domestic recession, as international economies are already demonstrating signs of a slowdown. Also stoking anxiety was a tweet from Treasury Secretary Steven Mnuchin to assess the health of the banking system, which has raised some questions about liquidity among those institutions that had not previously been raised. Treasury officials insist that the calls to bank executives were just a routine checkup.

The ongoing success of Abenomics.

• Japan’s Nikkei Drops 5% After Wall Street Slide Deepens (CNBC)

Japan’s Nikkei retreated to a 20-month low on Tuesday after a slide on Wall Street deepened with a series of unnerving U.S. political developments. The Nikkei share average ended the day down 5.01 percent at 19,155.74 after brushing its lowest since late April 2017. The day’s performance put the index well into bear market territory — off more than 20 percent since its October high. Japan’s broader Topix closed 4.88 percent lower at 1,415.55 after touching 1,412.90, its weakest since November 2016.

Meanwhile, in China, the Shanghai Index posted losses of more than 2 percent by mid-day, but then gained some ground back into the afternoon. Chinese sectors lost ground across the board, led by financial shares and energy firms as oil prices slumped. So far this year, the Shanghai stock index is down about 24 percent. Those Asia moves followed Wall Street stocks extending their steep sell-off on Monday, with the S&P 500 down nearly 15 percent so far this month, as investors were rattled by the U.S. Treasury secretary’s convening of a crisis group and by other political developments.

Many financial markets in Asia, Europe and North America are closed on Tuesday for Christmas Day. “Negative sentiment has replaced logic, as is often the case during a sell-off. A third of the selling is induced by panic, another third by loss-cutting and the remaining third by speculators trying to make a profit from the market rout,” said Takashi Hiroki, chief strategist at Monex Securities in Tokyo. “The sell-off is triggered almost entirely by developments in the U.S. markets, rather than by negative factors unique to the domestic market.”

Oil swings too much to be safe.

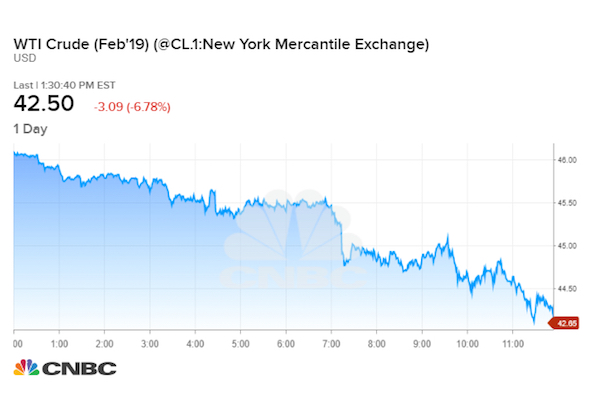

• US Crude Plunges 6.7%, Settling At 18-Month Low At $42.53 (CNBC)

U.S. crude plunged nearly 7 percent on Monday, hitting its lowest levels in a year and half, as the oil market fell in tandem with equities amid deepening turmoil in Washington DC. The Dow Jones Industrial Average plummeted more than 600 points, while the S&P 500 closed in bear market territory. Both stock indexes were buffeted by headlines out of Washington, including a government shutdown and President Donald Trump’s reported desire to fire Federal Reserve chair Jerome Powell over the central bank’s interest rate increases.

The selling in global risk assets on Christmas Eve deepened a nearly three-month slide in oil prices. From peak to trough, U.S. crude has fallen nearly 45 percent from its 52-week high at the start of October. Brent has fallen as much as 42 percent over the same period. “For now, there’s no place to hide in any of these markets. Oil’s being taken down with the stock market and the negative sentiment that’s sweeping across really everything, and for now the downward pressure is going to persist,” John Kilduff, founding partner at energy hedge fund Again Capital told CNBC’s “Closing Bell” on Friday.

The so-called experts see themselves as mighty smart when all they’ve done is suck from the fed’s trough. Humbug!

• ‘The Worst Is Yet To Come’: Experts Say Global Bear Market Coming (CNBC)

Volatility on Wall Street has led shares across the globe on a wild ride in recent months, resulting in a number of stock markets dipping into bear territory. That’s set to worsen in the new year, experts told CNBC on Monday. Bear markets — typically defined as 20 percent or more off a recent peak — are threatening investors worldwide. In the U.S., the Nasdaq Composite closed in a bear market on Friday and the S&P 500 entered one on Monday. Globally, Germany’s DAX and China’s Shanghai Composite have also entered bear market levels. Major market risks remain, experts said. The Federal Reserve is likely to continue raising interest rates and worries about a global economic slowdown — made worse by a trade war between the U.S. and China — are mounting.

“I would love to be more optimistic but i just don’t see too many positives out there. I think the worst is yet to come next year, we’re still in the first half of a global equity bear market with more to come next year,” Mark Jolley, global strategist at CCB International Securities, told CNBC’s “Squawk Box.” For Jolley, the big risk lies in the credit markets. With the Fed projecting another two interest rate hikes in 2019, companies will find it increasingly difficult to service their debt causing some to default or get downgraded, he said. Such weakness in the credit markets will spill over to stocks, noted Jolley. “My core scenario will be a credit event, which will further weigh on equity markets, which will definitely weigh on high growth sectors like tech,” he said.

More generally, investors have fewer reasons to be optimistic now because the Fed tightening monetary policy means there will be less money for investments, said Vishnu Varathan, head of economics and strategy at Mizuho Bank. “There is really no conviction for markets to buy back because they’re not sure this is the bottom, and so they are thinking this is the proverbial falling knives,” Varathan told CNBC’s “Squawk Box.”

The Fed spent the past 10 years making sure its member banks kept on making indecent amounts of money. And now they need to be defended?

• In Defense of the Fed (Stephen S. Roach)

I have not been a fan of the policies of the US Federal Reserve for many years. Despite great personal fondness for my first employer, and appreciation of all that working there gave me in terms of professional training and intellectual stimulation, the Fed had lost its way. From bubble to bubble, from crisis to crisis, there were increasingly compelling reasons to question the Fed’s stewardship of the US economy. That now appears to be changing. Notwithstanding howls of protest from market participants and rumored unconstitutional threats from an unhinged US president, the Fed should be congratulated for its steadfast commitment to policy “normalization.”

It is finally confronting the beast that former Fed Chairman Alan Greenspan unleashed over 30 years ago: the “Greenspan put” that provided asymmetric support to financial markets by easing policy aggressively during periods of market distress while condoning froth during upswings. Since the October 19, 1987 stock-market crash, investors have learned to count on the Fed’s unfailing support, which was justified as being consistent with what is widely viewed as the anchor of its dual mandate: price stability. With inflation as measured by the Consumer Price Index averaging a mandate-compliant 2.1% in the 20-year period ending in 2017, the Fed was, in effect, liberated to go for growth.

And so it did. But the problem with the growth gambit is that it was built on the quicksand of an increasingly asset-dependent and ultimately bubble- and crisis-prone US economy. Greenspan, as a market-focused disciple of Ayn Rand, set this trap. Drawing comfort from his tactical successes in addressing the 1987 crash, he upped the ante in the late 1990s, arguing that the dot-com bubble reflected a new paradigm of productivity-led growth in the US. Then, in the early 2000s, he committed a far more serious blunder, insisting that a credit-fueled housing bubble, inflated by “innovative” financial products, posed no threat to the US economy’s fundamentals. As one error compounded the other, the asset-dependent economy took on a life of its own.

Someone better collect some pieces on Mattis from 2 years ago. Won’t look anything like the sainthood declarations he’s getting today.

• Trump, Annoyed By Resignation Letter, Pushes Out Mattis Early (R.)

U.S. President Donald Trump on Sunday said he was replacing Defense Secretary Jim Mattis two months earlier than had been expected, a move officials said was driven by Trump’s anger at Mattis’ resignation letter and its rebuke of his foreign policy. On Thursday, Mattis had abruptly said he was quitting, effective Feb. 28, after falling out with Trump over his foreign policy, including surprise decisions to withdraw all troops from Syria and start planning a drawdown in Afghanistan. Trump has come under withering criticism from fellow Republicans, Democrats and international allies over his decisions about Syria and Afghanistan, against the advice of his top aides and U.S. commanders.

The exit of Mattis, highly regarded by Republicans and Democrats alike, added to concerns over what many see as Trump’s unpredictable, go-it-alone approach to global security. Trump said Deputy Defense Secretary Patrick Shanahan would take over on an acting basis from Jan. 1. In announcing his resignation, Mattis distributed a candid resignation letter addressed to Trump that laid bare the growing divide between them, and implicitly criticized Trump for failing to value America’s closest allies, who fought alongside the United States in both conflicts. Mattis said that Trump deserved to have a defense secretary more aligned with his views.

Trump, who tweeted on Thursday that Mattis was “retiring, with distinction, at the end of February,” made his displeasure clear on Saturday by tweeting that the retired Marine general had been “ingloriously fired” by former President Barack Obama and he had given Mattis a second chance.

The only interesting question: why go public with something so ordinary?

• Mnuchin Holds Calls With Heads Of America’s 6 Biggest Banks Amid Shutdown (F.)

No need to panic. That was the message Treasury Secretary Steven Mnuchin sought to convey after holding unscheduled Sunday afternoon calls with the heads of the largest banks in America, Jamie Dimon of JPMorgan, Brian Moynihan of Bank of America, Michael Corbat of Citigroup, Tim Sloan of Wells Fargo, David Solomon of Goldman Sachs and James Gorman of Morgan Stanley. In a statement released by Treasury, Mnuchin said these CEOs confirmed “markets continue to function properly.” These bankers also assured Mnuchin their firms have the liquidity to fund themselves and their lending activities, and reported no clearance or margin issues on their trades, Treasury said.

A decade ago, such calls and terse press releases were routine Sunday events as Treasury officials, the Federal Reserve, and bank heads worked together to stem the worst financial panic since the Great Depression. This time, however, Mnuchin’s unusual efforts come amid a growing economy where credit is flowing freely. Instead of a financial panic, his comments seemed aimed at market concerns coming from political turmoil in Washington.

On Monday, Mnuchin will convene a call with the President’s Working Group on financial markets “to discuss coordination efforts to ensure normal market operations,” bringing together the Board of Governors of the Federal Reserve System, the Securities and Exchange Commission, the Commodities Futures Trading Commission, the Office of the Comptroller of the Currency and the Federal Deposit Insurance Commission.

They’re all grossly overvalued.

• Facebook Is The ‘Biggest Concern’ Among The FAANGs (CNBC)

One industry analyst has sounded the alarm on Facebook, calling the company the “biggest concern” among the so-called FAANG stocks. “The digital economy operates on trust, and they’ve broken trust on so many levels,” Ray Wang, principal analyst and founder at Silicon Valley-based Constellation Research, told CNBC’s “Squawk Box” on Monday. The FAANG stocks consist of Silicon Valley tech giants Facebook, Amazon, Apple, Netflix and Google-parent Alphabet.

Wang said many of Facebook’s trust woes have been “centralized” around Chief Operating Officer Sheryl Sandberg, who was in the spotlight after a New York Times report in mid-November about the executive and the social media company’s internal operations. The Times report came on the back of a series of scandals and incidents which have mired Facebook in controversy and sent its stock sinking in 2018. As of its last close after extended hours trade on Dec. 21, the company’s stock price was more than 40 percent off its 52-week high. Asked about the possibility of Sandberg departing from Facebook, Wang said it was “in the rumor category.”

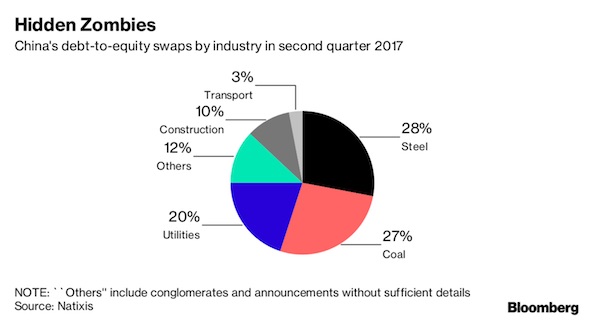

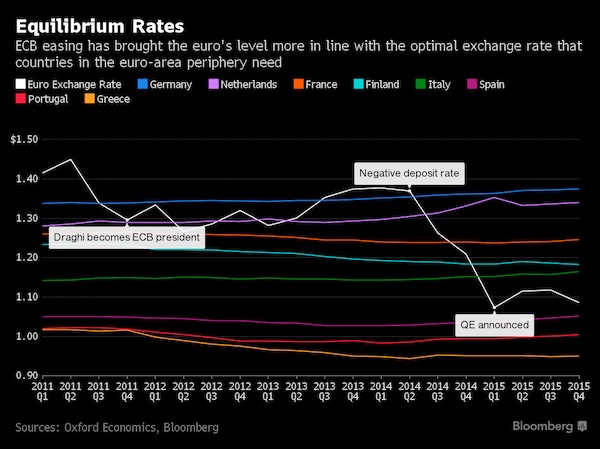

China’s afraid of the exchange rate.

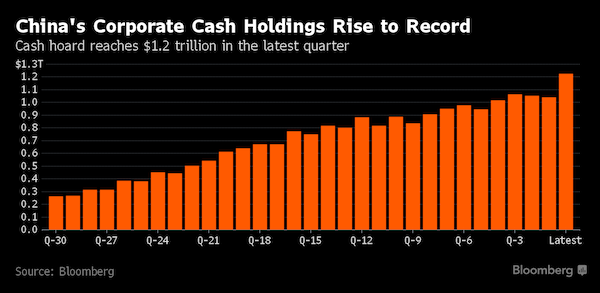

• China Won’t Resort To Massive Monetary Stimulus Next Year – PBOC (CNBC)

China will not resort to “flood-like” stimulus in monetary policy next year, although it will consider more cuts as needed to reserves held at commercial banks, local media quoted a central bank adviser as saying in a report on Tuesday. The Chinese economy will face downward pressure in 2019, while the pace of growth will gradually stabilize, the 21st Century Business Herald quoted Sheng Songcheng, an advisor to the People’s Bank of China (PBOC), as saying. “Monetary policy will remain prudent and won’t be a ‘flood.’ Otherwise, funds will likely flow into the property sector again,” Sheng was quoted as saying by the state-backed newspaper.

There remains room for further cuts in banks’ reserve requirement ratios (RRRs), and Sheng does not recommend broad-based reductions in interest rates, it said. China will bolster support next year for its economy, the world’s second-largest, by cutting taxes and keeping liquidity ample, the official Xinhua news agency said after last week’s Central Economic Work Conference, an annual closed-door gathering of party leaders and policymakers. [..] On exchange rates, the central bank adviser said China should defend the yuan at the key seven-per-dollar level. “The key threshold of seven per dollar is very important. If the yuan weakens past that crucial point, the cost of stabilizing the exchange rate will be greater,” Sheng was quoted as saying.

The level of incompetence is sobering.

Police tell BBC News they “cannot discount the possibility that there may have been no drone at all”.

• Gatwick Drones Pair ‘No Longer Suspects’ (BBC)

A man and woman arrested in connection with drone sightings that grounded flights at Gatwick Airport have been released without charge. The 47-year-old man and 54-year-old woman, from Crawley, West Sussex, had been arrested on Friday night. Sussex Police said there had been 67 reports of drone sightings – having earlier cast doubt on “genuine drone activity”. Det Ch Supt Jason Tingley said no footage of a drone had been obtained. And he said there was “always a possibility” the reported sightings of drones were mistaken.

However, he later confirmed the reported sightings made by the public, police and airport staff from December 19 to 21 were being “actively investigated”. “We are interviewing those who have reported these sightings, are carrying out extensive house-to-house inquiries, and carrying out a forensic examination of a damaged drone found near the perimeter of the airport.” Det Ch Supt Tingley said it was “a working assumption” the device could be connected to their investigation, but officers were keeping “an open mind”.

‘We are working with human beings saying they have seen something..’ Cue 150,000 ruined holidays.

• Gatwick Police Say They Cannot Discount Possibility There Was No Drone (Ind.)

Detectives investigating the Gatwick drone attacks which caused three days of chaos for passengers say it is possible there never were any drones. Police do not have any footage of the flying machines at the airfield and are relying on accounts from witnesses and the discovery of a damaged device. The revelation by Detective Chief Superintendent Jason Tingley came after the couple arrested by Sussex Police on Friday night were released without charge. Asked about speculation there never was a drone, he said: “Of course, that’s a possibility. We are working with human beings saying they have seen something. “Until we’ve got more clarity around what they’ve said, the detail – the time, place, direction of travel, all those types of things – and that’s a big task.”

Mr Tingley said one of the “working theories” was that the damaged drone found close to the airport in Sussex was responsible for causing the disruption. “Always look at it with an open mind, but actually it’s very basic common sense that a damaged drone, which may have not been there at a particular point in time has now been seen by an occupier, a member of the public, and then they’ve told us, ‘we’ve found this’. “Then we go and forensically recover it and do everything we can at that location to try and get a bit more information.” [..] Gatwick Airport has offered a £50,000 reward through Crimestoppers for information leading to the arrest and conviction of those responsible for the chaos.

It doesn’t matter what anybody does, Trump still hoards the attention.

• ‘Home Alone’: Bored Trump Tweets Up Storm During Christmas Shutdown (RT)

With the US government shut down due to the dispute over funding President Donald Trump’s border wall, and his family in Florida, the chief executive has chosen to spend the Christmas holiday taking potshots at critics on Twitter. Funding for about a quarter of US government services ran out on Friday at midnight, as Senate Democrats refused to endorse a House funding bill that would’ve given Trump $5.7 billion for the border wall. Trump was supposed to celebrate Christmas at Mar-a-Lago with his family, but elected to stay in the White House instead, tweeting up a storm.

Trump tweeted twenty times on Thursday, as the shutdown loomed. He continued posting on Friday (ten), Saturday (seven) and Sunday (eight), then ramped up the schedule on Monday, with ten tweets by the early afternoon. In addition to his usual complaints about “Fake News” and Democrats, Trump has also taken aim at the Federal Reserve, praised Saudi Arabia, and dismissed Washington’s envoy to the anti-ISIS coalition as an “Obama appointee” who gave Iran $1.8 billion “in CASH” as part of the “horrific” nuclear deal. He also complained, tongue firmly in cheek, about being “all alone (poor me) in the White House waiting for the Democrats to come back and make a deal on desperately needed Border Security.”

I am all alone (poor me) in the White House waiting for the Democrats to come back and make a deal on desperately needed Border Security. At some point the Democrats not wanting to make a deal will cost our Country more money than the Border Wall we are all talking about. Crazy!

— Donald J. Trump (@realDonaldTrump) December 24, 2018

Though Trump’s Twitter tirades usually trigger the trolls, that last one brought up a multitude of call-backs to the president’s cameo in 1992’s Christmas comedy ‘Home Alone 2: Lost in New York.’