René Magritte Memory of a voyage 1955

A mother of 2 young children dies from the vaccine. And Twitter has the gall to call her obituary misleading. Not an ounce of decency.

Zuby

When given even an ounce of control, government officials WILL take advantage of it.@ZubyMusic

— YAF (@yaf) October 2, 2021

Prediction

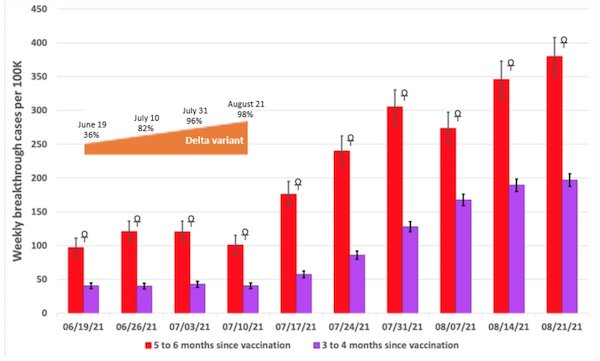

Not the whole story. 2x more breakthrough cases after 5-6 months compared to 3-4 months.

• Covid Vaccine Antibody Levels Drop ‘Nearly 10-Fold’ After About Six Months (JTN)

A preliminary study this week claimed to have found a steep reduction in the number of coronavirus-fighting antibodies in patients roughly half a year after they received the COVID-19 vaccine. Researchers “analyzed blood samples from 46 healthy, mostly young or middle-aged adults after receipt of the two doses and again six months after the second dose,” Reuters reported this week. The study indicated that “vaccination with the Pfizer-BioNtech vaccine induces high levels of neutralizing antibodies against the original vaccine strain, but these levels drop by nearly 10-fold by seven months,” two of the researchers told the news wire.

The study, which has not yet been certified by peer review, comes amid growing talk of the possible need for a booster shot of the COVID-19 vaccine to ensure a robust immune response. The study determined that “administering a booster dose at around 6 to 7 months following the initial immunization will likely enhance protection against SARS-CoV-2 and its variants.”

https://www.humetrix.com/powerpoint-vaccine.html

“All that would remain are vaccinated people humbly bowing to a perpetual mandate in the name of a promised security that is not even demonstrable.”

• Public Health Or Power Play? (AC)

If the pro-vaccination syndicate has its way, every American, and eventually every human, will have the Covid-19 vaccination. Furthermore, if recent chatter and momentum are any indication, regular boosters will be soon be standard. For instance, last week an FDA panel rejected a Pfizer request to recommend boosters for the general population, recommending, instead, boosters for people over 65 and those deemed at high risk. CDC director Rochelle Walensky, however, unilaterally chose to expand the recommendation to include high risk occupations, teachers, grocery store employees, and other “essential” workers.

Of course, there’s no clear reason why one booster will suffice. A policy of perpetual, mandated boosters is a remarkable achievement. If nothing else, there is a lot of money at stake in this vaccination ballet. But there is something here that should interest anyone concerned with “the science.” If everyone is vaccinated, there is no control group and therefore no group against which we can accurately judge the effectiveness of the vaccine. This is a monopoly of the most excellent sort and also an exquisite insulation against lawsuits: The government mandates regular doses of a drug the long-term effects of which are unknown—and unknowable—because we will have nothing with which to compare. All that would remain are vaccinated people humbly bowing to a perpetual mandate in the name of a promised security that is not even demonstrable.

“Politicized science” is being used as a club to bludgeon dissenters into submission. But this is not science, for science requires open and free inquiry. It is not politics, either, for legitimate politics requires free and vigorous debate. It is, instead, naked power masquerading as science. Combine this with a chorus of eager and self-righteous minions and you have a toxic situation where power is dramatically expanded and abused in the name of public health. Science is an obvious casualty, but when you dress up power in the garb of pseudo-science, another casualty is freedom.

“They had less infection when they had no protection. So, that’s a problem.”

• Vaccine Related Injuries and Deaths Far More Widespread Than Reported (CTH)

Thanks to a Whistleblower that came forth to Attorney Thomas Renz, the public is now seeing, for the first time ever, hard data from the largest database available in the U.S. to study the COVID-19 impact including deaths & injuries; The CMS Medicare Tracking System. The Total number of American Citizens that died within 14 days of receiving the COVID-19 vaccine is 48,465 according to hard data revealed in the Medicare Tracking System. Attorney Renz is also in possession of Remdesivir death data from the Medicare Tracking System that has been withheld by the government from our citizens. The Remdesivir data reveals of the 7,960 beneficiaries prescribed Remdesivir for Covid-19, 2,058 died. That is 25.9%.

46% of people died within 14 days of the Remdesivir Treatment. The Remdesivir Treatment was established in U.S. Hospitals at the direction of Dr. Anthony Fauci. Serious adverse events were reported in 131 of the 532 patients who received Remdesivir. That is 24.6%. Attorney Renz says, ”This begs the question… why is this the protocol in American Hospitals? Does this appear “Safe and Effective” to you?” LifeSiteNews has more details on the presentation specifically as it pertains to the risks within the Pfizer vaccine. “So, when they weren’t injected, their infection rate was 1.3%, and when they got injected, it was 4.34%. It went up by over 300%,” Kingston stated. “They had less infection when they had no protection. So, that’s a problem.”

Funny that the CDC and WHO supported it. But the Ziverdo kit has been known for a long time to include doxycyclin, ivermectin, zinc. So there is no secret.

Wonder why Justin Hope would present it that way.

• India’s Ivermectin Blackout: The Secret Revealed (Hope)

The Rapid Response Teams derive support from the United States CDC under the umbrella of the WHO. This fact further validates the Uttar Pradesh test and treat program and solidifies this as a joint effort by the WHO and CDC. Perhaps the most telling portion of the WHO article was the last sentence, “WHO will also support the Uttar Pradesh government on the compilation of the final reports. None have yet been published. Just five short weeks later, on June 14, 2021, new cases had dropped a staggering 97.1 percent, and the Uttar Pradesh program was hailed as a resounding success. [..] By July 2, 2021, three weeks later, cases were down a full 99 percent. On August 6, 2021, India’s Ivermectin media blackout ended with MSM reporting.

Western media, including MSN, finally acknowledged what was contained in those Uttar Pradesh medicine kits. Among the medicines were Doxycycline and Ivermectin. On August 25, 2021, the Indian media noticed the discrepancy between Uttar Pradesh’s massive success and other states, like Kerala’s, comparative failure. Although Uttar Pradesh was only 5% vaccinated to Kerala’s 20%, Uttar Pradesh had (only) 22 new COVID cases, while Kerala was overwhelmed with 31,445 in one day. So it became apparent that whatever was contained in those treatment kits must have been pretty effective. News18 reported, “Let’s look at the contrasting picture. Kerala, with its 3.5 crore population – or 35 million, on August 25 reported 31,445 new cases, a bulk of the total cases reported in the country.

Uttar Pradesh, the biggest state with a population of nearly 24 crore – or 240 million – meanwhile reported just 22 cases in the same period. Two days ago, just seven fresh positive cases were reported from Uttar Pradesh. Kerala reported 215 deaths on August 25, while Uttar Pradesh only reported two deaths. In fact, no deaths have been reported from Uttar Pradesh in recent days. There are only 345 active cases in Uttar Pradesh now while Kerala’s figure is at 1.7 lakh – or 170,000.” “Kerala has done a much better job in vaccination coverage with 56% of its population being vaccinated with one dose and 20% of the population being fully vaccinated with a total of 2.66 crore – or 26.6 million – doses being administered.

Uttar Pradesh had given over 6.5 crore – or 65 million – doses, the maximum in the country, but only 25% of people have got their first dose while less than 5% of people are fully vaccinated. Given the present COVID numbers, Uttar Pradesh seems to be trumping Kerala for the tag of the most successful model against COVID.” [..] ” By September 12, 2021, Livemint reported that 34 districts were declared COVID-free or had no active cases. Only 14 new cases were recorded in the entire state of Uttar Pradesh. On September 22, 2021, YouTube hosted a video by popular science blogger Dr. John Campbell detailing the Uttar Pradesh success story. He gave a breakdown of the ingredients and dosages of the magical medicine home treatment kit responsible for eradicating COVID in Uttar Pradesh. The same kit was also used in the state of Goa.

Dr. John Campbell broke India’s Ivermectin Blackout wide open on YouTube by revealing the formula of the secret sauce, much to the dismay of Big Pharma, the WHO, and the CDC. Readers will want to watch this before it is taken down. See mark 2:22. Each home kit contained the following: Paracetamol tablets [tylenol], Vitamin C, Multivitamin, Zinc, Vitamin D3, Ivermectin 12 mg [quantity #10 tablets], Doxycycline 100 mg [quantity #10 tablets]. Other non-medication components included face masks, sanitizer, gloves and alcohol wipes, a digital thermometer, and a pulse oximeter.

“Why would you study a drug if you didn’t get to keep the proceeds from success? Does that prove they don’t work? Nope. That which you don’t study you don’t prove.”

• The Flu Shot Stupidity (Denninger)

Now comes Merck who, big shock, invents an oral protease inhibitor that will be on patent and appears to work. I’m not surprised at those results; they may or may not bear out over time but it wouldn’t shock me if they do. You see, Merck has every reason to invest money in something they’ll profit handsomely from if it does work. Who has a similar incentive if HCQ, Ivermectin, Budesonide, Claritin+Zpak and several other readily-available, inexpensive and off-patent medications also work? Nobody. There’s no way to prevent some other generic manufacturer from making the sales, is there? Why would you study a drug if you didn’t get to keep the proceeds from success? Does that prove they don’t work? Nope. That which you don’t study you don’t prove.

Anecdotes, such as my personal experience, are not data. But bans and public maligning of the off-label use of drugs which have decades-long safety profiles and are safe are the work of ghouls, monsters, and profit-driven *******s who, in the middle of a pandemic, deserve destruction — personally and professionally. May I remind you that it is exactly through that process that we discovered HCQ, which you wouldn’t expect to work for Lupus and RA, in fact does? This of course isn’t the first time either. For decades you so-called “experts” told Americans to eat the “food pyramid”, loaded at the bottom with fast carbohydrates. You also told us to substitute for butter and other saturated fats with unsaturated, machine-processed and stabilized vegetable oil replacements and claimed they were good.

We now know that was bull**** and in fact transfats, which do not exist in nature, have a safe human dose approximating zero. I listened to you folks on “what to eat” for a couple of decades. My body mass and waistline kept getting bigger. After Obamacare was passed it became abundantly clear that within a decade or so the health system would go straight down the crapper and thus if I needed it I was going to die, and it would probably hurt. So I did the exact opposite of what all you ghouls recommend — and promptly lost 60lbs, entirely stabilized my glucose metabolism and now am faster, as a runner, than I was at 17 in High School. Argue with the clock if you’d like.

Oh, there was not one pharmaceutical preparation involved in that and I consume zero on a routine basis as there’s no need. As for the medical system going down the crapper I made that call in 2011. Is it not ten years later? Threatening to, say much less actually firing doctors, nurses and support staff who won’t take a medication they believe, on good evidence, is dangerous — especially when they’ve already had the disease as a result of providing care to sick people for the last 18 months and thus are presumptively immune — into the maw of an alleged health emergency with flu season just around the corner is flat-out insane.

Well, if you exclude 72% of blacks…

• NYC Restaurateurs: Business Down 40 to 60% Due to Vaccine Mandate (ET)

New York City restaurateurs are complaining that their business has been slashed severely by the COVID-19 vaccine mandate, which requires people 12 and older to show vaccination proof for indoor dining, indoor fitness, and indoor entertainment. Pre-pandemic, O’Donoghue’s Pub and Restaurant was a successful business that has been open for 10 years in Times Square, Manhattan. Fergal Burke, the owner of O’Donoghue’s noticed that his business has seen “a massive drop,” since the vaccine mandate came into effect. “We don’t have the money here to survive without the help of our landlord, [who] has been very supportive and has been giving us breaks on the rent, but without our landlord, we would not be in business,” Burke told The Epoch Times.

He said that he needed to hire another person to be at the door checking for vaccination proof, which increased his expenses. Comparing the clientele from pre-mandate to when it kicked in about two weeks ago, “Our business is definitely down 50, I’m going to say 60 percent,” Burke said with a somewhat downhearted tone. “There’s just not people coming into the restaurant, they have the fear of being asked for vaccines.” Burke and his staff have had to refuse a lot of customers for not having the passes. “They’re being refused and they get a resentment against us, they don’t get a resentment against Bill de Blasio or Biden, or whoever is mandating us to check for this.” “It comes as a personal rejection,” he said, further stressing that it’s not O’Donoghue’s that wants this. “We don’t want this mandate, we want nothing to do with this.”

He also noted how the subway is full of people but there’s no requirement to show vaccination proof. “I mean how is that fair in New York City, that the trains are jammed with people with a silly mask on and they’re not being mandated to show nothing, and yet they’re coming against the heart of the city. We’re the ones that’s trying to keep 20 people employed here,” Burke said. “We will go out of business if this continues, it’s gonna force us to shut our doors.”

No clients, no workers, no business.

• Restaurants’ Fragile Recovery Is Fizzling in the US (BBG)

After a brief glimpse of normalcy this summer, the fragile recovery in the U.S. restaurant industry is sputtering. Data and interviews with restaurateurs point to a deterioration in finances due to surging costs for everything from salmon to uniforms and labor shortages. A survey found that 51% of small restaurants in the country couldn’t pay their rent in September, up from 40% in July. Unlike during most of 2020, today’s struggles aren’t visible with the naked eye: Customers are still flocking to eateries, for the most part, in spite of rising prices and lingering fears of the delta coronavirus variant. But the anxiety over mounting expenses is palpable among restaurant owners from New York City to Nashville, Tennessee.

“You might see a restaurant that’s doing well on a Friday night, but that doesn’t at all tell the story of how they’re doing. Probably not good,” said Daisuke Utagawa, a Washington, D.C., chef whose restaurants include Haikan and Daikaya. “For us, personally, we haven’t seen any sort of recovery. We are still underwater.” The industry is raising the alarm. Its main lobbying group this week called on Congress for more aid to help meet payroll and pay down debt, citing a survey showing that a majority of restaurant operators have seen business conditions deteriorate in the past three months. Like many companies around the world, food-service firms are also hit by supply-chain bottlenecks. Underscoring the surge in expenses, a closely watched price gauge hit its highest since 1991 in August, driven by energy and food, the Commerce Department said Friday. “Our kitchen labor costs are up 20%, maybe more,” said Jeff Katz, partner at Crown Shy and Saga in New York City.

“The question is, how much more can the customer handle. We haven’t raised our prices yet, but these costs are real.” The rebound has been shaky and uneven across the country, even for national chains. Darden Restaurants Inc., which has about 870 Olive Garden locations, said last week that sales bounced back slightly in September after falling off in August. Georgia and Florida have seen pressure from the delta variant in recent weeks, Chief Executive Officer Gene Lee said on a conference call. But California locations are getting better. Large public-traded companies including Chipotle Mexican Grill Inc. and McDonald’s Corp. are scheduled to report quarterly earnings in October. While the recovery in fast food has been stronger, with brisk sales via drive-thru and takeout options, costs and the lack of workers are eating into profitability.

Calgary

https://twitter.com/i/status/1444268828871958536

“I don’t believe that being unvaccinated means infected or being vaccinated means uninfected.”

• Dozens of NBA Players Refuse the Shot (PJM)

The NBA season is close upon us and there are some interesting developments that are blowing up the conventional wisdom on those refusing to get vaccinated. The League says that 5-10 percent of players have yet to be vaccinated. This presents a big problem because most major cities where NBA teams play have vaccine mandates that prevent players from participating unless they’ve been jabbed. The League has taken the position that if players won’t play, their pay will be docked. NBA players are paid by the game in most cases so this could get serious. After spending most of the last few months portraying those refusing to get vaccinated as anti-science, Kool-aid-drinking MAGA supporters, the media is now stuck. How do they stereotype mostly black NBA players who refuse to get vaccinated? Especially a player like the Orlando Magic’s Jonathan Isaac. Mr. Isaac, who has already contracted COVID-19, wonders why he has to get jabbed if the antibodies in his system are already protecting him? Nobody had an answer for him because there is none.

“I understand that the vaccine would help if you have COVID, you’ll be able to have less symptoms from contracting it. But with me having COVID in the past and having antibodies, with my current age group and physical fitness level, it’s not necessarily a fear of mine. Taking the vaccine, like I said, it would decrease my chances of having a severe reaction, but it does open me up to the albeit rare chance but the possibility of me having an adverse reaction to the vaccine itself. I don’t believe that being unvaccinated means infected or being vaccinated means uninfected. You can still catch COVID with or with not having the vaccine. I would say honestly the craziness of it all in terms of not being able to say that it should be everybody’s fair choice without being demeaned or talked crazy to doesn’t make one comfortable to do what said person is telling them to do.” Stephen Miller points out the left’s conundrum.

“I don’t personally agree with his vaccine stance. I myself contracted COVID last year and still chose to get vaccinated. However there is a deeper meaning to what he’s saying that goes beyond ‘Bill Gates is trying to microchip everyone.’ It stands against what the media and the Biden administration are attempting to do by shaming and other-ing anyone who opts not to get vaccinated or can’t because of medical reasons. And that’s before we even get into the dark history African Americans and vaccinations, which has no doubt played a role in lower vaccination rates among that demographic. Isaac is rejecting the atmosphere of division, the idea that anyone who’s unvaccinated is deserving of scorn from the desks at CNN, as well as ostracization from polite society by employers, friends and family. Division is the lingua franca of the national media — and Isaac isn’t speaking it. Legitimate medical diagnoses are being lumped in with QAnon Facebook conspiracists. That leads nowhere good.”

These players are more eloquent and educated than all politicians put together.

Guardian: “..the NBA waited just long enough for some of its star players to irresponsibly contribute to the very reason that the NBA and American society are in this predicament in the first place: the misinformation crisis..”

• The NBA’s Vaccine Problem Is Bigger Than A Few High-Profile Holdouts (G.)

[..] the NBA’s vaccine problem extends beyond a couple of high-profile holdouts: the league and the players’ union were not prepared for just how important and divisive a political issue vaccines have become over the past year, and they failed in their responsibility to get out ahead of it. Instead of being leaders on the vaccine issue like the WNBA was – and like the NBA was when it came to the Black Lives Matter protests last year – the NBA waited too long to figure out just how polarized the league was on the topic. Washington Wizards guard Bradley Beal said he “didn’t get sick at all” after contracting coronavirus in July, making him miss the chance to represent Team USA at the Tokyo Olympics. “I lost my smell. That’s it.” “People with vaccines, why are they still getting Covid?…

Like, it’s funny that, ‘Oh, it reduces your chances of going to the hospital.’ It doesn’t eliminate anybody from getting COVID, right? Some people have bad reactions to the vaccine. Nobody likes to talk about that. What happens if one of our players gets the vaccine and can’t play after that? Or they have complications after that? Because there are cases like that.” Jonathan Isaac, a religious man who plays for the Orlando Magic, said: “At the end of the day, it’s people [developing vaccines], and you can’t always put your trust completely in people.” And Denver Nuggets wing Michael Porter J said: “For me, I had Covid twice, I saw how my body reacted, and although the chances are slim, with the vaccine, there’s a chance you could have a bad reaction to it. For me, I don’t feel comfortable.

“If you want to get it because you feel more protected and you feel safer, and it’s protecting people around you, get it. That’s good for you. But if you feel like, ‘Oh, for me, I don’t feel safe getting it, then don’t get it.’” Forget that there are no publicly known cases of professional basketball players missing time because of side effects related to the vaccine, and severe side effects are rare for anyone. And remember that some athletes have spoken about lingering respiratory and muscle issues after contracting Covid-19, with Boston Celtics star Jayson Tatum suffering lingering impairment for months after contracting the virus last season, requiring the use of an inhaler before games to help his breathing long after he recovered. Also, forget that these vaccine holdouts are ignoring a crucial reason to get the vaccine, which is to protect others.

What’s more important is that the NBA waited just long enough for some of its star players to irresponsibly contribute to the very reason that the NBA and American society are in this predicament in the first place: the misinformation crisis. And that is the bigger issue here: not the fact that Wiggins and Irving might be willing to sit out 41 home games instead of getting the vaccine, but the fact that the NBA let it get to a point where influential NBA players are broadcasting vaccine skepticism and misinformation to a highly vulnerable American public.

Including Air Force 1?

• Senate Bill To Require Vaccines Or Testing For All US Domestic Flights (JTN)

A bill introduced in the Senate this week would require all domestic U.S. air travelers to show either proof of COVID-19 vaccination or a negative COVID test prior to boarding a flight. The U.S. Air Travel Public Safety Act, introduced by California Sen. Dianne Feinstein, would mandate “national vaccination verification standards” that would order airlines to require “documentation demonstrating that the passenger is fully vaccinated” against the SARS-Cov-2 virus. The bill does not specifically define “vaccination,” leaving it instead up to the Secretary of Health and Human Services and indicating that the qualifications for vaccination could change over time. Passengers would also be permitted to fly with “proof of a negative pre-departure qualifying test” for SARS-Cov-2.

With two heart conditions.

The politicians are looking for people they can force to jump through hoops. Teachers, nurses, soldiers.

• Afghan War Vet Faces Dishonorable Discharge For Refusing Vaccine (JTN)

A United States Marine corporal who served in Afghanistan during Operation Freedom Sentinel and Operation Southern Vigilance is facing dishonorable discharge for refusing to take the COVID-19 shots as required by the secretary of defense. Having been diagnosed with two heart conditions, arrhythmia and right bundle branch blockage, taking an experimental drug with unknown long-term side effects isn’t a medical option for him, he says, especially since the shots have already been proven to cause blood clots and heart inflammation. However, he was informed that the only medical waiver he could receive was if he was diagnosed with congenital heart failure.

The nonprofit religious freedom law firm Liberty Counsel says it’s “been inundated with heartrending pleas for help from military members who are being ordered to get the COVID shots or face discipline, including solitary confinement and dishonorable discharge.” This Marine’s story is just one of many. “If I don’t stand for what I believe in, I could never look at myself in the mirror again,” the corporal said in a statement issued by Liberty Counsel. “This is everything I’ve fought for and taught my Marines and everything our Founding Fathers stood against. This is completely unconstitutional and goes against more than one Amendment.” All military members who refuse the COVID shots are facing dishonorable and bad conduct discharge for failing to obey a lawful order, a violation of the Uniform Code of Military Justice.

Non-compliance could mean a general court martial at the Divisional Commander Level, six months solitary confinement/imprisonment, and a felony charge. The DOD even created a new disciplinary department, the COVID Consolidated Disposition Authority, or CCDA, according to messages released by the U.S. Navy to servicemembers. Last month, Secretary of the Navy Carlos Del Toro said the new CCDA would decide what happens to sailors who refuse to get the shots, Military.com reported. The CCDA would use “the full range of administrative and disciplinary actions,” Del Toro said, adding that “until further notice” he wouldn’t allow the CCDA to begin “non-judicial punishment, courts-martial, or administrative separation in cases of Navy Service Members refusing the vaccine.”

But the U.S. Air Force warned, “Any refusal to receive the COVID-19 vaccine, absent an approved exemption or accommodation, may be punishable under the Uniform Code of Military Justice (UCMJ). Military commanders retain the full range of disciplinary options available to them under the UCMJ.” Liberty Counsel warns that for members dishonorably discharged, the potential consequences are dire, including loss of eligibility for a range of important benefits, opportunities, honors and rights, including: VA home loans and medical benefits, educational benefits under the GI Bill, military funeral honors, reenlistment in another military branch, and the right to own a firearm — all for simply refusing to take an experimental drug.

How about the kids? Neighbors?

• Largest Louisiana Health System Fines Employees With Unvaccinated Spouses (Fox)

The largest health system in Louisiana will start fining employees hundreds of dollars a month if they are married to an unvaccinated person. “The reality is the cost of treating COVID-19, particularly for patients requiring intensive inpatient care, is expensive, and we spent more than $9 million on COVID care for those who are covered on our health plans over the last year,” CEO of Ochsner Health, Warner Thomas, told NOLA. Ochsner Health will start charging employees $200 per month, or $100 per pay period, if their spouse or partner is unvaccinated. The “spousal COVID vaccine fee” will begin in 2022, and Thomas said it is not a mandate, saying non-employed spouses and domestic partners can select a health plan outside the Ochsner’s offerings.

“This is not a mandate as non-employed spouses and domestic partners can choose to select a health plan outside of Ochsner Health offerings,” he told NOLA. The fee only applies to domestic partners or spouses, not other dependents such as children, who are covered by the employee’s health insurance. [..] The rollout of vaccine mandates in hospitals is spurring nurses and other healthcare workers across the country to quit their jobs or face termination over their refusal to comply with the rules. Protests have also formed in recent weeks with healthcare workers holding signs reading phrases such as, “We are still essential,” “Say no to vaccines and yes to freedom of choice,” “Healthcare heroes demand medical freedom,” and “Don’t fire last year’s heroes.”

“We were celebrated last year,” Indiana nurse Adara Allen told Fox News this week. “But a few nurses did end up leaving due to [the hospital] not accepting their medical issues or having a reaction or adverse effect to the first dose of the covid vaccine.” Allen was told to no longer come into her hospital in Indianapolis over refusing the vaccine during her high-risk pregnancy.

Too late. The perception is there.

• Biden Reportedly Floats Smaller Spending Bill To Avert Perceived Defeat (JTN)

President Biden addressed House Democrats at the Capitol in a closed-door meeting on Friday, urging them to reach an agreement that yields passage of the Senate infrastructure bill and a budget reconciliation bill. Biden reportedly signaled that the caucus would likely have to accept a spending package smaller than $3.5 trillion to gain the support of all Democratic members. Democrats such as Sen. Joe Manchin of West Virginia have called for spending $1.5 trillion as part of a budget reconciliation bill. “He basically said it’s not going to be $3.5 [trillion],” said Rep. Henry Cuellar (D-Texas) about the meeting with Biden. “It could be $1.9 trillion-$2 trillion. The president threw out some numbers, so I assume there was a reason why.”

The Associated Press reported that Biden privately told Democrats that not passing the $1.2 trillion infrastructure bill and a separate reconciliation bill would be seen as a defeat and “embolden the same forces” that led to the Jan. 6 riot. Biden also said those forces are opposed to raising the nation’s debt limit. Republican leaders in Congress have said they do not want to vote for raising the debt limit due to Democrats proceeding with spending trillions on new benefit programs with a party-line vote. Pelosi had said a House vote on the Senate infrastructure bill would take place on Thursday, but it was delayed due to progressive opposition to passing the infrastructure bill before a reconciliation bill. “Even a smaller bill can make historic investments,” Biden reportedly said in the meeting with Democrats.

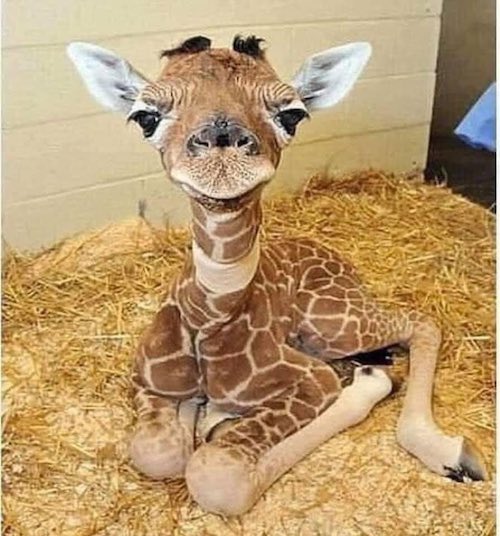

2 days old.

Support the Automatic Earth in virustime; donate with Paypal, Bitcoin and Patreon.