Roy Lichtenstein Woman With Flowered Hat 1963

Well, Dr. D is back again. You might want to sit down for this one.

Dr. D: In my last article I wrote about cows and hay and unrealistic estimates of production of the land. But surely that is all academic. What could possibly force Americans to once again eat by the sweat of their brow?

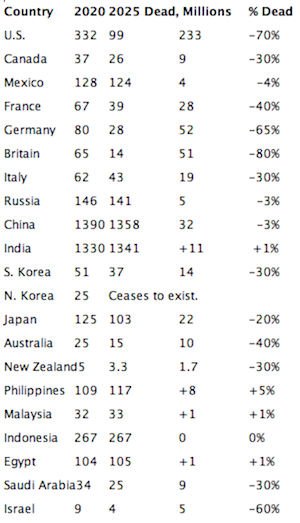

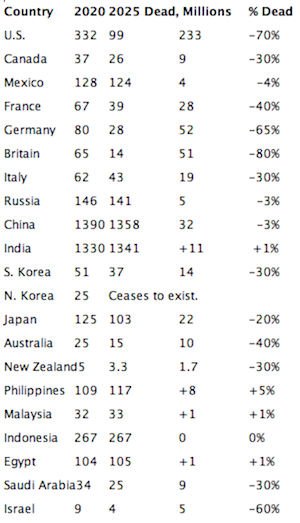

Insider military think tank Deagel.com. The think tank that in 2015 estimated the death of 200M Americans by 2025.

Deagel – Forecast 2025

The Great Reset; like the climate change, extinction rebellion, planetary crisis, green revolution, shale oil (…) hoaxes promoted by the system; is another attempt to slow down dramatically the consumption of natural resources and therefore extend the lifetime of the current system. It can be effective for awhile but finally won’t address the bottom-line problem and will only delay the inevitable. The core ruling elites hope to stay in power which is in effect the only thing that really worries them.

The collapse of the Western financial system – and ultimately the Western civilization – has been the major driver in the forecast along with a confluence of crisis with a devastating outcome. As COVID has proven Western societies embracing multiculturalism and extreme liberalism are unable to deal with any real hardship. The Spanish flu one century ago represented the death of 40-50 million people.

Today the world’s population is four times greater with air travel in full swing which is by definition a super spreader. The death casualties in today’s World would represent 160 to 200 million in relative terms but more likely 300-400 million taking into consideration the air travel factor that did not exist one century ago. So far, COVID death toll is roughly 1 million people. It is quite likely that the economic crisis due to the lockdowns will cause more deaths than the virus worldwide.

The Soviet system was less able to deliver goodies to the people than the Western one. Nevertheless Soviet society was more compact and resilient under an authoritarian regime. That in mind, the collapse of the Soviet system wiped out 10 percent of the population. The stark reality of diverse and multicultural Western societies is that a collapse will have a toll of 50 to 80 percent depending on several factors but in general terms the most diverse, multicultural, indebted and wealthy (highest standard of living) will suffer the highest toll.

The only glue that keeps united such aberrant collage from falling apart is overconsumption with heavy doses of bottomless degeneracy disguised as virtue. Nevertheless the widespread censorship, hate laws and contradictory signals mean that even that glue is not working any more. Not everybody has to die migration can also play a positive role in this.

…

We expected this situation to unfold and actually is unfolding right now with the November election triggering a major bomb if Trump is re-elected. If Biden is elected there will very bad consequences as well. There is a lot of bad blood in the Western societies and the protests, demonstrations, rioting and looting are only the first symptoms of what is coming. However a new trend is taking place overshadowing this one…

Six years ago the likelihood of a major war was tiny. Since then it has grown steadily and dramatically and today is by far the most likely major event in the 2020s. The ultimate conflict can come from two ways. A conventional conflict involving at least two major powers that escalates into an open nuclear war. …

If there is not a dramatic change of course the world is going to witness the first nuclear war. The Western block collapse may come before, during or after the war. It does not matter. A nuclear war is a game with billions of casualties and the collapse plays in the hundreds of millions.” – Deagel, September 25, 2020

Now clearly this is ridiculous. Even these new, revised estimates have population drop in the U.S. to 99 Million in 4 years.

So what do we see here? A catastrophic event that hurts only very specific nations, leaving nearby neighbors untouched or even improved. That is, not a climate event or asteroid strike. It hurts a few nations most specifically, that is, Britain, U.S., Germany, Israel, France, Australia, Italy, S. Korea, Saudi Arabia.

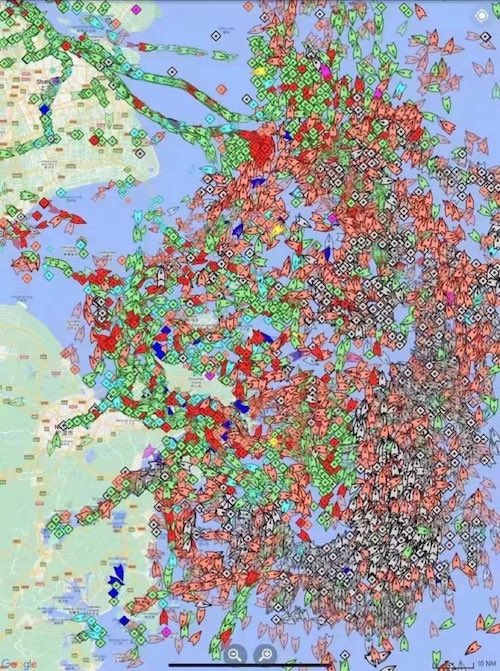

What do these nations all have in common? They are the Western Allies, and under the Western fiat central banking system. While India and Asia prosper most, conspicuous in the list is China and Russia, presumably the Axis in any new war. China takes a massive numbers hit, but a unimportant percentage hit. Russia is unmoved. That would seem to rule out wars of food, wars of money, and wars with Russia or in Europe.

What type of singular event can kill several billion people in just 4 years, leaving some nations erased and some nations untouched? Not economic wars. Not conventional wars.

That leaves nuclear and biological war, almost certainly a first-strike surprise war. Clearly this will not be with Russia, which would take more injury in a counter attack, so a first strike surprise war from China, perhaps via close proxy North Korea, as they are the only two Axis countries that (presumably) take any damage. They are counter-attacked, but weakly. Their own allies, in SE Asia, are unharmed. Australia is depopulated and easy to conquer. As is the United States, but not Canada or Mexico. Note if they attacked India they would be nuked again and open second front in a land war in Asia against an equal power, and China leaves them alone for this round, the presumed Deagel scenario.

Now what did I just tell you a few weeks ago?

If China doesn’t conquer and colonize the United States, they die.

That seems true for Australia, or at least corollary. Here’s the same phrase: If China DOES conquer and colonize the United States, WE die.

Now why would they do that? Their people are rioting with dissent, of increased expectations that have been capped. There are more riots and protests in China than anywhere on earth, both in percentage, and sheer numbers, and riot of 250,000 is rightfully identified as a mortal threat. There are no longer any food exports worldwide. The U.S. and to some extent Australia are the only ones. China is the net food importer, having everything else. If they do not solve their food and space problem, they – or rather the CCP – are overthrown and die. If the CCP can solve the food and space problem, they are heroes, stay in power, and prosper for a generation.

Is there any reason to believe China would undertake such a unprecedented, violent act? Well, when we ask if they would murder 70% of all Americans, they are presently erasing 70% of all Uighers who are their own citizens, and in the most brutal, appalling, and mercantile ways. Taking their property. Selling their slave labor. Harvesting their live organs. Selling their women to a man-heavy population thanks to an earlier wave of murder and genocide. So if they are happy to kill 70% of their own people – who they consider inferior, not being Han, and are proud to the world about the fact – how much easier is it to kill 70% of your major rival and solve all your problems for 100 years?

It’s your Lebensraum for a Socialist State-Corporate entity, totalitarian, race-based, using the fascio of combining government, industrial, and corporate power into one. There could hardly be any difference, and are along the same timeline as 1938. They are imprisoning their own people by ethnic origin and social-credit cooperation scores, then killing them for efficiency, while the West denies this is happening and refuses to prepare or respond, or in fact gleefully cooperates with open concentration camps, buying and selling cheap misery.

Surely this is slander, from a military-complex site selling military hardware and predictions. There is nothing from the Chinese to substantiate such an attack.

“A senior Chinese general has warned that his country could destroy hundreds of American cities if the two nations clash over Taiwan.” –The Guardian This week clashing over Taiwan as China has escalated buzzing Taiwanese and American ships and airspace.

In 2005 “Major General Zhu Shin Hu, Dean of the National Defense University, Speaking at a lecture, he said “War logic dictates that a weaker power needs to use maximum effort to defeat a stronger rival. If the Americans draw their missiles and position guided ammunition on to the target zone on Chinese territory, I think we will have to respond with nuclear weapons.” And goes on to describe destroying hundreds of American cities in a nuclear war over Taiwan. 15 years ago.

=

Deputy Chief PLA Juang Won Kai, “ Americans should worry more about Los Angeles than Taipei. They will be using nuclear weapons in the Taiwan conflict.” Kai later was diplomat to the United States.

“20 years of the idyllic theme of ‘peace and development’ have come to an end, and concluded that modernization under the saber is the only option for China’s next phase. I also mention we have a vital stake overseas.”

More alarmingly, General Chi Houtian in a speech to the CCP before 2003, said, “in an online survey asking if Chinese would shoot at women, children, and prisoners of war, more than 80% answered in the affirmative. …The purpose of the survey is to…If China’s development will necessitate massive deaths in enemy countries, will our people endorse that scenario [and] be for…it?”

After highlighting the similar youth propaganda departments he says,

“China is alarmingly similar to Germany back then. Both of them regard themselves as the most superior races; both of them have a history of being exploited by foreign powers and are therefore vindictive; both of them have the tradition of worshiping their own authorities; both of them feel they have seriously insufficient living space; both of them raise high the two banners of nationalism and socialism and label themselves as ‘national socialists’; both of them worship ‘one party, one state, one leader, one doctrine.’”

“We don’t have to worry about the labels of ‘totalitarianism’ or ‘dictatorship’. Whether we [the CCP] can forever represent the Chinese people depends on whether we can succeed in leading the Chinese people out of China. …Whether we can lead the Chinese people out of China is the most important determinant of the CCP”.

Lebensraum. Living space. Down the Silk Road. Expansion, conquest that – according to their own party and generals – is the only way the CCP leadership survives. Nationalist, hypermilitary expansion is the last hallmark of fascist regimes, a most grave one, as other nations therefore cannot entirely respect national boundaries and sovereignty.

How will they lead the Chinese out and conquer new lands?

“Once we open our doors, the profit-seeking western capitalists will invest capital and technology in China to assist our development so they can occupy the largest market in the world. …the most favorable environment for foreign capital, foreign technology, and advanced experience in China. …China’s economic expansion will inevitably come with significant development in our military forces, creating conditions for our expansion overseas. …China…is advancing into the world and has become unstoppable.”

“Solving the issue of America is key to solving all other issues. This makes it possible for us to have many people migrate there and establish another China under the CCP. …America was discovered by the yellow race [and] we are entitled to the possession of the land.

…The residents of the yellow race have a very low social status in the United States. We need to liberate them. After solving the ‘issue of America’, the western countries of Europe will bow to us , not to mention Japan, Taiwan…” – General Chi Haotain

Lebensraum. The master race. Liberating nations as a duty to their racial brothers. At the expense of inferior races.

“We must transcend conventions and restrictions. In history, [one] could not kill all the people in the conquered land because you could not kill people effectively [enough]. …Only by using special means to ‘clean up’ America will we be able to lead people there. This is the only choice left to us. It is not a matter of whether we are willing.

…What kind of special methods do we have to ‘clean up’ America? …We are not as foolish as to want to perish together with America by using nuclear weapons… There has been a rapid development in modern biological technology, and new bio-weapons have been developed one after the other. …We are capable of ‘cleaning up’ America all of a sudden. Lethal weapons that can eliminate mass populations of the enemy country.”

But it’s not all bad:

“From a humanitarian perspective, we should issue a warning to the American people and persuade them to leave America and leave the land to the Chinese people. Or they should at least leave half of America to be China’s colony…but if this strategy does not work, there is only one choice left…”

“That is, use decisive means to ‘clean up’ America in a moment. …Historical experience has been that as long as we make it happen, nobody in the world can do anything about us. Furthermore, if the United States as leader is gone, then our other enemies have to surrender to us.”

“If the Americans do not die, then the Chinese have to die. If the Chinese are strapped to the land, a total societal collapse is bound to take place. …[Then] more than half the Chinese people will die, and that figure will be 800 million. …The Great Collapse will occur at any time and more than half the population will have to go. …The population can be reproduced. But if the Party falls, everything is gone, and forever gone.”

How very like our own Western leaders.

Cool story bro. I feel for your position. Now let me ask you a question: If you knew you were running out of food and space, why did you pave every rice paddy and poison every river? Wouldn’t you rather take 6 time zones of Russian lands which are lush, actually empty, and on your own border? And how ARE you out of space when the entire Gobi desert, or indeed much of north and western China, are as empty as the United States?

You might not have heard, but most of the United States was also considered a desert, a wasteland from Iowa to San Diego that would never be occupied by humankind, yet through hard work and imagination we created the innovation that has made our prosperity and our population possible. It only seems easy now, in hindsight, like some automatic miracle we didn’t deserve. Yet, in the most high-tech era ever recorded, I think no less of the power of men on the Silk Road or Mongolia.

So perhaps I’m asking: are you really sure you NEED to do this? Or is it just that America is big, rich, and shiny and you WANT to do this? You WANT to do to Americans what you do to the Uighurs. Because I strongly suspect the latter.

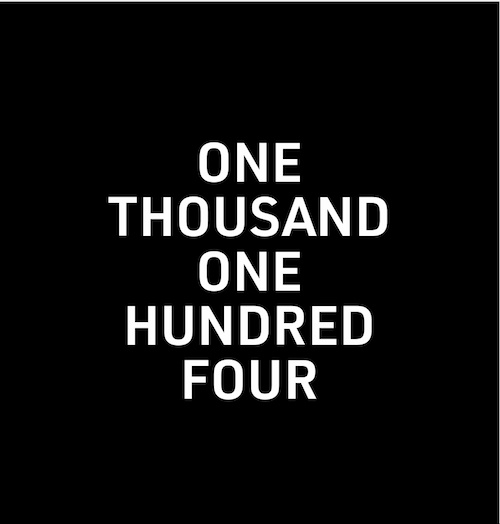

The specifics of their plan was revealed elsewhere, the “1, 3, 5, 7, 9 Plan”

1 Create a bioweapon

3 Make it available in three years (from 2017)

5 Insure effectiveness for 5 years.

7 Paralyze the 7 Western countries including Japan and India.

9 Release vaccines 9 months later to blackmail the world.

Now, is that the plan that was just attempted in 2019? Or was that a beta test for a real, upcoming attack? Was this genocide deflected, the payload of the “China Virus”, hollowed out, only narrowly missed? Or is that mere slander? Do we know? Can we tell?

The West of course would fight such an attack. In 1994, in a world conference in San Francisco’s Fairmont Hotel including H. Bush and M. Thatcher, Xin He reported, “The outstanding people of the world attendance thought that in the 21st century a mere 20% of the world’s population would be adequate to maintain the world’s economy and prosperity. The other 80% will be human garbage, unable to produce…high-tech means should be used to eliminate them gradually .”

That also sounds like our Western leaders.

Remember “Event 201”, promoted by these very same ‘outstanding people’? “ In the simulation, the virus infected the globe within six months, and killed 65 million people, triggering a global financial crisis. All of this took place just months before COVID-19 emerged.” Gee that sounds familiar. Good timing too. So good it almost defies credulity.

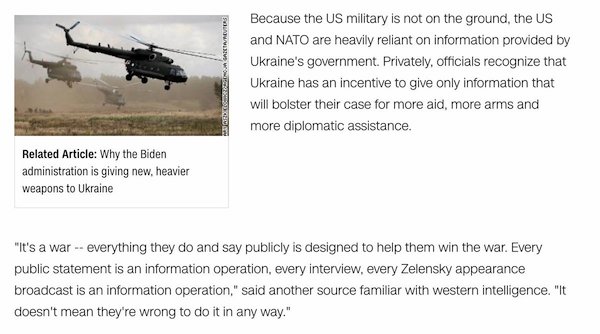

This goes along with the long-held rumor that the U.S. was planned and positioned to be in a war and to lose it. Many aspects, from causing unnecessary and unusual internal strife, to the complete erasure of our manufacturing and production – except for food – as well as our sale or loss of most military secrets to China, support such a hypothesis. Then there is the open exposure of Chinese agents with Feinstein for 20 years, and Swalwell, both of whom were on high-level committees.

Worse, when this was exposed, nothing was done, hinting at a much deeper level of capture, where some agents and proxies appear to be clearly covering and supporting other Chinese proxies against the interests of the people of the United States. They do not explain how they thought it remotely possible that with 20% of the population they could defend a rich, empty, unproductive West from complete, inevitable Chinese conquest. Perhaps China did not remind them.

The problem could be, it probably is, far deeper, harder, graver, and wider than we on the outside can contemplate. While I disagree – for in a democracy the people must be informed to make hard, informed decisions – we can see that many times the attempt has been made to inform people, and the facts are widely and regularly rebuffed and rejected. If you started here, where I have, the general population would say you were simply being political, ginning up for more war profits, or are simply lying and making it up simply because they haven’t heard it before. The truth has been intentionally withheld in favor of colored trinkets for 40 years. All attempts to prevent it have been shot down. That isn’t reversed in a day.

Now I’m not saying Deagel is right. Already they’ve had to update their 2015 prediction. However, we can infer from this that the present situation is far more complicated than cartoon. Far deeper and more grave than Twitter. It transcends one man, one party, or even one generation. And can help illuminate why certain positions, certain actions, certain reactions, and certain IN-actions, may have happened right now.

While I don’t personally feel this is our future, I do believe the situation as described is entirely true. There are such opinions and such plans and such weapons. Therefore it should be dealt with in our own lives, and in the actions of our country, in the firm, defensive preparations that Americans are known for. Regardless of such a war, which should naturally be avoided, a number of other responses are indicated:

1) Remove as much reliance on China as possible without crippling them either. We already learned we do not have medicines, masks, rare earths, or semiconductors here, as well as learning their steel and raw materials may be intentionally substandard and undermining. This especially includes communications infrastructure.

2) Our own nation needs much attention and support with the re-opening of our own parallel manufacturing that must also be dispersed so as not to be a single target for destruction or capture.

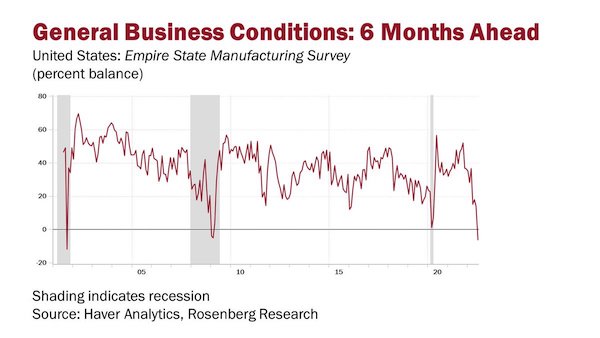

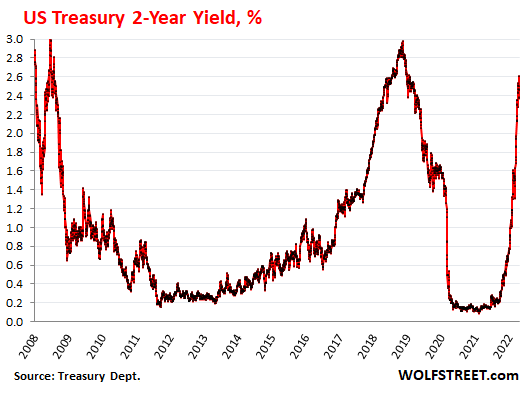

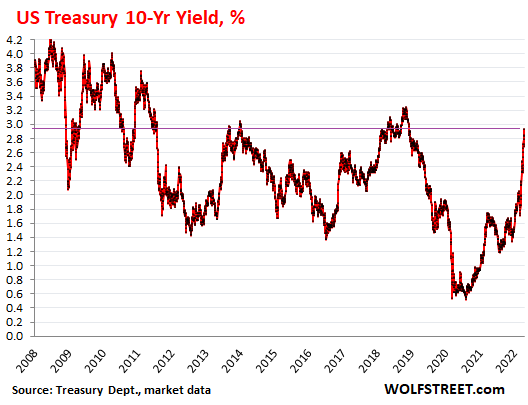

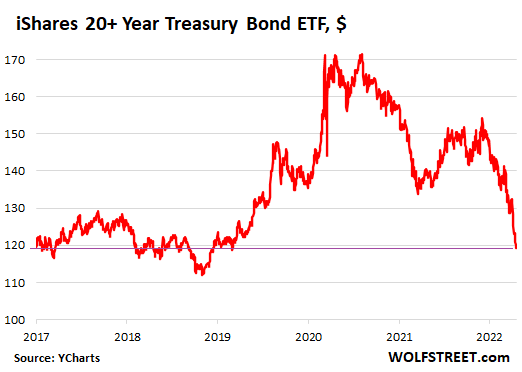

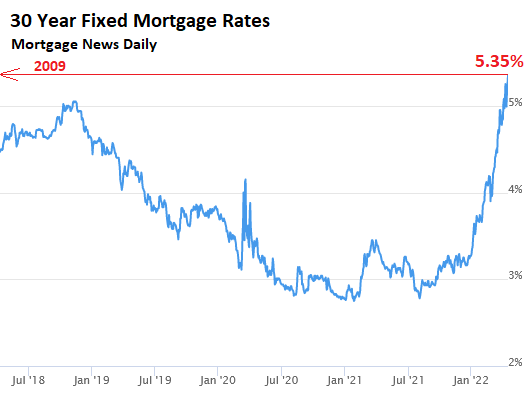

3) The U.S. Dollar and financial system is wholly established on financeering and imports. This comes from the too-high dollar and world reserve currency that necessitates the destruction of internal production and complete hollowing of business, culture, politics, psychology, society, and morality. Yet its reversal and replacement will be extremely disruptive, and the loss of the reserve currency will quite suddenly drop us from emperor to peer. Nevertheless, this can not be delayed or avoided.

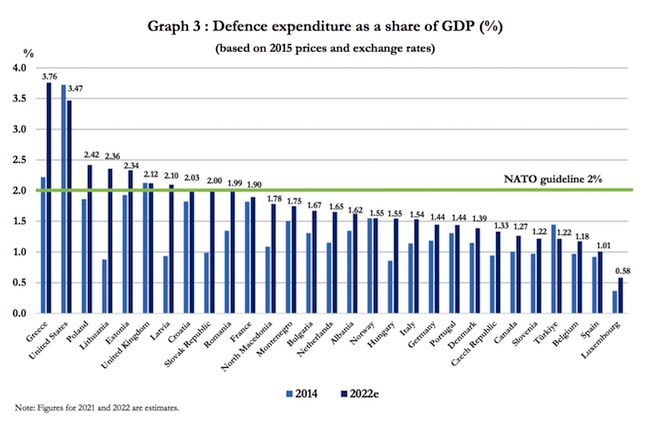

4) The U.S. Military, with the loss of the reserve currency, must retreat home, and therefore needs to re-tool and re-position rapidly to a defensive role, while still maintaining the overwhelming deterrent effect on China, and helping allies – thus preventing China from taking over the world nation-by-nation. Defense is enormously cheaper and easier, and as an ally, not an empire, our position would be far easier and more supported. This published reality may cause other nations to take more action than we could alone. While at home we may follow the Swiss model of having every man capable of arms and the materials secretly cached and available in each town.

5) While we may not have to come back to God to have the internal sense of equality, justice, morality, and enthusiasm for self-denial and hardship this will require, historically nothing else has sufficed for the righting of the ship and return to a forgiving, cohesive unity, and not weakening, atomized discord.

6) Along with our own ports, canals, rivers, grids, and mines, we need to maintain our own food production and distribution, and counter-intuitively sell it to our own rival or enemy. First, cutting off food must cause a certain war just as the embargo of Japanese oil did in 1940. Second, and not innocently, food is a major export we already have when we are no longer an importer of exorbitant privilege. Not less, as equals, we can always promote ourselves as being a friend and thereby encourage our rivals to pass through where they are or what plans they may have in favor of a stable peace that advantages all. Or else, like Switzerland, we must be certain to communicate we will most assuredly make them wish they had for their plans will not succeed.

7) We must recognize that such weapons are a reality now that cannot be reversed but must be accounted for and avoided with new strategies and new consciousness that does not require gain at the expense of others. The experience of the U.S. in making deserts bloom with the simplest tools is a good example.

Now these are easily supported by all Americans, all except the very few who are profiting by the existing system. So should there be a war or no war, with China or no China, all these responses are good for the country, the individual, and the world.

They are also workable in our own lives. As we’ve seen recently with massive, unpredictable, and longstanding supply disruptions that are only cured with more local production, smaller businesses, and local food. We see how having far more preparation, far more resiliency, far more local support, are important, both in hardship, but in our daily lives as well. Producing more, with more meaning, and consuming less, but better, are the only ways we can exit both this peril, and our own national failings at home.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.