Odilon Redon Peyrelebade landscape 1880

Arming Ukraine

The new CBS Reports documentary, "Arming Ukraine," explores why much of the billions of dollars of military aid that the U.S. is sending to Ukraine doesn't make it to the front lines: "Like 30% of it reaches its final destination." Stream now: https://t.co/Ob7Y3EsWkn pic.twitter.com/YgVbpYZkHn

— CBS News (@CBSNews) August 5, 2022

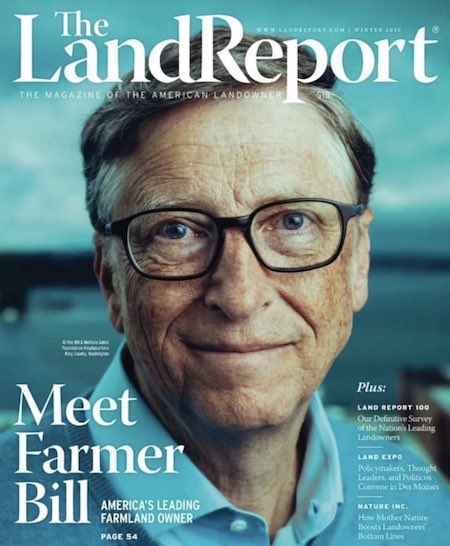

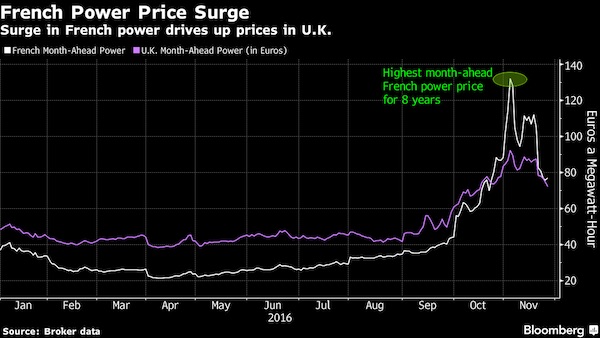

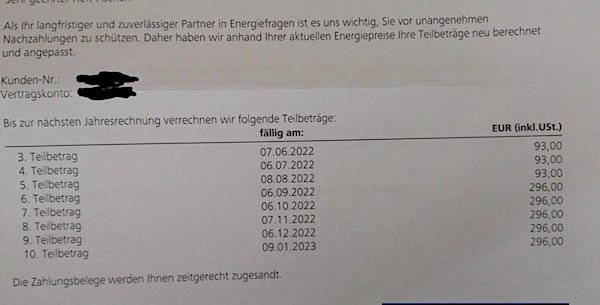

German electricity bill more than triples

60 years ago

Interesting… pic.twitter.com/1Yg4i6KalW

— Francis O'Neill (@FrancisxONeill) August 4, 2022

“..Blinken claimed that the US is a much more “responsible” nuclear-armed state..”

• Russia Explains Why It Won’t Use Nukes In Ukraine (RT)

Allegations about Russia threatening to use nuclear weapons against Kiev are “untenable and baseless,” the deputy head of Moscow’s delegation to the UN Non-Proliferation Treaty (NPT) review conference, Andrey Belousov, said on Friday in New York. “This is impossible since Russian doctrinal guidelines strictly limit emergency situations in which the use of nuclear weapons is hypothetically possible, namely in response to aggression involving weapons of mass destruction, or in response to aggression involving conventional weapons, where the very existence of the state is threatened,” Belousov explained. “None of these hypothetical scenarios is relevant to the situation in Ukraine,” he stated.

The Russian diplomat also rejected insinuations about Moscow placing its nuclear deterrent on “high alert,” explaining that the current state of “increased vigilance,” with extra personnel on duty at strategic command posts, is “completely different” from an actual “state of high alert of strategic nuclear forces.” Belousov argued that any warnings about a “serious risk of nuclear war” ever voiced by Russian officials in the context of the Ukraine crisis were directed at NATO, as a way to deter Western countries from direct aggression, as they “dangerously balance on the edge of a direct armed confrontation with Russia.”

While he did not name the accusers, Belousov’s response comes after the Ukrainian delegation to the NPT conference on Wednesday accused Moscow of “nuclear terrorism” and “openly threatening the world with its ability to use nuclear weapons,” while citing rhetoric by the “Russian media, think tanks and experts.” US Secretary of State Antony Blinken also accused Russia of “reckless, dangerous nuclear saber-rattling” to “those supporting Ukraine’s self-defense,” in his address on Monday. Blinken claimed that the US is a much more “responsible” nuclear-armed state, and “would only consider the use of nuclear weapons in extreme circumstances to defend the vital interests of the United States, its allies, and partners.”

“World War One. World War Two. Korea. Vietnam. Palestine. Iran. Nicaragua. Afghanistan. Iraq. Syria. Ukraine. Taiwan.”

• The Decline and Fall of the Western Empire (Batiushka)

Sometime in the future a learned academic will be writing a weighty tome with the title The Decline and Fall of the Western Empire. Perhaps the Contents Page will include, among others, twelve chapters with titles something like this: World War One. World War Two. Korea. Vietnam. Palestine. Iran. Nicaragua. Afghanistan. Iraq. Syria. Ukraine. Taiwan. Indeed, Karin Kneissel, the former Austrian Foreign Minister, is at present writing a book with the working title A Requiem for Europe. In an interview with Asia Times on 31 July she declared that ‘European countries are growing ever weaker on the international stage and their places are being taken by Asian countries’. She said that the Europe ‘where she was born and grew up and to which she was devoted no longer exists’. ‘European leaders, through ignorance and arrogance, are neglecting the existing geopolitical realities and basic principles of diplomacy and this has created a dangerous situation’.

She added: ‘This is connected with Eurocentrism. We believe that we are so great that nobody can do without us…It seems to me that Europe needs Russia more than Russia needs Europe. If I am right, then is it really in the interests of the Old World to treat Moscow as an enemy, inclining Moscow to Beijing? Today Europeans are more and more disillusioned and desperate and this may cause mass disorder and anti-government violence’. Kneissel, who is from Central Europe, makes it sound as if Europe is living in the past, before 1914, when it was politically central to the world, instead of being a more or less irrelevant political backwater as it is in 2022. What is certain is that the physical fall of an empire is always preceded by its spiritual fall. What did this spiritual fall consist of?

“..it’s also an attack on our values and the world order we want..”

• NATO Chief: Russia Must Not Win Its War In Ukraine (OP)

NATO Secretary-General Jens Stoltenberg says Russia must not be permitted to win in the war it launched against Ukraine, which has given rise to the most dangerous moment for Europe since World War II. Speaking in Norway on August 4, Stoltenberg said the alliance and its member countries may have to continue to support Ukraine with arms and other assistance for a long time in order to keep Russia from succeeding after it launched its unprovoked invasion of Ukraine on February 24. “It’s in our interest that this type of aggressive policy does not succeed,” Stoltenberg said. “This is the most dangerous situation in Europe since World War II,” he said, adding, “what happens in Ukraine is terrible but it would be much worse if there was a war between Russia and NATO.”

Stoltenberg then reaffirmed the alliance’s resolve to defend all its 30 member countries. “If (Russian) President (Vladimir) Putin even thinks of doing something similar to a NATO country as he has done to Georgia, Moldova or Ukraine, then all of NATO will be involved immediately,” Stoltenberg said. The war has led previously nonaligned Finland and Sweden to seek NATO membership, with the request so far ratified by 23 of the 30 member states, including the United States. “This is not just an attack on Ukraine, an independent democratic nation with more than 40 million people, it’s also an attack on our values and the world order we want,” the NATO chief said of the war.

“The Americans have taken up a course of suppressing any independence..”

• Lavrov Speaks Out On US Effort To Dominate World (RT)

Washington’s attempts to spread its influence to more and more areas around the globe are doomed to fail, Russian Foreign Minister Sergey Lavrov said on Friday. “Our American colleagues demonstrate permissiveness” for themselves in international affairs “every time they try to assert their dominance” in new places, Lavrov said during a meeting with Chinese counterpart Wang Yi on the sidelines of the East Asia Summit in Cambodia’s capital of Phnom Penh. “The Americans have taken up a course of suppressing any independence,” Russia’s top diplomat insisted. But those who follow their actions “understand the futility of a policy according to which you can just turn a blind eye to one situation, one crisis created by the US, and expect that everything will be more or less OK there,” he said.

Lavrov mentioned the conflict in Ukraine and the current crisis over Taiwan as examples of reckless policies pursued by the US. “They decided to turn Ukraine into a menace for Russia and for many years ignored the racist policies of the Kiev regime, which has been destroying everything Russian… they violated the principles of indivisible security, which they signed up for at the highest level and which they simply trampled upon,” he explained. Moscow has pointed to the persecution of Russian speakers in Donbass by the Kiev authorities and the US push to make Ukraine a member of NATO as being among the main reasons for launching its military operation in the neighboring country in late February. “Similarly, in the case of [US House speaker] Nancy Pelosi’s visit to Taiwan, they [the Americans] ignored their own principles, which they proclaimed publicly,” the Russian foreign minister pointed out.

“..some groups have already sought to organize protests in Berlin under the slogans “Revolt,” “Uprising,” and “Civil War.”

• Germany Risks Facing ‘Winter Of Anger’ (RT)

Germany’s federal and regional governments are bracing for a potential wave of protests which might come this autumn or winter, the state-funded ARD and RBB broadcasters reported this week. Chancellor Olaf Scholz’s cabinet fears that rising food and energy prices could lead to social unrest and be exploited by various “radical” movements, the outlets explained. According to the media, the protests might be similar to the ones Germany experienced during the Covid-19 pandemic, when the government faced resistance to its lockdown and vaccination policies. ARD’s Tagesschau news service reported that some groups have already sought to organize protests in Berlin under the slogans “Revolt,” “Uprising,” and “Civil War.”

According to the reports, the protests might be similar to those experienced during the Covid-19 pandemic, when the government faced resistance to its lockdown and vaccination policies. The new rallies might once again unite people known as the Querdenker (lateral thinkers) in Germany. This is a loose organization of grassroots movements that became prominent during the anti-lockdown protests. The German media has repeatedly pointed to the movement’s supposed links to various far-right extremist groups. A “Free Saxony” movement in the eastern German state of Saxony has also called for “massive civil resistance,” according to Tagesschau, citing Matthias Quent, a researcher with the Magdeburg-Stendal University of Applied Sciences.

Saxony’s interior minister, Armin Schuster, also told ARD that his ministry was preparing for “various” scenarios, adding that some “groups, activists or parties” might seek to “exploit” the current situation for their own narrow goals. Some of those who “mobilize and agitate”people had already drawn the attention of his ministry, he added. According to the media, German Economy Minister Robert Habeck also faced criticism during his summer tour across Germany and his speech in the town of Bayreuth in Bavaria was “massively disturbed” last week. The protesters, who staged demonstrations during his tour reportedly called for the launch of the Nord Stream 2 gas pipeline to alleviate the energy crisis. They also allegedly demanded sanctions imposed against Russia be lifted.

The hand that feeds you..

Zelensky is hurting from the Amnesty report.

• Zelenskyy Lashes Out At EU Aid Delay (Pol.eu)

A new draft proposal by the European Commission would provide €8 billion in financial aid to Ukraine through a mix of grants and loans, two EU officials told POLITICO Friday. The EU would disburse up to €5 billion as long-term loans leveraged on the back of guarantees provided by EU countries, according to their contribution to the bloc’s budget. Interest payments would be subsidized by the EU’s budget. The remaining amount, around €3 billion, would be provided as grants, the officials said. The new draft proposal comes after Germany refused to provide guarantees to back up to €9 billion in loans for Ukraine. Berlin argued that grants are better suited to help Kyiv — which is already heavily in debt — and pointed to its own bilateral grant of €1 billion.

That position caused Italy and France, which also provided bilateral aid, to raise issues as well, forcing the Commission back to the drawing board. While there’s no timeline yet, the Commission is aiming to obtain approval by the European Parliament and EU countries in September so that disbursement can start in October, one official said. The issue of aid has become fraught, with Ukraine President Volodymyr Zelenskyy blasting the EU for the delay in his most recent overnight address. Back in May, EU leaders pledged to provide “up to €9 billion” in macro financial assistance to Kyiv. But so far, the Commission has only been able to disburse €1 billion in loans backed by the EU’s budget.

The challenge is acute, because Kyiv has been running a budget deficit of around $5 billion per month since Russia’s invasion. It has called on international donors for help so it can cover basic costs like pensions and public sector wages — or risk financial collapse. “Every day and in various ways, I remind some leaders of the European Union that Ukrainian pensioners, our displaced persons, our teachers and other people who depend on budget payments cannot be held hostage to their indecision or bureaucracy,” Zelenskyy said. “Such an artificial delay of macro-financial assistance to our state is either a crime or a mistake, and it is difficult to say which is worse in such conditions of a full-scale war,” Zelenskyy said, referring to the remaining €8 billion.

Make peace and your kids won’t be in the cold.

• Two EU Members Reject Gas Rationing Plan (RT)

Poland and Hungary have refused to support the EU’s plan to cut gas consumption by 15%, Reuters reported on Saturday, citing a document published by the Czech Republic, which currently chairs negotiations within the bloc. EU countries last week agreed on a plan to reduce gas usage in order to fill storages amid concern of a possible shut-off of Russian supplies. The EU Council approved the plan on Friday. However, according to Reuters, the vote for approval only required a simple majority – meaning the support of 15 of the bloc’s 28 members – to be adopted. Hungary, which is currently in talks to secure more gas supplies from Russia, had opposed the scheme from the very beginning. According to the document seen by Reuters, Budapest questioned the legality of the plan, claiming that it would affect the country’s energy security.

Poland, meanwhile, initially agreed to cut consumption but on Friday voted against the plan, the agency reports. Warsaw called the legal basis of the document “defective” and said that decisions affecting the energy mix of EU countries should be made with the unanimous approval of all of member states. The newly adopted rationing plan is not mandatory unless the EU Council triggers a ‘Union alert’ on gas supply security. It also includes a number of exemptions. In particular, member states that are not connected to the gas networks of other EU countries are exempt from the requirement. In addition, members can request a relaxation of the conditions if they have exceeded their storage capacity targets or if their strategically important industries are heavily dependent on gas.

Something George Webb is looking into.

• Russia Connects USAID’s Bat Capture Program To Emergence Of Covid-19 (Tass)

Russian Defense Ministry assumes a connection between the United States Agency for International Development (USAID) program on bat control and the emergence of Covid, Russian Nuclear, Chemical and Biological Protection Troops commander Lieutenant General Igor Kirillov said Thursday. “We consider a possibility that the USAID is involved in the emergency of the novel coronavirus. Since 2009, the agency funded the PREDICT program, which focused on studying novel coronaviruses and capturing bats that transmit these viruses. One of the program’s contractors was Metabiota, notorious for its military biological operations in Ukraine,” he said. He also stated that the statements made by US congressmen also raise concerns about the role of US biologists in the emergence and spread of COVID-19.

Kirillov pointed out that member of the US House Intelligence Committee Jason Crow warned US citizens during the National Security Conference in July against handing over their DNA samples to private companies, because they could be sold to third parties. “There are now weapons under development, and developed, that are designed to target specific people,” Crow said at the time. “Considering the interest of the US Administration to research of focused action biological means, such statements provide a new angle on the reasons behind the emergence of the novel coronavirus infection and the spread of the COVID-19 pathogen,” Kirillov said.

The general noted that the Johns Hopkins University held the Event 201 exercise that focused on actions amid an epidemic of an unknown coronavirus. “According to the exercise background, [the coronavirus] was transmitted from bats to humans through an intermediate carrier – pigs. This is how the Spanish flu, which took lives of tens of millions of human lives, became a pandemic,” Kirillov noted. “The implementation of the COVID-19 development scenario, as well as the emergency shutdown of the PREDICT program in 2019, make it possible to assume the intentional nature of the pandemic and the US’ involvement in its emergence,” he concluded.

“..concerns that “the FBI has become too politicized in its decision making” were allegedly “removed from this year’s final report”..

• FBI Director Sets New Record For Lies, Dodges, And Obfuscations (Fed.)

Ranking member Chuck Grassley was just one of the many Republicans who grilled Wray about the FBI’s increasing partisanship and the effect that a weaponized federal agency has on Americans’ trust in its institutions. “Director Wray, simply put, the FBI’s credibility is on the line, as are principles that helped found and sustain our great nation,” Grassley said in his opening statement. Grassley sent a letter to Wray and Attorney General Merrick Garland last month outlining how both the Department of Justice and the nation’s primary domestic intelligence agency are “institutionally corrupted to their very core to the point in which the United States Congress and the American people will have no confidence in the equal application of the law.”

That was after multiple whistleblowers alleged that high-ranking bureau officials manipulated evidence related to an investigation into President Joe Biden’s son Hunter Biden and his “pay-to-play scandal of influence-peddling.” Evidence also suggests that “FBI Headquarters either improperly withheld information or presented inaccurate information to the U.S. attorney’s office in Pittsburgh and possibly also Delaware” about Hunter. When Grassley asked Wray on Thursday why concerns that “the FBI has become too politicized in its decision making” were allegedly “removed from this year’s final report” and what Wray plans to do to address those concerns, the director dodged the question.

“I think you’ve answered the process. But you haven’t answered this specific thing about why that information was taken out of the report,” Grassley noted after Wray went on a tangent about visiting various field offices. “Yeah, I don’t, I’m not familiar with that. … Let me see if there’s something we can share with you on that,” Wray said. [..] One of Wray’s talking points during the hearing was the spike in violent crime across the county. When Republican Sen. John Cornyn of Texas asked him how that violence is related to the crime rings operating thanks to the compromised U.S.-Mexico border, Wray danced around the issue.

“Director Wray, I’ve always thought of you as a straight shooter but you won’t answer that question?” Cornyn asked. It was then that Wray conceded that the “border presents significant security issues” that feed the violence he claims his agency is struggling to combat. “There’s a wide array of criminal threats that we encounter down at the border. You mentioned a little bit in some of your questions, the transnational criminal organizations that use diverse and complex methods to traffick drugs, that then cascades over into prison and street gangs who distribute it,” Wray admitted.

Texas Gov. Greg Abbott has had enough of open borders, sent 6,500 migrants aboard 160 buses to Washington..

• Pentagon Rejects DC Request For National Guard To Handle Illegal Migrants

Washington D.C. Mayor Muriel Bowser revealed Friday the Defense Department rejected her request to provide National Guard troops to the city to deal with a growing number of a illegal migrants being bused from Texas. Bowser said she plans to modify her request and submit it again in hopes that being more specific about the use of troops may persuade the Pentagon to change its mind. “We want to continue to work with the Department of Defense so that they understand our operational needs, and to assure that any political considerations are not a part of their decision,” she said. Bowser said the Pentagon raised “the concern about the open-ended nature of our request, and their ability to respond to it.”

“So having just looked at their letter, they appear to say a more specified request would help them understand our needs,” she said. Bowser’s announcement came the same day Texas Gov. Greg Abbott revealed he is now beginning to ship illegal migrants to New York City after Mayor Eric Adams refused his request to come visit the border. According to Abbott’s office, more than 6,500 migrants have been moved aboard 160 buses to Washington. In its letter to the District of Columbia government, the Pentagon said troops are unnecessary because the city has already received enough federal funding through a nonprofit agency to house and care for the migrants.

“Democrats are telling their senators not to get tested for covid to ensure they can pass their $800 billion spending bill before summer recess. They can’t lose a single vote so a positive covid test would derail the bill. ”

• Democrats Abandon Covid Protocols To Vote On Bill (OK)

After years of obsessively following and promoting COVID related policies, Democrats are abandoning their precious mass testing policy now that it suits their political agenda. The laughably named “Inflation Reduction Act,” which naturally does nothing to reduce inflation, is so important to the Democrats’ legislative agenda that they’re throwing caution to the wind to ensure that no Senators will miss an upcoming vote. During the pandemic, there have been concerns over delayed votes due to potential positive COVID tests, but that won’t be getting in the way this time. According to a new report, there’s a new and unofficial “Don’t Test, Don’t Tell” policy to ensure they don’t delay enacting their latest tax and spending bill: This is, as usual from Democratic politicians these days, the height of hypocrisy.

They’ve indefinitely advocated for mass testing and “taking COVID seriously,” which causes huge disruptions to work and school life, as well as creating panic over every positive COVID test, regardless of severity. Democrats have criticized Republicans for not doing enough to combat every possible positive case, even though their politicians, including President Biden, continue to get the virus. After making COVID “interventions” a pseudo-religious ritual for those on the left, suddenly politics comes first. Possibly the most unintentionally comedic part of this unofficial announcement is that they seem to believe that wearing masks will prevent the spread of the virus: “They’re not going to delay it if a member has gotten Covid. Counterparts are saying they’re not going to test anymore. It’s not an official mandate but we all know we’re not letting Covid get in the way. The deal is happening. Less testing, just wear masks and get it done.”.

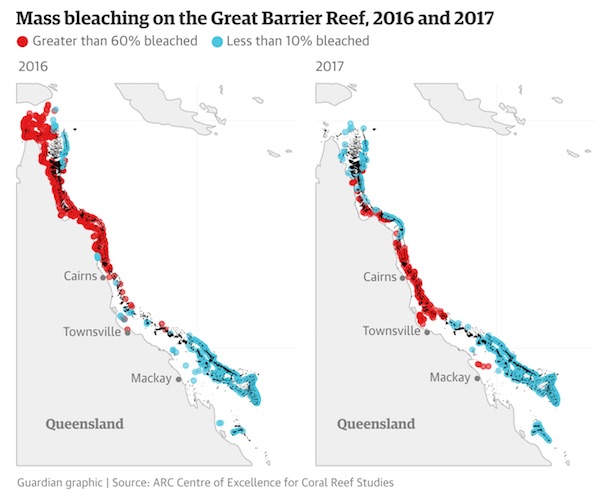

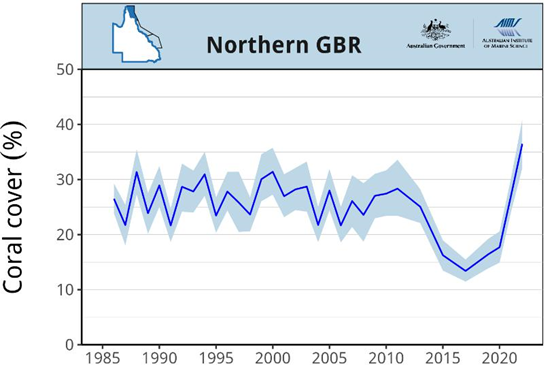

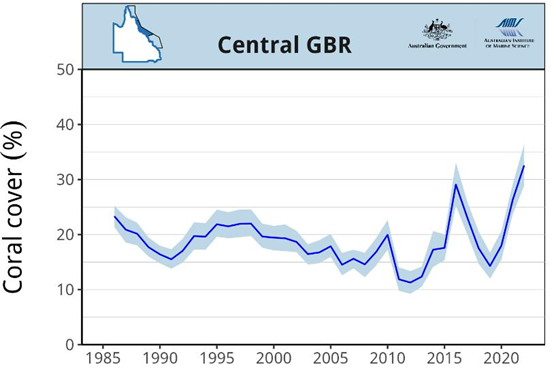

“Only three of the 24 reefs surveyed in the last two years had decreased hard coral cover…”

• Mass Coral Growth at Great Barrier Reef Defies Doomsday Predictions (DS)

The near vertiginous rise in the annual growth of coral at the Great Barrier Reef (GBR) is continuing, with further major increases recorded across large areas. According to the 2021-22 annual summary from the Australian Institute of Marine Science (AIMS), levels of coral cover in the northern and central areas of the reef were at their highest levels over the past 36 years of monitoring. The growth is of course excellent news for environmentalists, but curiously, at the time of writing, the news is being downplayed in the mainstream media. The demise of the world’s coral reefs has long been a go-to poster scare story for Net Zero promoters. As late as October 2020, the BBC was telling stories about the Reef losing half of its coral.[..]

This notion that global warming will cause corals to die is frankly a big whopping fib. Tropical coral, which is closely related to its cnidarian cousin the jellyfish, thrives in waters between 24°C and 32°C. It is highly adaptable but seems to dislike sudden changes in temperature, often caused by natural weather oscillations such as El Niño events. As the latest results from the AIMS show, coral quickly recovers when normal localised conditions return. In fact, coral often grows faster in warmer waters nearer the equator than the GBR. The big agitprop lie suggests minor long-term sea temperatures changes will wipe out the coral, but the scientific evidence suggests otherwise.

Recovery is said to have continued following a “period of cumulative disturbances” from 2014 to 2020. Only three of the 24 reefs surveyed in the last two years had decreased hard coral cover. The biggest disturbance, of course, arose around 2016 and was caused by a powerful, and natural, El Niño Pacific oscillation that quickly raised surrounding ocean temperatures by up to 3°C. Sudden warming spooks the coral and they expel symbiotic algae in a process commonly known as bleaching.

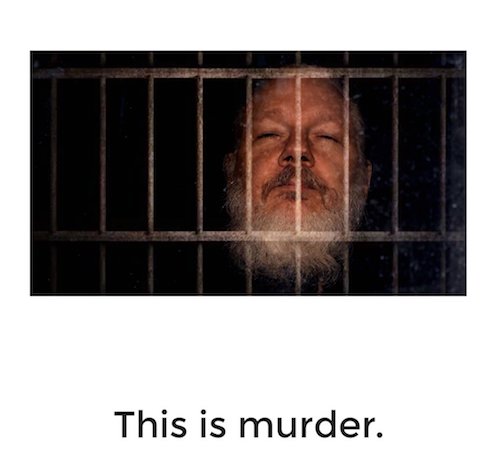

The book by the UN special rapporteur on torture, no less.

• Assange Family Barred From Taking Melzer Book Into Australia Parliament (G.)

Security staff at Parliament House in Canberra seized copies of a book about Julian Assange from his family members as they entered the building to meet MPs on Thursday, deeming it “protest material”. Assange’s family and supporters visited parliament on Thursday to urge the Albanese government to intervene in the proposed extradition of the WikiLeaks founder from the UK to the United States. They were carrying copies of a book on Assange’s case by Nils Melzer, the former United Nations special rapporteur on torture, which they intended to give to MPs and media. But Assange’s brother, Gabriel Shipton, said parliament security refused to let the family take the book into the building, because they deemed it to be “protest material”.

“I was saying ‘this is ridiculous. They’re books’,” Gabriel Shipton said. “I offered to call Andrew Wilkie, who was the MP who co-chaired the Parliamentary Friends of the Bring Julian Assange Home Group. He said ‘yes, go ahead, call him, but you can’t take the books in’.” The family was able to distribute books to MPs and media from a box already stored in Wilkie’s office, and a staffer from Wilkie’s office was able to later retrieve the seized books. But Louise Bennet, a campaigner with the Bring Assange Home Campaign, said the actions of security were “ridiculous”. “They were incredibly adamant that it was protest material and that it was not allowed into the building,” Bennet said. “It just blows my mind. This is the sort of thing that we see in Trump’s America, that we criticise in China. What is our parliament afraid of that we can’t bring a book in?”

EVs

Sean Hannity left STUNNED after guest EXPOSES the dark truth about Biden's radical agenda— What it's REALLY about… pic.twitter.com/KVL8NlA6H9

— Benny Johnson (@bennyjohnson) August 5, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.