Arnold Böcklin The Isle of the Dead III 1883

McCullough

@P_McCulloughMD pic.twitter.com/SG6gGtWFUW

— carolina_bonita (@carolina_bonita) December 31, 2021

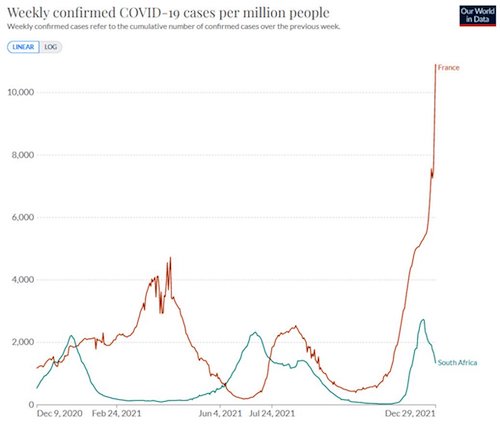

“Peak in four weeks and precipitous decline in another two. This Omicron wave is over in the city of Tshwane. It was a flash flood more than a wave..”

• South Africa Says Death Toll ‘Extremely Low’ After Omicron Wave (JTN)

South Africa is nearing the end of its fourth COVID-19 wave without seeing as many deaths as previous waves, according to a government statement Wednesday. “Hospitalisations and deaths are lower than the second and third wave,” Premier of Western Cape Alan Winde said. The COVID variant omicron was discovered in South Africa last month, greatly contributing to the fourth wave. While cases are now declining, Winde said, “the gap between cases, admissions and deaths continues to widen during the fourth wave.” Fareed Abdullah of the South African Medical Research Council told The New York Times: “The speed with which the Omicron-driven fourth wave rose, peaked and then declined has been staggering.” “Peak in four weeks and precipitous decline in another two. This Omicron wave is over in the city of Tshwane. It was a flash flood more than a wave,” he said.

The high of South Africa’s most recent wave appears to have occurred the week of Dec. 13. with nearly 163,000 cases, while the wave’s peak death toll seems to have occurred the week of Dec. 20 with 428 deaths, according to World Health Organization data. This sharply contrasts with previous South African waves. For example, during the third wave there, nearly 133,000 people were diagnosed with COVID the week of July 5, and more than 2,800 people died the week of July 19. “While the case numbers and test positivity rate during the fourth wave have exceeded previous waves, admissions are below the peak of both the second and the third wave and deaths remain extremely low, in line with previous interwave periods. There is therefore a widening gap between these metrics, pointing to less severe disease during the fourth wave,” Winde said.

More much ado.

• Omicron-Fuelled Fourth Covid Wave Has Passed, Says South Africa (G.)

South Africa has lifted a nightime curfew on people’s movement with immediate effect, believing the country has passed the peak of its fourth coronavirus wave driven by the Omicron variant. As the head of the World Health Organization sounded an optimistic note about beating the pandemic in 2022, the government in Pretoria removed the midnight-to-4am curfew based on the trajectory of the pandemic, vaccination levels and available capacity in the health sector, the government said on Thursday. “All indicators suggest the country may have passed the peak of the fourth wave at a national level,” a statement from a special cabinet meeting held earlier on Thursday said. “While the Omicron variant is highly transmissible, there has been lower rates of hospitalisation than in previous waves,” the cabinet statement said.

Data from South Africa’s health department showed a 29.7% weekly decrease in new cases detected in the week ending 25 December, the government said. Hospital admissions have declined in eight of South Africa’s nine provinces. South Africa, with close to 3.5 million infections and 91,000 deaths, has been the worst-hit country in Africa during the pandemic on both counts, and was where the Omicron variant of the coronavirus was first detected last month. The country is at the lowest of its five-stage Covid-19 alert levels. Besides lifting the restrictions on public movement, the government also ruled that alcohol shops with licences to operate beyond 11pm may revert back to full licence conditions, a welcome boon for traders and businesses hard hit by the pandemic and looking to recover during the festive season.

Why don’t I see anyone saying if this is true for kids, it’s true for all hospitalizations? Because that is the inevitable conclusion.

• Fauci Takes Professional Gaslighting to New Levels (CTH)

This admission is exactly what people have been arguing for two years. This exact point, and the “with COVID -vs- from COVID” argument within the false narrative, is what justified Big Tech to ban COVID critics from their speech platforms. I’m not going to comment further; at a certain point these reversals just get silly. Suddenly, as the magic politics of COVID infection rates turns into a liability, the accuracy of hospitalized COVID tests is something to clarify. These officials are just throwing magic beans into the audience at this point. In the past ten days, the CDC, NIH and FDA have jumped so far over the justification shark, the light from where justification shark jumping starts could not catch them for years.

More kids, but also:

“..people in the 65+ demographic are five times as likely to die from the inoculation as from COVID-19 under the most favorable assumptions!”

• COVID-19 Genetic Vaccine Safety in Children (Malone)

“Even as experts expressed concern about a marked jump in hospitalizations — an increase more than double that among adults — doctors and researchers said they were not seeing evidence that Omicron was more threatening to children. In fact, preliminary data suggests that compared with the Delta variant, Omicron appears to be causing milder illness in children, similar to early findings for adults.” NY Times, “Omicron Is Not More Severe for Children, Despite Rising Hospitalizations” By Andrew Jacobs Dec. 28, 2021

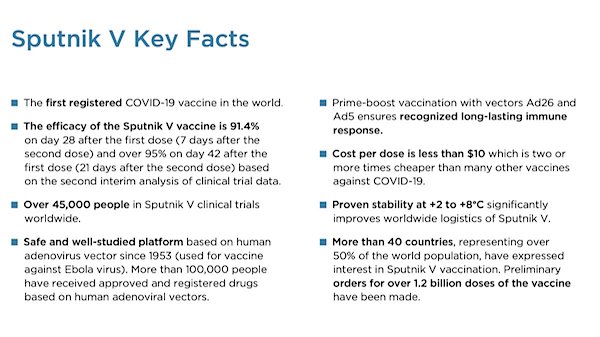

The risk of death associated with COVID-19 in healthy children is virtually non-existent, as children have significant immunologic advantages relative to the older adult population (> 65 years) which comprises the high risk cohort for COVID-19. The risk of death and disease in children has become even more rare with Omicron. Yet even prior to the advent of Omicron, a peer reviewed study clearly demonstrated (using safety data accumulated during past variant circulation) that the genetic COVID-19 vaccines carry a risk/benefit ratio of five deaths in the older, high risk cohort for every one life saved from COVID-19 (and those data did not account for the reporting bias inherent in US deaths due to COVID consequent to inappropriate use of PCR tests).

“Thus, our extremely conservative estimate for risk-benefit ratio is about 5/1. In plain English, people in the 65+ demographic are five times as likely to die from the inoculation as from COVID-19 under the most favorable assumptions! This demographic is the most vulnerable to adverse effects from COVID-19. As the age demographics go below about 35 years old, the chances of death from COVID-19 become very small, and when they go below 18, become negligible.” The new variant of COVID-19, Omicron, has exploded onto the scene. What was already an inverted risk benefit ratio for genetic vaccination in children and adults (greater risk of death from vaccine than from COVID-19) will become even more inverted since the risks of COVID-19 are further reduced with Omicron.

The Omicron variant is different in five essential ways:

• More infectious and will soon be the dominant variant in the USA

• Less pathogenic

• Poorly matched to currently available vaccines

• Natural immunity is providing good protection against Omicron

• Disease symptoms are more similar to the common cold

Anyone seen those goalposts?

• Officials Ponder What It Means To Be ‘Fully Vaccinated’ (NYT)

Goldman Sachs and Jeffries, the investment banks, are demanding that employees get booster shots. The University of Oregon and other institutions are requiring that students and staff members get boosters. New York state has said it plans to stop considering residents fully vaccinated unless they have gotten the shots. As the highly transmissible Omicron variant spreads from coast to coast, corporations, schools, governments and even sports leagues are reconsidering what it means to be “fully vaccinated.” Now federal health officials, too, have taken on the question. Although top policymakers want to encourage Americans to get three doses, some would like to avoid changing the definition of a phrase that has become pivotal to daily life in much of the country, according to officials who spoke on condition of anonymity to describe internal deliberations.

Dr. Rochelle Walensky, director of the Centers for Disease Control and Prevention, said Tuesday that she and other health officials were “working through that question” now. “There really isn’t debate here in what people should do,” she added. “CDC is crystal clear on what people should do: If they’re eligible for a boost, they should get boosted.” With Omicron’s sharp rise — more than 488,000 new cases were reported Wednesday alone — some experts think the moment for change has arrived. “I think the time is now,” said Dr. Georges Benjamin, executive director of the American Public Health Association. From a medical perspective, he said, receiving that additional booster dose “is really what we should be thinking of as fully vaccinated.”

Redefining “fully vaccinated” could lead to enormous logistical challenges, as even supporters of the idea concede, and it is likely to incite political backlash. Tens of millions of Americans who thought of themselves as vaccinated might discover that without boosters, they could lose access to restaurants, offices, concerts, events, gatherings — any place where proof of vaccination is required to enter. Moreover, the change risks undermining trust in public health officials after two years of shifting recommendations, experts said. Some Americans may feel that the goal posts have been moved again, and too suddenly. “While a determination of what constitutes full vaccination may be grounded in science, it does have significant political and economic ripple effects,” said Larry Levitt, executive vice president of KFF, a nonprofit organization that focuses on health issues.

The CDC currently defines “fully vaccinated” as those who have received two doses of the Pfizer-BioNTech or Moderna shots, or one dose of the Johnson & Johnson shot. Although experts continue to believe that these regimens protect against hospitalization and death, the vaccines’ effectiveness against infection with the virus wanes over time. What had been considered full vaccination is substantially less effective against infection with Omicron, which is able to partially evade the body’s antibodies.

“According to the Vermont Department of Health, “Half of the [Covid] deaths in August were breakthrough cases. Almost three-quarters of them in September were..”

• Covid and Corrupt Federal Statistics (Bovard)

During his update on his Winter Covid Campaign on Tuesday, President Biden declared, “Almost everyone who has died from COVID-19 in the past many months has been unvaccinated.” This was true from the start of the pandemic in early 2020, until the vaccines’ efficacy began failing badly in recent months. Oregon officially classifies roughly a quarter of its Covid fatalities since August as “vaccine breakthrough deaths.” In Illinois, roughly 30 percent of Covid fatalities have occurred among fully vaccinated individuals. According to the Vermont Department of Health, “Half of the [Covid] deaths in August were breakthrough cases. Almost three-quarters of them in September were,” as well, according to Burlington, Vermont TV station WCAX.

The Biden administration guaranteed that the vast majority of “breakthrough” infections would not be counted when the Centers for Disease Control in May ceased keeping track of “breakthrough” infections unless they resulted in hospitalization or death. Ignoring that data permitted Biden to go on CNN in July and make the ludicrously false assertion: “You’re not going to get COVID if you have these vaccinations.” But federal data on fully vaxxed Covid fatalities is far flimsier and less reliable than the numbers compiled by some states. Honestly recognizing the limits of vaccines could be fatal to Biden’s push for compulsory vaccinations.

The same policymakers who claim to be guided by data have little or no idea how many Americans have been hit by Covid. According to the CDC, there have been 51,115,304 Covid cases in America. But a different CDC web page estimates that there had been 146.6 million Covid infections in the US as of October 2, 2021. That CDC analysis estimated that only one in four Covid infections have been reported, which would mean that based on the latest official case numbers, more than 200 million Americans have contracted Covid. For Biden and his fellow policymakers, a potential error of 150 million Covid infections is “close enough for government work.” Relying on the lower number is convenient for policymakers who want to continue ignoring the natural immunity acquired by 199 million Americans who survived Covid infections.

“..psychopathe fasciste..”

• Justin Trudeau Calls Unvaccinated ‘Racist and Misogynistic Extremists’ (RAIR)

Canadian Prime Minister Justin Trudeau stunned viewers during a television appearance in Quebec when he announced people who do not receive the experimental Covid “vaccine” are “often racist and misogynistic extremists.” The left-wing Canadian leader questioned whether the country needed to “tolerate these people.” He further bashed anyone unvaccinated, smearing them as “science deniers.” Although those refusing to be injected are a “small group of the population,” states Trudeau, they are still “taking up space.” The leader stressed that the only way to end this pandemic is by getting jabbed. “We will emerge from this pandemic through vaccination,” said Trudeau. The radical leaders praised the “80% of Quebecers” who received the injection and “did the right thing.”

Canadians “want to get back to the things we like doing,” stressed Trudeau. “These people who are not [vaccinated] are going to block us now,” warned the leader. In Quebec, 77.6% of residents have received two injections vaccination. A total of 15,245,140 doses have been administered. After his shocking comments, the conservative leader of the People’s Party of Canada, Maxime Bernier, took to Twitter to call Trudeau a “fascist psychopath.”

Does it get any messier than this?

• Healthcare Worker Vaccine Mandate Reinstated In Half Of US (JTN)

The Centers for Medicare & Medicaid Services (CMS) on Tuesday reversed on a previous decision, and will now mandate health care workers to receive the COVID-19 vaccine within the next month in half of the nation where the mandate has not been put on hold by the court. The new CMS rule reverses a decision made on Nov. 5 that suspended the mandate, making it dependent on the future of two cases, State of Louisiana et al v. Xavier Becerra, Sec. of HHS, et al and Joseph Biden, President of U.S., et al v. Missouri, et al. Half of all U.S. states joined in these lawsuits to stop the federal vaccine requirement for health care employees. The Supreme Court combined the two and will hear arguments next week.

Facilities in states not part of the pending case will be forced to have 100% of staff vaccinated by Jan. 27, 2022. If a health care center has a compliance rate of more than 80% and plans to reach a 100% rate within 60 days, then the facility will not be “subject to additional enforcement action.” Depending on the rate of vaccination, enforcement mechanisms include “plans of correction, civil monetary penalties, denial of payment, termination, etc.” Workers must receive a second dose by Feb. 28, the memo states. All employees must receive the vaccine “regardless” of their job responsibilities or the amount of time they are in contact with patients. Health care employees affected by the new rule are allowed to opt-out of the vaccine mandate, and receive other “accommodations” if they have a “disability or sincerely held religious beliefs, practices, or observations.”

FDA and CDC play good cop/bad cop.

• FDA: PCR Tests For Covid Are ‘Gold Standard’ (JTN)

Centers for Disease Control and Prevention Director Rochelle Walensky’s recent admission that common tests for COVID-19 can detect long-gone infections has some calling into question the Food and Drug Administration’s claim that the tests represent the “gold standard” for diagnosing coronavirus. The CDC’s new caution also falls in line with reports going back 16 months about widespread false positives among the so-called PCR tests, particularly when labs run them at high “cycle thresholds,” which pick up viral loads that may be dead or too small to transmit. The CDC’s decision Monday to halve the recommended “isolation” time for asymptomatic COVID-19 infections amid the Omicron wave, regardless of whether individuals test negative, prompted consternation in some medical circles.

The agency justified the new 5-day isolation by claiming “the majority of SARS-CoV-2 transmission occurs early in the course of illness, generally in the 1-2 days prior to onset of symptoms and the 2-3 days after.” But Walensky also emphasized that neither rapid antigen tests, which are currently in short supply, nor PCR tests were appropriate for determining if a person can safely leave isolation. She told CBS Mornings that antigen tests may not be sensitive enough to detect infectiousness, while PCR tests are so sensitive that “it can stay positive for up to 12 weeks, for months and months.” People would have to stay isolated “for a very long time if we were relying on PCRs,” she told Good Morning America. The significance of Walensky’s declaration, which has sweeping implications for COVID policy in the workplace, school and travel settings, went largely unnoticed except among skeptics of COVID policy.

“Think of all the lives ruined, jobs lost, education squandered b/c of false positives,” tweeted Justin Hart, chief data analyst for the COVID contrarian website Rational Ground. “We’ve been saying since summer 2020 that the PCR test can be positive at 5 days or 75 days. And ONLY JUST NOW is it being used to adjust policy,” he said. Hart is suing Facebook, Twitter and the feds for viewpoint discrimination by “conspiring … to censor messages with which [the government] disagrees.” The suit was triggered by Facebook suspending him over a graphic questioning the science behind school mask mandates. The New York Times highlighted the sensitivity problem with PCR tests in August 2020. In a review of testing data with cycle thresholds (CTs) from Massachusetts, New York and Nevada, the newspaper found that “up to 90 percent of people testing positive carried barely any virus.” The newspaper said most tests in the U.S. were run at 40 CTs and “a few at 37,” but experts it consulted said the threshold should be 30-35, if that high.

Slow death.

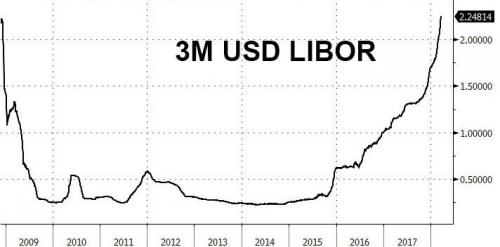

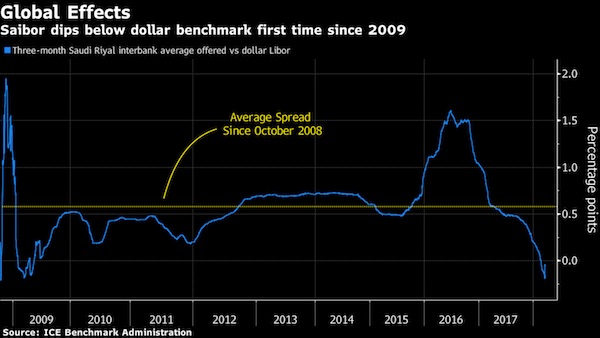

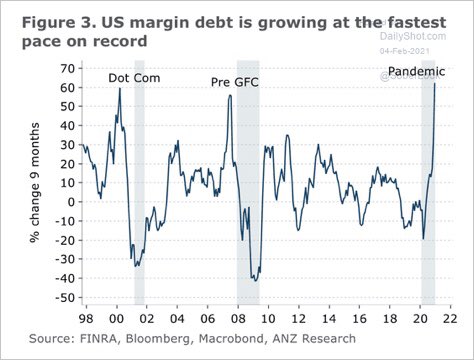

• Has The $230 Trillion LIBOR Derivative Time-Bomb Really Been Defused? (ZH)

Years ago, we predicted that the Fed’s commitment to phase out Libor, the interest rate set by committee (not market forces) that had come to undergird trillions of dollars in loans and securities around the world, would ultimately prove unsuccessful. Now, as the FT points out, it appears we were correct. Libor won’t be phased out completely by the start of next year. While technically speaking no new securities can be bechmarked to Libor, there’s still the matter of the $230 trillion in existing contracts that rely on the benchmark. And the rates that undergird these contracts will continue to be published. Still, plenty of other Libor rates won’t. Only the most popular will survive, according to the FT. So in a way, next month does mark the moment when “four years of arduous preparation to live without it goes into effect.”

“It’s one of the biggest transitions in financial markets in decades,” said Dixit Joshi, group treasurer of Deutsche Bank. “This is a milestone for the regulators since the great financial crisis about lessons learned.” But it’s not a complete break, which is what the world was promised in the wake of the scandals that inspired the decision. Much lower in its story on the impending Libor deadline, the FT concedes that, in order to make the transition “work”, America’s financial regulators had to help build a workaround whereby futures markets based on the US dollar LIbor would need to be allowed to continue on until mid-2023, something we noted a year ago. As a result, the US dollar Libor rates will continue to be published until that point (and potentially beyond mid-2023, once regulators devise some new excuse for keeping it alive for even longer).

Courtesy of US intel.

• NGO Memorial Closed By Russian Court Over ‘Foreign Agent’ Breaches (RT)

A Moscow court has ruled that a prominent organization campaigning on human rights issues should be dissolved after prosecutors insisted that it was breaching the country’s laws regulating ‘foreign agents.’ In a ruling on Wednesday, the Moscow City Court said that the Memorial Human Rights Center would be dissolved. Handing down the verdict, judge Mikhail Kazakov said that he would “rule in favor of the claims of the prosecutor’s office to liquidate the inter-regional public organization [Memorial] in full.” Officials allege that the civil society association repeatedly broke the terms of its ‘foreign agent’ status, imposed over links to overseas funding.

The day before, Russia’s Supreme Court ordered that the group’s sister organization, which is dedicated to the memory of the victims of Communist-era repressions, be dissolved as well. Authorities filed applications to liquidate the two entities in November. During the hearing on Tuesday, the Prosecutor General’s office argued that Memorial had been created in the late 1980s originally “as an organization to perpetuate historical memory, but now it is almost completely focused on distorting historical memory, primarily about the Great Patriotic War,” as WWII is known in Russia. According to officials, the group “creates a false image of the USSR as a terrorist state” and “attempts to whitewash and rehabilitate Nazi war criminals who have the blood of Soviet citizens on their hands… probably because someone is paying for this.”

Memorial had faced a number of fines after authorities found it failed to prominently display its ‘foreign agents’ status on its materials. Russian President Vladimir Putin has previously said that the rules “exist simply to protect Russia from external meddling in its politics,” and insisted that organizations that adhere to them can keep working. However, the legislation has come under fire from a number of groups which argue the measures are too restrictive. In August, an open letter signed by 10 separate outlets asked the Kremlin to investigate the use of the ‘foreign agent’ legislation as part of “the persecution of independent journalism in the country.”

Timing is everything.

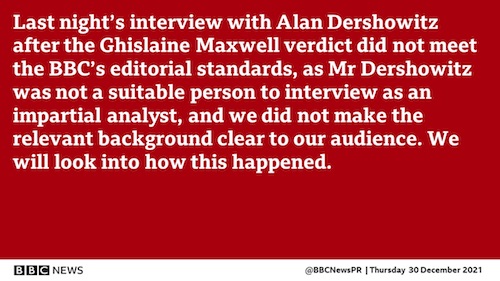

• Epstein’s Guards Accused Of Sleeping On Job, Falsifying Records Go Free (JTN)

Federal prosecutors moved Thursday to drop criminal charges against two Bureau of Prisons guards who admitted to falsifying records the night convicted pedophile Jeffrey Epstein died on their watch. Manhattan guards Tova Noel and Michael Thomas avoided prison time in May 2021 through deferred prosecution agreements mandating that they cooperate with a federal investigation on Epstein’s death and perform 100 hours of volunteer work each. Both complied with the agreements, and the prosecutors asked a judge Thursday to dismiss the charges, Reuters reported. Epstein was awaiting trial on federal sex trafficking charges. He was found in August 2019 hanging in his Manhattan cell, and the New York City medical examiner officially declared his death a suicide.

Noel and Thomas were accused of falling asleep on the job and surfing online despite having orders to check every half hour on Epstein, who had recently been taken off of suicide watch. Both admitted to “willfully and knowingly” falsifying records of monitoring Epstein that evening. The prosecution’s move comes the day after Epstein’s girlfriend Ghislaine Maxwell was convicted on five of the six sex trafficking-related charges brought against her. She is expected to appeal. While Noel’s lawyers could not be reached, Thomas’s lawyer “his client was happy with the dismissal and looked forward to putting the matter behind him,” Reuters reported.

Records were sealed for a reason.

• Maxwell Conviction Leaves Glaring Questions Over Lack of Prosecutions (Turley)

The conviction of Ghislaine Maxwell for five out of six criminal charges was heralded by many as bringing some justice for the girls abused through her actions. Indeed, the Southern District of New York correctly called the underlying conduct as “one of the worst crimes imaginable – facilitating and participating in the sexual abuse of children.” However, that statement only begged the question of why none of the men listed on flights of the “Lolita Express” or on the guest lists of these parties have been prosecuted. That list includes former presidents Bill Clinton and Donald Trump as well as Prince Andrew and an assortment of billionaires. It is not clear if these men committed criminal acts but it is also not clear that they have been formally questioned by the FBI.

As I discussed last night, this criminal enterprise was allegedly not only to bring girls and women to Epstein but to his powerful friends. Without pursuing those alleged “johns,” the Maxwell prosecution seems like arresting a getaway driver but letting the bank robbers escape. The pictures of men on these trips are now well-known. They do not in themselves establish criminal conduct. For example, the pictures of Clinton getting a message from a 22-year-old woman is not illegal and she later described him as a “perfect gentleman.” However, Clinton has been accused of misleading the public on his number of flights with Epstein. The media has reported at least 26 flights with Epstein. Being a repeated guest with an infamous child molester raises obvious concerns. It is certainly enough to warrant questioning by the FBI.

Then there is Prince Andrew who has been pursued for questioning. Much of the litigation, however, has come from civil litigation. Prince Andrew recently put forward a novel defense in one such case. Yet, there is a concern that the Justice Department has previously worked to scuttle rather than to pursue the underlying wrongdoing, including a disgraceful plea agreement. I was an early and vocal critic of that deal with Epstein. Despite a strong case for prosecution, Epstein’s lawyers were able to secure a ridiculous deal with prosecutors. He was accused of abusing more than forty minor girls (with many between the ages of 13 and 17). Epstein pleaded guilty to a Florida state charge of felony solicitation of underage girls in 2008 and served a 13-month jail sentence. Epstein was facing a 53-page indictment that could have resulted in life in prison. However, he got the 13 month deal. Moreover, to my lasting surprise, former Miami U.S. attorney Alexander Acosta was inexplicably made labor secretary under Trump. He later resigned.

Dog

That’s not on human…pic.twitter.com/aL9ODOrQgb

— The World Of Funny (@TheWorldOfFunny) December 29, 2021

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.