Ford Madox Brown Finding of Don Juan by Haidee 1873

Groundhog Day. They just want to get (re-)elected. Which won’t happen if they tell people to cut their driving and flying.

• World Leaders ‘Have Moral Obligation To Act’ After UN Climate Report (G.)

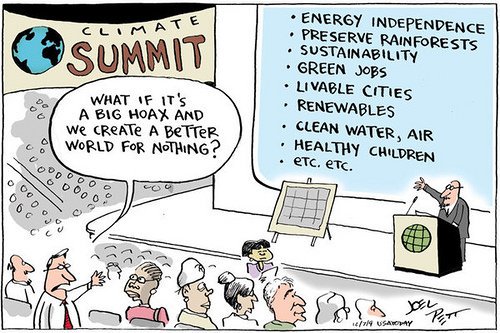

World leaders have been told they have moral obligation to ramp up their action on the climate crisis in the wake of a new UN report that shows even half a degree of extra warming will affect hundreds of millions of people, decimate corals and intensify heat extremes. But the muted response by Britain, Australia and other governments highlights the immense political challenges facing adoption of pathways to the relatively safe limit of 1.5C above pre-industrial temperatures outlined on Monday by the IPCC. With the report set to be presented at a major climate summit in Poland in December, known as COP24, there is little time for squabbles. The report noted that emissions need to be cut by 45% by 2030 in order to keep warming within 1.5C.

That means decisions have to be taken in the next two years to decommission coal power plants and replace them with renewables, because major investments usually have a lifecycle of at least a decade. Mary Robinson, a UN special envoy on climate, said Europe should set an example by adopting a target of zero-carbon emissions by 2050. “Before this, people talked vaguely about staying at or below 2C – we now know that 2C is dangerous,” she said. “So it is really important that governments take the responsibility, but we must all do what we can.” The UK, which has gone further than most nations by cutting its annual emissions by 40% since 1990, will need to step up if the more ambitious goal is to be reached.

Both think adapting to climate change is easy.

• US Economists Win Nobel Memorial For Work On Climate And Growth (G.)

Two American economists at the forefront of work on climate change and the role of governments in boosting growth have been jointly awarded the prestigious Nobel Memorial prize for economics. The Royal Swedish Academy of Sciences said William Nordhaus and Paul Romer were being honoured for their research into two of the most “basic and pressing” economic issues of the age. Nordhaus made his name by warning policymakers during the first stirrings of concern about climate change in the 1970s that their economic models were not properly taking account of the impact of global warming and he is seen as one of the pioneers of environmental economics.

The Yale economist was honoured a day after the latest UN warning on global warming said that urgent and unprecedented changes were needed to keep climate change to a maximum of 1.5C (2.7F). The co-winner – Romer – is seen as the prime mover behind the endogenous growth theory, the notion that countries can improve their underlying performance if they concentrate on supply-side measures such as research and development, innovation and skills. [..] Responding to news of his award, Romer said it was perfectly possible for global warming to be kept to a maximum of 1.5C, in line with the latest recommendation of the UN Intergovernmental Panel on Climate Change. “Once we start to try to reduce carbon emissions, we’ll be surprised that it wasn’t as hard as we anticipated. The danger with very alarming forecasts is that it will make people feel apathetic and hopeless.

“One problem today is that people think protecting the environment will be so costly and so hard that they want to ignore the problem and pretend it doesn’t exist. Humans are capable of amazing accomplishments if we set our minds to it.” [..] Nordhaus has been a prominent advocate of the use of a uniformly applied carbon tax as the best way to put a true cost on the use of burning fossil fuels and so reducing greenhouse gas emissions. The committee that awarded the prize said he was the first person to design “simple but dynamic and quantitative models of the global economic-climate system, now called integrated assessment models (IAMs). “His tools allow us to simulate how the economy and climate would co-evolve in the future under alternative assumptions about the workings of nature and the market economy, including relevant policies.”

This is useful h/t Yves. Peter Dorman on how Martin Weitzman, who has a far more aggressive take on economics and climate, was snubbed so Nordhaus’ light version would get the attention.

• Nobel Prizes in Economics, Awarded and Withheld (NC)

Nordhaus was widely expected to be a winner for his work on the economics of climate change. For decades he has assembled and tweaked a model called DICE (Dynamic Integrated Climate-Economy), that melds computable general equilibrium theory from economics and equations from the various strands of climate science. His goal has been to estimate the “optimal” amount of climate change, where the marginal cost of abating it equals the marginal cost of undergoing it. From this comes an optimal carbon price, the “social cost of carbon”, which should be implemented now and allowed to rise over time at the rate of interest. In his first published work using DICE, from the early 1990s, he recommended a carbon tax of $5 a tonne of CO2, inching slowly upward until peaking at $20 in 2085. His “optimal” policy was expected to result in an atmospheric concentration of CO2 of over 1400 ppm (parts per million) at the end of this planning horizon, yielding global warming in excess of 3º C. (Nordhaus, 1992)

Over time Nordhaus has become slightly more concerned with the potential economic costs of climate change but also more sanguine about the prospects for decarbonized economic growth, even in the absence of policy. In his latest work he advocates a carbon tax of $31 per tonne in 2015, increasing at 3% per year over the following century. This too would result in more than 3º warming. To give a sense of how modest his suggestion is, consider that, in the same paper, Nordhaus calculates that the most efficient carbon tax to limit warming to 2.5º is between $107-184 per tonne depending on assumptions. The target of the Paris Accord is 2º, and most scientists consider this an upper bound for the amount of warming we should permit.

What do these “optimal” tax numbers mean? Based on the carbon content of gas, each $1 carbon tax translates into a one cent tax on a gallon of gas at the pump. If we adopted Nordhaus’ suggestion for carbon pricing, the result would be minuscule compared to the year-to-year fluctuations in energy prices due to other causes. In other words, while his prize is being trumpeted as a statement from the Swedish bankers on the importance of climate change, in fact he is a key spokesman for the position, rejected by nearly all climate scientists, that the problem is modest and can be solved by easy-to-digest, nearly imperceptible adjustments to energy prices. If we go down his road we face a significant risk of a climate apocalypse.

The benefits of climate change.

• The End Of The World Will Save Theresa May From Brexit (Ind.)

Brexit has been in its “something will turn up phase” for some time now and possibly, at last, something has. This is meant to be Theresa May’s “Hell Week”, with important post-Brexit proposals to be published in both Brussels and the UK, both of which will of course necessitate demented rows within her own party (current “strategies” include threatening to vote down the Budget), but Hell Week could hardly have got off to a better start. The most sensible reading of Hell Week is that it looks likely to end with May agreeing to keep the UK in the EU’s customs union until 2022. In the circumstances, the prime minister will not have failed to notice that, according to this morning’s report from the UN’s IPCC, that is a mere eight years before all of the planet’s inbuilt life preserving systems are currently scheduled to turn against humanity in act of vengeance that will be swift and total.

To borrow briefly from the probability-based lexicon of the climate science community, let’s take a look at the likelihood of Brexit being concluded by then in any meaningful way. Even in the unlikely event of Britain voting to leave the European Union, right up until around 8am on 24 June 2016, the latest point at which it was all meant to have been sorted out was 24 June 2018. But when David Cameron decided not to trigger the two-year Article 50 process “straight away” as he had consistently claimed he would, but resigned instead, that date was eventually pushed back by May to 29 March 2019, expanding Brexit by 37.5 per cent.

Then, in March 2018, the Brexit “transition period” was agreed to last until until 31 December 2020, and now, just seven months later, that deadline has been extended until the next general election in 2022, a further eighteen months. At the most conservative estimate, that gives Brexit a rate of expansion of around two hundred per cent, or four years for every two. If the depth to which it can be kicked into the long grass can be maintained on this exponential gradient, May has every reason to be optimistic that tornadoes of sulphuric gas will be moving freely over the Irish border long before she has to deliver any acceptable proposals for how to avoid the reintroduction of customs infrastructure across it.

Not the only issue.

• Stock Markets Stage Sharp Sell-Off Amid Fear Of Italy-EU Budget Fight (G.)

Global stock markets staged a sharp sell-off on Monday amid growing concerns over a budget showdown between Italy and the EU and the prospect of weaker growth in the Chinese economy. Italian borrowing costs jumped and the euro dropped on foreign exchanges as the war of words between Rome and Brussels escalated, while shares on Wall Street and other major international markets declined amid growing concerns over the US-China trade war. Italian bond yields jumped by as much as 30 basis points to the highest levels since early 2014 after the Italian deputy prime minister, Matteo Salvini, attacked the European commission president, Jean-Claude Juncker, and the economics commissioner, Pierre Moscovici, as enemies of Europe.

Speaking at a news conference with the French far-right leader Marine Le Pen, he said the country would not cave to pressure from the financial markets or retreat from its plan for government spending. “We are against the enemies of Europe — Juncker and Moscovici — shut away in the Brussels bunker,” he said. Brussels has told Italy it is concerned over the plan because it would mean the nation running a larger budget deficit – the gap between income from taxes and government spending – than previously planned for the next three years. Rome is to submit its draft budget to the commission, the EU’s executive arm, which will check whether it is in line with EU rules by 15 October.

When the easy money goes, how do we keep the bubbles inflated?

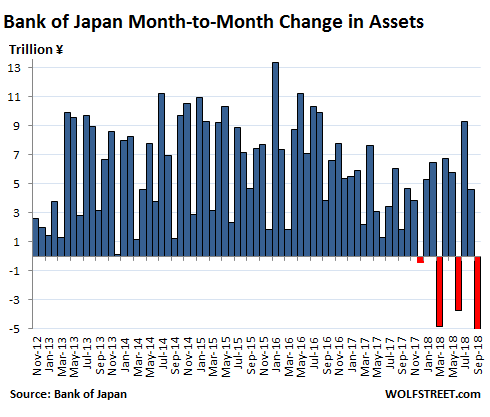

• QE Party Is Drying Up, Even at the Bank of Japan (WS)

As of September 30, total assets on the Bank of Japan’s elephantine balance sheet dropped by ¥5.4 trillion ($33 billion) from a month earlier, to ¥537 trillion ($4.87 trillion). It was the fourth month-over-month decline in a series that started in December. This chart shows the month-to-month changes of the balance sheet. Despite all the volatility, the trend since mid-2016 is becoming clear: Abenomics became the economic religion of Japan in later 2012, and “QQE” (Qualitative and Quantitative Easing) was an integral part of it. So has the “QQE Unwind” commenced? Are central bankers, even at the Bank of Japan, getting cold feet about the consequences?

At BOJ policy meetings, concerns have been voiced over the “sustainability” of the stimulus program, according to the minutes of the July meeting, released on September 25. So the BOJ staff “proposed measures to enhance the sustainability of the current monetary easing while taking into consideration, for example, their effects on financial markets.” And “flexibility” has been proposed as solution to those concerns. The minutes reiterated that the BOJ would continue to buy Japanese Government Bonds (JGBs) in “a flexible manner” so that its holdings would increase by about ¥80 trillion a year. But this is precisely what has not been happening, in line with this “flexibility.”

Over the past 12 months, the BOJ’s holdings of JGBs rose by “only” ¥26.2 trillion – not ¥80 trillion. And they declined in September from the prior month (more in a moment). Shortly after the minutes had been released, BOJ Governor Haruhiko Kuroda, once the most reckless among the money printers, changed his tune and said in a speech that, “in continuing with powerful monetary easing, we now need to consider both its positive effects and side-effects in a balanced manner.” The Fed has already whittled down its balance sheet by $285 billion since it started its QE unwind last October. The ECB has tapered its QE from a peak of buying €85 billion a month to buying €15 billion currently and will end it altogether in December. The discussion has switched to raising rates and unwinding QE.

Like the graph.

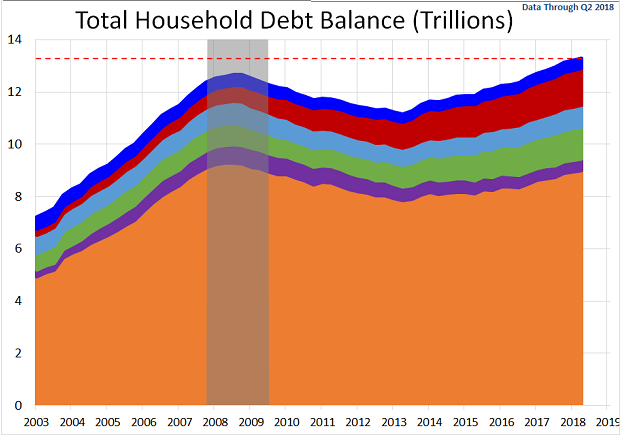

• Higher Rates Will Hurt Stocks Far More Than You Think (SA)

Federal Reserve Chair Jerome Powell thinks the economy is awesome. And he has no problem telling us so. What Powell will never discuss, however, is the “way-too-low-for-way-too-long” stimulus that the central bank engaged in to get here. In particular, the Fed has kept the neutral rate of interest far beneath the rate of inflation (CPI) for an entire decade. Consumers, corporations and Uncle Sam predictably borrowed as if there’d never be consequences. What consequences? Asset bubbles. Stocks, bonds, real estate, collectibles, cryptos, alternatives, everything. Straight across the Ouija board.

Perhaps ironically, we have seen this streaming video before. “Too-low-for-to-long” rate policy in the previous economic expansion (11/01-12/07) created an environment whereby the quality and the quantity of household mortgage debt became toxic. Granted, mortgage debt is less of an issue in the current credit cycle. Nevertheless, total household debt levels may not be sustainable at higher average interest costs. Meanwhile, the federal government is making households look downright responsible.

Long after the Great Recession ended, the country averaged $1.07 trillion in deficits (2010-2017). We’ve now hit $21.5 trillion in our national debt. Uncle Sammy’s bar tab won’t be getting smaller anytime soon. The new tax law, which has provided a near-term kick start for economic growth (GDP), will keep the trillion-dollar deficit train running for years to come. None of this would be so ominous were it not for the rapid-fire advance of interest expense. Interest expense alone accounts for 11% of the federal budget. Just interest. No debt repayment. Tack on higher interest rates to new borrowing needs? Pretty soon interest expense will surpass the money that goes to the Department of Defense (13.6%).

Belt and Road. Silk Road.

• Pakistan Seeks Bailout From IMF (WSJ)

Pakistan, the flagship country for China’s global infrastructure building initiative, said Monday that it needed a bailout from the International Monetary Fund, amid growing concerns that Beijing’s program is pushing recipient countries into financial crisis. The fiscal constraints of an IMF program would also undercut the promises made by Prime Minister Imran Khan’s new government, which include millions of new jobs and the establishment of a welfare state.

But a ballooning trade deficit and fast-depleting foreign exchange reserves left the Pakistani government no other choice, officials said, after markets were spooked by the government’s recent suggestions that it might try to make do without the fund. “Uncertainty was growing and the stock market was falling,” said Chaudhry Fawad Hussain, the Information Minister. “We decided to end the uncertainty.” The Pakistani request for an IMF loan could further test already-strained U.S.-China relations. In July, U.S. Secretary of State Mike Pompeo warned that the U.S. didn’t want to see any IMF lending to Pakistan “go to bail out Chinese bondholders or—or China itself.”

Growing at 6.9%(?) and still in need of pretty extreme support. I’d be concerned.

• IMF Not Concerned About China’s Ability To Defend The Yuan (R.)

IMF Chief Economist Maurice Obstfeld said on Tuesday that he was not concerned about the Chinese government’s ability to defend its currency despite the recent depreciation of the yuan. “No, I don’t think it’s a problem,” Obstfeld said when asked about the issue on the sidelines of a news conference at the IMF and World Bank annual meetings in Bali. But Obstfeld also told the news conference that Beijing would face a “balancing act” between actions to shore up growth and ensure financial stability. China’s yuan currency has faced strong selling pressure this year, losing over 8% between March and August at the height of market worries, though it has since pared losses as authorities stepped up support.

On Tuesday, China’s central bank fixed the yuan’s official mid-point for trading at 6.9019 per dollar, edging close to the psychologically important 7.0 barrier and helping to send Asian stocks to a 17-month low. A U.S. Treasury official on Monday repeated that the Trump administration was concerned about the yuan’s recent weakening as the department prepares a semi-annual report on currency manipulation due out next week. Obstfeld said financial markets have overly emphasized short-term movements in China’s currency, adding that the yuan has often quickly recovered from periods of volatility in recent years.

Reading this, I kept thinking: what sharp slowdown? Where is it? Not in the numbers…

• Sharp Slowdown In Consumer Spending Cools UK Retail Sales (G.)

Britain’s retailers experienced a sharp slowdown in consumer spending last month, bringing to a close the World Cup-inspired summer spree on the high street. According to the British Retail Consortium (BRC) and the accountancy firm KPMG, growth in total sales dropped to the weakest level in almost a year. Total sales grew at an annual rate of 0.7% in September, compared with 2.3% growth during the same month a year ago. The BRC said this was the lowest growth rate since October 2017. Excluding new store openings, like-for-like sales dropped by 0.2% in the year to September, compared with a 19.9% increase for the same period a year ago.

The latest snapshot for the retail sector comes before the important autumn and winter shopping periods, vital for industry profits, when sales of gifts and electrical goods are lifted by the Black Friday sales event in November and shoppers buying Christmas presents. Retailers have been hit hard by a combination of problems that have led to job cuts and store closures across Britain. The ongoing shift to online shopping has increased competition, while sluggish wage growth and high levels of inflation have damaged the spending power of British households. Sales of stationery, footwear and clothing fell last month, while retailers sold more computers, jewellery, furniture, home accessories and food.

If this doesn’t scare you…

• Google Drops Out Of Bidding For $10 Billion Pentagon Data Deal (R.)

Alphabet Inc’s Google said on Monday it was no longer vying for a $10 billion cloud computing contract with the U.S. Defense Department, in part because the company’s new ethical guidelines do not align with the project, without elaborating. Google said in a statement “we couldn’t be assured that [the JEDI deal] would align with our AI Principles and second, we determined that there were portions of the contract that were out of scope with our current government certifications.” The principles bar use of Google’s artificial intelligence (AI) software in weapons as well as services that violate international norms for surveillance and human rights.

Google was provisionally certified in March to handle U.S. government data with “moderate” security, but Amazon.com Inc and Microsoft Corp have higher clearances. Amazon was widely viewed among Pentagon officials and technology vendors as the front-runner for the contract, known as the Joint Enterprise Defense Infrastructure cloud, or JEDI. Google had been angling for the deal, hoping that the $10 billion annual contract could provide a giant boost to its nascent cloud business and catch up with Amazon and fellow JEDI competitor Microsoft. That the Pentagon could trust housing its digital data with Google would have been helpful to its marketing efforts with large companies. But thousands of Google employees this year protested use of Google’s technology in warfare or in ways that could lead to human rights violations.