Andy Warhol Mao 1972

McCarthy

Finally. @SpeakerMcCarthy suggests impeachment inquiry of Biden in the offing. pic.twitter.com/ejBX49vzzY

— Tom Fitton (@TomFitton) July 25, 2023

Jordan

https://twitter.com/i/status/1683473091215921152

Donalds

https://twitter.com/i/status/1683490143536300032

Biden Archer

JUST IN: Hunter Biden’s former business partner Devon Archer is set to testify this week that Joe Biden was deeply involved with Hunter Biden’s overseas business dealings, attending meetings both over the phone and in person.

Despite all of the growing evidence Biden is still… pic.twitter.com/MNrlaTA9k1

— Collin Rugg (@CollinRugg) July 24, 2023

Biden short stairs

President Joe Biden has taken to using a shorter set of stairs to board and deboard Air Force One, according to reports—among a series of measures his staff is taking to avoid both rhetorical and physical stumbles that could bolster concerns about the president’s age. pic.twitter.com/Mx40Z2KsWP

— Forbes (@Forbes) July 24, 2023

Might as well (attack).

• RFK Jr. Calls For Corruption Investigation Of Joe Biden (JTN)

Democratic presidential candidate Robert F. Kennedy Jr. changed tactics Sunday and demanded for the first time an investigation into possible corruption by President Joe Biden, his party’s standard bearer. Kennedy’s request was prompted by the release last week of an FBI informant report that alleged that Biden was part of a $10 million bribery scheme involving an Ukraine company that hired his son Hunter. The report released by Sen. Chuck Grassley (R-Iowa) alleges Burisma Holdings founder Mykola Zlochevsky told a the informant that he was “coerced” into paying the Bidens $10 million to get a Ukrainian investigation shut down. “I have avoided criticizing the president because I’m trying to bring people together and end some of the vitriol, the poison that’s made politics so poisonous,” Kennedy told Fox News host Maria Bartiromo’s “Sunday Morning Futures.”

https://twitter.com/i/status/1683647670513029121

“I think though the issues that are now coming up are worrying enough that we really need a real investigation of what happened,” he said. “I mean, these revelations where you have Burisma — which is a notoriously corrupt company that paid out apparently $10 million to Hunter and his dad — if that’s true, then it is really troubling.” Kennedy added Americans should also be worried about the politicization of federal law enforcement. “I think that that’s something that every American needs to worry about and our federal agencies, which used to be above politics, and now become weaponized as political instruments, and that, again, is another really damaging trend for our democracy,” he said.

RFK

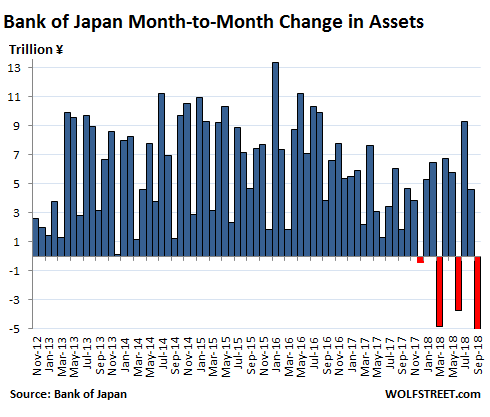

Why aren't we talking about the disappearance of the middle class? Thanks @JoeRogan for a great discussion! #Kennedy24 pic.twitter.com/yd48lSKpuR

— Robert F. Kennedy Jr (@RobertKennedyJr) July 24, 2023

“Jack Smith [..] employs 40 to 60 career prosecutors, paralegals and support staff [..] In his first four months on the job [..] Mr. Smith’s investigation incurred expenses of $9.2 million..”

“With that budget and the brainpower of such a large staff one could find fault with anyone and indict any person for whatever without much problems..”

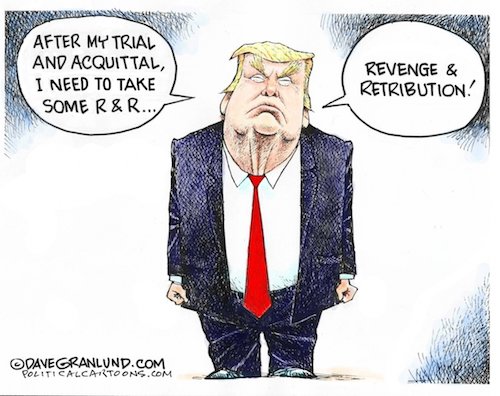

• The Failed State Effort Of Indicting Trump (MoA)

The effort Biden’s Justice Department puts into preventing the leader of its opposition from gaining another presidency has reached an insane level. “As Inquiries Compound, Justice System Pours Resources Into Scrutinizing Trump” – NY Times – Jul 23, 2023. “Jack Smith, the special counsel overseeing criminal investigations into former President Donald J. Trump, employs 40 to 60 career prosecutors, paralegals and support staff, augmented by a rotating cast of F.B.I. agents and technical specialists, according to people familiar with the situation. In his first four months on the job, starting in November, Mr. Smith’s investigation incurred expenses of $9.2 million. That included $1.9 million to pay the U.S. Marshals Service to protect Mr. Smith, his family and other investigators who have faced threats after the former president and his allies singled them out on social media. At this rate, the special counsel is on track to spend about $25 million a year.”

With that budget and the brainpower of such a large staff one could find fault with anyone and indict any person for whatever without much problems. If this would happen in a foreign democracy that is not friendly with the U.S. the State Department and various think tanks would be outraged about such anti-democratic behavior. It would be explained as a sign that the state in question is falling apart. “The main driver of all these efforts and their concurrent expenses is Mr. Trump’s own behavior — his unwillingness to accept the results of an election as every one of his predecessors has done, his refusal to heed his own lawyers’ advice and a grand jury’s order to return government documents and his lashing out at prosecutors in personal terms.”

That all might be a bit outrageous but what is actual criminal with it? The government documents are back to where they are supposed to be and none were reportedly of any great significance. So why still make such a fuzz about them? Seen from the outside U.S. internal politics now look like a bad reality show. This is not the self confident behavior of an elite of the sole superpower the U.S. still pretends to be. There is a theory that the U.S. is undergoing some form of sovietization with a similar accumulation of defects and inefficiencies as occurred in the U.S.S.R. before it fell apart. I am not sure that it is the case, but many significant factors – transportation, public service, health, education, industry, policies – now look worse to me than I remember them to be.

“..if the news media were not a pseudopod of the Blob..”

• The Purple Hour (James Howard Kunstler)

Forgive me for bringing this up, but remember the first impeachment of Mr. Trump on the grounds of a phone call to freshly-minted President Z in Ukraine pertaining to some fishy matters around the Burisma gas company? Yes, Mr. T was impeached over a mere inquiry into possible misconduct by a former high US official (being one “Joe Biden,” ex-veep) and his bag-man son. The setup was patently obvious even to us bloggers who enjoy no intimate correspondence with organelles of the DC Blob. A CIA spook “whistleblower” named Eric Ciaramella (sssshhhh) was injected into the scene with help from the devious Col. Vindman at NSA and an assist from Intel Community Inspector General Michael Atkinson… and voila! Recall the solemn pageantry of Nancy Pelosi’s march across the Capitol rotunda with the hallowed bill of impeachment on a satin pillow….

And now, more than three years later, the nation is informed of all the particulars around those Burisma Company’s doings with the Biden family in granular detail ($5-million plus $5-million), laying out just one instance of treasonous moneygrubbing by this family among many grifts in other nations. And in case of any lingering questions — if the news media were not a pseudopod of the Blob — a long roster of bank transfer records has been assembled by Rep. Comer of the House Oversight Committee to validate the deal memos, emails and audio recordings already available for inspection in the alt.news.

You realize, don’t you, that the DOJ and the FBI had all of this info (a.k.a evidence) in its possession even before Trump impeachment number one? AG William Barr and FBI Director Wray could have stepped up at any time after October, 2019, and said, “Oh, here’s what that phone call to Z was about.” That they didn’t is arguably the most blatant crime among scores of crimes committed by the Blob in the Trump and post-Trump years. “Federal Justice Manual 9-5.000, Section B: Constitutional obligation to ensure a fair trial and disclose material exculpatory and impeachment evidence. Government disclosure of material exculpatory and impeachment evidence is part of the constitutional guarantee to a fair trial. Brady v. Maryland, 373 U.S. 83, 87 (1963). The law requires the disclosure of exculpatory and impeachment evidence when such evidence is material to guilt or punishment.”

So now the Blob is desperate to jettison this embodiment of its corruption and lawlessness, “Joe Biden,” before the Trump-deranged masses start paying attention to the distant yelling from the asteroid belt of actual news beyond noisy Planet MSNBC. The Blob will be fighting for its very life anyway. The Ukraine operation is not proceeding according to plan. Do you know why? Answer: because it was a stupid plan concocted by purblind Neocon idiots. Russia has been insulted to the degree that it deems America unworthy of negotiation — meaning Russia will bring the Ukraine mess to a conclusion on its terms. They will take care to do it gingerly, so as not to further inflame the psychosis afflicting America and tempt us into even grosser stupidities. Namely, they will insist on a neutral Ukraine with no foreign operators in it and some rearrangement of Ukraine’s borders.

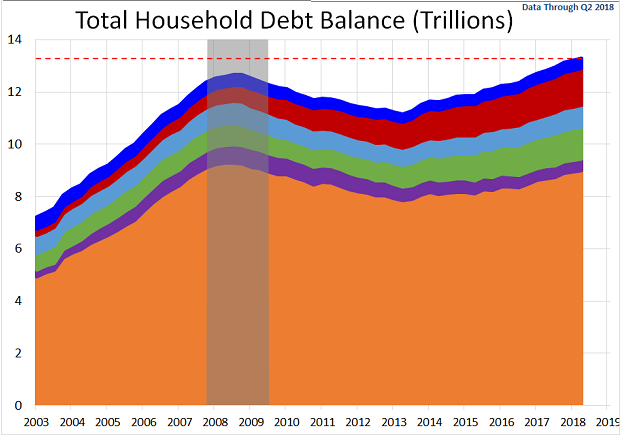

America will have to lump it. The Blob Neocon faction will blame the whole lamentable affair on “Joe Biden,” who, by then, will be gone from the White House. How does that happen? The 25th Amendment, since we are now at the point where his infirmity is as hard to ignore as the evidence of his crimes. How the Blob deals with his successor, the distressing Ms. Harris, is another bridge to cross. The switcheroo itself may be enough to tank the financial markets, which will give the restive nation something else to think about: the personal ruin of every household in the land. Then, things get really interesting.

“Putin makes the most important statement by a Russian leader in more than a hundred years..”

• The NATO Generals Know The War Against Russia Is Lost (Helmer)

Soldiers lay down smoke on the battlefield to conceal their movements, advancing or retreating, from the troops on the other side. In the US Army manuals for warfighting with smoke, there are four kinds for the battlefield (lead image) – obscuring smoke which is aimed at blinding the enemy so he can’t see what you have coming for him; screening smoke which is laid down between you and your enemy, so he can’t see what you are doing in your positions; protecting smoke which is aimed at disrupting the laser and other targeting systems of the other side’s artillery and rockets; and marking smoke whose purpose is either to pinpoint targets for air attackers or rear artillery, or identify safety positions on a rapid-movement battlefield.

With the White House in the lead, in the war the NATO allies are fighting against Russia to the last Ukrainian, an entirely new kind of smoke has been used – it’s the blowback smoke which blinds its users. On the Ukrainian battlefield this smokescreen conceals nothing from the Russians. Instead, it is being used to deceive the NATO country media, voters, and parliaments which must agree to subscribe the money to pay the Ukrainians to fight, and supply them with NATO ammunition, weapons, intelligence, and support services, including credits and cash. Vladimir Zelensky, the Ukrainian president best known for career comic turns — the most famous of which was playing a piano with his penis (screened, protected, marked) — is the master of the blowback smoke on the present battlefield.

A day ago, he told the Ukrainian deputy prime minister of Canada, Chrystia Freeland: “we are approaching a moment when relevant actions can gain pace because we are already going through some mines locations and we are demining these areas.” The calculated ambiguities – “moment”, “approaching”, “relevant”, “can”, “pace”, “some” – are the smoke. The blowback was started by Freeland who told Zelensky that how his counteroffensive was going against the Russians is “the question in the minds of everyone here [and] the preoccupation of all of your friends in the world”. Zelensky’s smoke was invited by Freeland to blind the world, especially their friends. In this week’s War of the Worlds discussion with Swiss Army Colonel Jacques Baud, this tactic is exposed, and in its place evidence revealed of the French and other allied general staffs trying to find their way off the battlefield, as Zelensky forces are destroyed, along with the best of US, French, British and other NATO weapons. The programme was pre-recorded on Thursday.

Less than twenty-four hours later at a virtual session of the Russian Security Council, President Vladimir Putin made an unusual introduction to the closed-door plans of his military, security and intelligence chiefs. “It is clear today,” Putin said, referring to the Americans, French, Germans, and British, “that the Western curators of the Kiev regime are certainly disappointed with the results of the counteroffensive that the current Ukrainian authorities announced in previous months. There are no results, at least for now.” “The whole world sees that the vaunted Western, supposedly invulnerable, military equipment is on fire, and is often even inferior to some of the Soviet-made weapons in terms of its tactical and technical characteristics.” Then on the topic of Poland and Galicia, Putin makes the most important statement by a Russian leader in more than a hundred years. Putin warns the Polish government, together with the Lithuanians, not to make a troop move on Galicia’s capital Lvov, as the Germans had done in 1941.

He also warns Berlin not to imagine they can recover the old Prussian or the more recent Third Reich sway in those territories. Between the lines also, Putin issued an invitation to two of the ruling factions in Kiev – the military command and the Lvov Banderites – that they should remove Zelensky quickly, before they lose what will be left of their territory, after the Russian Army goes on the offensive. If they want to keep Galicia, “this, I repeat”, Putin said, “is in the end their business. If they want to relinquish or sell off something in order to pay their bosses, as traitors usually do, that’s their business. We will not interfere in this.” Putin’s smoke signal carried a subliminal meaning. He didn’t identify the Biden administration. Instead, he implied that Zelensky is the Americans’ underboss; and that if the Ukrainians want to survive the war in which everything made in America is “on fire”, the Ukrainians don’t have long.

“The myth of American power, NATO competence and the reputation of U.S. weaponry hangs in the balance..”

• Counter-Revolution – ‘Do You Know What Time It Is?’ (Alastair Crooke)

To be blunt, both the U.S. and Europe have stalked brazenly into traps of their own making. Caught in the lies and deceit woven around a claimed inheritance of superior cultural DNA, (vouchsafing, it is said, almost certain victory), the West is awakening to a fast-approaching disaster to which there are no easy solutions. Cultural exceptionalism, together with the prospect of a clear ‘win’ over Russia, are draining rapidly away – but exiting delusion is both slow and humiliating. The coming devastation is not just centred around the failed Ukraine offensive and NATO’s weak showing. It comprises multiple vectors that have been building over the years, but which are reaching culmination synchronously.

In the U.S., the run-up to momentous elections is underway. The Democrats are in a fix: The party has long since turned its back on its old blue-collar constituency, engaging instead with an urban ‘creative class’ in an exalted, world-shaping ‘social engineering’ project of moral redress, in alliance with Silicon Valley and the Permanent Nomenklatura. But that experiment has run off into the weeds, becoming ever more extreme and absurd. Push-back is building. Predictably enough, the Democratic campaign is not gaining traction. Team Biden has low, low approval ratings. But Biden family pressure insists that Biden must persevere with his candidature, and not yield to another. Either way – Biden staying or going – there is no ready solution to the Party’s conundrum of a non-performing, non-platform.

The electoral landscape is a mess. Heavy ‘lawfare’ artillery is intended to break the Trump defences and drive him off the field, whilst an attrition of disclosures of Biden family malfeasance are intended wear down and implode the Biden bubble. The Democratic Establishment is spooked too by the flanking manoeuvre of the R. F. Kennedy candidature, which is snowballing rapidly. Put simply, the Democratic wokish ideology of historical redress is separating the U.S. into two nations living in one land. Divided not so much by ‘Red or Blue’, or class, but defined by irreconcilable ‘ways of being’. The old categories: Left, Right, Democrat or GOP are being dissolved by a Cultural War that respects no categories, crossing the boundaries of class and party affiliation. Indeed, even ethnic minorities have been alienated by the zealots wanting to sexualise children at age 5 years, and by the pushing of the trans agenda on to school children.

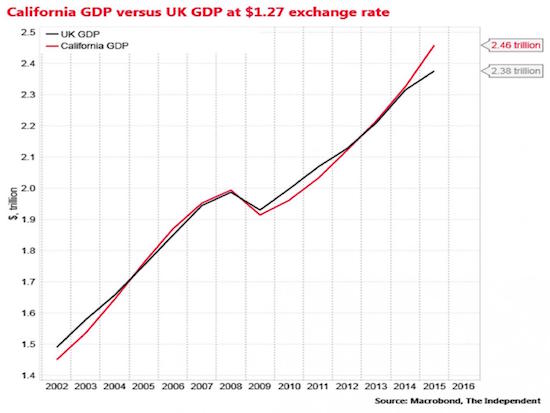

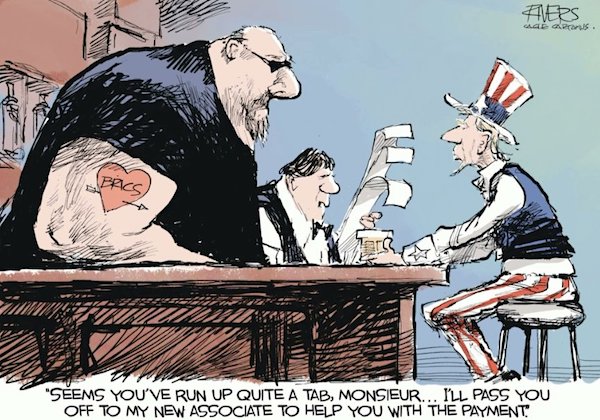

Ukraine has served as the solvent to the old order and has become the Albatross hanging around the neck of the Biden Admin: How to spin the looming Ukraine debacle as somehow ‘mission achieved’. Can that be done? Because the escape route of a ceasefire and a frozen line of contact is unacceptable to Moscow. In short, ‘Biden’s war’ cannot continue as it is, but nor can it do ‘other’ without facing humiliation. The myth of American power, NATO competence and the reputation of U.S. weaponry hangs in the balance. The economic narrative (‘everything is fine’) is poised, for somewhat unconnected reasons, to turn sour too. Debt – finally – is becoming the sword suspended above the economy’s neck. Credit is being tightly squeezed. And next month, the BRICS-SCO bloc will take the first strategic steps to disentangle up to 40 countries from the dollar. Who then will buy Yellen’s $ 1.1 trillion Treasuries – now and in the future – that is needed to fund U.S. government expenditure? These events ostensibly are disconnected, but in reality, they form a self-reinforcing loop. One leading to a ‘run on the political bank’ – that is to say, the U.S.’ credibility itself.

According to Russia, 5,000 foreign mercenaries have been killed, and another 5,000 have fled.

• The Strange Lives And Pointless Deaths Of Foreign Mercenaries In Ukraine (Sizova)

Since February 24, 2022, a projected 11,675 foreign mercenaries from 84 countries have joined the Armed Forces of Ukraine (AFU). This was stated by the Russian Ministry of Defense on July 10. The largest numbers of mercenaries apparently came from Poland (over 2,600), the US and Canada (over 900 from each), Georgia (over 800), Great Britain and Romania (over 700 each), Croatia (over 300), as well as from France and the part of Syria controlled by Türkiye (over 200 each). According to Moscow, the peak influx of foreign mercenaries was from March to April of last year, but after the first casualties, the growth rate suddenly decreased.

The number of foreign mercenaries in Ukraine appears to be rapidly declining. Russia’s Ministry of Defense believes that only around 2,000 remain today. It has also claimed that about 5,000 foreign volunteers fled Ukraine after seeing how the authorities treated them. During interrogations, captured Ukrainian servicemen have reportedly said the commanders of front-line AFU units are not held accountable for losses among mercenaries.“The Ukrainian command throws units with foreign mercenaries into so-called ‘meat-grinder assaults’ on Russian positions. Wounded mercenaries are the last to be evacuated, only after all Ukrainian servicemen are removed [from the battlefield],” said the Russian Ministry of Defense.

Shortly after the start of Russia’s offensive, President Vladimir Zelensky announced the formation of the International Legion of Territorial Defense in order to attract foreign volunteers to Ukraine. Ukraine’s Ministry of Defense claimed that over 20,000 people wanted to join. In March of this year, however, The New York Times called the data exaggerated. “Ukrainian officials initially boasted of 20,000 potential Legion volunteers, but far fewer actually enlisted. Currently, there are around 1,500 members in the organization,” the article said. Citing internal documents, the newspaper noted that the Legion was experiencing problems and that recruitment had “stagnated.” As the The Washington-based Counter Extremism Project claimed in March, the Legion and other groups tied to it “continue to feature individuals widely seen as unfit to perform their duties”.

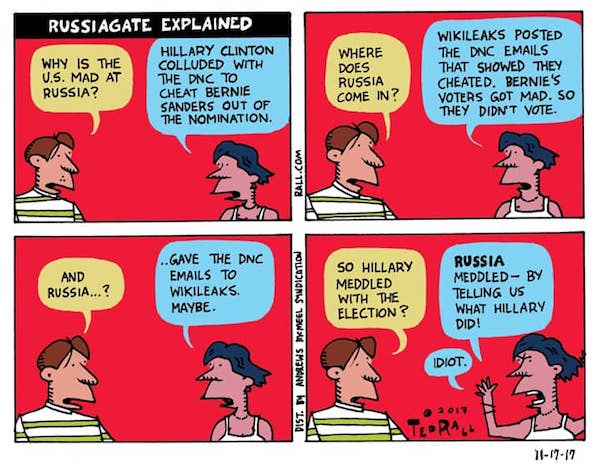

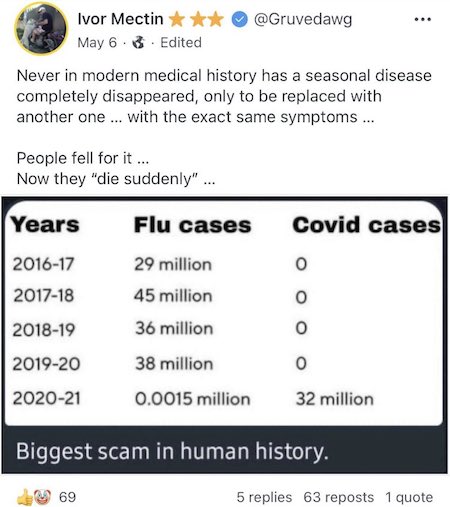

See the difference?!

• Russian Monthly Munition Production Exceeds Volumes for the Whole of 2022 (Sp.)

Monthly production of munitions by Russia’s defense industry has exceeded production volumes for entire 2022, Russian Minister of Industry and Trade Denis Manturov said on Monday. Manturov also said that almost all defense firms are meeting deadlines to implement defense orders. “You know that since the start of the current year, the volume of production of numerous weapons, special military equipment has exceeded the volumes for the entire past year. If we talk about means of destruction, we are now entering a level where a monthly production rate exceeds the overall production volume of the past year,” the minister stated.

In January, President Vladimir Putin said that the productivity of Russia’s defense industry is key to victory in the special military operation. “For example, we produce air defense missiles three times more per year than in the United States. And, in general, our defense industry produces about the same amount of air defense missiles for various purposes per year as all the military-industrial enterprises of the world produce,” Putin said during a visit to the Obukhov State Plant, a northwestern branch of Almaz-Antey Aerospace Defense Concern.

“..the Ukrainian parliament… is even worse than the Russian Duma.”

• Richard Nixon Predicted Ukraine Conflict In 1994 – WSJ (RT)

Former US president Richard Nixon warned his successor Bill Clinton nearly 30 years ago that Ukraine could plunge into bloody turmoil, while predicting major political changes in Russia, according to a document made available to the public last week. In a seven-page letter dated March 21, 1994 and cited by the Wall Street Journal, the late president gave his take on the volatile post-Soviet political landscape right after he returned from a trip to Russia and Ukraine. Nixon described Ukraine as “indispensable” and warned that the situation there was “highly explosive.” “If it is allowed to get out of control, it will make Bosnia look like a PTA garden party,” he said, referring to the 1992-1995 ethnic conflict in the Balkans that claimed the lives of tens of thousands of people.

The former president pointed to an “unpredictable” political situation in the country, lamenting that “the Ukrainian parliament… is even worse than the Russian Duma.” He urged Clinton to strengthen the American diplomatic presence in Ukraine and prioritize funding for Kiev. Nixon also noted that the political clout of then Russian president Boris Yeltsin had “rapidly deteriorated,” adding that “the days of his unquestioned leadership of Russia are numbered.” He also remarked that Yeltsin came to indulge himself in longer drinking bouts and could no longer deliver on his commitments to Western leaders in “an increasingly anti-American environment in the [State] Duma and in the country.”

The former US leader was uncertain who could replace Yeltsin but suggested that Russia’s anti-Western forces could produce a “credible candidate for president.” Yeltsin stepped down in late 1999, with Vladimir Putin taking up the reins. Relations between Ukraine and Russia rapidly deteriorated in 2014 after a Western-backed coup in Kiev and the onset of hostilities in Donbass. Russia sent troops into the neighboring country on February 24, 2022, citing Kiev’s failure to implement the Minsk agreements, designed to give the regions of Donetsk and Lugansk special status within the Ukrainian state.

The protocols, brokered by Germany and France, were first signed in 2014. Former Ukrainian president Pyotr Poroshenko has since admitted that Kiev’s main goal was to use the ceasefire to buy time and “create powerful armed forces.” Shortly before the start of the current conflict, the Kremlin recognized the Donbass republics as independent states and demanded that Ukraine officially declare itself a neutral country that would never join any Western military bloc. Last September, Donetsk and Lugansk, as well as Kherson and Zaporozhye Regions, were incorporated into Russia after the holding of referendums.

Russia fires with high precision. Moreover, the Russian Kh-22 anti-ship missile Zelensky said hit the cathedral is so powerful, there would not be a cathedral anymore.

• Russia Does Not Target Civilian Buildings – Kremlin (RT)

Kremlin spokesman Dmitry Peskov has reiterated Russian denials that one of its missiles was responsible for the damage done to the Transfiguration Cathedral in Odessa over the weekend. The claims coming from Kiev are “absolutely not true”, he told journalists on Monday. “Our armed forces never conduct strikes on objects of social infrastructure, even less so on temples, churches and similar objects,” he assured. The Russian Defense Ministry previously said a Ukrainian interceptor missile was likely to blame, an assertion that Peskov endorsed. The cathedral was heavily damaged on Sunday morning amid a Russian missile attack on targets in several Ukrainian Black Sea ports. Ukrainian President Vladimir Zelensky said later in the day that a Russian Kh-22 anti-ship missile had struck the church’s altar. The Ukrainian leader alleged that Moscow was targeting “the people and the foundations of our pan-European culture” and pledged that the church would be rebuilt, with Italy potentially footing the bill.

The Russian Defense Ministry denied the Ukrainian charge, suggesting later on Sunday that the incompetence of the country’s air defense forces was the most probable cause of the damage. Russia targets only military locations and takes care to select only those far from civilians and sites of cultural value, it said. Meanwhile Ukrainian military leaders “place air defense assets in residential areas on purpose.” The practice was acknowledged earlier this month by a spokesman for the Ukrainian military, who claimed that it was necessary because the country doesn’t have enough longer-range air defense systems. Kiev has previously accused Russia of damage done by its own troops. The most notable case happened last November, when Zelensky accused Moscow of killing two Polish farmers in a border region and urged NATO to retaliate. Warsaw swiftly acknowledged that the projectile was likely fired by the Ukrainian side.

Last week, Russia started a series of attacks on targets in Ukrainian ports, which the military described as retaliation for Kiev’s drone strike on the Crimean Bridge last Monday. The Sunday barrage was aimed at sites where “the Kiev regime and foreign specialists planned terrorist attacks against Russia,” the Defense Ministry said. The Transfiguration Cathedral in Odessa was founded in 1794 and was one of the primary Christian places of worship in Imperial Russia. The Soviet government blew it up in 1936, after declaring that it had no historic value. The building was restored over a decade starting 1999 and re-concentrated in 2010.

“..throw Vladimir Putin out of office and restore a pro-Western neoliberal leader who would pry Russia away from its alliance with China..”

• The Looming War Against China (Michael Hudson)

The U.S.-imposed sanctions against trade with Russia are a dress rehearsal for imposing similar sanctions against China. But only the NATO allies have joined the fight. And instead of wrecking Russia’s economy and “turning the ruble to rubble” as President Biden predicted, NATO’s sanctions have made it more self-reliant, increasing its balance of payments and international monetary reserves, and hence the ruble’s exchange rate. To cap matters, despite the failure of trade and financial sanctions to injure Russia – and indeed, despite NATO’s failures in Afghanistan and Libya, NATO countries committed themselves to trying the same tactics against China. The world economy is to be split between US/NATO/Five Eyes on the one hand, and the rest of the world – the Global Majority – on the other.

EU Commissioner Joseph Borrell calls this as a split between the US/European Garden (the Golden Billion) and the Jungle threatening to engulf it, like an invasion of its well-manicured lawns by an invasive species. From an economic vantage point, NATO’s behavior since its military buildup to attack Ukraine’s Russian-speaking eastern states in February 2022 has been a drastic failure. The U.S. plan was to bleed Russia and leave it so economically destitute that its population would revolt, throw Vladimir Putin out of office and restore a pro-Western neoliberal leader who would pry Russia away from its alliance with China – and then proceed with America’s grand plan to mobilize Europe to impose sanctions on China. What makes it so difficult in trying to evaluate where NATO, Europe and the United States are going is that the traditional assumption that nations and classes will act in their economic self-interest is not of help.

The traditional logic of geopolitical analysis is to assume that business and financial interests steer almost every nation’s politics. The ancillary assumption is that governing officials have a fairly realistic understanding of the economic and political dynamics at work. Forecasting the future is thus usually an exercise in spelling out these dynamics. The US/NATO West has led this global fracture, yet it will be the big loser. NATO members already have seen Ukraine deplete their inventory of guns and bullets, artillery and ammunition, tanks, helicopters weapons and other arms accumulated over five decades. But Europe’s loss has become America’s sales opportunity, creating a vast new market for America’s military-industrial complex to re-supply Europe. To gain support, the United States has sponsored a new way of thinking about international trade and investment. The focus has shifted to “national security,” meaning to secure a U.S.-centered unipolar order.

“Putin tested Pretoria and exposed it to the whole Global South as a fragile node of the “jungle” – actually the Global Majority – easily threatened by the western “garden” gang..”

• BRICS Problems, BRI Solutions (Pepe Escobar)

As the BRICS approach the most important summit in their history on August 22-24 in Johannesburg, South Africa, some fundamentals need to be observed. The top three BRICS cooperation platforms are politics and security, finance and the economy, and culture. So the notion that a new BRICS gold-backed reserve currency will be announced at the South Africa summit is spurious. What is in progress, as confirmed by BRICS sherpas, is the R5: a new common payment system. The sherpas are only in the preliminary stages of discussing a new reserve currency which could be gold or commodities-based. The discussions within the Eurasia Economic Union (EAEU), led by Sergey Glazyev, by comparison, are way more advanced. The order of priorities is to get R5 rolling. All current BRICS currencies start with an “R”: renminbi (yuan), ruble, real, rupee, and rand.

R5 will allow current members to increase mutual trade by bypassing the US dollar and reducing their US dollar reserves. This is only the first of many practical steps in the long and winding road of de-dollarization. An expanded role for the New Development Bank (NDB) – the BRICS bank – is still being discussed. The NDB may, for instance, grant loans denominated in BRICS gold – making it a global unit of account in trade and financial transactions. BRICS exporters will then have to sell their goods against BRICS gold, instead of US dollars, as much as importers from the collective west would have to be willing to pay in BRICS gold. That’s a long way away, to put it mildly. Frequent discussions with sherpas from Russia and also independent financial operators in the EU and the Persian Gulf always touch on the key problem: imbalances and weak nodes inside the BRICS, which will tend to serially proliferate with the imminent BRICS+ expansion.

Within BRICS, there’s a wealth of serious unsolved dossiers between China-India, while Brazil is squeezed between a list of imperial dictates and President Luiz Inacio Lula da Silva’s natural drive to fortify the Global South. Argentina has been all but forced by the usual suspects to “postpone” its admission request to join BRICS+. And then there’s the weak link by definition: South Africa. Squeezed between a rock and a hard place, the organizer of the most important summit in BRICS history opted for a humiliating compromise not exactly worthy of an independent Global South middle-ranked power.

South Africa decided not to receive Russian President Vladimir Putin and opted instead for the presence of Foreign Minister Sergey Lavrov – as Pretoria first suggested to Moscow. The other BRICS members validated the decision. The compromise means that Russia will be physically represented by Lavrov while Putin will participate in the whole process – and subsequent decisions – via videoconference. Translation: Putin tested Pretoria and exposed it to the whole Global South as a fragile node of the “jungle” – actually the Global Majority – easily threatened by the western “garden” gang and not a real independent foreign policy practitioner.

“..an obvious and immediate distrust of that once neutral world reserve currency..”

• The BRICS Won’t Kill the Dollar, US Policy Will (GS)

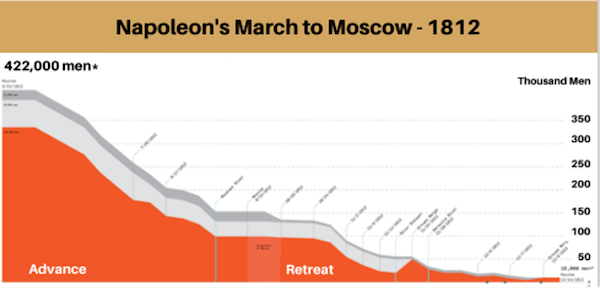

As made clear literally from Day 1 of the Western sanctions against Putin, the West may have been aiming for Putin’s (or the Ruble’s) chest, but it then shot itself in the foot. After decades of DC exporting USD inflation from Argentina to Moscow, a large swath of the developing countries of the world who owe greater than $14T in USD-denominated debt were already reeling under the pain of rate-hike gyrations which made their own debt and currency markets flip and flop like a dying fish on the dock. Needless to say, a 500-basis-point spike in the cost of that debt under Powell didn’t help. In fact, it did little good (or goodwill) for USD friends and enemies alike, from the gilt markets in London to the fruit markets in Santiago. Adding insult to injury, DC coupled this strong-Dollar policy with a now weaponized-Dollar policy in which a nuclear and economic power like Russia had its FX reserves frozen and access to SDRs and SWIFT transactions blocked. Like Napoleon at Moscow, this was going a step too far…

The net result was an obvious and immediate distrust of that once neutral world reserve currency, an outcome which economists like Robert Triffin warned our congress against in 1960, and even John Maynard Keyes warned the world against long before. Heck, even Obama warned against such weaponization of a reserve currency as recently as 2015. Thus, and as I (and many others) warned from Day 1 of the sanctions, the distrust for the USD unleashed by the sanctions in early 2022 was “a genie that can never go back in the bottle.” Or more simply stated, the trend toward de-dollarization was now going to come at greater speed and with greater force.

This force, of course, is now being seen, as well as debated, under the highly symbolic as well as substantive example of the BRICS+ nations seeking to usher in a gold-backed trade currency to move openly away from the USD, a move which some maintain will soon de-throne the USD as a world reserve currency and send its value immediately to the ocean floor. We know, for example, that Russian finance experts like Sergei Glasyev have real motives and sound reasons for planning a new (anti-Dollar) financial system which not only seeks a Eurasian Economic Union for cross boarder trade settlements backed by local currencies and commodities, but to which gold will likely be added as a “backer” to the same.

Glasyev has also made headlines with plans regarding the Moscow World Standard as a far more fair-playing and fair-priced gold exchange alternative to the Western LBMA exchange. If we take his gold backing plans seriously, we must also take seriously the plan to expand such gold-backed trade currency plans into the Shanghai Cooperation Organization which would make the final tally of BRICS+ nations “going gold” as high as 41 country codes. This could ostensibly mean greater than 50% of the world’s population and GDP would be trading in a gold-backed settlement currency outside of the USD, and that, well, matters to both the demand and strength of that Dollar…

Napoleon centralized governments like no-one before. He gave most Europeans their family names.

• From Napoléon to Macron: How France Learned To Love Big Brother (Pol.eu)

Last month, the French parliament approved a controversial government plan to allow investigators to track suspected criminals in real-time via access to their devices’ geolocation, camera and microphone. Paris also lobbied in Brussels to be allowed to spy on reporters in the name of national security. Helping France down the path of mass surveillance: a historically strong and centralized state; a powerful law enforcement community; political discourse increasingly focused on law and order; and the terrorist attacks of the 2010s. In the wake of President Emmanuel Macron’s agenda for so-called strategic autonomy, French defense and security giants, as well as innovative tech startups, have also gotten a boost to help them compete globally with American, Israeli and Chinese companies.

“Whenever there’s a security issue, the first reflex is surveillance and repression. There’s no attempt in either words or deeds to address it with a more social angle,” said Alouette, an activist at French digital rights NGO La Quadrature du Net who uses a pseudonym to protect her identity. As surveillance and security laws have piled up in recent decades, advocates have lined up on opposite sides. Supporters argue law enforcement and intelligence agencies need such powers to fight terrorism and crime. Algorithmic video surveillance would have prevented the 2016 Nice terror attack, claimed Sacha Houlié, a prominent lawmaker from Macron’s Renaissance party.

Opponents point to the laws’ effect on civil liberties and fear France is morphing into a dystopian society. In June, the watchdog in charge of monitoring intelligence services said in a harsh report that French legislation is not compliant with the European Court of Human Rights’ case law, especially when it comes to intelligence-sharing between French and foreign agencies. “We’re in a polarized debate with good guys and bad guys, where if you oppose mass surveillance, you’re on the bad guys’ side,” said Estelle Massé, Europe legislative manager and global data protection lead at digital rights NGO Access Now.

Both the 9/11 and the Paris 2015 terror attacks have accelerated mass surveillance in France, but the country’s tradition of snooping, monitoring and data collection dates way back — to Napoléon Bonaparte in the early 1800s. “Historically, France has been at the forefront of these issues, in terms of police files and records. During the First Empire, France’s highly centralized government was determined to square the entire territory,” said Olivier Aïm, a lecturer at Sorbonne Université Celsa who authored a book on surveillance theories. Before electronic devices, paper was the main tool of control because identification documents were used to monitor travels, he explained. The French emperor revived the Paris Police Prefecture — which exists to this day — and tasked law enforcement with new powers to keep political opponents in check.

“..order, order, order.”

• Macron Says France Needs Return To Authority ‘At Every Level’ After Unrest (G.)

Emmanuel Macron has said France needs a return to authority “at every level” after recent urban unrest over the police shooting of a teenager, suggesting that poor parenting was part of the reason teenagers had taken to the streets. The police killing of Nahel, a 17-year-old of Algerian background, during a traffic stop last month triggered protest marches and six nights of disorder as young men clashed with police and set alight public buildings and cars. Many accused the government of allowing a culture of institutional racism in the police to fester. The officer who fired at Nahel has been charged with voluntary homicide and jailed awaiting trial.

The French president used his first TV interview since the unrest to condemn what he called the “indescribable violence” of the clashes on the streets, including “the burning of schools, city halls, gyms and libraries” and “the violence of looting”. He said: “The lesson I draw from this is: order, order, order.” Macron did not refer to concerns on the left and from rights groups that the rioting reflected longstanding anger over racism and discrimination in law enforcement. He instead took a hard line on the need for more authority, law and order, saying, “Order must prevail. There is no freedom without order.”

Macron repeated his suggestion that poor parenting, particularly by single parents, had contributed to teenagers as young as 16 taking to the streets against police. He said of those arrested: “An overwhelming majority have a fragile family framework, either because they come from a single-parent family or their family is on child support benefits.” He said he would launch policies in the autumn to focus on parenting skills and supporting families. Macron also repeated his criticism over the role of social networks during the unrest and looting, saying: “We need to better protect our teenagers and young adults from screens.” He said certain content should be removed when it was a call to violence and that “public digital order” was needed “to stop excesses”.

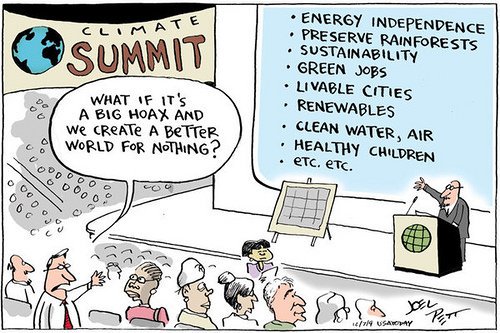

“The same team that tells us that we must ‘listen to the experts’ won’t listen to any experts they don’t like.”

“The thing about sceptical Nobel Prize winners is that they make the name-calling ‘climate denier’ programme look as stupid as it can get..”

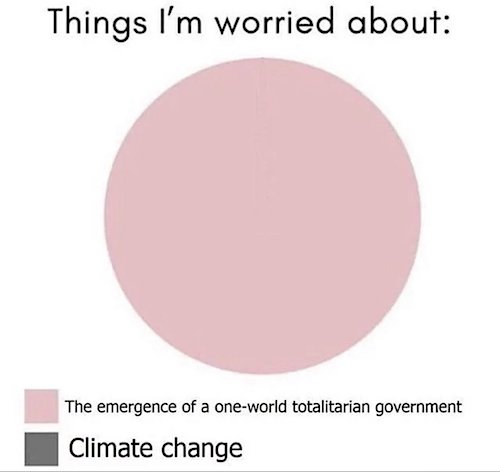

• Nobel Physics Laureate Speaks Out About “Corruption” of Climate Science (DS)

Earlier this month, the 2022 Nobel Physics Laureate Dr. John Clauser slammed the ‘climate emergency’ narrative as a “dangerous corruption of science that threatens the world’s economy and the well-being of billions of people”. Inevitably, the punishments have begun. A talk that Dr. Clauser was due to give to the International Monetary Fund on climate models has been abruptly cancelled, and the page announcing the event removed from the IMF site. Dr. Clauser was due to speak to the IMF’s Independent Evaluation Office this Thursday under the title: “Let’s talk – How much can we trust IPCC climate predictions?” It would appear that “not a lot” isn’t the politically correct answer. Clauser is a longstanding critic of climate models and criticised the award of the Physics Nobel in 2021 for work on them.

He is not alone, since many feel that climate models are primarily based on mathematics, and a history of failed opinionated climate predictions leave them undeserving of recognition at the highest level of pure science. Not that this opinion is shared by the green activist National Geographic magazine, which ran an article: “How climate models got so accurate they won a Nobel.” Last week, Clauser observed that misguided climate science has “metastasised into massive shock-journalistic pseudoscience”. This pseudoscience, he continued, has become a scapegoat for a wide variety of other related ills. It has been promoted and extended by similarly misguided business marketing agents, politicians, journalists, government agencies and environmentalists. “In my opinion, there is no real climate crisis,” he added.

Clauser is the latest Nobel physics laureate to dismiss the notion of a climate crisis. Professor Ivar Giaever, a fellow laureate, is the lead signatory of the World Climate Declaration that states there is no climate emergency. It further argues that climate models are “not remotely plausible as global policy tools”. The 1998 winner Professor Robert Laughlin has expressed the view that the climate is “beyond our power to control” and humanity cannot and should not do anything to respond to climate change. The Australian climate journalist Jo Nova was in fine form reporting on Clauser’s recent comments. “The thing about sceptical Nobel Prize winners is that they make the name-calling ‘climate denier’ programme look as stupid as it can get,” she observed.

She noted the lack of any mainstream media interest in Clauser’s recent comments, asking: “How much damage would it do to the cause if the audience finds out that one of the highest ranking scientists in the world disagrees with the mantra?” A question of course with an obvious answer. Quite a lot. The same team that tells us that we must ‘listen to the experts’ won’t listen to any experts they don’t like. They rave about ‘UN Experts’ that hide the decline, but run a mile to avoid the giants of science. They’ll ask high-school dropouts about climate change on prime-time TV before they interview Nobel Prize winners. It’s a lie by omission. It’s active deception. And the whole climate movement is built on it.

Nobel laureate Dr. John Clauser, a CO2 Coalition Board of Directors member, delivered a lecture at Quantum Korea 2023 Seoul on June 26, 2023. Regarding climate, Dr. Clauser stated “I don’t believe there is a climate crisis” in his address. “The world we live in today is… pic.twitter.com/l1OwnSjPsD

— Wittgenstein (@backtolife_2023) July 24, 2023

“Borfarginbinder.”

• Biden Blames White House Cocaine On Black Guy Who Lived There Before (BBee)

With the rumor mill still churning despite the Secret Service closing its investigation, President Joe Biden blamed the presence of cocaine in the West Wing of the White House on a black man who used to live there. “One of those suspicious colored fellas used to live here,” Biden said to reporters assembled on the White House lawn as he came outside for his morning recess time. “Black folks are always dealing drugs, which is why I pushed so hard to incarcerate them decades ago. Nobody listened. Now, one of them lived here for years. He was a bad dude. Borfarginbinder.” Ever since a white powder that later tested positive for cocaine was discovered in the White House, speculation has run rampant that it may have belonged to President Biden’s son, Hunter.

“People are trying to say it belonged to my son, but that’s an awful thing to say because my son passed away years ago,” Biden said. “It’s time for us to move on, just like the black fella who lived here before. He doesn’t live here anymore, he just calls me up every day and tells me what I need to do. Mint chocolate chip.” As Biden was being led away, he was heard muttering about the White House’s former tenants. “Whatever happened to that guy?” he asked. “And what about his wife — the tall, burly fella?” At publishing time, administration officials also confirmed that drugs found in Hunter Biden’s car and home also belonged to a previous black resident of the White House.

Juan Passarelli’s half hour doc on Julian Assange

What's the hype about #JulianAssange? Why is he in prison in UK for charges he faces in the US? Why did the @CIA plan his kidnapping from an embassy in Central London?

Watch my short film "The War on Journalism: The Case of Julian Assange" for simple answers of a complex case pic.twitter.com/fvo25N6bNV

— Juan Passarelli (@JuanAndOnlyDude) July 24, 2023

REMEDY

The Truth About Vaccines Presents: #REMEDY

This is the film you don't want to miss. It's the film series of our lifetime. It just might save your life or the life of someone you love.

Be someone's hero and SHARE it! #SpreadTheRemedy #TimeForRemedy pic.twitter.com/s3PxGhkaRI

— The Truth About Vaccines (@TTAVOfficial) July 18, 2023

Beetle

The Golden Tortoise Beetle

(Aspidimorpha sanctaecrucis)

pic.twitter.com/fDm7e4qm2t— Science girl (@gunsnrosesgirl3) July 24, 2023

Climate science

'Climate Science' debunked in 90 seconds. pic.twitter.com/WauPVIh0ii

— Dr. Simon Goddek (@goddeketal) July 24, 2023

Feed birds

No matter what, I will always be the positive side of this platform.. pic.twitter.com/ScRsn9Xg9v

— Buitengebieden (@buitengebieden) July 24, 2023

Jump

This is WoWpic.twitter.com/uS2Szd9Qz4

— Figen (@TheFigen_) July 24, 2023

Nose

https://twitter.com/i/status/1683462823362408448

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.