Gottscho-Schleisner New York City views. Looking down South Street 1933

“Despite all the claims that U.S. companies are awash with cash and have “never had it so good,”[..] in reality Corporate America has “overspent” in recent years to the tune of hundreds of billions of dollars.”

• Why Are Stock Prices So High? Borrowed Money (MarketWatch)

Why are stock prices so high? Follow the borrowed money Maybe the bears and cynics and general party-poopers are all wrong. Maybe the stock market these days isn’t a giant Ponzi scheme. Maybe it’s a shell game. The cheerleaders on the Street of Shame won’t tell you this, but lurking behind the phenomenon of today’s skyrocketing stock prices is a surge in corporate borrowing. Companies have been borrowing money with both fists, and spend the money to buy back shares and in the process drive up their share prices. But what the stock market giveth, the bond market taketh away.

Despite all the claims that U.S. companies are awash with cash and have “never had it so good,” an analysis by investment bank SG Securities calculates that in reality Corporate America has “overspent” in recent years to the tune of hundreds of billions of dollars. Over the past five years, equity prices have almost doubled — but so has the net debt of nonfinancial companies. Both have outstripped a 60% rise in profits. Or, to put it another way, since March 2009, the cash pile of non-financial U.S. corporations has risen by $570 billion, but debt has risen by $1.6 trillion. Indeed over the past year net debt has risen about 20%,SG estimates — while gross cash flows have risen a more modest 4%. Indeed, “it is also those companies with the weakest sales growth that are buying back the most,” warns SG quantitative strategist Andrew Lapthorne in a new report for clients.

And that’s not all. The “net debt” figures for most of the stock market are even worse than many will tell you, for the simple reason that the overall figure is skewed by a handful of companies with big cash piles — such as Apple AAPL, +1.08% . When you remove those from the equation, the picture for the rest of the pack looks a lot worse. Many of those cash piles are sitting offshore, untaxed or lightly taxed. Net of tax, the levels are lower. And anyone who tries to give you comfort by pointing out that net debt levels aren’t too bad when compared to asset prices needs to offer a big caveat. Such ratios always look good during a boom, because asset prices get inflated. If or when the tide turns, the asset prices can tumble — but the value of the debt, alas, sticks around at its previous level.

Read more …

“The function of banking should be to provide affordable loans to businesses to create jobs. The function of banking should be to provide affordable loans to Americans to purchase homes and cars. Wall Street cannot be an island unto itself..”

• Break Up Big Banks (Senator Bernie Sanders)

We don’t hear it discussed much in the media, but the reality is that the middle class of this country, once the envy of the world, is collapsing, 45 million Americans are living in poverty, and the gap between the rich and everyone else is growing wider and wider. Despite a huge increase in technology and productivity, median family income is almost $5,000 lower today than it was in 1999. There are 45 million people living in poverty and we have the highest rate of childhood poverty of any major country on earth. Half of the American people have less than $10,000 in savings and have no idea how they will retire with dignity. Real unemployment is not 5.5% – it’s close to 11%. Today, 99% of all new income goes to the top 1%.

During the last two years, the 14 wealthiest Americans saw their wealth increase by $157 billion, which is more wealth than is owned by the bottom 130 million Americans. In the midst of all this grotesque level of income and wealth inequality comes Wall Street.

As we all know, it was the greed, recklessness and illegal behavior on Wall Street six years ago that drove this country into the worst recession since the Great Depression. Millions of Americans lost their jobs, homes, life savings and ability to send their kids to college. The middle class is still suffering from the horrendous damage huge financial institutions and insurance companies did to this country in 2008. It seems like almost every day we read about one giant financial institution after another being fined or reaching settlements for their reckless, unfair, and deceptive activities.

In fact, since 2009, huge financial institutions have paid $176 billion in fines and settlement payments for fraudulent and unscrupulous activities. It should make every American very nervous that in this weak regulatory environment, the financial supervisors in this country and around the world are still able to uncover an enormous amount of fraud on Wall Street to this day. I fear very much that the financial system is even more fragile than many people may perceive. This huge issue cannot be swept under the rug. It has got to be addressed. Although I voted for Dodd-Frank, I did so knowing it was a modest piece of legislation. Dodd-Frank did not end much of the casino-style gambling on Wall Street. In fact, much of this reckless activity is still going on today. Yet, today, three out of the four financial institutions in this country (JP Morgan, BoA, and Wells Fargo) are 80% larger today than they were on September 30, 2007, a year before the taxpayers of this country bailed them out. 80%!

Read more …

“It is absolute pandemonium in the fixed income markets..”

• Violent Bond Moves Signal Tectonic Shifts In Global Markets (AEP)

A wave of turmoil is sweeping through sovereign bond markets, setting off the most dramatic gyrations seen in recent years and threatening to spill over into over-heated equity markets. Yields on German 10-year Bunds spiked violently by almost 20 basis points to 0.78pc in early trading on Thursday as funds scrambled to unwind the so-called “QE trade” in Europe, with powerful ripple effects reaching Japan, Australia, Brazil and even US Treasuries. “It is absolute pandemonium in the fixed income markets,” said Andrew Roberts at RBS. “Everybody has been trying to get out of long-duration positions at the same time but the door is getting smaller.” German yields fell back just as fast to 0.58pc later, as bargain-hunters came back into the European debt markets, but are still unrecognisable from the historic lows of 0.07pc two weeks ago.

Ructions of this magnitude are extremely rare in government bond markets. Investors are nursing almost half a trillion dollars in paper losses in two weeks, a staggering sum in what is supposed to be a rock-solid repository for institutional investors. French, Italian, Spanish and Portuguese bonds have all been sold off sharply over the past two weeks, obliterating the gains in yield compression since the European Central Bank unveiled a bond purchase programme of €60bn a month in January. “Anything over-populated is being cleared out. People got too exuberant and they’re coming back to reality,” said David Bloom, currency chief at HSBC. Peter Schaffrik, at RBC Capital Markets, said rising yields can be a healthy development if the global economy is picking up speed. It is a different matter if they suddenly jump at a time of sluggish growth and disappointing figures in the US.

“It is potentially dangerous. What worries me is that we don’t have a good macro-economic back-drop driving yields higher. We don’t see a reflationary recovery,” he said. Investors already face a changed world from early April, when deflation was still on everybody’s lips and Mexico was able to sell €1.5bn of 100-year bonds at a rate of 4.2pc. The worm turned two weeks later when bond king Bill Gross declared that Bunds had become unhinged and were the “short of a lifetime”, quickly followed by warnings from Warren Buffett that bonds were “very overvalued”. The sharp moves have been exacerbated by a lack of liquidity as traditional dealers withdraw from the market to comply with stricter rules. The Institute of International Finance said this week that thin liquidity had become the top issue in talks with central banks and regulators.

It said the new rules amounted to a “dramatic revolution” that had re-engineered the global financial system and pushed risk out into the shadows, storing up outcomes that are likely to be “pretty painful and certainly unknowable”.

Read more …

“..there is a timebomb ticking away in the bond markets, with the unwinding of QE, particularly in Europe, being more difficult and destructive than most people now appreciate.”

• Bond Yields, Not Political Fallout, Should Be Worrying Us Now (Independent)

I am worrying about something. No, not what will happen in the UK in the next few days, though maybe that should be a worry. It’s that there is a timebomb ticking away in the bond markets, with the unwinding of QE, particularly in Europe, being more difficult and destructive than most people now appreciate. There are, as is usual after any long bull equity run, quite a few warnings around of a forthcoming crash in share prices, and there is in any case a good chance of a correction during the summer. But what has been happening in the bond markets is rather different. Bond prices are not as interesting as share prices: a 10-basis point move in 10-year German bund yields makes a worse headline than a 3% rise in the share price of HSBC when it says it may move its headquarters out of London.

But bund yields have an impact on the cost of mortgages across the eurozone (and to some extent here), whereas the price of HSBC shares really has not that much effect on anything. The easiest way to get one’s mind round what is happening is to start with 10-year government bond yields. US treasuries yielded 2.2% and UK gilts just under 2%. Many of us think these are far too low; what is inflation going to be over the next 10 years? Say 2%. So an investor would get no real reward at all. But while these are far too low, they are not ridiculously low. For that you look at German bunds. Yesterday they yielded just over 0.5%. At that level you are bound to lose money and would be far better with just about anything else: equities obviously, or maybe buying a flat in Berlin or even Athens, the latter being rather cheap right now.

Actually bunds yielding 0.5% represent some return to sanity compared with yields in the middle of last month. As you can see from the red line in the top graph, yields dipped to 0.1% for a short period. If you were nutty enough to buy at that level you would have lost quite a lot of money by now. You could argue that German yields make sense if you think the country will dump the euro and return to the deutschmark, for investors would make a currency gain. But that is some way off and in any case the argument would not apply to French or Italian bonds, yielding 0.9% and 1.9% respectively. So ask yourself this: which country is more likely to be able to pay its debt back in 10 years’ time, Italy or the US? Not many people would say Italy. Yet Italian yields are lower than US ones. This cannot be right. So why is this happening?

Read more …

“U.S. stocks will have to sing for their supper..”

• Rising European Yields Are A Worry For US Stocks (CNBC)

Over the past three weeks, the yield on the 10-year German bund has more than tripled, albeit from incredibly low levels. And that’s sending up warning signs for investors, particularly in U.S. equities. “Low interest rates have supported global equity prices during a period of very slow macro growth,” Convergex chief strategist Nicholas Colas wrote in a note Wednesday to clients. “To hold stock prices constant—or see them rise—during a period of rising rates, you need to see tangible signs of economic growth and rising corporate earnings.” The basic issue is that low bond yields support rich stock valuations, as they reduce the attractiveness of alternatives to risk assets. But U.S. yields have risen alongside European ones lately, in a move than investors have long been anticipating. If rates continues to surge, stocks will need to show some serious earnings growth.

“U.S. stocks will have to sing for their supper,” Colas wrote. “It can be a nice tune about lower interest rates, sung in the European language of your choice. Or, it can be a robust march with verses promising a vigorous domestic economy.” Others also have some concerns. Technical analyst Todd Gordon sees the recent yield move as giving the Federal Reserve license to hike rates—which could be an issue for stocks. “Why are commodities rallying? Why are bonds selling off? Why is the dollar selling off? Everything from an intermarket point of view points to inflation. … So I wonder if the Fed’s going to be move sooner rather than later,” Gordon said. “I think that may be trouble for equities if we are in fact going to get a rate hike.” Forecasting inflation is a major departure from the market’s recent milieu: The big modern concern has been disinflation or deflation, rather than inflation.

Read more …

““The Fed are fully aware that ultra-low interest rates have been a huge factor behind U.S. equities hitting all-time highs..”

• Stocks May Find It Tough To Wiggle Out Of The Bond-Market Mess (MarketWatch)

Look at it this way — someday, you’ll have some great financial war stories to tell. “The latter part of 2014 and the dawn of 2015 will probably represent one of those episodes in financial history when the fixed-income markets were gripped by a confluence of factors that is unlikely to be repeated over the next hundred years,” said Jefferies’s chief equity strategist, Sean Darby. There’s fodder for your future tales of battles past this morning, as Fed Chairwoman Janet Yellen’s assets-are-bubbly comments continue to rattle global markets, which have already been duly freaked out by plummeting global bonds. She’s hit us at a tough time. While some shout, “Off with her head!”, over at IG, analyst David Madden says Yellen was probably just trying to ready investors for an eventual hike.

“The Fed are fully aware that ultra-low interest rates have been a huge factor behind U.S. equities hitting all-time highs this year, and the last thing the U.S. central bank wants is a crash when rates start to rise,” he says. Or maybe she and the rest of her Fed minions are as confused as the rest of us. That’s the theory from Ed Yardeni, chief investment strategist at Yardeni Research, who notes that Fed officials have been pretty silent since the last meeting. He says they’re probably struggling to work backups in bond yields and oil prices into their policy-making decisions. Hang on until summer, he says, when the Fed will get less confused and less confusing.

Read more …

“..the market in German government debt is meant to be deep, liquid and populated by grown-ups.”

• The Great German Government Bond Sell-Off Mystery (Guardian)

It’s a head-scratcher. Why have investors suddenly decided to dump German government bonds? The sell-off, seemingly on no news, has been extraordinary, affecting the entire European bond market. Yields, which move inversely to the price of the bond, briefly hit 0.8% on 10-year German debt on Thursday. Then they fell to 0.57%, but even that represents a surge from 0.1% only a few weeks ago. A glib explanation is to say that the ultra-low yields were wrong in the first place. Deflation is a worry, not a probability, so isn’t lending to any government for a decade for a near-zero return a surefire way to destroy your capital? But that doesn’t explain the suddenness of the move: the market in German government debt is meant to be deep, liquid and populated by grown-ups.

Greece doesn’t offer a plausible answer. Grexit – if anything – seems more likely than it did a month ago, in which case you’d expect a rush into German debt. “Supply indigestion,” ran another idea – in other words, lots of European governments issuing bonds, trying to take advantage of the European Central Bank’s bond-buying programme. Possibly. But what will happen when bond yields start to rise for reasons that are easier to explain – for example, a return of modest inflation and higher interest rates. On the evidence of Thursday’s brief wobble in stock markets, it won’t be pretty for share prices.

Read more …

A sign of bankruptcy.

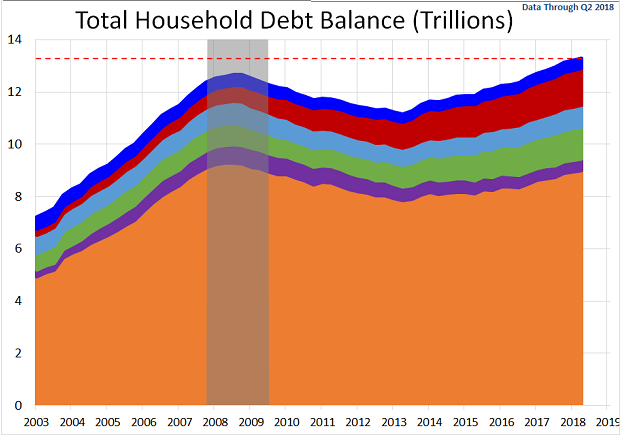

• 98% Of Q1 Consumer Credit Was Used For Student And Car Loans (Zero Hedge)

By now everyone realizes that Q1 will be the second consecutive first quarter to see a negative GDP print. Wall Street’s weathermen formerly known as “economists” have been quick to scapegoat harsh weather once again for this unprecedented “non-recessionary” contraction in the US economy, however what the actual reason for the drop is irrelevant for this specific post; what is relevant is that even in a quarter in which US GDP is set to decline consumer credit, according to the latest update from the Federal Reserve, increased by just over $45 billion. But how is it possible that with such a massive expansion in household credit there was no actual benefit to the underlying economy? Simple: 98% of the credit lent out in the first quarter, or $44.3 billion, went to student and car loans!

The amount of credit that actually made it into the broader, consumer economy, i.e., credit card or revolving credit: a negative $600 million, despite a jump in revolving credit in March, when it rose by $4.4 billion to $889.4 billion. So $889.4 billion in credit card debt: as a reminder this is the key credit amount that has to keep growing for consumers to telegraph optimism about their wages, jobs, and generally, the economy. The problem is that as of Q1, this amount was lower than both car debt, at $972.4 billion, and certainly student debt, which in Q1 rose by another $30 billion to a record $1.355 trillion! In other words, virtually every dollar lent out in Q1 went to such dead-end uses as bailed out General Motors and student loans keeping an entire generation away from the harsh reality of the labor market.

But the most troubling discovery in Q1 is that as we reported last month, America’s consumer banks, i.e. depositor institutions, have shut down the lending spigot after seeing a jump in consumer bank lending in 2014. In fact, in the first three months of 2015, depository institutions saw a $32 billion decline in the total amount of credit lent out. So who did lend? Why the US government of course, which was the source of over $39 billion in consumer credit, or the vast bulk, lent out in the first quarter. In other words, the US government lends out cash, so US consumers can either buy cars from Government Motors in one truly epic circle jerk, or stay in the safe, ivory tower confines of college, and avoid the reality of what is really going on with the US economy.

Read more …

Exports down 15% in March, another 6.4% in April. Where oh where is the 7% growth going to come from?

• China Exports, Imports Fall Sharply In April (CNBC)

China’s exports and imports tumbled in April, dashing hopes of a seasonal rebound and underscoring concerns over the soggy trade picture in the world’s second biggest economy. Exports fell 6.4% in April from the year-ago period, coming in worse than the 2.4% rise forecast in a Reuters poll and following a 15% plunge in March. Imports dived 16.2% on year, also missing the 12% expected drop and after falling 12.7% in March. This brought the trade surplus for the month to $34.13 billion, compared with the $39.45 billion forecast and March’s print of $30.8 billion. The news dampened prospects for Australia, one of the mainland’s major trading partners, and the Australian dollar fell to fresh session lows on the news, easing to $0.7859.

Markets had been hoping April’s trade numbers will rebound from the depressed levels in February and March blamed on the Lunar New Year holiday. “This [Lunar New Year] effect should have fully dissipated last month, so it is slightly surprising that export growth remained in negative territory,” said Julian Evans-Pritchard, China economist with Capital Economics, in a note. “The trade data suggest that both foreign and domestic demand has softened going into the second quarter.” Weak external and domestic demand has been a key factor behind the slowing Chinese economy, which Beijing expects will grow around 7% this year.

Read more …

Every day this lasts hurts Brussels more.

• Varoufakis Says Greece Ready to Take EU Impasse Down to the Wire (Bloomberg)

Greek Finance Minister Yanis Varoufakis said his government is prepared to go “down to the wire” in talks with its creditors as policy makers signal they’re losing patience with the country after months of brinkmanship. Varoufakis, who denies he’s been sidelined by Greek Prime Minister Alexis Tsipras in the negotiations, said he expects an agreement in the next two weeks, though one is unlikely to be announced when euro-area finance chiefs meet on Monday. Greece has less than a week to prove to the European Central Bank that it’s serious about reaching an agreement with international lenders. Failure to make progress in bailout talks or repay about €745 million owed to the IMF on May 12 may prompt the imposition of tighter liquidity rules on its banks.

“Europe works in glacial ways and eventually does the right thing after trying all alternatives,” Varoufakis, 54, told BBC World on Thursday. “So we probably won’t have an agreement on Monday, but certainly we’re going to have an agreement in the next couple of weeks or so.” More than 100 days of talks between Europe’s most-indebted state and its creditors have failed to produce an agreement on the terms attached to the country’s €240 billion bailout. The standoff between Greece’s governing coalition and euro-area member states has led to an unprecedented flight of deposits from Greek banks and renewed concern over the country’s future in the single currency.

“To speak of Greek exit now is profoundly anti-European because it will begin a process of fragmentation in Europe that will actually be very detrimental to Britain, let alone Greece and Europe,” said Varoufakis. “The solution is to agree on a debt sustainability analysis and a fiscal consolidation plan that makes sense, unlike the ones in the past.” Varoufakis said that while there’s convergence between the two sides, the Greek government won’t bow to creditors’ demands for more austerity. “This cycle of debt deflation and insincerity has to end,” he said in the BBC interview. “We are prepared to go all the way down to the wire.”

Read more …

Good on them.

• Greece To Rehire Cleaners, School Guards Laid Off Under Austerity (Kath.)

Greece’s parliament passed a law on Thursday paving the way for the government to rehire about 4,000 public sector workers who were laid off or earmarked for dismissal under austerity cuts imposed by international creditors. The move made good on a campaign promise by Prime Minister Alexis Tsipras, who rode a wave of public anger against austerity measures to win January elections, and does not explicitly violate the terms of the EU/IMF bailout which allows Greece to hire one public employee for every five who leave. But the plan to rehire school guards, cleaning ladies and civil servants appeared to go against the spirit of the layoff scheme in the bailout, which says the firings were aimed at rejuvenating the public administration by bringing in new, motivated workers and ending the legacy of patronage hiring.

“This is an unorganised, irresponsible settlement of your party’s pre-election pledges,» opposition lawmaker Kyriakos Mitsotakis, the former administrative reforms minister who sacked many of those being rehired, told parliament. The previous government had intended for hirings this year to be focused mainly on the health and education sectors. Tsipras received a jubilant group of about 50 cleaning ladies – who protested against their dismissal outside the finance ministry for months – at his office on Thursday. “Even the Chancellor, in a meeting that we had and without me bringing it up, referred to how unfair what the previous government did to you was,” Tsipras told the group, in an apparent reference to German Chancellor Angela Merkel. “Your fight was known abroad because it was a fair fight.”

An official at the administrative reforms ministry said the reinstatement of the workers would have an annual cost of €33.5 million that was already included in the country’s 2015 budget plan approved with last year. The 3,928 workers to be rehired include 2,100 who were fired outright and another 1,900 in a so-called labour reserve where workers received partial salaries while they waited to see if they would be moved into new jobs. The state was already paying salaries for about 1,000 school guards in the reserve, limiting costs involved in their hiring, the ministry official said. Greece has pledged not to make unilateral actions reversing bailout reforms it opposes while talks with its international lenders continue.

Read more …

“Syriza ministers and lawmakers believe they have a duty to Greece and Europe to fight, even if the odds are against them.”

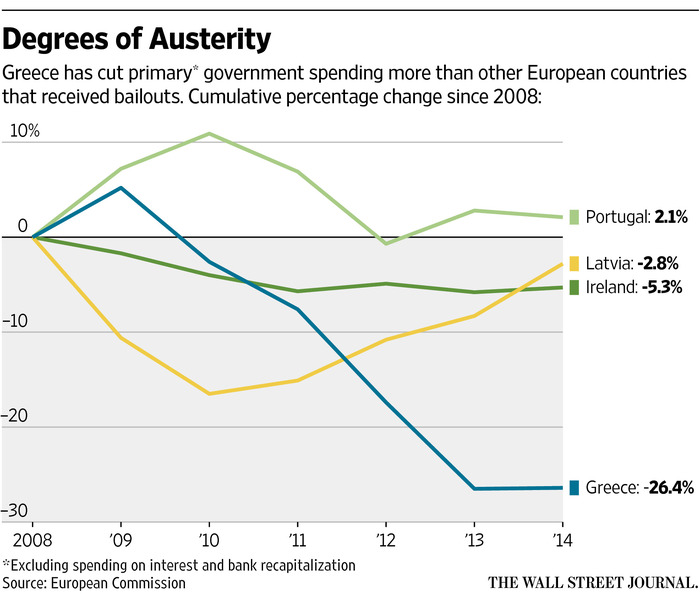

• Five Years On, Doctor and Patient Split on Greek Cure (WSJ)

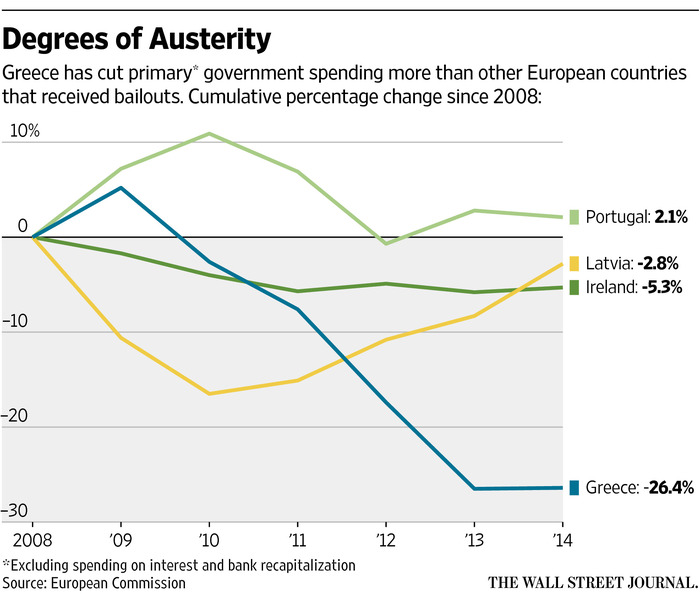

Greece and its creditors, deadlocked over fresh financing, agree on at least one thing about the country’s mammoth bailout, launched five years ago this month: It hasn’t worked as hoped. But Athens and its lenders—the eurozone and the IMF—disagree diametrically on why the bailout program has flopped. This dispute about the past five years helps explain why the players so often seem to be talking past each other today, and why reaching agreement on further aid is proving so hard. Lenders, led by Germany, believe that the bailout’s blueprint was and remains correct, but that Greece failed to follow it. Rapid deficit-cutting was the only way to cure Greece’s debt problem. The rollback of stifling regulation and unaffordable social benefits and an injection of free-market competition were unavoidable if Greece was to grow sustainably.

German leaders such as Finance Minister Wolfgang Schäuble see Greece as the patient that didn’t take its pills, unlike others in the same hospital, such as Portugal and Ireland, who swallowed the same medicine and recovered. To many Greeks, however, the eurozone seems more like the psychiatric ward in the Ken Kesey novel “One Flew Over the Cuckoo’s Nest,” where a domineering “Big Nurse” controls the inmates through punishment and humiliation. In this view, Greece under Syriza is Europe’s Randle McMurphy, the rebel inmate who rattles Big Nurse Merkel’s regimen with constant provocations, encouraging others to stand up for themselves, too. Syriza ministers and lawmakers believe they have a duty to Greece and Europe to fight, even if the odds are against them.

There is little doubt that major economic overhauls were overdue in Greece, and that painful fiscal austerity was unavoidable. Athens had lost control of its budget and nobody was prepared to finance its deficits. But most economists, and some officials on the creditors’ side, say the bailout program always suffered from at least three design flaws. Firstly, the scale and speed of austerity were unique, and proved to be an overdose, many economists say. Greek spending cuts and tax-revenue measures totaled over 30% of gross domestic product in 2010-14, according to Greek and EU data. That 30%-of-GDP austerity effort improved Greece’s primary budget balance, excluding debt interest, but only by 11 percentage points of GDP.

Read more …

Still, many, like Varoufakis, have returned recently.

• Greece’s Biggest Brain Drain Since The Death Of Socrates (MarketWatch)

Ancient Greece was once a magnet for the world’s intellectual elite. Scholarly work out of Athens contributed to everything from logic and philosophy to the politics that formed the basis of modern civilization. But as the Hellenic Republic struggles to strike an agreement to repay more than €300 billion it owes international creditors, it is also facing the depletion of its most important asset: human capital. A devastating brain drain is luring away the best and brightest of Greece’s workforce, several reports showed, with estimates varying between 180,000 and 200,000 well-educated citizens leaving the cash-strapped nation. At that rate, the exodus translates to about 10% of the country’s total university-educated workforce, said Lois Lambrinidis, a professor of economic geography at the University of Macedonia.

On a macro level, this movement is a clear brain drain, said Nicholas Alexiou, a sociology professor at CUNY’s Queens College who studies Greek immigration patterns. What differentiates a brain drain from other types of migrant waves is the high percentage of skilled and educated people who leave the country, Alexiou said. In other words, Greece is losing its “youngest, best and brightest,” as a European University Institute study dated March 2014 noted. According to the study, of those who have left 88% hold a university degree, and of those, over 60% have a master’s degree, while 11% hold a Ph.D. According to the EUI report, 79% of those who left Greece during the crisis were actually employed but felt that there was “no future” in the country (50%) or no professional opportunities (25%).

Read more …

It takes time to fight a corruption so deeply entrenched.

• Greek Bank Bailout Fund CEO To Stand Trial, Asked To Resign (Kathimerini)

Greece’s government late Thursday asked the chief executive of its bank bailout fund to resign, after prosecutors ordered her to stand trial for her role in bad loans issued by defunct state lender Hellenic Postbank. Anastasia Sakellariou has been chief executive of the Hellenic Financial Stability Fund (HFSF) since February 2013. She was charged last year with breach of trust for restructuring loans issued by the state lender from 2008 to 2012 and was told to stand trial on Wednesday, according to court officials. Sakellariou’s resignation means the fund is now headless after its chairman, Christos Sclavounis, stepped down in March. The new leftist government of Alexis Tsipras has not yet replaced him.

“(The government) asked Mrs. Sakellariou today to hand in her resignation,” a government official told Reuters, speaking on condition of anonymity. The HFSF, funded from Greece’s €240 billion bailout by the European Union and International Monetary Fund, has recapitalised the country’s banking sector and also used its funds to wind down non-viable lenders. The HFSF has said that, in 2012, Sakellariou was a member of a Hellenic Postbank committee that handled the restructuring of two loans. HFSF has remaining funds of €10.9 billion in European Financial Stability Fund bonds, which were handed over to the European Stability Mechanism.

Read more …

Brexit, Grexit, bring it on sooner rather than later.

• Greece and Britain Test the Union (Kathimerini)

Two very different countries are challenging the European Union’s cohesion and the outcome of this test will determine the future of the greatest experiment in democracy that the world has known. Britain, a former superpower, once said that the sun never set on its imperial domain, and it is still the EU’s second-largest economy; Greece, which has been plagued by bankruptcies since its independence, is the Union’s most troubled economy. Both present problems that demand a radical shift in the way that the EU has operated over the past decades, in order to protect all that it has achieved.

Whereas Greece’s need for its partners’ support stems from the country’s inability to reform its economy, public administration and political system so as to be a viable competitor in the global economy, Britain is putting similar pressure on the EU’s cohesion in the belief that it has to insulate itself from its partners, to safeguard what it considers its special advantages. The two countries’ political systems and economies are vastly different, as is their geopolitical stature. Greece has been an enthusiastic member of the EU since it joined in 1981 and is part of its inner sanctum, the eurozone. Britain has always been at pains to opt out from too much union, avoiding the euro and abstaining from Greece’s bailout.

During the crisis, Greece has benefited from the support (with painful strings attached) of its partners, while Britain has gained enormously – from money fleeing the European periphery for what is seen as the safe haven of Britain, and from the Bank of England’s independence from the austerity dogma imposed on the rest of the EU. Both Greece and Britain have contributed to the EU in their own unique way, and each one’s relationship with the rest of the Union also shows the great tension at the heart of every association: Even as every member needs the advantages provided by the group, each fears being absorbed by the others, to the extent that it loses its independence, its special characteristics and the freedom to exploit its differences to its own advantage. Greece cannot function without financial support, yet it also cannot accept the loss of independence that this entails.

Britain, which has gained much from being “in and out” of the Union, is in danger of getting too far from the center of gravity. But a total break will leave it on its own, unable to influence EU policy. In the EU the great question today is whether countries can place the common good above their national interest. The Greek elections in January intensified the push and pull between the country and its partners, with results that are still unpredictable. Whatever the outcome of Thursday’s election, Britain, too, will test the limits of membership and the Union’s cohesion. All players should remember two simple facts: Thanks to ever closer union, Europe has enjoyed 70 years of unprecedented peace and prosperity; pulling too hard can break any bond.

Read more …

“In the first four months of the year, at least 21,745 migrants arrived in Greece by boat, compared with 33,951 in all of 2014..”

• Greece Sees Massive Increase In Refugees Arriving By Boat (Guardian)

The scale of mass migration across the Mediterranean has been revealed by new figures showing that record numbers of migrants are now arriving by boat in Greece as well as Italy. Just four months into the year, the number of arrivals in Greece is already two-thirds as high as last year’s total, highlighting the volume of migration in not just the central Mediterranean, between Libya and Italy, but also at its eastern fringes. Even as the UN security council mulls using military force against smugglers in Libya, the figures suggest migrants are increasingly using other routes to break into Fortress Europe. In the first four months of the year, at least 21,745 migrants arrived in Greece by boat, compared with 33,951 in all of 2014, according to figures from the International Organisation for Migration, and compiled by the Greek coastguard.

The numbers are even higher than estimates released earlier in the year, and show almost as many migrants are arriving in Greece as in Italy. At least 26,228 have reached Italy since the start of 2015, fractionally down on last year’s equivalent level. Aid workers in the Greek islands, where most migrants travelling by sea arrive from Turkey, say the rises are all the more surprising because the peak smuggling season has not yet started. Stathis Kyroussis, head of mission in Greece for Médecins sans Frontières, which provides support to migrants, said: “It’s not just an increase, it’s an explosive increase. It’s already five times up on last year. In one island – the biggest, Kos – last year we had 72 entries in all of April. This year we had 2,110. In Leros last April we had zero. This year we had 900.”

Kyroussis said the increase in arrivals in Greece seemed to have been caused in part by a rise in Syrians making the trip. “There is a higher percentage of Syrians travelling to the Greek islands: last year it was 60%, this year it is 80%,” said Kyroussis. “So part of the increase is a change in the route of the Syrians. Instead of Italy, they’re coming through Greece.” This analysis appears to be corroborated by further IOM statistics, which show that Syrians account for only 8% of arrivals in Italy this year, compared with 25% in 2014. Theories for the rise include the civil war in Libya, which may have put Syrians off travelling there; and the worsening situation in Syria, which has persuaded many Syrian refugees in Turkey that there is no longer point in waiting for Syria’s chaos to be resolved.

Read more …

“It might not matter so much if what these funds did was socially useful. But it is not.”

• Hedge Funds Aren’t Casino Capitalists. They’re Parasite Capitalists (Ind.)

Adair Turner coined a neat phrase for many of the banking industry’s activities during the financial crisis. In a biting critique he opined that they were “socially useless”. He was right. But it’s not just banking at which his criticism could be aimed. Consider the bastard child of investment banking and asset management: the hedge fund industry. It is a place where a portion of the elite of both have found homes. Multiple homes, in fact, funded by salary packages which make even the dizzying rewards on offer at the height of the big investment banks’ insanity look modest. According to a list published by Institutional Investor’s Alpha magazine, the top 25 collectively gorged upon $11.62bn (£7.6bn) in 2014.

Their bumper paydays came in a year when the industry produced returns averaging in the low single digits, even though the S&P 500 stock market index – the most reliable US benchmark – would have produced nearly 14% in dollar terms had you tracked it. The New York Times reports that just half of the top 10 earners managed to beat it. These massive rewards for mediocre performance were in part due to the industry’s structure: typically managers skim 2% of their investors’ funds every year and 20% of their profits. So when they do well the rewards are staggering. When they do less well the rewards are staggering. Just a bit less staggering.

It might not matter so much if what these funds did was socially useful. But it is not. It is true that some provide a certain Darwinian screening process by attacking under-performing companies and their complacent boards. Elliott Advisors’ assault on Alliance Trust is an example that may ultimately prove to be of benefit to a legion of small investors. However, for every Alliance Trust there is an ABN Amro. Activist funds delivered the Dutch bank to a consortium made up of Royal Bank of Scotland, Fortis and Banco Santander in a transaction which left only the latter unscathed and the taxpayers of three countries to pick up the pieces.

Read more …

Propaganda.

• The British Press Has Lost It (Politico)

Fasten your seatbelt: it’s going to be a bumpy ride. With the two major parties, Conservative and Labour, neck and neck in the polls; and two new insurrectionary forces, UKIP and the Scottish National Party, set to disrupt the two-and-a-half party system that’s dominated British politics for 40 years, Thursday’s election night is going to be fought constituency by constituency, sometimes recount by recount. There will be unexpected triumphs, unforeseen disasters (“Were you up for the moment when so-and-so lost their seat?”). Only one thing is for sure. This is the election during which Britain’s press ‘lost it.’ The press just haven’t reflected reality, let alone the views of their readers. For months polls have put Conservatives and Labour close with about third of the vote each, and smaller parties destined to hold some balance of power.

But there has been no balance in the papers. Tracked by Election Unspun, the coverage has been unremittingly hostile to Ed Miliband, the Labour challenger, with national newspapers backing the Conservative incumbent, David Cameron over Labour by a ratio of five to one. Veteran US campaign manager David Axelrod finds this politicization of the print media one of the most salient differences with the US. “I’ve worked in aggressive media environments before,” he told POLITICO, “but not this partisan.” Axelrod may have ax to grind as he advises the Labour Party, but even a conservative commentator and long-serving lieutenant of Rupert Murdoch has been shocked. “Tomorrow’s front pages show British press at partisan worst,” Andrew Neil, former editor of the Sunday Times rued. “All pretense of separation between news and opinion gone, even in ‘qualities.’”

And that’s the difference. The whole newspaper industry seems to be affected by the tabloid tendentiousness trade-marked by Murdoch’s best-selling the Sun when it roared, in 1992, “It’s the Sun Wot Won It.” The Daily Mail specializes in political character assassination and the ‘Red Ed’ tag was predictable. But when the paper went on from attacking Miliband’s dead father to a hit-job on his wife’s appearance, the politics of personal destruction sank from gutter to sewer. In this precipitous race to the bottom, perhaps the Daily Telegraph had the steepest fall. Known as a bastion of the Tory thinking, it had long been respected for separating fact from comment. During this election cycle is was caught sourcing its front pages direct from Conservative Campaign HQ, seeming to confirm the parting words of its senior political commentator, Peter Oborne, that it was intent on committing “a fraud on its readership.”

Read more …

It would be quite something if she refuses to. End of credibility.

• Angela Merkel Under Pressure To Reveal All About US Spying Agreement (Guardian)

Angela Merkel’s reputation as an unassailable chancellor is under threat amid mounting pressure for her to reveal how much she knew about a German-supported US spying operation on European companies and officials. The onus on her government to deliver answers over the spying scandal has only increased with the Austrian government’s announcement that it has filed a legal complaint against an unnamed party over “covert intelligence to the detriment of Austria”. EADS, now Airbus, one of the companies known to have been spied on by the BND – Germany’s foreign intelligence agency – is also taking legal action, saying it will file a complaint with prosecutors in Germany. The BND stands accused of spying on behalf of America’s NSA on European companies such as EADS, as well as the French presidency and the EU commission.

There are also suspicions that German government workers and journalists were spied on. The Social Democrats (SPD), Merkel’s government partners, along with Germany’s federal public prosecutor, Harald Range, are demanding the release of a list of “selectors” – 40,000 search terms used in the spying operations – the results of which were passed on to the NSA. “The list must be published and only then is clarification possible,” said Christine Lambrecht, parliamentary head of the SPD faction. Merkel has so far refused to allow its release. Her spokesman, Steffen Seibert, said she would make a decision on whether or not to do so only “once consultations with the American partners are completed”.

Thomas de Maizière, the interior minister and a close Merkel confidante, is under even more pressure than the chancellor over allegations he lied about what he knew of BND/NSA cooperation. On Wednesday he answered questions on the affair to a parliamentary committee investigating the row, but only in camera and in a bug-proof room. Among other alleged shortcomings over the affair, he stands accused of failing to act when the BND informed him of the espionage activities in 2008 when he was Merkel’s chief of staff. He has repeatedly been portrayed in the tabloid media with a Pinocchio nose.

Responding to journalists during a break in the proceedings, he once again vehemently denied the allegations. “As chief of staff in 2008, I learned nothing about search terms used by the US for the purposes of economic espionage in Germany,” he said. But he acknowledged knowing about American efforts to intensify the intelligence swapping, calling it “problematic cooperation”, and said the requests had been turned down by the BND.

Read more …

Balance.

• Chinese Warships To Join Russian Navy Drill In Black Sea, Mediterranean (RT)

Two Chinese missile frigates will enter the Russian Black Sea naval base of Novorossiysk for the first time in history. They will then conduct joint exercises with Russia in the Mediterranean. The Linyi and the Weifang will enter the port of Novorossiysk on May 8 to take part in Victory Day celebrations, according to the Russian Defense Ministry. Each is a 4,000-ton vessel of the relatively new Type 054A (also known as Jiangkai II), which first entered service in 2007. They are accompanied by a support ship. This is the first time Chinese warships will have entered the Russian base. The ships will then head to the Mediterranean for joint drills with Russian forces.

“It is planned that the People s Liberation Army Navy warships will leave Novorossiysk on May 12 and relocate to the designated area of the Mediterranean Sea for the Russian-Chinese exercise Sea Cooperation-2015,” the Russian Defense Ministry said in a statement. The exercise will take place from May 11-21. Nine ships are scheduled to take part in total in the first drill of its kind to happen in the Mediterranean. The drills’ goal has been stated as deepening friendly cooperation between China and Russia and strengthening their combat ability in repelling naval threats. The exercise comes at a time when NATO and its allies are holding a massive wave of military drills all across Europe.

Collectively codenamed Operation Atlantic Resolve, NATO commanders and European leaders have said the training sends a message to Russia over its alleged aggression and the crisis in Ukraine. Some states are also conducting their own training maneuvers parallel to Atlantic Resolve. Russia has been conducting a series of military exercises within its territory throughout winter and in early spring, including massive drills in the Baltic Sea, Black Sea, the Arctic and the Far East.

Read more …

“Third-world bondage” down under.

• Modern Slavery In Australia: Labour Exploitation Rife In Agriculture (RT)

The Australian investigative journalism program “Four Corners” has discovered that Australia’s biggest supermarkets and fast food chains are supplied with food from farms exploiting workers in slave labour-like conditions. According to Four Corners reporters, who used hidden cameras and undercover surveillance to reveal the “third-world bondage,” supermarkets such as Woolworths, Coles, Aldi, IGA and Costco and such fast food outlets as KFC, Red Rooster and Subway are implicated in the exploitative practice. The workers who are being abused are frequently migrants from Asia and Europe. They are being routinely harassed, forced to work and underpaid. Moreover, women workers are often propositioned for sex or asked to perform sexual favours in exchange for visas.

Underpayment for migrant workers gives the farms a competitive advantage over their contestants. Supermarkets prefer cheaper suppliers without paying attention to the labour conditions on their farms. This leads to a paradox: suppliers who play by the rules lose market share to those who don’t, according to ABC TV. For instance, SA Potatoes, one of the largest potato suppliers in Australia, says it has lately lost some of its contracts. “It’s gutting,” said the company’s CEO, Steve Marafioti, “They’re cheating the system…It’s not the correct thing. It’s not the right thing. It’s actually changing the shape of our industry.” Migrants come to Australia on the 417 working holiday visa system which gives them an opportunity to stay in Australia for 12 months and to work up to six months with a single employer.

However, the system is very often used to supply cheap labour in such low-skilled jobs as fruit and vegetable picking. The Four Corners investigation has prompted outrage across Australian society. “We will be known as a country that exploits vulnerable people who are looking for a better chance at life,” labour law and migration expert Joanna Howe told ABC News. She says the 417 visa should replaced with a new low-skilled work visa. “Successive governments, Labor and Liberal, have turned a blind eye to the fact that both international students and working holiday makers are being used as a low-skilled source of labour for farmers and other people across the country,” Howe said. A low-skilled work visa “would allow the whole system to be better regulated,” she added.

Read more …

More slavery.

• Nepal Quake Victims’ Families Not Allowed To Leave Qatar For Funerals (Ind.)

Tens of thousands of workers on the 2022 football World Cup in Qatar cannot get home to see their families and attend funerals in the wake of last month’s Nepal earthquake. Qatar’s strict worker rules, known as kafala, mean that many of the 400,000 Nepalese workers in the country have their passports taken by employers and find it difficult to get permission to go home. The international campaign group Avaaz has written to Qatari authorities demanding compassionate leave for workers with families affected by the earthquake; it has yet to receive a response.

Sam Barratt, Avaaz’s campaign director, said: “We’re calling for these workers to be granted amnesty to go home. They are working on World Cup related infrastructure projects. Qatar was built with Nepal’s cheap labour; the least they can do is allow them to go home and grieve.” A Nepalese worker in Doha, who asked not to be named, said that his wife and children were now homeless: “My family lives in a village outside Kathmandu. Since the quake I have not been able to contact them… Two of my relatives in Kathmandu have died in the quake. My wife and two little children are sleeping on the road. I am desperate to go back… but I can’t leave because my employer won’t let me go. I can’t leave the job because I have to pay back the loan I had taken to get to Qatar.”

Read more …

“..the recent modest decrease in the rate of warming has elicited numerous articles and special issues of leading journals.”

• How Climate Science Denial Affects The Scientific Community (PhysOrg)

Climate change denial in public discourse may encourage climate scientists to over-emphasise scientific uncertainty and is also affecting how they themselves speak – and perhaps even think – about their own research, a new study from the University of Bristol, UK argues. Professor Stephan Lewandowsky, from Bristol’s School of Experimental Psychology and the Cabot Institute, and colleagues from Harvard University and three institutions in Australia show how the language used by people who oppose the scientific consensus on climate change has seeped into scientists’ discussion of the alleged recent ‘hiatus’ or ‘pause’ in global warming, and has thereby unwittingly reinforced a misleading message.

The idea that ‘global warming has stopped’ has been promoted in contrarian blogs and media articles for many years, and ultimately the idea of a ‘pause’ or ‘hiatus’ has become ensconced in the scientific literature, including in the latest assessment report of the Intergovernmental Panel on Climate Change (IPCC). Multiple lines of evidence indicate that global warming continues unabated, which implies that talk of a ‘pause’ or ‘hiatus’ is misleading. Recent warming has been slower than the long term trend, but this fluctuation differs little from past fluctuations in warming rate, including past periods of more rapid than average warming. Crucially, on previous occasions when decadal warming was particularly rapid, the scientific community did not give short-term climate variability the attention it has now received, when decadal warming was slower. During earlier rapid warming there was no additional research effort directed at explaining ‘catastrophic’ warming. By contrast, the recent modest decrease in the rate of warming has elicited numerous articles and special issues of leading journals.

This asymmetry in response to fluctuations in the decadal warming trend likely reflects what the study’s authors call the ‘seepage’ of contrarian claims into scientific work. Professor Lewandowsky said: “It seems reasonable to conclude that the pressure of climate contrarians has contributed, at least to some degree, to scientists re-examining their own theory, data and models, even though all of them permit – indeed, expect – changes in the rate of warming over any arbitrarily chosen period.” So why might scientists be affected by contrarian public discourse? The study argues that three recognised psychological mechanisms are at work: ‘stereotype threat’, ‘pluralistic ignorance’ and the ‘third-person effect’.

Read more …