Alfred Wertheimer Elvis 1956

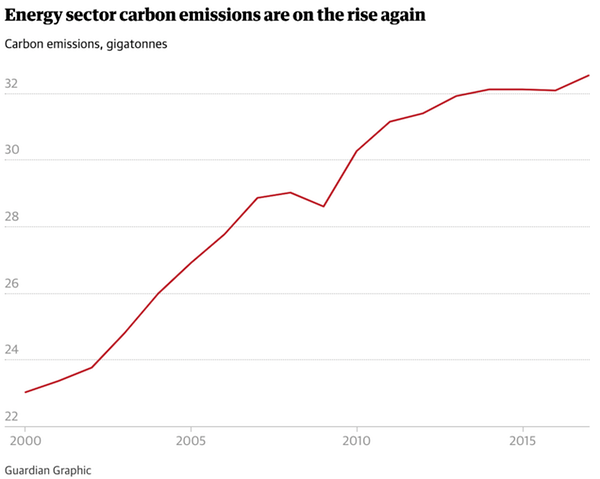

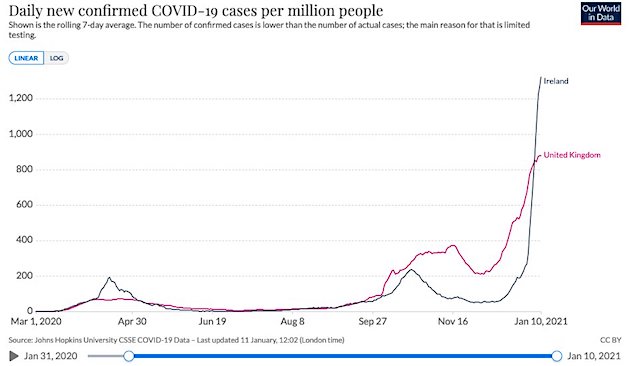

The B.1.1.7 COVID variant is starting to look as scary as the social media giant censorship.

A call on the US to close its borders to the UK. At present, dozens of flights arrive from London every day.

“I’ve never seen an epi curve like this. The B.1.1.7 variant is spreading like wildfire in the UK and Ireland. If it spreads here, it will make an already-bad situation even worse.”

Lynn Parramore taks to Phillip Alvelda, a former NASA & DARPA technologist.

• New Covid “Super Strain” is a Game-Changer for Schools and More (Parramore)

LP: New, fast-spreading “super strains” are raising a lot of concerns, such as more infection among young people. You’ve been studying the U.K. variant, which has shown up in the United States. What do we need to know?

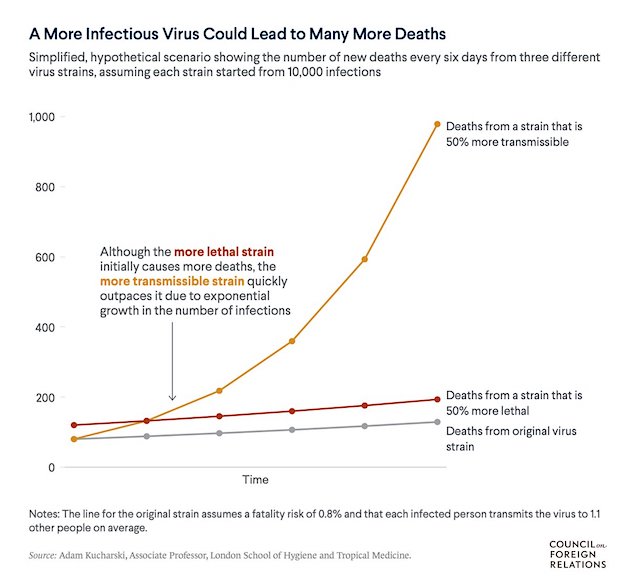

PA: We saw the U.K. strain coming for some time. All of a sudden there began to be dramatic upticks in infection rates, even without material changes in individual behavior en masse or the abatement measures enacted and observed. England has not been the most Johnny-on-the-spot responder to the coronavirus, and there has been a lot of confusion about what abatement measures should be observed, in which areas, etc. Of the developed nations, the U.S. and the U.K. have struggled the most as societies to communicate, plan and observe reasonable measures that other countries have more successfully applied. The U.K. variant, which has now spread across Europe and into several U.S. states, has what appear to be a couple of important mutations in the spike protein, which allows the virus to attach to the receptors in the lungs. Apparently, the new variant is stickier – better at binding to the receptors. That means that it takes less of the virus to get you sick, or the same viral load gets you sicker.

A big change is that the U.K. variant appears be somewhere between 40 and 70% more infectious. For a person who has this variant, they’re likely to infect 40% to 70% more people. If you think about what we have done to reduce the effectiveness of transmission, getting people to wear masks has been a successful campaign. But some masks are better at protecting people than others. A well-fitted N95 and KN95 masks will filter 95% of the virus particles from coming into your lungs, but there are also terrible masks that don’t protect people much at all. If you average mask-wearing over the population, it seems that the mask mandates reduce the infectiousness of the virus by about 40 to 50%. To put the U.K. variant in perspective, with its faster spread, we are effectively put back to where we once were without masks — even when we’re now wearing masks!

LP: The idea of young people under 20 getting infected at high rates is alarming, though there have been conflicting reports as to why those numbers are higher, such as behavior patterns. What’s your take?

PA: There is no doubt that the U.K. strain is infecting more young people than any prior variants. I think the conflicting reports may have more to do with where that variant is prevalent and where it is not. It would not be true to say that all of the hospitals in the U.K. are being overrun by younger patients. But in those regions where the new variant is prevalent, the hospitalization and case data now show that more than ever before, young people are having almost as many cases and hospitalizations as the older people. That is a substantial change. With older variants, symptoms were usually not bad enough to even bring the kids in to test — and we know there were a lot of asymptomatic carriers that were never tested or acknowledged.

With the new variant, symptoms are bad enough that kids need the testing and they’re being hospitalized. It’s probably premature to speculate on the lethality. There is some hope, for example, that the U.K. variant could be more infectious but less lethal. But we just don’t know. It’s likely going to be weeks before the case trend that is now beginning to translate into the hospitalization trend will translate into the mortality trend. Unfortunately, given what we’ve seen in the past from the virus, it’s our expectation that if the case data is showing more young people infected, and the hospitalization data is showing more of them hospitalized, in a matter of weeks we will see more deaths.

They’re talking again about “immunity” provided by vaccines. But have we seen any proof of that?

• WHO Warns Of ‘Highly Problematic’ New Covid-19 Variants (F.)

WHO Director-General Tedros Adhanom Ghebreyesus on Monday issued a dire warning about the new variants of Covid-19 that are emerging across the globe, noting that because those variants can be more contagious, the surge in cases they’re likely to cause could further stress hospitals and health workers already stretched to the brink. During a press briefing Monday, Ghebreyesus said that more contagious variants of the coronavirus “can drive a surge of cases and hospitalizations, which is highly problematic for health workers and hospitals already close to the breaking point.” The added strain on hospitals puts other essential health services at risk, he added, meaning that critical surgeries or procedures may become more difficult because hospital resources are more limited.

While these variants have been found to be more contagious, experts say they don’t appear to cause more severe sickness or increase the risk of death. Dr. Tom Frieden, a former director of the Centers for Disease Control and Prevention, warned last week that the U.S. is “close to a worst-case scenario” because of the rapid spread of a new, highly contagious strain of Covid-19. New variants of Covid-19 have been found in the United Kingdom, the United States (where 63 cases have been detected), Canada, South Africa, and Nigeria, among other countries, the CDC says. Japan’s health authorities announced over the weekend that they had detected a new variant of the virus in four travelers from Brazil, Reuters reported.

Scientists are keeping track of new mutations as they emerge and studying how they will impact the effectiveness of vaccines. “I’m quite optimistic that even with these mutations, immunity is not going to suddenly fail on us,” Jesse Bloom, an evolutionary virologist at the Fred Hutchinson Cancer Research Center in Seattle, told the healthcare publication STAT. “It might be gradually eroded, but it’s not going to fail on us, at least in the short term.” A recent study from the University of Texas and pharma giant Pfizer found that Pfizer’s Covid-19 vaccine is still effective in protecting against new variants of the virus.

Excellent analysis: “The more it is used wrongly, the more misinformation ensues.”

• An Epidemic of COVID Positive Tests (John Hunt)

How does this same 95% sensitive/95% specific test work in this screening setting? The good news is that this test will likely identify the 5 people out of every 1000 with Relevant Infectious COVID! Yay! The bad news is that, out of every 1000 people, it will also falsely label 50 people as COVID-positive who don’t have Relevant Infectious COVID. Out of 55 people with positive tests in each group of 1000 people, 5 actually have the disease. 50 of the tests are false positives. With a Positive Predictive Value of only 9%, one could say that’s a pretty lousy test. It’s far lousier if you test only people with no symptoms (such as screening a school, jobsite, or college), in whom the up-front likelihood of having Relevant Infectious COVID Disease is substantially lower.

The very same test that is pretty good when testing people who are actually ill or at risk is lousy when screening people who aren’t. In the first scenario (with symptoms), the test is being used correctly for diagnosis. In the second scenario (no symptoms), the test is being used wrongly for screening. A diagnostic test is used to diagnose a patient the doctor thinks has a reasonable chance of having the disease (having symptoms like fever, cough, a snotty nose, and shortness of breath during a viral season). A screening test is used to check for the presence of a disease in a person without symptoms and no heightened risk of having the disease.

A screening test may be appropriate to use when it has very high specificity (99% or more), when the prevalence of the disease in the population is pretty high, and when there is something we can do about the disease if we identify it. However, if the prevalence of a disease is low (as is the case for Relevant Infectious COVID) and the test isn’t adequately specific (as is the case with PCR and rapid antigen tests for the COVID virus), then using such a test as a screening measure in healthy people is forcing the test to be lousy. The more it is used wrongly, the more misinformation ensues. Our health authorities are recommending more testing of asymptomatic people. In other words, they are encouraging the wrong and lousy application of these tests.

“The proportion of COVID-19 deaths that occurred in nursing homes was often higher” under tough restrictions “rather than under less restrictive measures.”

• Lockdown ‘Ineffective’ Against Spread Of Covid-19, May Even Increase Risk (RT)

A Stanford University study claims mandatory stay-at-home orders and business closures have “no clear, significant beneficial effect” on Covid-19 case growth and may even lead to more frequent infections in nursing homes. Researchers at Stanford University in California aimed to assess how tough lockdowns influence the growth in infections as compared to less restrictive measures. They used data from England, France, Germany, Iran, Italy, Netherlands, Spain, South Korea, Sweden, and the US, collected during the initial stages of the pandemic in the spring 2020. They compared the data from Sweden and South Korea, two countries that did not introduce tough lockdowns at that time, with that from the other eight countries.

They found that introducing any restrictive non-pharmaceutical interventions’ (NPIs) such as reduced working hours, working from home and social distancing helped curb the rise of infections in nine out of 10 study countries, except for Spain, where the effect was “non-significant.” However, when they compared epidemic spreads in places that implemented less restrictive measures with those opting for a full-blown lockdown they found “no clear, significant beneficial effect” of the latter on the number of cases in any country. The research goes on to suggest that empirical data from the later wave of infections shows that restrictive measures fail to protect vulnerable populations. “The proportion of COVID-19 deaths that occurred in nursing homes was often higher” under tough restrictions “rather than under less restrictive measures.”

It also says that there’s evidence suggesting that “sometimes under more restrictive measures, infections may be more frequent in settings where vulnerable populations reside relative to the general population.” The research admits that lockdowns in early 2020 were justified because the disease was spreading rapidly and overwhelming health systems, and scientists or medics did not know what the mortality data of the virus was. However, it points at the potential harmful health effects of tough restrictions, such as hunger, health services becoming unavailable for non-Covid diseases, domestic abuse and mental health issues, and the effects of these on the economy mean that the benefits of the tough restrictions might be overrated and need to be studied carefully.

“..social media giants shouldn’t have the power to decide who has the right to free speech…”

• French Government “Shocked” at Twitter Banning of Trump (SN)

The French government has echoed Angela Merkel’s sentiment in saying it is “shocked” at Twitter’s banning of President Trump, asserting that Big Tech is a threat to democracy. Junior Minister for European Union Affairs Clement Beaune said the decision to silence Trump proved the need for Big Tech platforms to be tightly regulated. “This should be decided by citizens, not by a CEO,” he told Bloomberg TV on Monday. “There needs to be public regulation of big online platforms.” Finance Minister Bruno Le Maire also said that “the digital oligarchy” was “one of the threats” to democracy and should be reigned in by the state. As we highlighted earlier, the German government also warned that Big Tech’s deplatforming of Trump set a very dangerous precedent.

Communicating via a spokesman, Chancellor Angela Merkel called the move “problematic,” adding that social media giants shouldn’t have the power to decide who has the right to free speech.

“This fundamental right can be intervened in, but according to the law and within the framework defined by legislators — not according to a decision by the management of social media platforms,” said the statement. While Republicans were completely toothless in their efforts to control Big Tech during Trump’s administration, Poland could be set to pass a law that would fine social media companies $2.2 million a pop for censoring lawful free speech. “In the event of removal or blockage, a complaint can be sent to the platform, which will have 24 hours to consider it. Within 48 hours of the decision, the user will be able to file a petition to the court for the return of access. The court will consider complaints within seven days of receipt and the entire process is to be electronic,” reported Poland In.

Anyone setting up a better alternative will be crushed.

• Twitter Has Suspended More Than 70,000 Accounts Since Friday (ZH)

In a Monday night blog post, Twitter lays out all the latest details of a historic purge that started with the suspension of president Trump and has escalated into the ban of tens of thousands of conservative voices, or as Twitter puts it, “steps taken to protect the conversation on our service from attempts to incite violence, organize attacks, and share deliberately misleading information about the election outcome.” Odd how none of those considerations emerged during the summer when US cities were literally burning as a result of countless violent protests and frequent riots, but we digress. In any case, In twitter’s own delightfully ironic words, “It’s important to be transparent about all of this work as the US Presidential Inauguration on January 20, 2021, approaches.” Which is a probably a good idea in the aftermath of the biggest censorship purge in twitter history, one which sent Twitter stock tumbling. So this is what how twitter justifies “the purge”:

We’ve been clear that we will take strong enforcement action on behavior that has the potential to lead to offline harm. Given the violent events in Washington, DC, and increased risk of harm, we began permanently suspending thousands of accounts that were primarily dedicated to sharing QAnon content on Friday afternoon. And with tens of thousands of accounts suspended (most of them permanently), banned, or merely disappeared, it will hardly be a surprise that according to Tiwtter, “more than 70,000 accounts have been suspended”. What is the justification? “These accounts were engaged in sharing harmful QAnon-associated content at scale and were primarily dedicated to the propagation of this conspiracy theory across the service.”

“Sunlight has always been the best disinfectant as a way of fighting radicalization.”

• The Big Tech Backfire (Miller)

Some are excusing Big Tech’s foray into massive censorship by arguing that these are private companies and can choose who they provide service to. Anyone who has a problem with their behavior, they reason, should just create their own platforms. But that is exactly what Parler did, and it was subsequently crushed. Unfortunately, because Big Tech companies have grown so large and monopolistic, the only real way to have a viable competitor is to create an entirely new internet. Amazon’s hypocritical justification for banning Parler shows that these companies will do basically anything in order to destroy the competition. Amazon claimed that Parler is responsible for the content that it allowed users to publish, which is the exact same argument made by people who wish to remove Section 230 protections for social media companies.

Amazon thus introduced a moral and legal standard for a potential competitor that it would resist tooth and nail if applied to itself. The company notably used Section 230 as a defense in a recent court case to try to avoid liability for selling defective products. It’s worth noting that many conservatives do not believe that social-media companies should do away with all content moderation. The problem is that platforms like Twitter, Facebook, and now Amazon, do not enforce their policies equally. After suspending Trump, Twitter was still hosting virulent anti-Semites, Chinese Communist party propaganda, vaccine conspiracists and antifa glorification accounts like the New York Times. If these companies only enforce policies against accounts with certain political leanings, it will radicalize a base of the population even more.

The people who are targeted online by Twitter and Facebook’s increasingly wide nets will simply find deeper and darker holes to communicate. Sunlight has always been the best disinfectant as a way of fighting radicalization. Deleting the account of someone with a radical opinion does not stop that person from holding that opinion; in fact, it may cause them to dig in even deeper in retaliation. Meanwhile, people who are unfairly targeted by social media platforms may start to sympathize with the radicals.

“Drifting apart into two separate tribes, with a separate set of facts and separate realities, with nothing in common except our hostility towards each other and mistrust for the few national institutions that we all still share.”

• We Need a New Media System (Taibbi)

The moment a group of people stormed the Capitol building last Wednesday, news companies began the process of sorting and commoditizing information that long ago became standard in American media. Media firms work backward. They first ask, “How does our target demographic want to understand what’s just unfolded?” Then they pick both the words and the facts they want to emphasize. It’s why Fox News uses the term, “Pro-Trump protesters,” while New York and The Atlantic use “Insurrectionists.” It’s why conservative media today is stressing how Apple, Google, and Amazon shut down the “Free Speech” platform Parler over the weekend, while mainstream outlets are emphasizing a new round of potentially armed protests reportedly planned for January 19th or 20th.

What happened last Wednesday was the apotheosis of the Hate Inc. era, when this audience-first model became the primary means of communicating facts to the population. For a hundred reasons dating back to the mid-eighties, from the advent of the Internet to the development of the 24-hour news cycle to the end of the Fairness Doctrine and the Fox-led discovery that news can be sold as character-driven, episodic TV in the manner of soap operas, the concept of a “Just the facts” newscast designed to be consumed by everyone died out. News companies now clean world events like whalers, using every part of the animal, funneling different facts to different consumers based upon calculations about what will bring back the biggest engagement kick.

The Migrant Caravan? Fox slices off comments from a Homeland Security official describing most of the border-crossers as single adults coming for “economic reasons.” The New York Times counters by running a story about how the caravan was deployed as a political issue by a Trump White House staring at poor results in midterm elections. Repeat this info-sifting process a few billion times and this is how we became, as none other than Mitch McConnell put it last week, a country: “Drifting apart into two separate tribes, with a separate set of facts and separate realities, with nothing in common except our hostility towards each other and mistrust for the few national institutions that we all still share.”

Jim holds on to the last straws.

• Insurrection Versus Insurrection (Kunstler)

Mr. Trump is still president, and you’ve probably noticed he has been president for four years to date, which ought to suggest that he holds a great deal of accumulated information about the seditionists who have been playing games with him through all those years. So, two questions might be: how much of that information describes criminal acts by his adversaries — most recently, a deeply suspicious national election based on hackable vote-tabulation computers — and what’s within the president’s power to do something about it? I guess we’ll find out. Or, to state it a little differently, it is impossible that the president does not have barge-loads of information about the people who strove mightily to take him down for four years.

At least two pillars of the Intel Community — the CIA and the FBI — have been actively and visibly working to undermine and gaslight him, but you can be sure that the president knows where the gas has been coming from, and these agencies are not the only sources of dark information in this world. Also consider that not all the employees at these agencies are on the side of sedition. By its work this weekend, starring Jack Dorsey (Twitter), Zuck (Facebook), Tim Cook (Apple), and Jeff Bezos (Amazon and The WashPo), you know exactly what you would be getting with The Resistance taking power in the White House and Congress: unvarnished tyranny. No free speech for you!

They will not permit opposing voices to be heard, especially about the janky election that elevated America’s booby-prize, Joe Biden, to the highest office in the land. Now there’s a charismatic, charming, dynamic, in-charge guy! He’s already doing such a swell job “healing America.” For instance, his declaration Tuesday to give $30-billion to businesses run by “black, brown, and Native American entrepreneurs” (WashPo). Uh, white folks need not apply? Since when are federal disbursements explicitly race-based? What and who, exactly, comprise the committee set up to operate Joe Biden, the hypothetical, holographic President?

If anything calls for a Special Counsel, it’s Russiagate. But with the Dems back in power, the chances are zero.

• The Rise and Fall of the ‘Steele Dossier’ (Maté)

On January 10, 2017, BuzzFeed News published the “Steele dossier,” the collection of DNC-funded reports alleging a high-level conspiracy between Trump and Moscow. The catalyst had come four days earlier, when then–FBI Director Jim Comey personally briefed Trump on the dossier’s existence. Their meeting was then promptly leaked to the media, giving BuzzFeed the news hook to publish the Steele material in full. Despite its outlandish assertions and partisan provenance, Steele’s work product somehow became a road map for Democratic leaders, media outlets, and, most egregiously, intelligence officials carrying out the Russia investigation.

According to Steele, Trump and the Kremlin engaged in a “well-developed conspiracy of cooperation.” Russia had, Steele alleged, been “cultivating, supporting and assisting Trump for at least five years,” dating back to the time when Trump was merely the host of The Apprentice. Russia, Steele claimed, handed Trump “a regular flow of intelligence,” including on “political rivals.” The conspiracy supposedly escalated during the 2016 campaign, when then–Trump lawyer Michael Cohen slipped into Prague for “secret discussions with Kremlin representatives and associated operators/hackers.”

This purported plot was not just based on mutual nefarious interests but, worse, outright coercion. To keep their asset in line, Steele alleged, the Russians had videotaped Trump hiring and watching prostitutes “perform a ‘golden showers’ (urination) show,” in a Moscow Ritz-Carlton hotel room. This “kompromat” meant that the leader of the free world was not only a traitor but also a blackmail victim of his Kremlin handlers. If the Steele dossier’s far-fetched claims were not enough reason to dismiss it with ridicule, another obvious marker should have set off alarms. Reading the Steele dossier chronologically, a glaring pattern emerges: Steele has no advance knowledge of anything that later proved to be true, and, just as tellingly, many of his most explosive claims appear only after some approximate prediction has come out in public form.

Despite his supposed high-level sources inside the Kremlin, it was only after Wikileaks published the DNC e-mails in July 2016 that Steele first mentioned them. When Steele made the headline-consuming claim that “the TRUMP team had agreed to sideline Russian intervention in Ukraine as a campaign issue” in exchange for Russian help, he did so only after a meaningless Ukraine-related platform change at the RNC was reported (and mischaracterized) in The Washington Post. When Steele claimed that former Trump campaign adviser Carter Page was offered up to a 19 percent stake in the state-owned Russian oil company Rosneft if he could get Trump to lift Western sanctions, it was only after the media had reported Page’s visit to Moscow.

In short, far from having access to high-level intelligence, Steele and his “sources” only had access to news outlets and their own imaginations.

Support that comes way too late.

• Assange Is Still In Prison. And America’s Principles Are Still At Stake. (NBC)

The Justice Department’s case against Assange raised serious press freedom concerns from the outset. This is partly because so much of the indictment is devoted to describing activity that journalists engage in routinely — like cultivating government sources, communicating with them confidentially, protecting their identities and publishing classified secrets. In defending the indictment, Justice Department spokespeople have insisted that the case does not implicate press freedom because Assange himself is not a journalist and because WikiLeaks, which Assange founded, is not a media organization. But this defense misses the point. The point is that Assange is being prosecuted for activities that national security journalists engage in every day — and that they need to engage in if they are to serve as a meaningful check on government power.

Of particular concern are three counts in the indictment that charge Assange with having violated the Espionage Act merely by publishing classified information. As the Justice Department knows, publishing government secrets is an important part of what American news organizations do. The Washington Post disclosed classified information when it revealed the CIA’s network of black sites. The New York Times disclosed classified information when it exposed the National Security Agency’s warrantless wiretapping program. The truth is that there is no way that American news organizations could report responsibly about war, foreign relations or national security without sometimes disclosing classified information. Max Frankel of The New York Times famously made this point in an affidavit filed 50 years ago in the Pentagon Papers case, and the point is even more true today.

The ruling issued in London on Monday by Judge Vanessa Baraitser will forestall the Justice Department, at least for now, from pursuing Assange’s prosecution in U.S. courts. This is a significant thing. While the indictment certainly has a chilling effect on national security journalism, a successful prosecution of Assange under the Espionage Act would be even more oppressive — indeed, it would likely compel U.S. news organizations to radically curtail some of the most important work they do. The problem with Baraitser’s ruling, from the perspective of press freedom, is that it rejected the extradition request only because of concerns relating to Assange’s mental health and the conditions in which he would be imprisoned were he handed over to the United States. This aspect of Baraitser’s ruling appears to be well supported by the evidence, but, significantly, its protection does not extend beyond Assange.

Really? The UK goverment will protect the planet? And Prince Charles makes a cameo? Fool me once, shame on you.

• 50 Countries Commit To Protection Of 30% of Earth’s Land and Oceans (G.)

A coalition of 50 countries has committed to protect almost a third of the planet by 2030 to halt the destruction of the natural world and slow extinctions of wildlife. The High Ambition Coalition (HAC) for Nature and People, which includes the UK and countries from six continents, made the pledge to protect at least 30% of the planet’s land and oceans before the One Planet summit in Paris on Monday, hosted by the French president, Emmanuel Macron.

Scientists have said human activities are driving the sixth mass extinction of life on Earth, and agricultural production, mining and pollution are threatening the healthy functioning of life-sustaining ecosystems crucial to human civilisation.In the announcement, the HAC said protecting at least 30% of the planet for nature by the end of the decade was crucial to preventing mass extinctions of plants and animals, and ensuring the natural production of clean air and water. The commitment is likely to be the headline target of the “Paris agreement for nature” that will be negotiated at Cop15 in Kunming, China later this year. The HAC said it hoped early commitments from countries such as Colombia, Costa Rica, Nigeria, Pakistan and Canada would ensure it formed the basis of the UN agreement. The UK environment minister Zac Goldsmith said: “We know there is no pathway to tackling climate change that does not involve a massive increase in our efforts to protect and restore nature.

“So as co-host of the next Climate Cop, the UK is absolutely committed to leading the global fight against biodiversity loss and we are proud to act as co-chair of the High Ambition Coalition. “We have an enormous opportunity at this year’s biodiversity conference in China to forge an agreement to protect at least 30% of the world’s land and ocean by 2030. I am hopeful our joint ambition will curb the global decline of the natural environment, so vital to the survival of our planet.”

A feature not a bug?!

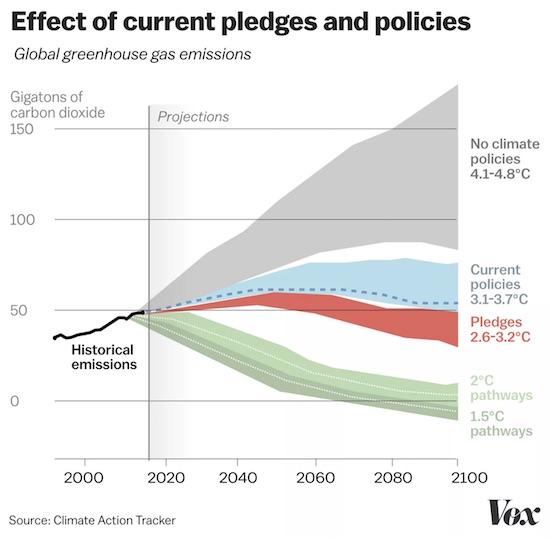

• Economic Failures of the IPCC Process (Steve Keen)

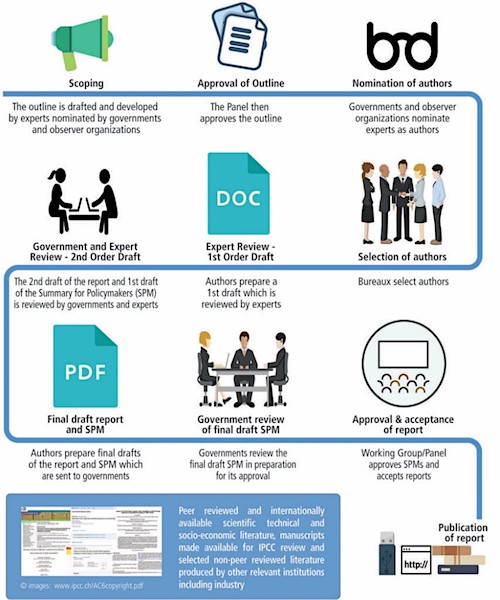

The Intergovernmental Panel on Climate Change (IPCC) is the premier international body collating the scientific assessment of climate change, and proposals for mitigation. A joint creation of the United Nations agencies the World Meteorological Organization (WMO) and the United Nations Environment Programme (UNEP), it brings together scientists from myriad disciplines to assess and summarize the current research on climate change, collating knowledge that is then used to inform governments and politicians. The scientists work on a volunteer basis. The IPCC relies upon its member governments and “Observers Organizations” to nominate its volunteer authors. This means that, subject to their willingness to volunteer, the most prestigious individuals specialising in climate change in each discipline become the authors of the relevant IPCC chapter for their discipline.

They then undertake a review of the peer-reviewed literature in their field (and some non-peer-reviewed work, such as government reports) to distil the current state of knowledge about climate change in their discipline. A laborious review process is also followed, so the draft reports of the volunteer experts is reviewed by other experts in each field, to ensure conformity of the report with the discipline’s current perception of climate change. The emphasis upon producing reports which reflect the consensus within a discipline has resulted in numerous charges that the IPCC’s warnings are inherently too conservative. But the main weaknesses with the IPCC’s methodology are firstly that, in economics, it exclusively selects Neoclassical economists, and secondly, because there is no built-in review of one discipline’s findings by another, the conclusions of these Neoclassical economists about the dangers of climate change are reviewed only by other Neoclassical economists. The economic sections of IPCC reports are therefore unchallenged by other disciplines who also contribute to the IPCC’s reports.

Given the extent to which economists dominate the formation of most government policies in almost all fields, and not just strictly economic policy, the otherwise acceptable process by which the IPCC collates human knowledge on climate change has critically weakened, rather than strengthened, human society’s response to climate change. This is because, commencing with “Nobel Laureate” William Nordhaus, the economists who specialise on climate change have falsely trivialized the dangers that climate change poses to human civilization. In his 2018 Nobel Prize lecture, William Nordhaus described a trajectory that would lead to global temperatures peaking at 4°C above pre-industrial levels in 2145 as “optimal” because, according to his calculations, the damages from climate change over time, plus the abatement costs over time, are minimised on this trajectory.

He estimated the discounted cost of the economic damages from unabated climate change — which would see temperatures approach 6°C above pre-industrial levels by 2150 — at $24 trillion, whereas the 4°C trajectory had damages of about $15 trillion and abatement costs of about $3 trillion. Trajectories with lower peak temperatures had higher abatement costs that overwhelmed the benefits. In a subsequent paper, Nordhaus claimed that even a 6°C increase would only reduce global income by only 7.9%, compared to what it would be in the complete absence of global warming.

“Welcome to Brexit, sir, I’m sorry.”

• Dutch Officials Seize Ham Sandwiches From British Drivers (G.)

Dutch TV news has aired footage of customs officers confiscating ham sandwiches from drivers arriving by ferry from the UK under post-Brexit rules banning personal imports of meat and dairy products into the EU. Officials wearing high-visibility jackets are shown explaining to startled car and lorry drivers at the Hook of Holland ferry terminal that since Brexit, “you are no longer allowed to bring certain foods to Europe, like meat, fruit, vegetables, fish, that kind of stuff.” To a bemused driver with several sandwiches wrapped in tin foil who asked if he could maybe surrender the meat and keep just the bread, one customs officer replied: “No, everything will be confiscated. Welcome to Brexit, sir, I’m sorry.”

The ban came into force on New Year’s Day as the Brexit transition period came to an end, with the Department for Environment, Food and Rural Affairs (Defra) saying travellers should “use, consume, or dispose of” prohibited items at or before the border. “From 1 January 2021 you will not be able to bring POAO (products of an animal origin) such as those containing meat or dairy (eg a ham and cheese sandwich) into the EU,” the Defra guidance for commercial drivers states. The European commission says the ban is necessary because meat and dairy products can contain pathogens causing animal diseases such as foot-and-mouth or swine fever and “continue to present a real threat to animal health throughout the union”.

Dutch customs also posted a photograph of foodstuffs ranging from breakfast cereals to oranges that officials had confiscated in the ferry terminal, adding: “Since 1 January, you can’t just bring more food from the UK.” The customs service added: “So prepare yourself if you travel to the Netherlands from the UK and spread the word. This is how we prevent food waste and together ensure that the controls are speeded up.”

“Let’s all remain peaceful,” he said, which clearly meant, “Go burn down the Capitol Building.”

• ‘Let’s All Remain Peaceful,’ Says Trump In Clear Incitement To Violence (BBee)

A review of Trump’s statements last week made it clear that he was inciting violence, as he very clearly told people to “remain peaceful” and not carry out any violence. The dangerous cult leader encouraged his followers to protest at the Capitol, but to remain peaceful, which is an obvious instance of inciting violence, according to leading language experts and journalists. “Let’s all remain peaceful,” he said, which clearly meant, “Go burn down the Capitol Building.” “No violence!” added the deranged lunatic, which, according to the New York Times, was a dog whistle for “Minions, attack!” “Go home,” he added, which meant, “Keep pressing the attack! We will not be defeated! Blow stuff up!” At publishing time, Trump had said, “I’ve always encouraged peaceful protesting,” which meant he wanted his followers to go ransack an Arby’s.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in 2021. Click at the top of the sidebars to donate with Paypal and Patreon.