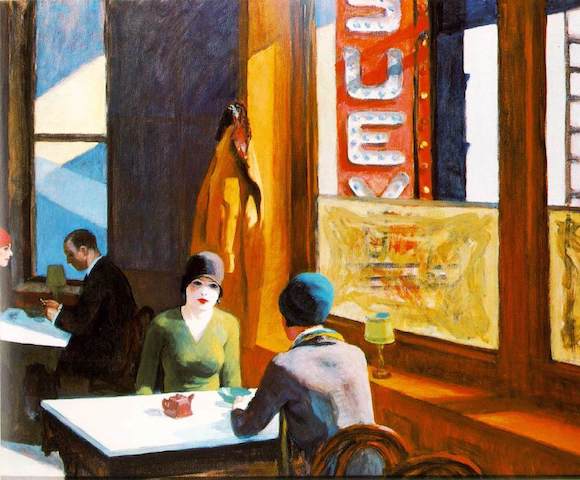

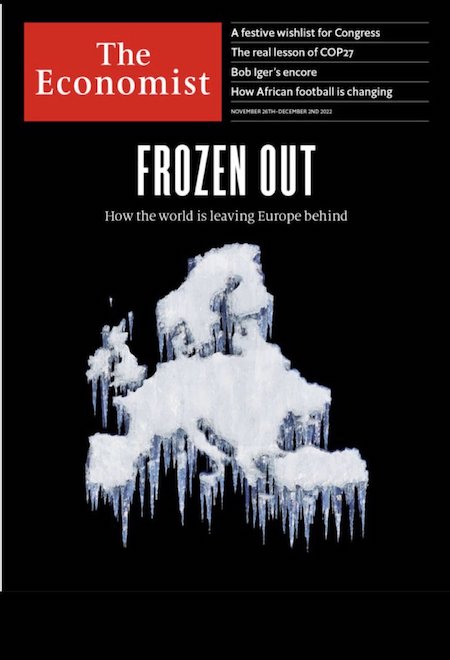

Vincent van Gogh Le moulin de la galette 1886

Kimmel

https://twitter.com/i/status/1767014173391585295

Mace

Rep. Nancy Mace eviscerates ABC’s George Stephanopoulos after he asks, “As a rape victim… how can you endorse Trump?”

“You're asking me a question about my political choices, trying to shame me as a rape victim. And I find it disgusting,” said Mace.pic.twitter.com/rvCXJ4Z6rp

— The Post Millennial (@TPostMillennial) March 10, 2024

Schiff Trump

BREAKING: Adam Schiff states the U.S. Intelligence Community will withhold intelligence briefings from Donald Trump, conceiling information, sources, and methods if he wins re-election this fall. pic.twitter.com/0CUsqAQqXN

— The General (@GeneralMCNews) March 10, 2024

Melania

Reminder: During Trump’s presidency (2017-2021), Melania Trump, unlike her predecessors such as Michelle Obama and Laura Bush, was not featured on the cover of any major US fashion magazine like Vogue, Elle, or Harper’s Bazaar. pic.twitter.com/hLtHK9f7ky

— @amuse (@amuse) March 11, 2024

Rogan X

https://twitter.com/i/status/1767284402143334811

Bannon Rickards

Tucker Cuomo

Ep. 80 The Chris Cuomo Interview pic.twitter.com/bEnFxnpx9U

— Tucker Carlson (@TuckerCarlson) March 11, 2024

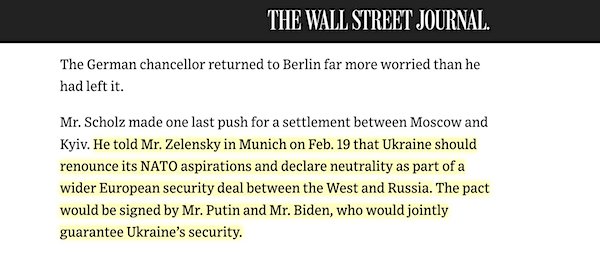

“Let’s demolish this green rat and install Zaluzhny!”

• Elite Units of Ukrainian Armed Forces Discuss Overthrowing Zelensky (Sp.)

Following the recent reshuffle in Ukraine’s military leadership, discontent is brewing among elite units, with discussions of ousting President Volodymyr Zelensky and reinstating Valery Zaluzhny, the former commander-in-chief, a source has revealed to Sputnik. Commanders and soldiers in elite units of the Ukrainian Armed Forces are dissatisfied with the reshuffle in the country’s military leadership and are seriously discussing the ousting of Volodymyr Zelensky, a representative of the Russian security services has told Sputnik. He explained that specialists had gained access to a closed Telegram channel called “ParaBelum,” which consists of radically-minded fighters from the elite units of the Ukrainian Armed Forces.

“Our specialists have gained access to a resource in which members of various elite units, such as the Marines, special forces, intelligence, special forces of the SBU [Security Service of Ukraine], as well as various nationalist battalions, communicate. They are highly qualified specialists who are clearly dissatisfied with the change of command. They are seriously discussing options for overthrowing the current government and the command of the Ukrainian Armed Forces,” the interlocutor said. Based on the materials at the disposal of Sputnik, the soldiers express dissatisfaction with the actions of Zelensky and the new commander-in-chief of the Ukrainian Armed Forces, Oleksandr Syrsky, who was appointed a month ago to replace Valery Zaluzhny. Thus, the commander of the reconnaissance group of Ukraine’s 80th Separate Air Assault Nrigade, Maxim Shevtsov, with the call sign “Winter,” calls on members of “ParaBelum” to overthrow Zelensky.

“If people don’t come to the defense of Zaluzhny, if the military doesn’t come to the defense of Zaluzhny, then this rat [Zelensky] will torpedo everyone… Let’s demolish this green rat and install Zaluzhny! In fact, it’s Zelensky who needs to be changed, not Zaluzhny. This rat feels that he has a zero rating, and Zaluzhny has a higher rating, and [this is why Zelensky] is trying to torpedo him,” a voice message from Shevtsov says. A recent poll by the Ukrainian Center for Social and Marketing Research SOCIS suggests that if the presidential election were held in Ukraine in 2024, former Ukrainian Commander-in-Chief Valery Zaluzhny would secure a significant lead, with 41.4% of the first-round vote, surpassing Volodymyr Zelensky’s 23.7%. In the parliamentary scenario, Zaluzhny’s hypothetical bloc would lead with 46.4% of the vote, according to the same poll.

“This is to buy time for a miracle to happen and the Ukrainians are hoping the miracle will be the arrival of a French battlegroup.”

• Pentagon’s ‘Ukrainian Fantasy’ Is Falling Apart – Scott Ritter (Sp.)

The US Pentagon’s fantasy in Ukraine is falling apart, former UN weapons inspector and commentator Scott Ritter told Sputnik’s Fault Lines on Monday. Speaking on reports in US media that said there are growing tensions between Kiev and Washington because Ukraine reportedly did not listen to tactical advice offered by the Pentagon, Ritter said he believes the assertions are not based in reality but instead are designed to shift the blame away from the United States. “The Pentagon is definitely trying to create political cover for itself because their huge Ukrainian fantasy is falling apart,” Ritter asserted, explaining earlier that Ukraine had little choice but to hold Avdeyevka for as long as possible so that defensive lines could be built behind it, noting however, that Russian airpower prevented even that goal from being achieved.

“It’s easy to play armchair quarterback and just sit back there and pick apart. But the reality is what other choices [did] Ukrainians have but to try and hold onto the last defensible position they [had]?” The Kiev regime is “waking up to the reality that their so-called friends and allies are abandoning them and leaving Ukraine to its own fate” Ritter explained earlier while discussing Macron’s comments that French troops may be deployed in Ukraine, a hypothetical that Ritter says is only being discussed because of the position Ukraine is in. “To understand why Macron would be even talking about this, you have to understand how dire the situation is for Ukraine right now. They are facing military collapse, right now as we speak the last reserves of Ukraine are being thrown into the battle outside the village of Orlovka,” Ritter explained. “This is to buy time for a miracle to happen and the Ukrainians are hoping the miracle will be the arrival of a French battlegroup.”

That possible “miracle” would not change the outlook on the battlefield, Ritter argued, saying that their ability “to deploy a military meaningful force to Ukraine is very slim,” with or without the Baltic State allies Macron is reportedly seeking. Meanwhile, Ritter argues, the election season is forcing the United States to step back from the conflict. “Biden is in a presidential election cycle, we’re coming up on the final sprint to November. … Biden will do whatever is necessary to minimize his political exposure.” “We fired [Under Secretary of State for Political Affairs] Victoria Nuland, the architect of [the Ukraine] policy, and we [took] a step back.” That has left Europe “sitting there, realizing that, frankly speaking, they are nothing without American money. This is a hard pill to swallow and meanwhile, on the battlefield, the Ukrainian army is in absolutely desperate straits.”

“..a highly telling stigma – ‘negative outlook,’ ‘a virtual certainty of default,’ ‘debt susceptible to non-payment..’”

• Ukraine Already Bankrupt Long Ago – Former Prime Minister (TASS)

Ukraine has long been completely insolvent, former Ukrainian Prime Minister (2010-2014) Nikolay Azarov said in commenting on the Standard & Poor’s rating agency’s downgrade of its credit rating on Ukraine’s sovereign debt to “junk” status. “Ukraine is fully insolvent. However, international agencies do not risk assigning it a default rating. Although Ukraine went bankrupt long ago,” he wrote on his Telegram channel. Earlier, S&P downgraded Ukraine from a “CCC” rating to “CC.” “Now the country’s long-term sovereign [debt] rating has received a highly telling stigma – ‘negative outlook,’ ‘a virtual certainty of default,’ ‘debt susceptible to non-payment,’” the former head of the Ukrainian government added.

“..the Houthis “demonstrating in real time just how target-rich developed nations are..”

• Houthis ‘Schooling’ West in Asymmetric Warfare (Sp.)

The Yemeni militia has led a sustained campaign of ship seizures, drone and missile attacks against suspected Israeli-tied commercial vessels and Western warships operating in the Red Sea for nearly four months straight, with commercial freight volume through the strategic maritime chokepoint down as much as 80 percent. Ansar Allah, the Yemeni militia group also known as the Houthis, has “more surprises” in store for the US and Israel, and will continue its campaign of maritime attacks so long as Tel Aviv continues its brutal assault in Gaza and blocks humanitarian aid from getting through, leading Houthi figure Abdul Sattar Al-Nehmi has said. “We have a firm belief in our leadership and its decisions, which motivates us to continue these operations in support of our brothers in Gaza,” al-Nehmi said in an interview with local media. The official did not elaborate on the “surprises” Washington and Tel Aviv should expect, but stressed the maritime campaign will continue until the Houthis manage to “force” global powers to bring Israel to heel.

Houthi leader Abdul-Malik al-Houthi offered a tally of militia missile and drone attacks and ship seizures to date last week, saying 96 missile and drone attacks have been launched and 61 ships targeted so far amid the ongoing campaign. Separately on Monday, Bloomberg Middle East contributor Marc Champion warned that the Houthis have succeeded in “schooling” the West “in asymmetric warfare,” with neither the “extraordinary power of US carrier fleets,” nor attempts to “get tougher” by bombing the militia group succeeding in reining in Ansar Allah’s activities. “The first challenge is that advances in the production of missiles and drones have democratized extremely powerful weapons that until recently were available only to the richest states,” Champion wrote. “The second is a growing asymmetry of vulnerabilities,” with the Houthis “demonstrating in real time just how target-rich developed nations are,” and the US and its allies showing that they have much more to lose than humble Yemenis.

“When the Houthis disrupt the roughly 12% of global shipping that passes through the Bab al-Mandab Strait between the Arabian Peninsula and the Horn of Africa, it impacts consumers in Europe and manufacturers in Asia, but not Yemen. If oil tankers have to shift to longer, more expensive routes than the Suez Canal, nudging up the price of gasoline at US pumps, the Houthis will be much less affected,” the commentator emphasized. And that’s not to mention the “trillions of dollars” worth of information passing through the communications cables which lie at the bottom of the Red Sea, which Western media fear the Houthis might sabotage, or the “communications and the data that sophisticated militaries rely on to operate.” Champion urged Washington to “resist the temptation to escalate its fight with the Houthis,” and to prevent the situation from spinning even further out of control, as any “reliable success” against the militia would require a full-scale invasion or heavy bombardment – neither of which “would be remotely worth the cost.”

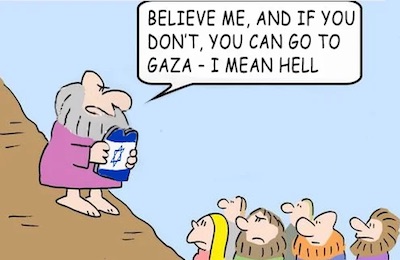

“Israel’s public genocide is a private secret among Americans who are paying for it..”

• God Is Underwriting Israel’s Genocide Bond (Helmer)

Last week it happened that God and the United States Treasury managed to underwrite a record issue of Israel Government bonds to continue the war against the Arabs in Gaza, West Bank, Lebanon, Syria, Iraq – and Iran if necessary. The war financing comprised $2 billion of five-year bonds, and $3 billion each of 10 and 30-year bonds. The US Treasury guarantees bond holders that if Israel defaults on repayment of its obligations, the US will pay instead. Notwithstanding this, the Israelis were obliged to offer an extra 1.35%, 1.45%, and 1.75% more in interest over the going rate for US Treasury bonds for the same length of term. The Reuters news agency headline on March 6 celebrated “Israel sells record $8 billion in bonds despite Oct 7 attacks, downgrade”. The propaganda agency based in New York quoted Israel’s Accountant-General as claiming the bond placement “results showed an “unprecedented expression of confidence in Israel’s economy by the world’s largest international investors”.*

In fact, according to well-informed bond trade sources in Europe, with the higher interest rates the market has just demanded from the Israelis, the spread between the Israel bonds and US Treasuries has never been wider, and the worse this spread will become for Israel. This is a vote of no-confidence from the market which the Israelis, the Americans, and their media are trying to keep secret. The longer the war is protracted, the more obvious the costs of Israel Defence Forces’ (IDF) failure will become – and the deeper the negative bond sentiment will grow. By converting secrecy into money, the market is signalling that it has begun to turn against Israel – and profit at Israel’s expense. Also unprecedented is the secrecy in which the “expression of confidence” has been managed by the US, French, and German banks acting as managers of the Israeli bond issue; and of the US Securities and Exchange Commission (SEC), which has had regulatory oversight of the process.

The debt financing has been reported as a “private placement”; this has removed the requirement that the Israelis produce a public prospectus explaining how they think their war – plausibly genocide, according to the International Court of Justice in its ruling of January 26, 2024 – is going, and how long the IDF claim it will last. This does not remove the legal requirement on the two US banks engaged in marketing the bonds to US investors, Bank of America and Goldman Sachs, to submit a formal application for SEC approval of what is called a letter of consent. However, asked to confirm the contents of the letter of consent application for the sale of the Israeli bonds, and its official approval, the SEC has refused to give any answer. Goldman Sachs was asked the same questions. The bank also refuses to say.

Last October the chief executive of Goldman Sachs, David Solomon,* issued a personal letter to the bank’s employees claiming the Hamas operation was a “violation of fundamental human values”: Solomon then proposed a $2 million gift of bank funds “to organizations providing critical support and humanitarian relief in Israel”; plus additional bank money, three bank dollars for every one contributed by bank staff making donations under $25, and one for one if the staff contribution was over $25. Asked how much money has been raised for Solomon’s gift to the Israelis, the bank is refusing to reply. In other words, Israel’s public genocide is a private secret among Americans who are paying for it, and among US government officials responsible for regulating the scheme according to US law. According to well-informed bond traders, this deal-making is worth in fees to the dealmakers, led by Goldman Sachs, about $100 million.

“Everyone can see the tactics that are used to defeat the enemy in war, but what no one can see is the strategy from which great victory arises.”

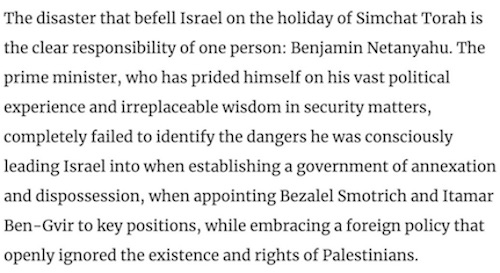

• Chasing ‘Tactical’ Wins, Israel Now Faces ‘Strategic’ Defeat (Sweidan)

In a fight like this, the center of gravity is the civilian population. And if you make them fall into the hands of the enemy, you turn tactical victory into strategic defeat. US Defense Secretary Lloyd Austin issued this warning to Israel back in December during his address at the Reagan National Defense Forum in California. Drawing on hard-earned lessons from US wars in Iraq and Afghanistan, Austin stressed that winning battles on the ground does not guarantee a strategic victory and may even lead to a strategic defeat – if Israel refuses to look at the bigger picture. This is one of the main sources of Washington’s pressure on Tel Aviv, especially in light of the allies’ differing political visions for Gaza in the post-war period and the man-made humanitarian crisis Israel has imposed on the Strip. It’s a philosophy rooted in foresight, echoing Robert Greene’s wisdom from his 33 War Strategies: “Grand strategy is the art of looking beyond the present battle and calculating ahead.”

Israeli Prime Minister Benjamin Netanyahu’s cabinet has outlined two primary objectives for the Gaza war: dismantling Hamas’ military infrastructure and securing the release of prisoners detained since 7 October. Netanyahu later expanded on these objectives, adding a crucial third goal: ensuring Gaza’s inability to threaten the occupation state’s security in the future. Consequently, the success of Israel’s brutal military assault on Gaza hinges on achieving these pivotal objectives. Despite their shared goals, disparities have emerged between the American and Israeli approaches. While both advocate for neutralizing Hamas, the Biden administration advocates for a more politically driven strategy, while Netanyahu seeks an almost entirely military-centric approach.

Hamas, on the other hand, announced three main objectives of Operation Al-Aqsa Flood immediately following the events of 7 October. First, success in conducting a prisoner exchange with the enemy entity. Second, retaliation against Israeli aggression in the occupied West Bank and safeguarding Al-Aqsa Mosque from settler extremists. Third, placing the Palestinian issue back on the global stage. Chinese General Sun Tzu’s timeless wisdom in his Art of War distinguishes between tactical maneuvers and strategic foresight: “Everyone can see the tactics that are used to defeat the enemy in war, but what no one can see is the strategy from which great victory arises.” In warfare, tactical objectives focus on short-term gains – specific engagements or territorial advances. In contrast, strategic goals require long-term vision, aligning military actions with political priorities. In essence, tactics look to answer the “how,” while strategy answers the “why” in military engagement, ultimately with a political endgame.

Any state or party to a conflict can achieve tactical objectives by excelling in battlefield maneuvers, using superior technology, or having better trained and equipped forces. But winning battles – that is, achieving tactical goals – does not necessarily mean winning the war. This discrepancy occurs because the cumulative effect of tactical victories may not align with or contribute adequately to broader strategic objectives. While tactics are essential to winning battles, they must be used as part of a strategy aimed at achieving the ultimate goals of war. History offers several sobering reminders of the perils of prioritizing tactics over strategy. For example, in the Vietnam War, the US achieved numerous tactical victories yet failed strategically. Despite inflicting heavy losses, the broader goal of fostering a non-communist South Vietnam remained elusive. The US’s longest war, in Afghanistan against the Taliban, ended in another humiliating withdrawal, only for the Taliban to return to unprecedented political power across the country.

Esteemed Israeli historian and critic of Zionism, Ilan Pappe, believes that the failures of the genocidal war on Gaza will ultimately lead to the downfall of the Zionist entity, with the war being the most perilous chapter in the “history of a project fighting for its existence.”

Yanis

"How many rivers of Palestinian blood need to flow before you feel cleansed of your guilt over the Holocaust"@YanisVaroufakis pic.twitter.com/BVBCcOwCr1

— Double Down News (@DoubleDownNews) March 11, 2024

“Like Florida, [a] key state, where the votes of the Jews can decide who will move into the White House, so too can the votes of the Muslims in Michigan decide … ”

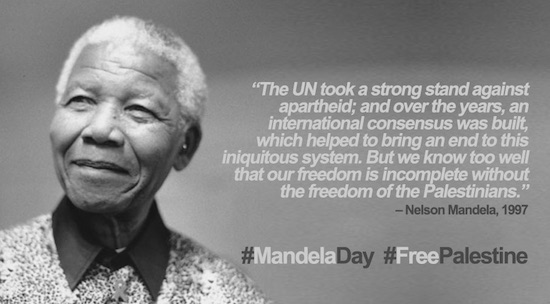

• White House Fails to Navigate the Israeli Re-calibration (Alastair Crooke)

Alon Pinkas, a former senior Israeli diplomat, well-plugged into Washington, tells us that a frustrated White House finally has “had enough”. The rupture with Netanyahu is complete: The Prime Minister does not comport himself as ‘an U.S. ally’ should; he severely criticises Biden’s Middle East policies, and now the United States has come to understand this fact. Biden cannot afford any further Israel-affects to jeopardise his electoral campaign, and so – as his State of the Union Speech makes clear – he will double-down on misconstrued policy frameworks for both Israel and Ukraine. So what does Biden intend to do about Netanyahu’s act of defiance against the ‘holy grail’ of U.S. policy recommendations? Well, he invited Benny Gantz, a member of Israel’s War Cabinet to Washington, and wrapped him around an agenda “reserved for a prime minister, or someone they think will, or should be, premier”. Officials apparently thought that by initiating a visit outside of usual diplomatic protocols, they may “have unleashed a dynamic that could lead to an election in Israel”, Pinkas notes, resulting in a leadership more amenable to U.S. ideas.

It was clearly intended as a first step to ‘soft power’ régime change. And the prime reason for the declaration of war on Netanyahu? Gaza. Biden apparently didn’t appreciate the snub received in the Michigan primary when the Gaza protest vote surpassed 100,000 ‘uncommitted votes’. Polls – especially amongst the young – are flashing red warning signals for November (in no small part because of Gaza). Democratic national leaders are beginning to worry. Leading Israeli commentator, Nahum Barnea, warns that Israel is “loosing America”: “We are accustomed to thinking of America in familial terms … We receive weapons and international backing and the Jews give their votes in the key states and money to the campaigns. This time, the situation is different … Since the votes in [presidential] elections are counted regionally, only a few states … actually decide … Like Florida, [a] key state, where the votes of the Jews can decide who will move into the White House, so too can the votes of the Muslims in Michigan decide …

“[Activists] called on the primary voters to vote “uncommitted” to protest Biden’s support for Israel … Their campaign succeeded beyond expectations: 130,000 Democratic voters supported it. The slap in the face to Biden reverberated across the entire length and breadth of the political establishment. It not only attested to the rise of a new, efficient and toxic political lobby, [but] also to the revulsion that many Americans feel when they see the pictures from Gaza”. “Biden loves Israel and is truly afraid for it”, concludes Barnea “but he has no intention of losing the elections because of it. That is an existential threat”. The problem however, is the converse: It is that U.S. policy is deeply flawed, and wholly incongruent with majority public sentiment in Israel. Many Israelis feel they are fighting an existential struggle, and must not become ‘just fodder’ (as they see it) to a U.S. Democratic electoral strategy. The reality is that Israel is rupturing with Team Biden – not the converse.

Biden’s key plan which rests on a revitalised Palestinian security apparatus is described – even in the Washington Post – as ‘improbable’. The U.S. tried a PA security ‘revitalising’ initiative under U.S. General Zinni in 2002 and Dayton in 2010. It did not work – and for good reason: Palestinian Authority security forces are simply viewed by most Palestinians as the hated stooges enforcing continued Israeli occupation. They work to Israeli security interests, not Palestinian security interests. The other main components to U.S. policy is an even more improbable ‘de-radicalised’ and anaemic ‘two-state solution’, buried within a regional concert of conservative Arab States acting as its security overseer. This policy approach reflects a White House out of kilter with today’s more eschatological Israel, and one failing to move on from perspectives and policies hailing from decades past which, even then, were failures. The White House therefore has resorted to an old trick: To project all of its own policy failings onto a foreign leader for not making the ‘unworkable’ work, and to try to replace that leader with someone more compliant. Pinkas writes:

“Once the United States became convinced that Netanyahu was not being cooperative, not being a considerate ally, behaving like a crude ingrate … focused only on his political survival after the October 7 debacle, the time was ripe to try a new political course”. However, Netanyahu’s policy – for better or worse – reflects what a majority of Israelis think. Netanyahu has his well-known personality defects and is seriously unpopular in Israel, yet that does not mean that a plurality disagrees with his, and his government’s programme. So “enter Gantz”, unleashed by Team Biden as prospective PM-in-waiting into the Washington and London diplomatic pool.

Kash Patel

https://twitter.com/i/status/1766847857460437487

“..Biden’s recent blunder in which he mixed up Ukraine and the Middle East sums up his poor mental state..”

• Biden a ‘Rare Kind of Idiot’ – Medvedev (RT)

US President Joe Biden’s recent blunder in which he mixed up Ukraine and the Middle East sums up his poor mental state, former Russian leader Dmitry Medvedev has claimed. Biden’s gaffe came in an interview with MSNBC on Saturday, as he discussed the Israeli military campaign in Gaza with host Jonathan Capehart. The US leader said West Jerusalem should not repeat the mistakes that Washington made following the September 2001 terrorist attacks. “America made a mistake. We went after Osama bin Laden until we got him, but we shouldn’t have gone into Ukraine,” Biden stated. He then corrected himself, saying he meant “the whole thing in Iraq and Afghanistan,” referring to the US invasions and occupation of the two Middle Eastern nations. Confusing places and people has been a recurring issue for the 81-year-old president. Medvedev, who serves as deputy chair of the Russian Security Council, posted a short clip of the gaffe on Sunday on social media, adding: “A rare kind of idiot.”

Some Russian officials have suggested that Biden’s slip of the tongue was Freudian. “He didn’t mix it up. He can no longer keep to himself what everyone understands – the US has disgraced itself in the bloodiest manner with the whole Ukrainian project,” Foreign Ministry spokeswoman Maria Zakharova said. Moscow perceives the Ukraine conflict as a US-led proxy war against Russia, in which Ukrainian soldiers serve as ‘cannon fodder’. The Russian military estimated that by the end of February, Kiev’s military losses had reached 444,000. In the nine-minute interview with MSNBC, Biden mentioned Ukraine once, calling out former President Donald Trump for his skeptical attitude towards NATO. The incumbent leader described the organization as “critical to our national defense.” Moscow has cited the expansion of the military bloc in Europe as a key cause of the hostilities with Ukraine.

“Macron preparing to visit Kiev? But he’s a zoological coward!”

• Macron is a ‘Coward’ – Medvedev (RT)

French President Emmanuel Macron has postponed his visit to Ukraine because he is a pathological coward, former Russian President Dmitry Medvedev has claimed. The Elysee Palace announced on Monday that Macron’s long-awaited visit to Ukraine will take place sometime “in the coming weeks.” The announcement marks the third delay of the French leader’s visit to Ukraine. Macron had initially planned to visit Kiev to sign a bilateral security agreement last month, but the document ended up being signed during Ukrainian President Vladimir Zelensky’s trip to Paris. “Macron preparing to visit Kiev? But he’s a zoological coward!” Medvedev posted in French on X (formerly Twitter), recommending that Macron’s office pack “several changes of underwear” and prepare for a “strong stink.”

Medvedev claimed that he originally wrote the message in the morning, but by the time he decided to post it – the French president had already “s**t himself” and pulled out of the planned visit. “Poor France!” he added. Instead of hurrying to Kiev, Macron wants to “take the necessary time” for talks with allies to be able to visit Ukraine “with tangible results,” Politico wrote on Monday, citing an anonymous French diplomat. In recent weeks, the French president has escalated his hawkish rhetoric towards Russia, suggesting in late February that sending Western troops to Ukraine cannot be ruled out. Last Tuesday in Prague, he called on European nations to step up support for Kiev amid the Ukraine-Russia conflict, saying Europe is facing times “where it will be appropriate not to be a coward.”

NATO members are seeking to boost military aid to Kiev amid worries that funding from Ukraine’s biggest war sponsor – the US – will dry up. Earlier this year, the White House said that Washington had used up all the money allocated to Ukraine thus far – more than $113 billion. An additional $60 billion in US funding is still being held up in Congress, although recently it was suggested that the money should be loaned to Kiev, rather than given away. Moscow maintains that Western military aid to Ukraine does little to alter the course of the conflict, while extending the hostilities and causing needless deaths. Commenting on Macron’s words regarding the possibility of deploying Western troops to Ukraine, Kremlin spokesman Dmitry Peskov warned that doing so would make a direct clash between NATO and Russia “inevitable.”

“The EU, whose initial vocation as a peacemaker in Europe has completely slipped and transformed into a warmonger..”

• ‘Warmonger’ EU’s Defense Strategy a Wishful Dream (Sp.)

The European Commission’s newly proposed strategy to coordinate its military industries to tackle the “existential threat” posed by Russia is, above all, a pipe dream, Colonel Jacques Hogard, who served 26 years in the French Army as an airborne officer in the Foreign Legion and the special forces, told Sputnik. “The EU, whose initial vocation as a peacemaker in Europe has completely slipped and transformed into a warmonger, is seeking to exist, in the face of the visible disengagement of the United States in Ukraine. It clumsily tries to find a way out of the trap into which the Americans have made it fall. But in reality, ‘defense Europe’ is a dream. Born from a desire to bring the Franco-German couple together, this dream has never had the slightest beginning of concrete realization,” Hogard stated.

The pundit elaborated by pointing to the TIGER III, MAWS, and CIFS programs that were all successively “abandoned by Berlin, either to adopt purely German solutions or to turn to American equipment.” The remaining two programs – SCAF (Future Combat Air System) and MGCS (Main Ground Combat System) – were plagued by “disagreements over the distribution of roles between German and French industries.” “These programs were pushed through under pressure from politicians, without their future being assured,” Jacques Hogard said. Continuing to support Ukraine militarily has left European countries’ existing stocks depleted, EU foreign policy chief Josep Borrell admitted in his latest blog post. He urged moving “from an emergency mode to a longer-term vision, in a new strategy would allow the EU to be able to “replenish our stocks and develop the defense capabilities,” while continuing to provide “adequate military support to Ukraine.”

“To strengthen our defense in a tense geopolitical context, we urgently need to overcome the fragmentation of our defense industry through more joint procurement and more common projects,” he wrote. The blog post further elaborated on the new European Defense Industrial Strategy recently unveiled by Brussels. The European Commission, the EU’s executive branch, touted its plan worth around €1.5 billion (US $1.6 billion) as a way to turbocharge the bloc’s military-industrial sector. The strategy is geared to reduce the EU member states’ dependence on the US for defense needs. Procurement outside the bloc was declared “no longer sustainable.” The plans will need to be approved by the European Parliament and by member countries, who are already squabbling over military and weapons spending on Ukraine aid.

“..Macron effectively offered to share French nuclear weapons. “These statements by Macron are extremely serious..”

• EU Nuclear Umbrella to Embolden Member States to Use French Nukes (Sp.)

The idea of the EU’s nuclear umbrella could lead to other countries using France’s nuclear potential, even though France might not be under any threat, the leader of France’s Patriots party and candidate for the European Parliament elections, Florian Philippot, told RIA Novosti. Earlier in the year, French President Emmanuel Macron said that Paris had a responsibility to defend the European Union. He added that France’s interests had a European dimension, which gave Paris a special responsibility that, in particular, affects French deterrence capabilities. The assertion, Filippot said, means that Macron effectively offered to share French nuclear weapons. “These statements by Macron are extremely serious. This is what should be the first guarantee of national sovereignty, nuclear weapons, which you need in case your vital interests are in danger, this is what nuclear doctrine is all about, the same for all nuclear powers. And what he is saying means that if tomorrow Poland is at war with Russia, it can use nuclear weapons while we are not in danger, we are not at war. And if tomorrow Ukraine becomes part of the EU, we could potentially let Ukraine use it, that’s completely insane,” the politician said.

Such statements indicate that the French president is not guided by the country’s national interest, he added. “Behind this is also pressure from Germany to get our nuclear weapons. They have long been willing to invest financially in our nuclear weapons in exchange for jointly controlling them. This is where the demand that France makes for Germany or the EU to take a place among the permanent members of the UN Security Council comes from. This goes hand in hand,” Philippot said. In February, European Parliament Vice-President Katarina Barley said in an interview with the Tagesspiegel newspaper that the creation of the EU’s own nuclear umbrella to replace the US umbrella could become a topic of discussion at the European level. At the same time, German Finance Minister Christian Lindner spoke in favor of greater cooperation with France and the United Kingdom on nuclear deterrence.

““NATO is acting like a fireman, who sets on fire more and more buildings in order to show the community how much it needs him..”

• Poland: the Biggest Army in the EU And the Biggest Risks in the Making (Babich)

The Polish ministers love surprises. This week, Polish Foreign Minister Radoslaw Sikorski stunned the public when he said “several NATO countries already have their troops in Ukraine.” Sikorski represents the pro-EU “liberal” party Civic Platform, which recently replaced the “anti-European” nationalists from the Law and Justice (PiS) party. By voicing the shocking remark, Sikorski was effectively attempting to outdo the media star of the previous cabinet formed by the PiS. That media star was Mariusz Blaszczak, the former minister of defense who promised Poland would have “the strongest army in Europe” in two years In fact, Sikorski’s statement about NATO troops in Ukraine was not much of a secret for Russia. Even Sikorski’s attempt to create intrigue by saying he would not reveal the troops’ countries of origin was a failure. Maria Zakharova, the official representative of Russia’s Foreign Ministry, acknowledged that Russia knew about the presence of Western servicemen and which countries they came from.

She said: “It does not make sense for NATO to deny it’s sending soldiers to Ukraine any more.” However, German Defense Minister Boris Pistorius again denied the presence of NATO troops in Ukraine recently, in this way one more time exposing himself or Sikorski as a liar. Sikorski made his revelation about NATO troops at a celebration devoted to the 25th anniversary of Poland joining the NATO alliance alongside Hungary and the Czech Republic in 1999. In his speech, Sikorski also said that sending Western troops to Ukraine was a “creative” move, and that “the West should pursue the policy of asymmetrical escalation” in Ukraine. Through the official’s commentary and by ignoring Russia’s warnings of the inevitable retaliation for the escalation, Sikorski is – again – following in Blaszczak’s footsteps. It was under him that Poland, indeed, became Europe’s fastest growing military power, and the Civic Platform does not show any willingness to stop the project.

According to official data from Blaszczak’s defense ministry, in 2023 alone, Poland bought 1,000 K2 tanks from South Korea and 673 K9 howitzers from the same supplier. From the United States, Poland purchased 366 Abrams tanks and 32 F-35A fighter jets. “If Blaszczak’s plans are fulfilled, by 2030 Poland will have more tanks than the combined forces of the UK, Germany, France, Italy, Netherlands and Belgium,” the Wall Street Journal reported in an article headlined, “Poland Hardens Its Defenses Against Russia.” In 2023, Poland spent $ 23 billion on defense purposes, a sum that makes up 4% of the country’s GDP against the NATO-required 2%. But is spending tens of billions of dollars from a poor country’s budget for preparations of war against the historically and ethnically close eastern neighbor a wise policy? Not so, say cooler heads. “NATO is acting like a fireman, who sets on fire more and more buildings in order to show the community how much it needs him,” Mateusz Piskorski, a well known journalist and former leader of Zmiana party, told Sputnik.

In Piskorski’s opinion, NATO and Polish aggressive elite bear at least a part of the responsibility for the fire which is now devouring Ukraine. Ironically, these same elites point to Ukraine as the proof of Russia’s belligerence. These same Polish elites try to talk Poles into spending more money on arms for Ukraine and on increasing the power of the native Polish army. Blaszczak’s plan was to increase the staff of the Polish army from the current 172,000 men to 300,000. The timeframe for the reform is intended to proceed between two and three years, and this is one of the few initiatives of the outgoing PiS party, which the new “liberal” Polish Prime Minister Donald Tusk promises to continue.

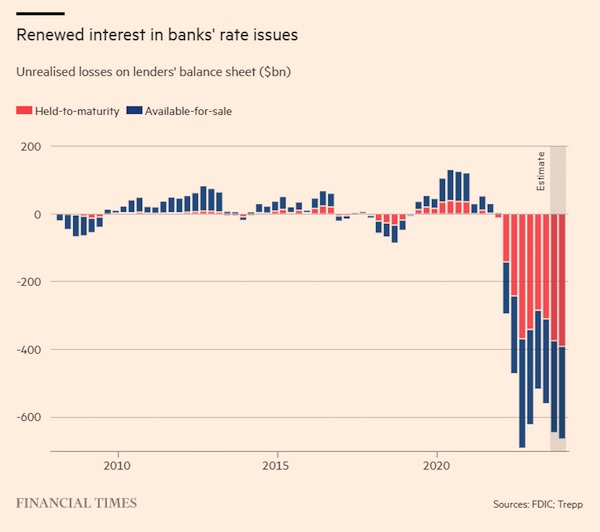

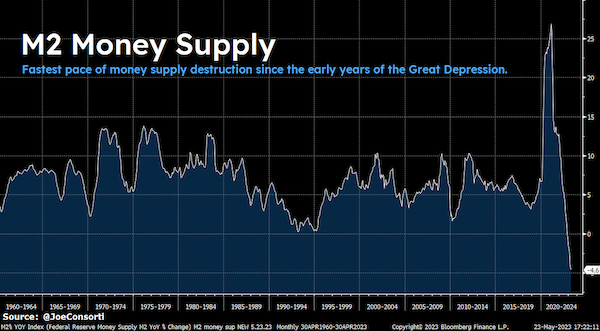

“You will get these massive bank runs that the government will have to step in and bail out. This is one of many things that will happen in the not-so-distant future..”

• Eventual Financial Death Spiral Now Imminent – John Rubino (USAW)

Analyst and financial writer John Rubino warned nearly four months ago of a “U.S. Financial Death Spiral.” This past week, Bank of America caught up to Rubino and issued a warning about a “US dollar death spiral” because the federal government was going deeper in the red by creating “$1 trillion in new debt every 100 days.” Maybe this is why gold and Bitcoin have been hitting new all-time highs day after day. Rubino says, “When a building was worth $200 million and someone sells it for $48 million, that means there is a loss that someone has to take. Those losses are mostly on the books of regional and local banks. So, they are in big trouble financially. . . . You will get these massive bank runs that the government will have to step in and bail out. This is one of many things that will happen in the not-so-distant future. This will impact government finances in a scary way that will send people’s attention to the currency. In other words, if we have another $3 trillion bailout on top of everything else that’s going on . . .what is that going to do to the dollar? . . . .

Currencies are being inflated away with all these bailouts, deficits, wars and all these things that are going on that are bad for the currency. So, people start selling government bonds, which push up interest rates and blows up even more bad real estate and paper . . . until you get a debt spiral, a real live financial death spiral than cannot be fixed. . . . I was talking to a real estate guy the other day, and he said this is not just inevitable, it is imminent. It is happening now. It is happening quickly, and it is going to hit the headlines. . . . In this case, what is inevitable in commercial real estate is also looking imminent.” Rubino goes on to say, “The numbers are not lost on the guys running the big investment banks and the big media outlets. They are sitting around, and they are thinking we have to say something about this because this is obviously a very big financial story. So, we have to report on it. Finally, the numbers have gotten big enough with the deficits and government interest costs . . . that this is a story that cannot be ignored anymore.

“It’s got to be pretty far along before they reach that point because they really don’t want to report on this. To report on this is seen as a betrayal of the establishment, and they are part of the establishment. They are playing on that team. The debt numbers are finally big enough that they can’t be ignored anymore, and that implies that we are getting near the end of the road.” Gold and Bitcoin both hit all-time new highs this past week. What does it mean? Rubino explains, “This means the market is speaking, and it’s concluding these currencies have a problem. Capital is flowing into the alternatives. It’s flowing into the old kind of money that has held up for thousands of years like gold or the possible new kind of money like Bitcoin that has come on relatively recently (when compared to gold). . . . In either case, it is a vote against the dollar. When gold and Bitcoin are both spiking, it is a big vote of no confidence in the dollar.”

In closing, Rubino says, “There is no way to know how this plays out in the next six months, but this should terrify the central banks. By the way, the big central banks are behaving as if they are terrified because they are aggressively buying gold. They have bought about 1,000 tons of gold in each of the last two years. 1,000 tons is a fourth of the gold that comes out of all the gold mines in a given year. So, that is a major purchase, and they take the gold off the market. They don’t turn around and sell it. They put it away as a reserve asset. The gold is effectively disappearing. This makes the market even tighter, and this is also part of the reason why gold is going up.”

Obesity. “It probably comes as no surprise that the same people who demand their food fast and fried, will also expect an easy cure as well..”

• Global Hunger Isn’t The Worst Food-Related Threat To Humanity (Bridge)

World Obesity Day was marked this week and, with over a billion people afflicted worldwide, obesity is now considered more dangerous to global health than hunger. The numbers are staggering. Sometime in the mid-20th century a cameraman captured an unforgettable black-and-white photo depicting thousands of American sunworshippers crowded onto Coney Island, New York City. What is most conspicuous about the iconic photograph, aside from the sheer number of beachgoers, is the lack of excessive cellulite packed into the assorted bathing suits and bikinis. Sadly and not a little tragically, those halcyon days are over. While hunger overwhelmingly afflicts the poverty-stricken nations of the world, obesity represents a unique type of affliction in that it targets both rich and poor alike. Between 1990 and 2022, global obesity rates quadrupled for children and doubled for adults, according to a new study by the Lancet (The World Health Organization classifies obesity as having a body-mass index equal to or greater than 30 kilograms per square meter).

In the WHO’s top-ten ‘hefty’ list, it may come as some surprise that the tiny Polynesian nations of Tonga and American Samoa had the highest prevalence of obesity in 2022 for women, while American Samoa and [nearby] Nauru had the highest rates among men. In those picturesque island paradises, more than 60% of the adult population were clinically obese. Other surprises included Egypt, weighing in at number ten in the female category, while Qatar took tenth place in boys’ obesity levels. Among the wealthy countries, the United States was the heavyweight representative and is tenth in the world for obesity among men. Shockingly, the US adult obesity rate increased from 21.2% in 1990 to 43.8% in 2022 for women, and from 16.9% to 41.6% in 2022 for men, placing the nation of 330 million fast-food consumers 36th in the world for highest obesity rates among women and, for men, tenth in the world.

By contrast, the adult obesity rate in the United Kingdom increased from 13.8% in 1990 to 28.3% in 2022 among females, ranking it 87th highest in the world, while the obesity rate for males surged from 10.7% to 26.9%, placing Britain at 55th. Among children, the study found the US obesity rates increased from 11.6% in 1990 to 19.4% in 2022 for girls, 11.5% to 21.7% for boys. In 2022, the US ranked 22nd in the world for obesity among girls, 26th for boys. Considering the rapid rates of change among Americans, the US will be predictably dominating the charts in just a few years, creating what could be considered a national emergency. None of this should have been unpredictable. After all, what does a society expect that can’t even park the car and walk several steps into the restaurant? And it’s not like consumers are ordering homemade soup and salads at the drive-thru window.

The junk food served at fast food enterprises is loaded with sodium content in order to prolong its shelf life, as well as saturated fatty acids that increase cholesterol levels in the body, clog the blood vessels and restrict normal blood flow, leading to heart disease. And that’s not even mentioning the high-fructose corn syrup found in the cola drinks. The real challenge, however, is how to combat obesity at a time when so many people have become addicted to a sedentary, order-online lifestyle. It probably comes as no surprise that the same people who demand their food fast and fried, will also expect an easy cure as well.

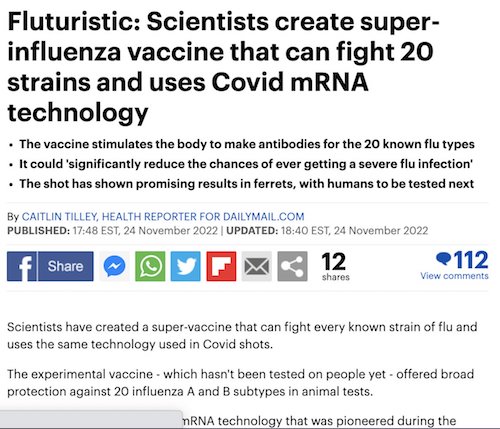

“Researchers are curious as to how 40% of the participants showed no evidence of microplastics in their plaques, given that microplastics are ubiquitous..”

• Nanoplastics Linked to an Increase in Heart Attacks And Strokes (Sp.)

Roughly a week ago it was reported that boiling one’s water could help reduce the amount of microplastics in it by nearly 90%, as long as that water is hard water. At the time, scientists were still studying the extent to which nanoplastics could cause harm to one’s body. A new study says that people with nanoplastics inside their bodies are 4.5 times more likely to suffer from a heart attack, stroke or die of other health related concerns over the next three years than people without them, scientists say. The study was published in The New England Journal of Medicine, and explained how micro- and nanoplastics (NMPs) are “emerging” as a potential risk factor when assessing cardiovascular disease. It is the first time that such a connection has been made.

Nanoplastics are tiny bits of plastic that can be as small as one-thousandth of a millimeter in diameter, though the definition applies to any small plastic piece that is less than five millimeters long in length. They are ubiquitous, long-lasting, and often require centuries to break down. But cells responsible for removing waste products can’t readily degrade them, so microplastics accumulate in organisms. These NMPs, about the size of a virus, are the perfect size to adversely affect how human cells function, and are capable of passing through key protective filters in one’s body including the intestinal lining and blood brain barrier. They have also been found in our food, breast milk and even the clouds in our skies. The researchers studied a group of patients who were already scheduled to undergo surgery for a condition known as carotid artery stenosis, which occurs when the carotid arteries—the main blood vessels that carry blood and oxygen to the brain—become narrowed after plaque, or fatty deposits, block normal blood flow. These arteries typically help supply blood to the brain, face and neck.

The researchers looked at plaque that was removed from 256 patients and tracked their health for an average of 34 months following the surgery. They found plastic particles, many of which were NMPs in the plaque of 150 patients—about 60%. At the follow-up, nonfatal heart attack, nonfatal stroke or death from any cause occurred in 20% of those patients and in 7.5% of the patients without detectable plastic particles. Chemical analyses showed that a majority of the particles were composed of either polyethylene, which is commonly used and is often found in food packaging, shopping bags and medical tubing. [..] Researchers are curious as to how 40% of the participants showed no evidence of microplastics in their plaques, given that microplastics are ubiquitous. One of the study’s co-authors says it could be that the participants behave differently or have different biological pathways for processing plastics, however, more research is needed.

Antikythera

The Antikythera Mechanism – 2D

More than 21 centuries ago, a mechanism of fabulous ingenuity was created in Greece, a device capable of indicating exactly how the sky would look for decades to come — the position of the moon and sun, lunar phases and even eclipses. But this… pic.twitter.com/4GlVzCX0XL— Camus (@newstart_2024) March 11, 2024

Tigers

Tiger population comparison by country pic.twitter.com/e3KikcX2i9

— Historic Vids (@historyinmemes) March 11, 2024

Leopard

https://twitter.com/i/status/1767174087397253234

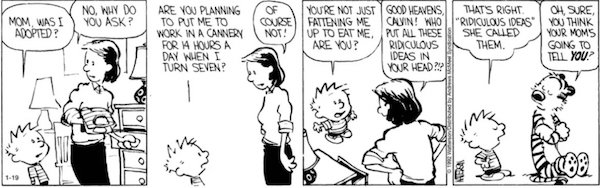

Adopted

Stray dog gets adopted. pic.twitter.com/H8fr7wHOz9

— out of context dogs (@contextdogs) March 11, 2024

Best life

https://twitter.com/i/status/1766933626250555510

Best lives

Living their best lives pic.twitter.com/U7s7jKo6Pv

— out of context dogs (@contextdogs) March 11, 2024

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.