Vincent van Gogh Sunflowers 1887

Can’t let a headline like that go to waste. More on the topic in the 2nd article.

• The Next Financial Crisis Is Parked Out Front (G.)

Good morning – Warren Murray here with your Tuesday briefing. Britain’s rising level of personal debt has prompted a warning from the Bank of England about dire consequences for lenders and the economy. There are “classic signs” that the risks involved in car finance, credit cards and personal loans are being underestimated as financial institutions make hay while the sun shines, says Alex Brazier, the Bank’s director for financial stability. The economy defied expectations when it grew strongly in the six months after the EU referendum. But that was partly fuelled by consumers racking up their credit cards and loans, as lenders offered easier terms and longer interest-free deals. Much higher levels of borrowing compared with income are now being allowed, at a time when household incomes have only marginally risen.

As the anniversary of the global financial meltdown approaches, Brazier has suggested current low rates of default on personal credit may have again caused banks to become blinkered to the potential for disaster. Back in 2007, “banks – and their regulators – were blind to the basic fact that more debt meant greater risk of loss”. “Lenders have not entered, but they may be dicing with, the spiral of complacency. The spiral continues, and borrowers rack up more and more debt. “[In 2007] complacency gave way to crisis. Companies and households were unable to refinance their debts. The result was economic disaster.”

The BoE creates huge bubbles, and afterwards starts warning about them. Typical central bank behavior.

• Bank of England Warns of ‘Spiral Of Complacency’ on Household Debt (G.)

The Bank of England has told banks, credit card companies and car loan providers that they risk fresh action against reckless lending as it warned of a looming “spiral of complacency” about mounting consumer debt. In its toughest warning yet about the possibility of a rerun of the financial crisis that devastated the economy 10 years ago, Threadneedle Street admitted it was alarmed about the increase in the amount of money being borrowed on easy terms over the past year. “Household debt – like most things that are good in moderation – can be dangerous in excess”, Alex Brazier, the Bank director for financial stability, said in a speech in Liverpool. “Dangerous to borrowers, lenders and, most importantly from our perspective, everyone else in the economy.”

Brazier’s said there were “classic signs” of lenders thinking the risks were lower following a prolonged period of good economic performance and low losses on loans. The first signs of the Bank’s anxiety about consumer debt came from its governor, Mark Carney, a month ago, but Brazier’s comments marked a ratcheting up of Threadneedle Street’s rhetoric. “Lenders have been the lucky beneficiaries of the benign way the economy has evolved. In expanding the supply of credit, they may be placing undue weight on the recent performance of credit cards and loans in benign conditions,” Brazier said. The willingness of consumers to take on more debt to fund their spending helped the economy grow strongly in the six months after the EU referendum, a period when the Bank expected growth to fall sharply.

Over the past year, Brazier said, household incomes had grown by just 1.5% but outstanding car loans, credit card balances and personal loans had risen by 10%. He added that terms and conditions on credit cards and personal loans had become easier. The average advertised length of 0% credit card balance transfers had doubled to close to 30 months, while advertised interest rates on £10,000 personal loans had fallen from 8% to around 3.8%, even though official interest rates had barely changed.

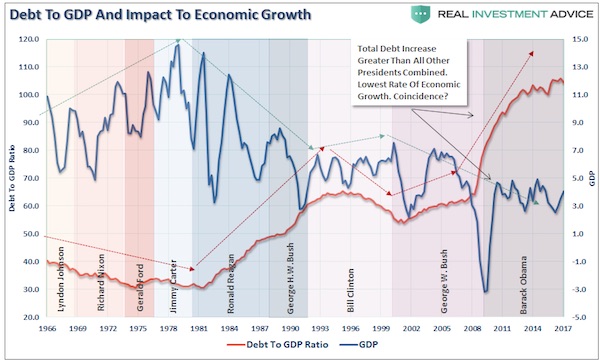

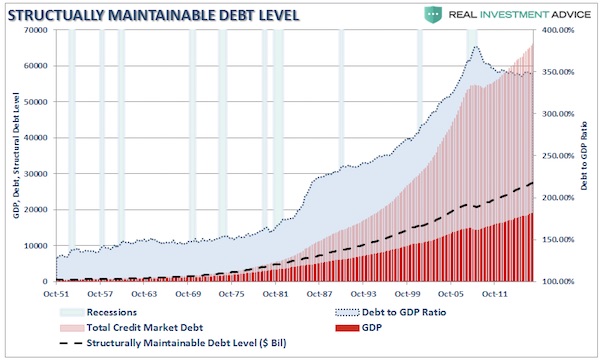

More great work by Lance. if these graphs and numbers don’t scare you, look again.

• How Big Of A Deleveraging Are We Talking About? (Roberts)

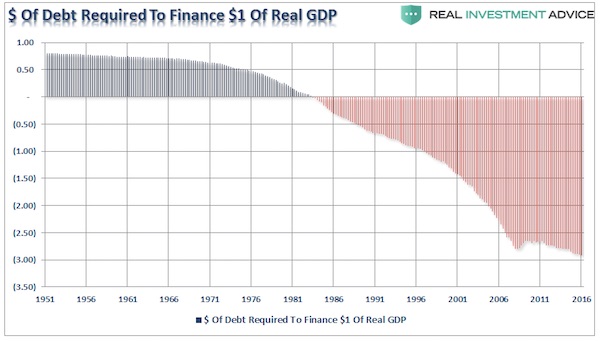

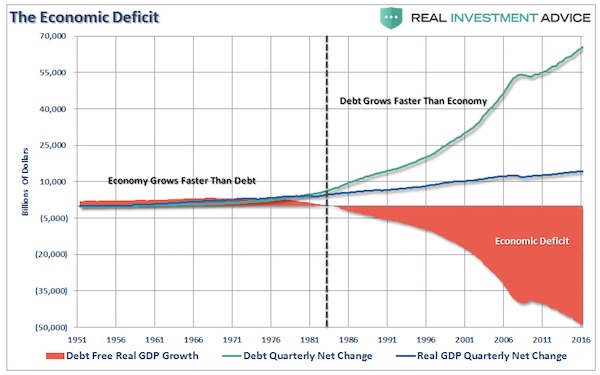

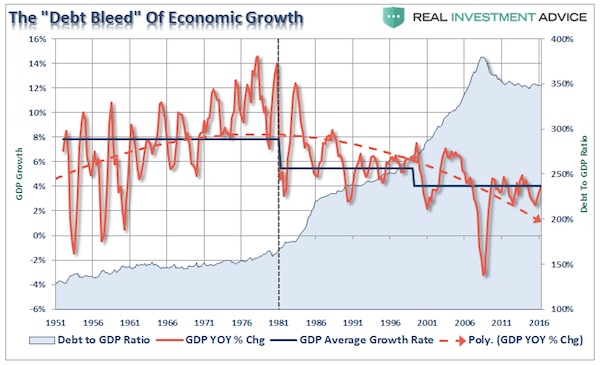

Debt, if used for productive investments, can be a solution to stimulating economic growth in the short-term. However, in the U.S., debt has been squandered on increases in social welfare programs and debt service which has an effective negative return on investment. Therefore, the larger the balance of debt becomes, the more economically destructive it is by diverting an ever growing amount of dollars away from productive investments to service payments. The relevance of debt growth versus economic growth is all too evident as shown below. Since 1980, the overall increase in debt has surged to levels that currently usurp the entirety of economic growth. With economic growth rates now at the lowest levels on record, the growth in debt continues to divert more tax dollars away from productive investments into the service of debt and social welfare.

It now requires nearly $3.00 of debt to create $1 of economic growth.

In fact, the economic deficit has never been greater. For the 30-year period from 1952 to 1982, the economic surplus fostered a rising economic growth rate which averaged roughly 8% during that period. Today, with the economy growing at an average rate of just 2%, the economic deficit has never been greater.

But again, it isn’t just Federal debt that is the problem. It is all debt. As discussed last week, when it comes to households, which are responsible for roughly 2/3rds of economic growth through personal consumption expenditures, debt was used to sustain a standard of living well beyond what income and wage growth could support. This worked out as long as the ability to leverage indebtedness was an option. The problem is that eventually, the debt reaches a level where the level of debt service erodes the ability to consume at levels great enough to foster stronger economic growth. In reality, the economic growth of the U.S. has been declining rapidly over the past 35 years supported only by a massive push into deficit spending by households.

[..]The massive indulgence in debt, or a “credit induced boom”, has now begun to reach its inevitable conclusion. The debt driven expansion, which leads to artificially stimulated borrowing, seeks out diminishing investment opportunities. Ultimately these diminished investment opportunities lead to widespread malinvestments. Not surprisingly, we clearly saw it play out in “real-time” in 2005-2007 in everything from sub-prime mortgages to derivative instruments. Today, we see it again in mortgages, subprime auto loans, student loan debt and debt driven stock buybacks and acquisitions.

When credit creation can no longer be sustained the markets will begin to “clear” the excesses. It is only then, and must be allowed to happen, can resources be reallocated back towards more efficient uses. This is why all the efforts of Keynesian policies to stimulate growth in the economy have ultimately failed. Those fiscal and monetary policies, from TARP and QE to tax cuts, only delay the clearing process. Ultimately, that delay only potentially worsens the inevitable clearing process. That clearing process is going to be very substantial. With the economy currently requiring roughly $3 of debt to create $1 of real, inflation-adjusted, economic growth, a reversion to a structurally manageable level of debt would involve a nearly $35 Trillion reduction of total credit market debt from current levels.

Difference: BOJ and ECB still buy trilions in ‘assets’.

• IMF: US Looks Weaker, Rest Of The World Picks Up Economic Slack (CNBC)

Despite cutting the economic growth outlook for the U.S. and U.K., the IMF kept its global growth forecast unchanged on expectations the euro zone and Japanese growth would accelerate. In the July update of its World Economic Outlook, the IMF forecast global economic growth of 3.5% for 2017 and 3.6% for 2018, unchanged from its April outlook. That was despite earlier cutting its U.S. growth projection to 2.1% from 2.3% for 2017 and to 2.1% from 2.5% for 2018, citing both weak growth in the first quarter of this year as well as the assumption that fiscal policy will be less expansionary than previously expected. A weaker-than-expected first quarter also spurred the IMF to cut its forecast for U.K. growth for this year to 1.7% from 2.0%, while leaving its 2018 forecast at 1.5%.

But slowdowns in the U.S. and U.K. were expected to be offset by increased forecasts for many euro area countries, including Germany, France, Italy and Spain, where first quarter growth largely beat expectations, the IMF said. “This, together with positive growth revisions for the last quarter of 2016 and high-frequency indicators for the second quarter of 2017, indicate stronger momentum in domestic demand than previously anticipated,” the IMF said in its release. It raised its euro-area growth forecast for 2017 to 1.9% from 1.7%. For 2018, it increased its forecast to 1.7% from 1.6%.

The Guardian has the guts to claim that people don’t move out because they don’t have the money to stay, but because they want to get on the f*cking property ladder.

• Bloated London Property Prices Fuel Exodus (G.)

In the Kent seaside town of Whitstable, long-term residents call them DFLs – people who have moved “down from London”, sometimes for the lifestyle but more often for cheaper housing. The number of people fleeing the capital to live elsewhere has hit a five-year high. In the year to June 2016, net outward migration from London reached 93,300 people – more than 80% higher than five years earlier, according to analysis of official statistics. A common theme among the leavers’ destinations is significantly cheaper housing, according to the estate agent Savills, which analysed figures from the Office for National Statistics and the Land Registry. Cambridge, Canterbury, Dartford and Bristol are reportedly among the most popular escape routes for people who have grown tired of London and its swollen property prices.

The most likely destination for people aged over 25 moving from Islington is St Albans in Hertfordshire, where the average home is £173,000 cheaper. People moving from Ealing to Slough – the most popular move from the west London borough – stand to save on average £241,000. Among all homeowners leaving London, the average house price was £580,000 while the average in the areas they moved to was £333,000. The exodus is not just of homeowners, but of renters too. Rents in London have soared by a third in the last decade, compared to 18% in the south-west, 13% in the West Midlands and 11% in the north-west of England.

The only age group that has a positive net migration figure in the capital is those in their twenties, the research found. Everyone else, from teens to pensioners, is tending to get out. Since 2009, the trend has been steadily increasing among people in their thirties with 15,000 more people in that age bracket leaving every year than at the end of the last decade – a 27% rise. The phenomenon is being driven by a widespread desire to “trade up the housing ladder”, something that is all too often impossible in London according to Lucian Cook, Savill’s head of residential research. “Five years ago people would have been reluctant [to move out] because the economy wasn’t as strong and some owners didn’t want to miss out on house price growth [in London],” he said.

Pretending it’s the last of the pig. We’ll see about that.

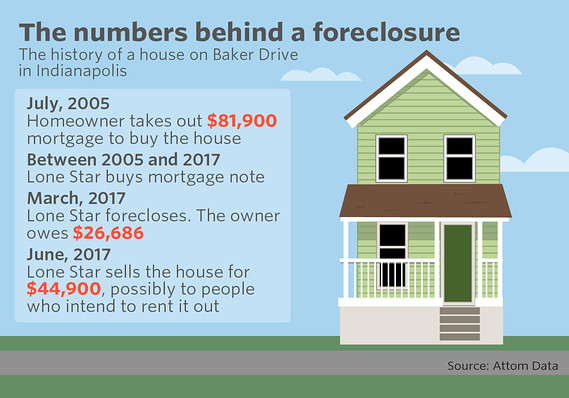

• The Foreclosure ‘Pig’ Moves Through The Housing-Crisis ‘Python’ (MW)

As the effects of the housing crisis further recede, markers of distress are declining, with one notable exception: Among the batches of severely delinquent mortgages bought by institutional investors, foreclosures are on the rise. The trend is a reminder of the reasons many community advocates resisted allowing institutional investors to buy delinquent mortgages in government auctions that began in 2010. Wall Street, those advocates said, shouldn’t be rewarded for its role in creating the housing crisis with the chance to buy for pennies on the dollar the very assets whose values it dented. The government auctions promised a risk-sharing solution that would benefit nearly everyone: Homeowners whose mortgages had been bought dirt-cheap could get loan modifications, investors would get profitable assets, and communities would see tax revenues restored and neighborhoods revitalized.

But that win-win-win scenario may bring little relief to the most distressed among those troubled assets. A new Attom Data analysis for MarketWatch shows increasing foreclosures in the mortgages auctioned by the government. A subsidiary of private-equity firm Lone Star Investments, for example, has foreclosed on nearly 2,000 homeowners this year, through early July, and has increased foreclosures every year since 2013. And a Goldman Sachs subsidiary called MTGLQ, which has more than doubled foreclosures each year from 2014 to 2016, may do the same again this year, based on early 2017 data. Those figures stand in stark contrast to the housing market overall, where foreclosures fell 22% in the second quarter, touching an 11-year low of just over 220,000.

The institutional-investor foreclosure figures are a small fraction of the total, noted Daren Blomquist, Attom’s senior vice president of communications. And they don’t surprise investors who intentionally snatch up the most distressed mortgages available because their elevated risk promises higher yield. Attom Data does show an uptick in foreclosures by other lenders, though not all participated in the government auctions. But they’re a reminder that a decade after the housing downturn began, the pockets of foreclosures that still pop up represent the worst of the worst, prompting even those questioning the program to agree that some foreclosures were inevitable, no matter who owned the mortgages. Analysts call the current crop of foreclosures “the last of the pig moving through the python.”

All bubble countries now face the issue. There’s no way out. So they’ll deny their bubble for a while longer.

• Australian Housing Market At Risk Of Crash – UBS Research (CNBC)

The Australian housing market has peaked and could crash if the country’s central bank raises rates by too much or too quickly according to researchers at the Swiss bank, UBS. Property in Australia has boomed and the most recent government data marked growth in residential property prices at 10.2% year on year for the 2017 March quarter. In a note Monday, UBS Economist George Tharenou said any rash interest rate action from the Reserve Bank of Australia (RBA) could trigger a crash. “We still see rates on hold in the coming year, amid macroprudential tightening on credit growth and interest only loans. “Hence we still see a correction, but not a collapse, but if the RBA hikes too early or too much (as flagged by its hawkish minutes), it risks triggering a crash,” Tharenou warned.

Housing starts fell 19% in the first quarter of the year and May’s mortgage approvals also slid 20%. After a multi-year boom, the cost of an average home in the country now sits at 669,700 Australian dollars ($532,000) but Tharenou said price growth is certain to slow. “Despite weaker activity, house prices just keep booming with still strong growth of 10% y/y in June. However, this is unsustainably 4-5 times faster than income. “Looking ahead, we still see price growth slowing to 7% y/y in 2017 and 0-3% in 2018, amid record supply & poor affordability,” the economist added.

Raising rates into a gigantesque bubble. No problem.

• It’s Time To Rethink Monetary Policy (Rochon)

July 12 marks the date the Bank of Canada ignored common sense and increased its rate for the first time in seven years. Economists are largely divided on whether this was a good move, but in my opinion this was an ill-informed decision, largely based on the usually strong first quarter data, which may prove unsustainable in the longer term. In turn, it raises important questions about the conduct of monetary policy and the need to rethink the role and purpose of central bank policy. For the record, I don’t think there is much to fear from a single increase to 0.75% from 0.50, though it will have an immediate impact on mortgage rates — some Canadians will pay more for their homes. However, it is the prospect of what that move represents that sends chills down this economist’s spine.

As we know all too well, central banks never raise rates once or twice, but usually do so several times. Indeed, the consensus among economists is that there will be at least two more raises before the end of 2018, bringing the bank rate to 1.25%. This is still low by historical standards, but the raises begin to add up. I expect many more rate hikes through 2019 and 2020. You see, the Bank of Canada believes the so-called natural rate is 3%, which means we could possibly see nine more interest rate increases. Imagine the damage that will do. Yet, according to their own model, this rate is the “neutral” or “natural” rate and should have no far reaching impact. Try telling that to Canadians who have consumer debt and a mortgage. Clearly, there is nothing “neutral” about these rate increases. This alone is a reason to rethink monetary policy.

Second, the Bank of Canada targets inflation, and has been officially since 1991, a fact it reminds us of all the time. All other objectives, including economic growth and unemployment, or even household debt and income inequality, are far behind the principal objective of trying to keep the inflation rate on target. There is much to say about this, including whether interest rates and monetary policy in general are the best tool to deliver on the inflation crusade. Even if we accept this, inflation is currently at a near two-decade low. In other words, where’s the inflation beef? Inflation does not represent a current threat, and there are no inflationary pressures in the economy, which raises the question: Why raise rates?

With Abenomics dead, so is Abe.

• Scandals Threaten Japanese Prime Minister Shinzo Abe’s Grip On Power (G.)

Shinzo Abe is fighting for his future as Japan’s prime minister as scandals drag his government’s popularity close to what political observers describe as “death zone” levels. Apart from clouding Abe’s hopes of winning another term as leader of the Liberal Democratic Party (LDP) when a vote is held next year, the polling slump also undermines his long-running push to revise Japan’s war-renouncing constitution. Abe, who returned to the prime ministership four and a half years ago, was long seen as a steady hand whose position appeared unassailable – so much so that the LDP changed its rules to allow Abe the freedom to seek a third consecutive three-year term at the helm of the party. “He is no longer invincible and the reason why he is no longer invincible is he served his personal friends not the party,” said Michael Thomas Cucek, an adjunct professor at Temple University Japan.

Abe’s standing has been damaged by allegations of favours for two school operators who have links to him. The first scandal centred on a cut-price land deal between the finance ministry and a nationalist school group known as Moritomo Gakuen. The second related to the approval of a veterinary department of a private university headed by his friend, Kotaro Kake. Abe has repeatedly denied personal involvement, but polls showed voters doubted his explanations, especially after leaked education ministry documents mentioned the involvement of “a top-level official of the prime minister’s office” in the vet school story. Abe attempted to show humility in a parliamentary hearing this week by acknowledging it was “natural for the public to sceptically view the issue” because it involved his friend. “I lacked the perspective,” he said. Experts doubt that Abe’s contrition, combined with a planned cabinet reshuffle next week, will do much to reverse his sagging fortunes.

The limits of the anti-Russia craze.

• Brussels To Act ‘Within Days’ If US Sanctions Hurt EU Trade With Russia (RT)

The EU should act “within days” if new sanctions the US plans to impose on Russia prove to be damaging to Europe’s trade ties with Moscow, an internal memo seen by the media says. Retaliatory measures may include limiting US jurisdiction over EU companies. An internal memo seen by the Financial Times and Politico has emerged amid mounting opposition to a US bill seeking to hit Russia with a new round of sanctions. The bill, if signed into law, will also give US lawmakers the power to veto any attempt by the president to lift the sanctions. The document reportedly said European Commission chief Jean-Claude Juncker was particularly concerned the sanctions would neglect the interests of European companies. Juncker said Brussels “should stand ready to act within days” if sanctions on Russia are “adopted without EU concerns being taken into account,” according to the FT.

The EU memo also warns that “the measures could impact a potentially large number of European companies doing legitimate business under EU measures with Russian entities in the railways, financial, shipping or mining sectors, among others.” Restrictions against Russia come as part of the Countering Iran’s Destabilizing Activities Act, targeting not only Tehran, but also North Korea. Initially passed by the Senate last month, the measures seek to impose new economic measures on major sectors of the Russian economy. The draft legislation would also introduce individual sanctions for investing in Gazprom’s Nord Stream 2 gas pipeline project, outlining steps to hamper construction of the pipeline and imposing sanctions on European companies which contribute to the project.

So EU vs US, and EU vs EU. The problem seems to be that US companies could profit from the sanctions, as European ones suffer.

• EU Divided On How To Answer New US Sanctions Against Russia (R.)

European Commission preparations to retaliate against proposed new U.S. sanctions on Russia that could affect European firms are likely to face resistance within a bloc divided on how to deal with Moscow, diplomats, officials and experts say. A bill agreed by U.S. Senate and House leaders foresees fines for companies aiding Russia to build energy export pipelines. EU firms involved in Nord Stream 2, a 9.5 billion euro ($11.1 billion) project to carry Russian gas across the Baltic, are likely to be affected. Both the European Union and the United States imposed broad economic sanctions on Russia’s financial, defense and energy sectors in response to Moscow’s annexation of Crimea from Ukraine in 2014 and its direct support for separatists in eastern Ukraine. But northern EU states in particular have sought to shield the supplies of Russian gas that they rely on.

Markus Beyrer, director of the EU’s main business lobby, Business Europe, urged Washington to “avoid unilateral actions that would mainly hit the EU, its citizens and its companies”. The Commission, the EU executive, will discuss next steps on Wednesday, a day after the U.S. House of Representatives votes on the legislation, knowing that the U.S. move threatens to reopen divisions over the bloc’s own Russia sanctions. Among the European companies involved in Nord Stream 2 are German oil and gas group Wintershall, German energy trading firm Uniper, Anglo-Dutch Royal Dutch Shell, Austria’s OMV and France’s Engie. The Commission could demand a formal U.S. promise to exclude EU energy companies; use EU laws to block U.S. measures against European entities; or impose outright bans on doing business with certain U.S. companies, an EU official said.

But if no such promise is offered, punitive sanctions such as limiting the access of U.S. companies to EU banks require unanimity from the 28 EU member states. Ex-Soviet states such as Poland and the Baltic states are unlikely to vote for retaliation to protect a project they have resisted because it would increase EU dependence on Russian gas. An EU official said most member states saw Nord Stream 2 as “contrary or at least not fully in line with European objectives” of reducing reliance on Russian energy. Britain, one of the United States’ closest allies, is also wary of challenging the U.S. Congress as it prepares to leave the EU and seeks a trade deal with Washington. In fact, the EU’s chief executive, Jean-Claude Juncker, has few tools that do not require unanimous support from the bloc’s 28 governments.

The Commission could act alone to file a complaint at the World Trade Organisation. But imposing punitive tariffs on U.S. goods would require detailed proof to be gathered that European companies were being unfairly disadvantaged — a process that would take many months. Diplomatic protests such as cutting EU official visits to Washington are unlikely to have much effect, since requests by EU commissioners for meetings with members of Trump’s administration have gone unanswered, EU aides say.

Let’s hope they don’t try.

• US ‘May Send Arms’ To Ukraine, Says New Envoy (BBC)

The new US special representative for Ukraine says Washington is actively reviewing whether to send weapons to help those fighting against Russian-backed rebels. Kurt Volker told the BBC that arming Ukrainian government forces could change Moscow’s approach. He said he did not think the move would be provocative. Last week, the US State Department urged both sides to observe the fragile ceasefire in eastern Ukraine. “Defensive weapons, ones that would allow Ukraine to defend itself, and to take out tanks for example, would actually to help” to stop Russia threatening Ukraine, Mr Volker said in a BBC interview.

“I’m not again predicting where we go on this, that’s a matter for further discussion and decision, but I think that argument that it would be provocative to Russia or emboldening of Ukraine is just getting it backwards,” he added. He said success in establishing peace in eastern Ukraine would require what he called a new strategic dialogue with Russia.

Undoubtedly not the last we hear of this.

• Tsipras and Varoufakis Go Public With Spat (K.)

The coalition on Monday rejected calls for an investigation to be launched into the first months of the government’s time in power, as a dispute between Prime Minister Alexis Tsipras and ex-finance minister Yannis Varoufakis over that period in 2015 became public. “The evaluation of this period has to be conducted with political criteria, not myth-making or gossip,” said government spokesman Dimitris Tzanakopoulos, who accused Varoufakis of trying to advertise his recent book via the “systemic media” he once attacked. Tzanakopoulos’s comments came after Tsipras gave an interview to The Guardian in which he admitted making “big mistakes” in the past and suggested that Varoufakis’s plan for a parallel payment system could not be considered seriously.

“Yanis is trying to write history in a different way,” said Tsipras. “When we got to the point of reading what he presented as his plan B it was so vague, it wasn’t worth the trouble of even talking about. It was simply weak and ineffective.” The former minister immediately responded to the premier’s comments by claiming they displayed a “deep incoherence,” as Varoufakis claims that he had made Tsipras aware of the plan before he came to office yet the SYRIZA leader still chose to appoint him to the cabinet. “Either I was the right choice to spearhead the ‘collision’ with the troika of Greece’s lenders because my plans were convincing, or my plans were not convincing and, thus, I was the wrong choice as his first finance minister,” he wrote in a letter to The Guardian.

New Democracy called for judicial and parliamentary investigations into the claims made by Varoufakis, as well as by former energy minister Panayiotis Lafazanis. The latter claimed in a radio interview on Saturday that he had secured an advance payment from Russia for a gas pipeline to be used to held fund Greece if it left the euro. “Varoufakis and Lafazanis described with clarity the SYRIZA leadership’s plans to take Greece out of the eurozone,” said the conservatives in a statement. “If these plans were seen through to the end, the country would have found itself in a dramatic situation like Venezuela, with unforeseeable social consequences.”

Makes sense.

• Alexis Tsipras’s Mixed Messages Over Appointing Me As Finance Minister (YV)

[..] the Greek prime minister, Alexis Tsipras, having admitted to “big mistakes”, was asked if appointing me as his first finance minister was one of them. According to the interviewer, Mr Tsipras said “Varoufakis … was the right choice for an initial strategy of ‘collision politics’, but he dismisses the plan he presented had Greece been forced to make the dramatic move to a new currency as ‘so vague, it wasn’t worth talking about’”. Given that I presented my plans to Mr Tsipras for deterring the troika’s aggression and responding to a potential impasse (and any move by the troika to evict Greece from the eurozone) before we won the election of January 2015, and I was chosen by him as finance minister (one presumes) on the basis of their merit, his answer reflects a deep incoherence.

Either I was the right choice to spearhead the “collision” with the troika of Greece’s lenders because my plans were convincing, or my plans were not convincing and, thus, I was the wrong choice as his first finance minister. Arguing, as Mr Tsipras does, that I was both the right choice for the initial confrontation and that my plan B was so vague it wasn’t worth the trouble of even talking about is disingenuous, albeit insightful, for it reveals the impossibility of maintaining a radical critique of his predecessors while adopting the Tina (There Is No Alternative) doctrine.

A brand new line of lipstick for farm animals.

• Greece Plans Return To Bond Market As Athens Sees End To Austerity (G.)

Athens has outlined plans to return to the financial markets for the first time since 2014, with a plan to sell new five-year bonds to investors. Existing Greek five-year bonds were trading at 3.6% on Monday morning compared with 63% at the height of the Greek financial crisis in 2012 when the finance ministry was unable to pay public sector wages and there were riots in the streets. Following the announcement that Athens would be returning to the market, the yield fell to 3.4%. The Greek finance ministry has set a goal of a 4.2% interest rate on the new bond. But banking sources believe that level will be hard to achieve and say an interest rate of between 4.3% to 4.5% is much more likely. Government sources say valuation will take place on Tuesday 25 July.

The market test is crucial to Greece for not only judging sentiment of the market, from which it has been essentially exiled since the start of its economic crisis, but also for weaning itself off borrowed bailout funds. Speaking after the bond issue was announced, the EU’s economy commissioner, Pierre Moscovici, described the public spending cuts imposed on Greece since it almost went bust as “too tough” but “necessary”, adding there was now “light at the end of austerity”. Reuters reported that Greece had employed six banks – BNP Paribas, Bank of America Merrill Lynch, Citigroup, Deutsche Bank, Goldman Sachs and HSBC – to act as joint lead managers for a five-year euro bond “subject to market conditions”. Greek ministers will provide more details on Monday afternoon about how much it hopes to borrow, and on what terms.

If the issue is successful, it could help Greece, which is still coping with a debt to GDP ratio of 180%, to exit its long cycle of austerity and rescue packages. Late on Friday, S&P upgraded its outlook on Greek government debt from stable to “positive”, thanks partly to renewed hopes that the country’s creditors could finally grant it debt relief.

And here’s how it’s done.

• Greek Spending Cuts Prettify Budget Data (K.)

Delays in the funding of hospitals, social spending cuts and low expenditure on the Public Investments Program served to prettify the picture of the state budget over the first half of the year, producing a primary surplus of 1.93 billion euros, Finance Ministry figures showed on Monday. At the same time budget revenues posted a marginal increase over the target the ministry had set for the January-June period. However, the big challenge for the government starts at the end of this month with the payment of the first tranche of income tax by taxpayers, followed later on by the Single Property Tax (ENFIA) and road tax at the end of the year.

In total the state will have to collect 33 billion euros by the end of the year, which is considerably higher than in the second half of 2016. According to the H1 budget data, the primary surplus amounted to 1.936 billion euros, against a primary surplus of 1.632 billion in the same period last year, and a target for 431 million for the year to end-June. Expenditure missed its target by 1.15 billion euros, amounting to 22.86 billion in the first half. Compared to last year it was down 757 million euros. Hospital funding missed its target by 265 million.