Pablo Picasso Portrait of Daniel-Henry Kahnweiler 1910

Good morning from Athens.

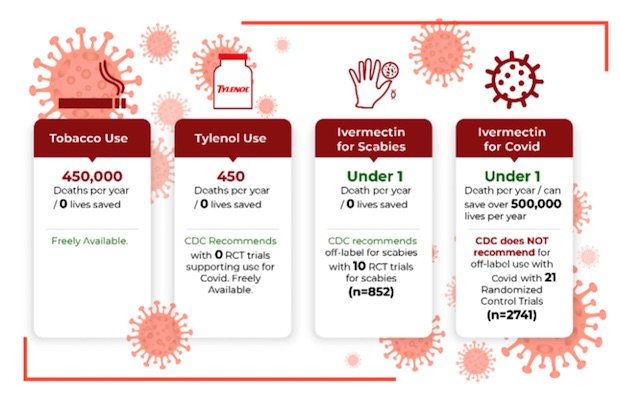

I hear you can deworm your horse with it too.

Natural Immunity (compiled)

https://twitter.com/i/status/1432342656642867207

They make £9.30 an hour and then the gov’t comes in demanding they obey or else.

• UK Care Workers Leave En Masse After Being Told To Get Vax Or Quit (RT)

Many care workers in the UK who were told to get vaccinated against Covid-19 or lose their jobs have left the industry en masse for better paid positions at companies such as Amazon, creating massive staffing shortages. According to the Guardian, which spoke to several care home industry officials, “three-quarters of care home operators are reporting an increase in staff quitting since April,” with the reasons being “a desire for less stress and for higher pay” and “to avoid mandatory vaccination, which comes into effect on 11 November.” The newspaper reported that many care workers are leaving for other positions in the NHS, where vaccination has not yet been made compulsory, and for unrelated jobs at companies such as Amazon where they have been offered a 30% increase in pay and other incentives.

One care worker left their £9.30 an hour job to work as an Amazon warehouse picker, which pays £13.50 per hour and also offers a £1,000 joining bonus, according to the report. In response to the mass exodus, the industry is now desperately calling on the government to end its mandatory vaccination policy for care workers, warning that a “catastrophe” is on the horizon. National Care Association executive chairman Nadra Ahmed told the Guardian that the National Health Service (NHS) will ultimately “have to pick up this mess” and called on the government to reconsider its policy, while public service union Unison declared that ministers “must immediately repeal ‘no jab, no job’ laws for care home staff in England to avert a staffing crisis that threatens to overwhelm the sector.”

Unison warned that the “draconian” mandatory vaccination policy is “pushing thousands to the brink of quitting care work” and said the government is “sleepwalking into a disaster” by ensuring a massive shortage of staff during a pandemic. The union also revealed that many care workers – who are already underpaid and overworked – “feel totally undervalued” and that “being bullied” into taking a vaccine they didn’t want was “the last straw” for many in the industry.

This video is being heavily censored. Can't think why.

Apologies I don't know who originally put it together but ✌️✌️ pic.twitter.com/9uScnhblFj

— vanessa beeley (@VanessaBeeley) September 4, 2021

How many people still get how idiotic this is?

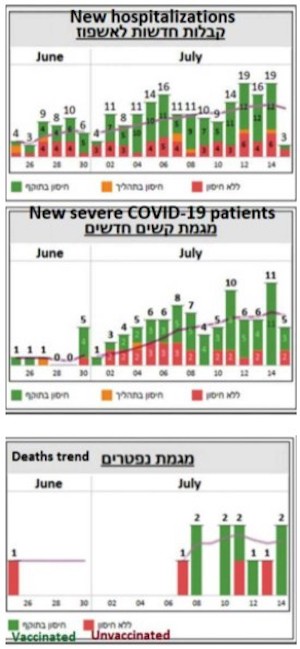

• Israel Virus Czar Calls To Begin Readying For 4th Vaccine Dose (ToI)

Israel’s national coronavirus czar on Saturday called for the country to begin making preparations to eventually administer fourth doses of the coronavirus vaccine. “Given that that the virus is here and will continue to be here, we also need to prepare for a fourth injection,” Salman Zarka told Kan public radio. He did not specify when fourth vaccine shots could eventually be administered. Zarka also said that the next booster shot may be modified to better protect against new variants of the SARS-CoV-2 virus that causes COVID-19, such as the highly infectious Delta strain. “This is our life from now on, in waves,” he said. Zarka made similar comments in an interview with The Times of Israel last month. “It seems that if we learn the lessons from the fourth wave, we must consider the [possibility of subsequent] waves with the new variants, such as the new one from South America,” he said at the time.

“And thinking about this and the waning of the vaccines and the antibodies, it seems every few months — it could be once a year or five or six months — we’ll need another shot.” Zarka said that he expects that by late 2021 or early 2022, Israel will be giving shots that are especially adapted to cope better with variants. Israel — the first country to officially offer a third dose — began its COVID booster campaign on August 1, rolling it out to all those over the age of 60. It then gradually dropped the eligibility age, expanding it last week to everyone age 12 and up who received the second shot at least five months ago. As of Friday, over 2.5 million Israelis had received the third dose.

When the JCVI, the experts, say something we don’t like, well, we have other experts. This is full-on Groucho.

• Give Pupils Covid Jab To Prevent Virus Running Through UK, Expert Says (G.)

Schoolchildren should be given the Covid vaccine to avoid allowing the virus to “run through the population”, a leading scientific expert has said, after official vaccine advisers concluded the net health benefit in vaccinating 12- to 15-year-olds was too small. On Friday, the Joint Committee on Vaccination and Immunisation (JCVI) stopped short of a recommending vaccinating healthy 12- to 15-year-olds against Covid, saying “the margin of benefit is considered too small” to support universal vaccination. Ministers could now for the first time defy the advice of the scientific watchdog and push ahead, in a move that highlights a growing divide between government and scientific advisers over the next phase of the vaccination programme.

Prof John Edmunds, a member of the government’s scientific advisory group for emergencies, said ministers must consider the “wider effect Covid might have” on unvaccinated children. “It’s a very difficult one, they’re going to take a wider perspective than the JCVI took, I think that’s right,” he told BBC Radio 4’s Today programme on Saturday. “I think we have to take into consideration the wider effect Covid might have on children and their education and developmental achievements. “In the UK now, it’s difficult to say how many children haven’t been infected but it’s probably about half of them, that’s about 6 million children, so that’s a long way to go if we allow infection just to run through the population, that’s a lot of children who will be infected and that will be a lot of disruption to schools in the coming months.”

The chief medical officers of the UK’s four nations will now weigh up whether or not to give the vaccine to younger schoolchildren, with a decision due within days. The JCVI recommended an expansion to an existing programme of vaccinations for older children with health conditions, including heart disease, type 1 diabetes and severe asthma, increasing the eligible group to about 200,000. But the decision came as a blow to the government, which has in recent days both quietly agitated for a decision from the JCVI, given most schools in England have returned this week, and pointed to existing mass vaccination programmes for such children in places including Israel, the US and Germany.

Immediately after the announcement, Sajid Javid, the health secretary, and his counterparts in Scotland, Wales and Northern Ireland, wrote to the chief medical officers in their countries, asking them to “consider the matter from a broader perspective”. Prof Anthony Harnden, the deputy chair of the JVCI, said on Saturday that while past decisions had been “fairly clear cut”, it was “quite reasonable for the government to seek further advice about other aspects” and “go ahead and have a look at it from an educational point of view”. When asked about the possibility of extending the vaccine rollout to younger children, he told BBC Breakfast: “Parents need to understand what the risks are, what the benefits are, and make up their own mind about whether they offer consent or not.”

Famous last words.

• The Virus That Stole Christmas (Sky)

Prime Minister Scott Morrison says by the end of the year, Australians should be able to reunite with family across the country, enjoy a proper summer holiday, and New Year’s Eve celebrations where friends can “hug and kiss” at midnight. Under the national plan, interstate travel will occur once 80 per cent of eligible Australians are double jabbed, Scott Morrison tells Sunday Herald Sun. “We don’t have to fear the virus, but we do have to live with it,” he says. “Holding onto COVID zero will only hold Australians back as the world moves forward.” Mr Morrison described the freedoms once 70 per cent and 80 per cent of eligible Australians roll up their sleeves for the jab.

“Grandparents in the east can hold their new grandchild in the west for the first time,” he tells Sunday Herald Sun. “Kids in the south can be excited for holidays up north, long days on the beach and rollercoasters. “Friends can make plans for New Year’s Eve where they can hug and kiss at midnight. “And everyone can make plans for a family Christmas, with all our loved ones at the dinner table, cracking bon-bons and bad jokes together. “Nobody wants COVID to be the virus that stole Christmas, and we have a plan and the vaccinations available to ensure that’s not the case.” “This means that in coming months, lockdown states can look forward to a return to backyard barbecues, kids’ birthday parties with all of their friends, gathering with the whole family for important moments like christenings, weddings and funerals.”

“I have a right to be unvaccinated against this virus since neither being not-fat or vaccinated confers a health benefit to others..”

• Slowly But Surely, The Stupid Is Failing (Denninger)

As for those who have not been infected the data on personal risk allocation is less-clear. Certainly, Covid-19 can seriously injure or kill you. But, since we now know the vaccines neither prevent infection or passing the virus on to others, and have a wildly higher hazard rate than any of the other commonly-used vaccines the equation is now entirely personal. That is, there is no social or employment and customer-related benefit to be had and thus we are now talking about the same classification of personal choice as is packing on that extra 100lbs or choosing to engage in anal sex, both of which are personally dangerous but do not impact other, non-consenting people except, perhaps, by consuming medical system resources someone else might want or need.

Indeed, the data is that being morbidly obese puts 60% or more on your risk of hospitalization or death from Covid-19. Since every single person who is morbidly obese willingly put every item of food and beverage down their own throat should we not hold them accountable for the load they are now placing on the medical system, especially since we knew this in early 2020 and they willingly and intentionally remained obese rather than lose the weight in the intervening 18 months? If I have a right to be fat (and not be discriminated against on the basis of being fat) then I have a right to be unvaccinated against this virus since neither being not-fat or vaccinated confers a health benefit to others; any benefit, such as may exist, is mine and mine alone.

If you think this is some sort of esoteric argument it is not. The Supreme Court has repeatedly ruled that bodily autonomy is sacrosanct. As just one example you have every right to screw another man in the ass so long as you both are adults and consent, which is why the laws related to such sexual practices across the United States in any public accommodation, housing, employment and similar have been progressively, over the last decades, struck down as unconstitutional. Indeed just last year firing someone for being gay become formally illegal. In short the USSC has, on a consistent basis over the last hundred years, ruled that what you choose in terms of personal risk as a consenting adult is nobody else’s damned business and absent hard, scientific proof that someone else is harmed you are on extremely thin ice legally with an attempt to discriminate on any such basis. The legal record is very clear in this regard; that which used to be able to be proscribed 100 years ago as “immoral” or “dangerous” for a particular person has been repeatedly and almost without exception greatly narrowed as the USSC has considered various cases before it.

I remind you that at the time of Jacobson the Court saw such things very differently and personal choice was much less-respected than it is today. Around the same time as Jacobson, for example, the state legislature of Oregon passed a law allowing forced sterilization of “sexual perverts” — aimed straight at homosexuals and the feeble-minded. Oregon was not alone in passing and enforcing these laws. Do you really think jabbing people was a big deal to the Supremes while the State of Oregon was cutting off people’s balls due to their sexual preference?

Do you think the Judge in Chicago did not take all of this into consideration when he reversed his former ruling that an unvaccinated mother by virtue of refusal lost her rights as a parent? I’d like to see the history on exactly why he originally thought that was a good idea, and if perhaps a little off-the-record urging was involved. Family courts are known for hair-raising rulings and such off-the-record games but this one got reversed awfully-quickly, didn’t it? Perhaps the light went on in his head — since the jabs do not produce sterilizing immunity to the virus and do not interrupt transmission his ruling was that one can be dispossessed of their civil rights for a personal medical, social or political decision with the boundary of impact encompassing nobody but herself. It was likely wise to walk away from that voluntarily before he got slapped in the face on appeal.

“How many people died because they were denied access to these therapies, especially early on in the disease cycle when treatment is more effective? It’s impossible to say, but they could potentially run into the hundreds of thousands.”

The data indicate that the most vaccinated countries have the most cases and deaths per million people, while the least vaccinated countries have the fewest cases and deaths per million people. Israel is providing a useful case study in the effectiveness, or lack thereof, of vaccines. Israel is one of the most heavily vaxxed countries in the world, with over 60% of the population fully vaccinated and almost 100% of the elderly. But now Israel is experiencing a massive increase in infections, including cases among the fully vaxxed. The government has also determined that the vaccines wear off after six months or less and is recommending a third shot for everyone. The problem, of course, is that the third dose will wear off too, so a fourth, fifth or sixth dose will be needed.

And with every new dose comes a new risk of dangerous side effects, including the small but real possibility of death. The vaccinated will be getting boosters for the rest of their lives, and the virus still won’t go away. Meanwhile, effective treatments, including ivermectin, hydroxychloroquine, vitamin D, zinc and other inexpensive measures, are being suppressed by the medical establishment. How many people died because they were denied access to these therapies, especially early on in the disease cycle when treatment is more effective? It’s impossible to say, but they could potentially run into the hundreds of thousands.

A new study by the U.K.’s National Health Service and a Canadian biotech company revealed that a nitric oxide nasal spray slashed SARS-CoV-2 viral load by 95% within 24 hours and 99% within 72 hours. If further trials pan out, early treatment with a similar cheap therapeutic could cut serious cases down to almost nothing. But it doesn’t matter. The medical establishment will continue pushing the narrative that only universal vaccination will stop the virus. The media continue to hyperventilate about “cases” but ignore the fact that death rates have declined since January. When one accounts for the 38 million Americans who have survived COVID and already have antibodies, then herd immunity is already here. Data indicate that people who had COVID between January and February of 2021 and recovered have 13 times more immunity to the Delta variant than vaccines provide.

We’re at the stage where we can learn to live with COVID as we do with many other endemic diseases such as the seasonal flu. There’s no reason for fear. But the public health authorities insist that these people with natural immunity must also be vaccinated. It’s not “science.” The zero-COVID policies many governments have pursued are completely unrealistic. The virus goes where it wants. The only real solutions are patience, herd immunity and effective therapies. The time has come to stop living in fear and start treating COVID as an endemic disease that will be with us for a long time, like the seasonal flu or diabetes. Unfortunately, government authorities continue to insist they can control the situation with orders and mandates.

All it took to find out was one phone call. But nobody at Rolling Stone had a spare dime.

• Rolling Stone ‘Horse Dewormer’ Hit-Piece Debunked (ZH)

After Joe Rogan announced that he’d kicked Covid in just a few days using a cocktail of drugs, including Ivermectin – an anti-parasitic prescribed for humans for over 35 years, with over 4 billion doses administered (and most recently as a Covid-19 treatment), the left quickly started mocking Rogan for having taken a ‘horse dewormer’ due to its dual use in livestock. [..] On Friday, Rolling Stone’s Peter Wade took another stab – publishing a hit piece claiming that Oklahoma ERs were overflowing with people ‘overdosing on horse dewormer.’ It was suspect from the beginning. The report, sourced to local Oaklahoma outlet KFOR’s Katelyn Ogle, cites Oklahoma ER doctor Dr. Jason McElyea – claimed that people overdosing on ivermectin horse dewormer are causing emergency rooms to be “so backed up that gunshot victims were having hard times getting” access to health facilities.

“As people take the drug, McElyea said patients have arrived at hospitals with negative reactions like nausea, vomiting, muscle aches, and cramping — or even loss of sight. “The scariest one that I’ve heard of and seen is people coming in with vision loss,” the doctor said.” -Rolling Stone. Except, the article provided zero evidence for McElyea’s claims, causing people to start asking questions. And while neither KFOR or Rolling Stone mention the hospital McElyea worked for, NHS Sequoyah, located in Sallisaw, Oklahoma – just issued a statement disavowing McElyea’s claims, which pops up when you visit their website. It reads:

“Although Dr. Jason McElyea is not an employee of NHS Sequoyah, he is affiliated with a medical staffing group that provides coverage for our emergency room. With that said, Dr. McElyea has not worked at our Sallisaw location in over 2 months. NHS Sequoyah has not treated any patients due to complications related to taking ivermectin. This includes not treating any patients for ivermectin overdose. All patients who have visited our emergency room have received medical attention as appropriate. Our hospital has not had to turn away any patients seeking emergency care. We want to reassure our community that our staff is working hard to provide quality healthcare to all patients. We appreciate the opportunity to clarify this issue and as always, we value our community’s support.”

[..] McElyea is also listed as working at Integris Grove Hospital in Grove, OK as a general family practitioner – not in the ER. A phone call to them provided no insight as to any ivermectin overdoses, however the gentleman who answered the phone sounded quite amused. What’s more, Grove, OK – with a population of 7,129, had just 14 aggravated assaults in all of 2019 according to the FBI’s latest data. We somehow doubt that ‘gunshot victims were lining up outside the ER,’ while just 11 ivermectin related hospital cases have been reported in the entire state since the beginning of May.

“Very little is referenced, because I can very easily find a contradictory reference to any reference I provide. For each fact, there is an equal and opposite fact.”

• I Have Not Been Silenced (Malcolm Kendrick)

Thank you to the many people who have e-mailed me recently and asked if I have been silenced. I have not. I have had letters from Public Health England and the General Medical Council, informing me that I was under investigation for daring to question anything about COVID19, particularly vaccines. The good news is the investigations ended up nowhere, and were closed down. I have also had irate phone calls from doctors, telling me that I must not question vaccination and suchlike. This has been somewhat wearing and has caused me to remain silent for a while and think about things. However, I do know how to play the medical regulations game. Don’t make a statement you cannot reference from a peer-reviewed journal.

Don’t give direct advice to people over the internet. Provide facts, and do not make statements such as ‘vaccines are killing thousands of people.’ Or suchlike. Not that I ever would. My self-appointed role within the COVID19 mayhem, was to search for the truth – as far as it could be found – and to attempt to provide useful information for those who wish to read my blog. The main reason for prolonged silence, and introspection, is that I am not sure I can find the truth. I do not know if it can be found anymore. Today I am unsure what represents a fact, and what has simply been made up. A sad and scary state of affairs. This is not just true of the mainstream and the mainstream media, which has simply decided to parrot all Government and WHO statements without any critical engagement…or thought.

For example, the BBC intones that ‘In the last day, fifty people died within twenty-eight days of a positive COVID19 test…’ Or a hundred, or six. What the hell is this supposed to mean? It means nothing, it is the very definition of scientific meaninglessness. Especially when it seems that very nearly a half of those admitted to hospital with COVID19 were not admitted to hospital with COVID19. They were admitted with something else entirely, then had a positive test whilst in hospital. In short, they were not admitted to hospital with COVID19, and almost certainly did not die of COVID19. They died with a positive COVID19 test. With, not of. But the misinformation is equally a problem for those on the other side. Claims are made for the benefits of Ivermectin and hydroxychloroquine that simply do not stand up to scrutiny.

Yes, I believe both drugs may provide some benefit, but not the claimed 90% reduction in deaths that I have seen trumpeted. So, I have given up on COVID19. It is a complete mess, and I feel that, without being certain of the ground under my feet, I have nothing to contribute. I too am in danger of starting to make statements that are not true. However, before leaving the area entirely, I would like to make clear some of the things I currently believe to be true, and what I do not believe to be true. If this is of any assistance to anyone. Very little is referenced, because I can very easily find a contradictory reference to any reference I provide. For each fact, there is an equal and opposite fact.

“And that, my friends, is where we are. We didn’t get here overnight.”

• The Road to Totalitarianism (CJ Hopkins)

The time for people to “wake up” is over. At this point, you either join the fight to preserve what is left of those rights, and that sovereignty, or you surrender to the “New Normal,” to global-capitalist totalitarianism. I couldn’t care less what you believe about the virus, or its mutant variants, or the experimental “vaccines.” This isn’t an abstract argument over “the science.” It is a fight … a political, ideological fight. On one side is democracy, on the other is totalitarianism. Pick a fucking side, and live with it. Anyway, here’s where we are at the moment, and how we got here, just the broad strokes. It’s August 2021, and Germany has officially banned demonstrations against the “New Normal” official ideology. Other public assemblies, like the Christopher Street Day demo, one week ago, are still allowed.

The outlawing of political opposition is a classic hallmark of totalitarian systems. It’s also a classic move by the German authorities, which will give them the pretext they need to unleash the New Normal goon squads on the demonstrators tomorrow. In Australia, the military has been deployed to enforce total compliance with government decrees … lockdowns, mandatory public obedience rituals, etc. In other words, it is de facto martial law. This is another classic hallmark of totalitarian systems. In France, restaurant and other business owners who serve “the Unvaccinated” will now be imprisoned, as will, of course, “the Unvaccinated.” The scapegoating, demonizing, and segregating of “the Unvaccinated” is happening in countries all over the world. France is just an extreme example. The scapegoating, dehumanizing, and segregating of minorities — particularly the regime’s political opponents — is another classic hallmark of totalitarian systems.

In the UK, Italy, Greece, and numerous other countries throughout the world, this pseudo-medical social-segregation system is also being introduced, in order to divide societies into “good people” (i.e., compliant) and “bad” (i.e., non-compliant). The “good people” are being given license and encouraged by the authorities and the corporate media to unleash their rage on the “the Unvaccinated,” to demand our segregation in internment camps, to openly threaten to viciously murder us. This is also a hallmark of totalitarian systems. And that, my friends, is where we are. We didn’t get here overnight. Here are just a few of the unmistakable signs along the road to totalitarianism that I have pointed out over the last 17 months.

Xi is getting bold.

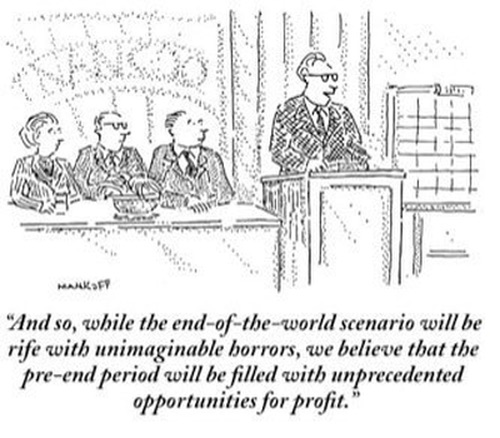

• China’s Marxist “Profound Revolution” Is Here (Every)

Political developments in China have been front page news in the financial press over the past few months. Beijing’s crackdown on Ant Financial, largely dismissed by Wall Street, then spread to Didi and on to the broader sectors these championed, fin- and transport-tech; then it grew to encompass swathes of the economy, from tech to health to education to property to private equity to gaming. In terms of tech, there are now sharp limits on IPOs in the US (mirrored from the US side) and new algo/pricing and data regulations that require Beijing to hold on to it; the private tuition field was made non-profit; there has been a sharp reduction in credit to property developers along with the official message that “houses are for living in, not speculation”, and rental increase caps of 5% annually; under-18s have been limited to just 3 hours of computer gaming a week, in allotted slots; and private equity has been cut off from residential investment.

Beijing has also called for curbs on “excessive” income, and for the wealthy and profitable firms “to give back more to society.” (Tencent already pledged $15bn.) This is also matched by: a social campaign against excessive business drinking, “unpatriotic” karaoke songs, and celebrity culture; ‘Xi Jinping Thought’ made obligatory at all schools and universities; and, as Bloomberg puts it, controls on social media financial commentary – “China to Cleanse Online Content that ‘Bad Mouths’ its Economy”. This has all taken place under the slogan of “Common Prosperity”. Going further, commentary reposted by Chinese state media on 30 August stressed these changes are a “profound revolution” sweeping the country, warning anyone who resisted would face punishment.

It added: “This is a return from the capital group to the masses of the people, and this is a transformation from capital-centred to people-centred,” marking a return to the original intention of the Communist Party, and “Therefore, this is a political change, and the people are becoming the main body of this change again, and all those who block this people-centred change will be discarded.” Notably, a WeChat blogger originally made the post, but it was then reposted by major state-run media outlets such as the People’s Daily, Xinhua News Agency, PLA Daily, CCTV, China Youth Daily, and China News Service. The author also wrote that high housing prices and medical costs will become the next targets of the campaign –which was backed by an official announcement on 1 September– and that the government needed to “combat the chaos of big capital,” adding “The capital market will no longer become a paradise for capitalists to get rich overnight… and public opinion will no longer be in a position worshiping Western culture.”

Dave Collum: “Yeah. It had nothing to do with those last 2,000 Whoppers and 2,500 bags of Funions…”

Do read the story below the photo.

God

What an amazing answer. pic.twitter.com/ICZLaXD0fR

— AliciaStump2000 (@AStump2000) July 17, 2021

Support the Automatic Earth in virustime; donate with Paypal and Patreon.