Paul Gauguin Horsemen on the beach �1902

Tomorrow is a travel day, no posts.

Up a bit this morning, plunge protection, but Shanghai down 30% for the year. Stocks are not Xi’s worst fear, though, the housing market is, along with debt. And you wonder how this is possible with all the GDP growth numbers.

• Implosion of Stock Market Double-Bubble in China Hits New Lows (WS)

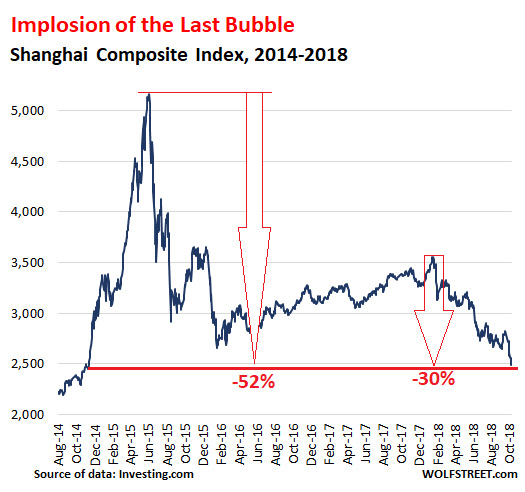

Today, the Shanghai Composite Index dropped another 2.9% to 2,486.42. In the bigger picture, that’s quite an accomplishment:

• Lowest since November 27, 2014, nearly four years ago

• Down 30% from its recent peak on January 24, 2018, (3,559.47)

• Down 52% from its last bubble peak on June 12, 2015 (5,166)

• Down 59% from its all-time bubble peak on October 16, 2007 (6,092)

• And back where it had first been on December 27, 2006, nearly 12 years ago.The chart of the Shanghai Stock Exchange Composite Index (SSE) shows the 2015-bubble and its implosion, followed by a rise from the January-2016 low, which had been endlessly touted in the US as the next big buying opportunity to lure US investors into the China miracle. Investors who swallowed this hype got crushed again:

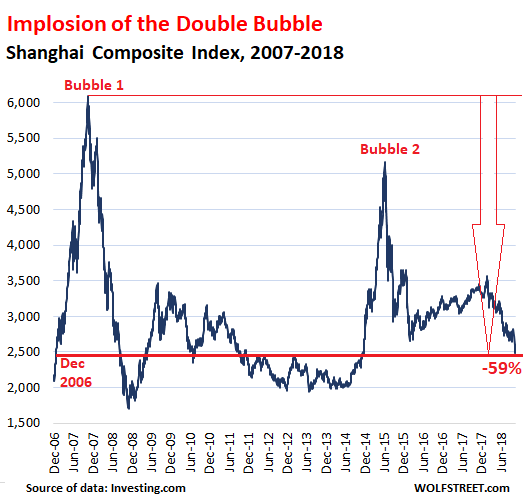

Over the longer view, the implosion is even more spectacular. Today’s close puts the SSE back where it had first been nearly 12 years ago, on December 27, 2007. This dynamic has created a double-bubble and a double-implosion, with every recovery rally in between getting finally wiped out. The index is now down 59% from its all-time high in October 2007, the super-hype era in the run-up to the Beijing Olympics. It is not often that a stock market of one of the largest economies in the world is whipped into two frenetically majestic bubbles that implode back to levels first seen 12 years earlier – despite inflation in the currency in which these stocks are denominated.

Betcha China’s foreign reserves are dwindling.

• Trump Trade War Forces Beijing To Retreat From Its Anti-Debt Battle (CNBC)

Just as China started to come to grips with the scale of its massive debt accumulation, the impact of the trade war with the U.S. is forcing a retreat. One expert said that could prove “disastrous” for the country’s economy. Years of big-ticket investment projects helped spur double-digit growth in China’s GDP, sending the country into position as the world’s second-largest economy — trailing only the United States. The price tag, however, was a mountain of debt that needed to be drawn down as authorities refashioned growth to a more sustainable model. The plan has been to base the more mature economy on the increasing spending power of China’s rising consumer class rather than old-fashioned investments in infrastructure.

But the trade war is denting China’s economic growth and forcing a rethink in debt reduction — known as deleveraging — as authorities look for ways to juice the economy to make up for hits resulting from U.S. President Donald Trump’s tariffs on Chinese exports. Economists increasingly see future tariffs as likely to apply to all shipments from China to the United States, meaning Beijing is set to even further loosen financial taps. That’s already been seen in the form of cuts to reserve requirement ratios for banks, which set the amount of funds they must keep on hand. The recent moves mean banks have more money to lend out, stimulating the economy with more debt.

To what extent is this Brussels teaching Rome a lesson?

• Italy’s Debt Crisis Thickens (DQ)

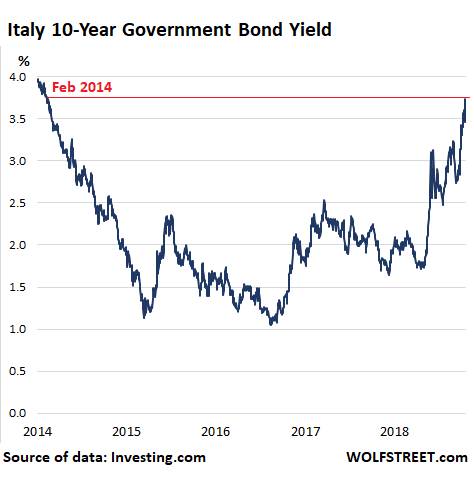

Italy’s government bonds are sinking and their yields are spiking. There are plenty of reasons, including possible downgrades by Moody’s and/or Standard and Poor’s later this month. If it is a one-notch downgrade, Italy’s credit rating will be one notch above junk. If it is a two-notch down-grade, as some are fearing, Italy’s credit rating will be junk. That the Italian government remains stuck on its deficit-busting budget, which will almost certainly be rejected by the European Commission, is not helpful either. Today, the 10-year yield jumped nearly 20 basis points to 3.74%, the highest since February 2014. Note that the ECB’s policy rate is still negative -0.4%:

But the current crisis has shown little sign of infecting other large Euro Zone economies. Greek banks may be sinking in unison, their shares down well over 50% since August despite being given a clean bill of health just months earlier by the ECB, but Greece is no longer systemically important and its banks have been zombies for years. Far more important are Germany, France and Spain — and their credit markets have resisted contagion. A good indicator of this is the spread between Spanish and Italian 10-year bonds, which climbed to 2.08 percentage points last week, its highest level since December 1997, before easing back to 1.88 percentage points this week.

Much to the dismay of Italy’s struggling banks, the Italian government has also unveiled plans to tighten tax rules on banks’ sales of bad loans in a bid to raise additional revenues. The proposed measures would further erode the banks’ already flimsy capital buffers and hurt their already scarce cash reserves. And ominous signs are piling up that a run on large bank deposits in Italy may have already begun.

So far the government is sticking to its plans.

• Italian Bond Yields Spike To 4-Year Highs As EU Slams New Budget Plan (CNBC)

Italian sovereign debt yields hit fresh multi-year highs Friday morning, as investors grow cautious over lending to the embattled government after it unveiled new budget plans. Ten-year and 30-year bond yields — yields have an inverse relationship to a bond’s price — hit their highest levels since early 2014, according to Reuters, just hours after the European Union warned of rule breaches in Italy’s draft budget. Investors have shown concerns over Italy’s 2019 budget, which was officially sent to the EU this week for analysis. The anti-establishment and partly right-wing government in Italy plans to increase public spending in the country, sticking with campaign pledges before the general election in March this year.

There are strong concerns that the fiscal plan will derail the reduction of the country’s debt pile — which is the second largest in the euro zone, totaling 2.3 trillion euros ($2.6 trillion). Italy’s prime minister has defended its free-spending budget this week, after officials in Brussels criticized the plans and labelled it an unprecedented breach of the EU’s budgetary rules.

Picked up the graph apart from the article. It says exactly why there won’t be a deal: it’s not possible.

• EU Leaders Ready To Help May Sell Brexit Deal To Parliament (G.)

EU leaders are preparing to back Theresa May in building a “coalition of the reasonable” in the UK parliament, in a desperate bid to avoid a no-deal Brexit. Following what has been described by diplomats as a “call for help” by the prime minister at a crunch summit in Brussels, the German chancellor, Angela Merkel, stressed that the EU had to pursue “all avenues” to find a deal that can get through the Commons.“I think where there is a will there is a way,” she said. Jean-Claude Juncker, the European commission president, said: “It will be done.” He is understood to have told EU leaders that May needed “help” to sell a deal in parliament.

While ruling out major concessions, Emmanuel Macron, the French president, said it was clear that the roadblock to a deal did not lie in Brussels. A potential agreement had been derailed on Sunday when Dominic Raab, the Brexit secretary, made an unscheduled visit to Brussels to inform the EU’s chief negotiator, Michel Barnier, that May could not get an agreement past her cabinet or the DUP, on whose votes her government relies.

A bit of honesty.

• Tory MP Calls UK Government ‘A Shitshow’ (Ind.)

A Tory MP has labelled the government “a shitshow” and said he would not vote Conservative. Johnny Mercer, a former army officer, claimed his party was being run by “technocrats and managers” and labelled Theresa May’s Brexit plan a sign of a “classic professional politician”. He vowed to launch a “serious shit-fight” to stop the UK heading “towards the edge of the cliff”. The Plymouth Moor View MP launched the astonishing attack on his own party as he voiced concerns that it no longer shared his values. He told The House magazine: “The party will never really change until you have somebody who is leading the party who has won a seat and knows what it’s like to go out every weekend and advocate for what you just voted for that week.

“We’ve lost this ability to fight, to scrap for what we believe in. Until we get that art back – ultimately our core business as politicians is winning elections. That is our basic core business. “We’ve lost focus on that for some very good, very capable but ultimately technocrats and managers. That’s not what Britain’s about.” [..] in a shock admission, he said that, were he not an MP, he would not vote for the Conservatives. Asked how the Johnny Mercer who left the military in 2012 would vote now, he said: “I wouldn’t go and vote. “Just being honest, I wouldn’t vote. Of course I wouldn’t, no.” He added: “There’s no doubt about it that my set of values and ethos, I was comfortable that it was aligned with the Conservative Party. I’m not as comfortable that that’s the case any more.”

The political center vanishes everywhere.

• Greens Surge Across Europe As Centre-Left Flounders (G.)

In conservative Bavaria, the Greens doubled their vote in state elections to become the second largest party. In Belgium’s local elections they achieved record scores of more than 30% and finished first in several Brussels districts, and runners-up overall. In Luxembourg’s general election they increased their tally of MPs by 50%. The elections in three countries last weekend suggest that as Europe’s historic mainstream parties plummet in the polls and struggle to see off the far right’s challenge, for liberal-minded voters the Greens look like an answer. Offering a pro-EU stance, a humane approach to migration and clear positions on issues such as climate change, biodiversity and sustainability, Green parties in several countries are now polling higher nationally than the traditional centre-left.

“They represent a clear place where people can go who are frustrated with the traditional mainstream parties but who don’t like the far right,” said Alexander Clarkson, a lecturer in European studies at King’s College London. “They offer a very clear counter-model to the positions and arguments of parties like Germany’s AfD. Also they’ve been around for a while now, more than 40 years, and they’ve governed responsibly both locally and regionally. They kind of look like the adults in the room.”

In Germany, where the Greens partner parties from the centre-right to the hard-left in nine of the 16 state governments, recent national polling put the party ahead of the centre-left SPD, Angela Merkel’s coalition partner, with a 17%-plus share of the vote, compared with 8.9% in last year’s federal election. In the Netherlands, the GreenLeft party boosted its representation from four to 14 MPs in elections last year and has advance further since then, from 9% to a second-placed 18% in the polls.

Fun research.

• Male Birds Can Be Good Singers Or Good Looking, But Not Both (NS)

The call of a male peacock is no pleasure to listen to, but its splendid tail means it doesn’t matter. Now an analysis of more than 500 species shows that this is a common trade-off in the bird world: the best lookers aren’t the most talented singers, while the best vocalists aren’t as easy on the eye. Sexual selection is an evolutionary process that shapes traits that animals use to attract mates, and birds are well known to resort to elaborate songs and flashy feathers in the name of reproduction. To investigate which species use which traits, Christopher Cooney at the University of Oxford and his colleagues collected the songs of 518 species, and compared these with their feather colours.

In particular, they looked at how much feathers differed between the males and females of each species – a sign that sexual selection has influenced their plumage. They found that birds in which one sex has more showy plumage than the other tend to have less interesting, more monotonous songs. In species in which the males and females more closely resemble each other, the males sing longer songs over a larger range of musical notes. The reason why bird evolution favours one trait over the other is unclear. It might be that birds living in dense forests with lower visibility rely more on their songs instead of colour to attract mates, but Cooney’s analysis didn’t find any relationship between sexually selected traits and habitat.

Instead, his team think that mate-attracting traits are costly to develop, so a species tends to evolve only one. Alternatively, once one attractive trait has begun to emerge, it may simply be pointless to develop a second.

“Why do we have a jury system if the judge can just toss it out?”

• Jurors Urge Judge To Uphold Monsanto Cancer Ruling (G.)

Jurors who ruled that Monsanto caused a dying man’s cancer are fighting to uphold their landmark $289m verdict, publicly urging a judge not to overturn their decision in a groundbreaking trial. Four California jurors told the Guardian that they were shocked and angry to learn that the judge overseeing their trial had moved to throw out their unanimous verdict, which said the agrochemical corporation failed to warn consumers that its popular weedkiller product posed health risks. The ruling in August, which sparked concerns across the globe about the Roundup herbicide, included $250m in punitive damages to the plaintiff, Dewayne “Lee” Johnson, who has terminal cancer.

But San Francisco superior court judge Suzanne Bolanos stunned campaigners and jurors last week when she issued a tentative ruling on Monsanto’s appeal motion, saying she would likely grant a new trial due to the “insufficiency of the evidence”. “I was just gobsmacked and outraged. I was astonished,” Robert Howard, juror No 4, said in an interview on Thursday. “Why do we have a jury system if the judge can just toss it out?” Bolanos hasn’t yet made a final ruling, leading to an unusual public plea from the jurors and mounting pressure on the judge in recent days. Some jurors said they became emotionally invested in the trial and now felt it was their duty to advocate for their decision and fight for Johnson to receive his award.

The list is endless. They’re all leaving.

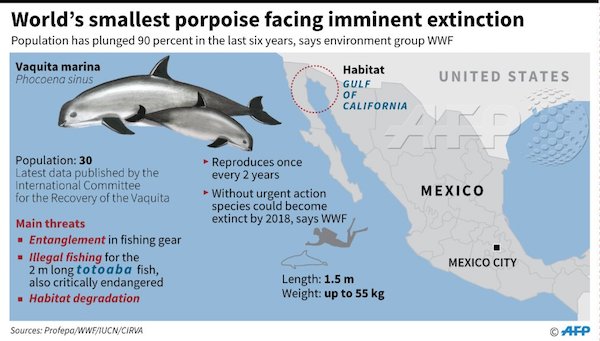

• World’s Smallest Porpoise Faces Extinction (AFP)

The near-extinct vaquita marina, the world’s smallest porpoise, has not yet disappeared from its habitat off the coast of Mexico, a research team said Wednesday after spotting six of them. The vaquita has been nearly wiped out by illegal fishing in its native habitat, the Gulf of California, and the World Wildlife Fund (WWF) warned in May that it could go extinct this year. But “all hope is not lost” for saving the species after the recent sightings, said Lorenzo Rojas of the International Committee for the Recovery of the Vaquita (CIRVA), presenting the researchers’ findings. In an 11-day study conducted in late September and early October, marine scientists spotted six vaquitas, including a calf.

The team emphasized that the study was not a full population estimate, which they will present in January after further research. In the last full population estimate, carried out in 2017, CIRVA found there were only 30 vaquitas left. Known as “the panda of the sea” for the distinctive black circles around its eyes, the vaquita has been decimated by gillnets used to fish for another species, the also endangered totoaba fish. The totoaba’s swim bladder is considered a delicacy in China and can fetch up to $20,000 on the black market. Hollywood star Leonardo DiCaprio and Mexican billionaire Carlos Slim have thrown their backing behind the campaign to save the vaquita.

Select your salt wisely.

• Microplastics Found In 90% Of Table Salt (NatGeo)

Microplastics were found in sea salt several years ago. But how extensively plastic bits are spread throughout the most commonly used seasoning remained unclear. Now, new research shows microplastics in 90 percent of the table salt brands sampled worldwide. Of 39 salt brands tested, 36 had microplastics in them, according to a new analysis by researchers in South Korea and Greenpeace East Asia. Using prior salt studies, this new effort is the first of its scale to look at the geographical spread of microplastics in table salt and their correlation to where plastic pollution is found in the environment. “The findings suggest that human ingestion of microplastics via marine products is strongly related to emissions in a given region,” said Seung-Kyu Kim, a marine science professor at Incheon National University in South Korea.

Salt samples from 21 countries in Europe, North and South America, Africa, and Asia were analyzed. The three brands that did not contain microplastics are from Taiwan (refined sea salt), China (refined rock salt), and France (unrefined sea salt produced by solar evaporation). The study was published this month in the journal Environmental Science & Technology. The density of microplastics found in salt varied dramatically among different brands, but those from Asian brands were especially high, the study found. The highest quantities of microplastics were found in salt sold in Indonesia. Asia is a hot spot for plastic pollution, and Indonesia—with 34,000 miles (54,720 km) of coastline—ranked in an unrelated 2015 study as suffering the second-worst level of plastic pollution in the world.