Paul Klee Still Life 1929

If you needed any more proof that the Fed has caused the crisis.

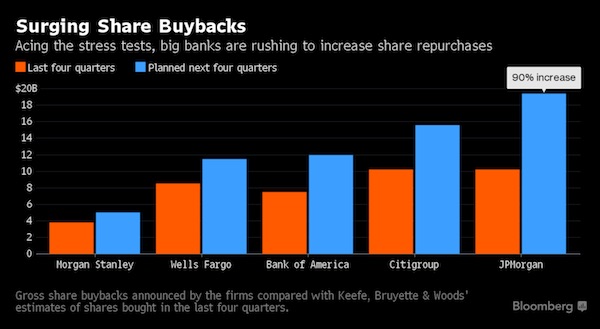

• Banks Unleash Big Payouts After Fed’s Stress Tests (BBG)

The Federal Reserve told big banks they have more than enough capital, and they promptly announced a windfall for their shareholders. JPMorgan Chase, Citigroup and Bank of America led U.S. firms in unveiling plans to boost dividends and stock buybacks more than analysts had projected, after every lender passed annual stress tests for the first time since the Fed began the reviews in the wake of the 2008 financial crisis. Shares across the industry rallied in late trading. Still, Capital One slipped more than 2% after it was the lone bank to stumble through the exam Wednesday, garnering conditional approval to make payouts while it fixes “material weaknesses” in planning. Lofty payouts once made banks hot stocks before the financial crisis exposed many of them as too thinly capitalized.

The companies’ plans unveiled on Wednesday show how they’re trying to generate investor interest – even as many still struggle to meet profitability targets and a few languish below book value. “This is the big payoff after seven years of pushing the industry to get to a place where capital planning is well ingrained,” said David Wright, a managing director at Deloitte’s advisory business who once worked at the Fed. “They reached the summit.” The Fed’s projections also show regulators may have more leeway to ease rules after years of forcing companies to curtail risk-taking and beef up internal controls – demands that eroded revenue and fueled costs.

The industry is counting on President Donald Trump to soften that oversight by appointing more business-friendly board members to the Fed, shifting the balance of power from regulators to shareholders. Earlier this month, Treasury Secretary Steven Mnuchin recommended that stress tests be performed every other year and that banks maintaining a sufficiently high level of capital be exempt from exams. “The highly positive report card puts more wind at the backs of the Trump administration and others who want to soften Dodd-Frank-era regulations,” Ian Katz at Capital Alpha Partners said in a note Wednesday, referring to a 2010 rewrite of industry rules. “That’s an additional bit of longer-term good news for banks.”

Yellen has fallen victim to the opioid epidemic.

• Yellen Questioned As China Debt Surpasses 300% Of GDP (CNBC)

Global debt has hit a record level in the first quarter of this year, mainly driven by emerging markets, raising questions of whether there will be another financial crisis in the near future. Data from the Institute of International Finance showed that global debt reached $217 trillion in the first quarter of this year, or 327% of GDP. “The debt burden is not distributed evenly. Some countries/sectors have seen deleveraging while others have built up very high debt levels. For the latter, rising debt may create headwinds for long-term growth and eventually pose risks for financial stability,” the IIF said in its Global Debt Monitor report on Tuesday. On Tuesday, U.S. Fed Chair Janet Yellen told an audience in London that banks are in a “very much stronger” position and another financial crisis is unlikely “in our lifetime.”

The 2008 financial crisis began with high indebtedness levels by U.S. households. But Yellen’s remarks aren’t’ consensual. “I think Yellen’s comment – if I am interpreting it correctly – is a huge hostage to fortune. The words Titanic and unsinkable spring to mind,” Erik Jones, professor of international political economy at Johns Hopkins University, told CNBC via email. Casrten Brzeski, senior economist at ING said that “high debt levels mean that the debt crisis has not been solved, yet. Neither in the US, nor in the Eurozone. Increasing debt levels in Asia and other emerging market economies also show that a structural change has not yet taken place.” “All of this, however, does not mean that we are at the verge of a other financial crisis. Central banks and low interest rates have and should continue to limit this risk significantly,” he added via email.

[..] “Total debt in emerging markets (excluding China) has increased by some $0.9 trillion to over $23.6 trillion in the first quarter of 2017—mainly driven by Brazil (up $0.6 trillion to $3.6 trillion) and India (up $0.2 trillion to 2.9 trillion),” the IFF said in its report. China poses a great risk in itself with households accelerating their borrowing. “The household debt-to-GDP ratio hit an all-time high of over 45% in the first quarter of 2017 —well above the Emerging Market average of around 35%. In addition, our estimates based on monthly data on total social financing suggest that China’s total debt surpassed 304% of GDP as of May 2017,” the IIF noted.

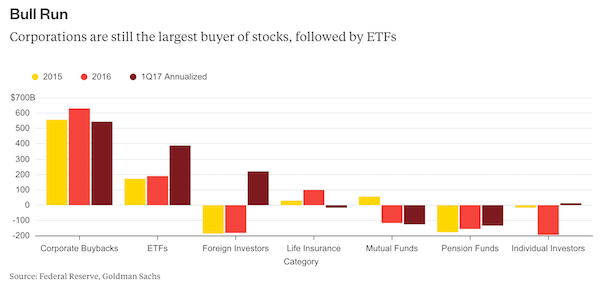

Buyback Mountain.

• Corporations Are Still The Largest Buyer Of Stocks (BBG)

The buyers of stocks may not be who everyone thinks they are.Last week, Goldman Sachs released a report saying the recent bull market is being increasingly fed by a single source: exchange-traded funds. The Wall Street Journal echoed on Wednesday with an article titled “ETF Buyers Propel Stock Market Rally.” That certainly follows the recent narrative that the great shift to passive investing – ETFs predominantly follow indexes – is what is driving the market. It is also appears to be wrong, at least according to the most recent data, which came out earlier this month from the Federal Reserve. ETFs, which it should be said are mostly just individuals buying stocks in new packaging, are indeed on pace to plow more money into equities this year than they have in the past, nearly $400 billion, up slightly more than 100% from a year ago.

But they are still not the biggest buyer of stocks. The entities shoveling more money into the stock market than any other this year, as has been the case for the past few years, remain corporations. Buybacks are on pace to reach nearly $550 billion, or $150 billion more than ETFs. ETFs, which it should be said are mostly just individuals buying stocks in new packaging, are indeed on pace to plow more money into equities this year than they have in the past, nearly $400 billion, up slightly more than 100% from a year ago. But they are still not the biggest buyer of stocks. The entities shoveling more money into the stock market than any other this year, as has been the case for the past few years, remain corporations. Buybacks are on pace to reach nearly $550 billion, or $150 billion more than ETFs.

Buybacks are down this year, by 13%, for the first time in a while. So a case could be made that the force driving the market is shifting, though it’s a weak one. Earlier this year, many were predicting that buybacks would drop by 30%. But even if what’s driving the market is shifting, ETFs still do not appear to be holding the keys.

A longtime favorite among panicky dictatorial types.

• NYSE President Targets Short Sellers (WS)

Short sellers like Andrew Left, founder of Citron Research, serve a real purpose in the markets and in society. His analysis helped reveal what’s going on at Valeant Pharmaceuticals and brought media focus on how the company conspired not only to manipulate up its reported sales and earnings but also drug prices for consumers. But short sellers are nuts. Short sellers are fighting a system that is totally rigged in every way against them. They’ve chosen to make money when share prices fall. They’ve chosen to make money in the most painful way possible. Self-flagellation comes to mind. Because the entire system is rigged to make share prices rise, no matter what. And when they rise, short sellers get their heads handed to them.

NYSE Group President Tom Farley, who should be neutral about share prices and should be primarily concerned about the functioning of the market, hammered home just how rigged that fight is. “It feels kind of icky and un-American, betting against a company,” he told lawmakers in Washington yesterday. Even those engaging in rampant hype, lies, and worse, I presume. According to Bloomberg: He added that because short-selling can actually improve markets, public companies don’t necessarily want to ban it outright – instead they want to see more stringent disclosure. “They say, ‘Let’s have a little more transparency,”’ said Farley. This urge for “transparency” is ironic. No one complains how Warren Buffett does it. Through Berkshire Hathaway, he quietly buys enough shares of a company to gain ownership in the single-digit percentage range.

This buying activity drives up the price. His brokerage firm knows, word spreads, and those in the know also buy the shares. Then the stake is disclosed in an SEC filing. Instantly, shares jump further. “Buffett Buys x% of…” the media scream. With his avuncular face on CNBC and other TV shows, he gets to promote what a great company this is, how he believes in the management, yada-yada-yada. Shares jump further. Then he quietly buys some more shares, a small amount this time. When the SEC filing becomes public, the whole media circus starts all over again, and shares jump some more.

Something I’ve been hammering on forever. Only, if you follow the logic, there’s another step: investors should realize that they themselves are fake, too.

• Forget Fake News, Investors Should Realize The Markets Are Fake (CNBC)

The global rally in financial markets is unsustainable because it only seems to respond to changes in the real economy when it fits a certain narrative, according to the CIO of investment firm Fasanara Capital. “I call it fake markets… you know, these days they talk about fake news (but) these are fake markets in a way right?” Francesco Filia, CIO of Fasanara Capital, told CNBC on Wednesday. Filia argued financial markets had become “complacent” and “insensitive” to fundamental changes in the economy. He suggested while markets appeared to surge higher on so-called good data, a mirrored response lower on negative sentiment had not been evident.

“I think this kind of market environment is both unstable and unsustainable… at some point, something is going to happen that is going to all of a sudden wake up markets as to this overvaluation,” Filia said. European bourses were trading lower on Wednesday after European Central Bank President Mario Draghi appeared to hint the ECB would be prepared to scale back its monetary policy amid improving economic prospects for Europe. Meanwhile, in the U.S., the broader S&P 500 index posted its biggest one-day drop in about six weeks overnight and closed at its lowest point since the end of May. Wall Street’s losses appeared to accelerate on news that the U.S. Senate had delayed voting on a health care reform bill.

When Filia was asked to explain how his ‘fake markets’ theory stacked up with declining global stocks on Wednesday, he replied, “A pullback of 1% in the stock market from all-time highs? I wouldn’t call it exactly re-pricing things up. It’s just slowing the pace at which you grow.” Filia cited “Stein’s Law” as a fitting adage for the state of financial markets at present. Herbert Stein, chief economist to U.S. President Richard Nixon wrote: “If something cannot continue forever, it will stop.”

Ouch. Project Veritas has promised a -compromising- CNN video ‘every day this week’. A conversation that’s long overdue.

• CNN’s Van Jones: “The Russia Thing Is Just A Big Nothing Burger” (ZH)

Yesterday, after dropping his first undercover CNN bombshell, which starred producer John Bonifield admitting that CNN’s endless ‘Russian meddling’ crusade was “mostly bullshit” directed by the network’s CEO Jeff Zucker with the sole intent of spiking ratings, Project Veritas’ James O’Keefe promised there was more to come. And, all we knew was that the subject of the second video would be “someone we all knew…” As it turns out, that ‘someone’ is none other than CNN’s Van Jones who inadvertently got caught revealing his true thoughts on CNN’s ‘Russian meddling’ narrative, namely that the whole story is a “big nothing burger.” PV Reporter: “What do you think is going to happen this week with the whole Russia thing?” Van Jones: “The Russia Thing Is Just A Big Nothing Burger” PV Reporter: “Really?” Van Jones: “Yeah.”

Of course, while we’re happy that Van Jones decided to tell the truth, if only while he thought no one was listening, we do wonder how he intends to explain his seemingly conflicted ‘on-air’ versus ‘off-air’ personalities to his children. As you may recall, Jones was the same distraught CNN commentator who spent election night describing Trump as a “bully” and a “bigot” all while saying that his “biggest fear” was how he could explain Trump’s victory to his children… Perhaps it’s time to think about how you can explain to your children why you exploited your position and fame to provoke mass hysteria among a divided American electorate, over a story you knew to be false…hysteria which very well could have contributed to a mass shooting that nearly claimed the life of Steven Scalise.

Only possible comeback attempt? Problem is: CNN war on Trump may be “Physically Endangering Reporters” at least as much. And no, Trump didn’t start this.

• CNN Proclaims Trump’s War On Media “Is Physically Endangering Reporters” (ZH)

It’s been a tough week for CNN, so they needed a distraction, and what better way to try and gain back some credibility – from a worldwide audience now likely questioning every word out of the ‘news’ network’s mouth – than to proclaim “we are going to see a reporter face physical harm because” of President Trump’s “declaration of war on the media.” As RealClear Politics reports, CNN’s Clarissa Ward, a foreign correspondent serving as guest co-host on Wednesday’s broadcast of CNN’s News Day, fretted “people” in war zones have been “emboldened” by President Trump’s “declaration of war on the media.” Ward, expressing concern for members of the media in dangerous areas of the world, said to guest Chris Cillizza, “I can only imagine what a person like you is dealing with. At what point does this become reckless or irresponsible?”

Playboy White House correspondent Brian Karem – who is now infamous for his whiney exchange with White House deputy spokeswoman Sarah Huckabee Sanders at Tuesday’s press briefing – replied that Ward is “absolutely right” and talked about the trial and tribulations of reporters who have been jailed and even killed. “Our newspapers after Donald Trump’s election, we’ve gotten threats from both the far left and the far right,” Karem said. “They are emboldened, it is dangerous, and the fact of the matter is, it is insulting to the memory of the people who have given their lives for the cause for providing information to the public to then be told you are fake media, you do not matter, and what you’re doing is false.” Karem went as far to predict “we are going to see a reporter face physical harm because” of Trump.

“And quite frankly, every one of us should stand up against that because it is undermining the First Amendment. It is dangerous, making it dangerous for reporters. You’re absolutely right, there is going to come a time, and it’s not going to be too far off I surmise when we’re going to see a reporter is going to face physical harm because of this,” he said. We suggest readers put down all sharp objects before embarking on the following four minutes of utter farce as each personality seems to want to one-up the last in their grandstanding of just how threatened they are by Trump’s words…

Paul Craig Roberts put what I wrote last night in Feeding Frenzy in the Echo Chamber, in a sharper perspective.

• The Presstitutes, Not Russia, Interfered in the US Presidential Election (PCR)

Unlike Oliver Stone, who knew how to interview Vladimir Putin, Megyn Kelly did not. Thus, she made a fool of herself, which is par for her course. Now the entire Western media has joined Megyn in foolishness, or so it appears from a RT report. James O’Keefe has senior CNN producer John Bonifield on video telling O’Keefe that CNN’s anti-Russia reporting is purely for ratings: “It’s mostly bullshit right now. Like, we don’t have any big giant proof.” CNN’s Bonifield is reported to go on to say that “our CIA is doing shit all the time, we’re out there trying to manipulate governments.” And, of course, the American people, the European peoples, and the US and European governments are being conditioned by the “Russia did it” storyline to distrust Russia and to accept whatever dangerous and irresponsible policy toward Russia that Washington comes up with next.

Is the anti-Russian propaganda driven by ratings as Bonifield is reported to claim, or are ratings the neoconservatives and military/security complex’s cover for media disinformation that increases tensions between the superpowers and prepares the ground for nuclear war? RT acknowledges that the entire story could be just another piece of false news, which is all that the Western media is known for. Nevertheless, what we do know is that the fake news reporting pertains to Russia’s alleged interference in the US presidential election. Allegedly, Trump was elected by Putin’s interference in the election. This claim is absurd, but if you are Megyn Kelly you lack the IQ to see that. Instead, presstitutes turn a nonsense story into a real story despite the absence of any evidence. Who actually interfered in the US presidential election, Putin or the presstitutes themselves?

The answer is clear and obvious. It was the presstitutes, who were out to get Trump from day one of the presidential campaign. It is CIA director John Brennan, who did everything in his power to brand Trump some sort of Russian agent. It is FBI director Comey who did likewise by continuing to “investigate” what he knew was a non-event. We now have a former FBI director playing the role of special prosecutor investigating Trump for “obstruction of justice” when there is no evidence of a crime to be obstructed! What we are witnessing is the ongoing interference in the presidential election, an interference that not only makes a mockery of democracy but also of the rule of law. The presstitutes not only interfered in the presidential election; they are now interfering with democracy itself. They are seeking to overturn the people’s choice by discrediting the President of the United States and those who elected him.

The Democratic Party is a part of this attack on American democracy. It is the DNC that insists that a Putin/Trump conspiracy stole the presidency from Hillary. The Democrats’ position is that it is too risky to permit the American people—the “deplorables”— to vote. The Democratic Party’s line is that if you let Americans vote, they will elect a Putin stooge and America will be ruled by Russia. Many wonder why Trump doesn’t use the power of the office of the presidency to indict the hit squad that is out to get him. There is no doubt that a jury of deplorables would indict Brennan, Comey, Megyn Kelly and the rest. On the other hand, perhaps Trump’s view is that the Republican Party cannot afford to go down with him, and, therefore, as he is politically protected by the Republican majority, the best strategy is to let the Democrats and the presstitutes destroy themselves in the eyes of flyover America.

Er, wait, Schaeuble was there when the loophole was put into place.

• Schaeuble Bemoans EU ‘Loophole’ Used in Italy Banks’ Rescue (CNBC)

Finance Minister Wolfgang Schaeuble on Wednesday underscored Germany’s concerns about what he called a regulatory loophole after the EU cleared Italy to wind up two failed banks at a hefty cost to local taxpayers. Schaeuble told reporters that Europe should abide by rules enacted after the 2008 collapse of U.S. financial services firm Lehman Brothers that were meant to protect taxpayers. Existing European Union guidelines for restructuring banks aimed to ensure “what all political groups wanted: that taxpayers will never again carry the risks of banks,” he said.

Italy is transferring the good assets of the two Veneto lenders to the nation’s biggest retail bank, Intesa Sanpaolo , as part of a transaction that could cost the state up to €17 billion ($19 billion). The deal, approved by the European Commission, allows Rome to solve a banking crisis on its own terms rather than under potentially tougher European rules. Noting that closure under national insolvency laws benefited owners and investors, Schaeuble said: “We in Europe need to think about this regulatory loophole.”

Will Saud’s new kid on the block go to war with Qatar? What will Trump do? And Putin?

• Accept Demands or it’s Goodbye Qatar (GulfNews)

In a series of clear warning messages to Qatar, Arab Gulf officials have stressed that meeting a set of demands that were put forward by four Arab countries is the only way out of the crisis for Doha. The officials said they are considering further economic pressure on Qatar, such as reducing commercial links with states that continue to trade with Doha. UAE Ambassador to Moscow, Omar Gobash, sent a strong message to Doha that it could face expulsion from the Gulf Cooperation Council if it does not meet the 13-point-demands set by Saudi Arabia, the UAE, Bahrain and Egypt. The four countries had cut their diplomatic relations with Doha earlier this month over Qatar’s foreign policy and its support to terrorism.

In an interview in London with The Guardian, Gobash said there are “certain economic decisions that we can take which are being considered right now”. “One possibility would be to set conditions on our own trading partners and say you want to work with us then you have got to make a commercial choice. “If Qatar was not willing to accept the demands, it is a case of ‘Goodbye Qatar’ we do not need you in our tent anymore,” he said. Meanwhile, Dr Anwar Mohammad Gargash, UAE Minister of State for Foreign Affairs, called on Qatar to make a “wise and well-thought choice” move before the time frame given by the four Arab countries to Doha to comply with the demands. “Now that the hour of truth is coming nearer, we invite the brother to choose his surroundings, to choose honesty and transparency in dealing [with the issue],” he said in a tweet.

“We have long suffered from the brother’s conspiracy to undermine our stability and we have witnessed his support for a partisan agenda seeking to create chaos in our Arab world. Now, we tell him: Enough! Get back to your senses or go on your way, but without us,” he posted on his Twitter account yesterday. He was referring to Qatar as brother. In Washington, Saudi Foreign Minister Adel Jubeir showed a tougher stand saying that there is no room for negotiations with Qatar. “We made our point, we took our steps and it’s up to the Qataris to amend their behavior,” Saudi Foreign Minister Adel Al Jubeir told reporters. Once they do, “then things will be worked out. But if they don’t, they will remain isolated.”

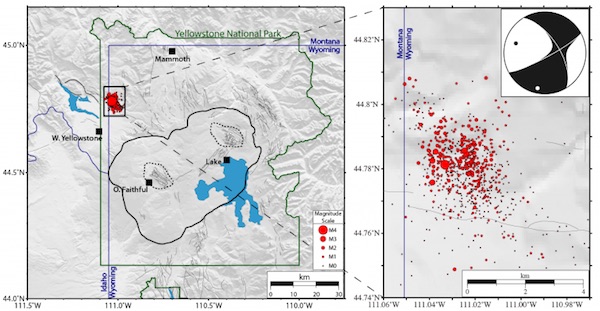

One of the world’s largest supervolcanoes.

• Scientists Fear “Supervolcano” Eruption At Yellowstone (ZH)

More than 800 earthquakes have now been recorded at the Yellowstone Caldera, a long-dormant supervolcano located in Yellowstone National Park, over the last two weeks – an ominous sign that a potentially catastrophic eruption could be brewing. However, despite earthquakes occurring at a frequency unseen during any period in the past five years, the US Geological Survey says the risk level remains in the “green,” unchanged from its normal levels, according to Newsweek. The biggest earthquake in this “swarm” – which registered a magnitude of 4.4 – took place on June 15, three days after the rumblings started. That quake was the biggest in the region since a magnitude 4.8 earthquake struck close to Norris Geyser Basin in March 2014. This magnitude 4.4 earthquake was so powerful that people felt it in Bozman Montana, about eight miles away.

A scientist from the University of Utah said the quakes have also included five in the magnitude three range, and 68 in the magnitude two range. “The swarm consists of one earthquake in the magnitude 4 range, five earthquakes in the magnitude 3 range, 68 earthquakes in the magnitude 2 range, 277 earthquakes in the magnitude 1 range, 508 earthquakes in the magnitude 0 range, and 19 earthquakes with magnitudes of less than zero,” the latest report said. An earthquake with a magnitude less than zero is a very small event that can only be detected with the extremely sensitive instruments used in earthquake monitoring.” There is normally a rise in seismic activity before a volcano erupts. And scientists currently believe there’s a 10% chance that a “supervolcanic Category 7 eruption” could take place this century, as pointed out by theoretical physicist Michio Kaku.

An eruption, Kaku said, is long overdue: The last one occurred 640,000 years ago. To be sure, the swarm has slowed down considerably this week, and larger swarms have been recorded in the past, according to Jacob Lowenstern, the scientists in charge of the Yellowstone Volcano Observatory. Yet the possibility that the volcano could be on the verge of what’s called a “supereruption” should be enough to give the government pause. But scientists have said recently that there’s some evidence to suggest the next one could occur this century.

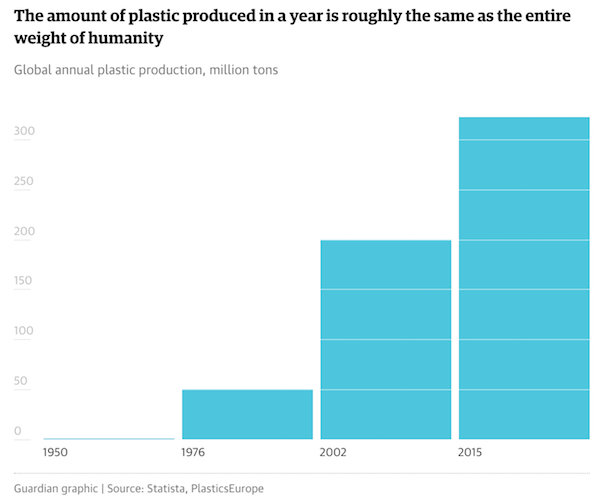

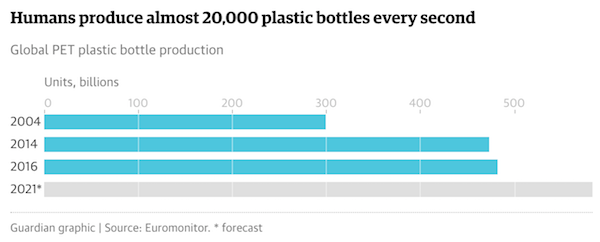

That’s over 30 pieces of plastic each and every day:

“..people who eat seafood ingest up to 11,000 tiny pieces of plastic every year.”

• World’s Plastic Binge ‘As Dangerous As Climate Change’ (G.)

A million plastic bottles are bought around the world every minute and the number will jump another 20% by 2021, creating an environmental crisis some campaigners predict will be as serious as climate change. New figures obtained by the Guardian reveal the surge in usage of plastic bottles, more than half a trillion of which will be sold annually by the end of the decade. The demand, equivalent to about 20,000 bottles being bought every second, is driven by an apparently insatiable desire for bottled water and the spread of a western, urbanised “on the go” culture to China and the Asia Pacific region. More than 480bn plastic drinking bottles were sold in 2016 across the world, up from about 300bn a decade ago. If placed end to end, they would extend more than halfway to the sun. By 2021 this will increase to 583.3bn, according to the most up-to-date estimates from Euromonitor International’s global packaging trends report.

Most plastic bottles used for soft drinks and water are made from polyethylene terephthalate (Pet), which is highly recyclable. But as their use soars across the globe, efforts to collect and recycle the bottles to keep them from polluting the oceans, are failing to keep up. Fewer than half of the bottles bought in 2016 were collected for recycling and just 7% of those collected were turned into new bottles. Instead most plastic bottles produced end up in landfill or in the ocean. Between 5m and 13m tonnes of plastic leaks into the world’s oceans each year to be ingested by sea birds, fish and other organisms, and by 2050 the ocean will contain more plastic by weight than fish, according to research by the Ellen MacArthur Foundation. Experts warn that some of it is already finding its way into the human food chain.Scientists at Ghent University in Belgium recently calculated people who eat seafood ingest up to 11,000 tiny pieces of plastic every year.

Last August, the results of a study by Plymouth University reported plastic was found in a third of UK-caught fish, including cod, haddock, mackerel and shellfish. Last year, the European Food Safety Authority called for urgent research, citing increasing concern for human health and food safety “given the potential for microplastic pollution in edible tissues of commercial fish”. Dame Ellen MacArthur, the round the world yachtswoman, now campaigns to promote a circular economy in which plastic bottles are reused, refilled and recycled rather than used once and thrown away. “Shifting to a real circular economy for plastics is a massive opportunity to close the loop, save billions of dollars, and decouple plastics production from fossil fuel consumption,” she said.