Pablo Picasso� Five women �1907

Not much on the Kavanaugh front right now, other than the same voices saying more of the same. We don’t expect that to last through the day today. We expect mayhem. But first, some economy:

• Europe, Russia And China Join Forces To Dodge Iran Sanctions (CNBC)

In the latest sign of the growing divide between Washington and its allies, the European Union’s foreign policy chief announced Monday that the bloc was creating a new payment mechanism to allow countries to transact with Iran while avoiding U.S. sanctions. Called the “special purpose vehicle” (SPV), this mechanism would aim to “assist and reassure economic operators pursuing legitimate business with Iran,” according to a joint statement released by the remaining members of the Iran nuclear deal — France, Britain, Germany, Russia and China.

“This will mean that EU member states will set up a legal entity to facilitate legitimate financial transactions with Iran and this will allow European companies to continue to trade with Iran in accordance with EU law and could be open to other partners in the world,” Federica Mogherini, the EU’s high representative for foreign affairs, told the UN General Assembly on Tuesday. The technical details will be worked on by experts in future meetings, she said. American sanctions have already been imposed on a number of Iran’s industries — including aviation, metals, automotives and its ability to trade gold and acquire dollars — as a result of President Donald Trump’s withdrawal from the 2015 nuclear deal. On November 4, a second round of penalties will fall on Iran’s massive oil sector, which accounts for 70 percent of the country’s exports. Iran is the world’s seventh-largest oil producer.

More detail on the above.

• Europe Unveils “Special Purpose Vehicle” To Bypass SWIFT (ZH)

Germany, France and the U.K. would set up a multinational state-backed financial intermediary that would deal with companies interested in Iran transactions and with Iranian counter-parties. Such transactions, presumably in euros and pounds sterling, would not be transparent to American authorities. European companies dealing with the state-owned intermediary technically might not even be in violation of the U.S. sanctions as currently written. And, in a potentially massive development, the system would be likely be open to Russia and China as well as it would enable the world’s economies to trade with each other, fully independent of SWIFT.

Europe would thus provide an infrastructure for legal, secure sanctions-busting — and a guarantee that the transactions would not be reported to American regulators. That said, Washington would not be without recourse, although at that point, all the U.S. could do is sanction the participating countries’ central banks or SWIFT for facilitating the transactions (if the special purpose vehicle uses SWIFT, rather than ad hoc messaging).

That, Hellman and Batmanghelidj wrote, would be self-defeating: “There are two possible outcomes if these institutions proceed to work with Iran despite U.S. secondary sanctions. Either U.S. authorities fail to take enforcement action given the massive consequences for the operations and integrity of the American financial system, serving to “defang” the enforcement threats and reduce the risk of European self-sanctioning on the basis of fear, or U.S. authorities take such an enforcement action, a step that would only serve to accelerate European efforts to create a defensible banking architecture that goes beyond the Iran issue alone.”

Europe, naturally, needs a “neutral” pretext to implement this SPV, and that would be Brussels’ desire to continue transacting with Iran: “We are not backing down [on the Iran nuclear agreement],” said a European diplomat. He said the speeches of European leaders at a Security Council meeting Mr. Trump is hosting on Wednesday on nonproliferation, including Iran, will reflect the Monday night statement. Additionally, as basis for the potentially revolutionary development, the participants of the 2015 nuclear deal, formally known as the Joint Comprehensive Plan of Action or JCPOA, “underlined their determination to protect the freedom of their economic operators to pursue legitimate business with Iran.”

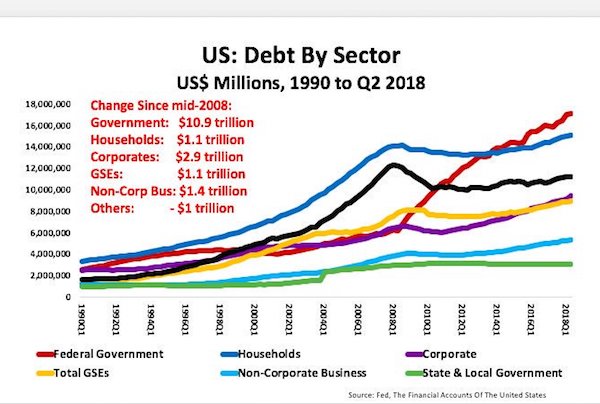

There’s one thing only that keeps the wheeels turning: cheap debt. They’re about to take that away. I added the graph.

• Fed Likely To Raise Rates, Possibly End ‘Accommodative’ Policy Era (R.)

With the Federal Reserve widely expected to raise interest rates on Wednesday, financial markets are focused on whether signs of an acceleration in U.S. economic growth will prompt the central bank to ramp up the pace of monetary policy tightening. This week’s two-day policy meeting could mark the formal end of the “accommodative” level of rates the Fed has used to support the American economy since the onset of the 2007-2009 recession. The Fed’s current policy statement has included that description of loose policy as a staple element in recent years, though officials recently have described it as out of date and likely to be removed, either this week or in the near future.

The probability the Fed will raise its benchmark overnight lending rate by a quarter of a percentage point on Wednesday, in what would be its third hike this year, is nearly 95 percent, based on an analysis of fed fund futures contracts by CME Group. The larger question is whether the Fed reshapes its monetary policy outlook for the next few years to factor in stronger GDP growth or whether concerns about a possible global trade war or economic slowdown cause it to stick close to its current view.

Jamie Dimon as a parasite.

• Free-Riding Investors Set up Markets for a Major Collapse (Rickards)

The biggest free riders in the financial system are bank executives such as Jamie Dimon, the CEO of J.P. Morgan. Bank liabilities are guaranteed by the FDIC up to $250,000 per account. Liabilities in excess of that are implicitly guaranteed by the “too big to fail” policy of the Federal Reserve. The big banks can engage in swap and other derivative contracts “off the books” without providing adequate capital for the market risk involved. Interest rates were held near zero for years by the Fed to help the banks earn profits by not passing the benefits of low rates along to their borrowers. Put all of this (and more) together and it’s a recipe for billions of dollars in bank profits and huge paychecks and bonuses for the top executives like Dimon.

What is the executives’ contribution to the system? Nothing. They just sit there like parasites and collect the benefits while offering nothing in return. Given all of these federal subsidies to the banks, a trained pet could be CEO of J.P. Morgan and the profits would be the same. This is the essence of parasitic behavior. Yet there’s another parasite problem affecting markets that is harder to see and may be even more dangerous that the bank CEO free riders. This is the problem of “active” versus “passive” investors. An active investor is one who does original research and due diligence on her investments or who relies on an investment adviser or mutual fund that does its own research.

T he active investor makes bets, takes risks and is the lifeblood of price discovery in securities markets. The active investor may make money or lose money (usually it’s a bit of both) but in all cases earns her money by thoughtful investment. The active investor contributes to markets while trying to make money in them. A passive investor is a parasite. The passive investor simply buys an index fund, sits back and enjoys the show. Since markets mostly go up, the passive investor mostly makes money but contributes nothing to price discovery.

That’ll be good for a whole lot more smear. The Telegraph runs a we ad right now that says: “We must ditch Chequers or be condemned to a crazed Corbynista takeover”. And a photo of Hitler accompanied by: “The Nazis were socialists”.

• Corbyn Vows To End ‘Greed-is-Good’ Capitalism In UK (G.)

Jeremy Corbyn will on Wednesday attack the “greed-is-good” capitalism that he claims has resulted in large swaths of the UK being left behind, promising a raft of new policies including a “green jobs revolution” that will create 400,000 new positions. The Labour leader will attempt to reset the theme of the Labour conference which has so far been dominated by deep divisions over its Brexit stance and return to his core argument about the failure of the broken economic system. Corbyn will use his main conference speech to set out his plans to change the direction of the economy, following a week in which his shadow chancellor, John McDonnell, laid out a series of redistributive policies.

The Labour leader will say: “Ten years ago this month, the whole edifice of greed-is-good, deregulated financial capitalism, lauded for a generation as the only way to run a modern economy, came crashing to earth, with devastating consequences.” ”But instead of making essential changes to a broken economic system, the political and corporate establishment strained every sinew to bail out and prop up the system that led to the crash in the first place. “People in this country know – they showed that in June last year – that the old way of running things isn’t working any more. That’s why Labour is offering a radical plan to rebuild and transform Britain.” Corbyn will announce plans for a rollout of green technologies including 13,500 onshore and offshore wind turbines, solar panels on thousands of roofs and wide-scale home insulation.

Well, he doesn’t hold back.

• Why Corbyn Is Promising A “Green Jobs Revolution” (NS)

A Labour government would “kickstart a green jobs revolution” in a bid to radically overhaul the economy after Brexit, Jeremy Corbyn will say in a conference speech that implicitly criticises the last Labour government tomorrow. Laying out his party’s vision to reduce carbon emissions and create 400,000 new skilled jobs by 2030, the Labour leader will tell delegates in Liverpool that his government will return “skills and security to communities held back for too long” with a large-scale programme of investment in green infrastructure and training. Sources close to Corbyn have described the speech as a direct pitch to communities that voted for Brexit – “the millions of people who have been most directly affected by deindustrialisation and austerity” – and its policy platform as a bid to remedy to its root economic causes.

Corbyn will announce plans to reduce carbon emissions by 60 per cent by 2030, and to zero by 2050, through a large-scale programme of public sector investment and sweeping changes to planning regulations. A Labour government would seek to increase offshore wind power by seven times, double onshore wind, treble solar panel, and would launch a £12.8 billion home insulation programme. An independent panel of researchers said that the plans – which would involve both public and private sector investment – would create some 400,000 skilled jobs. Corbyn will describe the plans as a “radical plan we need to rebuild and transform Britain”, adding: “The old way of running things isn’t working anymore.”

If May gives in enough, it could come later today.

• Brexit Agreement Could Come In October – Merkel (CNBC)

German Chancellor Angela Merkel said Tuesday that a Brexit agreement between the European Union and the U.K. is possible in October, but it is not yet clear what the British government wants. Speaking at a conference in Germany, Merkel said the U.K. cannot choose to be part of the single market — the European common area where goods, services and people move freely — without respecting all its principles. The U.K. government wants to control the number of European citizens moving to the U.K. During a cabinet meeting Monday, Prime Minister Theresa May’s government agreed that EU workers should face the same immigration rules as non-EU citizens. Some have argued that restricting the number of low-skilled EU migrants will hurt the U.K. economy.

Merkel also said Tuesday that European businesses need clarity, which demands “hard work” from Brexit negotiators in the next six to eight weeks. There have been repeated comments from both sides of the English Channel that negotiations need to be intensified to reach a deal by no later than November. However, many analysts are sceptical that a Brexit agreement will be reached. “We have highlighted for some time that the risks of ‘no deal’ are appreciably high,” Dean Turner, economist at UBS Global Wealth Management, said in a note Tuesday morning. “We don’t believe that this will happen by design, as it is in neither sides’ interests to generate the kind of economic disruption that would likely ensue. But with every day that passes without progress, the risks grow that such an outcome could occur by accident.”

Two weeks on…

• 1000s Told To Flee As Florence-Triggered Floods Wash Into South Carolina (R.)

Thousands of people in the Georgetown, South Carolina, area were urged to evacuate their homes on Tuesday as rainwater unleashed by Hurricane Florence surged down rivers, threatening to submerge some neighborhoods under 10 feet of water. Georgetown, which sits at the confluence of the Waccamaw, Great Pee Dee and Sampit rivers, was largely spared the initial fury of Florence, which came ashore on Sept. 14 as a Category 1 hurricane, killing 46 people in three states. But the port city of more than 9,000 stands in the path of what the National Weather Service has said could be significant flooding as water dumped by the storm system drains to the ocean.

“We are urging people to take this event seriously. We expect the flooding to be worse than Hurricane Matthew a couple years ago,” said Randy Akers, deputy public information officer for Georgetown County. “We always urge people to prepare for the worst and hope for the best.” Akers said between 6,000 and 8,000 people have been exhorted to leave, but it was not clear how many had done so as of Tuesday evening. He said the county lacked authority to mandate evacuations.

They blame it on mismanagement. Not on producing the waste in the first place. World Bank.

• Global Waste Could Increase By 70% By 2050 – World Bank (WEF)

Global waste could grow by 70 percent by 2050 as urbanisation and populations rise, said the World Bank on Thursday, with South Asia and Sub-Saharan Africa set to generate the biggest increase in rubbish. Countries could reap economic and environmental benefits by better collecting, recycling and disposing of trash, according to a report, which calculated that a third of the world’s waste is instead dumped openly, with no treatment. “We really need to pay attention to South Asia and Sub-Saharan Africa, as by 2050, South Asia’s waste will double, sub-Saharan Africa’s waste will triple,” said Silpa Kaza, World Bank urban development specialist and report lead author.

“If we don’t take any action it could have quite significant implications for health, productivity, environment, livelihoods,” she told the Thomson Reuters Foundation by phone from Belarus. The rise in rubbish will outstrip population growth, reaching 3.4 billion tons by 2050 from around 2 billion tons in 2016, according to the report. High-income countries produce a third of the world’s waste, despite having only 16 percent of world’s population, while a quarter comes from East Asia and the Pacific regions, it said. While more than a third of waste globally ends up in landfill, over 90 percent is dumped openly in lower income countries that often lack adequate disposal and treatment facilities, said the report.

“This guy is dealing with the reality of his mortality..”

• The Man Who Beat Monsanto: ‘They Have To Pay For Not Being Honest’ (G.)

Regardless of the outcome, Johnson v Monsanto was always going to be a newsworthy trial, because the judge allowed the cancer patient’s legal team to bring scientific arguments to the courtroom. The proceedings further shined a light on internal Monsanto emails over the years that Johnson’s attorneys said showed how the company had repeatedly rejected critical research and expert warnings. Some evidence suggested that Monsanto had also strategized plans to “ghostwrite” favorable research. Monsanto, which was bought by pharmaceutical giant Bayer earlier this year, has continued to argue that Roundup does not cause cancer and that critics are “cherrypicking” studies while ignoring research that showed its products were safe.

The jury disagreed. They ruled that Johnson also deserved $250m in punitive damages and $39.2m for losses. When the verdict was announced, Johnson said his body briefly went into a kind of shock. “I felt like all the fluids went out of my body and rushed back in,” he recalled. The jury’s unanimous decision said Monsanto’s products presented a “substantial danger” to people and the company failed to warn consumers of the risks. “They have been hiding for years and getting away with it,” Johnson said. “They have to pay the price for not being honest and putting people’s health at risk for the sake of making a profit.”

Prior to the verdict, Johnson said he had no expectations about the outcome. “I never really discussed winning or money or amounts with the legal guys,” he said, adding that he did fear the implications of a Monsanto win: “If we lose, the facts won’t keep coming out. That would be the worst part.” Pedram Esfandiary, one of Johnson’s lawyers, said he was consistently impressed with Johnson’s ability to remain optimistic and focused on exposing the facts and protecting others from Roundup hazards. “This guy is dealing with the reality of his mortality,” he said. “His life is on the line because of what happened … He was concerned about getting the truth out.”

Time for a boycott. Demand labels that say whether glyphosate was used in crops.

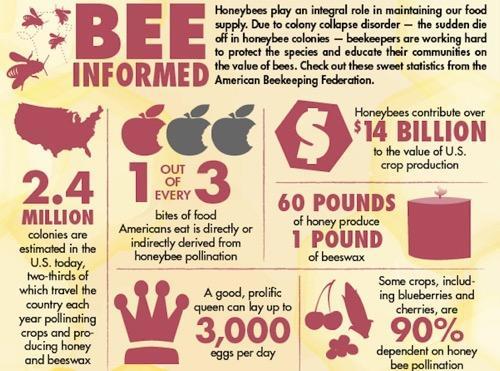

• Monsanto’s Glyphosate Linked To Global Decline In Honey Bees (ZH)

In recent times, US beekeepers have reported a massive loss of bees or CCD. Millions of bees mysteriously disappeared, leaving farms with fewer pollinators for crops. Officials have been baffled, and the media has been quite about the bee population collapse. Explanations for the phenomenon have included exposure to pesticides or antibiotics, habitat loss, and bacterial infections. The latest study now adds herbicides to the list as a possible contributing factor. “It’s not the only thing causing all these bee deaths, but it is definitely something people should worry about because glyphosate is used everywhere,” said Motta.

And that, researchers, believe, is evidence that glyphosate might be contributing to the collapse of honeybees around the world. The Western honeybee, the world’s premier pollinator species, has been in high demand for its services on fruit, nut, and vegetable farmers. Among the nuts, almond growers have the largest need for bee pollination. Bee pollination is worth $15 billion to the US farming industry.

Any sharp change in global bee populations could affect the beef and dairy industries. Bees pollinate clover, hay, and other forage crops. As the bee population dwindles, it increases the cost of feedstock. That forces inflation into beef and milk prices at the grocery store and ultimately hurts the American consumer. This could then lead to increased imports of produce from foreign countries where bee populations are healthy, further widening the trade deficit. Couple this with the current trade war and this particular “black swan” – or rather “black bee” – problem, may be just the tipping point that finally forces the US economy to catch down to the rest of the world.

EU starts investigating abuse of funds. Been going on for years now. 30% of people have attempted suicide.

• IRC Warns Of Mental Health Crisis On Lesbos As Greece Moves Asylum Seekers (R.)

Greece moved another 400 people from its biggest migrant camp on Tuesday as the International Rescue Committee (IRC) charity warned of a mental health emergency there with 30 percent of people having attempted suicide. The government, under pressure from aid groups and local authorities, has said it will transfer 2,000 people from Moria camp on Lesbos to the mainland by the end of the month. In a report published on Tuesday, the IRC said asylum-seekers in Moria, most of whom are Syrian, Iraqi and Afghan, were under “enormous mental strain”. Citing testimonials of patients who have visited its own clinic on the island, IRC said that in addition to the 30 percent of people who had attempted suicide about 60 percent had contemplated it.

“Several times I have attempted suicide,” it quoted Ahmad, a 35-year-old Iraqi single father of four children as saying. “The only reason I am glad I didn’t succeed is because of the children.” Asylum seekers were living in conditions that did not meet humanitarian standards, IRC said. Eighty-four people shared one shower and 72 shared one toilet. “The sewage system is so overwhelmed that raw sewage has been known to reach the mattresses where children sleep, and flows untreated into open drains and sewers,” IRC said. Moria, in a disused military base, now holds nearly three times as many people as it was designed to, according to government figures, forcing hundreds to spill over in tents in an olive grove.

Close to 900 people were moved between Sept. 10-20 and a another 1,000 will be transferred this week, Migration Minister Dimitris Vitsas said on Monday. Most are taken to facilities in northern Greece.

Oh, to once have met one, just the once.

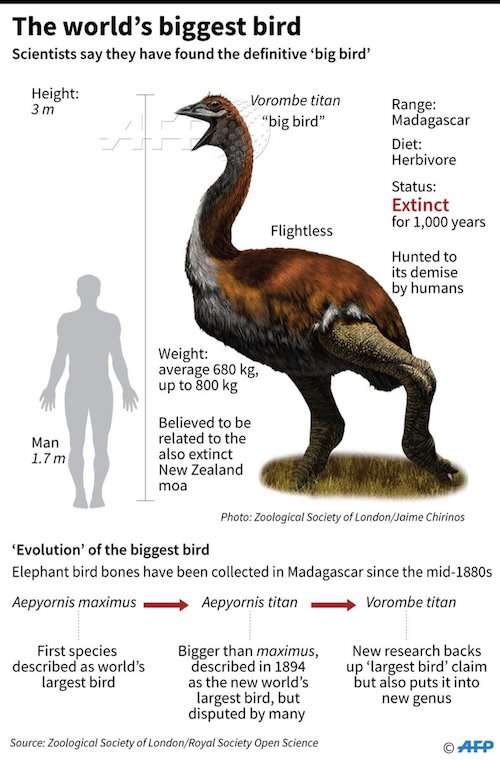

• Ending Decades Of Doubt, ‘Biggest Bird’ Dispute Put To Nest (AFP)

[..] scientists said Wednesday they have finally solved the riddle of the world’s largest bird. For 60 million years the colossal, flightless elephant bird — Aepyornis maximus — stalked the savannah and rainforests of Madagascar until it was hunted to extinction around 1,000 years ago. In the 19th century, a new breed of buccaneering European zoologist obsessed over the creature, pillaging skeletons and fossilised eggs to prove they had discovered the biggest bird on Earth. But a study released Wednesday by British scientists suggests that one species of elephant bird was even larger than previously thought, with a specimen weighing an estimated 860 kilogrammes (1,895 pounds) — about the same as a fully grown giraffe.

“They would have towered over people,” James Hansford, lead author at the Zoological Society of London, told AFP. “They definitely couldn’t fly as they couldn’t have supported anywhere near their weight.” In the study, published in the journal Royal Society Open Science, Hanson examined elephant bird bones found around the world, feeding their dimensions into a machine-learned algorithm to create a spread of expected animal sizes. Until now, the largest-ever elephant bird was described in 1894 by the British scientist C.W. Andrews as Aepyornis titan — a larger species of Aepyornis maximus. But a French rival of Andrews dismissed the discovery of titan as just an outsized maximus specimen, and for decades the debate remained deadlocked.

Hanson said his research proved titan was indeed a different species. But he also found that its bones were so distinct from other elephant bird specimens that titan was in fact an entirely separate genus. Named Vorombe titan – Malagasy for “big bird” – the creature would have stood at least three metres (10 feet) tall, and had an average weight of 650 kilogrammes, making it the largest bird genus yet uncovered. “At the extreme extent we found one bone that really pushed the limits of what we now understand about bird size,” said Hanson, referring to the 860-kilogramme specimen. “And there were some that led up to that too, so it’s not an outlier — there was a range of masses that are extraordinarily large.”