Paul Gauguin The ford � 1901

First, here’s Ted Koppel agreeing with me that Trump Sells Better Than Sex, and Stelter really doesn’t understand:

Video: To consternation of @BrianStelter, Ted Koppel contended during 10/1 Kalb Report @PressClubDC: “You would be lost without @realDonaldTrump. CNN’s ratings would be in the toilet without Trump.” Stelter: “Ted, you know that’s not true. You’re playing for laughs.” #NPCLive pic.twitter.com/XGZl9yNzqh

— Brent Baker (@BrentHBaker) October 3, 2018

And then he closed the spigots…

• Fed’s Powell Says US Outlook ‘Remarkably Positive’ (R.)

U.S. Federal Reserve Chairman Jerome Powell on Tuesday hailed a “remarkably positive outlook” for the U.S. economy that he feels is on the verge of a “historically rare” era of ultra-low unemployment and tame prices for the foreseeable future. It is a view, he said, based on how a changed economy is operating today, with businesses and households immunized by strong central bank policy from the inflationary psychology that caused unemployment, inflation and interest rates to swing wildly in the 1960s and 1970s. It is an outlook that includes an economic performance “unique in modern U.S. data,” with unemployment of below 4 percent expected for at least two more years and inflation remaining modest even as wages rise.

And it is an outlook he feels will even survive the Trump administration’s efforts to rewrite the global trading system, a policy shift Powell said may lead to one-time price hikes, but not to persistent changes in the annual rate of inflation going forward. “This forecast is not too good to be true,” Powell told the National Associate for Business Economics, but instead “is testament to the fact that we remain in extraordinary times.” “These developments amount to a better world for households and businesses which no longer experience or even fear the scourge of high and volatile inflation.”

There can be no doubt.

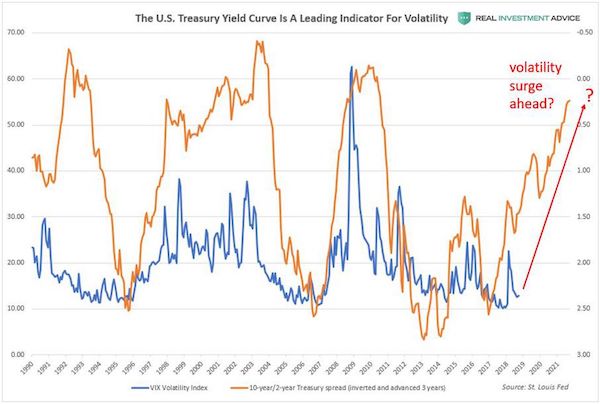

• Another Market Volatility Surge Is Likely Ahead (Colombo)

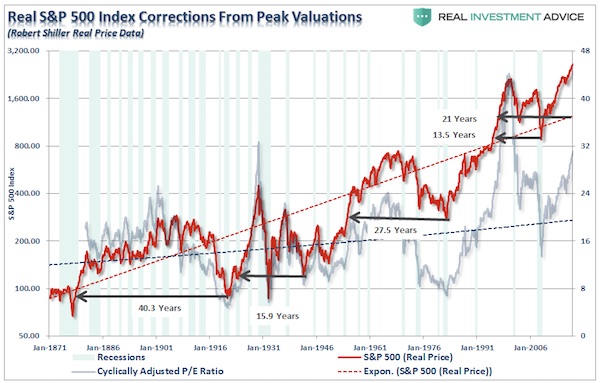

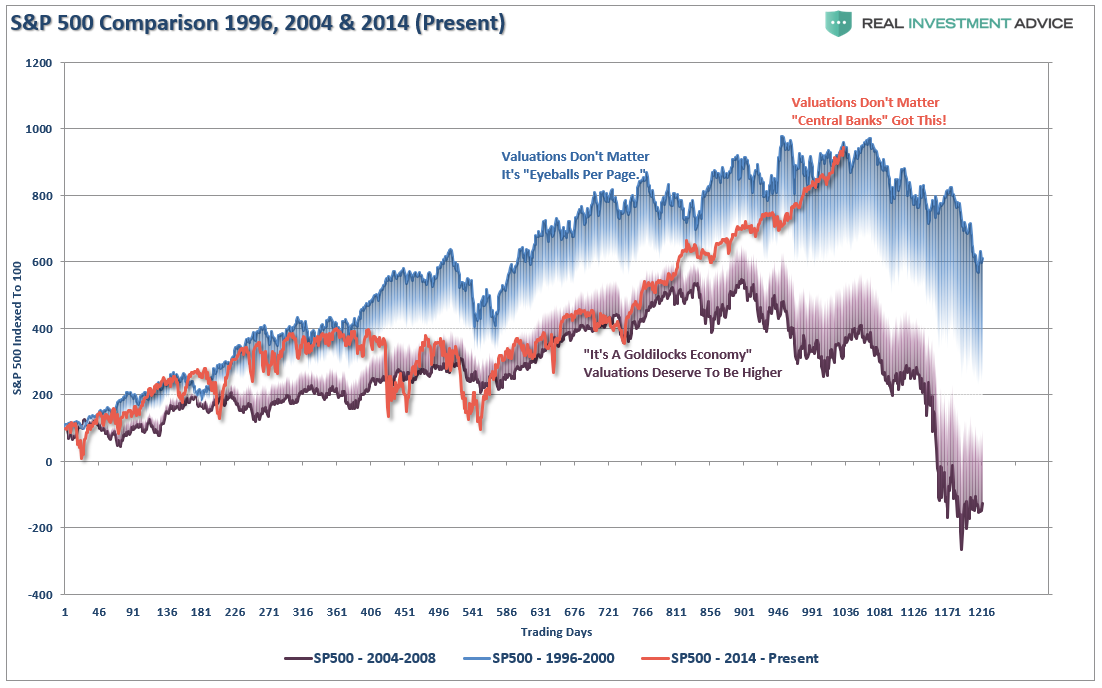

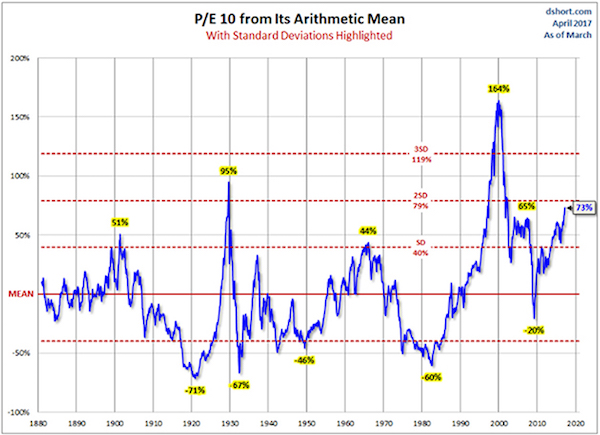

The U.S. stock market is climbing to record highs once again and volatility has calmed down dramatically from its panic-induced levels reached earlier this year. Traders have become complacent as they passively ride the stock market higher and bet on lower volatility again. While it may seem like all is well, several reliable indicators are warning that another powerful volatility surge is likely ahead.

The first indicator is the 10-year/2-year Treasury spread that is calculated by subtracting the 2-year Treasury note yield from the 10-year Treasury note yield. The 10-year/2-year Treasury spread is helpful for estimating when the next recession is likely to occur, as I explained in a recent Forbes piece. The chart below (which I recreated from a chart made by BofA’s Savita Subramanian) shows that the inverted 10-year/2-year Treasury spread leads the CBOE Volatility Index or VIX by approximately three years. If this historic relationship holds true, we are about to experience a whole lot more volatility over the next few years.

The next chart shows the positioning of the “smart money” and “dumb money” in the Volatility Index or VIX futures. The “smart money”, or commercial futures hedgers (who tend to be right at major market turning points), are building up another bullish position in VIX futures, just like they did one year ago ahead of the stock market correction and volatility spike. In addition, the “dumb money”, or large traders (who tend to be wrong at major turning points), have built up a large short position, like they did before the early-2018 volatility spike. The positioning of these groups of traders indicates that another volatility spike is likely ahead in the not-too-distant future.

Decades old, started when Trump was a toddler, good luck. Of course they pay as little as they can, but once the IRS signs off on it…

• White House Responds To “Misleading” NYTimes’ Trump Tax Fraud Story (ZH)

Update 2: The White House has finally responded to the NYTimes story…(via Sarah Sanders) “Fred Trump has been gone for nearly twenty years and it’s sad to witness this misleading attack against the Trump family by the failing New York Times. Many decades ago the IRS reviewed and signed off on these transactions. The New York Times’ and other media outlets’ credibility with the American people is at an all time low because they are consumed with attacking the president and his family 24/7 instead of reporting the news.

The truth is the market is at an all-time high, unemployment is at a fifty year low, taxes for families and businesses have been cut, wages are up, farmers and workers are empowered from better trade deals, and America’s military is stronger than ever, yet the New York Times can rarely find anything positive about the President and has tremendous record of success to report. Perhaps another apology from the New York Times, like the one they had to issue after they got the 2016 election so embarrassingly wrong, is in order.”

The NYT reported that Trump and his siblings set up a “sham” corporation to help disguise otherwise taxable income that came from gifts from their parents. The president also allegedly helped his father take improper tax deductions that amounted to millions of dollars and helped formulate strategy to undervalue his parents’ real estate holdings, with the Internal Revenue Service reportedly providing little pushback against the Trumps’ reported tactics. According to the leaked confidential filings, Trump’s parents left more than $1 billion to their children, which would have resulted in a roughly $550 million tax bill at the time.

However, the Trumps paid a total of $52.2 million on that source of income, according to the NYT report. To achieve this, the newspaper cited records that showed Trump helped undervalue his father’s real estate holdings, which led to a lower tax bill when he and his siblings inherited the properties. In total, Trump received the equivalent today of at least $413 million from his father’s real estate empire, based on questionable tax dealings starting when he was a toddler and continuing to this day. And, in what will attract the most attention, the newspaper wrote that Trump’s behavior amounted to fraud in some cases.

I don’t think this one’s over yet.

• Italy Folds To Europe On Budget Deficit; Euro Surges (ZH)

After two days of brutal punishment by the markets which sent Italian bond yields to 4 years highs and slammed the euro, the Italian government appears to have folded to pressure from Brussels (and the one place in the world where the bond vigilantes still operate, just ask Sylvio Berlusconi), and according to Corriere della Sera, Italy’s draft budget plan will pledge to cut the deficit to 2% in 2021, after Rome reversed a proposal to maintain a 2.4% shortfall in the face of pressure from the EU. As a result, while the 2019 deficit will still rise to 2.4% of GDP in 2019, it will decline by 0.2% to 2.2% in 2020, and another 0.2% the year after. In kneejerk reaction, futures lept to fresh session highs, Treasury yields jumped by 2bps to 3.07% and the EURUSD spiked 50 pips higher to 1.1590.

Italy is not out of the woods yet though: according to Mizuho, the sustainability of the euro’s rebound will depend on whether the EU sees Italy’s latest budget plan as appropriate. It could be that Italy has already made compromise with the EU, but hard to predict whether the euro’s rebound has more legs until we see a reaction from the EU: “It all boils down to the EU’s response”, and if the ongoing war of words is any indication, merely promising to trim the deficit in the next three years will hardly be smiled upon. Others were even more skeptical. According to bond fund manager Daintree Capital, “The euro’s definitely reacting to the headlines on Italian budget plans, and it will continue to do so for future headlines.” However, “anyone who believes a populist government is all of a sudden going to be particularly responsible in a fiscal sense, has a misguided view.”

Merkel’s losing it.

• Merkel’s End Could Spark EU Breakdown (Luongo)

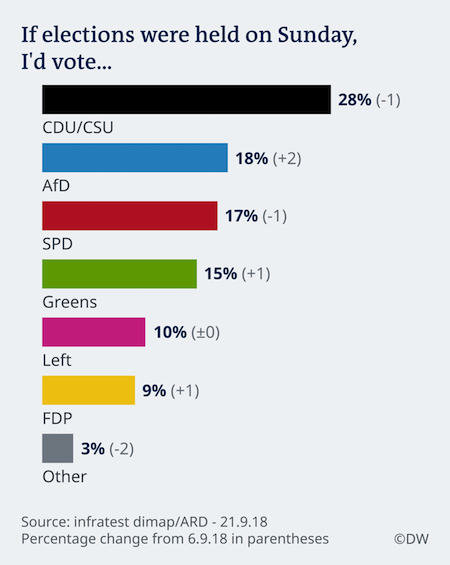

I saw a recent poll from Die Welt which has Alternative for Germany (AfD) creep past Merkel’s Grand Coalition partner, the Social Democrats (SPD), and challenge the CDU itself. Because when you back out the Christian Social Union’s (CSU) total which runs between 8% and 9% AfD is now in a position to become the party with the highest backing in Germany. And this is happening on the eve of Bavarian State elections this month. [..] I’ve talked about AfD’s chances to achieve this result in the past in terms of them crossing the 16% Chasm. And it appears, that slowly, they are doing so. German politics, from what I understand, is not used to this kind of upheaval and certainly not these kinds of leadership challenges. Earlier this year Merkel barely survived a challenge by former CSU Leader Horst Seehofer over immigration.

So, where to things go from here? As Mercouris points out, Merkel has very skillfully gutted the landscape of the CDU to keep potential leaders from emerging within the party. The SPD is falling off a cliff having lost more than half of its support since the 2014 elections. And the CSU is primarily a Bavarian party so they don’t have the support of the entirety of Germany. This landscape is why we’ve seen the Greens rise to 15% as well as AfD’s rise. And that cannot be ignored. The hard left of German politics is now split and ineffectual. But, no party has emerged in this chaos to take the reins of power.

This is reminding me of Italy’s situation at the end of 2017 with no less than five parties polling in double digits. It’s a messy situation and it makes more sense in Germany that big shifts in voter preference would occur at a slower rate given the stability of German coalition governments since the modern state was founded after World War II. In other words Germans are loathe to make these kinds of changes. So, you know the situation must be bad if these numbers are changing this quickly. So, it shouldn’t be much of a surprise really to see this type of breakdown and the slow rise of AfD past the 16% chasm. It may be the riots in Chemnitz that finally begin pushing their poll numbers into the 20’s nationally.

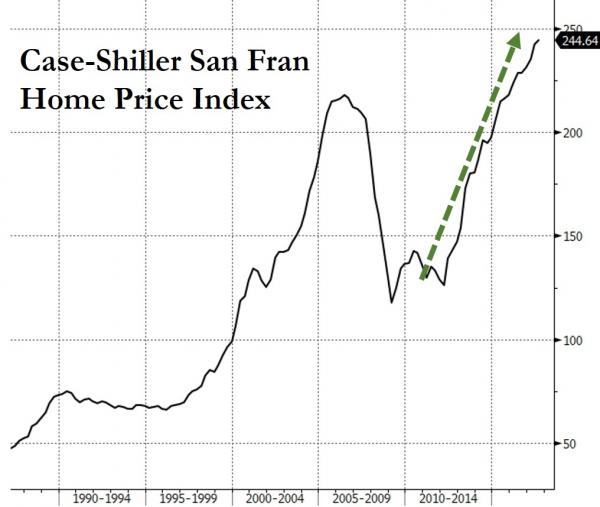

Glass half full: “”There’s more selection for home buyers to choose from today.”

• Vancouver Home Sales Crash 44% As “For Sale” Inventory Soars (ZH)

What happens when prices rise so high that a chasm forms between bids and asks? The market grinds to a halt. That’s what happened in Vancouver housing in September, when according to the Real Estate Board of Vancouver (REBGV), residential property sales tumbled by 17.3% from August 2018, and a whopping 43.5% from one year ago. In fact, a total of only 1,595 transactions took place as both buyers and sellers continue to sit on their hands amid confusion whether the recent torrid price gains will continue or whether the housing bubble has burst. Sales of detached properties in July was just 508, a decrease of 40.4% from the 852 recorded in September 2017, and the 812 apartments sold was a 44% drop compared to the 1,451 sales in September 2017.

And no, it’s not seasonal: last month’s sales were a whopping 36.1% below the 10-year September sales average. The reason for the collapse in transactions: the formerly all too willing buyers, mostly Chinese oligarchs who would use Vancouver real estate as their offshore Swiss bank account, have disappeared. Meanwhile sellers are dumping properties in the market in hopes of a quick flip. “Fewer home sales are allowing listings to accumulate and prices to ease across the Metro Vancouver housing market,” Ashley Smith, REBGV president-elect said. “There’s more selection for home buyers to choose from today. Since spring, home listing totals have risen to levels we haven’t seen in our market in four years.”

What would we do without our housing bubble?

• Australia Banking Royal Commission Could Trigger House Price Collapse (ABC.au)

There is a lot riding on the policy recommendations from the banking royal commission, not least of which is the stability of the Australian property market, according to some respected analysts. Independent economist Saul Eslake said there was potential for the royal commission’s recommendations to have what economists refer to as “unintended consequences”. The unintended consequences Mr Eslake is referring to include a steep fall in house prices spurred on by a royal commission-inspired clampdown on bank lending. Capital Economics chief economist Paul Dales said while house price falls to date have been small, Australia could be in for a record housing decline, at least in its recent history.

“At the moment the trajectory is a bit worrying cause the house prices seem to be declining at a faster rate and, in our view at Capital Economics, this will eventually prove to be the largest downturn in Australia’s modern history,” he said. Mr Dales is forecasting a protracted slowdown in the housing market as a result of a crackdown in bank lending standards, the banking royal commission itself and rising interest rates. “There’s significant time delays with these things,” he said. “I would have thought over the next six to 12 months is where we would, if there was going to be a big pullback in lending, that’s when we would see it and then, thereafter as and when the royal commission makes any recommendations and the Government implements them, the next six to 12 months after that.

Korea’s move on.

• DMZ Demining Operations Lay Groundwork For Korean Peninsula Peace (YH)

After a 15-minute bumpy ride along a dusty, hilly path inside the Demilitarized Zone (DMZ), dozens of South Korean troops in full gear disembarked near a grisly site of intense battles during the 1950-53 Korean War. Accompanying them in the buffer zone separating the two Koreas was a phalanx of security guards, medical specialists and other personnel specializing in disposing of unidentified explosives and excavating war remains. They are part of the 120-member team tasked with removing landmines in the Arrowhead Ridge, or Hill 281 in Cheorwon, some 90 kilometers northeast of Seoul — a site that the two Koreas have designated for a joint project to retrieve war remains from April to October next year.

There were three key battles against communist forces on the notorious ridge from 1952-53. The remains of more than 200 South Korean soldiers and dozens of U.N. Command (UNC) forces, such as U.S. and French troops, are thought to be buried in it. “We have made preparations (for the landmine removal) for a long period and are well prepared now,” the commander in charge of the frontline areas told reporters on condition of anonymity on Tuesday, the second day of the demining work set to continue until Nov. 30. “We will not rush and will carry out our mission with the first and foremost priority placed on the safety of our troops,” he added.

EU and NATO want to keep pushing, but how about democracy?

• Russia May Veto Greece-FYROM Name Deal at the UN (GR)

Russia is implicitly threatening that it may block the Prespa agreement at the UN Security Council. In a statement on Monday, following the referendum in FYROM, the Russian foreign ministry says that the low turnout “means that the referendum cannot be recognised as valid.” It clearly indicates that the voters “chose to boycott the solutions imposed on Skopje and Athens.” The statement also blasts leading politicians from NATO and EU member states who participated in “large-scale propaganda campaign directly, freely interfering in the internal affairs of this Balkan state.” Despite the low turnout, Prime Minister Zoran Zaev vowed to push ahead with the name change on Monday.

The Russian foreign ministry condemned the move: “There is a clear drive to ensure Skopje’s entanglement in NATO despite the will of the Macedonian people.” Russia is traditionally wary of NATO’s enlargement in eastern Europe. The alliance’s 1999 bombings of its ally Serbia caused a major rift in Russia’s relations with the West at the time. Moscow says that a long-term solution can only be agreed upon by the two parties on their own, without any external interference, and only within the framework of the law and with broad public support.

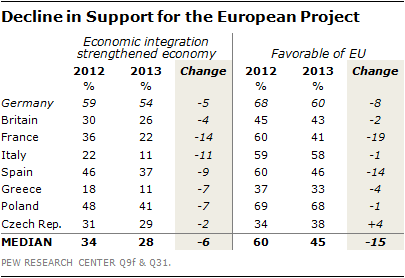

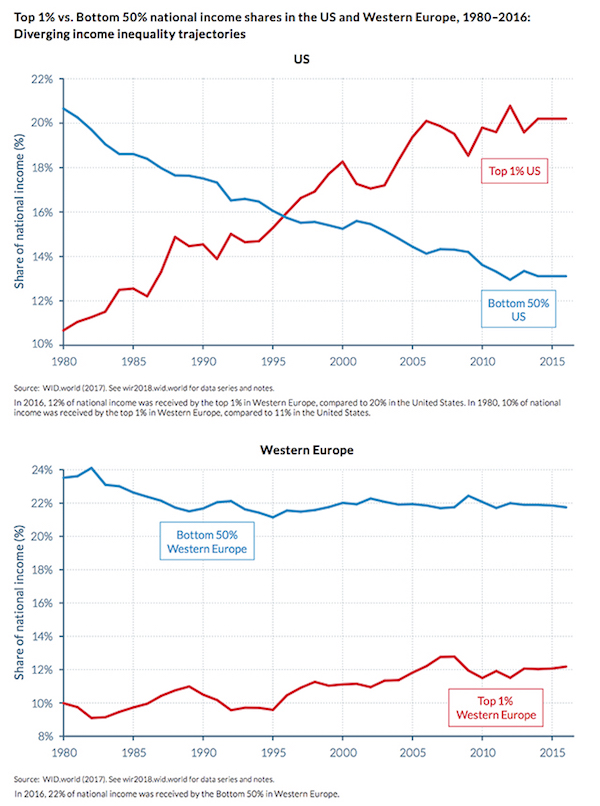

Inequality in Europe rises fast, too. Where are the breaking points?

• The Case For Paying Every American A Dividend On The Nation’s Wealth (MW)

The newest research shows that unconditional cash transfers boost work productivity and quality of life, including better mental and physical health, and reduce crime. A study by the Roosevelt Institute in New York, a left-leaning think tank, concludes that giving $500 a month to every adult American could meaningfully grow the U.S. economy and address its widening wealth gap. (The top 1% of Americans now receive 20% of the national income, while those in the bottom 50% receive 13%; in 1980, the numbers were essentially reversed, at 11% and 20%, respectively, according to the 2018 World Inequality Report.)

Yet basic income in the U.S., characterized as a utopian solution by its true believers but as welfare, socialism or worse by its detractors, has gone nowhere. Basic income did enjoy a bit of a heyday in the U.S. in the 1960s and 1970s and was even embraced in conservative circles; free-market economist Milton Friedman went so far in 1962 as to propose a negative federal income tax that would guarantee a basic income to the poorest Americans while also incentivizing work. Other ideals of the era — the four-day workweek, the 30-hour workweek, the all but limitless vacation allotment — have fallen by the wayside, even as U.S. labor conditions have worsened.

In France, this is a nation-wide law.

• Restaurants In Austin Banned From Throwing Away Food (Hill)

Restaurants in Austin, Texas, will no longer be allowed to throw out food waste, the city announced this week. Under a new policy that began Monday, all food-permitted businesses in the city are required to keep organic material, such as food scraps and soiled paper products, from landfills. Businesses can dispose of their food waste by donating extra food, giving scraps to local farms for animals, or composting, the city government said in a press release announcing the policy.

The city’s Universal Recycling Ordinance also requires businesses to provide employees with training on organic waste diversion, and to post information about the plan. Official city data shows that 37 percent of material sent to landfills is organic and could have otherwise been donated or composted, the city said. Austin’s ordinance is the latest move by a major city to introduce eco-friendly policies. Dozens of cities and businesses nationwide have banned plastic straws and other single-use plastic items in an effort to cut down on waste.

Welcome to Europe.

• ‘We Have Found Hell’: Trauma Runs Deep For Children At Dire Lesbos Camp (G.)

The drawings tell of trauma. Stormy seas dotted with terrified faces. Lifeless bodies of children floating among the waves. And planes dropping bombs, down on to homes and on to people. Eyes that weep blood. The pencil scrawls were made by children who are part of a growing phenomenon in the Moria refugee camp in Lesbos, Greece. All have attempted suicide or serious self-harm since they came to this place. Approximately 3,000 minors live in the Moria camp, which Médecins Sans Frontières (MSF) calls a giant open-air “mental asylum” owing to the overcrowding and dire sanitary conditions. Last Tuesday an adolescent attempted to hang himself from a pole. In August, a 10-year-old boy only just failed to take his own life.

The camp, among hills dotted with olive trees a few kilometres from the island’s capital town of Mytilene, is home to 9,000 asylum seekers living in a centre designed to hold one third of that number. Migrants live in groups of up to 30 people, crammed into tents or metal containers situated just centimetres apart. Rubbish, scattered everywhere, makes the air almost unbreathable. Most come from war-torn countries like Syria, Iraq and Afghanistan. They arrive in dinghies from the Turkish towns of Ayvalik or Canakkale. According to aid agencies, the controversial deal brokered between Brussels and Ankara aimed at stopping the flow of migrants to Europe via Turkey, combined with the refusal on the part of European countries to take in asylum seekers arriving in Greece, have transformed Lesbos into an Alcatraz, leaving people imprisoned on the island with no way out.

“Although the vast majority of migrants who arrive in Moria are traumatised, after having fled from violent conflicts in their home countries, conditions in the camp have exacerbated their trauma,” says Luca Fontana, field coordinator of MSF on the island. “After two years, some are still awaiting transferral, even if they know they could be deported to Turkey at a moment’s notice. I’ve worked in camps infested with Ebola in Sierra Leone and Guinea, but I guarantee you that this is the worst situation I’ve ever seen.”