Jean-Michel Basquiat Untitled 1982

How old is the president?

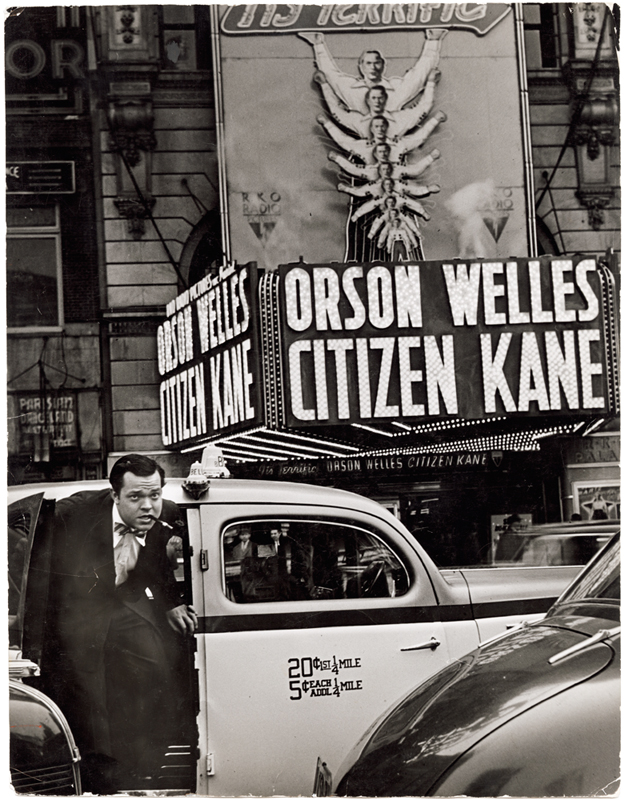

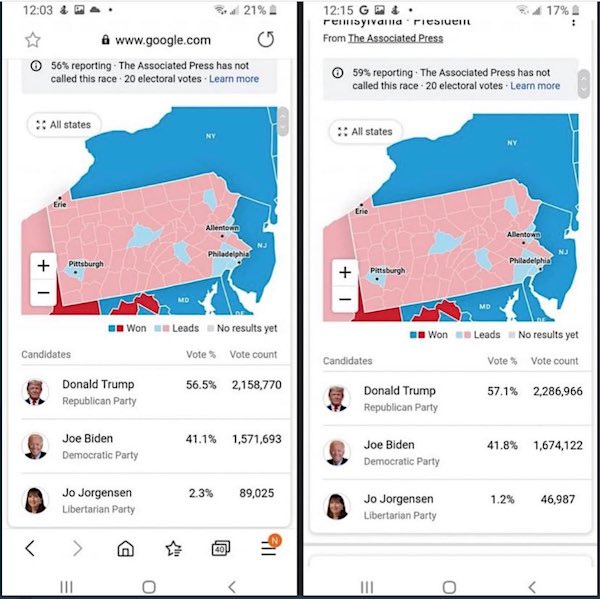

Has someone explained this “glitch”? pic.twitter.com/qlsRJR60uF

— Cerno (@Cernovich) November 9, 2020

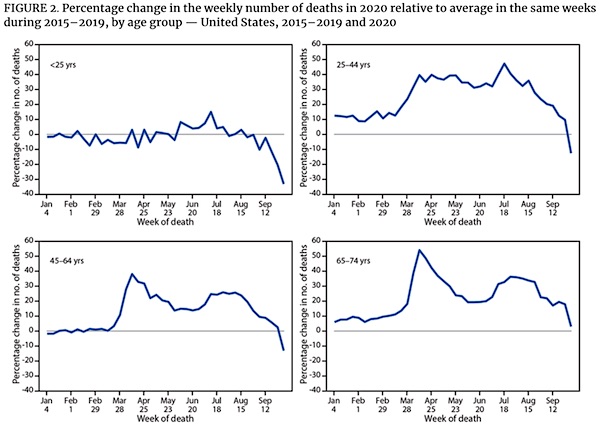

“Listen to the science” becomes hollow and meaningless when scientists start contradicting each other. Because it shows there is no such thing as “the science”.

• COVID Risk Exaggerated, Talk Of A Second Wave Misleading – 500 Academics (DM)

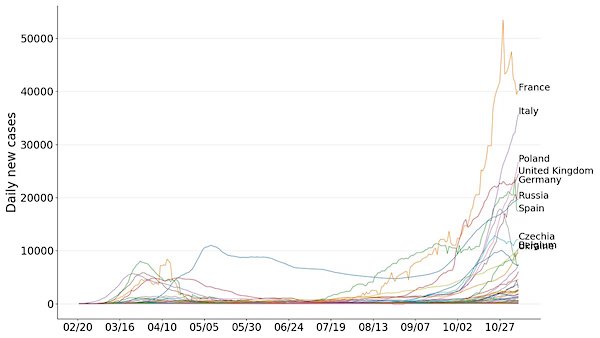

Official data is ‘exaggerating’ the risk of Covid-19 and talk of a second wave is ‘misleading’, nearly 500 academics told Boris Johnson in open letter attacking lockdown. The doctors and scientists said the Government’s response to the coronavirus pandemic has become ‘disproportionate’ and that mass testing has distorted the risk of the virus. They said tests are likely to be producing high numbers of ‘false positive’ results and the Government must do more to put infection and death rates within the context of normal seasonal rates. The letter criticised the Government’s handling of coronavirus for ‘causing more harm than good’. It comes after the UK yesterday confirmed a further 24,957 positive Covid tests, up just 13.9 per cent on last week’s total.

Top scientists suggested the UK’s second wave of coronavirus has already peaked. Professor Tim Spector, who leads the Covid Symptom Study app aiming to track the spread of Covid-19 in the UK, confirmed that there were ‘positive signs’ the country has ‘passed the peak of the second wave’. The open letter to the Prime Minister was signed by 469 medics and is titled First Do No Harm – the medical principle that a cure must never be worse than the disease itself. It is signed by immunologist Dr Charlotte R Bell, paediatrician Dr Rosamond Jones, consultant surgeon and Keith Willison, Professor of Chemical Biology at Imperial College.

The letter reads: ‘The management of the crisis has become disproportionate and is now causing more harm than good. ‘We urge policy-makers to remember that this pandemic, like all pandemics, will eventually pass but the social and psychological damage that it is causing risks becoming permanent. ‘After the initial justifiable response to Covid-19, the evidence base now shows a different picture.

Mask mandates in the US are an invitation for unrest.

• Biden’s First Move As President-elect? Mask Mandate For All (Fox)

One of Joe Biden’s first priorities as president-elect will be implementing mask mandates nationwide by working with governors. The future 46th president, however, says if they refuse than he will go to mayors and county executives and get local masking requirements in place. Fox News medical contributor Dr. Marc Siegel believes that while masks are “the icing on the physical distancing cake” and should be worn properly both indoors and outdoors, especially when people are too close together, a more punitive approach to mask wearing may have the opposite impact of what the administration intends.

“I think masks are quite useful, but they have a place and they’re not the be all and end all,” Siegel said. “I’m worried that mandating this with fines and such may actually lead to more of a rebellion against it.” He noted that the use of masks should be determined based on how much of the risk of exposure to the coronavirus is in a specific area rather than mandating it everywhere. As for social distancing, Biden’s plan says it will be used as more of a “dial” approach that will determine the risk of spread using evidence-based guidance from the Centers for Disease Control and Prevention, a move Siegel says is a mistake.

“I don’t think social distancing is dial. I think masks are a dial,” Siegel said. “Social distancing is something we should just be doing right now. You never know how much virus was in the community.” He believes physical distancing is actually more important to curbing the spread than masks are. “I think physical distancing is more important than masks,” Siegel argued. “If you’re 10 feet away from someone, you’re not going to get the virus. If you’re one foot away with a mask, you might.”

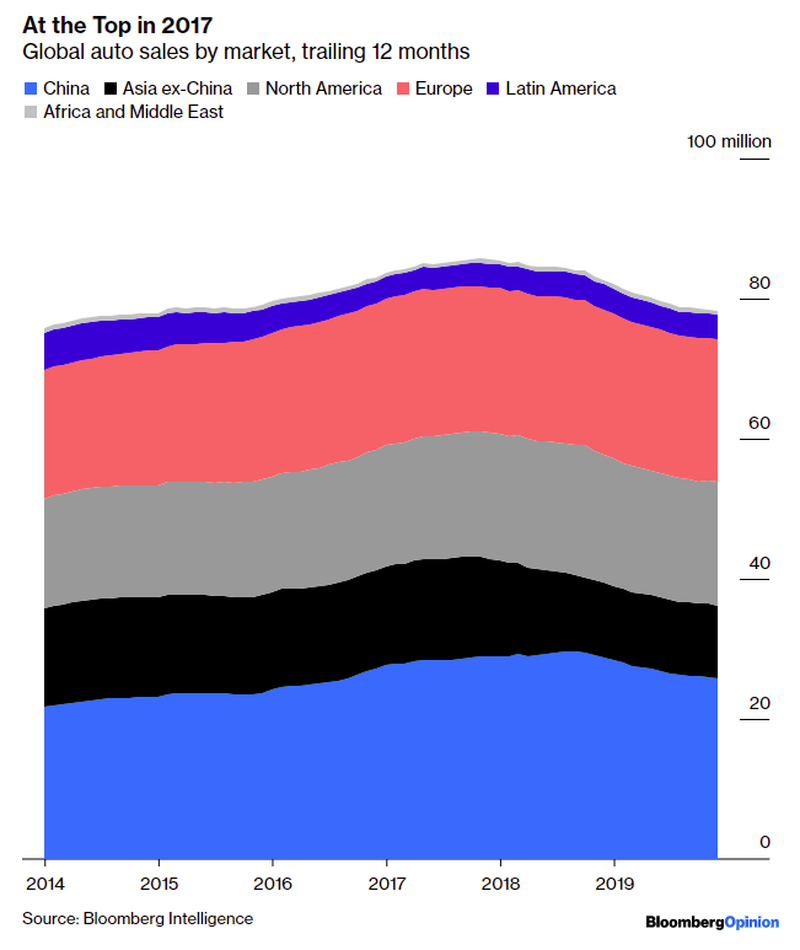

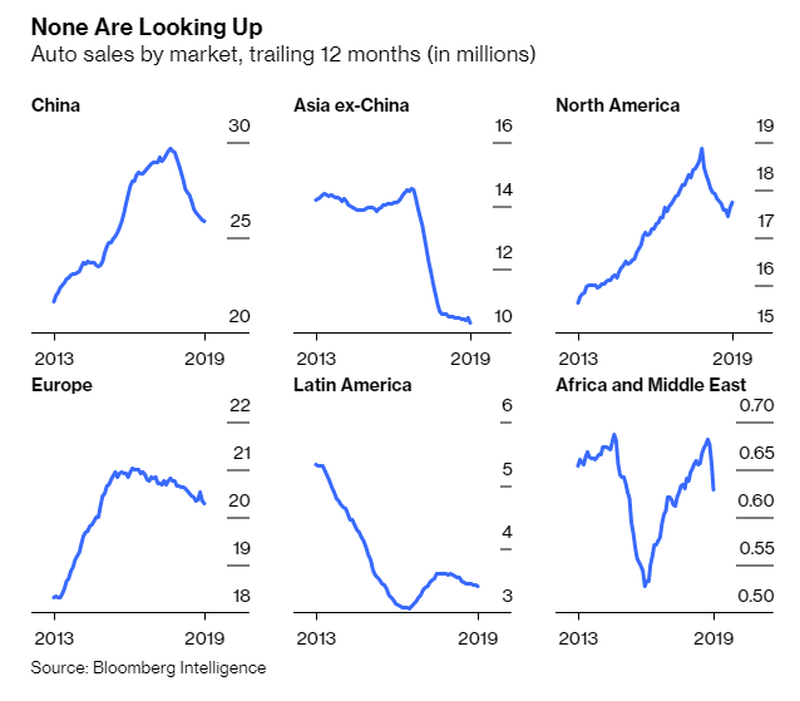

But not nearly as much as the destruction of public transport did.

• COVID Set Back Attitudes To Public Transport By Two Decades (G.)

The pandemic has put back attitudes to driving versus public transport by two decades, with almost two-thirds of UK car owners now considering their vehicle essential, research has found. A clear majority would now refuse to switch to a greener alternative even if better trains or buses were available, according to the RAC. The research for its annual Report on Motoring found reluctance to use public transport was now at its highest for 18 years. Compared with 2019, significantly more young drivers, and those living in the capital – around 65% of each – regard their vehicle as essential.

Although 50% reported actually using their car less overall this year, with 33% of the 3,000 respondents currently working from home, more than half, some 57%, perceived access to a car as more important now than before the coronavirus pandemic. While 54% said safety was a consideration, an increasing number now deemed a car necessary to shop or visit friends. Meanwhile, only 43% agreed they would use their cars less if there was better public transport, a sharp fall from 57% in 2019, and the lowest figure since 2002. The findings will further concern transport campaigners, with optimism dwindling that lower traffic volumes and increased cycling and walking could be maintained as a positive side-effect after the pandemic.

Cycling trips fell significantly below pre-pandemic levels in October, and people largely continued to avoid public transport. Passenger numbers were around 30% of normal demand on rail, and 60% on buses, while car use had risen to around 90% of pre-pandemic levels, according to the latest government figures up to last Monday. Other sources showed road traffic leapt in the following days before new lockdown restrictions, with data from satnav providers showing some of the worst congestion in two years on Wednesday.

Something I’ve mentioned numerous times:

“Numerous media outlets that in 2015 were sputtering if not collapsing, and numerous television personalities about to be fired because nobody was watching them, were first rescued and then propelled into the stratosphere by The Trump Show.”

• The Bush/Cheney Administration Was Far Worse Than Trump (Greenwald)

That the liberal belief in and fear of a Trump-led fascist dictatorship and violent coup is actually a fantasy — a longing, a desire, a craving — has long been obvious. The Democrats’ own actions proved that they never believed their own melodramatic and self-glorifying rhetoric about Trump as The New Hitler — from their leaders joining with the GOP to increase The Fascist Dictator’s domestic spying powers and military spending to their (correct) belief that the way to oust The Neo-Nazi Tyrant was through a peaceful and lawfully conducted democratic election in which vote totals and, if necessary, duly constituted courts would determine the next president. The motives for concocting this Wagnerian fantasy about coups, dictatorship, concentration camps and civil war are numerous.

Politics is boring, and your life unspectacular, if it’s dedicated to a goal as banal and uninspiring as empowering a septuagenarian career-politician — the centrist-authoritarian author of the 1994 Crime Bill, the credit card industry’s most loyal servant, and key Iraq War advocate — along with his tough-on-crime prosecutor-running-mate who always seems as if she just left a meeting of the Aetna Board of Directors where massive hikes in deductibles were approved. Glory is available only if one can convincingly herald oneself as a front-line warrior risking it all to courageously battle unprecedented evil and a Nazi-like menace. But working to do nothing more than elect Joe Biden, Kamala Harris and the rest of the painfully ordinary and mediocre corporatist and imperialist Democratic Party politicians through a standard American election?

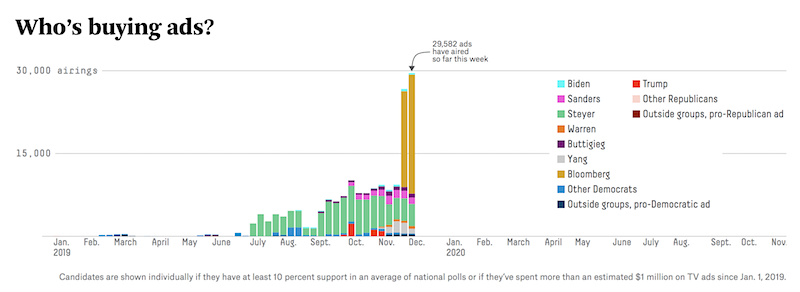

There’s no glory residing in that, no courage needed for it, to put it mildly. Posturing as a courageous soldier in an existential battle for freedom, democracy and the survival of the marginalized against Nazi despotism is far more exciting and psychologically satisfying (and financially profitable) than being an obedient liberal drone marching in perfect tune to the dreary, McKinsey-scripted musical theater produced by Tom Perez and the DNC. That is therefore the delusional storyline adopted by many. Then there’s the multi-pronged profit that the Trump-as-Hitler motif has generated for virtually every institution of American authority. Numerous media outlets that in 2015 were sputtering if not collapsing, and numerous television personalities about to be fired because nobody was watching them, were first rescued and then propelled into the stratosphere by The Trump Show.

“It may not be good for America, but it’s damn good for CBS,” said the network’s then-CEO Les Moonves in 2016 about Trump TV. Of course media outlets don’t want to declare the 2020 election over: they will milk the abundant Trumpian cash cow until the very last drop has been monetized. The frightening spectre of a Dictatorial Menace also led liberal advocacy groups such as the ACLU to drown in previously unimaginable quantities of #Resistance cash, frenetically donated in the name of stopping Trump’s incomparable evil. Rotted and discredited institutions like the CIA, NSA and FBI re-branded themselves as patriotic guardians of liberal democracy and stalwart protectors of a besieged population.

First cases to be launched today in an increasingly uphill battle. Legal costs will be phenomenal.

• Inside Trump’s Legal Warfare (Axios)

President Trump plans to brandish obituaries of people who supposedly voted but are dead — plus hold campaign-style rallies — in an effort to prolong his fight against apparent insurmountable election results, four Trump advisers told me during a conference call this afternoon. Obits for those who cast ballots are part of the “specific pieces of evidence” aimed at bolstering the Trump team’s so-far unsupported claims of widespread voter fraud and corruption that they say led to Joe Biden’s victory. Fueling the effort is the expected completion of vote counting this week, allowing Republicans to file for more recounts Team Trump is ready to announce specific recount teams in key states, and it plans to hold a series of Trump rallies focused on the litigation.

In Georgia: Doug Collins, the outgoing congressman who lost to Sen. Kelly Loeffler in a special election to fill former Sen. Johnny Isakson’s seat, will be leading the campaign’s recount efforts. The team has also redeployed 92 staffers from Florida to Georgia, doubling its group on the ground In Arizona: Kory Langhofer, former counsel for Trump’s 2016 transition, will serve as lead attorney. In Pennsylvania: Porter Wright’s Ron Hicks is heading up the legal effort. Nationwide: They’re assembling additional surrogates and lawyers. “We want to make sure we have an adequate supply of manpower on the ground for man-to-man combat,” one adviser said. The group is also staffing a campaign-style media operation.

The team led by Trump communications director Tim Murtaugh is now a surrogate messaging center. It will pump out “regular press briefings, releases on legal action and obviously things like talking points and booking people strategically on television,” one adviser said. They’ll also make a big play to raise money for their legal defense fund. Trump’s formal legal team includes 2020 campaign manager Bill Stepien, lawyer Justin Clark, and senior advisers Jason Miller and David Bossie. Reps. Jim Jordan and Scott Perry, as well as former White House Chief of Staff Reince Priebus, are also advising.

Meet the swamp creatures. For pete’s sake, John Kerry? Climate? Sally Yates? Wasn’t she supposed to be in jail?

• Kerry For Climate Chief, Buttigieg For Veterans, Yates For DOJ (ZH)

While Trump is still far from conceding the election, whose outcome is called not by the media, but by the Electoral College on Dec 14… … Joe Biden is already busy forming his cabinet, where he need to draw a fine line between the hard-left progressive in the Democratic party (AOC has already been quite vocal in her criticism of how the Squad has been ignored) and centrist elements. Also, in addition to rolling out such new policies as fighting climate change and aggressively promoting women and minorities, Biden will focus on an economic team that will confront the surging unemployment and business slowdown touched off by the coronavirus pandemic. In total, as he builds out his economic team Biden will need to fill out the nearly two dozen cabinet-level positions in his administration.

Starting at the very top, Bloomberg reports that Biden will look for a Treasury secretary and other key officials “to negotiate with Congress on more stimulus, roll back some of President Donald Trump’s tax cuts and mend relations with U.S. trading partners.” Among the contenders that have emerged to fill the top economic-policy job are Fed Governor Lael Brainard for Treasury and economist Heather Boushey as director of the National Economic Council. Other crucial jobs include naming the secretaries of Defense, State and Homeland Security, together responsible for carrying out administration policy and overseeing a federal bureaucracy with more than 2 million civilian employees.

While Biden will be mindful of the possibility that a Republican-controlled Senate would almost certainly scuttle nominees for top posts who belong to the progressive wing of the Democratic Party, liberal groups will be policing Biden’s choices closely, fearful that he won’t reach into their ranks for top positions but will instead choose “moderate” Democrats in his own mold. Biden may try to tamp down that sentiment by putting a liberals in jobs that don’t require Senate confirmation. Most importantly, this means that “the swamp” which Trump vowed to fight – and lost – is back, because in forming his cabinet, Biden will rely on an inner circle of longtime veterans from the Obama administration as well as Wall Streeters. Finally, while Biden could make history by naming the first women to lead the Defense and Treasury departments, his key White House advisers are likely to be White men.

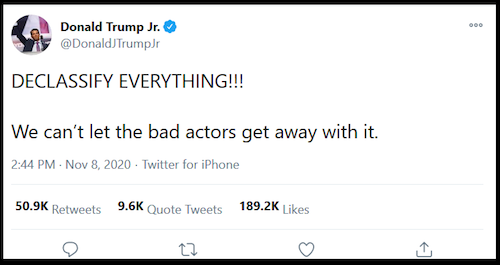

Too late: “I don’t think post-election this will work, because the executive branch cabinet officers will refuse to support it. The enemies inside the gate will protect DC.”

• Donald Trump Jr: “Declassify Everything” (sundance)

Amid all of the election ramifications and discussions, Donald Trump Jr. outlined a thought today that has likely been on the mind of many, myself included. I have spent a great deal of time thinking about this since the media began their insufferable onslaught and “president-elect Biden” narrative. The time has long past for President Trump to fully demand his executive cabinet members declassify the evidence outlining intrusive government surveillance upon not only himself, but all Americans. CTH has a rather unique perspective on the declassification angle. This conversation has traveled with me for over two years as I have talked to people inside the machinery.

Ultimately the discussion ends around something like this: Is the DC political surveillance state, and all of the ramifications within that reality, so fundamentally corrupt and against our nation’s interests, that no entity dare expose the scope and depth of it? And ultimately… is it the preservation of institutions that is causing so many disconnected outcomes from evidence intentionally downplayed? If we assume the scale of unconstitutional conduct has become systemic, that likely answers the questions. Personally, I believe this is the most likely scenario. “Likely” meaning the entire apparatus, DOJ, FBI, Legislative Oversight and the Intelligence Community (IC), is now so enmeshed within this corrupt out-of-control state that no-one, even the good guys, is willing to expose it because the institutional collapse would be devastating.

This is what I would call the Biggest of the Big Ugly. This catastrophic outcome, in combination with DC having made the system the primary source of their income, is what unites the Republicans and Democrats to stop anyone from exposing it. Once any elected official goes inside this system, they end up serving it. All of that said, I have previously outlined a pre-election process for President Trump to declassify information that would lay the system naked to We The People. However, I don’t think post-election this will work, because the executive branch cabinet officers will refuse to support it. The enemies inside the gate will protect DC.

Nancy Pelosi’s Chief of Staff Is Chief Executive and Feinstein’s Husband a Major Shareholder at Dominion Ballot Counting Systems

• Software That Gave Biden 1000s Of Michigan Votes Used In 28 Other States (JTN)

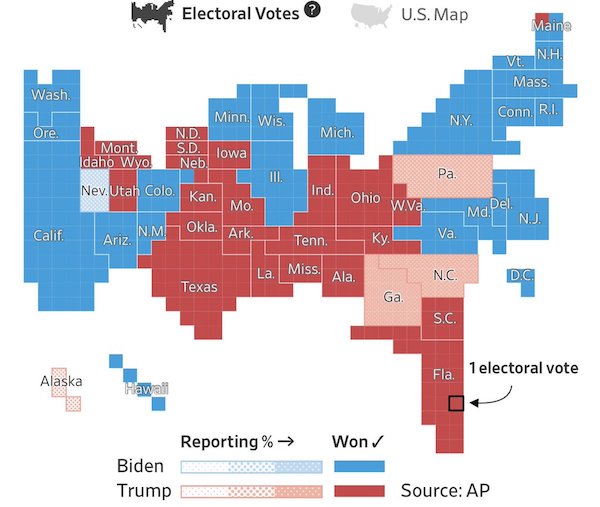

Election software that incorrectly awarded thousands of votes to Joe Biden in Michigan is used in a majority of U.S. states, including statewide in Georgia where it has reportedly been implicated in several voting-related “glitches” there. The Michigan Secretary of State confirmed on Friday that a software error in Antrim County, Michigan, in which Joe Biden was incorrectly awarded thousands of votes that led him to be declared the county winner, was caused by an error in which the county clerk “did not update the software used to collect voting machine data and report unofficial results.” The software is administered by the company Dominion Voting Systems. Following the correction of the error, the county flipped back to Trump, who walked away with 2,500 more votes than Biden.

Beyond Michigan, Dominion Voting System is also used in a majority of U.S. states, with the company boasting on its website of having “customers in 28 states,” including “9 of the top 20 counties” and “4 of the top 10 counties” throughout the county. The system was used for a presidential election in Georgia for the first time this year, after the state announced in July of 2019 that Dominion would be given a statewide contract to provide systems and software to the state’s 159 counties. Multiple election-related “glitches” have been reported in the state since Tuesday. In one instance, voting in two Georgia counties ground to a halt for several hours after an unknown update was applied to voting machines there.

In another county, a “software glitch” caused a delay in counting thousands of absentee ballots. Dominion reportedly received a $107 million contract last year to install 30,000 voting machines throughout the state. Georgia was moving away from its earlier election equipment provider, Election Systems & Software, after complaints following the 2018 midterm elections. Joe Biden currently leads in Georgia by about 7,000 votes.

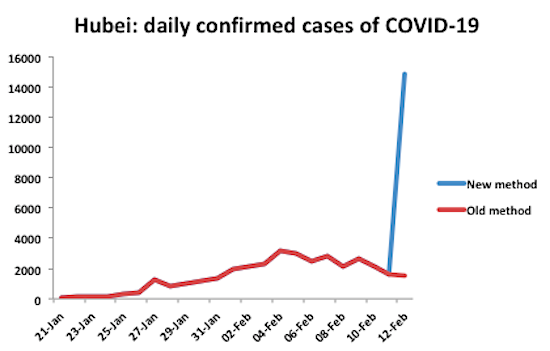

Standard deviations

The 2020 US Presidential election far exceeded 2 standard deviations of historical voter turnout over the past ~100 years.

A statistically improbable outcome.

For comparison, both the 2012 and 2016 elections with Obama were well within a single standard deviation. pic.twitter.com/mcivSZ4qYW

— James Todaro, MD (@JamesTodaroMD) November 8, 2020

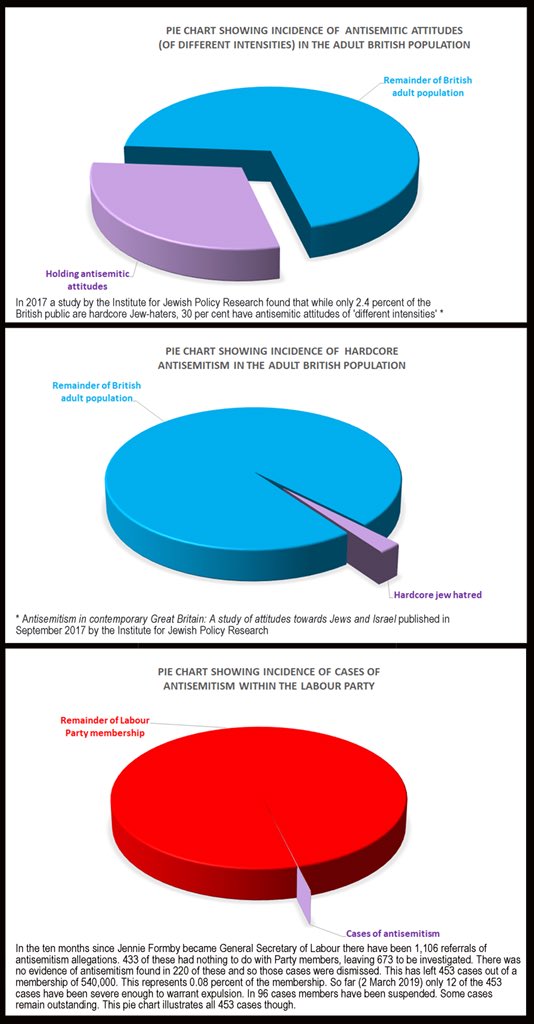

The report says no antisemitism, so it’s used to suggest … antisemitism. Works exactly the way Russiagate does.

• EHRC Report Into Labour Antisemitism Is The Real Political Interference (Cook)

I recently published in Middle East Eye a detailed analysis of last week’s report by the Equalities and Human Rights Commission into the question of whether the UK Labour party had an especial antisemitism problem. (You can read a slightly fuller version of that article on my website.) In the piece, I reached two main conclusions. First, the commission’s headline verdict – though you would never know it from reading the media’s coverage – was that no case was found that Labour suffered from “institutional antisemitism”. That, however, was precisely the claim that had been made by groups like the Jewish Labour Movement, the Campaign Against Antisemitism, the Board of Deputies and prominent rabbis such as Ephraim Mirvis.

Their claims were amplified by Jewish media outlets such as the Jewish Chronicle and individual journalists such as Jonathan Freedland of the Guardian. All are now shown to have been wrong, to have maligned the Labour party and to have irresponsibly inflamed the concerns of Britain’s wider Jewish community. Not that any of these organisations or individuals will have to apologise. The corporate media – from the Mail to the Guardian – are continuing to mislead and misdirect on this issue, as they have been doing for the best part of five years. Neither Jewish leadership groups such as the Board of Deputies nor the corporate media have an interest in highlighting the embarrassing fact that the commission’s findings exposed their campaign against Corbyn as misinformation.

What the report found instead were mainly breaches of party protocol and procedure: that complaints about antisemitism were not handled promptly and transparently. But even here the issue was not really about antisemitism, as the report indicates, even if obliquely. Delays in resolving complaints were chiefly the responsibility not of Corbyn and his staff but of a party bureaucracy that he inherited and was deeply and explicitly hostile to him. Senior officials stalled antisemitism complaints not because they were especially antisemitic but because they knew the delays would embarrass Corbyn and weaken him inside the party, as the leaked report of an Labour internal inquiry revealed in the spring.

The swamp hasn’t had a new war in ages.

• NATO Says Biden Victory Will Help With ‘Assertive Russia’ (RT)

After Joe Biden declared victory in the US presidential election on Saturday, there are fears that tensions between Russia and the West could escalate under his leadership. Congratulating the Democratic candidate on his projected win, which incumbent President Donald Trump continues to allege is the result of electoral fraud, the secretary general of NATO singled out Moscow as a priority for the incoming American leader. In a statement on the US-led military bloc’s website, Jens Stoltenberg wrote, “I warmly welcome the election of Joe Biden as the next president of the United States. I know Mr. Biden as a strong supporter of NATO and the transatlantic relationship.”

He continued: “We need this collective strength to deal with the many challenges we face, including a more assertive Russia, international terrorism, cyber and missile threats, and a shift in the global balance of power with the rise of China.” Russia’s Foreign Ministry has argued that NATO is increasingly succumbing to anti-Russian rhetoric. Spokesperson Maria Zakharova told reporters last month in a discussion about tensions with Sweden that the bloc was the source of “invented anti-Russian phobias” and “fanning tensions and the escalation of military activities in Northern Europe, one of the most stable regions in the world until recently.”

The past record of Biden, a stalwart of the US Senate’s Foreign Relations Committee, has concerned many Moscow lawmakers. The presumptive winner is unlikely to oversee an easing of tensions between the two countries, cautioned Leonid Slutsky, who heads the State Duma Committee on Foreign Affairs, which is the Russian equivalent to the body which Biden chaired, adding that he didn’t “expect essential changes for the better.” “Biden, together with President [Barack] Obama, launched the flywheel of new deterrents against Russia, with a series of sanctions at various levels,” Slutsky said.He also pointed to comments that Biden made in the past in which the Democratic candidate positioned Russia as America’s “main enemy” in his pre-election rhetoric.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

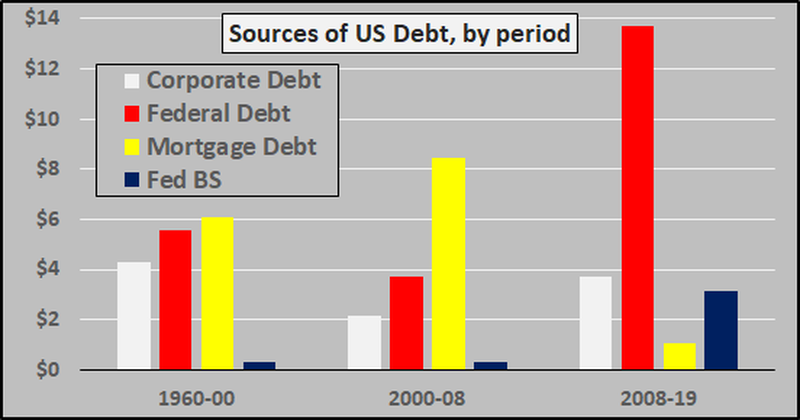

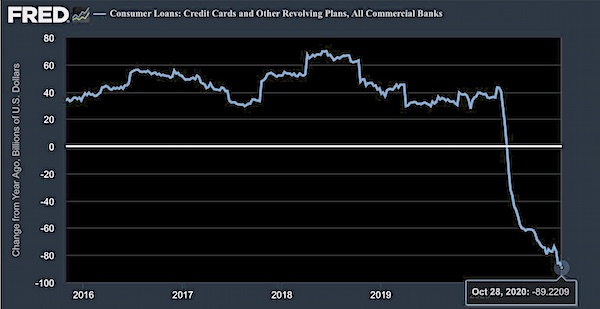

Nothing much trickling down from the untold billions the banks have gotten.

“The secret to happiness, of course, is not getting what you want. It’s wanting what you get.”

– Alex Trebek, (1940 – 2020).

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.